The National Association of Homebuilders (NAHB) has once again demonstrated its allegiance to Canadian industry and Canadian workers by strongly backing S. 3943, a bill that would cost American jobs, destabilize the domestic supply of softwood lumber, and bolster Canada’s ability to unload its massive excess lumber capacity into the US market. “The simple fact is that S. 3943, which the NAHB champions, would do nothing to actually address the important issue of housing affordability,” stated Steve Swanson, CEO of Swanson Group, and Chairman of the US Lumber Coalition. …Said Swanson, “If the NAHB and the National Lumber and Building Material Dealers Association want a stable supply of lumber that is not impacted by duties or tariffs, the answer is to enforce our trade laws fully and effectively to allow our domestic industry to continue on its growth path. Simply put, trade law enforcement and Section 232 tariffs will further increase domestic production.”

The National Association of Homebuilders (NAHB) has once again demonstrated its allegiance to Canadian industry and Canadian workers by strongly backing S. 3943, a bill that would cost American jobs, destabilize the domestic supply of softwood lumber, and bolster Canada’s ability to unload its massive excess lumber capacity into the US market. “The simple fact is that S. 3943, which the NAHB champions, would do nothing to actually address the important issue of housing affordability,” stated Steve Swanson, CEO of Swanson Group, and Chairman of the US Lumber Coalition. …Said Swanson, “If the NAHB and the National Lumber and Building Material Dealers Association want a stable supply of lumber that is not impacted by duties or tariffs, the answer is to enforce our trade laws fully and effectively to allow our domestic industry to continue on its growth path. Simply put, trade law enforcement and Section 232 tariffs will further increase domestic production.”

Conifex Timber announced that its wholly-owned subsidiary Conifex Mackenzie Forest Products has completed a $19 million secured term loan with the Business Development Bank of Canada (BDC) under the Softwood Lumber Guarantee Program. The loan has a maturity date of July 15, 2033. …The loan allows for interest-only payments until August 2028. A portion of the loan was used to repay a bridge advance from Conifex’s existing senior secured timber lender. The balance of the loan is available for working capital and general corporate purposes. Conifex also announced that it successfully restarted its sawmill in February. With the successful completion of the term loan, the Company is progressing toward normalized operations and currently anticipates sustaining two-shift operations in the second half of 2026, subject to fibre supply conditions.

Conifex Timber announced that its wholly-owned subsidiary Conifex Mackenzie Forest Products has completed a $19 million secured term loan with the Business Development Bank of Canada (BDC) under the Softwood Lumber Guarantee Program. The loan has a maturity date of July 15, 2033. …The loan allows for interest-only payments until August 2028. A portion of the loan was used to repay a bridge advance from Conifex’s existing senior secured timber lender. The balance of the loan is available for working capital and general corporate purposes. Conifex also announced that it successfully restarted its sawmill in February. With the successful completion of the term loan, the Company is progressing toward normalized operations and currently anticipates sustaining two-shift operations in the second half of 2026, subject to fibre supply conditions. The Musqueam First Nation’s agreement with Ottawa to advance the nation’s rights and title over an area that spans the western half of Greater Vancouver will force Canada to grapple with overlapping Indigenous claims, the boundaries of civic governance, and the principles of co-operative federalism. The deal acknowledges the existence of constitutionally protected Aboriginal title and creates a framework to implement Musqueam’s rights and title in their traditional territory. It is accompanied by two other agreements that create a framework for shared decision-making over fisheries, marine stewardship and land use. Just where that title will be recognized, and what rights will be affirmed, are yet to be negotiated. The Musqueam’s traditional territory has overlapping and shared territories with its First Nation neighbours. …Ottawa’s deal with Musqueam First Nation raises alarm about property rights in Vancouver area. …Cowichan decision leads to another claim on private lands in BC. [to access the full story a Globe & Mail subscription is required]

