Two Requests for Panel Review were filed in the matter of Certain Softwood Lumber Products from Canada: Final Results and Rescission, in Part, of the Countervailing Duty Administrative Review; 2023 with the U.S. Section of the USMCA Secretariat on September 11, 2025. The first Request for Panel Review was filed on behalf of Resolute FP, the Conseil de l’industrie forestière du Quebec, the Ontario Forest Industries Association, and each association’s respective individual members (collectively Central Canada). …The second was filed by The Government of Canada, the Governments of Alberta, British Columbia, Ontario, and Québec; Alberta Softwood Lumber Trade Council, British Columbia Lumber Trade Council; Canfor, Interfor, EACOM, Chaleur Forest Products, J.D. Irving, Tolko, Gilbert Smith Forest Products, and West Fraser. The USMCA Secretariat has assigned case number USA-CDA-2025-10.12-03 to this request.

VANCOUVER — Canfor Corporation announced that its 77%-owned subsidiary, Vida AB, has completed the acquisition of AB Karl Hedin Sågverk. The transaction,

VANCOUVER — Canfor Corporation announced that its 77%-owned subsidiary, Vida AB, has completed the acquisition of AB Karl Hedin Sågverk. The transaction,

Prime Minister Mark Carney is embarking on a pivotal meeting with Mexican President Claudia Sheinbaum, just as the United States officially launches the process to review the North American trade agreement. The Office of the US Trade Representative will seek public comments on the Canada-US-Mexico Agreement (CUSMA) over 45 days and has scheduled a public hearing in November. Public consultation is required by law and is a clear sign that the Trump administration is preparing to renegotiate, not just review, the trilateral agreement, says Eric Miller, president of Rideau Potomac Strategy Group. Under the current agreement, Canada’s trade with the U.S. is 85% tariff free, but that could change when CUSMA expires next June. …It’s under this pressure that Carney is meeting with Sheinbaum to

Prime Minister Mark Carney is embarking on a pivotal meeting with Mexican President Claudia Sheinbaum, just as the United States officially launches the process to review the North American trade agreement. The Office of the US Trade Representative will seek public comments on the Canada-US-Mexico Agreement (CUSMA) over 45 days and has scheduled a public hearing in November. Public consultation is required by law and is a clear sign that the Trump administration is preparing to renegotiate, not just review, the trilateral agreement, says Eric Miller, president of Rideau Potomac Strategy Group. Under the current agreement, Canada’s trade with the U.S. is 85% tariff free, but that could change when CUSMA expires next June. …It’s under this pressure that Carney is meeting with Sheinbaum to

VANCOUVER ISLAND — Over 3 months later, 105 forestry workers are still on the picket lines this week after walking off the job June 6, and it doesn’t look like they expect to be going back to work anytime soon. …“I didn’t think we’d get to this point,” said United Steelworkers’ Jason Cox. …The union says the company wants to contract out jobs but La-kwa sa muqw Forestry says that’s not the case, it just wants to give new employees the choice. Operations manager Greg DeMille said, “They are demanding that we agree to mandatory union certification. And so with that and the fact we can’t agree to that because we feel it impacts employee’s rights to choose and has an impact to First Nations rights to free, prior and informed consent. …The union says it respects First Nation rights but insists this should be considered a “normal labour dispute” and nothing else.

VANCOUVER ISLAND — Over 3 months later, 105 forestry workers are still on the picket lines this week after walking off the job June 6, and it doesn’t look like they expect to be going back to work anytime soon. …“I didn’t think we’d get to this point,” said United Steelworkers’ Jason Cox. …The union says the company wants to contract out jobs but La-kwa sa muqw Forestry says that’s not the case, it just wants to give new employees the choice. Operations manager Greg DeMille said, “They are demanding that we agree to mandatory union certification. And so with that and the fact we can’t agree to that because we feel it impacts employee’s rights to choose and has an impact to First Nations rights to free, prior and informed consent. …The union says it respects First Nation rights but insists this should be considered a “normal labour dispute” and nothing else.

