The annual pace of inflation held steady at 1.7% in May as cooling shelter costs helped tame price pressures, Statistics Canada said. Shelter costs rose three per cent in May, StatCan said, marking a slowdown from 3.4% in April. The agency singled out Ontario as the major source of rent relief in the country. …Mortgage interest costs meanwhile decelerated for the 21st consecutive month amid lower interest rates from the Bank of Canada. Economists had broadly expected inflation would remain unchanged heading into Tuesday. The removal of the consumer carbon price continues to drive down gasoline costs annually, StatCan said. …Inflation excluding tax changes – stripping out influences from the carbon price removal – was also steady at 2.3 per cent last month. …The central bank’s closely watched core inflation metrics meanwhile ticked down a tenth of a percentage point to three per cent in May.

The annual pace of inflation held steady at 1.7% in May as cooling shelter costs helped tame price pressures, Statistics Canada said. Shelter costs rose three per cent in May, StatCan said, marking a slowdown from 3.4% in April. The agency singled out Ontario as the major source of rent relief in the country. …Mortgage interest costs meanwhile decelerated for the 21st consecutive month amid lower interest rates from the Bank of Canada. Economists had broadly expected inflation would remain unchanged heading into Tuesday. The removal of the consumer carbon price continues to drive down gasoline costs annually, StatCan said. …Inflation excluding tax changes – stripping out influences from the carbon price removal – was also steady at 2.3 per cent last month. …The central bank’s closely watched core inflation metrics meanwhile ticked down a tenth of a percentage point to three per cent in May.

Lumber futures traded below $610 per thousand board feet, easing from two-month highs of $626 seen June 13th, driven by improving supply while demand slowed. This pullback reflects a temporary surge in supply as sawmills and wholesalers restocked early-season safety stocks, while builders delayed purchases after earlier buying . The decline also stems from softer demand: high mortgage rates continue to suppress new house builds and remodeling activity, with treaters and end-users scaling back orders. Although longer-term forecasts expect a pickup in Q3, driven by renewed tariff pressure and projected housing recovery, the current correction is supply-led, driven by modest restocking, seasonal slowdown, and rate-constrained construction spending. [END]›

Lumber futures traded below $610 per thousand board feet, easing from two-month highs of $626 seen June 13th, driven by improving supply while demand slowed. This pullback reflects a temporary surge in supply as sawmills and wholesalers restocked early-season safety stocks, while builders delayed purchases after earlier buying . The decline also stems from softer demand: high mortgage rates continue to suppress new house builds and remodeling activity, with treaters and end-users scaling back orders. Although longer-term forecasts expect a pickup in Q3, driven by renewed tariff pressure and projected housing recovery, the current correction is supply-led, driven by modest restocking, seasonal slowdown, and rate-constrained construction spending. [END]› As Ottawa bets big on EVs and batteries, core manufacturers in sectors like lumber, metal and machinery are left fighting uphill battles at home. Among his various and sometimes conflicting economic objectives, Donald Trump has identified revitalizing manufacturing as a priority. He has railed against the decline in factory jobs — a complaint that overlooks the jump in U.S. manufacturing employment since 2015 but does reflect the fact that manufacturing today accounts for a significantly smaller share of U.S. jobs than it did 30 years ago. Canadian policymakers have also been paying more attention to manufacturing, particularly since the 2020-21 COVID shock highlighted the country’s vulnerability to supply chain disruptions. Unfortunately, Ottawa’s preferred game-plan has been to dole out vast taxpayer-funded subsidies to politically favoured segments: Electric vehicles, batteries and clean-tech products.

As Ottawa bets big on EVs and batteries, core manufacturers in sectors like lumber, metal and machinery are left fighting uphill battles at home. Among his various and sometimes conflicting economic objectives, Donald Trump has identified revitalizing manufacturing as a priority. He has railed against the decline in factory jobs — a complaint that overlooks the jump in U.S. manufacturing employment since 2015 but does reflect the fact that manufacturing today accounts for a significantly smaller share of U.S. jobs than it did 30 years ago. Canadian policymakers have also been paying more attention to manufacturing, particularly since the 2020-21 COVID shock highlighted the country’s vulnerability to supply chain disruptions. Unfortunately, Ottawa’s preferred game-plan has been to dole out vast taxpayer-funded subsidies to politically favoured segments: Electric vehicles, batteries and clean-tech products.

