The Tree Frog News featured the panels and speakers from last week’s International Pulp Week. In today’s Tree Frog News are links to all of the conference sessions in chronological order.

The Tree Frog News featured the panels and speakers from last week’s International Pulp Week. In today’s Tree Frog News are links to all of the conference sessions in chronological order.

Day One – June 1, 2025

- Registration and Wecome Cocktail

Day Two – June 2, 2025

- Looking Back, Moving Forward: 20 Years of Industry Insights: Kevin Mason

- Economic Uncertainty: A Macro View on Tariffs and Markets: Joaquin Kritz Lara

- Metsä Fibre’s enhanced position in Softwood Pulp: Mikko Antsalo

- The Global Hardwood Market: Leonardo Grimaldi

- How Carbon Capture and Removal is Unlocking Opportunity: Jonathan Rhone

- Navigating EUDR Compliance with Automation and Digital Tools: Parker Budding

Day Two – June 3, 2025

- Managing Geopolitical Uncertainty and Its Challenges: Robert McKellar

- Reshaping China’s P&P Industry in a Shifting Global Landscape: Haidong Weng

- The Shanghai Pulp Futures Exchange Path to Internationalization: Jin Feifei

- How Luojing Terminal is Meeting China’s Pulp Demand: Tian Jun

- Current Trends in End-Use Markets: Mathieu Wener

- Global Pulp Market: Demand Drivers and Outlook: Emanuele Bona

Over the past decade, Canadian forestry companies have significantly expanded their footprint in the American lumber industry. While foreign investment remains a key component of a dynamic US economy, industry analysts and policymakers are increasingly scrutinizing the long-term implications of international control over critical domestic manufacturing infrastructure. Canadian-owned firms—including West Fraser, Canfor and Interfor—now operate dozens of sawmills in the US, with many holding more assets south of the border than in their home country. Additional Canadian firms—such as Tolko, Maibec, J.D. Irving, and Kruger—also maintain active operations and land holdings throughout the country. As foreign ownership of US lumber mills grows, several key concerns are emerging: Supply Chain Autonomy… Economic Retention… Market Influence. …Industry stakeholders are urging a closer examination of the issue. Policy suggestions include incentivizing domestic ownership, increasing sourcing transparency, and evaluating regulatory frameworks around foreign investment in strategic industries.

Over the past decade, Canadian forestry companies have significantly expanded their footprint in the American lumber industry. While foreign investment remains a key component of a dynamic US economy, industry analysts and policymakers are increasingly scrutinizing the long-term implications of international control over critical domestic manufacturing infrastructure. Canadian-owned firms—including West Fraser, Canfor and Interfor—now operate dozens of sawmills in the US, with many holding more assets south of the border than in their home country. Additional Canadian firms—such as Tolko, Maibec, J.D. Irving, and Kruger—also maintain active operations and land holdings throughout the country. As foreign ownership of US lumber mills grows, several key concerns are emerging: Supply Chain Autonomy… Economic Retention… Market Influence. …Industry stakeholders are urging a closer examination of the issue. Policy suggestions include incentivizing domestic ownership, increasing sourcing transparency, and evaluating regulatory frameworks around foreign investment in strategic industries.

SURREY, BC — Mackenzie Sawmill is back in the courts, a little more than a decade after the sum of three fires ruined a large mill built in 1938. The first of three fires was on Nov. 12, 2010, followed by a second on Jan. 25, 2011 and the third on Oct. 31, 2014 essentially destroyed what was left of it. …Judge Rory Krentz, presided over a hearing in B.C. Supreme Court in Vancouver, where the defendants applied for a dismissal for want of prosecution. Mackenzie ceased operations in early 2011 after the second fire, with two groups of employees entitled to severance pay. The court heard Mackenzie told the union the company intended to build another mill on site, enabling the union employees to keep their jobs. …This was before the third fire, after which Mackenzie indicated it still planned to rebuild the mill. But the union alleges MacKenzie decided before the last fire happened that it wouldn’t rebuild.

