Kevin Mason

Notwithstanding expectations for slowing global growth in 2024, the new year has brought with it more challenges, including the extension of the Middle East conflict to the Red Sea. The re-routing of ships around the Horn of Africa is adding 10‒14 days to any Europe–Asia transit and impacting 10‒12% of global seaborne trade. Volumes through the Suez have dropped ~40% since the conflict began. …For many exports of pulp and paper & board, the change adds $20‒$60 per metric tonne to container costs in the near-term. Second-order impacts may include keeping more pulp (and paper) in Europe, depressing prices in that market, and keeping more paper & board in Asia, reducing pulp demand there. In other forest products, an interruption in log and glulam shipments from Europe last year drove Pacific Northwest log prices through the roof for the Japanese market; the same may happen again in this context. …If the disruption lingers, there will be significant first- and second-order impacts on the shape of markets in 2024.

It’s been a sluggish start to 2024 for North American lumber markets. …Lumber prices continue to languish. Supply reductions to date have been insufficient to tighten the market, but a short-lived spring rally is likely. OSB prices have held at profitable levels, but cracks are forming and new supply is coming to market (with delays). Rate cuts by the Fed are the overarching focus, with disappointment a possibility. We prefer lumber over panels for the next year or two but expect volatility across the spectrum. …Pulp prices have been facing challenges in their biggest market (China), although prices have nudged up elsewhere. Closures remain a risk for the softwood market. Shipping issues are adding costs and complexity. Tissue producers should benefit from any price slippage, but their own topline prices are under pressure.

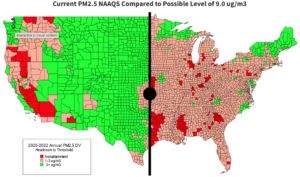

The American Forest & Paper Association CEO Heidi Brock and American Wood Council CEO Jackson Morrill responded to the Environmental Protection Agency’s announcement of an updated National Ambient Air Quality Standards for particulate matter. “EPA’s rule delivers a devastating blow to U.S. manufacturing and the economy while doing nothing to address the largest sources of particulate matter, including wildfire smoke. …”We are very concerned that many of the modernization projects in the paper and wood products industry and across U.S. manufacturing will no longer be able to move forward. “The new rule defies common sense. This Administration has set the standard at near background levels, ensuring permit gridlock for most manufacturing sectors, while failing to address 84% of overall PM2.5 emissions. …Our industry has demonstrated a continued commitment to be a good steward and community partner. We need sustainable regulation to make environmental progress and keep vital manufacturing jobs in America.

The American Forest & Paper Association CEO Heidi Brock and American Wood Council CEO Jackson Morrill responded to the Environmental Protection Agency’s announcement of an updated National Ambient Air Quality Standards for particulate matter. “EPA’s rule delivers a devastating blow to U.S. manufacturing and the economy while doing nothing to address the largest sources of particulate matter, including wildfire smoke. …”We are very concerned that many of the modernization projects in the paper and wood products industry and across U.S. manufacturing will no longer be able to move forward. “The new rule defies common sense. This Administration has set the standard at near background levels, ensuring permit gridlock for most manufacturing sectors, while failing to address 84% of overall PM2.5 emissions. …Our industry has demonstrated a continued commitment to be a good steward and community partner. We need sustainable regulation to make environmental progress and keep vital manufacturing jobs in America.

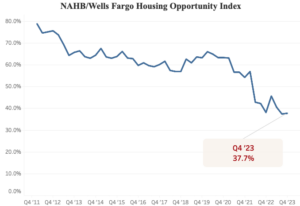

Mortgage rates that hit more than a 20-year high, coupled with elevated construction costs and excessive regulatory costs, left housing affordability in the fourth quarter of 2023 virtually unchanged from the previous quarter and holding near its lowest level in more than a decade. According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), just 37.7% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $96,300. This is nearly identical to the 37.4% posted in the third quarter of last year, which was the lowest reading since NAHB began tracking affordability on a consistent basis in 2012.

