Kelly McCloskey

Robert McKellar

Earlier this year, Tree Frog reached out to political risk expert Robert McKellar for a two-part op-ed, titled Trump’s Re-Emergence and Political Risk in the Canadian Forest Sector. Robert set the stage by looking at Trump’s leadership style and his approach to business, and outlined how forest product companies can assess and manage political risk. He also highlighted four challenges facing Canadian producers: tariffs, duties, economic nationalist treatment of Canadian subsidiaries, and the impact of US-China trade tensions on lumber sales.

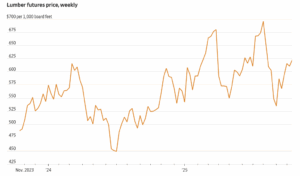

Since that series was published, many of those risks have materialized. The Trump administration has imposed the expected softwood lumber duties—higher than feared—and added a 10% Section 232 tariff. Combined, these measures amount to a staggering 45% levy on Canadian softwood exports. Meanwhile, lumber prices have remained low, production curtailments are mounting, and the sector is entering one of its most challenging periods in decades. While the Canadian government has provided interim support and is attempting to re-engage the US on a broader trade deal, lumber is not currently on the table. As a result, companies face not only a deepening financial crisis but a structural one.

With that context, we sought Robert’s perspective again—not as an extension of our earlier conversation, but as a fresh stock-taking and forward-looking reflection. His earlier analysis anticipated many of the outcomes now unfolding, and given what we now know—we asked him to weigh in on the core issues shaping the sector’s future and how Canadian companies can better prepare. In this new long-read feature, Robert addresses those questions head-on—offering his take on what may or may not change under the current US administration, the rise of protectionism and political risk south of the border, and the renewed China-US rift that continues to influence global markets. It’s a thoughtful, in-depth read for anyone trying to make sense of what comes next for Canada’s forest sector.

BURNABY, BC — Interfor announced today revised operating plans for the fourth quarter of 2025. Due to persistently weak market conditions and ongoing economic uncertainty, Interfor will further temporarily reduce lumber production across its operations in British Columbia, Ontario, the US Pacific Northwest and the US South. These curtailments are expected to reduce lumber production in the fourth quarter of 2025 by approximately 250 million board feet, or 26%, as compared to the second quarter of 2025, which reflected a more normal operating stance. The curtailment volumes are approximately evenly split between Interfor’s Canadian and U.S. operations. …These curtailments are an amendment to Interfor’s previously announced curtailments on September 4, 2025. “Lumber prices in all regions of North America have continued to weaken, from already unsustainably low levels,” said Ian Fillinger, Interfor’s CEO. …While necessary, we fully recognize the impact these actions will have on our employees, contractors, suppliers and communities.”

BURNABY, BC — Interfor announced today revised operating plans for the fourth quarter of 2025. Due to persistently weak market conditions and ongoing economic uncertainty, Interfor will further temporarily reduce lumber production across its operations in British Columbia, Ontario, the US Pacific Northwest and the US South. These curtailments are expected to reduce lumber production in the fourth quarter of 2025 by approximately 250 million board feet, or 26%, as compared to the second quarter of 2025, which reflected a more normal operating stance. The curtailment volumes are approximately evenly split between Interfor’s Canadian and U.S. operations. …These curtailments are an amendment to Interfor’s previously announced curtailments on September 4, 2025. “Lumber prices in all regions of North America have continued to weaken, from already unsustainably low levels,” said Ian Fillinger, Interfor’s CEO. …While necessary, we fully recognize the impact these actions will have on our employees, contractors, suppliers and communities.”

The US imports about 40% of the softwood lumber the nation uses each year, more than 80% of that from Canada. President Trump says that the US has the capacity to meet 95% of softwood lumber demand and directed federal officials to update policies and regulatory guidelines to expand domestic timber harvesting and curb the arrival of foreign lumber. …As researchers studying the forestry sector and international trade, we recognize that the US has ample forest resources. But replacing imports with domestic lumber isn’t as simple as it sounds. There are differences in tree species and quality, and U.S. lumber often comes at a higher cost, even with tariffs on imports. Challenges like limited labor and manufacturing capacity require long-term investments, which temporary tariffs and uncertain trade policies often fail to encourage. In addition, the amount of lumber imported tends to mirror the boom-and-bust cycles of housing construction, a dynamic that tariffs alone are unlikely to change.