The Musqueam First Nation’s agreement with Ottawa to advance the nation’s rights and title over an area that spans the western half of Greater Vancouver will force Canada to grapple with overlapping Indigenous claims, the boundaries of civic governance, and the principles of co-operative federalism. The deal acknowledges the existence of constitutionally protected Aboriginal title and creates a framework to implement Musqueam’s rights and title in their traditional territory. It is accompanied by two other agreements that create a framework for shared decision-making over fisheries, marine stewardship and land use. Just where that title will be recognized, and what rights will be affirmed, are yet to be negotiated. The Musqueam’s traditional territory has overlapping and shared territories with its First Nation neighbours. …Ottawa’s deal with Musqueam First Nation raises alarm about property rights in Vancouver area. …Cowichan decision leads to another claim on private lands in BC. [to access the full story a Globe & Mail subscription is required]

March 19, 2026 | 6:30-9 PM | UBC Robson Square Theatre — Experts from the Allard School of Law (Ljiljana Biuković), Vancouver School of Economics (Torsten Jaccard), Faculty of Forestry & Environmental Stewardship (Harry Nelson), and Political Science (Stewart Prest) will explore the evolving Canada–U.S. economic relationship and what it means for Canada’s future. As the 2026 joint review of the Canada–United States–Mexico Agreement (CUSMA) approaches, Canada faces significant shifts in its most important trading relationship. From tariffs on steel to ongoing tensions in British Columbia’s forestry sector, long-standing trade dynamics are being tested and the era of predictable trade and stable multilateral rules may be coming to an end. Policymakers, industry leaders, and people interested in understanding the structural changes shaping Canada’s economic future are encouraged to attend. Panelists will examine emerging geopolitical realities and their implications for Canada, highlighting BC forestry as a case study on how international trade pressures are affecting local industries, workers, and communities.

March 19, 2026 | 6:30-9 PM | UBC Robson Square Theatre — Experts from the Allard School of Law (Ljiljana Biuković), Vancouver School of Economics (Torsten Jaccard), Faculty of Forestry & Environmental Stewardship (Harry Nelson), and Political Science (Stewart Prest) will explore the evolving Canada–U.S. economic relationship and what it means for Canada’s future. As the 2026 joint review of the Canada–United States–Mexico Agreement (CUSMA) approaches, Canada faces significant shifts in its most important trading relationship. From tariffs on steel to ongoing tensions in British Columbia’s forestry sector, long-standing trade dynamics are being tested and the era of predictable trade and stable multilateral rules may be coming to an end. Policymakers, industry leaders, and people interested in understanding the structural changes shaping Canada’s economic future are encouraged to attend. Panelists will examine emerging geopolitical realities and their implications for Canada, highlighting BC forestry as a case study on how international trade pressures are affecting local industries, workers, and communities.

The head of B.C.’s Declaration Act Secretariat has left government on the eve of Premier David Eby’s move to change the landmark law to address court rulings that threaten private property rights. Jessica Wood, the province’s first Indigenous deputy minister, announced late last week she was departing the secretariat. “The Declaration Act was the first legislation in Canada to require consideration and alignment of provincial law with the United Nations Declaration on the Rights of Indigenous Peoples in consultation and cooperation with Indigenous Peoples,” Wood said in a post on

The head of B.C.’s Declaration Act Secretariat has left government on the eve of Premier David Eby’s move to change the landmark law to address court rulings that threaten private property rights. Jessica Wood, the province’s first Indigenous deputy minister, announced late last week she was departing the secretariat. “The Declaration Act was the first legislation in Canada to require consideration and alignment of provincial law with the United Nations Declaration on the Rights of Indigenous Peoples in consultation and cooperation with Indigenous Peoples,” Wood said in a post on  Twenty years after spinning out Canfor Pulp Products as a separate entity, Canfor Corp. plans to bring it back into the fold to prevent the subsidiary from sinking. …Since December, its stock has plunged to about $0.50 per share. A March 6 shareholder vote on a plan of arrangement is just one of the vital signs indicating how bad 2025 was for the forestry sector in general, and BC forestry companies in particular. …But B.C. has been particularly hard hit with sawmill and pulp mill closures due to its fibre constraints and higher operating costs. The most recent high-profile mill closure in BC was the Domtar pulp mill in Crofton at the end of December. BC pulp mills rely on wood chips from sawmills to produce pulp. But so many sawmills have permanently shuttered in B.C. in the last few years that pulp mills now struggle to find enough fibre to run their mills.