The American Property Casualty Insurance Association (APCIA) is pressing lawmakers to advance federal wildfire legislation, warning that inaction risks worsening losses for communities nationwide. …Sam Whitfield explained that federal reforms are essential to reduce wildfire risks, strengthen community resilience and protect lives and property. The House has passed its version of the Fix Our Forests Act, or H.R. 471, in January. In April, a companion bill, or S. 1462, was introduced in the Senate. Both bills align with recommendations from the Wildland Fire Mitigation and Management Commission. Provisions include reducing fuel loads in forests and rangelands, preventing utility infrastructure from sparking fires through vegetation management, and promoting community wildfire risk reduction. …The insurance industry has faced mounting wildfire-related losses. …Insurers have responded by tightening underwriting standards, reducing capacity in wildfire-exposed areas, and relying more heavily on reinsurance to absorb catastrophic risks.

The American Property Casualty Insurance Association (APCIA) is pressing lawmakers to advance federal wildfire legislation, warning that inaction risks worsening losses for communities nationwide. …Sam Whitfield explained that federal reforms are essential to reduce wildfire risks, strengthen community resilience and protect lives and property. The House has passed its version of the Fix Our Forests Act, or H.R. 471, in January. In April, a companion bill, or S. 1462, was introduced in the Senate. Both bills align with recommendations from the Wildland Fire Mitigation and Management Commission. Provisions include reducing fuel loads in forests and rangelands, preventing utility infrastructure from sparking fires through vegetation management, and promoting community wildfire risk reduction. …The insurance industry has faced mounting wildfire-related losses. …Insurers have responded by tightening underwriting standards, reducing capacity in wildfire-exposed areas, and relying more heavily on reinsurance to absorb catastrophic risks.

JONESBORO — The Arkansas State University System board of trustees approved several policy changes during a meeting Friday at Arkansas State University. Trustees approved a policy to “ensure the efficient disposition of real property,” effective immediately. …Trustees also approved creation of a new hire and annual employee training policy — effective Jan. 1, 2026 — as the system doesn’t currently have a mandatory training policy. …Trustees approved naming the workforce training center at Arkansas State University Three Rivers for West Fraser for the next decade. …West Fraser “has made significant contributions to ASU Three Rivers, of a magnitude worthy of special gratitude and lasting recognition, including funding that will provide program support for workforce development and generous support through sponsorships, donations, resources, and collaboration that has created significant revenue for the college,” according to the resolution. …Over the past eight years, the college has collaborated on more than 15,000 training hours with West Fraser.

JONESBORO — The Arkansas State University System board of trustees approved several policy changes during a meeting Friday at Arkansas State University. Trustees approved a policy to “ensure the efficient disposition of real property,” effective immediately. …Trustees also approved creation of a new hire and annual employee training policy — effective Jan. 1, 2026 — as the system doesn’t currently have a mandatory training policy. …Trustees approved naming the workforce training center at Arkansas State University Three Rivers for West Fraser for the next decade. …West Fraser “has made significant contributions to ASU Three Rivers, of a magnitude worthy of special gratitude and lasting recognition, including funding that will provide program support for workforce development and generous support through sponsorships, donations, resources, and collaboration that has created significant revenue for the college,” according to the resolution. …Over the past eight years, the college has collaborated on more than 15,000 training hours with West Fraser.

Higher duty rate and possible additional tariffs have transportation modes on edge. The softwood lumber dispute threatens to have repercussions on various transportation modes, particularly trucking. “Our members are saying their business is still okay, even with the softer rates due to mill overcapacity, but they’re worried that if anyone pushes on this wall with more tariffs, there’s nothing to hold it up,” says Dave Earle, the BC Trucking Association’s CEO. …Trucking has already been dealing with the overcapacity that was put in place for the greater demands for deliveries for most everything during the pandemic but has not subsided. …In terms of rail services, CPKC has seen its forest product shipments rise this year to date based on revenue ton miles. …At the Port of Vancouver in British Columbia, the potential to export more lumber is significant with approximately half of last year’s containers leaving the port empty.

