The foreign industrialist who controls Canada’s biggest pulp-and-paper company says he’s a “big believer” in this country and would welcome the opportunity to appear before Parliament to ease any concerns about his ownership. Jackson Widjaja, an Indonesian, says he launched Paper Excellence Group in Canada in 2006 because the country’s politics and regulatory environment are stable while its resources are “very rich.” And he says he intends to continue to invest here, as he aims to become the continent’s top pulp-and-paper producer. …The quick growth of his business empire has generated significant concern, centring on Paper Excellence’s documented ties to the Widjaja family’s other holdings – specifically Sinar Mas and its subsidiary Asia Pulp and Paper Group (APP). …The company lost its accreditation several years ago with the Forest Stewardship Council (FSC). …He said he’s confident that his team is doing everything it can to retain its FSC certification. Sustainability is “at the core of our business.” [to access the full story a Globe & Mail subscription is required]

WASHINGTON, DC — The American Kitchen Cabinet Alliance (AKCA) recently submitted formal comments as part of the Section 232 investigation on Timber, Lumber and Derivatives (including cabinets). Unfairly traded cabinet imports many of them sold at prices that are often over 60% below that of the domestic market are flooding into the US. …“American cabinet manufacturing plants cannot compete with foreign countries flooding the market with unfairly traded cabinets which has resulted in an estimated $6.5 billion in lost revenue to the domestic industry over the last five years,” remarked Perry Miller, President of Kountry Wood Products. “Foreign imports primarily from Cambodia, Malaysia, Mexico, Thailand, Vietnam that are heavily subsidized are destroying American cabinet jobs. …“The domestic cabinet industry is on the brink of collapse. “We are asking for a Section 232 tariff of at least 60%, to level the playing field and stop the cheating as we seek to protect over 250,000 American jobs.”

WASHINGTON, DC — The American Kitchen Cabinet Alliance (AKCA) recently submitted formal comments as part of the Section 232 investigation on Timber, Lumber and Derivatives (including cabinets). Unfairly traded cabinet imports many of them sold at prices that are often over 60% below that of the domestic market are flooding into the US. …“American cabinet manufacturing plants cannot compete with foreign countries flooding the market with unfairly traded cabinets which has resulted in an estimated $6.5 billion in lost revenue to the domestic industry over the last five years,” remarked Perry Miller, President of Kountry Wood Products. “Foreign imports primarily from Cambodia, Malaysia, Mexico, Thailand, Vietnam that are heavily subsidized are destroying American cabinet jobs. …“The domestic cabinet industry is on the brink of collapse. “We are asking for a Section 232 tariff of at least 60%, to level the playing field and stop the cheating as we seek to protect over 250,000 American jobs.” BINGEN, Washington — A plywood mill in the southern Washington city of Bingen will close next month and lay off all 81 workers, the plant’s operator said Thursday. The SDS facility has been operating — with occasional stoppages — since 1949. It uses older equipment, according to Wilkins, Kaiser & Olsen, which was part of a consortium of firms that acquired the mill in 2021. “Regrettably, the long-term challenges and the magnitude of the required investment render continued operation unsustainable,” the mill’s operators said. An adjacent stud mill, planer mill and marine facility will continue operating. Bingen is a small city just across the Columbia River from Hood River. WKO and an affiliated business, Mt. Hood Forest Products, are adding 60 full-time positions to increase their output by 35%. The firms said they will consider hiring some of the laid-off workers.

BINGEN, Washington — A plywood mill in the southern Washington city of Bingen will close next month and lay off all 81 workers, the plant’s operator said Thursday. The SDS facility has been operating — with occasional stoppages — since 1949. It uses older equipment, according to Wilkins, Kaiser & Olsen, which was part of a consortium of firms that acquired the mill in 2021. “Regrettably, the long-term challenges and the magnitude of the required investment render continued operation unsustainable,” the mill’s operators said. An adjacent stud mill, planer mill and marine facility will continue operating. Bingen is a small city just across the Columbia River from Hood River. WKO and an affiliated business, Mt. Hood Forest Products, are adding 60 full-time positions to increase their output by 35%. The firms said they will consider hiring some of the laid-off workers. A federal judge in Jackson, Mississippi, issued an order April 28 allowing a lawsuit by a newspaper publisher and lumber company against the Mississippi River Commission (MRC) to proceed. The lawsuit alleges a lack of transparency in meetings. The suit was originally filed in September 2024. Emmerich Newspapers Inc., which publishes dozens of publications across Mississippi, Louisiana and Arkansas, sued the MRC over what it claimed were secret meetings where proper records were not kept and the public was not notified or admitted. Emmerich was joined as plaintiff by a lumber company that manages hundreds of acres alongside the Mississippi River. The lumber company claims the Corps of Engineers’ decisions on flood control, informed by advice from the MRC, adversely affect its properties. The judge’s decision allows the lawsuit to proceed without ruling on the merits of the allegations.