Twenty years after spinning out Canfor Pulp Products as a separate entity, Canfor Corp. plans to bring it back into the fold to prevent the subsidiary from sinking. …Since December, its stock has plunged to about $0.50 per share. A March 6 shareholder vote on a plan of arrangement is just one of the vital signs indicating how bad 2025 was for the forestry sector in general, and BC forestry companies in particular. …But B.C. has been particularly hard hit with sawmill and pulp mill closures due to its fibre constraints and higher operating costs. The most recent high-profile mill closure in BC was the Domtar pulp mill in Crofton at the end of December. BC pulp mills rely on wood chips from sawmills to produce pulp. But so many sawmills have permanently shuttered in B.C. in the last few years that pulp mills now struggle to find enough fibre to run their mills.

On Dec. 2, 2025, Domtar announced it would permanently close Crofton’s nearly 70-year-old mill citing a lack of affordable fibre in BC and rising cost of materials. In response, the Municipality of North Cowichan created a Community Transition Table to coordinate union leadership, worker support and discussions on the future of the mill site. …The Discourse has compiled a timeline of major events at the Crofton mill to help understand the historical context of the latest mill closure. …1957: The mill opens and BC Forest Products (BCFP) told the citizens of Crofton it would employ 300 people and have an annual payroll of $1.5 million. Crofton was chosen as the location for the mill after an “extensive” three year survey by BCFP found the Cowichan River had adequate water supply for the mill. 1963: BCFP announced an $18.5 million expansion of the Crofton mill to expand the capacity to produce paper for its second newsprint machine.

On Dec. 2, 2025, Domtar announced it would permanently close Crofton’s nearly 70-year-old mill citing a lack of affordable fibre in BC and rising cost of materials. In response, the Municipality of North Cowichan created a Community Transition Table to coordinate union leadership, worker support and discussions on the future of the mill site. …The Discourse has compiled a timeline of major events at the Crofton mill to help understand the historical context of the latest mill closure. …1957: The mill opens and BC Forest Products (BCFP) told the citizens of Crofton it would employ 300 people and have an annual payroll of $1.5 million. Crofton was chosen as the location for the mill after an “extensive” three year survey by BCFP found the Cowichan River had adequate water supply for the mill. 1963: BCFP announced an $18.5 million expansion of the Crofton mill to expand the capacity to produce paper for its second newsprint machine. The mayors of Squamish and 100 Mile House, B.C., want to see the railway linking their two communities preserved. CN Rail is responsible for the maintenance and upkeep of a portion of B.C.’s rail network between Squamish and Exeter, just northwest of 100 Mile House. In July 2025, the national rail operator said it provided notice of its intent to discontinue those operations. 100 Mile House Mayor Maureen Pinkney says her town is working with several other municipalities to make a business case for the railway, and have hired a consultant to research the details. The rail line goes through an industrial park in 100 Mile House, explained Pinkney, connecting industries like forestry. The town’s oriented strand board plant shut down in 2019 and West Fraser closed its lumber mill at the end of last year, but Pinkney said there’s still fibre that can be utilized for other wood products.

The mayors of Squamish and 100 Mile House, B.C., want to see the railway linking their two communities preserved. CN Rail is responsible for the maintenance and upkeep of a portion of B.C.’s rail network between Squamish and Exeter, just northwest of 100 Mile House. In July 2025, the national rail operator said it provided notice of its intent to discontinue those operations. 100 Mile House Mayor Maureen Pinkney says her town is working with several other municipalities to make a business case for the railway, and have hired a consultant to research the details. The rail line goes through an industrial park in 100 Mile House, explained Pinkney, connecting industries like forestry. The town’s oriented strand board plant shut down in 2019 and West Fraser closed its lumber mill at the end of last year, but Pinkney said there’s still fibre that can be utilized for other wood products. HOUSTON, BC –Houston area First Nations were in talks to buy Canfor’s now-closed Houston sawmill and timber tenure throughout last fall, only to have an offer rejected in December, says the chief councillor from the Lake Babine Nation. “Canfor shut down all talks at once,” said Wilf Adam last week. “They did not like the price. That was it.” The company has been trying to sell its Houston and area holdings after years of rolling openings and closures in response to overall market pressure and high operations costs at the mill. …There was hope in the spring of 2023 when… but that hope was quashed in the spring of 2024 when the company announced it was shelving the prospect of a new mill. It then began looking for a buyer for the mill and tenure.