The US imports about 40% of the softwood lumber the nation uses each year, more than 80% of that from Canada. President Trump says that the US has the capacity to meet 95% of softwood lumber demand and directed federal officials to update policies and regulatory guidelines to expand domestic timber harvesting and curb the arrival of foreign lumber. …As researchers studying the forestry sector and international trade, we recognize that the US has ample forest resources. But replacing imports with domestic lumber isn’t as simple as it sounds. There are differences in tree species and quality, and U.S. lumber often comes at a higher cost, even with tariffs on imports. Challenges like limited labor and manufacturing capacity require long-term investments, which temporary tariffs and uncertain trade policies often fail to encourage. In addition, the amount of lumber imported tends to mirror the boom-and-bust cycles of housing construction, a dynamic that tariffs alone are unlikely to change.

The US is now collecting tariffs on imported timber, lumber, kitchen cabinets, bathroom vanities and upholstered furniture, duties that threaten to raise the cost of renovations and deter new home purchases. …Trump described his wood and furniture tariffs as helping to “strengthen supply chains… and increase domestic capacity utilization for wood products.” Yet

The US is now collecting tariffs on imported timber, lumber, kitchen cabinets, bathroom vanities and upholstered furniture, duties that threaten to raise the cost of renovations and deter new home purchases. …Trump described his wood and furniture tariffs as helping to “strengthen supply chains… and increase domestic capacity utilization for wood products.” Yet  President Trump ushered in new tariffs on imported furniture, kitchen cabinets and lumber on Tuesday, adding a fresh round of levies as he once again threatened to expand his trade war with China. Tariffs ranging from 10% to 50% on foreign wood products and furniture snapped into effect just after midnight. The tariffs are meant to encourage more domestic logging and furniture manufacturing. But critics say that the levies will raise prices for American consumers and could slow industries including home building that rely on materials from abroad. …Critics have called it a stretch to issue the furniture and lumber tariffs under the national-security-related law. …Some American manufacturers lobbied for the tariffs. …Some economists expect the higher price of lumber, along with home furnishings, will slow the pace of home building. That could set back the Trump administration’s goals of improving a weak housing market. [to assess the full story a NY Times subscription is required]

President Trump ushered in new tariffs on imported furniture, kitchen cabinets and lumber on Tuesday, adding a fresh round of levies as he once again threatened to expand his trade war with China. Tariffs ranging from 10% to 50% on foreign wood products and furniture snapped into effect just after midnight. The tariffs are meant to encourage more domestic logging and furniture manufacturing. But critics say that the levies will raise prices for American consumers and could slow industries including home building that rely on materials from abroad. …Critics have called it a stretch to issue the furniture and lumber tariffs under the national-security-related law. …Some American manufacturers lobbied for the tariffs. …Some economists expect the higher price of lumber, along with home furnishings, will slow the pace of home building. That could set back the Trump administration’s goals of improving a weak housing market. [to assess the full story a NY Times subscription is required]

Linda Bell says there has been turmoil and chaos along parts of the US and New Brunswick border as trucks carrying lumber navigate the new tariffs that came into effect on Tuesday. But Bell says there’s been confusion as to what’s included under the new tariffs. In her almost three decades working as the general manager of the Carleton Victoria Wood Producers Association in Florenceville, she says it’s the first time there appears to be a duty on roundwood. “Trucks that were headed over there have been turned back and had to be unloaded. Some have been allowed to cross. We really don’t know what is going on,” she said. She said a few large mills in Maine who’ve been buying New Brunswick wood for five decades have halted all deliveries until the confusion can be cleared up. …Minister Mélanie Joly said there are different interpretations happening at various border locations.