SURREY, BC — Mackenzie Sawmill is back in the courts, a little more than a decade after the sum of three fires ruined a large mill built in 1938. The first of three fires was on Nov. 12, 2010, followed by a second on Jan. 25, 2011 and the third on Oct. 31, 2014 essentially destroyed what was left of it. …Judge Rory Krentz, presided over a hearing in B.C. Supreme Court in Vancouver, where the defendants applied for a dismissal for want of prosecution. Mackenzie ceased operations in early 2011 after the second fire, with two groups of employees entitled to severance pay. The court heard Mackenzie told the union the company intended to build another mill on site, enabling the union employees to keep their jobs. …This was before the third fire, after which Mackenzie indicated it still planned to rebuild the mill. But the union alleges MacKenzie decided before the last fire happened that it wouldn’t rebuild. Western Forest Products says it will curtail all operations at its Chemainus sawmill next week, sidelining 150 employees for an indefinite period. The company said the curtailment, set to start June 18, is due to market challenges that include weaker lumber demand and higher US softwood lumber duties, as well as a lack of available viable log supplies. The company also blamed market conditions and a lack of log supplies for a similar shutdown in the spring of last year. Western Forest Products’ other mills at Duke Point, Ladysmith, Saltair and Cowichan Bay, and a value-added remanufacturing plant in Chemainus, will continue to operate, said Babita Khunkhun, senior director of communications for Western Forest Products. She said there is no end date for the curtailment at the Chemainus mill at this point, as the company monitors conditions. The mayor of North Cowichan said he was initially told 55 workers were facing layoffs.

Western Forest Products says it will curtail all operations at its Chemainus sawmill next week, sidelining 150 employees for an indefinite period. The company said the curtailment, set to start June 18, is due to market challenges that include weaker lumber demand and higher US softwood lumber duties, as well as a lack of available viable log supplies. The company also blamed market conditions and a lack of log supplies for a similar shutdown in the spring of last year. Western Forest Products’ other mills at Duke Point, Ladysmith, Saltair and Cowichan Bay, and a value-added remanufacturing plant in Chemainus, will continue to operate, said Babita Khunkhun, senior director of communications for Western Forest Products. She said there is no end date for the curtailment at the Chemainus mill at this point, as the company monitors conditions. The mayor of North Cowichan said he was initially told 55 workers were facing layoffs. TORONTO – The Ontario government released

TORONTO – The Ontario government released  The major assets of the beleaguered San Group are under contract to be sold, awaiting only court approval. The monitor overseeing the credit-protection process has applied to the courts for approval of the sale. A court date is set for this week. …The largest creditors support the sales, despite the fact “they will suffer a significant shortfall on their debt.” The main properties in question are the Coulson manufacturing sawmills and San Group’s value-added facility in Port Alberni. There is also a mill in Langley and an adjacent agricultural parcel. The Surrey-based Fraserview Cedar has agreed to buy the Coulson facility in Port Alberni. The group has said it expects to have the mill up and running this year if the deal closes. A numbered BC company has entered into an agreement to buy the value-added facility. The buyers will lease the site to Ucluelet-based IGV Housing, which specializes in manufacturing scalable housing that combines pre-fab and on-site processes.

The major assets of the beleaguered San Group are under contract to be sold, awaiting only court approval. The monitor overseeing the credit-protection process has applied to the courts for approval of the sale. A court date is set for this week. …The largest creditors support the sales, despite the fact “they will suffer a significant shortfall on their debt.” The main properties in question are the Coulson manufacturing sawmills and San Group’s value-added facility in Port Alberni. There is also a mill in Langley and an adjacent agricultural parcel. The Surrey-based Fraserview Cedar has agreed to buy the Coulson facility in Port Alberni. The group has said it expects to have the mill up and running this year if the deal closes. A numbered BC company has entered into an agreement to buy the value-added facility. The buyers will lease the site to Ucluelet-based IGV Housing, which specializes in manufacturing scalable housing that combines pre-fab and on-site processes.