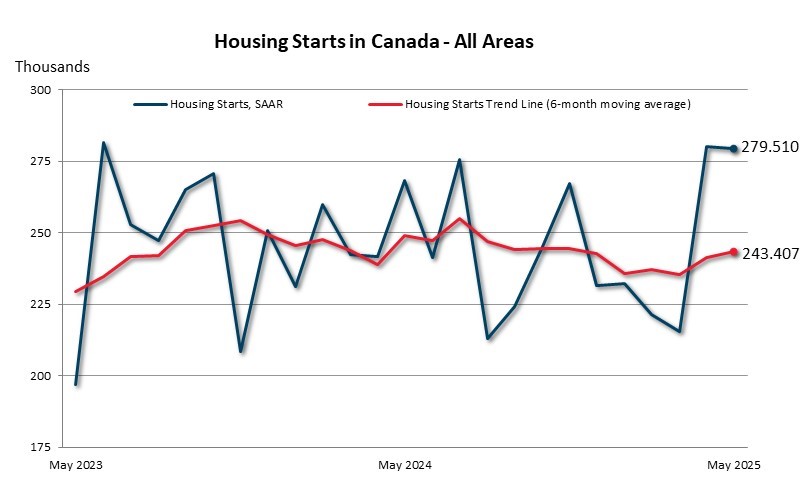

Lumber futures rose past $610 per thousand board feet, a ten-week high, as steady construction activity met tightening supply and mounting trade barriers. US homebuilding remains steady with single-family starts flat at 1.36 million units in April and permits edging lower, while Canadian multi-unit starts jumped 34%, keeping mill orders firm. Canadian harvests are constrained by pine-beetle infestations, prairie wildfires that have burned more than 200,000 hectares this spring and strict cut limits that left British Columbia nearly 42% below its allowable quota in 2023. In the US, sawmill utilization stalled in the mid-70% range despite recent capacity additions. Tariffs of roughly 14.5% on Canadian softwood, along with threats of higher levies, have discouraged cross-border shipments, while major exporters divert supply to Asian and European markets. Elevated fuel and transportation costs further raise delivered prices.

Lumber futures rose past $610 per thousand board feet, a ten-week high, as steady construction activity met tightening supply and mounting trade barriers. US homebuilding remains steady with single-family starts flat at 1.36 million units in April and permits edging lower, while Canadian multi-unit starts jumped 34%, keeping mill orders firm. Canadian harvests are constrained by pine-beetle infestations, prairie wildfires that have burned more than 200,000 hectares this spring and strict cut limits that left British Columbia nearly 42% below its allowable quota in 2023. In the US, sawmill utilization stalled in the mid-70% range despite recent capacity additions. Tariffs of roughly 14.5% on Canadian softwood, along with threats of higher levies, have discouraged cross-border shipments, while major exporters divert supply to Asian and European markets. Elevated fuel and transportation costs further raise delivered prices. The CME’s physical lumber futures have been in a bullish trend since the July 2024 low of $455.50 per 1,000 board feet. The weekly chart indicates that lumber futures have formed higher lows and higher highs, reaching a peak of $699 per 1,000 board feet in March 2025. While the price has dropped below the $600 level, the pattern of higher lows remains intact in June 2025. …Seasonality suggests that a lumber rally may need to wait until 2026… Lumber tends to be a seasonal commodity, with prices peaking during late winter and early spring as the weather improves and construction activity increases. In 2021, the old random-length lumber futures rose to a record high of $1,711.20 per 1,000 board feet in May, and in 2022, reached a lower high of $1,477.40 in March. …Keep an eye on interest rates as declines could ignite pent-up demand for new homes, which could light a bullish fuse under the lumber futures arena.

The CME’s physical lumber futures have been in a bullish trend since the July 2024 low of $455.50 per 1,000 board feet. The weekly chart indicates that lumber futures have formed higher lows and higher highs, reaching a peak of $699 per 1,000 board feet in March 2025. While the price has dropped below the $600 level, the pattern of higher lows remains intact in June 2025. …Seasonality suggests that a lumber rally may need to wait until 2026… Lumber tends to be a seasonal commodity, with prices peaking during late winter and early spring as the weather improves and construction activity increases. In 2021, the old random-length lumber futures rose to a record high of $1,711.20 per 1,000 board feet in May, and in 2022, reached a lower high of $1,477.40 in March. …Keep an eye on interest rates as declines could ignite pent-up demand for new homes, which could light a bullish fuse under the lumber futures arena.

