Canada’s lumber industry is at a tipping point, as Trump calls for more tariffs in response to Ontario’s Reagan TV ad. In related news: industry leaders say the additional tariff is uncalled for; Carney distances himself from provincial ads; Trump declines to meet Carney; West Fraser’s James Gorman says BC’s system needs reform; Greg Stewart explains Sinclar’s production reductions; and trade-expert John Weekes says don’t count on USMCA negotiations resolving the matter. Meanwhile: US inflation ticks up; US cabinet sales decline; and Fannie Mae’s GDP forecast rises.

Canada’s lumber industry is at a tipping point, as Trump calls for more tariffs in response to Ontario’s Reagan TV ad. In related news: industry leaders say the additional tariff is uncalled for; Carney distances himself from provincial ads; Trump declines to meet Carney; West Fraser’s James Gorman says BC’s system needs reform; Greg Stewart explains Sinclar’s production reductions; and trade-expert John Weekes says don’t count on USMCA negotiations resolving the matter. Meanwhile: US inflation ticks up; US cabinet sales decline; and Fannie Mae’s GDP forecast rises.

In Forestry news: BC’s Forest Advisory Council says changes are needed; Quebec’s Safety Board releases report on skidder-operator death; Nova Scotia debuts the Fairy Creek documentary; and Oregon seeks input on Public Lands Rule. Meanwhile: World Resources Institute says wildfires are burning at twice the rate of 20 years ago; BC Forest Professionals and Nova Scotia Woodlot Owners focus on wildfire prevention; and the US government shutdown is impacting wildfire mitigation in Oregon.

Finally, after 16 years, BC Forest Safety Council CEO Rob Moonen is retiring in March 2026.

Kelly McCloskey, Tree Frog Editor

WASHINGTON — The US Senate passed legislation Wednesday that would nullify US tariffs on Canada, just as US President Trump is engaged in trade talks in Asia as well as an increasingly bitter trade spat with US’s northern neighbour. The 50-46 tally was the latest in a series of votes this week to terminate the national emergencies that Trump has used to impose tariffs. While the resolutions won’t ultimately take effect, they have proven to be an effective way for Democrats to expose cracks between the president’s trade policy and Republican senators who have traditionally supported free trade arguments. …The Senate passed a similar resolution applying to Brazilian tariffs on Tuesday. …Vice-President JD Vance visited Republicans during a closed-door luncheon this week and also argued that they should steer clear of trade policy while the president negotiates deals.

WASHINGTON — The US Senate passed legislation Wednesday that would nullify US tariffs on Canada, just as US President Trump is engaged in trade talks in Asia as well as an increasingly bitter trade spat with US’s northern neighbour. The 50-46 tally was the latest in a series of votes this week to terminate the national emergencies that Trump has used to impose tariffs. While the resolutions won’t ultimately take effect, they have proven to be an effective way for Democrats to expose cracks between the president’s trade policy and Republican senators who have traditionally supported free trade arguments. …The Senate passed a similar resolution applying to Brazilian tariffs on Tuesday. …Vice-President JD Vance visited Republicans during a closed-door luncheon this week and also argued that they should steer clear of trade policy while the president negotiates deals. FORT MILL, South Carolina and MONTRÉAL and RICHMOND, BC — Domtar is proud to celebrate its one-year anniversary of uniting under a single brand: Domtar – The Fiber for the Future. The year has been one of expansion, achievement and living Domtar’s new values. “Reflecting on the last 12 months, I’m deeply impressed by the extraordinary progress our teams have made,” said John Williams, Non-Executive Chairman, Management Board. “Their hard work and commitment have been essential to the success of this integration. While we can’t acknowledge every achievement today, it’s important to pause and recognize the milestones that define our first year as one company.” They include: Reaching a historic agreement with Tla’amin Nation…; Investing in Wisconsin and the Rothschild Dam…; Donating lands to the Nature Conservancy of Canada… ;Publishing our first unified sustainability report…; Expanding our network in point-of-sale receipt rolls… ; and Winning industry recognition.

