A two-year investigation by the Forest Practices Board has found outdated rules and unclear responsibilities are preventing forestry from becoming a powerful wildfire-defence tool. The board examined forestry operations from 2019 until 2022 in the wildland-urban interface — areas where communities and forests meet. …It begins with fire hazard assessments, a cornerstone of wildfire risk reduction. The investigation found that 70% of assessments met content requirements. However, fewer than one in four were completed on time. …Municipalities, the most populated areas of the province, are excluded from the legal interface. …Despite the challenges, the board observed strong examples of wildfire-conscious forestry. …The board is recommending five actions to the Province. … If adopted, these changes would help turn everyday forestry into a proactive wildfire prevention tool, supporting faster fuel cleanup, better co-ordination and more consistent protection for people and communities throughout B.C. “This is an opportunity to improve our policies and processes toward proactive, risk-reducing forestry,” Keith Atkinson said.

A two-year investigation by the Forest Practices Board has found outdated rules and unclear responsibilities are preventing forestry from becoming a powerful wildfire-defence tool. The board examined forestry operations from 2019 until 2022 in the wildland-urban interface — areas where communities and forests meet. …It begins with fire hazard assessments, a cornerstone of wildfire risk reduction. The investigation found that 70% of assessments met content requirements. However, fewer than one in four were completed on time. …Municipalities, the most populated areas of the province, are excluded from the legal interface. …Despite the challenges, the board observed strong examples of wildfire-conscious forestry. …The board is recommending five actions to the Province. … If adopted, these changes would help turn everyday forestry into a proactive wildfire prevention tool, supporting faster fuel cleanup, better co-ordination and more consistent protection for people and communities throughout B.C. “This is an opportunity to improve our policies and processes toward proactive, risk-reducing forestry,” Keith Atkinson said.

Related coverage in:

The second Trump administration has come out swinging on trade. New tariffs have reignited uncertainty across global supply chains and forced America’s economic allies to find ways of placating the White House. For Canada and Mexico, Washington’s partners in Trump’s U.S.-Mexico-Canada Agreement, this has been a stark reminder of how easily trust can erode, even in the most integrated trade relationship in the world. …In terms of trade, the stakes could not be higher: Mexico and Canada are the United States’ no.1 and no. 2 trading partners. But the partners don’t just trade enormous amounts with each other; they build things together. Therefore, the review process is also a chance to modernize North America’s trade architecture, reinforce strategic industries, and rebuild the foundations of regional trust and cooperation. America’s competitiveness depends heavily on the integrated North American manufacturing platform, and thus on the success of Mexico and Canada, its partners.

The second Trump administration has come out swinging on trade. New tariffs have reignited uncertainty across global supply chains and forced America’s economic allies to find ways of placating the White House. For Canada and Mexico, Washington’s partners in Trump’s U.S.-Mexico-Canada Agreement, this has been a stark reminder of how easily trust can erode, even in the most integrated trade relationship in the world. …In terms of trade, the stakes could not be higher: Mexico and Canada are the United States’ no.1 and no. 2 trading partners. But the partners don’t just trade enormous amounts with each other; they build things together. Therefore, the review process is also a chance to modernize North America’s trade architecture, reinforce strategic industries, and rebuild the foundations of regional trust and cooperation. America’s competitiveness depends heavily on the integrated North American manufacturing platform, and thus on the success of Mexico and Canada, its partners.

USK, Washington — The owners of the defunct Ponderay Newsprint Mill plan to sell its equipment at auction next month after years of empty promises to reopen what had been one of the largest employers in northeast Washington. The sprawling 927-acre property in Usk has 29 buildings and storage facilities. It is situated adjacent to the Pend Oreille River and the Pend Oreille Valley Railroad. Instead of making paper or reconfiguring the mill to make cardboard, as the new owners promised multiple times in public hearings, the site has produced nothing for the past several years. Instead the owners used vast amounts of electricity to run computers mining for cryptocurrency. The paper mill previously was owned by Lake Superior Forest Products, a subsidiary of Quebec-based Resolute Forest Products, and five major U.S. publishers. They declared bankruptcy in 2020, ending the jobs of about 140 workers. Now that equipment is being listed by Capital Recovery Group to be viewed on July 21 with online auctions to commence on July 22 and July 23.