A federal judge in Jackson, Mississippi, issued an order April 28 allowing a lawsuit by a newspaper publisher and lumber company against the Mississippi River Commission (MRC) to proceed. The lawsuit alleges a lack of transparency in meetings. The suit was originally filed in September 2024. Emmerich Newspapers Inc., which publishes dozens of publications across Mississippi, Louisiana and Arkansas, sued the MRC over what it claimed were secret meetings where proper records were not kept and the public was not notified or admitted. Emmerich was joined as plaintiff by a lumber company that manages hundreds of acres alongside the Mississippi River. The lumber company claims the Corps of Engineers’ decisions on flood control, informed by advice from the MRC, adversely affect its properties. The judge’s decision allows the lawsuit to proceed without ruling on the merits of the allegations.

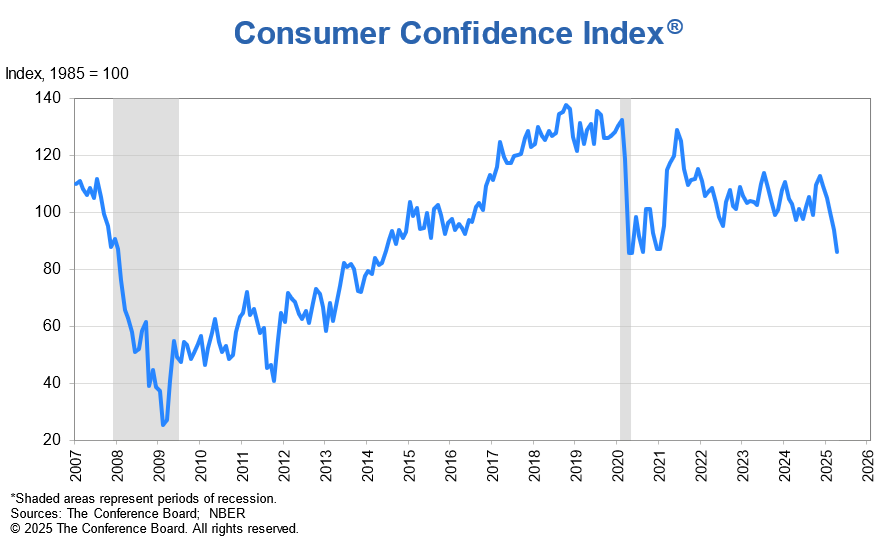

Gross domestic product (GDP) contracted in the first quarter by 0.3%, with imported goods being a large contributor to the decline as the suppliers prepared for President Trump’s tariff proposals once he took office. NAHB estimates this should even out in the second quarter. Other economic data of note are inflation, which is still elevated but creeping downward, and the unemployment rate, which remains low but may edge up among economic uncertainty. …NAHB Chief Economist Robert Dietz hasn’t hit the panic button yet. And I still think that we don’t know what President Trump’s economy really is yet. It’s been policy by sledgehammer, and now they’re going to start putting the pieces back together.” NAHB Senior Officers and staff continue to actively engage with lawmakers on this and other policies, including a special BUILD-PAC Capital Club event this week featuring an interview with Sen. Tim Sheehy.

Gross domestic product (GDP) contracted in the first quarter by 0.3%, with imported goods being a large contributor to the decline as the suppliers prepared for President Trump’s tariff proposals once he took office. NAHB estimates this should even out in the second quarter. Other economic data of note are inflation, which is still elevated but creeping downward, and the unemployment rate, which remains low but may edge up among economic uncertainty. …NAHB Chief Economist Robert Dietz hasn’t hit the panic button yet. And I still think that we don’t know what President Trump’s economy really is yet. It’s been policy by sledgehammer, and now they’re going to start putting the pieces back together.” NAHB Senior Officers and staff continue to actively engage with lawmakers on this and other policies, including a special BUILD-PAC Capital Club event this week featuring an interview with Sen. Tim Sheehy. To kick off National Home Remodeling Month in May, which promotes the benefits of hiring a professional remodeler, the National Association of Home Builders (NAHB) has highlighted

To kick off National Home Remodeling Month in May, which promotes the benefits of hiring a professional remodeler, the National Association of Home Builders (NAHB) has highlighted

Tuesday marked the 100th day of President Trump’s second term in office and there are signs of stress and jitters in the US construction industry, with rising prices, falling confidence, and a sharp uptick in abandoned projects. “Lumber and metals prices shot up in March, while contractors’ inboxes are bulging with ‘Dear Valued Customer’ letters announcing further increases for many products,” said Ken Simonson, chief economist at AGC. “Rapid-fire changes in tariffs threaten to drive prices higher for many essential construction goods,” he added. The price of materials and services used in nonresidential construction rose 0.4% in March, the third monthly increase in a row, AGC said. It was the first time since September 2023 that input prices had risen for three consecutive months, and comes after more than a year of stable or falling prices, Simonson said. …Within the 0.4% hike, lumber and plywood rose 2.7%.