HOUSTON, BC –Houston area First Nations were in talks to buy Canfor’s now-closed Houston sawmill and timber tenure throughout last fall, only to have an offer rejected in December, says the chief councillor from the Lake Babine Nation. “Canfor shut down all talks at once,” said Wilf Adam last week. “They did not like the price. That was it.” The company has been trying to sell its Houston and area holdings after years of rolling openings and closures in response to overall market pressure and high operations costs at the mill. …There was hope in the spring of 2023 when… but that hope was quashed in the spring of 2024 when the company announced it was shelving the prospect of a new mill. It then began looking for a buyer for the mill and tenure. OTTAWA — The federal government is being accused of creating an uneven playing field in Canada’s shipping industry, and critics claim the Prime Minister’s Office is unwilling to rectify it. Later this spring, Ottawa is expected to launch a federal subsidy program to help reduce the cost of shipping lumber and steel between provinces by 50%. But the subsidies — promised by Carney back in November — will only go to rail companies. “We support this initiative to give a boost to those Canadian industries. But what we were asking was for parity because many destinations and commodities, only maritime transport can handle that,” said Etienne Duchesne, business development project manager at Desgagnés, a maritime shipping company based in Quebec. …In the House of Commons last week, Bloc Québécois MP Claude DeBellefeuille said the government was creating “unfair competition between rail transportation and marine transportation,” putting jobs and supply chains at risk.

OTTAWA — The federal government is being accused of creating an uneven playing field in Canada’s shipping industry, and critics claim the Prime Minister’s Office is unwilling to rectify it. Later this spring, Ottawa is expected to launch a federal subsidy program to help reduce the cost of shipping lumber and steel between provinces by 50%. But the subsidies — promised by Carney back in November — will only go to rail companies. “We support this initiative to give a boost to those Canadian industries. But what we were asking was for parity because many destinations and commodities, only maritime transport can handle that,” said Etienne Duchesne, business development project manager at Desgagnés, a maritime shipping company based in Quebec. …In the House of Commons last week, Bloc Québécois MP Claude DeBellefeuille said the government was creating “unfair competition between rail transportation and marine transportation,” putting jobs and supply chains at risk.

EAR FALLS, Ontario — No news is not good news when it comes to the future of the sawmill in Ear Falls. Mayor of the community Kevin Kahoot says he’s supposed to talk with Interfor, the owner of the mill, this week. “We have regular conversations in the last few months…every couple of weeks,” says Kahoot. “It’s been kind of status quo recently. They keep pushing markets and tariffs and those kinds of things. But I don’t see a lot of movement maybe until springtime.” The sawmill shut down indefinitely back in October throwing 150 people out of work. [END]

EAR FALLS, Ontario — No news is not good news when it comes to the future of the sawmill in Ear Falls. Mayor of the community Kevin Kahoot says he’s supposed to talk with Interfor, the owner of the mill, this week. “We have regular conversations in the last few months…every couple of weeks,” says Kahoot. “It’s been kind of status quo recently. They keep pushing markets and tariffs and those kinds of things. But I don’t see a lot of movement maybe until springtime.” The sawmill shut down indefinitely back in October throwing 150 people out of work. [END] New Brunswick royalty revenues have plummeted by $45 million. It’s a figure that has forestry royalties on track to come in at an historic low in the current fiscal year. And it was a decision to significantly cut royalty rates made quietly by the Holt government last July that’s behind it. That’s as the government suggests it’s a move that’s successfully sheltered the industry from curtailments and closures that are being felt across the country. …The province moved to overhaul timber royalty rates in 2022 after acknowledging its former policy of charging forestry companies a flat rate for wood cut in public forests had failed to take advantage of a two-year explosion in international lumber prices. A new system created under the former Higgs government allowed for rates to rise and fall with the prices of various wood-based commodities. “As forest product markets improve in the future, royalty rates will index upwards,” Herron said.

