![]() Statistics Canada says the economy capped off a volatile year with a contraction in the final quarter of 2025. The agency said that real gross domestic product declined 0.6% on an annualized basis in the fourth quarter, falling short of expectations from the Bank of Canada and most economists for flat growth. Real GDP per capita was unchanged in the fourth quarter. StatCan said the main reason for the contraction was businesses drawing down their inventories. The economy swung back and forth between gains and losses every quarter last year as sharp changes in exports tied to US tariffs drove volatility in GDP data. …The agency said real GDP rose 1.7% in 2025 overall, cooling from 2% growth in each of the previous two years and marking the slowest pace of annual growth since 2016 outside the COVID-19 pandemic. “Lower exports, particularly to the United States, were the main contributor to the slower rise in GDP in 2025”.

Statistics Canada says the economy capped off a volatile year with a contraction in the final quarter of 2025. The agency said that real gross domestic product declined 0.6% on an annualized basis in the fourth quarter, falling short of expectations from the Bank of Canada and most economists for flat growth. Real GDP per capita was unchanged in the fourth quarter. StatCan said the main reason for the contraction was businesses drawing down their inventories. The economy swung back and forth between gains and losses every quarter last year as sharp changes in exports tied to US tariffs drove volatility in GDP data. …The agency said real GDP rose 1.7% in 2025 overall, cooling from 2% growth in each of the previous two years and marking the slowest pace of annual growth since 2016 outside the COVID-19 pandemic. “Lower exports, particularly to the United States, were the main contributor to the slower rise in GDP in 2025”.

Lumber futures fell toward $550 per thousand board feet, marking a six-week low, as a stagnant North American housing sector failed to absorb heavy seasonal inventories. Demand weakened as January data showed a 7% year over year drop in single family starts and an 8.4% decline in units under construction. High 6.25% mortgage rates and a 5.8% slump in Canadian home sales during January 2026 further stalled new project starts. On the supply side, regional inventory remained bloated. While BC curtailments continued harsh winter storms in the US South halted jobsite activity more than mill output, creating a distributor logjam and forcing aggressive dealer discounting to clear yard space. Additionally, while Trump’s administration 45% softwood duties were meant to buoy prices they instead stifled demand by adding nearly $17,500 to average home costs. This eroded the builder confidence needed to clear current supply.

Lumber futures fell toward $550 per thousand board feet, marking a six-week low, as a stagnant North American housing sector failed to absorb heavy seasonal inventories. Demand weakened as January data showed a 7% year over year drop in single family starts and an 8.4% decline in units under construction. High 6.25% mortgage rates and a 5.8% slump in Canadian home sales during January 2026 further stalled new project starts. On the supply side, regional inventory remained bloated. While BC curtailments continued harsh winter storms in the US South halted jobsite activity more than mill output, creating a distributor logjam and forcing aggressive dealer discounting to clear yard space. Additionally, while Trump’s administration 45% softwood duties were meant to buoy prices they instead stifled demand by adding nearly $17,500 to average home costs. This eroded the builder confidence needed to clear current supply. The strong momentum and bull run of basic materials carried over into 2026 and appears poised to be the TSX’s top-performing sector for the second consecutive year. While mining heavyweights continue to lead the surge, lumber stocks are delivering market-beating returns. Stella-Jones, Canfor Corporation, and Doman Building Materials are worth watching right now. These companies offer operational leverage and have maintained resilience amid persistent price volatility and trade restrictions.

The strong momentum and bull run of basic materials carried over into 2026 and appears poised to be the TSX’s top-performing sector for the second consecutive year. While mining heavyweights continue to lead the surge, lumber stocks are delivering market-beating returns. Stella-Jones, Canfor Corporation, and Doman Building Materials are worth watching right now. These companies offer operational leverage and have maintained resilience amid persistent price volatility and trade restrictions. VANCOUVER, BC – Canfor Corporation announced today that it will record a non-cash asset write down and impairment charge totaling approximately $321 million in its fourth quarter of 2025 results. Of this amount, $215 million relates to the Company’s lumber segment and $106 million relates to its pulp and paper segment. In the lumber segment, the impairment is associated with the Company’s European operations and reflects ongoing log supply pressures in the region, which have resulted in significant increases in log costs and reduced asset carrying values. In the pulp segment, the impairment reflects sustained declines in global US-dollar pulp list prices as well as continued challenges in securing economically viable fibre necessary to support operations. This impairment charge is non-cash in nature and does not affect Canfor’s liquidity position, cash flows or day-to-day operations.