FORT MILL, South Carolina and MONTRÉAL and RICHMOND, BC — Domtar is proud to celebrate its one-year anniversary of uniting under a single brand: Domtar – The Fiber for the Future. The year has been one of expansion, achievement and living Domtar’s new values. “Reflecting on the last 12 months, I’m deeply impressed by the extraordinary progress our teams have made,” said John Williams, Non-Executive Chairman, Management Board. “Their hard work and commitment have been essential to the success of this integration. While we can’t acknowledge every achievement today, it’s important to pause and recognize the milestones that define our first year as one company.” They include: Reaching a historic agreement with Tla’amin Nation…; Investing in Wisconsin and the Rothschild Dam…; Donating lands to the Nature Conservancy of Canada… ;Publishing our first unified sustainability report…; Expanding our network in point-of-sale receipt rolls… ; and Winning industry recognition. President Trump said that he, personally, wants to attend next month’s Supreme Court hearing on his tariff policies. The U.S. Supreme Court will hear oral arguments, beginning on November 5th, whether the president can unilaterally impose tariffs under emergency powers and is acting legally in his bypassing of Congress. The case involves the import tariffs against Canada, Mexico, and China, over allegations of fentanyl trafficking, as well as Trump’s reciprocal tariffs. …Canada is suffering under some of the toughest US tariff actions for some of its largest export sectors — the auto industry, along with steel, aluminum, and Canada’s softwood lumber. …John Weekes, one of the chief Canadian negotiators of the original North American Free Trade Agreement said a lot of Canadians seem to be holding onto hope that Trump’s tariff war will disappear when the USMCA is renegotiated next year. To that, John Weekes says don’t bet on it.

President Trump said that he, personally, wants to attend next month’s Supreme Court hearing on his tariff policies. The U.S. Supreme Court will hear oral arguments, beginning on November 5th, whether the president can unilaterally impose tariffs under emergency powers and is acting legally in his bypassing of Congress. The case involves the import tariffs against Canada, Mexico, and China, over allegations of fentanyl trafficking, as well as Trump’s reciprocal tariffs. …Canada is suffering under some of the toughest US tariff actions for some of its largest export sectors — the auto industry, along with steel, aluminum, and Canada’s softwood lumber. …John Weekes, one of the chief Canadian negotiators of the original North American Free Trade Agreement said a lot of Canadians seem to be holding onto hope that Trump’s tariff war will disappear when the USMCA is renegotiated next year. To that, John Weekes says don’t bet on it. SASKATCHEWAN — A massive pile of logs that caught fire Monday morning at the Meadow Lake Mechanical Pulp yard was continuing to burn Tuesday, and fire crews say the blaze won’t stop anytime soon. “It’s actually probably going to burn for at least a week, maybe longer, just due to the amount of material burning,” Meadow Lake fire department Chief Joe Grela said. …“We’re probably talking about 100,000 cubic meters of logs here, so quite an immense material,” Grela said. The company that owns the mill, Domtar, said the destruction of the wood is a huge loss. …”It’s always unfortunate when something like this happens, but it’s particularly unfortunate at a difficult time for the sector across the country.” The mill’s wood room was shut down as firefighters kept an eye on the smouldering logs. The fire department said the rest of the mill was running as usual.

SASKATCHEWAN — A massive pile of logs that caught fire Monday morning at the Meadow Lake Mechanical Pulp yard was continuing to burn Tuesday, and fire crews say the blaze won’t stop anytime soon. “It’s actually probably going to burn for at least a week, maybe longer, just due to the amount of material burning,” Meadow Lake fire department Chief Joe Grela said. …“We’re probably talking about 100,000 cubic meters of logs here, so quite an immense material,” Grela said. The company that owns the mill, Domtar, said the destruction of the wood is a huge loss. …”It’s always unfortunate when something like this happens, but it’s particularly unfortunate at a difficult time for the sector across the country.” The mill’s wood room was shut down as firefighters kept an eye on the smouldering logs. The fire department said the rest of the mill was running as usual. Efforts are underway to diversify and strengthen British Columbia’s forestry sector with a new office in London, England. The office will be a hub for BC’s forestry sector to expand its market share across Europe and the United Kingdom. “British Columbia is the second largest exporter of softwood lumber in the world, and with US President Trump’s continued attacks on our forestry workers and economy, we are not sitting idly by,” said Ravi Parmar, Minister of Forests. BC’s Crown corporation, Forestry Innovation Investment (FII), will be expanding its presence to the U.K. to work with the forestry industry there, around Europe, and eventually, select markets in the Middle East and northern Africa, to grow BC’s forestry sector footprint internationally. This new office will give B.C.’s forestry sector a representative to help expand growing wood markets in the UK and Europe. …This is the newest FII office, joining offices in China, India and Vietnam, and industry-led offices in Japan and South Korea.