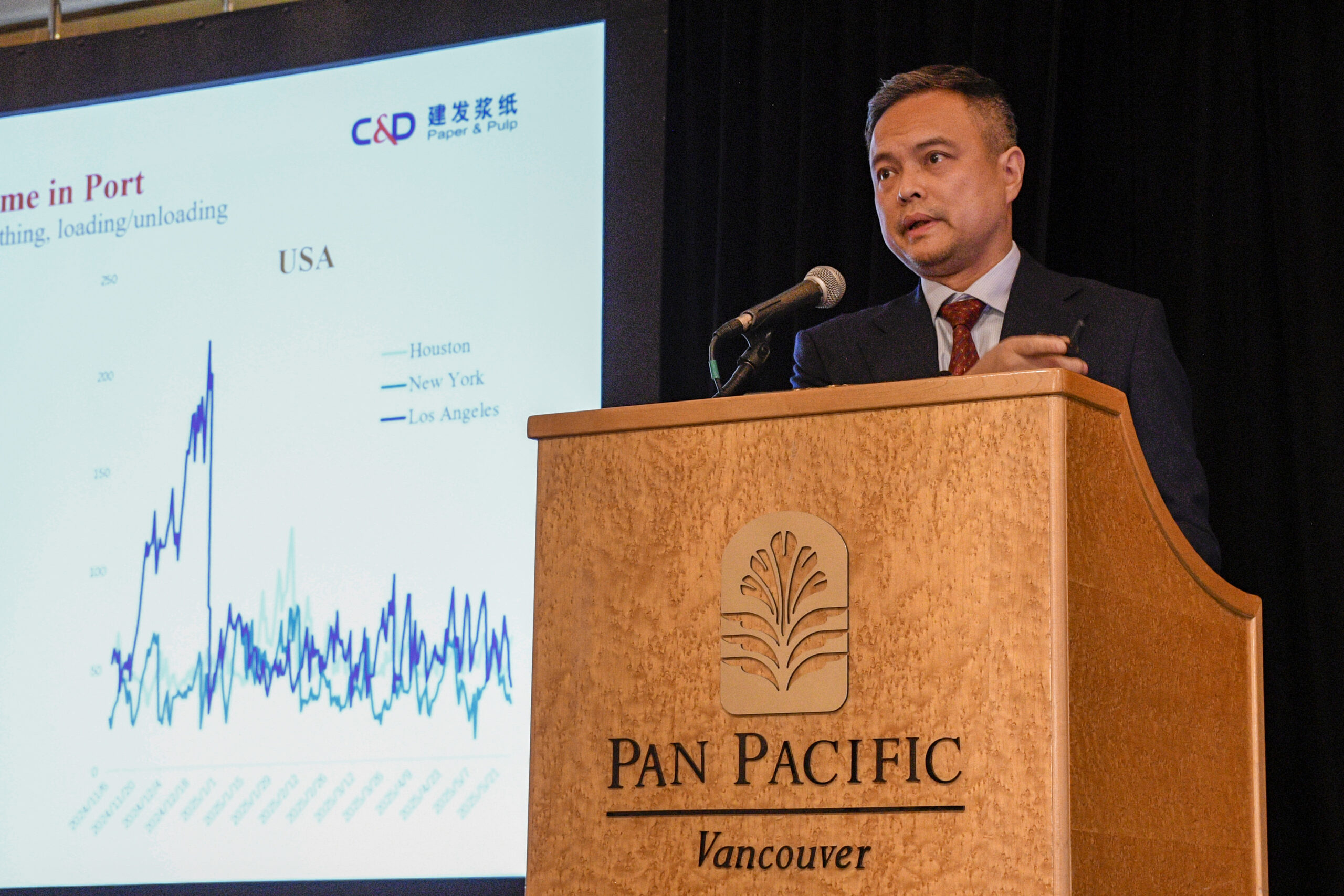

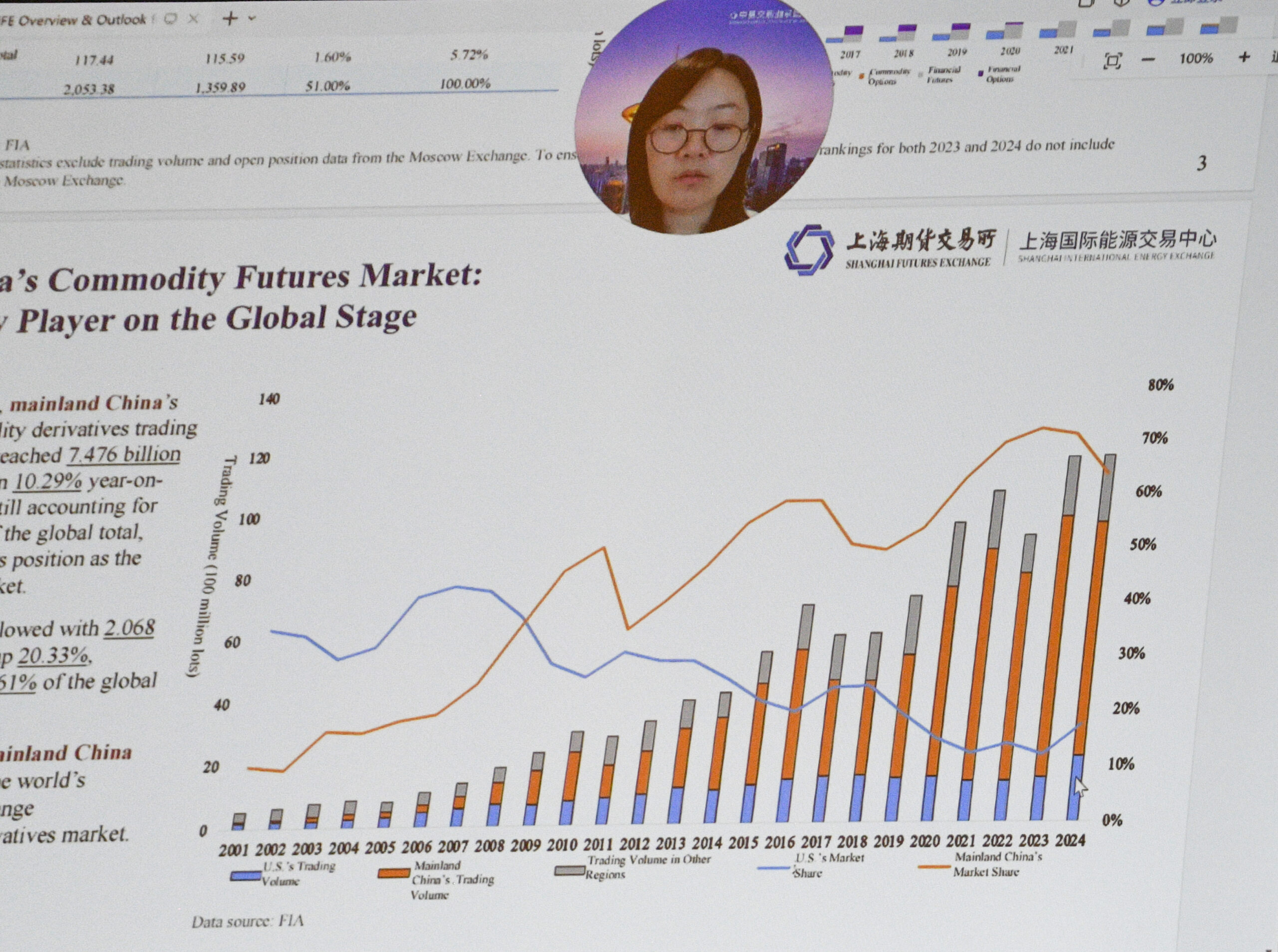

At International Pulp Week, three speakers discussed businesses that connect to China’s role in the global pulp industry — including trading, port logistics and the futures market. Haidong Weng, Executive Vice President of Pulp & Paper Research at Xiamen C&D… explained that after the US implemented its third wave of tariffs, Chinese exports of paper and board to the US fell sharply, with vessel density in major Chinese ports reflecting a significant pullback in trade flows. …He also described the cascading effects on US retail markets. …The scale and resilience of China’s port logistics were front and centre in a presentation by Tian Jun, representing the Shanghai International Port Group’s Luo Jing Terminal. Tian explained that SIPG views pulp as a strategic growth cargo across its network of general cargo terminals. …Another presentation came via video from Chi-Fei Fei of the Shanghai Futures Exchange (SHFE), who provided an overview of China’s pulp futures market.