VANCOUVER, BC – Canfor Corporation announced today that it will record a non-cash asset write down and impairment charge totaling approximately $321 million in its fourth quarter of 2025 results. Of this amount, $215 million relates to the Company’s lumber segment and $106 million relates to its pulp and paper segment. In the lumber segment, the impairment is associated with the Company’s European operations and reflects ongoing log supply pressures in the region, which have resulted in significant increases in log costs and reduced asset carrying values. In the pulp segment, the impairment reflects sustained declines in global US-dollar pulp list prices as well as continued challenges in securing economically viable fibre necessary to support operations. This impairment charge is non-cash in nature and does not affect Canfor’s liquidity position, cash flows or day-to-day operations.

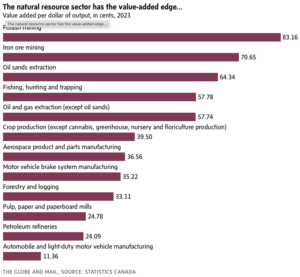

It’s been nearly a century since political economist Harold Innis popularized the phrase “hewers of wood and drawers of water” in decrying Canada’s dependence on natural resources. …Underpinning that cry is the (wrongheaded) assumption that natural resources such as mining, agriculture and energy are second-grade economic activity, less desirable than manufacturing. …That mistake is the foundation for many public policy blunders over many decades. The numbers demolish that myth, and tell a very different story, one in which energy, mining and other natural resources sectors create enormous economic value and are globally competitive. …The federal government needs to get itself out of the way of some of the strongest parts of the Canadian economy. Stop subsidizing inefficient sectors. Stop raising protective tariffs that harm other parts of the economy. Focus on rolling back unjustified regulatory barriers that harm the ability of the entire economy, particularly globally exposed natural resources sectors, to compete. And, most of all, stop the undervaluing Canada’s great natural advantage in natural resources. [to access the full story a Globe & Mail subscription is required]

It’s been nearly a century since political economist Harold Innis popularized the phrase “hewers of wood and drawers of water” in decrying Canada’s dependence on natural resources. …Underpinning that cry is the (wrongheaded) assumption that natural resources such as mining, agriculture and energy are second-grade economic activity, less desirable than manufacturing. …That mistake is the foundation for many public policy blunders over many decades. The numbers demolish that myth, and tell a very different story, one in which energy, mining and other natural resources sectors create enormous economic value and are globally competitive. …The federal government needs to get itself out of the way of some of the strongest parts of the Canadian economy. Stop subsidizing inefficient sectors. Stop raising protective tariffs that harm other parts of the economy. Focus on rolling back unjustified regulatory barriers that harm the ability of the entire economy, particularly globally exposed natural resources sectors, to compete. And, most of all, stop the undervaluing Canada’s great natural advantage in natural resources. [to access the full story a Globe & Mail subscription is required] The pace of homebuilding in Canada continues to slow with no near-term signs of a turnaround, said Canada Mortgage and Housing Corp. on Monday. The national housing agency said the seasonally-adjusted annual pace of housing starts declined 15% in January. Housing starts can vary considerably month-to-month as big projects get started, but the agency’s six-month moving average for annual starts also showed a 3.5% decline. “The six-month trend has decreased for the fourth consecutive month,” said CMHC deputy chief economist Tania Bourassa-Ochoa in a news release. “We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity.” She said a near-term turnaround is looking unlikely, and reflects what the agency has been hearing from developers over recent months. The pullback comes amid a variety of pressures, including lower immigration numbers and US trade policy.