Efforts are underway to diversify and strengthen British Columbia’s forestry sector with a new office in London, England. The office will be a hub for BC’s forestry sector to expand its market share across Europe and the United Kingdom. “British Columbia is the second largest exporter of softwood lumber in the world, and with US President Trump’s continued attacks on our forestry workers and economy, we are not sitting idly by,” said Ravi Parmar, Minister of Forests. BC’s Crown corporation, Forestry Innovation Investment (FII), will be expanding its presence to the U.K. to work with the forestry industry there, around Europe, and eventually, select markets in the Middle East and northern Africa, to grow BC’s forestry sector footprint internationally. This new office will give B.C.’s forestry sector a representative to help expand growing wood markets in the UK and Europe. …This is the newest FII office, joining offices in China, India and Vietnam, and industry-led offices in Japan and South Korea.

The judges at New Brunswick’s highest court are wrestling with how to award costs in the first part of a massive and complex litigation that has entangled the province’s biggest landowners. The New Brunswick Court of Appeal heard arguments from three timber firms that successfully argued their case in preliminary motions in a lower court in the Wolastoqey Nation’s big title claim for about 60% of the province’s territory. …Lawyers for J.D. Irving, Acadian Timber, and H.J. Crabbe and Sons argued that because the case is so complex and important for the rights of all private properties in the disputed territory, they deserve a bigger payout. …The case is expected to cost millions over the years. This is one of the reasons the Liberals say they decided the government should settle the dispute. …The judge said the court would make its decision known at a later date.

The judges at New Brunswick’s highest court are wrestling with how to award costs in the first part of a massive and complex litigation that has entangled the province’s biggest landowners. The New Brunswick Court of Appeal heard arguments from three timber firms that successfully argued their case in preliminary motions in a lower court in the Wolastoqey Nation’s big title claim for about 60% of the province’s territory. …Lawyers for J.D. Irving, Acadian Timber, and H.J. Crabbe and Sons argued that because the case is so complex and important for the rights of all private properties in the disputed territory, they deserve a bigger payout. …The case is expected to cost millions over the years. This is one of the reasons the Liberals say they decided the government should settle the dispute. …The judge said the court would make its decision known at a later date. Luke Lindberg, U.S. under secretary of agriculture for trade and foreign agricultural affairs with the USDA, in conjunction with U.S. Secretary of Agriculture Brooke Rollins, has announced a three-point plan to increase exports, advance rural prosperity, and chip away at the trade deficit. The three-point plan includes:

Luke Lindberg, U.S. under secretary of agriculture for trade and foreign agricultural affairs with the USDA, in conjunction with U.S. Secretary of Agriculture Brooke Rollins, has announced a three-point plan to increase exports, advance rural prosperity, and chip away at the trade deficit. The three-point plan includes: PORT OF LONGVIEW, Washington — If Northwest Advanced Bio-Fuels has its way, the Port of Longview may soon have a $2.4 billion sustainable aviation fuel plant. But the mega-project to turn timber waste into jet fuel has faced a slew of challenges on its way to landing at the giant riverfront Barlow Point site, a deal that’s still not inked after nearly four years. The people behind Northwest Advanced Bio-Fuels say the project is mere weeks away from finding the financing needed to lock in a site and build the plant — the first of a handful of additional facilities around the region to fulfill Delta Airlines’ immense need for sustainable aviation fuel. To port officials, however, the project is one of about 20 that have considered its flagship Barlow Point site, any one of which could put money down today and start the long process of realizing a mega-project there tomorrow.

PORT OF LONGVIEW, Washington — If Northwest Advanced Bio-Fuels has its way, the Port of Longview may soon have a $2.4 billion sustainable aviation fuel plant. But the mega-project to turn timber waste into jet fuel has faced a slew of challenges on its way to landing at the giant riverfront Barlow Point site, a deal that’s still not inked after nearly four years. The people behind Northwest Advanced Bio-Fuels say the project is mere weeks away from finding the financing needed to lock in a site and build the plant — the first of a handful of additional facilities around the region to fulfill Delta Airlines’ immense need for sustainable aviation fuel. To port officials, however, the project is one of about 20 that have considered its flagship Barlow Point site, any one of which could put money down today and start the long process of realizing a mega-project there tomorrow.