A program that protects privately owned forests for timber and other uses has survived in a megabill being put together in the Senate, after falling victim to House budget cutters in May. The Senate Agriculture, Nutrition and Forestry Committee saved the Forest Legacy Program in its piece of the big tax-cut and spending bill, refusing to cut off $100 million in Inflation Reduction Act funding. “This is a victory not only for forests, but for the families, economies, and ecosystems that depend on them,” said Lesley Kane Szynal, chair of the Land and Water Conservation Fund Coalition, an advocacy group, in a news release Thursday. The Forest Legacy Program pays for conservation easements and land purchases that prevent privately owned forests from being converted to other uses. In many cases, they’ve been used to keep timber operations in business while protecting forest watersheds and allowing for recreational access. [to access the full story an E&E News subscription is required]

A program that protects privately owned forests for timber and other uses has survived in a megabill being put together in the Senate, after falling victim to House budget cutters in May. The Senate Agriculture, Nutrition and Forestry Committee saved the Forest Legacy Program in its piece of the big tax-cut and spending bill, refusing to cut off $100 million in Inflation Reduction Act funding. “This is a victory not only for forests, but for the families, economies, and ecosystems that depend on them,” said Lesley Kane Szynal, chair of the Land and Water Conservation Fund Coalition, an advocacy group, in a news release Thursday. The Forest Legacy Program pays for conservation easements and land purchases that prevent privately owned forests from being converted to other uses. In many cases, they’ve been used to keep timber operations in business while protecting forest watersheds and allowing for recreational access. [to access the full story an E&E News subscription is required] LONDON — US and Chinese officials said on Tuesday they had agreed on a framework to get their trade truce back on track and remove China’s export restrictions on rare earths while offering little sign of a durable resolution to longstanding trade tensions. …Lutnick said the agreement would remove restrictions on Chinese exports of rare earth minerals and magnets and some of the recent US export restrictions “in a balanced way”, but did not provide details…. adding that both sides will now return to present the framework to their respective presidents for approvals. …The two sides left Geneva with fundamentally different views of the terms of that agreement and needed to be more specific on required actions, said Josh Lipsky. …They have until August 10 to negotiate a more comprehensive agreement, or tariff rates will snap back from about 30% to 145% on the U.S. side and from 10% to 125% on the Chinese side.

LONDON — US and Chinese officials said on Tuesday they had agreed on a framework to get their trade truce back on track and remove China’s export restrictions on rare earths while offering little sign of a durable resolution to longstanding trade tensions. …Lutnick said the agreement would remove restrictions on Chinese exports of rare earth minerals and magnets and some of the recent US export restrictions “in a balanced way”, but did not provide details…. adding that both sides will now return to present the framework to their respective presidents for approvals. …The two sides left Geneva with fundamentally different views of the terms of that agreement and needed to be more specific on required actions, said Josh Lipsky. …They have until August 10 to negotiate a more comprehensive agreement, or tariff rates will snap back from about 30% to 145% on the U.S. side and from 10% to 125% on the Chinese side. A federal appeals court on Tuesday agreed to let many of President Trump’s sweeping tariffs on US trade partners remain in effect for now, extending a pause issued late last month after a separate court ruled the tariffs were illegal. The Federal Circuit Court of Appeals granted the Trump administration’s request for a longer pause after issuing a temporary stay of the lower court ruling last month. The court put the case on a fast track to be resolved by the end of this summer, noting that “these cases present issues of exceptional importance warranting expedited en banc consideration of the merits in the first instance.” The decision comes after the US Court of International Trade ruled on May 28 that Congress did not delegate “unbounded” tariff authority to the president in the International Emergency Economic Powers Act of 1977. Trump appealed the ruling and, hours later, the appeals court granted the temporary stay.