New Brunswick royalty revenues have plummeted by $45 million. It’s a figure that has forestry royalties on track to come in at an historic low in the current fiscal year. And it was a decision to significantly cut royalty rates made quietly by the Holt government last July that’s behind it. That’s as the government suggests it’s a move that’s successfully sheltered the industry from curtailments and closures that are being felt across the country. …The province moved to overhaul timber royalty rates in 2022 after acknowledging its former policy of charging forestry companies a flat rate for wood cut in public forests had failed to take advantage of a two-year explosion in international lumber prices. A new system created under the former Higgs government allowed for rates to rise and fall with the prices of various wood-based commodities. “As forest product markets improve in the future, royalty rates will index upwards,” Herron said.

WASHINGTON — Some two dozen states challenged U.S. President Trump’s new global tariffs on Thursday, filing a lawsuit over import taxes he imposed after a stinging loss at the Supreme Court. The Democratic attorneys general and governors in the lawsuit argue that Trump is overstepping his power with planned 15% tariffs on much of the world. …Section 122, which has never been invoked, allows the president to impose tariffs of up to 15%. They are limited to five months unless extended by Congress. The lawsuit is led by attorneys general from Oregon, Arizona, California and New York. …The new suit argues that Trump can’t pivot to Section 122 because it was intended to be used only in specific, limited circumstances — not for sweeping import taxes. It also contends the tariffs will drive up costs for states, businesses and consumers.

WASHINGTON — Some two dozen states challenged U.S. President Trump’s new global tariffs on Thursday, filing a lawsuit over import taxes he imposed after a stinging loss at the Supreme Court. The Democratic attorneys general and governors in the lawsuit argue that Trump is overstepping his power with planned 15% tariffs on much of the world. …Section 122, which has never been invoked, allows the president to impose tariffs of up to 15%. They are limited to five months unless extended by Congress. The lawsuit is led by attorneys general from Oregon, Arizona, California and New York. …The new suit argues that Trump can’t pivot to Section 122 because it was intended to be used only in specific, limited circumstances — not for sweeping import taxes. It also contends the tariffs will drive up costs for states, businesses and consumers.

Fiber and glass are among the packaging substrates hardest hit by February closure and layoff announcements. Here are the North American facilities that have announced downsizing efforts:

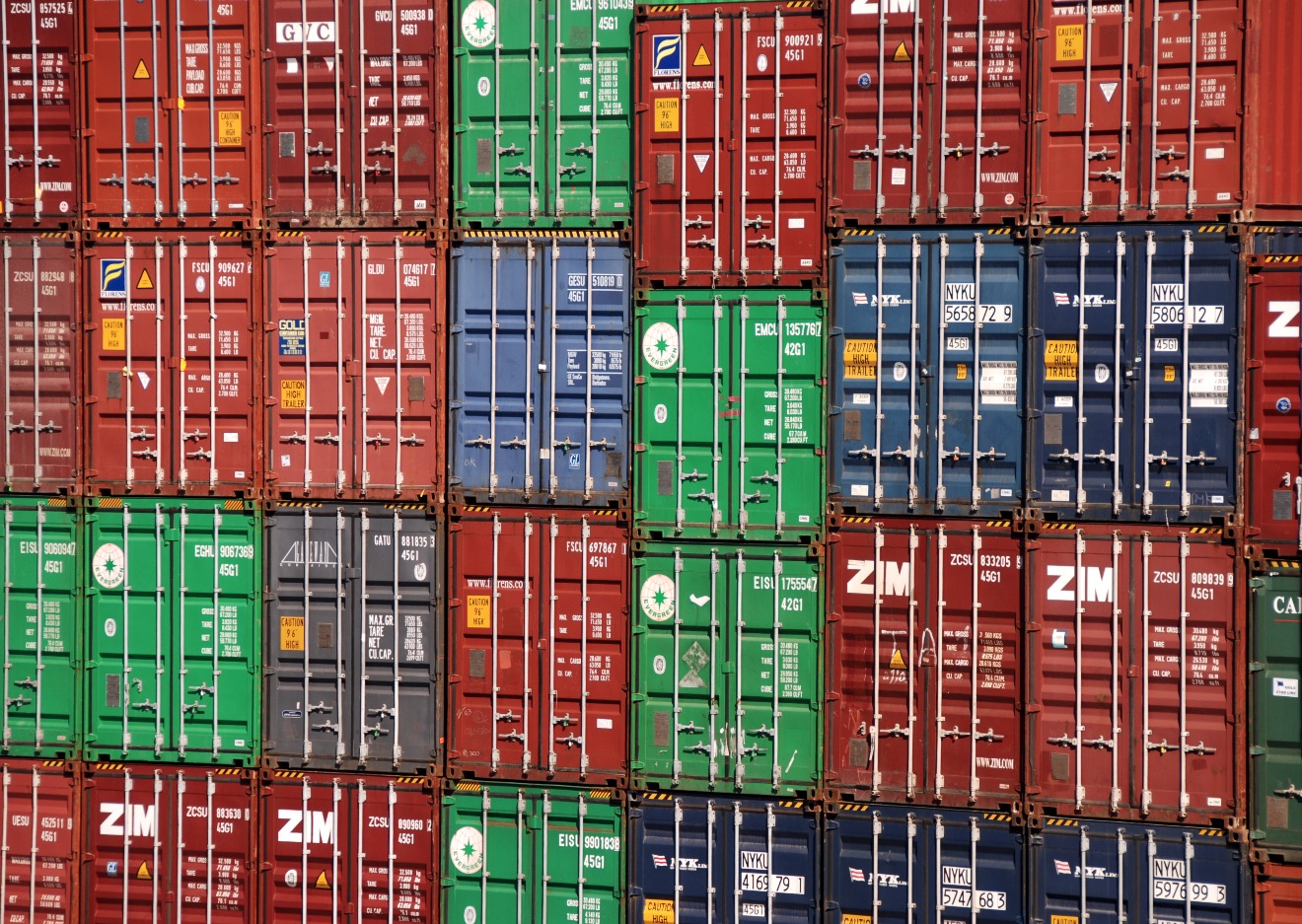

Fiber and glass are among the packaging substrates hardest hit by February closure and layoff announcements. Here are the North American facilities that have announced downsizing efforts: The escalating crisis in the Middle East could extend transport times for Finnish forest industry products to Asia by several weeks. At the same time, freight costs may rise, and container availability could become increasingly uncertain. Iran has announced the closure of the Strait of Hormuz. According to international reporting, several major shipping lines have also paused or reduced traffic through the Suez Canal, redirecting vessels around Africa via the Cape of Good Hope on routes to Asia. The Strait of Hormuz is a critical artery for global oil trade, and disruptions there primarily push up energy prices. For Finland’s forest industry, however, access through the Suez Canal is more directly decisive. Approximately 20 percent of the forest industry’s exports go to Asia, and the majority of those shipments pass through the Suez Canal, says Maarit Lindström, Director and Chief Economist at Metsäteollisuus ry.

The escalating crisis in the Middle East could extend transport times for Finnish forest industry products to Asia by several weeks. At the same time, freight costs may rise, and container availability could become increasingly uncertain. Iran has announced the closure of the Strait of Hormuz. According to international reporting, several major shipping lines have also paused or reduced traffic through the Suez Canal, redirecting vessels around Africa via the Cape of Good Hope on routes to Asia. The Strait of Hormuz is a critical artery for global oil trade, and disruptions there primarily push up energy prices. For Finland’s forest industry, however, access through the Suez Canal is more directly decisive. Approximately 20 percent of the forest industry’s exports go to Asia, and the majority of those shipments pass through the Suez Canal, says Maarit Lindström, Director and Chief Economist at Metsäteollisuus ry.