The pace of homebuilding in Canada continues to slow with no near-term signs of a turnaround, said Canada Mortgage and Housing Corp. on Monday. The national housing agency said the seasonally-adjusted annual pace of housing starts declined 15% in January. Housing starts can vary considerably month-to-month as big projects get started, but the agency’s six-month moving average for annual starts also showed a 3.5% decline. “The six-month trend has decreased for the fourth consecutive month,” said CMHC deputy chief economist Tania Bourassa-Ochoa in a news release. “We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity.” She said a near-term turnaround is looking unlikely, and reflects what the agency has been hearing from developers over recent months. The pullback comes amid a variety of pressures, including lower immigration numbers and US trade policy. Canada’s annual inflation rate edged down to 2.3% in January, Statistics Canada said on Tuesday, driven downward by a decline in the cost of gasoline. Economists were largely expecting the rate to remain unchanged from December’s 2.4%. Pump prices put pressure on the headline rate, having fallen 16.7% in January compared to the same period last year. With gas excluded, January’s inflation rate came in at 3%. The Bank of Canada’s preferred measures of core inflation, which strip away volatility from one-time tax changes and gas prices, all ticked down in January — bringing those rates closer to the central bank’s two per cent inflation target. “Overall, this is an encouraging result for the Bank of Canada, with inflation finally nearing the [2%] target on a broader basis,” wrote Douglas Porter, chief economist at Bank of Montreal. ›

Canada’s annual inflation rate edged down to 2.3% in January, Statistics Canada said on Tuesday, driven downward by a decline in the cost of gasoline. Economists were largely expecting the rate to remain unchanged from December’s 2.4%. Pump prices put pressure on the headline rate, having fallen 16.7% in January compared to the same period last year. With gas excluded, January’s inflation rate came in at 3%. The Bank of Canada’s preferred measures of core inflation, which strip away volatility from one-time tax changes and gas prices, all ticked down in January — bringing those rates closer to the central bank’s two per cent inflation target. “Overall, this is an encouraging result for the Bank of Canada, with inflation finally nearing the [2%] target on a broader basis,” wrote Douglas Porter, chief economist at Bank of Montreal. › BURNABY, BC — Interfor recorded a net loss in Q4, 2025 of $104.6 million, compared to a net loss of $215.8 million in Q3’25 and a net loss of $49.9 million in Q4’24. Adjusted EBITDA was a loss of $29.2 million on sales of $600.6 million in Q4’25 versus an Adjusted EBITDA loss of $183.8 million on sales of $689.3 million in Q3’25 and Adjusted EBITDA of $80.4 million on sales of $746.5 million in Q4’24. …During and subsequent to Q4’25, Interfor completed a series of financing transactions. Taken together, these transactions significantly enhance Interfor’s financial flexibility, bolster liquidity and provide meaningful additional runway as the Company continues to navigate volatile lumber market conditions. …Lumber production of 753 million board feet was down 159 million board feet versus the preceding quarter. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle.

BURNABY, BC — Interfor recorded a net loss in Q4, 2025 of $104.6 million, compared to a net loss of $215.8 million in Q3’25 and a net loss of $49.9 million in Q4’24. Adjusted EBITDA was a loss of $29.2 million on sales of $600.6 million in Q4’25 versus an Adjusted EBITDA loss of $183.8 million on sales of $689.3 million in Q3’25 and Adjusted EBITDA of $80.4 million on sales of $746.5 million in Q4’24. …During and subsequent to Q4’25, Interfor completed a series of financing transactions. Taken together, these transactions significantly enhance Interfor’s financial flexibility, bolster liquidity and provide meaningful additional runway as the Company continues to navigate volatile lumber market conditions. …Lumber production of 753 million board feet was down 159 million board feet versus the preceding quarter. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle. NEW YORK, New York — Mercer International reported fourth quarter 2025 Operating EBITDA of negative $20.1 million compared to positive $99.2 million in the same quarter of 2024 and negative $28.1 million in the third quarter of 2025. In the fourth quarter of 2025, net loss was $308.7 million compared to net income of $16.7 million in the fourth quarter of 2024 and a net loss of $80.8 million in the third quarter of 2025. The net loss in the fourth quarter of 2025 included total non-cash impairments of $238.7 million. This included non-cash impairments of $203.5 million recognized against long-lived assets at our Peace River mill due to the continued down-cycle environment of hardwood pulp markets, $12.2 million against certain obsolete equipment and $23.0 million against pulp inventory due to low prices and high fiber costs. …Mr. Juan Carlos Bueno, CEO: “We continue to prioritize improving liquidity and working capital, committing to rebalancing our asset portfolio and maintaining operating discipline.”