A federal appeals court on Tuesday agreed to let many of President Trump’s sweeping tariffs on US trade partners remain in effect for now, extending a pause issued late last month after a separate court ruled the tariffs were illegal. The Federal Circuit Court of Appeals granted the Trump administration’s request for a longer pause after issuing a temporary stay of the lower court ruling last month. The court put the case on a fast track to be resolved by the end of this summer, noting that “these cases present issues of exceptional importance warranting expedited en banc consideration of the merits in the first instance.” The decision comes after the US Court of International Trade ruled on May 28 that Congress did not delegate “unbounded” tariff authority to the president in the International Emergency Economic Powers Act of 1977. Trump appealed the ruling and, hours later, the appeals court granted the temporary stay.

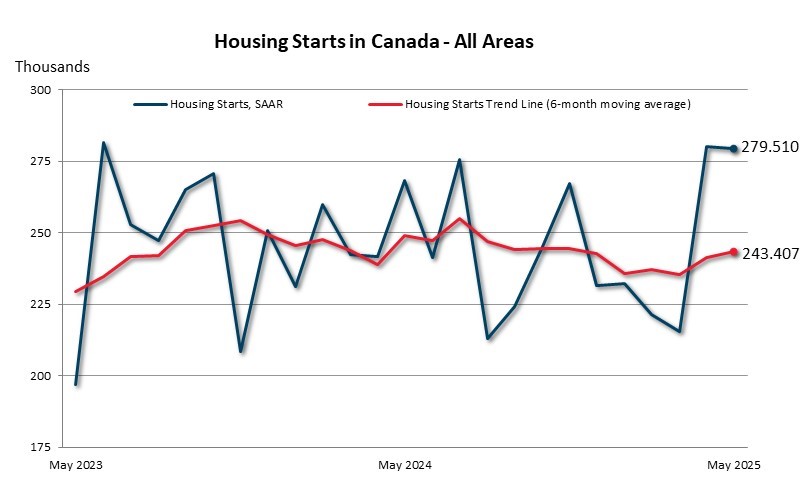

Lumber futures rose past $610 per thousand board feet, a ten-week high, as steady construction activity met tightening supply and mounting trade barriers. US homebuilding remains steady with single-family starts flat at 1.36 million units in April and permits edging lower, while Canadian multi-unit starts jumped 34%, keeping mill orders firm. Canadian harvests are constrained by pine-beetle infestations, prairie wildfires that have burned more than 200,000 hectares this spring and strict cut limits that left British Columbia nearly 42% below its allowable quota in 2023. In the US, sawmill utilization stalled in the mid-70% range despite recent capacity additions. Tariffs of roughly 14.5% on Canadian softwood, along with threats of higher levies, have discouraged cross-border shipments, while major exporters divert supply to Asian and European markets. Elevated fuel and transportation costs further raise delivered prices.

Lumber futures rose past $610 per thousand board feet, a ten-week high, as steady construction activity met tightening supply and mounting trade barriers. US homebuilding remains steady with single-family starts flat at 1.36 million units in April and permits edging lower, while Canadian multi-unit starts jumped 34%, keeping mill orders firm. Canadian harvests are constrained by pine-beetle infestations, prairie wildfires that have burned more than 200,000 hectares this spring and strict cut limits that left British Columbia nearly 42% below its allowable quota in 2023. In the US, sawmill utilization stalled in the mid-70% range despite recent capacity additions. Tariffs of roughly 14.5% on Canadian softwood, along with threats of higher levies, have discouraged cross-border shipments, while major exporters divert supply to Asian and European markets. Elevated fuel and transportation costs further raise delivered prices. The CME’s physical lumber futures have been in a bullish trend since the July 2024 low of $455.50 per 1,000 board feet. The weekly chart indicates that lumber futures have formed higher lows and higher highs, reaching a peak of $699 per 1,000 board feet in March 2025. While the price has dropped below the $600 level, the pattern of higher lows remains intact in June 2025. …Seasonality suggests that a lumber rally may need to wait until 2026… Lumber tends to be a seasonal commodity, with prices peaking during late winter and early spring as the weather improves and construction activity increases. In 2021, the old random-length lumber futures rose to a record high of $1,711.20 per 1,000 board feet in May, and in 2022, reached a lower high of $1,477.40 in March. …Keep an eye on interest rates as declines could ignite pent-up demand for new homes, which could light a bullish fuse under the lumber futures arena.