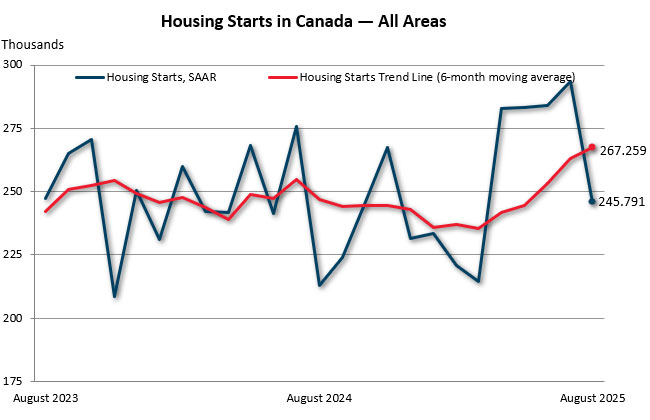

Higher duty rate and possible additional tariffs have transportation modes on edge. The softwood lumber dispute threatens to have repercussions on various transportation modes, particularly trucking. “Our members are saying their business is still okay, even with the softer rates due to mill overcapacity, but they’re worried that if anyone pushes on this wall with more tariffs, there’s nothing to hold it up,” says Dave Earle, the BC Trucking Association’s CEO. …Trucking has already been dealing with the overcapacity that was put in place for the greater demands for deliveries for most everything during the pandemic but has not subsided. …In terms of rail services, CPKC has seen its forest product shipments rise this year to date based on revenue ton miles. …At the Port of Vancouver in British Columbia, the potential to export more lumber is significant with approximately half of last year’s containers leaving the port empty.  Major concerns are being expressed on both sides of the border regarding the higher US duties on Canada’s softwood lumber. …The current 35.19% duty, along with any steeper tariff, is detrimental to US homebuilders and homebuyers longer term, warns Rose Quint, of NAHB Survey Research. Higher mortgage rates of 6% to 7% since 2022 have already weakened housing demand and caused lumber prices to edge downwards. The real effect of tariffs might be delayed by wholesalers having stocked up building materials earlier in the year to avoid higher tariffs “Years of building above and beyond our traditional baseline is required to make up the 1.5 million deficit that we have in new housing units,” Quint adds. …Affordability challenges already existed and will be further worsened by the higher costs. …The overriding hope among the Canadian producers and American homebuilders is that a suitable agreement will be reached between the US and Canada.

Major concerns are being expressed on both sides of the border regarding the higher US duties on Canada’s softwood lumber. …The current 35.19% duty, along with any steeper tariff, is detrimental to US homebuilders and homebuyers longer term, warns Rose Quint, of NAHB Survey Research. Higher mortgage rates of 6% to 7% since 2022 have already weakened housing demand and caused lumber prices to edge downwards. The real effect of tariffs might be delayed by wholesalers having stocked up building materials earlier in the year to avoid higher tariffs “Years of building above and beyond our traditional baseline is required to make up the 1.5 million deficit that we have in new housing units,” Quint adds. …Affordability challenges already existed and will be further worsened by the higher costs. …The overriding hope among the Canadian producers and American homebuilders is that a suitable agreement will be reached between the US and Canada.

Canada’s annual inflation rate rose to 1.9% in August, Statistics Canada said on Tuesday, the final piece of economic data to be released before the Bank of Canada’s next interest rate decision. The higher rate was largely expected. Gas prices, which dropped at a rate of more than 16% in July, were still declining in August — but at a slower pace than they had previously, contributing to the upward tick in the overall inflation rate. …With gas stripped away from the overall inflation rate, the numbers mostly ticked down in August. Economists anticipate that the central bank will cut rates by 25 basis points during its Wednesday meeting — which would mark the bank’s first cut since March. “This report was mostly a low-drama affair,” wrote Douglas Porter, chief economist at BMO, in a note to clients. The pace of price growth “won’t cause the Bank of Canada much stress,” Porter wrote.