NEW YORK, New York — Mercer International reported fourth quarter 2025 Operating EBITDA of negative $20.1 million compared to positive $99.2 million in the same quarter of 2024 and negative $28.1 million in the third quarter of 2025. In the fourth quarter of 2025, net loss was $308.7 million compared to net income of $16.7 million in the fourth quarter of 2024 and a net loss of $80.8 million in the third quarter of 2025. The net loss in the fourth quarter of 2025 included total non-cash impairments of $238.7 million. This included non-cash impairments of $203.5 million recognized against long-lived assets at our Peace River mill due to the continued down-cycle environment of hardwood pulp markets, $12.2 million against certain obsolete equipment and $23.0 million against pulp inventory due to low prices and high fiber costs. …Mr. Juan Carlos Bueno, CEO: “We continue to prioritize improving liquidity and working capital, committing to rebalancing our asset portfolio and maintaining operating discipline.” VANCOUVER, BC

VANCOUVER, BC

B.C.’s export performance moved against the national pattern in November. Domestic exports to international markets rose 7.6 per cent year over year to $4.59 billion, whereas exports nationally declined by about four per cent on a customs basis. This contrast partly reflects differences in the types of goods each region exports. Nevertheless, provincial export trends remain soft, reflecting U.S. tariffs on key products like lumber, and end of de minimis treatment of low value exports. Year-to-date, B.C. exports slipped a mild 0.1 per cent from same-period 2024, which was slightly stronger than the national reading. …That said, a declining trend continued in the battered forestry sector (-13.7 per cent year over year), where tariffs have compounded weakness from timber supply constraints and other duties already imposed by the U.S.

B.C.’s export performance moved against the national pattern in November. Domestic exports to international markets rose 7.6 per cent year over year to $4.59 billion, whereas exports nationally declined by about four per cent on a customs basis. This contrast partly reflects differences in the types of goods each region exports. Nevertheless, provincial export trends remain soft, reflecting U.S. tariffs on key products like lumber, and end of de minimis treatment of low value exports. Year-to-date, B.C. exports slipped a mild 0.1 per cent from same-period 2024, which was slightly stronger than the national reading. …That said, a declining trend continued in the battered forestry sector (-13.7 per cent year over year), where tariffs have compounded weakness from timber supply constraints and other duties already imposed by the U.S.

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended December 31, 2025 as well as for the full 2025 fiscal year. “While 2025 brought a multitude of challenges, Acadian delivered steady operational performance in New Brunswick, helping to offset weather-related challenges, trucking constraints, and productivity issues in Maine,” said Adam Sheparski, President and Chief Executive Officer. …During the fourth quarter, Acadian generated sales of $22.0 million compared to $20.2 million in the fourth quarter of 2024. Acadian generated $5.2 million of Adjusted EBITDA and declared dividends of $5.3 million. During 2025, Acadian generated revenue from timber sales and services of $87.0 million, compared to $91.6 million in the prior year. The sale of 752,100 voluntary carbon credits contributed an additional $24.6 million to total sales in 2024 while no sales of carbon credits occurred in 2025.

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended December 31, 2025 as well as for the full 2025 fiscal year. “While 2025 brought a multitude of challenges, Acadian delivered steady operational performance in New Brunswick, helping to offset weather-related challenges, trucking constraints, and productivity issues in Maine,” said Adam Sheparski, President and Chief Executive Officer. …During the fourth quarter, Acadian generated sales of $22.0 million compared to $20.2 million in the fourth quarter of 2024. Acadian generated $5.2 million of Adjusted EBITDA and declared dividends of $5.3 million. During 2025, Acadian generated revenue from timber sales and services of $87.0 million, compared to $91.6 million in the prior year. The sale of 752,100 voluntary carbon credits contributed an additional $24.6 million to total sales in 2024 while no sales of carbon credits occurred in 2025.

US labor productivity in construction falls 30% from 1970 to 2024, while aggregate US labor productivity more than doubles over the same period, widening a long-running gap between construction and the wider economy. Since 1965, construction labor productivity falls by an average 0.6% per year, while economy-wide productivity grows about 1.6% per year, based on analysis by Goldman Sachs Global Investment Research. The analysis links part of the gap to limited innovation in construction equipment and processes after a period of faster adoption in the 1950s and 1960s. The share of industrial machines in total construction production costs rises from 4% in 1948 to 12% in 1968, then slips to 10% in the 1970s and stays near that level, while pre-fabrication’s share of new residential housing units falls from about one-third at its peak in 1960–1970 to 5%.