The CME’s physical lumber futures have been in a bullish trend since the July 2024 low of $455.50 per 1,000 board feet. The weekly chart indicates that lumber futures have formed higher lows and higher highs, reaching a peak of $699 per 1,000 board feet in March 2025. While the price has dropped below the $600 level, the pattern of higher lows remains intact in June 2025. …Seasonality suggests that a lumber rally may need to wait until 2026… Lumber tends to be a seasonal commodity, with prices peaking during late winter and early spring as the weather improves and construction activity increases. In 2021, the old random-length lumber futures rose to a record high of $1,711.20 per 1,000 board feet in May, and in 2022, reached a lower high of $1,477.40 in March. …Keep an eye on interest rates as declines could ignite pent-up demand for new homes, which could light a bullish fuse under the lumber futures arena.  A final tally of which Ontario municipalities hit their housing targets and how many fell short last year has been finished since mid-February, according to government documents obtained, despite the province refusing to release the data for months. For the past two years, the Ford government has set targets for new homes in towns and cities, promising them extra cash if they meet those goals. The numbers Ontario uses to assess whether or not cities have hit their goals are made up of new homes, long-term care beds and additional units like basements or garden suites. The government set up a website to show which cities had hit their goals. Around October 2024, however, with housing starts across the province stuttering, the government stopped updating the tracker. …While the tracker has appeared abandoned for close to half a year, the government has had “finalized” data for months.

A final tally of which Ontario municipalities hit their housing targets and how many fell short last year has been finished since mid-February, according to government documents obtained, despite the province refusing to release the data for months. For the past two years, the Ford government has set targets for new homes in towns and cities, promising them extra cash if they meet those goals. The numbers Ontario uses to assess whether or not cities have hit their goals are made up of new homes, long-term care beds and additional units like basements or garden suites. The government set up a website to show which cities had hit their goals. Around October 2024, however, with housing starts across the province stuttering, the government stopped updating the tracker. …While the tracker has appeared abandoned for close to half a year, the government has had “finalized” data for months. Stocks wavered Thursday as President Trump threatened setting unilateral tariffs on trading partners in two weeks. The S&P 500 added 0.2%, while the Nasdaq Composite gained 0.1%. …Wall Street awaits further developments on trade policy, especially between the U.S. and China, as talks between the two countries have been a focal point this week. Trump said Wednesday he would be willing to extend a July 8 deadline for finishing trade talks with countries before higher US levies take effect, but that the extensions may not be necessary. …“We still think the primary driver for market direction and to break out to all-time highs would be some resolution for tariffs and how they interlink with the budget and the Fed. And we see a lot of headlines about negotiations or pauses or frameworks, but we still haven’t seen a single signed trade deal,” said Tom Hainlin at U.S. Bank Asset Management Group.

Stocks wavered Thursday as President Trump threatened setting unilateral tariffs on trading partners in two weeks. The S&P 500 added 0.2%, while the Nasdaq Composite gained 0.1%. …Wall Street awaits further developments on trade policy, especially between the U.S. and China, as talks between the two countries have been a focal point this week. Trump said Wednesday he would be willing to extend a July 8 deadline for finishing trade talks with countries before higher US levies take effect, but that the extensions may not be necessary. …“We still think the primary driver for market direction and to break out to all-time highs would be some resolution for tariffs and how they interlink with the budget and the Fed. And we see a lot of headlines about negotiations or pauses or frameworks, but we still haven’t seen a single signed trade deal,” said Tom Hainlin at U.S. Bank Asset Management Group.