The Bank of Canada cut its interest rate by 25 basis points to 2.25 per cent on Wednesday, but signalled that it may end its easing cycle there if the economy operates in line with its latest forecast. …Bank of Canada governor Tiff Macklem said, “If the economy evolves roughly in line with the outlook in our Monetary Policy Report, governing council sees the current policy rate at about the right level to keep inflation close to 2% while.” …The central bank presented its first baseline forecast since January after trade war uncertainty prompted policymakers to instead assess multiple potential scenarios. After a contraction in the second quarter, the bank expects weak growth for the remainder of 2025, with 0.5% annualized GDP growth in the third quarter and 1% growth in the last quarter of this year. It projects GDP growth of 1.1% in 2026 and 1.6& in 2027.

The Bank of Canada cut its interest rate by 25 basis points to 2.25 per cent on Wednesday, but signalled that it may end its easing cycle there if the economy operates in line with its latest forecast. …Bank of Canada governor Tiff Macklem said, “If the economy evolves roughly in line with the outlook in our Monetary Policy Report, governing council sees the current policy rate at about the right level to keep inflation close to 2% while.” …The central bank presented its first baseline forecast since January after trade war uncertainty prompted policymakers to instead assess multiple potential scenarios. After a contraction in the second quarter, the bank expects weak growth for the remainder of 2025, with 0.5% annualized GDP growth in the third quarter and 1% growth in the last quarter of this year. It projects GDP growth of 1.1% in 2026 and 1.6& in 2027. US tariffs on key Canadian goods and weakening global demand triggered a sharp pullback in exports in the second quarter of 2025, according to new data released by

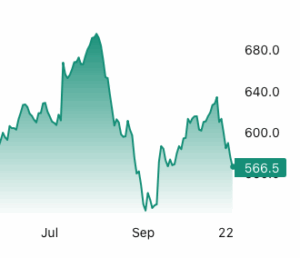

US tariffs on key Canadian goods and weakening global demand triggered a sharp pullback in exports in the second quarter of 2025, according to new data released by  Lumber futures tumbled toward $560 per thousand board feet, a seven-week low, as weakening demand, persistent oversupply, and trade-policy uncertainties converged. US tariffs are intensifying pressure on Canadian softwood, with existing antidumping and countervailing duties around 35%, plus new Section 232 levies of 10% on timber and 25% on wood products, lifting import costs above 45%. Weak demand compounds the decline, with US residential building permits at a seasonally adjusted 1.4 million units in July, the lowest since June 2020, and construction spending down 3.4% from May 2024. Housing starts remain near five-year lows, keeping retail price pass-through muted despite higher import costs. Export channels have narrowed, with Canadian softwood constrained by tariffs and hardwood exports to China dropping from 40% of volume in 2017 to 7% today. Temporary curtailments and mill closures are emerging, yet abundant inventories and sluggish construction sustain downward pressure. [END]

Lumber futures tumbled toward $560 per thousand board feet, a seven-week low, as weakening demand, persistent oversupply, and trade-policy uncertainties converged. US tariffs are intensifying pressure on Canadian softwood, with existing antidumping and countervailing duties around 35%, plus new Section 232 levies of 10% on timber and 25% on wood products, lifting import costs above 45%. Weak demand compounds the decline, with US residential building permits at a seasonally adjusted 1.4 million units in July, the lowest since June 2020, and construction spending down 3.4% from May 2024. Housing starts remain near five-year lows, keeping retail price pass-through muted despite higher import costs. Export channels have narrowed, with Canadian softwood constrained by tariffs and hardwood exports to China dropping from 40% of volume in 2017 to 7% today. Temporary curtailments and mill closures are emerging, yet abundant inventories and sluggish construction sustain downward pressure. [END] Let’s keep this simple: lumber and steel are two of the biggest drivers of flatbed freight in this country. …So where are we right now, closing out 2025? Lumber futures are sliding off their highs and steel demand is soft with some pockets still running hot. That combination is sending a pretty clear message to flatbed haulers: expect mixed demand instead of broad “every lane is on fire” demand. Some regions will stay busy. Some will get quiet. …Lumber futures have fallen back into the $590–$610/mbf range, down double digits from that August spike, and recently touched the lowest levels in weeks. …There are two main reasons for that weakness: Housing affordability is still brutal. Inventory is sitting. So instead of steady flatbed freight — lumber from mill to yard, yard to jobsite, jobsite to next jobsite — you get pauses. …Lumber and steel tell the truth before the broader market does.