USK, Washington — The owners of the defunct Ponderay Newsprint Mill plan to sell its equipment at auction next month after years of empty promises to reopen what had been one of the largest employers in northeast Washington. The sprawling 927-acre property in Usk has 29 buildings and storage facilities. It is situated adjacent to the Pend Oreille River and the Pend Oreille Valley Railroad. Instead of making paper or reconfiguring the mill to make cardboard, as the new owners promised multiple times in public hearings, the site has produced nothing for the past several years. Instead the owners used vast amounts of electricity to run computers mining for cryptocurrency. The paper mill previously was owned by Lake Superior Forest Products, a subsidiary of Quebec-based Resolute Forest Products, and five major U.S. publishers. They declared bankruptcy in 2020, ending the jobs of about 140 workers. Now that equipment is being listed by Capital Recovery Group to be viewed on July 21 with online auctions to commence on July 22 and July 23.

NEW ZEALAND — Forestry Minister Todd McClay has unveiled two-way forestry trade missions with India this year. The inbound visit – supported by industry partners – is expected to showcase New Zealand’s forestry systems and sustainable management practices. “The outbound mission will continue to open doors for deeper commercial and government partnerships,” McClay said. …McClay was speaking at the Fieldays Forestry Hub on Friday. Trade between New Zealand and India was valued at $3.14 billion in 2024. New Zealand’s exports to India last year included forestry products valued at $126 million. New Zealand’s wood exports to India have surged from $9.5 million in 2023 to an estimated $76.5 million this year. Pulp exports have more than doubled, from $20 million to $45.6 million. “India is one of the fastest-growing markets for our forestry exports – and we’re focused on turning that growth into long-term opportunity for New Zealand exporters,” McClay said.

NEW ZEALAND — Forestry Minister Todd McClay has unveiled two-way forestry trade missions with India this year. The inbound visit – supported by industry partners – is expected to showcase New Zealand’s forestry systems and sustainable management practices. “The outbound mission will continue to open doors for deeper commercial and government partnerships,” McClay said. …McClay was speaking at the Fieldays Forestry Hub on Friday. Trade between New Zealand and India was valued at $3.14 billion in 2024. New Zealand’s exports to India last year included forestry products valued at $126 million. New Zealand’s wood exports to India have surged from $9.5 million in 2023 to an estimated $76.5 million this year. Pulp exports have more than doubled, from $20 million to $45.6 million. “India is one of the fastest-growing markets for our forestry exports – and we’re focused on turning that growth into long-term opportunity for New Zealand exporters,” McClay said.

Construction of new homes fell 9.8% in May, as builders pulled back amid waning demand from home buyers. Housing starts fell to a 1.26 million annual pace from 1.39 million the previous month, the government said. The annual pace refers to how many houses would be built over an entire year if May’s rate of construction were to continue. The pace of home building is down to the lowest level since May 2020 — during the peak of the COVID-19 pandemic. New-home construction is down 4.6% from the same period a year ago. Building permits, a sign of future construction, also fell 2% from the previous month to a 1.39 million rate. Builders have slowed down the construction of new homes primarily due to a pullback in buyer demand. Rising inventory levels and weak buyer demand have resulted in homes sitting longer on the market. More builders are also resorting to home prices to encourage buyers.

Construction of new homes fell 9.8% in May, as builders pulled back amid waning demand from home buyers. Housing starts fell to a 1.26 million annual pace from 1.39 million the previous month, the government said. The annual pace refers to how many houses would be built over an entire year if May’s rate of construction were to continue. The pace of home building is down to the lowest level since May 2020 — during the peak of the COVID-19 pandemic. New-home construction is down 4.6% from the same period a year ago. Building permits, a sign of future construction, also fell 2% from the previous month to a 1.39 million rate. Builders have slowed down the construction of new homes primarily due to a pullback in buyer demand. Rising inventory levels and weak buyer demand have resulted in homes sitting longer on the market. More builders are also resorting to home prices to encourage buyers.

In an age of sleek finishes and synthetic shortcuts, timber framing offers something few modern materials can: substance. There’s a quiet grandeur to exposed beams that hold not only the weight of a home but the stories it gathers over time. The appeal isn’t rooted in nostalgia—it comes from discernment. Choosing timber is a commitment to craftsmanship, to the feel of hand-hewn structure beneath polished design. Bespoke estates, mountain retreats, and coastal getaways are embracing timber as both a form and a functional element. No longer reserved for rustic cabins or historical reproductions, it’s becoming the architectural signature of homes designed with permanence in mind. That kind of durability begins with sourcing, ensuring the materials behind the beauty are as intentional as the design itself. Timber framing is one of the oldest construction methods still in use, with roots stretching back over a thousand years.