Japan’s government remains cautiously optimistic, sticking to its long-held conviction that the economy should be able to weather both external shocks on already sluggish growth and a cost-led surge in domestic inflation, repeating it is expected to stay on a “modest recovery” track. In its monthly report for June released Wednesday by the Cabinet Office, less than three weeks after the prior report, the government repeated that the economy is “recovering at a moderate pace but confronted by the uncertainty arising from the US trade policy.” Tokyo appears to have brought forward the release of its monthly report by about two weeks so that it could officially update the status of Japan’s economy before the leaders of the Group of Seven major nations gather for their annual summit at Kananaskis in the Canadian province of Alberta from June 15 to June 17.

Japan’s government remains cautiously optimistic, sticking to its long-held conviction that the economy should be able to weather both external shocks on already sluggish growth and a cost-led surge in domestic inflation, repeating it is expected to stay on a “modest recovery” track. In its monthly report for June released Wednesday by the Cabinet Office, less than three weeks after the prior report, the government repeated that the economy is “recovering at a moderate pace but confronted by the uncertainty arising from the US trade policy.” Tokyo appears to have brought forward the release of its monthly report by about two weeks so that it could officially update the status of Japan’s economy before the leaders of the Group of Seven major nations gather for their annual summit at Kananaskis in the Canadian province of Alberta from June 15 to June 17.  The American military is looking at the possibility of using 3D printing, additive construction methods and cross-laminated timber (CLT) to build new military barracks and other buildings at various bases. The U.S. Army Corps of Engineers has already built new barracks at Fort Bliss, Texas, using 3D printing. …CLT is also being used in another centre planned at Joint Expeditionary Base Little Creek-Fort Story, also in Virginia. …Engineers at the Air Force Civil Engineer Center of the Air Force Installation and Mission Support Center are leading the way with research and development on the possibility of implementing concrete building construction techniques in future military construction projects. They discussed a number of topics, including additive construction, 3D-printed buildings, high performance cement and concrete mixes, geosynthetics, mass timber, composite materials, industrialized construction, tension fabric structures and carbon fiber-reinforced polymers.

The American military is looking at the possibility of using 3D printing, additive construction methods and cross-laminated timber (CLT) to build new military barracks and other buildings at various bases. The U.S. Army Corps of Engineers has already built new barracks at Fort Bliss, Texas, using 3D printing. …CLT is also being used in another centre planned at Joint Expeditionary Base Little Creek-Fort Story, also in Virginia. …Engineers at the Air Force Civil Engineer Center of the Air Force Installation and Mission Support Center are leading the way with research and development on the possibility of implementing concrete building construction techniques in future military construction projects. They discussed a number of topics, including additive construction, 3D-printed buildings, high performance cement and concrete mixes, geosynthetics, mass timber, composite materials, industrialized construction, tension fabric structures and carbon fiber-reinforced polymers. PORTLAND, Oregon – The Port of Portland is leasing a former marine terminal to a mass timber company as part of an effort to spur housing development and job growth in the area. On Wednesday, the Port of Portland approved a lease for Zaugg Timber Solutions to open a factory at the Port’s Mass Timber and Housing Innovation Campus at Terminal 2. …“Our partnership with ZTS marks a major leap forward in developing the Mass Timber and Housing Innovation Campus at T2,” said Kimberly Branam. “Their new manufacturing facility will boost our region’s economy by promoting sustainable forestry practices, creating quality jobs, and increasing housing production.” While the new 100,000-square-foot manufacturing facility is expected to open in 2028, ZTS will produce mass timber modular housing units, industrial and commercial buildings and other building components starting in 2026 in an interim manufacturing facility at the terminal, officials noted.