Linda Bell says there has been turmoil and chaos along parts of the US and New Brunswick border as trucks carrying lumber navigate the new tariffs that came into effect on Tuesday. But Bell says there’s been confusion as to what’s included under the new tariffs. In her almost three decades working as the general manager of the Carleton Victoria Wood Producers Association in Florenceville, she says it’s the first time there appears to be a duty on roundwood. “Trucks that were headed over there have been turned back and had to be unloaded. Some have been allowed to cross. We really don’t know what is going on,” she said. She said a few large mills in Maine who’ve been buying New Brunswick wood for five decades have halted all deliveries until the confusion can be cleared up. …Minister Mélanie Joly said there are different interpretations happening at various border locations. NEW YORK — Cabinet dealers, interior designers and remodeling contractors in the U.S. hope new tariffs on imported kitchen cabinets, bathroom vanities and upholstered wooden furniture will boost domestic production of those products. But several small business owners in the home improvement industry say they expect some short-term pains from the import taxes. Potential customers may postpone kitchen and bathroom renovations until costs — and the economy — seem more stable. …The American Kitchen Cabinet Alliance lobbied for tariffs to help offset what they described as a flood of cheap cabinets from countries such as Vietnam, Malaysia, China and elsewhere in the decades since manufacturing moved offshore. …Although the White House said the tariffs were intended to boost domestic production and protect U.S. businesses from predatory trade practices, some cabinet makers say that will be difficult because their supply chains are multinational.

NEW YORK — Cabinet dealers, interior designers and remodeling contractors in the U.S. hope new tariffs on imported kitchen cabinets, bathroom vanities and upholstered wooden furniture will boost domestic production of those products. But several small business owners in the home improvement industry say they expect some short-term pains from the import taxes. Potential customers may postpone kitchen and bathroom renovations until costs — and the economy — seem more stable. …The American Kitchen Cabinet Alliance lobbied for tariffs to help offset what they described as a flood of cheap cabinets from countries such as Vietnam, Malaysia, China and elsewhere in the decades since manufacturing moved offshore. …Although the White House said the tariffs were intended to boost domestic production and protect U.S. businesses from predatory trade practices, some cabinet makers say that will be difficult because their supply chains are multinational. President Trump’s new tariffs on imported lumber and wooden fixtures have taken effect, potentially raising the cost of home construction and renovations. …“These new tariffs will create additional headwinds for an already challenged housing market by further raising construction and renovation costs,” says NAHB Chairman Buddy Hughes. …According to an NAHB analysis, U.S. sawmills are operating at just 64% of their potential capacity, a figure that has dropped steadily since 2017. “It will take years until domestic lumber production ramps up to meet the needs of our citizens,” the trade group says”. …Framing costs, including the roof, averaged about $49,763 for new single-family homes last year, accounting for about 12% of the total cost of a new build, according to an NAHB breakdown. Cabinets and countertops cost $19,056 on average, accounting for 4.5% of the total, the analysis found. …Builder profit margins have already been shrinking, and many companies have pulled back on new construction.

President Trump’s new tariffs on imported lumber and wooden fixtures have taken effect, potentially raising the cost of home construction and renovations. …“These new tariffs will create additional headwinds for an already challenged housing market by further raising construction and renovation costs,” says NAHB Chairman Buddy Hughes. …According to an NAHB analysis, U.S. sawmills are operating at just 64% of their potential capacity, a figure that has dropped steadily since 2017. “It will take years until domestic lumber production ramps up to meet the needs of our citizens,” the trade group says”. …Framing costs, including the roof, averaged about $49,763 for new single-family homes last year, accounting for about 12% of the total cost of a new build, according to an NAHB breakdown. Cabinets and countertops cost $19,056 on average, accounting for 4.5% of the total, the analysis found. …Builder profit margins have already been shrinking, and many companies have pulled back on new construction.

The Mississippi Department of Environmental Quality permit board on Wednesday reversed a decision from earlier this year and granted wood pellet manufacturer Drax a permit that allows it to release more emissions from a facility in Gloster. The board held a two-day evidentiary hearing after denying the company the permit in April. The permit falls under Title V of the Clean Air Act and allows Drax’s facility Amite BioEnergy, to become a “major source” of Hazardous Air Pollutants, or HAPs. The board voted unanimously in favor of granting the permit said Kim Turner. Evidence from the hearing “sufficiently addressed” concerns the board previously had. MDEQ has found the facility in violation multiple times since Drax opened the Amite County plant in 2016. …Drax applied for the permit in order to better reflect its production capacity. Since violating the current permit, Amite BioEnergy has had to decrease its pellet output.