In an age of sleek finishes and synthetic shortcuts, timber framing offers something few modern materials can: substance. There’s a quiet grandeur to exposed beams that hold not only the weight of a home but the stories it gathers over time. The appeal isn’t rooted in nostalgia—it comes from discernment. Choosing timber is a commitment to craftsmanship, to the feel of hand-hewn structure beneath polished design. Bespoke estates, mountain retreats, and coastal getaways are embracing timber as both a form and a functional element. No longer reserved for rustic cabins or historical reproductions, it’s becoming the architectural signature of homes designed with permanence in mind. That kind of durability begins with sourcing, ensuring the materials behind the beauty are as intentional as the design itself. Timber framing is one of the oldest construction methods still in use, with roots stretching back over a thousand years.  I recently gave my electric pressure washer a vigorous workout. …Years ago, I walked into a lumber company to purchase materials and saw a placard on the counter advertising new maintenance-free pressure-treated lumber. Yes, at one time, residential pressure-treated lumber was a new thing. …We all discovered the claim was wrong. Pressure-treated lumber requires extensive maintenance. …This reality led to the first generation of composite decking. I remember when Trex was introduced. It dominated the marketplace, even though it was quite unattractive. It, too, was marketed as maintenance-free. Millions of other homeowners demanded a more realistic composite deck material. Generations two and three of composite decking followed. …The corporate attorneys for some decking manufacturers have reined in the optimistic marketing managers. You’ll now see clever descriptions such as “minimal maintenance.”

I recently gave my electric pressure washer a vigorous workout. …Years ago, I walked into a lumber company to purchase materials and saw a placard on the counter advertising new maintenance-free pressure-treated lumber. Yes, at one time, residential pressure-treated lumber was a new thing. …We all discovered the claim was wrong. Pressure-treated lumber requires extensive maintenance. …This reality led to the first generation of composite decking. I remember when Trex was introduced. It dominated the marketplace, even though it was quite unattractive. It, too, was marketed as maintenance-free. Millions of other homeowners demanded a more realistic composite deck material. Generations two and three of composite decking followed. …The corporate attorneys for some decking manufacturers have reined in the optimistic marketing managers. You’ll now see clever descriptions such as “minimal maintenance.” IRELAND — The Government is branching out in its bid to solve the housing crisis with a new “Wood First” plan that will see timber become the main building material used to build our homes, schools and libraries. It comes as the Cabinet will today give the green light to emergency legislation to extend rent pressure zones across the country in a scramble to stop greedy landlords cashing in on the Coalition’s rental policy changes. Forestry Minister Micheal Healy-Rae said Ireland has excellent forest resources that are being underused in our construction sector

IRELAND — The Government is branching out in its bid to solve the housing crisis with a new “Wood First” plan that will see timber become the main building material used to build our homes, schools and libraries. It comes as the Cabinet will today give the green light to emergency legislation to extend rent pressure zones across the country in a scramble to stop greedy landlords cashing in on the Coalition’s rental policy changes. Forestry Minister Micheal Healy-Rae said Ireland has excellent forest resources that are being underused in our construction sector Ash and chemicals from some of BC’s largest wildfires are winding up in the Fraser River, which could eventually lead to low oxygen levels and harm marine life, say UBC researchers. In a peer-reviewed study, published in the journal Science of The Total Environment, scientists linked increases in the concentrations of compounds like arsenic and lead, and nutrients such as nitrogen and phosphorus, to wildfires that had burned near the 1,375 kilometre long river. These are all compounds that are found naturally in the water. However, researchers tracked a significant increase in compounds as wildfires were happening near the river. The researchers studied fires within 500 metres, 1,000 metres and 1,500 metres. Fires burning close to major waterways had immediate influence on water quality, said Emily Brown, a research scientist at UBC’s institute for the oceans and fisheries. The more distant wildfires had delayed influence on water quality.

Ash and chemicals from some of BC’s largest wildfires are winding up in the Fraser River, which could eventually lead to low oxygen levels and harm marine life, say UBC researchers. In a peer-reviewed study, published in the journal Science of The Total Environment, scientists linked increases in the concentrations of compounds like arsenic and lead, and nutrients such as nitrogen and phosphorus, to wildfires that had burned near the 1,375 kilometre long river. These are all compounds that are found naturally in the water. However, researchers tracked a significant increase in compounds as wildfires were happening near the river. The researchers studied fires within 500 metres, 1,000 metres and 1,500 metres. Fires burning close to major waterways had immediate influence on water quality, said Emily Brown, a research scientist at UBC’s institute for the oceans and fisheries. The more distant wildfires had delayed influence on water quality. QUALICUM BEACH, BC — Alien invasive species like Scotch broom do not move into a void. They displace something that was originally present. Broom displaces grasses and native plants – but while grass is food, broom is toxic to grazing animals, wild and domestic. Broom provides flowers for bees in May – but wipes out the native flowers that bees rely on for the rest of the season. Farmers call broom the Scourge of Pastureland – and it affects our food security. Broom competing with young trees on forest land creates millions of dollars in losses to forest companies – and the loss to the future of our forests is beyond measure. Biodiversity? Researchers designate Scotch broom as THE invasive species doing the greatest harm to species at risk in all of B.C. Broom is the top offender of biodiversity. Wildfire? Broom’s high oil content, naturally occurring dry branches, and dense growth patterns make broom extremely flammable. FireSmart classifies broom in the highest risk category.