PORTLAND, Oregon – The Port of Portland is leasing a former marine terminal to a mass timber company as part of an effort to spur housing development and job growth in the area. On Wednesday, the Port of Portland approved a lease for Zaugg Timber Solutions to open a factory at the Port’s Mass Timber and Housing Innovation Campus at Terminal 2. …“Our partnership with ZTS marks a major leap forward in developing the Mass Timber and Housing Innovation Campus at T2,” said Kimberly Branam. “Their new manufacturing facility will boost our region’s economy by promoting sustainable forestry practices, creating quality jobs, and increasing housing production.” While the new 100,000-square-foot manufacturing facility is expected to open in 2028, ZTS will produce mass timber modular housing units, industrial and commercial buildings and other building components starting in 2026 in an interim manufacturing facility at the terminal, officials noted.

The buzz of saw teeth and scent of crushed pine needles filled the air as Roy Blackburn walked up a muddy path tucked away in the Willamette National Forest. …Timber once drove the economies of states like Oregon. But forest harvests nosedived beginning in the early 1990s due to stricter environmental regulations, a changing lumber market and other factors. President Trump hopes to reverse that trend by executive fiat, ordering the US Forest Service to ramp up logging on federal lands in what environmental groups like Earthjustice call a “cynical attempt to justify destructive logging.” …The amount of timber harvested on Forest Service land has decreased nearly 80% since reaching a high in 1987. …Canadian competition was on Trump’s mind in March when he signed an executive order to immediately expand timber production on federal lands. …Previous administrations allowed environmental groups to drive “the decision-making on our forests.” That’s changing.

The buzz of saw teeth and scent of crushed pine needles filled the air as Roy Blackburn walked up a muddy path tucked away in the Willamette National Forest. …Timber once drove the economies of states like Oregon. But forest harvests nosedived beginning in the early 1990s due to stricter environmental regulations, a changing lumber market and other factors. President Trump hopes to reverse that trend by executive fiat, ordering the US Forest Service to ramp up logging on federal lands in what environmental groups like Earthjustice call a “cynical attempt to justify destructive logging.” …The amount of timber harvested on Forest Service land has decreased nearly 80% since reaching a high in 1987. …Canadian competition was on Trump’s mind in March when he signed an executive order to immediately expand timber production on federal lands. …Previous administrations allowed environmental groups to drive “the decision-making on our forests.” That’s changing.

Trump administration officials on Tuesday warned of an ominous-looking fire season ahead as they repeated the case for unifying federal wildland firefighting agencies and thinning overgrown forests. Convening with the president in the White House Oval Office, Interior Secretary Doug Burgum and Agriculture Secretary Brook Rollins alternated lavishing praise on President Donald Trump with a fire-fighting call to arms and an insistence that their respective departments will be ready. “This is going to be an above-normal fire season,” Rollins said, standing near Trump, who was sitting behind the oak Resolute Desk. “This means that there is a higher likelihood of large and intense wildfires than is typically expected for this time of year for the next few months.” There were 64,897 wildfires reported in 2024, compared to 56,580 reported in 2023, according to the Boise, Idaho-based National Interagency Fire Center. The wildfires consumed 8.9 million acres in 2024 compared to 2.6 million acres in 2023. [to access the full story an E&E News subscription is required]

Trump administration officials on Tuesday warned of an ominous-looking fire season ahead as they repeated the case for unifying federal wildland firefighting agencies and thinning overgrown forests. Convening with the president in the White House Oval Office, Interior Secretary Doug Burgum and Agriculture Secretary Brook Rollins alternated lavishing praise on President Donald Trump with a fire-fighting call to arms and an insistence that their respective departments will be ready. “This is going to be an above-normal fire season,” Rollins said, standing near Trump, who was sitting behind the oak Resolute Desk. “This means that there is a higher likelihood of large and intense wildfires than is typically expected for this time of year for the next few months.” There were 64,897 wildfires reported in 2024, compared to 56,580 reported in 2023, according to the Boise, Idaho-based National Interagency Fire Center. The wildfires consumed 8.9 million acres in 2024 compared to 2.6 million acres in 2023. [to access the full story an E&E News subscription is required]