Let’s keep this simple: lumber and steel are two of the biggest drivers of flatbed freight in this country. …So where are we right now, closing out 2025? Lumber futures are sliding off their highs and steel demand is soft with some pockets still running hot. That combination is sending a pretty clear message to flatbed haulers: expect mixed demand instead of broad “every lane is on fire” demand. Some regions will stay busy. Some will get quiet. …Lumber futures have fallen back into the $590–$610/mbf range, down double digits from that August spike, and recently touched the lowest levels in weeks. …There are two main reasons for that weakness: Housing affordability is still brutal. Inventory is sitting. So instead of steady flatbed freight — lumber from mill to yard, yard to jobsite, jobsite to next jobsite — you get pauses. …Lumber and steel tell the truth before the broader market does.  Lumber futures tumbled toward $590 per thousand board feet, a near one-month low, as weakening US housing activity and pre-tariff front-loading left wholesalers awash with stock while stacked US duties on Canadian imports and trade uncertainty pushed prices lower. US homebuilding has slowed, with housing starts falling 8.5% in August to a 1.307 million annualized pace and building permits drifting lower. Many US buyers front-loaded inventories ahead of expected import tariffs earlier this autumn, leaving distributors to work down excess stock before fresh order flow returns. On the supply side, a 10% Section-232 tariff added in mid-October atop roughly 35% in existing duties lifted border costs above 45% for many Canadian shipments, forcing sellers to find new markets or accept lower domestic prices. Producers like Interfor have trimmed output since mid-October, but the cuts are too recent to significantly reduce inventories or regional log supply.

Lumber futures tumbled toward $590 per thousand board feet, a near one-month low, as weakening US housing activity and pre-tariff front-loading left wholesalers awash with stock while stacked US duties on Canadian imports and trade uncertainty pushed prices lower. US homebuilding has slowed, with housing starts falling 8.5% in August to a 1.307 million annualized pace and building permits drifting lower. Many US buyers front-loaded inventories ahead of expected import tariffs earlier this autumn, leaving distributors to work down excess stock before fresh order flow returns. On the supply side, a 10% Section-232 tariff added in mid-October atop roughly 35% in existing duties lifted border costs above 45% for many Canadian shipments, forcing sellers to find new markets or accept lower domestic prices. Producers like Interfor have trimmed output since mid-October, but the cuts are too recent to significantly reduce inventories or regional log supply. EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results1 for the three months ended September 27, 2025. Acadian generated sales of $23.0 million, compared to $26.0 million in the prior year period. …Operating costs and expenses decreased $2.0 million compared to the prior year period as a result of decreased timber sales volumes and timber services activity, partially offset by higher average operating costs and expenses per m

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results1 for the three months ended September 27, 2025. Acadian generated sales of $23.0 million, compared to $26.0 million in the prior year period. …Operating costs and expenses decreased $2.0 million compared to the prior year period as a result of decreased timber sales volumes and timber services activity, partially offset by higher average operating costs and expenses per m Shares of D.R. Horton took a hit Tuesday, as the home builder confirmed that the market for new houses was still weak, and it wasn’t just because prices and mortgage rates were too high — people are afraid to shell out so much for a new house when they’re worried about the economy and their jobs. …But even with lower prices and mortgage rates, the number of homes closed fell 1.2% to 23,368, which was below the average analyst estimate. And that weakness comes despite higher incentives to home buyers to boost sales, which pushed profits below what Wall Street was expecting. …Chief Executive Paul Romanowski said affordability was certainly still an issue. But consumers were also concerned about the “volatility and uncertainty” in the economy, which may be leading to worries about the job market. It certainly won’t help matters to see large layoff announcements from high-profile companies.

Shares of D.R. Horton took a hit Tuesday, as the home builder confirmed that the market for new houses was still weak, and it wasn’t just because prices and mortgage rates were too high — people are afraid to shell out so much for a new house when they’re worried about the economy and their jobs. …But even with lower prices and mortgage rates, the number of homes closed fell 1.2% to 23,368, which was below the average analyst estimate. And that weakness comes despite higher incentives to home buyers to boost sales, which pushed profits below what Wall Street was expecting. …Chief Executive Paul Romanowski said affordability was certainly still an issue. But consumers were also concerned about the “volatility and uncertainty” in the economy, which may be leading to worries about the job market. It certainly won’t help matters to see large layoff announcements from high-profile companies.