Tuesday marked the 100th day of President Trump’s second term in office and there are signs of stress and jitters in the US construction industry, with rising prices, falling confidence, and a sharp uptick in abandoned projects. “Lumber and metals prices shot up in March, while contractors’ inboxes are bulging with ‘Dear Valued Customer’ letters announcing further increases for many products,” said Ken Simonson, chief economist at AGC. “Rapid-fire changes in tariffs threaten to drive prices higher for many essential construction goods,” he added. The price of materials and services used in nonresidential construction rose 0.4% in March, the third monthly increase in a row, AGC said. It was the first time since September 2023 that input prices had risen for three consecutive months, and comes after more than a year of stable or falling prices, Simonson said. …Within the 0.4% hike, lumber and plywood rose 2.7%.

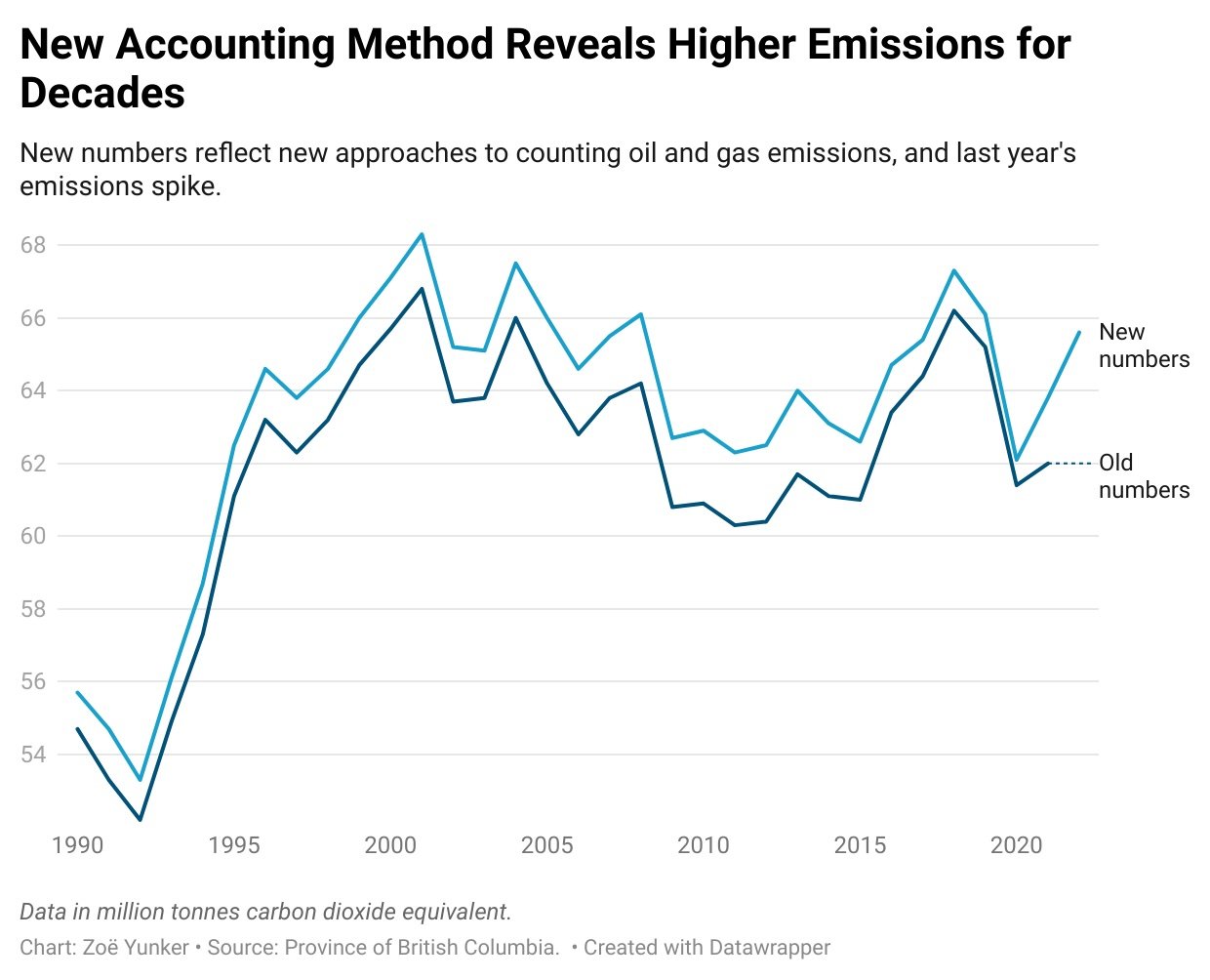

May is Invasive Species Action Month and 33 organizations throughout BC will be able to continue their work fighting invasive plants, due in part to a funding boost. …Ravi Parmar, Minister of Forests said “No one person, group, agency or government can effectively control invasive plant species alone, and collaboration is critical to everyone’s success. The work these groups do is crucial in our fight to ensure BC’s environments remain healthy and vibrant.” …Nearly $3 million will go toward groups, such as regional invasive species committees, local governments, environmental groups, researchers and the Invasive Species Council of BC, to continue collaboration and support of invasive plant programs and management actions. …Gail Wallin, executive director, Invasive Species Council of British Columbia said, “Invasive plants are estimated to cost us over $2 billion in losses annually.”

May is Invasive Species Action Month and 33 organizations throughout BC will be able to continue their work fighting invasive plants, due in part to a funding boost. …Ravi Parmar, Minister of Forests said “No one person, group, agency or government can effectively control invasive plant species alone, and collaboration is critical to everyone’s success. The work these groups do is crucial in our fight to ensure BC’s environments remain healthy and vibrant.” …Nearly $3 million will go toward groups, such as regional invasive species committees, local governments, environmental groups, researchers and the Invasive Species Council of BC, to continue collaboration and support of invasive plant programs and management actions. …Gail Wallin, executive director, Invasive Species Council of British Columbia said, “Invasive plants are estimated to cost us over $2 billion in losses annually.”