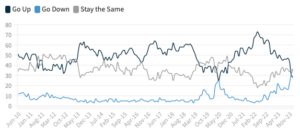

Mortgage rates that hit more than a 20-year high, coupled with elevated construction costs and excessive regulatory costs, left housing affordability in the fourth quarter of 2023 virtually unchanged from the previous quarter and holding near its lowest level in more than a decade. According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), just 37.7% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $96,300. This is nearly identical to the 37.4% posted in the third quarter of last year, which was the lowest reading since NAHB began tracking affordability on a consistent basis in 2012.  WASHINGTON, DC – The Fannie Mae Home Purchase Sentiment Index® increased 3.5 points in January to 70.7, its highest level since March 2022, due primarily to increased consumer confidence in job security and another significant jump in the share of consumers expecting mortgage rates to decrease. In January, 82% of consumers indicated that they are not concerned about losing their job in the next 12 months, up from 75% last month. Additionally, an all-time survey-high 36% of respondents indicated that they expect mortgage rates to go down in the next 12 months, while 28% expect them to go up, and 35% expect rates to remain the same. However, consumer perceptions of homebuying conditions remain overwhelmingly pessimistic, with only 17% of consumers indicating it’s a good time to buy a home. Overall, the full index is up 9.1 points year over year.

WASHINGTON, DC – The Fannie Mae Home Purchase Sentiment Index® increased 3.5 points in January to 70.7, its highest level since March 2022, due primarily to increased consumer confidence in job security and another significant jump in the share of consumers expecting mortgage rates to decrease. In January, 82% of consumers indicated that they are not concerned about losing their job in the next 12 months, up from 75% last month. Additionally, an all-time survey-high 36% of respondents indicated that they expect mortgage rates to go down in the next 12 months, while 28% expect them to go up, and 35% expect rates to remain the same. However, consumer perceptions of homebuying conditions remain overwhelmingly pessimistic, with only 17% of consumers indicating it’s a good time to buy a home. Overall, the full index is up 9.1 points year over year. NEW YORK — Lumber is a critical component in housing construction, and recent price action has started to weaken following a steady ascent since November. That rise in lumber prices coincided almost exactly with the decline in long-term Treasury yields, which has brought mortgage rates back down. In turn, this has sparked a renewed sense of optimism within the housing sector. However, the question remains: Is this optimism well-founded? Or is it fleeting sentiment set against a backdrop of broader economic uncertainties? …While the slow and steady ascent of lumber prices and the decline in mortgage rates offer a beacon of hope for the housing sector, investors must ground this optimism in the reality of persisting challenges. Risk-off conditions could soon present themselves yet again for a tail event in the stock market.

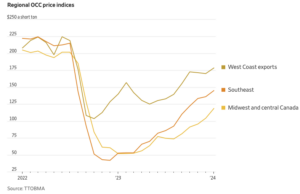

NEW YORK — Lumber is a critical component in housing construction, and recent price action has started to weaken following a steady ascent since November. That rise in lumber prices coincided almost exactly with the decline in long-term Treasury yields, which has brought mortgage rates back down. In turn, this has sparked a renewed sense of optimism within the housing sector. However, the question remains: Is this optimism well-founded? Or is it fleeting sentiment set against a backdrop of broader economic uncertainties? …While the slow and steady ascent of lumber prices and the decline in mortgage rates offer a beacon of hope for the housing sector, investors must ground this optimism in the reality of persisting challenges. Risk-off conditions could soon present themselves yet again for a tail event in the stock market. The recycled-box rally is still going strong. Prices for old corrugated containers, or OCC, have been climbing as several newly opened mills vie for old boxes to turn into new packaging. In the Southeast, prices for OCC rose 6.6% in January, according to TTOBMA, a pulp and paper consulting firm that tracks sales and prices. The hunt for old boxes has spilled into adjacent markets, pushing up the prices mills paid for OCC in the Midwest and central Canada roughly 14% last month, the firm said. [END]

The recycled-box rally is still going strong. Prices for old corrugated containers, or OCC, have been climbing as several newly opened mills vie for old boxes to turn into new packaging. In the Southeast, prices for OCC rose 6.6% in January, according to TTOBMA, a pulp and paper consulting firm that tracks sales and prices. The hunt for old boxes has spilled into adjacent markets, pushing up the prices mills paid for OCC in the Midwest and central Canada roughly 14% last month, the firm said. [END]

Washington, D.C. and Ottawa, ON

Washington, D.C. and Ottawa, ON

HELENA, Mont. – Governor Greg Gianforte today led a coalition of six governors in criticizing federal agencies for plans to adopt new forest management rules without addressing state concerns. In

HELENA, Mont. – Governor Greg Gianforte today led a coalition of six governors in criticizing federal agencies for plans to adopt new forest management rules without addressing state concerns. In