The Mississippi Department of Environmental Quality permit board on Wednesday reversed a decision from earlier this year and granted wood pellet manufacturer Drax a permit that allows it to release more emissions from a facility in Gloster. The board held a two-day evidentiary hearing after denying the company the permit in April. The permit falls under Title V of the Clean Air Act and allows Drax’s facility Amite BioEnergy, to become a “major source” of Hazardous Air Pollutants, or HAPs. The board voted unanimously in favor of granting the permit said Kim Turner. Evidence from the hearing “sufficiently addressed” concerns the board previously had. MDEQ has found the facility in violation multiple times since Drax opened the Amite County plant in 2016. …Drax applied for the permit in order to better reflect its production capacity. Since violating the current permit, Amite BioEnergy has had to decrease its pellet output.

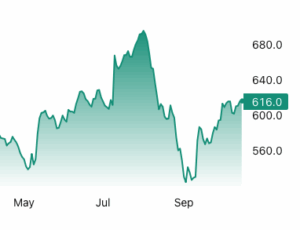

Lumber futures have risen about 19% from a low hit in early September, driven by the production cuts, hopes that declining interest rates will revive the housing market and Trump’s import tax. The 10% levy is on top of steep duties on Canadian lumber, which are adjusted annually in a heavily litigated process that is the result of a decades-long trade dispute. Those antidumping and countervailing duties rose in August to about 35% for most Canadian producers, up from roughly 15%. Canada’s sawmills are by far the largest source of softwood lumber from beyond U.S. borders, fulfilling about 24% of domestic consumption last year. Other significant importers of softwood lumber, the type used to frame houses, include Brazil and European countries such as Germany and Sweden. Homebuilders argue that import taxes will raise construction costs. U.S. lumber producers and timberland owners, however, urged Trump to enact a tariff.

Lumber futures have risen about 19% from a low hit in early September, driven by the production cuts, hopes that declining interest rates will revive the housing market and Trump’s import tax. The 10% levy is on top of steep duties on Canadian lumber, which are adjusted annually in a heavily litigated process that is the result of a decades-long trade dispute. Those antidumping and countervailing duties rose in August to about 35% for most Canadian producers, up from roughly 15%. Canada’s sawmills are by far the largest source of softwood lumber from beyond U.S. borders, fulfilling about 24% of domestic consumption last year. Other significant importers of softwood lumber, the type used to frame houses, include Brazil and European countries such as Germany and Sweden. Homebuilders argue that import taxes will raise construction costs. U.S. lumber producers and timberland owners, however, urged Trump to enact a tariff. Lumber futures rose past $610 per thousand board feet in mid-October, approaching monthly highs as markets priced in tighter near-term supply and looming trade restrictions. Under newly announced US Section 232 tariffs that take effect on October 14th, imported softwood lumber will face a 10% duty and finished wood goods such as cabinets and furniture will face higher levies, prompting importers to front-load purchases and draw down inventories. Domestic output is also constrained as sawmills run cautiously after years of underinvestment, logging curbs in sensitive regions and slow capacity restarts have limited production. The cost and delay of switching suppliers is material given that Canadian lumber, which supplies much of US demand, already carries elevated antidumping and countervailing duties, intensifying the supply squeeze.

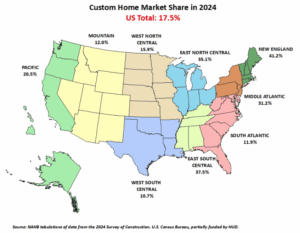

Lumber futures rose past $610 per thousand board feet in mid-October, approaching monthly highs as markets priced in tighter near-term supply and looming trade restrictions. Under newly announced US Section 232 tariffs that take effect on October 14th, imported softwood lumber will face a 10% duty and finished wood goods such as cabinets and furniture will face higher levies, prompting importers to front-load purchases and draw down inventories. Domestic output is also constrained as sawmills run cautiously after years of underinvestment, logging curbs in sensitive regions and slow capacity restarts have limited production. The cost and delay of switching suppliers is material given that Canadian lumber, which supplies much of US demand, already carries elevated antidumping and countervailing duties, intensifying the supply squeeze. In 2024, 17.5% of all new single-family homes started were custom homes. This share decreased from 18.8% in 2023 and from 20.4% in 2022, according to data tabulated from the Census Bureau’s Survey of Construction (SOC). The custom home market consists of contractor-built and owner-built homes—homes built for owner occupancy on the owner’s land, with either the owner or a builder acting as a general contractor. The alternatives are homes built-for-sale (on the builder’s land, often in subdivisions, with the intention of selling the house and land in one transaction) and homes built-for-rent. In 2024, 73.1% of the single-family homes started were built-for-sale and 9.3% were built-for-rent. At a 17.5% share, the number of custom homes started in 2024 was 176,932, falling from 177,850 in 2023.