US labor productivity in construction falls 30% from 1970 to 2024, while aggregate US labor productivity more than doubles over the same period, widening a long-running gap between construction and the wider economy. Since 1965, construction labor productivity falls by an average 0.6% per year, while economy-wide productivity grows about 1.6% per year, based on analysis by Goldman Sachs Global Investment Research. The analysis links part of the gap to limited innovation in construction equipment and processes after a period of faster adoption in the 1950s and 1960s. The share of industrial machines in total construction production costs rises from 4% in 1948 to 12% in 1968, then slips to 10% in the 1970s and stays near that level, while pre-fabrication’s share of new residential housing units falls from about one-third at its peak in 1960–1970 to 5%.

Contractors in certain niches can expect some meaningful materials price reductions after the Supreme Court struck down most of President Trump’s tariffs Friday. The court rejected Trump’s claim to authority to impose reciprocal tariffs. That would drive “a modest but meaningful reduction in materials price escalation” for specialty equipment, HVAC and electrical systems and fixtures, said Anirban Basu, chief economist at Associated Builders and Contractors. …But the administration quickly signaled plans for alternative tariff methods shortly after the ruling. AGC also noted other materials-specific tariffs on lumber, steel, aluminum and copper products are unaffected by Friday’s decision. Taken together, that means the Supreme Court decision “could be short-lived and completely counteracted,” said Basu. That back-and-forth tends to stall construction activity as owners and contractors weigh whether the decision will hold. …AGC has told builders not to hold their breath waiting for refund checks.

Contractors in certain niches can expect some meaningful materials price reductions after the Supreme Court struck down most of President Trump’s tariffs Friday. The court rejected Trump’s claim to authority to impose reciprocal tariffs. That would drive “a modest but meaningful reduction in materials price escalation” for specialty equipment, HVAC and electrical systems and fixtures, said Anirban Basu, chief economist at Associated Builders and Contractors. …But the administration quickly signaled plans for alternative tariff methods shortly after the ruling. AGC also noted other materials-specific tariffs on lumber, steel, aluminum and copper products are unaffected by Friday’s decision. Taken together, that means the Supreme Court decision “could be short-lived and completely counteracted,” said Basu. That back-and-forth tends to stall construction activity as owners and contractors weigh whether the decision will hold. …AGC has told builders not to hold their breath waiting for refund checks.

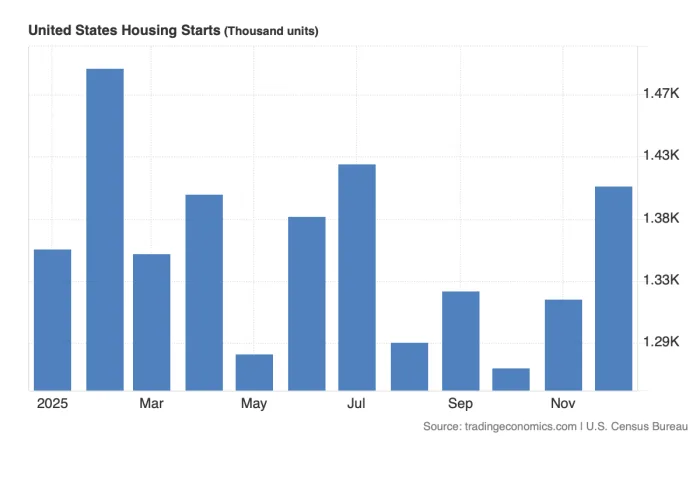

New residential construction in the US rose to a five-month high in December, as homebuilders boosted production to take advantage of lower borrowing costs. Housing starts increased 6.2% to an annual pace of 1.4 million homes in December, according to figures released Wednesday by the government, which were delayed by fall’s federal shutdown. …The advance was broad-based, with both single-family home starts and apartment projects rising at year’s end. The number of one-family homes started was the highest since February. The stronger construction numbers suggest that builders were growing more confident at year’s end even as they continued to sell off a bloated inventory of new houses. For the full year, however, starts notched a fourth-straight annual decline …In December, building permits, which point to future construction, rose 4.3% to an annualized pace of 1.45 million, the highest since March, government data show. Single-family permits fell slightly. [to access the full story a Bloomberg subscription is required]