At International Pulp Week, three speakers discussed businesses that connect to China’s role in the global pulp industry — including trading, port logistics and the futures market. Haidong Weng, Executive Vice President of Pulp & Paper Research at Xiamen C&D… explained that after the US implemented its third wave of tariffs, Chinese exports of paper and board to the US fell sharply, with vessel density in major Chinese ports reflecting a significant pullback in trade flows. …He also described the cascading effects on US retail markets. …The scale and resilience of China’s port logistics were front and centre in a presentation by Tian Jun, representing the Shanghai International Port Group’s Luo Jing Terminal. Tian explained that SIPG views pulp as a strategic growth cargo across its network of general cargo terminals. …Another presentation came via video from Chi-Fei Fei of the Shanghai Futures Exchange (SHFE), who provided an overview of China’s pulp futures market. At International Pulp Week, Mathieu Wener, Senior Economist at Numera Analytics, provided a detailed overview of current trends in key end-use markets for pulp, with a particular focus on tissue and printing and writing papers. Drawing on recent data and modelling, he examined how these sectors have evolved post-pandemic, what is driving demand patterns today, and what may lie ahead. Wener began with tissue markets, where profitability has remained strong despite considerable cost pressures in recent years. “Producers passed through rising costs since 2022,” he noted, showing how eurozone parent roll and pulp prices had shifted over that period. Although price differentials between pulp and tissue had narrowed, margins remained healthy.” …Wener underscored the importance of tracking both macroeconomic forces and demographic trends in shaping pulp demand. For tissue, slowing population growth and cautious consumer behaviour would temper growth expectations. For printing and writing papers, the secular decline would continue, but at a somewhat more stable pace.

At International Pulp Week, Mathieu Wener, Senior Economist at Numera Analytics, provided a detailed overview of current trends in key end-use markets for pulp, with a particular focus on tissue and printing and writing papers. Drawing on recent data and modelling, he examined how these sectors have evolved post-pandemic, what is driving demand patterns today, and what may lie ahead. Wener began with tissue markets, where profitability has remained strong despite considerable cost pressures in recent years. “Producers passed through rising costs since 2022,” he noted, showing how eurozone parent roll and pulp prices had shifted over that period. Although price differentials between pulp and tissue had narrowed, margins remained healthy.” …Wener underscored the importance of tracking both macroeconomic forces and demographic trends in shaping pulp demand. For tissue, slowing population growth and cautious consumer behaviour would temper growth expectations. For printing and writing papers, the secular decline would continue, but at a somewhat more stable pace. The final presenter at International Pulp Week, Emanuele Bona, VP of Europe for the Pulp and Paper Products Council (PPPC), provided a comprehensive update on global market pulp demand trends, with a particular focus on the rebound underway in 2025 and the longer-term outlook for key markets and product segments. Bona began by noting that 2024 had been a weak year for market pulp demand, with global chemical market pulp demand falling by 0.9 percent. However, the first months of 2025 showed a marked improvement. “In 2025, after four months, demand is up almost one million tonnes,” he reported. Both softwood and hardwood pulp segments contributed to this recovery. …Looking ahead, Bona projected that global market pulp demand would return to growth but at a more moderate pace. “Growth to average 1.5 percent through 2029,” he said. The long-term trend for softwood pulp was expected to remain flat at best, while hardwood demand growth was projected to slow despite ongoing substitution trends.