Canada’s annual inflation rate rose to 1.9% in August, Statistics Canada said on Tuesday, the final piece of economic data to be released before the Bank of Canada’s next interest rate decision. The higher rate was largely expected. Gas prices, which dropped at a rate of more than 16% in July, were still declining in August — but at a slower pace than they had previously, contributing to the upward tick in the overall inflation rate. …With gas stripped away from the overall inflation rate, the numbers mostly ticked down in August. Economists anticipate that the central bank will cut rates by 25 basis points during its Wednesday meeting — which would mark the bank’s first cut since March. “This report was mostly a low-drama affair,” wrote Douglas Porter, chief economist at BMO, in a note to clients. The pace of price growth “won’t cause the Bank of Canada much stress,” Porter wrote.

Housing starts in the US fell last month to the lowest since May, as bloated home inventory slowed builders’ appetites to boost production. New residential construction decreased 8.5% last month to an annualized rate of 1.31 million homes, government data released Wednesday showed. The median forecast in a Bloomberg survey of economist was for 1.37 million starts. Meantime, starts of one-family homes fell 7% to an annualized 890,000, the lowest in more than a year. Multifamily construction, which has helped lift overall construction in recent months, also declined, falling nearly 12% to a three-month low. …Traders expect the Federal Reserve to trim interest rates multiple times this year, starting on Wednesday. And separate data out Wednesday showed mortgage rates fell last week to the lowest level in nearly a year, spurring a surge in refinancing.

Housing starts in the US fell last month to the lowest since May, as bloated home inventory slowed builders’ appetites to boost production. New residential construction decreased 8.5% last month to an annualized rate of 1.31 million homes, government data released Wednesday showed. The median forecast in a Bloomberg survey of economist was for 1.37 million starts. Meantime, starts of one-family homes fell 7% to an annualized 890,000, the lowest in more than a year. Multifamily construction, which has helped lift overall construction in recent months, also declined, falling nearly 12% to a three-month low. …Traders expect the Federal Reserve to trim interest rates multiple times this year, starting on Wednesday. And separate data out Wednesday showed mortgage rates fell last week to the lowest level in nearly a year, spurring a surge in refinancing. Single-family housing permits slipped for the seventh month in a row, highlighting affordability headwinds and weak demand. While multifamily permits ticked up, the sector’s volatility leaves the outlook uncertain. The split underscores a housing market still under strain, with single-family softness weighing on broader growth prospects. Over the first seven months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 565,208. On a year-over-year (YoY) basis, this is a decline of 5.7% over the July 2024 level of 599,308. For multifamily, the total number of permits issued nationwide reached 286,836. This is 2.6% higher compared to the July 2024 level of 279,618.

Single-family housing permits slipped for the seventh month in a row, highlighting affordability headwinds and weak demand. While multifamily permits ticked up, the sector’s volatility leaves the outlook uncertain. The split underscores a housing market still under strain, with single-family softness weighing on broader growth prospects. Over the first seven months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 565,208. On a year-over-year (YoY) basis, this is a decline of 5.7% over the July 2024 level of 599,308. For multifamily, the total number of permits issued nationwide reached 286,836. This is 2.6% higher compared to the July 2024 level of 279,618.

Prime Minister Mark Carney announced Sunday afternoon the launch of Build Canada Homes, the federal government’s new agency that will oversee federal housing programs. The agency was part of the Liberals’ election promise to double housing construction. The government is touting Build Canada Homes as a centralized agency to oversee new affordable housing programs initiated at the federal level. Carney said the agency will “supercharge housing construction across Canada” by helping to build supportive and transitional housing in collaboration with provinces, territories and Indigenous communities. It will also expand “deeply affordable and community housing” and partner with private developers to build homes for the middle class. The prime minister also announced that former Toronto city councillor Ana Bailão will be the CEO of Build Canada Homes. …Carney said $13 billion is earmarked for the new agency.