New residential construction in the US rose to a five-month high in December, as homebuilders boosted production to take advantage of lower borrowing costs. Housing starts increased 6.2% to an annual pace of 1.4 million homes in December, according to figures released Wednesday by the government, which were delayed by fall’s federal shutdown. …The advance was broad-based, with both single-family home starts and apartment projects rising at year’s end. The number of one-family homes started was the highest since February. The stronger construction numbers suggest that builders were growing more confident at year’s end even as they continued to sell off a bloated inventory of new houses. For the full year, however, starts notched a fourth-straight annual decline …In December, building permits, which point to future construction, rose 4.3% to an annualized pace of 1.45 million, the highest since March, government data show. Single-family permits fell slightly. [to access the full story a Bloomberg subscription is required] Reality-television stars are rarely consulted on matters of public policy. But in April, Realtor.com asked Tarek El Moussa to comment on the White House’s “Liberation Day” tariffs. The Southern California entrepreneur, who rose to fame on the popularity of HGTV’s Flip or Fop franchise, warned that higher import taxes would harm “new-home builders” and “first-time buyers” the most — after all, “luxury buyers” could absorb greater costs. Aspiring homeowners, he averred, are “usually strapped for cash,” and “doing everything they can just to buy a house.” Now that the second Trump administration has passed its one-year anniversary, all evidence indicates that El Moussa understands his industry well. There is little doubt that his trade war erects a sizable obstacle before those looking to find a place of their own. …The types of wood available in the US are not always the same as what’s available from Canadian imports.

Reality-television stars are rarely consulted on matters of public policy. But in April, Realtor.com asked Tarek El Moussa to comment on the White House’s “Liberation Day” tariffs. The Southern California entrepreneur, who rose to fame on the popularity of HGTV’s Flip or Fop franchise, warned that higher import taxes would harm “new-home builders” and “first-time buyers” the most — after all, “luxury buyers” could absorb greater costs. Aspiring homeowners, he averred, are “usually strapped for cash,” and “doing everything they can just to buy a house.” Now that the second Trump administration has passed its one-year anniversary, all evidence indicates that El Moussa understands his industry well. There is little doubt that his trade war erects a sizable obstacle before those looking to find a place of their own. …The types of wood available in the US are not always the same as what’s available from Canadian imports.

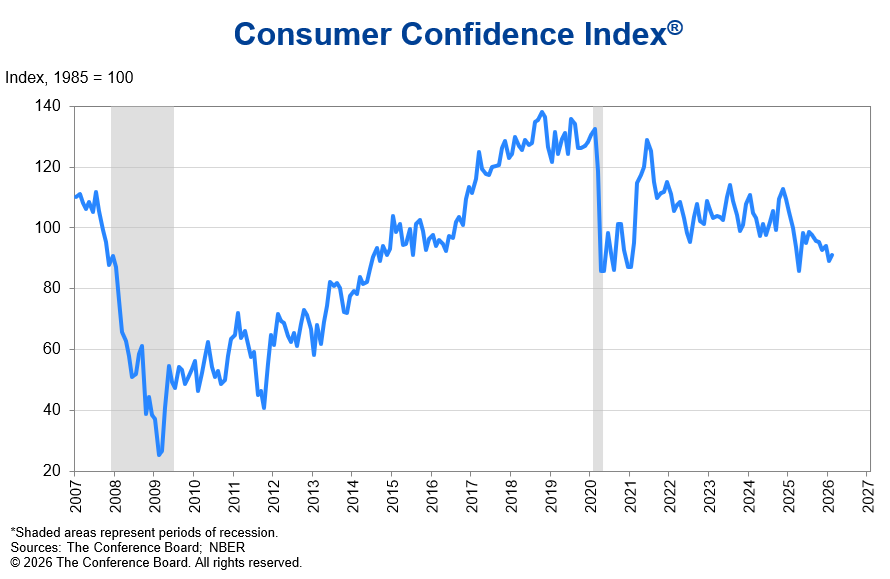

The cost of goods and services rose at a slower annual rate than expected in January, providing hope that the nagging U.S. inflation problem could be starting to ease. The consumer price index for January accelerated 2.4% from the same time a year ago, down 0.3 percentage point from the prior month, the Bureau of Labor Statistics reported Friday. That pulled the inflation rate down to where it was the month after President Donald Trump in April 2025 announced aggressive tariffs on U.S. imports. Excluding food and energy, the core CPI was up 2.5%. Economists surveyed by Dow Jones had been looking for an annual rate of 2.5% for both readings. On a monthly basis, the all-items index was up a seasonally adjusted 0.2% while core gained 0.3%. …Though the category accounted for much of the CPI gain, shelter costs rose just 0.2% for the month, bringing the annual increase down to 3%.