The US Department of Commerce preliminarily determined that hardwood and decorative plywood from China was sold in the US at less than fair value during the period Oct. 1, 2024, through March 31, 2025, and it also made a preliminary affirmative determination of critical circumstances. Starting March 2, 2026, the publication date of the Commerce Department notice in the Federal Register, US Customs and Border Protection will begin suspending liquidation and collecting cash deposits on covered entries at the applicable rates. The notice sets an estimated weighted-average dumping margin of 187.27% for the China-wide entity and an adjusted cash-deposit rate of 185.96% for the listed producer-exporter combinations as well as for the China-wide entity. …Commerce said it plans to issue its final determination by May 10, 2026, within 75 days of the preliminary decision’s Feb. 24 signature date, after which the US International Trade Commission will decide whether the U.S. industry was materially injured by the imports.

The US Department of Commerce preliminarily determined that hardwood and decorative plywood from China was sold in the US at less than fair value during the period Oct. 1, 2024, through March 31, 2025, and it also made a preliminary affirmative determination of critical circumstances. Starting March 2, 2026, the publication date of the Commerce Department notice in the Federal Register, US Customs and Border Protection will begin suspending liquidation and collecting cash deposits on covered entries at the applicable rates. The notice sets an estimated weighted-average dumping margin of 187.27% for the China-wide entity and an adjusted cash-deposit rate of 185.96% for the listed producer-exporter combinations as well as for the China-wide entity. …Commerce said it plans to issue its final determination by May 10, 2026, within 75 days of the preliminary decision’s Feb. 24 signature date, after which the US International Trade Commission will decide whether the U.S. industry was materially injured by the imports. Portland based Hampton Lumber, one of the nation’s largest lumber manufacturers, confirmed on Thursday that it has parted ways with CEO Randy Schillinger. Steve Zika, vice chair of the Hampton board and its chief executive for 20 years before Schillinger was named to the position in June 2023 has served in an interim capacity since early December, the company said in an emailed statement. [A Portland Business Journal subscription is required to access this full story]

Portland based Hampton Lumber, one of the nation’s largest lumber manufacturers, confirmed on Thursday that it has parted ways with CEO Randy Schillinger. Steve Zika, vice chair of the Hampton board and its chief executive for 20 years before Schillinger was named to the position in June 2023 has served in an interim capacity since early December, the company said in an emailed statement. [A Portland Business Journal subscription is required to access this full story]

VANCOUVER, Washington — Canadian-owned Western Forest Products plans to expand its Fruit Valley manufacturing operation, according to pre-planning documents submitted to the city of Vancouver. Plans show the company expects to build up to three prefabricated steel buildings and an office building, as well as demolish its existing Fruit Valley lumber drying kilns and storage buildings. “We are supporting a modest expansion of our product and service portfolio,” Babita Khunkhun, the company’s senior director of communications, said. Khunkhun said planning for the expansion will continue throughout the year. The company intends to invest in new machinery at its Fruit Valley manufacturing site and make ready-to-install fabricated glulam beams, she said. The Fruit Valley operation is currently used for secondary lumber manufacturing. …A summer blaze left the company’s Columbia Vista sawmill beyond repair according to a state layoff notification from July. The company has decided to sell that site.