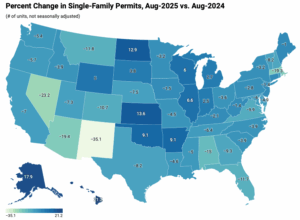

In 2024, 17.5% of all new single-family homes started were custom homes. This share decreased from 18.8% in 2023 and from 20.4% in 2022, according to data tabulated from the Census Bureau’s Survey of Construction (SOC). The custom home market consists of contractor-built and owner-built homes—homes built for owner occupancy on the owner’s land, with either the owner or a builder acting as a general contractor. The alternatives are homes built-for-sale (on the builder’s land, often in subdivisions, with the intention of selling the house and land in one transaction) and homes built-for-rent. In 2024, 73.1% of the single-family homes started were built-for-sale and 9.3% were built-for-rent. At a 17.5% share, the number of custom homes started in 2024 was 176,932, falling from 177,850 in 2023. In August, single-family permit activity softened, reflecting caution among developers amid persistent economic headwinds. This trend has been consistent for eight continuous months. On the multifamily front, permitting also cooled in August but remains in the positive territory. While single-family continues to bear the brunt of affordability headwinds, the multifamily space is showing tentative signs of rebalancing. Over the first eight months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 637,096. On a year-over-year (YoY) basis, this is a decline of 7.1% over the August 2024 level of 685,923. For multifamily, the total number of permits issued nationwide reached 330,617. This is 1.4% higher compared to the August 2024 level of 326,080. HBGI analysis indicates that this growth for multifamily development has been concentrated in lower density areas and among smaller builders.

In August, single-family permit activity softened, reflecting caution among developers amid persistent economic headwinds. This trend has been consistent for eight continuous months. On the multifamily front, permitting also cooled in August but remains in the positive territory. While single-family continues to bear the brunt of affordability headwinds, the multifamily space is showing tentative signs of rebalancing. Over the first eight months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 637,096. On a year-over-year (YoY) basis, this is a decline of 7.1% over the August 2024 level of 685,923. For multifamily, the total number of permits issued nationwide reached 330,617. This is 1.4% higher compared to the August 2024 level of 326,080. HBGI analysis indicates that this growth for multifamily development has been concentrated in lower density areas and among smaller builders.)

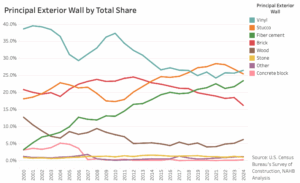

In 2024, vinyl siding was the most used principal exterior wall material for homes started. It holds just over a quarter share of homes, slightly surpassing stucco for the first time since 2018. …Vinyl was followed closely by stucco at 25%, and by fiber cement siding (such as Hardiplank or Hardiboard) at 23%. Each of these materials holds about a quarter of the market, with another 16% held by brick or brick veneer. Far smaller shares of single-family homes had wood or wood products (6%), stone, rock or other stone materials (1%), other (1%), or cement blocks (.2%) as the principal exterior wall material. …The strongest trend has been the growing popularity in fiber cement siding. The share of exterior siding material for fiber cement siding has increased by 5.5 percentage points in the last ten years…. Also notable is the decline of brick siding, from almost a quarter of homes in 2012, to just 16% in 2024.