The cost of goods and services rose at a slower annual rate than expected in January, providing hope that the nagging U.S. inflation problem could be starting to ease. The consumer price index for January accelerated 2.4% from the same time a year ago, down 0.3 percentage point from the prior month, the Bureau of Labor Statistics reported Friday. That pulled the inflation rate down to where it was the month after President Donald Trump in April 2025 announced aggressive tariffs on U.S. imports. Excluding food and energy, the core CPI was up 2.5%. Economists surveyed by Dow Jones had been looking for an annual rate of 2.5% for both readings. On a monthly basis, the all-items index was up a seasonally adjusted 0.2% while core gained 0.3%. …Though the category accounted for much of the CPI gain, shelter costs rose just 0.2% for the month, bringing the annual increase down to 3%.

Japan’s housing starts fell 0.4% yoy in January 2026, easing from a 1.3% drop in the previous month and beating market expectations of a 1.6% decline. It marked the third consecutive month of contraction, though the pace was the mildest since July 2024. Rental housing starts declined at a slower rate (-1.5% vs -3.4% in December). Meanwhile, owner-occupied homes rebounded (6.6% vs -1.8%), as did prefabricated housing (5.1% vs -6.1%). Starts for two-by-four homes also accelerated (8.7% vs 2.8%). In contrast, built-for-sale housing fell 4.8%, reversing a 1.9% increase in December.

Japan’s housing starts fell 0.4% yoy in January 2026, easing from a 1.3% drop in the previous month and beating market expectations of a 1.6% decline. It marked the third consecutive month of contraction, though the pace was the mildest since July 2024. Rental housing starts declined at a slower rate (-1.5% vs -3.4% in December). Meanwhile, owner-occupied homes rebounded (6.6% vs -1.8%), as did prefabricated housing (5.1% vs -6.1%). Starts for two-by-four homes also accelerated (8.7% vs 2.8%). In contrast, built-for-sale housing fell 4.8%, reversing a 1.9% increase in December. Drax Group Plc’s profit declined last year but exceeded analyst estimates, helping lift the shares to their highest level in almost two decades despite significant impairment charges. Adjusted earnings before interest, taxes, depreciation and amortization totaled £947 million ($1.3 billion), beating analyst estimates for £913.7 million. Citigroup Inc. analyst Jenny Ping cited lower pellet costs and record generation at its main biomass plant as supporting the result. The figure was still 11% lower than a year earlier, which Drax attributed to weaker power prices. The company’s share price rose as much as 6.2% to the highest since October 2006 before paring gains. …Drax reaffirmed its target of £600 million to £700 million of annual adjusted EBITDA after 2027 and said it expects 2026 earnings to align with analyst forecasts of about £662 million. The company also expects to return £1 billion to shareholders through dividends and share buybacks from 2025 until 2031, with £2 billion invested in growth areas.

Drax Group Plc’s profit declined last year but exceeded analyst estimates, helping lift the shares to their highest level in almost two decades despite significant impairment charges. Adjusted earnings before interest, taxes, depreciation and amortization totaled £947 million ($1.3 billion), beating analyst estimates for £913.7 million. Citigroup Inc. analyst Jenny Ping cited lower pellet costs and record generation at its main biomass plant as supporting the result. The figure was still 11% lower than a year earlier, which Drax attributed to weaker power prices. The company’s share price rose as much as 6.2% to the highest since October 2006 before paring gains. …Drax reaffirmed its target of £600 million to £700 million of annual adjusted EBITDA after 2027 and said it expects 2026 earnings to align with analyst forecasts of about £662 million. The company also expects to return £1 billion to shareholders through dividends and share buybacks from 2025 until 2031, with £2 billion invested in growth areas.