VANCOUVER, Washington — Canadian-owned Western Forest Products plans to expand its Fruit Valley manufacturing operation, according to pre-planning documents submitted to the city of Vancouver. Plans show the company expects to build up to three prefabricated steel buildings and an office building, as well as demolish its existing Fruit Valley lumber drying kilns and storage buildings. “We are supporting a modest expansion of our product and service portfolio,” Babita Khunkhun, the company’s senior director of communications, said. Khunkhun said planning for the expansion will continue throughout the year. The company intends to invest in new machinery at its Fruit Valley manufacturing site and make ready-to-install fabricated glulam beams, she said. The Fruit Valley operation is currently used for secondary lumber manufacturing. …A summer blaze left the company’s Columbia Vista sawmill beyond repair according to a state layoff notification from July. The company has decided to sell that site. NEOPIT, Wisconsin — A Neopit wood mill is closed Tuesday after it experienced an early morning fire. Menominee Tribal Enterprises says it lost its stacker building and associated equipment. Some lumber inventory was damaged in the fire as well. All employees are safe and no injuries were reported. Production operations are closed for the day as the organization assesses the damage and begins determining the next steps for recovery and continuity of operations. The Menominee Tribal Enterprises store and main office remain open and are operating during regular business hours.

NEOPIT, Wisconsin — A Neopit wood mill is closed Tuesday after it experienced an early morning fire. Menominee Tribal Enterprises says it lost its stacker building and associated equipment. Some lumber inventory was damaged in the fire as well. All employees are safe and no injuries were reported. Production operations are closed for the day as the organization assesses the damage and begins determining the next steps for recovery and continuity of operations. The Menominee Tribal Enterprises store and main office remain open and are operating during regular business hours. RHINELANDER, Wisconsin — Logging has been a major part of the Northwoods for centuries. In recent years, though, several economic factors may have the industry in jeopardy. Logging has a major economic impact in the Northwoods. But a trend is beginning to start with Wisconsin-based paper mills ceasing certain operations, meaning many logging companies are slowing lumber output. James Wilson, Master logger and owner of Wilson Forestry in Athens, has had his business for over 12 years, but after Ahlstrom announced it will close two paper machines and a pulp mill in Mosinee, options are running thin for where they can sell the wood to. Not only will it cost 200 mill workers their jobs, it will be a major blow to local loggers. Wilson was a supplier of the recently closed Mosinee pulp mill, and has his concerns about the future of the industry.

RHINELANDER, Wisconsin — Logging has been a major part of the Northwoods for centuries. In recent years, though, several economic factors may have the industry in jeopardy. Logging has a major economic impact in the Northwoods. But a trend is beginning to start with Wisconsin-based paper mills ceasing certain operations, meaning many logging companies are slowing lumber output. James Wilson, Master logger and owner of Wilson Forestry in Athens, has had his business for over 12 years, but after Ahlstrom announced it will close two paper machines and a pulp mill in Mosinee, options are running thin for where they can sell the wood to. Not only will it cost 200 mill workers their jobs, it will be a major blow to local loggers. Wilson was a supplier of the recently closed Mosinee pulp mill, and has his concerns about the future of the industry.

WASHINGTON — The widening conflict in the Middle East following joint U.S.-Israeli strikes against Iran is introducing fresh uncertainty into global markets, with potential downstream effects for furniture importers, who despite relying more heavily on Asia-based sourcing than directly in the region are still exposed to volatility across the global supply chain. Analysts told Reuters that a broader regional conflict could disrupt global trade routes, supply chains and commodity prices, all of which have implications downstream for furniture importers by heaping pressure on both costs and capacity. Three potential effects of the ongoing unrest in the Middle East that could spill over for furniture companies include higher fuel costs and landed container prices, container capacity pressures, and risks and longer-term supply chain strains. Over the longer term, the conflict underscores the need to reassess geographic concentration risk.

WASHINGTON — The widening conflict in the Middle East following joint U.S.-Israeli strikes against Iran is introducing fresh uncertainty into global markets, with potential downstream effects for furniture importers, who despite relying more heavily on Asia-based sourcing than directly in the region are still exposed to volatility across the global supply chain. Analysts told Reuters that a broader regional conflict could disrupt global trade routes, supply chains and commodity prices, all of which have implications downstream for furniture importers by heaping pressure on both costs and capacity. Three potential effects of the ongoing unrest in the Middle East that could spill over for furniture companies include higher fuel costs and landed container prices, container capacity pressures, and risks and longer-term supply chain strains. Over the longer term, the conflict underscores the need to reassess geographic concentration risk.