QUALICUM BEACH, BC — Alien invasive species like Scotch broom do not move into a void. They displace something that was originally present. Broom displaces grasses and native plants – but while grass is food, broom is toxic to grazing animals, wild and domestic. Broom provides flowers for bees in May – but wipes out the native flowers that bees rely on for the rest of the season. Farmers call broom the Scourge of Pastureland – and it affects our food security. Broom competing with young trees on forest land creates millions of dollars in losses to forest companies – and the loss to the future of our forests is beyond measure. Biodiversity? Researchers designate Scotch broom as THE invasive species doing the greatest harm to species at risk in all of B.C. Broom is the top offender of biodiversity. Wildfire? Broom’s high oil content, naturally occurring dry branches, and dense growth patterns make broom extremely flammable. FireSmart classifies broom in the highest risk category. An insolvent BC forestry company’s attempt to sell off a forest licence to pay back creditors has triggered a dispute with several First Nations, who allege the company is attempting an “end run” around their rights. This spring, three Indigenous groups challenged the Teal-Jones Group before a BC Supreme Court judge for attempting to complete an interim transfer of forest licence A19201 to Western Canadian Timber Products (WCTP). The move came before the B.C. Minister of Forests could consult with 39 First Nations who have territory in the area. …The legal dispute hinged on whether the proposed interim agreement triggered a duty to consult with First Nations. But Fitzpatrick ruled Teal Jones’ agreement with WCTP remained “the highest and best offer presently available for consideration and approval after all that time.” The judge concluded that the sales process had been conducted in a “fair and reasonable manner”.

An insolvent BC forestry company’s attempt to sell off a forest licence to pay back creditors has triggered a dispute with several First Nations, who allege the company is attempting an “end run” around their rights. This spring, three Indigenous groups challenged the Teal-Jones Group before a BC Supreme Court judge for attempting to complete an interim transfer of forest licence A19201 to Western Canadian Timber Products (WCTP). The move came before the B.C. Minister of Forests could consult with 39 First Nations who have territory in the area. …The legal dispute hinged on whether the proposed interim agreement triggered a duty to consult with First Nations. But Fitzpatrick ruled Teal Jones’ agreement with WCTP remained “the highest and best offer presently available for consideration and approval after all that time.” The judge concluded that the sales process had been conducted in a “fair and reasonable manner”.

A wildfire documentary funded in part by community donations and Okanagan businesses will be screened in Kelowna and Vernon later this month. B.C. is Burning is a 45-minute film that explores the causes and consequences of the megafires that have devastated communities in the province in recent years. It also looks at science-based solutions that could protect communities, forests and B.C.’s future. The documentary was produced and written by retired forester Murray Wilson, initiated by association producer Rick Maddison and directed/edited with production support from Ryan Tebbutt of Edge Digital Media in Kelowna. It combines expert interviews, government data, and powerful footage from both British Columbia and California. …We know how to stop this,” says Wilson. “B.C. can lead — if we stop solely reacting and start managing our forests to protect lives, cut emissions, and reduce wildfire risk.”