In 2024, vinyl siding was the most used principal exterior wall material for homes started. It holds just over a quarter share of homes, slightly surpassing stucco for the first time since 2018. …Vinyl was followed closely by stucco at 25%, and by fiber cement siding (such as Hardiplank or Hardiboard) at 23%. Each of these materials holds about a quarter of the market, with another 16% held by brick or brick veneer. Far smaller shares of single-family homes had wood or wood products (6%), stone, rock or other stone materials (1%), other (1%), or cement blocks (.2%) as the principal exterior wall material. …The strongest trend has been the growing popularity in fiber cement siding. The share of exterior siding material for fiber cement siding has increased by 5.5 percentage points in the last ten years…. Also notable is the decline of brick siding, from almost a quarter of homes in 2012, to just 16% in 2024. China’s pulp and paper industry continues to expand at an unprecedented pace, with new mill projects, advanced technologies, and state-backed financing driving record output. What began as a push to meet domestic demand has now evolved into an era of overcapacity and a structural imbalance that is reshaping trade dynamics, pricing strategies, and sustainability priorities worldwide. This expansion has far-reaching effects: global producers are contending with lower-priced exports, disrupted supply chains, and a shifting balance of power that challenges traditional market leaders in North America and Europe. …Industry observers expect consolidation in China’s pulp and paper sector, as smaller and less efficient mills struggle to survive. Strategic investments in transparency, benchmarking, and efficiency will be crucial for staying competitive in a tightening global market.

China’s pulp and paper industry continues to expand at an unprecedented pace, with new mill projects, advanced technologies, and state-backed financing driving record output. What began as a push to meet domestic demand has now evolved into an era of overcapacity and a structural imbalance that is reshaping trade dynamics, pricing strategies, and sustainability priorities worldwide. This expansion has far-reaching effects: global producers are contending with lower-priced exports, disrupted supply chains, and a shifting balance of power that challenges traditional market leaders in North America and Europe. …Industry observers expect consolidation in China’s pulp and paper sector, as smaller and less efficient mills struggle to survive. Strategic investments in transparency, benchmarking, and efficiency will be crucial for staying competitive in a tightening global market.

As National Forest Products Week is observed each October, the US Endowment for Forestry and Communities is highlighting one of its partner programs that supports and advances US-based manufacturing. The Endowment is administering $5 million of the USDA Forest Service’s $80 million Wood Innovation Grants program, overseeing 18 individual projects across the country. Each project includes matching funds from subaward recipients, resulting in a total impact of approximately $10 million. Together, these investments will advance wood product manufacturing, strengthen forest management and foster energy innovation for timber-producing communities. …“Our forests are only as strong as the markets that sustain them. Through programs like the Wood Innovation Grants, we’re creating new opportunities for innovation while reinforcing the resilience of both ecosystems and the communities that depend on them. Strengthening U.S. wood products manufacturing is necessary to achieve these goals.”

As National Forest Products Week is observed each October, the US Endowment for Forestry and Communities is highlighting one of its partner programs that supports and advances US-based manufacturing. The Endowment is administering $5 million of the USDA Forest Service’s $80 million Wood Innovation Grants program, overseeing 18 individual projects across the country. Each project includes matching funds from subaward recipients, resulting in a total impact of approximately $10 million. Together, these investments will advance wood product manufacturing, strengthen forest management and foster energy innovation for timber-producing communities. …“Our forests are only as strong as the markets that sustain them. Through programs like the Wood Innovation Grants, we’re creating new opportunities for innovation while reinforcing the resilience of both ecosystems and the communities that depend on them. Strengthening U.S. wood products manufacturing is necessary to achieve these goals.” Mass timber is gaining momentum as a structural material that, along with many other attributes, can reduce the embodied carbon in new buildings and retrofits. Despite this potential, and widespread enthusiasm in the design community, the uptake of mass timber has been relatively slow. Architecture 2030 and Pilot Projects Collaborative’s new report,

Mass timber is gaining momentum as a structural material that, along with many other attributes, can reduce the embodied carbon in new buildings and retrofits. Despite this potential, and widespread enthusiasm in the design community, the uptake of mass timber has been relatively slow. Architecture 2030 and Pilot Projects Collaborative’s new report,  While sustainable solutions are facing drastic funding cuts, mass timber as a sustainable construction material is steadily gaining traction across the US. Construction using mass timber began in 2015 in the US, and since then the number of projects has grown about 20% annually. Today, over 2,500 mass timber projects are built or in progress in the US, including corporate offices for companies such as Google, Microsoft and Under Armour. …“We have lots of tech firms and big companies that say, ‘Hey, we’re battling it out for workers. We want the best space possible,’” said Bill Parsons, COO at WoodWorks. …Legislation that promotes and programs that fund mass timber, such as the Mass Timber Federal Buildings Act and the Wood Innovations Grant Program from the USDA, are still progressing. …Studies have shown that living or working in a mass timber building improves occupants’ mental health and well-being, even lowering their blood pressure and heart rates.