The world’s largest green timber label will vote next week on whether to begin work on new traceability rules, amid renewed scrutiny and accusations over whether the body is doing enough to prevent fraud within its supply chains. The Bonn-based Forest Stewardship Council (FSC) bills itself as “the world’s most trusted mark for sustainable forestry.” …But forestry experts and whistleblowers have alleged for years that the FSC lacks a proper control system, allowing bad actors to fraudulently pass off timber that was illegally or unsustainably logged as FSC-certified. Phil Guillery, who was the FSC’s integrity director from 2011-21,

The world’s largest green timber label will vote next week on whether to begin work on new traceability rules, amid renewed scrutiny and accusations over whether the body is doing enough to prevent fraud within its supply chains. The Bonn-based Forest Stewardship Council (FSC) bills itself as “the world’s most trusted mark for sustainable forestry.” …But forestry experts and whistleblowers have alleged for years that the FSC lacks a proper control system, allowing bad actors to fraudulently pass off timber that was illegally or unsustainably logged as FSC-certified. Phil Guillery, who was the FSC’s integrity director from 2011-21,  QUESNEL, BC — Given what’s going on around the world, it’s easy to understand why more areas in BC are taking a closer look at the Community Forest form of log harvesting tenure. It returns the management and responsibility for small, designated areas of forest land back into the hands of appointed people who live, work and care about them. Some control of what happens to and on the forest land in their own back yard has a growing appeal to its residents. …A community forest attempts to better accommodate other land users. …Co-operating with others as one cohesive unit becomes the catalyst for achieving dynamic, site specific land use solutions. It’s challenging but exciting work. It requires administering a cocktail of flexibility and responsiveness. Nick Pickles understands all that. It’s part of the appeal to being manager of the Three Rivers Community Forest based in the Cariboo region.

QUESNEL, BC — Given what’s going on around the world, it’s easy to understand why more areas in BC are taking a closer look at the Community Forest form of log harvesting tenure. It returns the management and responsibility for small, designated areas of forest land back into the hands of appointed people who live, work and care about them. Some control of what happens to and on the forest land in their own back yard has a growing appeal to its residents. …A community forest attempts to better accommodate other land users. …Co-operating with others as one cohesive unit becomes the catalyst for achieving dynamic, site specific land use solutions. It’s challenging but exciting work. It requires administering a cocktail of flexibility and responsiveness. Nick Pickles understands all that. It’s part of the appeal to being manager of the Three Rivers Community Forest based in the Cariboo region.  North Cowichan Mayor Rob Douglas has, again, sent a letter to Minister of Forests Ravi Parmar asking the province to help increase the amount of timber that the municipality’s saw and pulp mills have access to. Douglas said that three tree-farm licenses held by Western Forest Products supply much of the timber and fibre for local mills. He said that improving access to timber in these areas could help stabilize mill operations and reduce the impact of challenging market conditions and trade pressures. Douglas said Parmar’s mandate is to ensure a sustainable land base to enable the harvest of 45-million cubic metres of timber while the province is on track to harvest only 29-million cm this year. …The Domtar pulp mill in Crofton, along with Western Forest Products’ sawmills and remanufacturing plant in Chemainus and Cowichan Bay, collectively employ more than 670 workers and generate $7.7 million per year in property taxes for North Cowichan.

North Cowichan Mayor Rob Douglas has, again, sent a letter to Minister of Forests Ravi Parmar asking the province to help increase the amount of timber that the municipality’s saw and pulp mills have access to. Douglas said that three tree-farm licenses held by Western Forest Products supply much of the timber and fibre for local mills. He said that improving access to timber in these areas could help stabilize mill operations and reduce the impact of challenging market conditions and trade pressures. Douglas said Parmar’s mandate is to ensure a sustainable land base to enable the harvest of 45-million cubic metres of timber while the province is on track to harvest only 29-million cm this year. …The Domtar pulp mill in Crofton, along with Western Forest Products’ sawmills and remanufacturing plant in Chemainus and Cowichan Bay, collectively employ more than 670 workers and generate $7.7 million per year in property taxes for North Cowichan. For the Northwest Territories government’s 2024 Forest Health Report, published last month, researchers were only able to survey about one third of the area they would normally study. Smoke from nearby wildfires reduced visibility for crews on the ground and in the air, making it difficult for researchers to do their work. Even so, one of the report’s findings is the sheer impact of a drought that has covered much the NWT since June 2022 – and its effect on forests. Of about four million hectares of forest surveyed by researchers in 2024, more than 220,000 hectares showed stresses from either the ongoing drought or the high water of 2020 and 2021, the report asserted. Because the survey work was limited by factors like smoke, researchers think the real extent of the issue “is likely substantially larger.” …Drought can contribute to tree and plant mortality, which in turn creates fuel for wildfires.