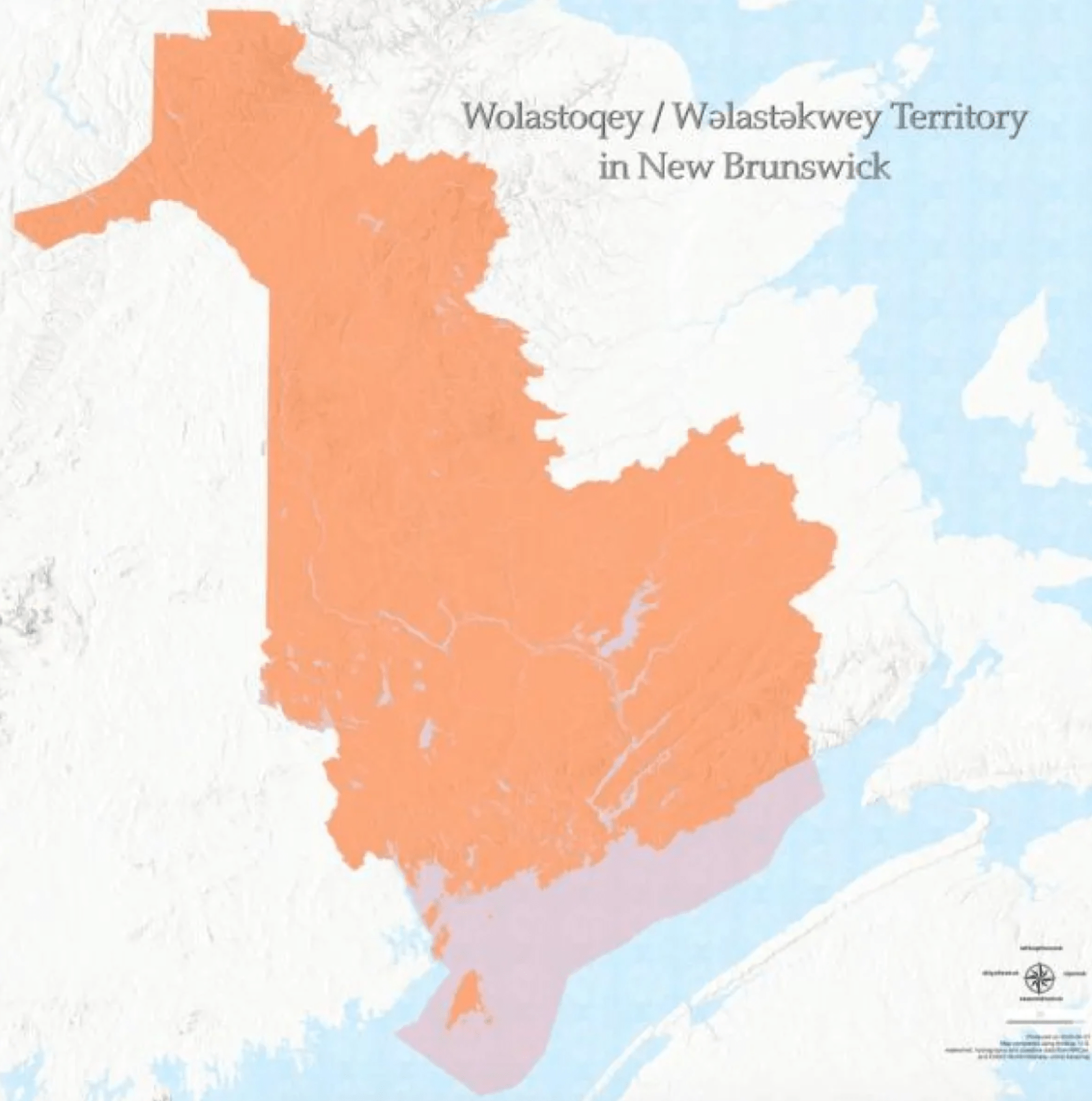

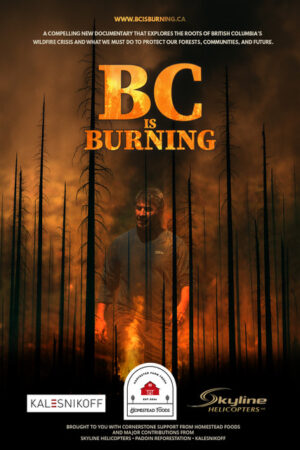

A wildfire documentary funded in part by community donations and Okanagan businesses will be screened in Kelowna and Vernon later this month. B.C. is Burning is a 45-minute film that explores the causes and consequences of the megafires that have devastated communities in the province in recent years. It also looks at science-based solutions that could protect communities, forests and B.C.’s future. The documentary was produced and written by retired forester Murray Wilson, initiated by association producer Rick Maddison and directed/edited with production support from Ryan Tebbutt of Edge Digital Media in Kelowna. It combines expert interviews, government data, and powerful footage from both British Columbia and California. …We know how to stop this,” says Wilson. “B.C. can lead — if we stop solely reacting and start managing our forests to protect lives, cut emissions, and reduce wildfire risk.” A new study suggests small, consistent amounts of exposure to the herbicide glyphosate can lead to higher incidents of cancer – a finding that has Green party Leader David Coon calling on the province to take the issue seriously. The study, by the Italian-based non-profit Ramazzini Institute, involved exposing rats to small levels of the herbicide and two other products for 2+ years. It found that “statistically significant dose-related (amounts of glyphosate) increased incidences of benign and malignant tumors.”…Bayer, which uses glyphosate in its Roundup herbicide, denounced the study. “It is clear this study has serious methodological flaws, which is consistent with the Ramazzini Institute’s long history of making misleading claims about the safety of various products,” the company said. …A government spokesperson initially told Brunswick News that the study’s findings weren’t applicable in New Brunswick because two products studied aren’t used in Canada.