While sustainable solutions are facing drastic funding cuts, mass timber as a sustainable construction material is steadily gaining traction across the US. Construction using mass timber began in 2015 in the US, and since then the number of projects has grown about 20% annually. Today, over 2,500 mass timber projects are built or in progress in the US, including corporate offices for companies such as Google, Microsoft and Under Armour. …“We have lots of tech firms and big companies that say, ‘Hey, we’re battling it out for workers. We want the best space possible,’” said Bill Parsons, COO at WoodWorks. …Legislation that promotes and programs that fund mass timber, such as the Mass Timber Federal Buildings Act and the Wood Innovations Grant Program from the USDA, are still progressing. …Studies have shown that living or working in a mass timber building improves occupants’ mental health and well-being, even lowering their blood pressure and heart rates.

The Saskatchewan NDP’s critic for forestry is calling on the province to provide support to help forests in the north recover from this summer’s destructive wildfire season. Cumberland MLA Jordan McPhail said more than 2.9 million hectares of forest was destroyed by fire over the summer, and this is having an impact on the forestry sector. “They’re literally seeing future profits go up in smoke,” he said. The northern Saskatchewan MLA said the provincial government can play a positive role by investing in reforestation work. McPhail said provincial regulations dictate that forestry companies replant two trees for every single tree they take. These dictates do not apply in instances where trees are destroyed by fires. …The Government of Saskatchewan said the province is committed to doubling growth in the forestry sector and is prepared to support the industry to do this.

The Saskatchewan NDP’s critic for forestry is calling on the province to provide support to help forests in the north recover from this summer’s destructive wildfire season. Cumberland MLA Jordan McPhail said more than 2.9 million hectares of forest was destroyed by fire over the summer, and this is having an impact on the forestry sector. “They’re literally seeing future profits go up in smoke,” he said. The northern Saskatchewan MLA said the provincial government can play a positive role by investing in reforestation work. McPhail said provincial regulations dictate that forestry companies replant two trees for every single tree they take. These dictates do not apply in instances where trees are destroyed by fires. …The Government of Saskatchewan said the province is committed to doubling growth in the forestry sector and is prepared to support the industry to do this. KAMLOOPS, BC — The impacts of climate change on wildland fires, cultural burning practices and inter-government cooperation are areas of research and interest among experts gathered by the newly-formed Wildfire Resilience Consortium of Canada. The national consortium was announced in July and received $11.7 million in funding over four years from Natural Resources Canada through the Wildfire Resilient Futures Initiative. Delegates from across Canada met for the first time on Thompson Rivers University’s campus last week for a three-day conference, which aimed to facilitate discussion, networking, and to pool knowledge. Rapid-fire presentations saw recipients of NRCan’s Building and Mobilize Foundational Wildland Fire Knowledge program speak about their projects and research studies. …Many of the presenters spoke of the increasing severity of wildfires, highlighting recent record-breaking fire seasons. University of Northern B.C. professor Che Elkin said climate change is having an impact on forest ecosystems, affecting individual tree growth and mortality.

KAMLOOPS, BC — The impacts of climate change on wildland fires, cultural burning practices and inter-government cooperation are areas of research and interest among experts gathered by the newly-formed Wildfire Resilience Consortium of Canada. The national consortium was announced in July and received $11.7 million in funding over four years from Natural Resources Canada through the Wildfire Resilient Futures Initiative. Delegates from across Canada met for the first time on Thompson Rivers University’s campus last week for a three-day conference, which aimed to facilitate discussion, networking, and to pool knowledge. Rapid-fire presentations saw recipients of NRCan’s Building and Mobilize Foundational Wildland Fire Knowledge program speak about their projects and research studies. …Many of the presenters spoke of the increasing severity of wildfires, highlighting recent record-breaking fire seasons. University of Northern B.C. professor Che Elkin said climate change is having an impact on forest ecosystems, affecting individual tree growth and mortality. ONTARIO — The Northwestern Ontario Innovation Centre has partnered with the Thunder Bay Community Economic Development Commission (CEDC), the Centre for Research and Innovation in the Bio-Economy (CRIBE), Lakehead University and Confederation College to launch the Boreal Springboard, an innovative initiative aimed at strengthening and diversifying the forestry sector in Northwestern Ontario. Graham Bracken, at the Northwestern Ontario Innovation Centre, said the launch comes at a critical time for forestry in the region. …“The trade pressures were really the impetus to focus people’s minds,” Bracken said. “The sector is really integrated, and any threat to protection on the sawmill side weakens the rest of the sector. There’s a real drive to look to trade diversification and try and develop new value-added products that we can access other markets with.” Bracken says these investors will bring skills, technologies, and solutions that can be adapted to strengthen and grow the sector.