MOUNTAIN VIEW COUNTY, Alberta – Provincial officials elevated the wildfire danger rating to extreme across the Rocky Mountain House Forest Area Saturday after five new wildfires ignited in the area in recent days. Parts of Mountain View County are included in the forest area, namely west of Sundre and Bergen, covering Coal Camp and Bearberry west of Range Road 60 from Township Road 312 to the north boundary of the county. “The wildfire danger is now extreme in the Rocky Mountain House Forest Area,” the province said in its May 3 update for the forest protection area. “Dead and dry vegetation continues to be a major concern, as it is highly flammable and provides an easily available fuel source for wildfires.” …On Thursday, two wildfires were discovered in the Rocky Mountain House Forest Area while three more were discovered on Friday.

MOUNTAIN VIEW COUNTY, Alberta – Provincial officials elevated the wildfire danger rating to extreme across the Rocky Mountain House Forest Area Saturday after five new wildfires ignited in the area in recent days. Parts of Mountain View County are included in the forest area, namely west of Sundre and Bergen, covering Coal Camp and Bearberry west of Range Road 60 from Township Road 312 to the north boundary of the county. “The wildfire danger is now extreme in the Rocky Mountain House Forest Area,” the province said in its May 3 update for the forest protection area. “Dead and dry vegetation continues to be a major concern, as it is highly flammable and provides an easily available fuel source for wildfires.” …On Thursday, two wildfires were discovered in the Rocky Mountain House Forest Area while three more were discovered on Friday. Firefighters from Fort St. John and the B.C. Wildfire Service were battling a blaze that prompted evacuations late Thursday, the city said. The fire is in the Fish Creek Community Forest on the northern outskirts of the city. …The wildfire service website indicates the out-of-control blaze was discovered Thursday and spanned an estimated 0.56 square kilometres — about four times the size of Granville Island in Vancouver — as of 7:32 p.m. The suspected cause of the fire is human activity. The fire is one of nearly two dozen active across BC on Thursday, as the provincial government warned that a combination of warm, dry conditions and strong winds would raise the fire risk in southern parts of B.C. It’s one of two blazes classified as burning out of control, the other being a 1.85-square-kilometre blaze that began as two separate fires about 30 kilometres southwest of Dawson Creek, which is south of Fort St. John.

Firefighters from Fort St. John and the B.C. Wildfire Service were battling a blaze that prompted evacuations late Thursday, the city said. The fire is in the Fish Creek Community Forest on the northern outskirts of the city. …The wildfire service website indicates the out-of-control blaze was discovered Thursday and spanned an estimated 0.56 square kilometres — about four times the size of Granville Island in Vancouver — as of 7:32 p.m. The suspected cause of the fire is human activity. The fire is one of nearly two dozen active across BC on Thursday, as the provincial government warned that a combination of warm, dry conditions and strong winds would raise the fire risk in southern parts of B.C. It’s one of two blazes classified as burning out of control, the other being a 1.85-square-kilometre blaze that began as two separate fires about 30 kilometres southwest of Dawson Creek, which is south of Fort St. John.