A new study suggests small, consistent amounts of exposure to the herbicide glyphosate can lead to higher incidents of cancer – a finding that has Green party Leader David Coon calling on the province to take the issue seriously. The study, by the Italian-based non-profit Ramazzini Institute, involved exposing rats to small levels of the herbicide and two other products for 2+ years. It found that “statistically significant dose-related (amounts of glyphosate) increased incidences of benign and malignant tumors.”…Bayer, which uses glyphosate in its Roundup herbicide, denounced the study. “It is clear this study has serious methodological flaws, which is consistent with the Ramazzini Institute’s long history of making misleading claims about the safety of various products,” the company said. …A government spokesperson initially told Brunswick News that the study’s findings weren’t applicable in New Brunswick because two products studied aren’t used in Canada. The Portland City Council made a major change last week to the team of inspectors that enforces the city’s Tree Code, which regulates all street trees and some trees on private land across the city. The council voted to move the entire tree regulation team—which currently falls under the Urban Forestry division, a program nested within the parks bureau—to Portland Permitting & Development. …Councilor Eric Zimmerman called into question Urban Forestry and how it polices and fines Portlanders seeking to trim or remove trees on or near their property. …The tree regulators—who also process and vet permits for tree removals, replantings and prunings—will no longer be the under the oversight of city forester Jenn Cairo, whose management has come under scrutiny.The council also voted to transfer $2.1 million of Parks Levy funds from the Tree Code regulation division to backfill maintenance cuts to outdoor parks.

The Portland City Council made a major change last week to the team of inspectors that enforces the city’s Tree Code, which regulates all street trees and some trees on private land across the city. The council voted to move the entire tree regulation team—which currently falls under the Urban Forestry division, a program nested within the parks bureau—to Portland Permitting & Development. …Councilor Eric Zimmerman called into question Urban Forestry and how it polices and fines Portlanders seeking to trim or remove trees on or near their property. …The tree regulators—who also process and vet permits for tree removals, replantings and prunings—will no longer be the under the oversight of city forester Jenn Cairo, whose management has come under scrutiny.The council also voted to transfer $2.1 million of Parks Levy funds from the Tree Code regulation division to backfill maintenance cuts to outdoor parks.  HOPLAND, California — …Dripping gasoline onto dry grass and deliberately setting it ablaze in the California countryside felt wildly reckless, especially for someone whose job involves interviewing survivors of the state’s all too frequent, catastrophic wildfires. But “good fire,” as Nielson called it, is essential for reducing the fuel available for bad fire, the kind that makes the headlines. The principle is as ancient as it is simple. …With that in mind, the state set an ambitious goal in the early 2020s to deliberately burn at least 400,000 acres of wilderness each year. …But California officials worry their ambitious goals are likely to be thwarted by deep cuts to those federal agencies. Gov. Gavin Newsom added $72 million to the state’s forest management budget to bridge some of the gap expected to be left by federal agencies. But wildfire experts say that’s just a drop in the bucket.

HOPLAND, California — …Dripping gasoline onto dry grass and deliberately setting it ablaze in the California countryside felt wildly reckless, especially for someone whose job involves interviewing survivors of the state’s all too frequent, catastrophic wildfires. But “good fire,” as Nielson called it, is essential for reducing the fuel available for bad fire, the kind that makes the headlines. The principle is as ancient as it is simple. …With that in mind, the state set an ambitious goal in the early 2020s to deliberately burn at least 400,000 acres of wilderness each year. …But California officials worry their ambitious goals are likely to be thwarted by deep cuts to those federal agencies. Gov. Gavin Newsom added $72 million to the state’s forest management budget to bridge some of the gap expected to be left by federal agencies. But wildfire experts say that’s just a drop in the bucket. It has only been in the past few years that wildfire smoke from Canada has become a persistent risk to the air we all breathe. Why is this? …A vast swath across northern Canada has a subarctic climate. The types of vegetation best adapted to these conditions are conifer forests dominated by black and white spruce with some pine, balsam fir, larch, aspen and birch. Fire has always been an element of this biome. Historically, about 7.3 million acres have burned annually but in 2023, an astonishing 67 million acres burned. This year’s acreage is on pace to meet or exceed the record-breaking year of 2023. …The fire season is changing in Canada because the climate of Canada is changing. …What this means is that large, long-duration wildfires in Canada’s boreal forest and the smoke plumes they produce are likely to be a new and persistent phenomenon going forward.