Prime Minister Mark Carney announced Sunday afternoon the launch of Build Canada Homes, the federal government’s new agency that will oversee federal housing programs. The agency was part of the Liberals’ election promise to double housing construction. The government is touting Build Canada Homes as a centralized agency to oversee new affordable housing programs initiated at the federal level. Carney said the agency will “supercharge housing construction across Canada” by helping to build supportive and transitional housing in collaboration with provinces, territories and Indigenous communities. It will also expand “deeply affordable and community housing” and partner with private developers to build homes for the middle class. The prime minister also announced that former Toronto city councillor Ana Bailão will be the CEO of Build Canada Homes. …Carney said $13 billion is earmarked for the new agency.

A shaggy, cool-green lichen hangs from the trunk of a tree in a forest on northeastern Vancouver Island. Lichenologist Trevor Goward has named it oldgrowth specklebelly. …Old-growth advocate Joshua Wright photographed oldgrowth specklebelly this summer in a forest about 400 kilometres northwest of Victoria. …Wright and Goward prize the forest in the Tsitika River watershed for its age and biodiversity, and a provincially appointed panel recommended that it be set aside from logging in 2021. But if a plan by the provincial logging agency, BC Timber Sales, goes ahead, the site will be auctioned for clearcut logging by the end of September. The area was stewarded by several Indigenous nations. …The plan to log it reveals differing opinions among Kwakwaka’wakw leaders on how to protect old-growth forests, while raising questions about which Aboriginal rights holders the BC government chooses to listen to, and why.

A shaggy, cool-green lichen hangs from the trunk of a tree in a forest on northeastern Vancouver Island. Lichenologist Trevor Goward has named it oldgrowth specklebelly. …Old-growth advocate Joshua Wright photographed oldgrowth specklebelly this summer in a forest about 400 kilometres northwest of Victoria. …Wright and Goward prize the forest in the Tsitika River watershed for its age and biodiversity, and a provincially appointed panel recommended that it be set aside from logging in 2021. But if a plan by the provincial logging agency, BC Timber Sales, goes ahead, the site will be auctioned for clearcut logging by the end of September. The area was stewarded by several Indigenous nations. …The plan to log it reveals differing opinions among Kwakwaka’wakw leaders on how to protect old-growth forests, while raising questions about which Aboriginal rights holders the BC government chooses to listen to, and why.

First Nations in the North Cowichan region on Vancouver Island say a motion by the municipality is undermining collaborative efforts on the future of logging in the region’s forest reserve. …Cindy Daniels, chief of Cowichan Tribes, said the move by the council “undermines the collaborative nature” of work to date on a joint plan for the forest. …The North Cowichan council has been in discussions for a collaborative framework with Quw’utsun Nation since 2021 and announced a commitment to establish a co-management strategy for the forest reserve in April 2024. …Gary Merkel, director of the Centre for Indigenous Land Stewardship at UBC…. “It’s a little bit ahead of itself that motion, but not too far. I mean, they haven’t said ‘we’re just going to go and log,’ they’ve allowed the possibility”. …”We are going to get a staff report outlining some of the implications and next steps,” North Cowichan Mayor Rob Douglas said.