ONTARIO — The Northwestern Ontario Innovation Centre has partnered with the Thunder Bay Community Economic Development Commission (CEDC), the Centre for Research and Innovation in the Bio-Economy (CRIBE), Lakehead University and Confederation College to launch the Boreal Springboard, an innovative initiative aimed at strengthening and diversifying the forestry sector in Northwestern Ontario. Graham Bracken, at the Northwestern Ontario Innovation Centre, said the launch comes at a critical time for forestry in the region. …“The trade pressures were really the impetus to focus people’s minds,” Bracken said. “The sector is really integrated, and any threat to protection on the sawmill side weakens the rest of the sector. There’s a real drive to look to trade diversification and try and develop new value-added products that we can access other markets with.” Bracken says these investors will bring skills, technologies, and solutions that can be adapted to strengthen and grow the sector. Europe’s sawn timber industry is grappling with growing strategic uncertainty and rising compliance costs while the EU prepares to delay implementation of its landmark anti-deforestation law for a second time. While the postponement of the regulation to December 2026 may offer temporary relief, it also threatens to erode market incentives for early adopters and undermine confidence in the bloc’s regulatory direction. Producers across the continent have already invested billions of euros to meet the regulation’s demanding traceability requirements—developing digital platforms, upgrading Enterprise Resource Planning (ERP) systems, and restructuring supply chains to prove that every cubic meter of wood originates from deforestation-free sources. …In a strongly worded letter to the EC’s Environment Commissioner Jessika Roswall, a

Europe’s sawn timber industry is grappling with growing strategic uncertainty and rising compliance costs while the EU prepares to delay implementation of its landmark anti-deforestation law for a second time. While the postponement of the regulation to December 2026 may offer temporary relief, it also threatens to erode market incentives for early adopters and undermine confidence in the bloc’s regulatory direction. Producers across the continent have already invested billions of euros to meet the regulation’s demanding traceability requirements—developing digital platforms, upgrading Enterprise Resource Planning (ERP) systems, and restructuring supply chains to prove that every cubic meter of wood originates from deforestation-free sources. …In a strongly worded letter to the EC’s Environment Commissioner Jessika Roswall, a

BILLINGS, Montana — A federal judge on Wednesday dismissed a lawsuit from young climate activists seeking to block President Donald Trump’s executive orders promoting fossil fuels and discouraging renewable energy. U.S. District Judge Dana Christensen said the plaintiffs showed overwhelming evidence climate change affects them and that it will worsen as a result of Trump’s orders. But Christensen concluded their request for the courts to intervene was “unworkable” because it was beyond the power of the judiciary to create environmental policies. The 22 plaintiffs included youths who prevailed in a landmark climate trial against the state of Montana in 2023. …Legal experts said the young activists and their lawyers from the environmental group Our Children’s Trust faced long odds in the federal case. …The climate activists will appeal Wednesday’s ruling, said Julia Olson, chief legal counsel at Our Children’s Trust.

BILLINGS, Montana — A federal judge on Wednesday dismissed a lawsuit from young climate activists seeking to block President Donald Trump’s executive orders promoting fossil fuels and discouraging renewable energy. U.S. District Judge Dana Christensen said the plaintiffs showed overwhelming evidence climate change affects them and that it will worsen as a result of Trump’s orders. But Christensen concluded their request for the courts to intervene was “unworkable” because it was beyond the power of the judiciary to create environmental policies. The 22 plaintiffs included youths who prevailed in a landmark climate trial against the state of Montana in 2023. …Legal experts said the young activists and their lawyers from the environmental group Our Children’s Trust faced long odds in the federal case. …The climate activists will appeal Wednesday’s ruling, said Julia Olson, chief legal counsel at Our Children’s Trust.