Democratic lawmakers are split over whether a greater share of the hundreds of millions of dollars needed to protect the state from wildfires should come from all Oregon taxpayers or from the private property and business owners whose valuable assets receive state protection. During the five weeks of the Legislative session, Sen. Elizabeth Steiner, D-Portland and Rep. Paul Evans, D-Monmouth will both attempt to convince their peers to ask the public for more money, and Steiner also will propose reducing costs for the timber industry. Two of their colleagues – Sen. Jeff Golden, D-Ashland, and Rep. Paul Holvey, D-Eugene – will make the case that the timber industry has been allowed for too long to contribute too little and needs to step up to fill funding gaps. At stake is not only the ability for state agencies to prevent and fight wildfires, but also widely needed resources for communities and homeowners … to stop fires from spreading.

Democratic lawmakers are split over whether a greater share of the hundreds of millions of dollars needed to protect the state from wildfires should come from all Oregon taxpayers or from the private property and business owners whose valuable assets receive state protection. During the five weeks of the Legislative session, Sen. Elizabeth Steiner, D-Portland and Rep. Paul Evans, D-Monmouth will both attempt to convince their peers to ask the public for more money, and Steiner also will propose reducing costs for the timber industry. Two of their colleagues – Sen. Jeff Golden, D-Ashland, and Rep. Paul Holvey, D-Eugene – will make the case that the timber industry has been allowed for too long to contribute too little and needs to step up to fill funding gaps. At stake is not only the ability for state agencies to prevent and fight wildfires, but also widely needed resources for communities and homeowners … to stop fires from spreading.

Legislation currently pending in Washington state aims to require airport operators to make a minimum 10% blend of sustainable aviation fuel (SAF) available to private jets owned by individuals or businesses once certain conditions are met. The bill, SB 6114, was introduced by Washington Sen. Marko Liias on Jan. 10 and cleared the Senate Transportation Committee on Feb. 5. According to the bill text, the requirement would kick in within 24 months of the Washington Department of Ecology verifying cumulative SAF production capacity of 20 MMgy. The bill also requires the department to complete a feasibility study for enforcing and carrying out the bill’s requirements by Nov. 1, 2027. Rules for the program would have to be adopted within 12 months of the completion of that feasibility study.

Legislation currently pending in Washington state aims to require airport operators to make a minimum 10% blend of sustainable aviation fuel (SAF) available to private jets owned by individuals or businesses once certain conditions are met. The bill, SB 6114, was introduced by Washington Sen. Marko Liias on Jan. 10 and cleared the Senate Transportation Committee on Feb. 5. According to the bill text, the requirement would kick in within 24 months of the Washington Department of Ecology verifying cumulative SAF production capacity of 20 MMgy. The bill also requires the department to complete a feasibility study for enforcing and carrying out the bill’s requirements by Nov. 1, 2027. Rules for the program would have to be adopted within 12 months of the completion of that feasibility study.

Two of the five remaining wood-fired biomass energy plants in the Lower Peninsula may close in the coming months, raising questions about the energy source’s future as it attempts to compete with cheaper wind, solar and natural gas. The two plant owners and their primary customer, Consumers Energy, say the planned closures in Cadillac and the northeastern Lower Peninsula are a financial decision that will save ratepayers tens of millions of dollars. For its part, Consumers wants to replace the biomass contracts with solar. However, biomass supporters say a lack of policy support risks losing a useful baseload power source that acts as a hedge against intermittent renewables. The timber industry says shuttering biomass plants also jeopardizes forest management, increases the risk of wildfires and complicates habitat creation for the Kirtland’s warbler, which in 2019 was delisted after about 50 years as an endangered species.

Two of the five remaining wood-fired biomass energy plants in the Lower Peninsula may close in the coming months, raising questions about the energy source’s future as it attempts to compete with cheaper wind, solar and natural gas. The two plant owners and their primary customer, Consumers Energy, say the planned closures in Cadillac and the northeastern Lower Peninsula are a financial decision that will save ratepayers tens of millions of dollars. For its part, Consumers wants to replace the biomass contracts with solar. However, biomass supporters say a lack of policy support risks losing a useful baseload power source that acts as a hedge against intermittent renewables. The timber industry says shuttering biomass plants also jeopardizes forest management, increases the risk of wildfires and complicates habitat creation for the Kirtland’s warbler, which in 2019 was delisted after about 50 years as an endangered species.