First Nations in the North Cowichan region on Vancouver Island say a motion by the municipality is undermining collaborative efforts on the future of logging in the region’s forest reserve. …Cindy Daniels, chief of Cowichan Tribes, said the move by the council “undermines the collaborative nature” of work to date on a joint plan for the forest. …The North Cowichan council has been in discussions for a collaborative framework with Quw’utsun Nation since 2021 and announced a commitment to establish a co-management strategy for the forest reserve in April 2024. …Gary Merkel, director of the Centre for Indigenous Land Stewardship at UBC…. “It’s a little bit ahead of itself that motion, but not too far. I mean, they haven’t said ‘we’re just going to go and log,’ they’ve allowed the possibility”. …”We are going to get a staff report outlining some of the implications and next steps,” North Cowichan Mayor Rob Douglas said. Researchers from Trent University are immersing themselves in forests and streams in northwestern Ontario to understand how forestry practices and climate change affect brook trout populations and freshwater ecosystems. The team is working in the Walkinshaw and Wolf watersheds, northeast of Thunder Bay. They are focusing on headwater streams, which are small rivers that feed larger waterways across the Great Lakes. “Northern freshwater ecosystems are currently experiencing major disturbances, two of which are forest harvest and climate change. One of the effects of climate change is an increase in water temperatures. And the consequences of these predicted increased temperatures on the stream ecosystem are still unclear,” said PhD student Celeste Milli, who is leading the fieldwork. …Milli said the research could help inform science-based policy decisions in Canada’s northern forests, ensuring that both forest ecosystems and freshwater resources remain resilient in a changing climate.

Researchers from Trent University are immersing themselves in forests and streams in northwestern Ontario to understand how forestry practices and climate change affect brook trout populations and freshwater ecosystems. The team is working in the Walkinshaw and Wolf watersheds, northeast of Thunder Bay. They are focusing on headwater streams, which are small rivers that feed larger waterways across the Great Lakes. “Northern freshwater ecosystems are currently experiencing major disturbances, two of which are forest harvest and climate change. One of the effects of climate change is an increase in water temperatures. And the consequences of these predicted increased temperatures on the stream ecosystem are still unclear,” said PhD student Celeste Milli, who is leading the fieldwork. …Milli said the research could help inform science-based policy decisions in Canada’s northern forests, ensuring that both forest ecosystems and freshwater resources remain resilient in a changing climate. US Secretary of Agriculture Rollins issued a

US Secretary of Agriculture Rollins issued a  For Tom Schultz, the 21st chief of the U.S. Forest Service, repealing the Roadless Rule is not a matter of ideology but rather a matter of “common sense land management.” Leaving land alone and letting nature run its course is not management, Schultz explained, but a “false narrative.” “The idea that if I care about something, I walk away from it,” Schultz said. “I guess I don’t buy that.” The Roadless Rule… prevented the building of roads through nearly 60 million acres of Forest Service land, conserving a small percentage of the overall American landscape from further development. Today, after carve outs by several states, the total acreage is closer to 45 million. …Schultz spoke with Deseret News to explain why it’s important to repeal the provision, why the administration is working so “expeditiously” to do so and what the public might expect from the prospect.

For Tom Schultz, the 21st chief of the U.S. Forest Service, repealing the Roadless Rule is not a matter of ideology but rather a matter of “common sense land management.” Leaving land alone and letting nature run its course is not management, Schultz explained, but a “false narrative.” “The idea that if I care about something, I walk away from it,” Schultz said. “I guess I don’t buy that.” The Roadless Rule… prevented the building of roads through nearly 60 million acres of Forest Service land, conserving a small percentage of the overall American landscape from further development. Today, after carve outs by several states, the total acreage is closer to 45 million. …Schultz spoke with Deseret News to explain why it’s important to repeal the provision, why the administration is working so “expeditiously” to do so and what the public might expect from the prospect.  The European Union Deforestation Regulation (EUDR), one of the world’s most comprehensive legislations to curb tropical deforestation, will take effect at the end of December 2025. Since its adoption in 2023, debates over its implementation and effectiveness have been loud and persistent. Some claim the requirements are unclear or impossible to meet, especially for smallholders, while others fear the regulation will disrupt trade or place heavy burdens on businesses. …Despite the challenges, governments, companies and smallholders worldwide are showing that EUDR compliance is not only possible — it is already underway. Building on our previous analysis of why the EUDR is a necessary regulation to tackle deforestation linked to commodity supply chains, this article focuses on the practicality of compliance and highlights concrete steps being taken to prepare. …Guidance from EU national enforcement authorities, such as the Netherlands’ report, show that compliance with the EUDR is not rocket science.