For the Northwest Territories government’s 2024 Forest Health Report, published last month, researchers were only able to survey about one third of the area they would normally study. Smoke from nearby wildfires reduced visibility for crews on the ground and in the air, making it difficult for researchers to do their work. Even so, one of the report’s findings is the sheer impact of a drought that has covered much the NWT since June 2022 – and its effect on forests. Of about four million hectares of forest surveyed by researchers in 2024, more than 220,000 hectares showed stresses from either the ongoing drought or the high water of 2020 and 2021, the report asserted. Because the survey work was limited by factors like smoke, researchers think the real extent of the issue “is likely substantially larger.” …Drought can contribute to tree and plant mortality, which in turn creates fuel for wildfires.  HALIFAX – A documentary on BC’s Fairy Creek blockade is making waves in Nova Scotia. “Fairy Creek” covers a period of eight months in 2021, when thousands of activists blockaded logging roads leading to old-growth forests on Vancouver Island. …Now, it’s getting a Nova Scotia debut with screenings in Halifax, Tatamagouche, Inverness, Annapolis Royal and Wolfville. …Neal Livingston, a Nova Scotia filmmaker, says… “We don’t have a history of that (in Nova Scotia).” Livingston says the film is especially timely for Nova Scotians, as activists in Cape Breton say they have been targeted by recent legislation. …The province introduced an omnibus bill that would make blocking forest access roads illegal and come with a fine of up to $50,000 and/or six months in jail. This fine is a steep increase from the current $2,000 penalty.

HALIFAX – A documentary on BC’s Fairy Creek blockade is making waves in Nova Scotia. “Fairy Creek” covers a period of eight months in 2021, when thousands of activists blockaded logging roads leading to old-growth forests on Vancouver Island. …Now, it’s getting a Nova Scotia debut with screenings in Halifax, Tatamagouche, Inverness, Annapolis Royal and Wolfville. …Neal Livingston, a Nova Scotia filmmaker, says… “We don’t have a history of that (in Nova Scotia).” Livingston says the film is especially timely for Nova Scotians, as activists in Cape Breton say they have been targeted by recent legislation. …The province introduced an omnibus bill that would make blocking forest access roads illegal and come with a fine of up to $50,000 and/or six months in jail. This fine is a steep increase from the current $2,000 penalty.

Chopping down rainforests is daft. The social costs of clearing a typical patch of Brazilian Amazon are perhaps 30 times the benefits of rearing cows on it, by one estimate from 2023. The problem is, those costs, which include aggravating climate change, are spread across the entire world’s population, whereas the profits from cutting down the trees go to the men commanding the chainsaws. Somehow, the world has to find a way to make conservation pay. …Yet there is hope. Though Brazil lost more rainforest than any other country last year, due to to wildfires, it also shows how better policy can make a difference. …The pace of deforestation fell by 80% during Lula’s first terms (2003-11), and fell again when he returned in 2023, before the wildfires set things back. …Since preserving rainforests is a global public good, the world should help pay for it. [to access the full story an Economist subscription is required]

Chopping down rainforests is daft. The social costs of clearing a typical patch of Brazilian Amazon are perhaps 30 times the benefits of rearing cows on it, by one estimate from 2023. The problem is, those costs, which include aggravating climate change, are spread across the entire world’s population, whereas the profits from cutting down the trees go to the men commanding the chainsaws. Somehow, the world has to find a way to make conservation pay. …Yet there is hope. Though Brazil lost more rainforest than any other country last year, due to to wildfires, it also shows how better policy can make a difference. …The pace of deforestation fell by 80% during Lula’s first terms (2003-11), and fell again when he returned in 2023, before the wildfires set things back. …Since preserving rainforests is a global public good, the world should help pay for it. [to access the full story an Economist subscription is required]