The federal government could start selling off thousands of acres of Oregon public lands if provisions added to the Big Beautiful Bill win Congressional approval. A draft of the legislation was released Wednesday. Housing is also part of this latest push to sell Bureau of Land Management and Forest Service land. US Senator Mike Lee is calling for the heads of the US Interior and Agriculture departments to dispose of between 2.2 and 3.3 million acres of federal BLM and Forest Service land from 11 states – including Oregon. …Separately, the legislation calls for the Forest Service to boost logging by 75% over the next decade. It’s not clear if those logging goals are realistic. The Forest Service has missed its timber targets every year for more than a decade, though it’s possible that tariffs on Canadian lumber could boost demand for logging in the United States, according to industry analysts.

The federal government could start selling off thousands of acres of Oregon public lands if provisions added to the Big Beautiful Bill win Congressional approval. A draft of the legislation was released Wednesday. Housing is also part of this latest push to sell Bureau of Land Management and Forest Service land. US Senator Mike Lee is calling for the heads of the US Interior and Agriculture departments to dispose of between 2.2 and 3.3 million acres of federal BLM and Forest Service land from 11 states – including Oregon. …Separately, the legislation calls for the Forest Service to boost logging by 75% over the next decade. It’s not clear if those logging goals are realistic. The Forest Service has missed its timber targets every year for more than a decade, though it’s possible that tariffs on Canadian lumber could boost demand for logging in the United States, according to industry analysts.

TEXAS — A plan to open a bioenergy plant in Newton County has reached a new milestone with a landmark deal to supply wood for the site in Bon Wier. Mike Lout with KJAS, reports Nick Andrews, President and CEO of the Scottsdale, Arizona-based USA Bioenergy, announced on Tuesday that his company has

TEXAS — A plan to open a bioenergy plant in Newton County has reached a new milestone with a landmark deal to supply wood for the site in Bon Wier. Mike Lout with KJAS, reports Nick Andrews, President and CEO of the Scottsdale, Arizona-based USA Bioenergy, announced on Tuesday that his company has  The trucking industry has been facing unprecedented challenges in recent years, with a shortage of qualified drivers, rising fuel and insurance costs… and now economic uncertainty caused by tariffs. …Now, one large lawsuit against a trucking company highlights a dangerous practice that has been going on. …The Estate of Sarah Susman v. Starker Forests, Inc., R&T Logging of Oregon, Wolf Cr. Timber Services, Shane Mcvay – is a $65 million wrongful death claim. Sarah Susman… was driving to work in September 2021 when a logging truck operated by a 67-year-old driver rolled over and lost its load. …Family members of the victim believe that the incident can be attributed to a dangerous injury practice referred to as “double brokering.” …Court filings explained that double-brokering is a practice within the trucking industry where multiple contractors pass hauling jobs between them with very little oversight or enforcement of safety regulations.

The trucking industry has been facing unprecedented challenges in recent years, with a shortage of qualified drivers, rising fuel and insurance costs… and now economic uncertainty caused by tariffs. …Now, one large lawsuit against a trucking company highlights a dangerous practice that has been going on. …The Estate of Sarah Susman v. Starker Forests, Inc., R&T Logging of Oregon, Wolf Cr. Timber Services, Shane Mcvay – is a $65 million wrongful death claim. Sarah Susman… was driving to work in September 2021 when a logging truck operated by a 67-year-old driver rolled over and lost its load. …Family members of the victim believe that the incident can be attributed to a dangerous injury practice referred to as “double brokering.” …Court filings explained that double-brokering is a practice within the trucking industry where multiple contractors pass hauling jobs between them with very little oversight or enforcement of safety regulations.