It has only been in the past few years that wildfire smoke from Canada has become a persistent risk to the air we all breathe. Why is this? …A vast swath across northern Canada has a subarctic climate. The types of vegetation best adapted to these conditions are conifer forests dominated by black and white spruce with some pine, balsam fir, larch, aspen and birch. Fire has always been an element of this biome. Historically, about 7.3 million acres have burned annually but in 2023, an astonishing 67 million acres burned. This year’s acreage is on pace to meet or exceed the record-breaking year of 2023. …The fire season is changing in Canada because the climate of Canada is changing. …What this means is that large, long-duration wildfires in Canada’s boreal forest and the smoke plumes they produce are likely to be a new and persistent phenomenon going forward.  As a forester and now in my role at Grown in Britain, I regularly encounter a range of misconceptions about home-grown timber. …First, let’s address the elephant in the room. The UK imports a significant amount of timber, and these figures are often cited to suggest something isn’t working as it should be. However, increasing timber use in construction is a positive development, as it replaces more carbon-intensive materials. One of the key reasons Grown in Britain was set up – is we import substantial amounts of timber whilst neglecting our own forests and woodlands. Over 10 years ago, when GiB started, the government considered over 60% of our woods were not managed. Our initiative, alongside the efforts of many, has reduced this to nearer 40% today. …With global and UK timber demand increasing, it seems inappropriate to import so much when we’re not fully utilising our resources.

As a forester and now in my role at Grown in Britain, I regularly encounter a range of misconceptions about home-grown timber. …First, let’s address the elephant in the room. The UK imports a significant amount of timber, and these figures are often cited to suggest something isn’t working as it should be. However, increasing timber use in construction is a positive development, as it replaces more carbon-intensive materials. One of the key reasons Grown in Britain was set up – is we import substantial amounts of timber whilst neglecting our own forests and woodlands. Over 10 years ago, when GiB started, the government considered over 60% of our woods were not managed. Our initiative, alongside the efforts of many, has reduced this to nearer 40% today. …With global and UK timber demand increasing, it seems inappropriate to import so much when we’re not fully utilising our resources.