The European Union Deforestation Regulation (EUDR), one of the world’s most comprehensive legislations to curb tropical deforestation, will take effect at the end of December 2025. Since its adoption in 2023, debates over its implementation and effectiveness have been loud and persistent. Some claim the requirements are unclear or impossible to meet, especially for smallholders, while others fear the regulation will disrupt trade or place heavy burdens on businesses. …Despite the challenges, governments, companies and smallholders worldwide are showing that EUDR compliance is not only possible — it is already underway. Building on our previous analysis of why the EUDR is a necessary regulation to tackle deforestation linked to commodity supply chains, this article focuses on the practicality of compliance and highlights concrete steps being taken to prepare. …Guidance from EU national enforcement authorities, such as the Netherlands’ report, show that compliance with the EUDR is not rocket science.  Austria’s softwood sector may face a production decline of up to 10% if the EU Deforestation Regulation (EUDR) takes effect in its current form at the end of the year. The regulation requires full traceability of wood products across the entire supply chain, which industry representatives say is unworkable according to Markus Schmölzer of the Austrian Sawmill Association. Although the sector expects a 2% production increase in 2025, the EUDR poses a direct threat to the entire wood value chain. A decline in softwood production would affect manufacturers of building components, furniture, panel boards, paper, and pellet products, especially during winter months. …The Austrian industry urges the EU to either suspend the regulation entirely or revise it through an “Omnibus” legislative package aimed at reducing bureaucracy. …While supporting the goal of halting global deforestation, the sector proposes targeted monitoring for high-risk regions and exemptions for low-risk countries such as Austria.

Austria’s softwood sector may face a production decline of up to 10% if the EU Deforestation Regulation (EUDR) takes effect in its current form at the end of the year. The regulation requires full traceability of wood products across the entire supply chain, which industry representatives say is unworkable according to Markus Schmölzer of the Austrian Sawmill Association. Although the sector expects a 2% production increase in 2025, the EUDR poses a direct threat to the entire wood value chain. A decline in softwood production would affect manufacturers of building components, furniture, panel boards, paper, and pellet products, especially during winter months. …The Austrian industry urges the EU to either suspend the regulation entirely or revise it through an “Omnibus” legislative package aimed at reducing bureaucracy. …While supporting the goal of halting global deforestation, the sector proposes targeted monitoring for high-risk regions and exemptions for low-risk countries such as Austria. EUROPE — Climate change has large economic costs for society. An important effect is the disruption of natural resource supply by climate-mediated disturbances such as wildfires, pest outbreaks and storms. Here we show that disturbance-induced losses for Europe’s timber-based forestry could increase from the current €115 billion to €247 billion under severe climate change. This would diminish the timber value of Europe’s forests by up to 42% and reduce the current gross value added of the forestry sector by up to 15%. Central Europe emerges as a continental hotspot of disturbance costs, with projected future costs of up to €19,885 per hectare. Simultaneous climate-related increases in forest productivity could offset future economic losses from disturbances in Northern and Central Europe but not in Southern Europe. We find high disturbance-related cost of unmitigated warming, highlighting that climate change adaptation in forestry is not only an ecological but also an economic imperative.

EUROPE — Climate change has large economic costs for society. An important effect is the disruption of natural resource supply by climate-mediated disturbances such as wildfires, pest outbreaks and storms. Here we show that disturbance-induced losses for Europe’s timber-based forestry could increase from the current €115 billion to €247 billion under severe climate change. This would diminish the timber value of Europe’s forests by up to 42% and reduce the current gross value added of the forestry sector by up to 15%. Central Europe emerges as a continental hotspot of disturbance costs, with projected future costs of up to €19,885 per hectare. Simultaneous climate-related increases in forest productivity could offset future economic losses from disturbances in Northern and Central Europe but not in Southern Europe. We find high disturbance-related cost of unmitigated warming, highlighting that climate change adaptation in forestry is not only an ecological but also an economic imperative.