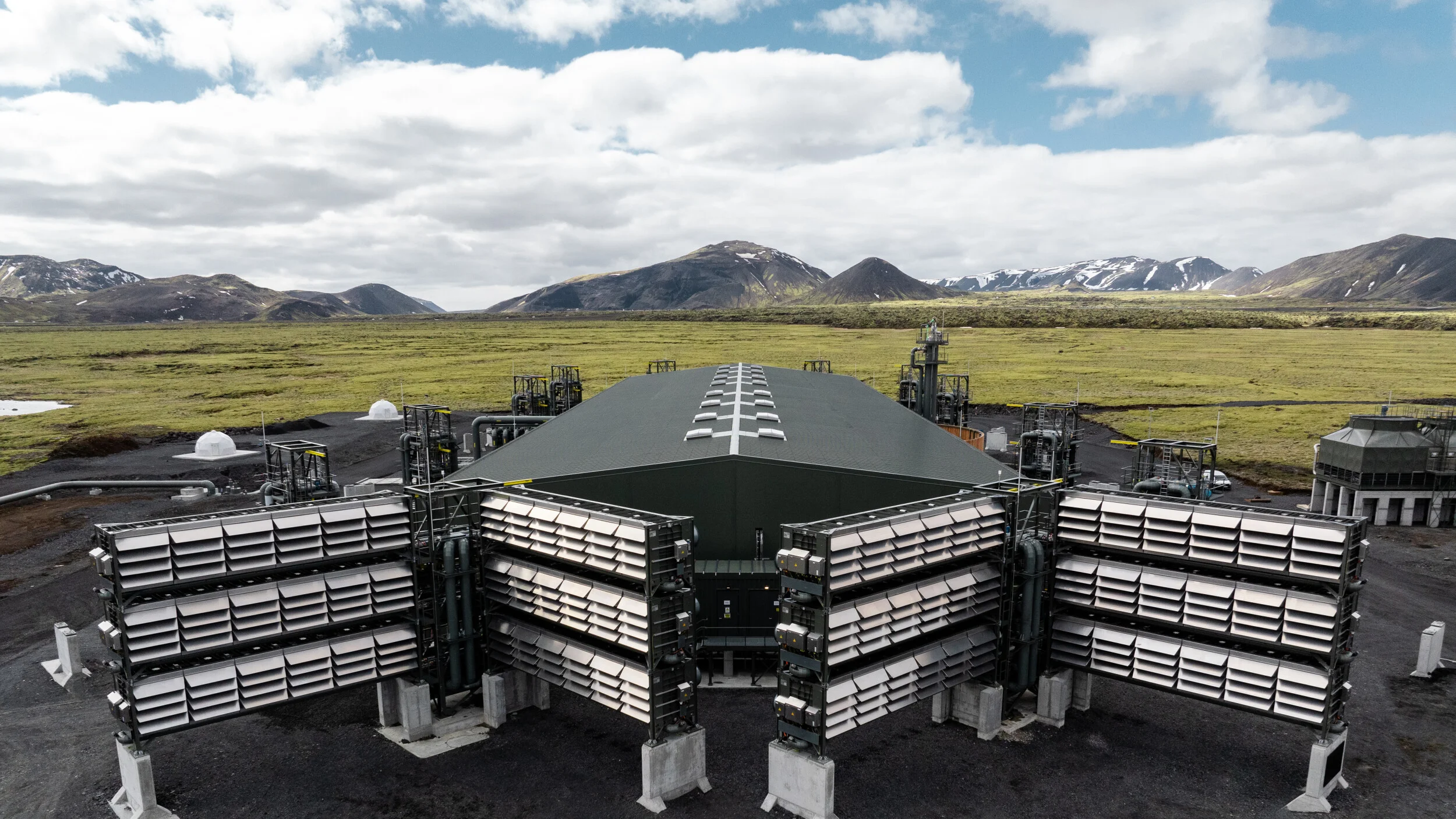

Earlier this year, Burnaby’s Svante Technologies made inroads in Alberta. The move eastward is partially powered by a newly formed partnership with Mercer International. The Canadian cleantech’s carbon capture project is targeting biogenic CO2 emissions from Mercer’s Peace River pulp mill. …One of the strategies the firm intends to adopt in Canada is carbon sequestration. Within Alberta, carbon sequestration is a sensible tactic to apply, according to Mercer International’s chief executive officer, Juan Carlos Bueno. “The reason why we’re doing it there is because the mill is located in Alberta, where you have geological formations that are suitable for sequestering CO2,” Bueno informed Andrew Snook of Pulp & Paper Canada. …Finalizing investment in the project, however, is no small consideration. There is a price tag north of $500 million and moving forward would require extensive support from both the Province of Alberta and Government of Canada.

Earlier this year, Burnaby’s Svante Technologies made inroads in Alberta. The move eastward is partially powered by a newly formed partnership with Mercer International. The Canadian cleantech’s carbon capture project is targeting biogenic CO2 emissions from Mercer’s Peace River pulp mill. …One of the strategies the firm intends to adopt in Canada is carbon sequestration. Within Alberta, carbon sequestration is a sensible tactic to apply, according to Mercer International’s chief executive officer, Juan Carlos Bueno. “The reason why we’re doing it there is because the mill is located in Alberta, where you have geological formations that are suitable for sequestering CO2,” Bueno informed Andrew Snook of Pulp & Paper Canada. …Finalizing investment in the project, however, is no small consideration. There is a price tag north of $500 million and moving forward would require extensive support from both the Province of Alberta and Government of Canada. Satellite data used by archaeologists to find traces of ancient ruins hidden under dense forest canopies can also be used to improve the speed and accuracy to measure how much carbon is retained and released in forests. Understanding this carbon cycle is key to climate change research, according to Hamdi Zurqani, for the Arkansas Forest Resources Center and the College of Forestry, Agriculture and Natural Resources at the University of Arkansas at Monticello. The center is headquartered at UAM and conducts research and extension activities through the Arkansas Agricultural Experiment Station. …In a study recently published in Ecological Informatics, Zurqani shows how information from open-access satellites can be integrated on Google Earth Engine with artificial intelligence algorithms to quickly and accurately map large-scale forest aboveground biomass, even in remote areas where accessibility is often an issue.

Satellite data used by archaeologists to find traces of ancient ruins hidden under dense forest canopies can also be used to improve the speed and accuracy to measure how much carbon is retained and released in forests. Understanding this carbon cycle is key to climate change research, according to Hamdi Zurqani, for the Arkansas Forest Resources Center and the College of Forestry, Agriculture and Natural Resources at the University of Arkansas at Monticello. The center is headquartered at UAM and conducts research and extension activities through the Arkansas Agricultural Experiment Station. …In a study recently published in Ecological Informatics, Zurqani shows how information from open-access satellites can be integrated on Google Earth Engine with artificial intelligence algorithms to quickly and accurately map large-scale forest aboveground biomass, even in remote areas where accessibility is often an issue.