The final presenter at International Pulp Week, Emanuele Bona, VP of Europe for the Pulp and Paper Products Council (PPPC), provided a comprehensive update on global market pulp demand trends, with a particular focus on the rebound underway in 2025 and the longer-term outlook for key markets and product segments. Bona began by noting that 2024 had been a weak year for market pulp demand, with global chemical market pulp demand falling by 0.9 percent. However, the first months of 2025 showed a marked improvement. “In 2025, after four months, demand is up almost one million tonnes,” he reported. Both softwood and hardwood pulp segments contributed to this recovery. …Looking ahead, Bona projected that global market pulp demand would return to growth but at a more moderate pace. “Growth to average 1.5 percent through 2029,” he said. The long-term trend for softwood pulp was expected to remain flat at best, while hardwood demand growth was projected to slow despite ongoing substitution trends. Uncertainty regarding tariffs continues to challenge companies across industries. It’s a common theme in every conversation I’ve had with fellow business owners lately: How do we plan, price or grow when the rules are constantly shifting? In our case, the lumber industry got a temporary break—framing lumber from Canada, which makes up over 30% of the US market, was exempt from the original tariffs. That’s good news for now, especially for residential construction. But there’s still no clarity on imports from other key countries like Brazil and China, where tariffs remain in full effect. That could have a serious impact on specialty products like Ipe and hardwood veneers. Other building materials—fasteners, finishes, flooring, and more—are also caught in the middle. …That cost will be passed on to the end user. Businesses like ours don’t have the luxury of absorbing increased costs indefinitely. If we did, we’d be out of business.

Uncertainty regarding tariffs continues to challenge companies across industries. It’s a common theme in every conversation I’ve had with fellow business owners lately: How do we plan, price or grow when the rules are constantly shifting? In our case, the lumber industry got a temporary break—framing lumber from Canada, which makes up over 30% of the US market, was exempt from the original tariffs. That’s good news for now, especially for residential construction. But there’s still no clarity on imports from other key countries like Brazil and China, where tariffs remain in full effect. That could have a serious impact on specialty products like Ipe and hardwood veneers. Other building materials—fasteners, finishes, flooring, and more—are also caught in the middle. …That cost will be passed on to the end user. Businesses like ours don’t have the luxury of absorbing increased costs indefinitely. If we did, we’d be out of business. There has been a lot of news recently on higher tariffs between the U.S. and its trading partners, including Canada and Mexico. One concern that is top of mind for many LBM dealers is how these new tariffs will affect lumber and other materials sold at yards and stores across the country. How concerned should I be and what action, if any, can I take to protect my business? Responses from lumberyards, full-line building material dealers, and specialty dealers/distributors:

There has been a lot of news recently on higher tariffs between the U.S. and its trading partners, including Canada and Mexico. One concern that is top of mind for many LBM dealers is how these new tariffs will affect lumber and other materials sold at yards and stores across the country. How concerned should I be and what action, if any, can I take to protect my business? Responses from lumberyards, full-line building material dealers, and specialty dealers/distributors: The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. Since the April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the US have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high. While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs. …In Canada, economic growth in the first quarter came in at 2.2%. …CPI inflation eased to 1.7% in April. …Excluding taxes, inflation rose 2.3% in April.

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. Since the April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the US have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high. While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs. …In Canada, economic growth in the first quarter came in at 2.2%. …CPI inflation eased to 1.7% in April. …Excluding taxes, inflation rose 2.3% in April. Economic growth forecasts for the US and globally were cut further by the Organisation for Economic Co-operation and Development (OEDC) as President Trump’s tariff turmoil weighs on expectations. The US growth outlook was downwardly revised to just 1.6% this year and 1.5% in 2026. In March, the OECD was still expecting a 2.2% expansion in 2025. The fallout from Trump’s tariff policy, elevated economic policy uncertainty, a slowdown of net immigration and a smaller federal workforce were cited as reasons for the latest downgrade. Global growth, meanwhile, is also expected to be lower than previously forecast, with the OECD saying that “the slowdown is concentrated in the United States, Canada and Mexico”. “Global GDP growth is projected to slow from 3.3% in 2024 to 2.9% this year and in 2026. It had previously forecast global growth of 3.1% this year and 3% in 2026. …The OECD adjusted its inflation forecast, saying “higher trade costs will also push up inflation.”

Economic growth forecasts for the US and globally were cut further by the Organisation for Economic Co-operation and Development (OEDC) as President Trump’s tariff turmoil weighs on expectations. The US growth outlook was downwardly revised to just 1.6% this year and 1.5% in 2026. In March, the OECD was still expecting a 2.2% expansion in 2025. The fallout from Trump’s tariff policy, elevated economic policy uncertainty, a slowdown of net immigration and a smaller federal workforce were cited as reasons for the latest downgrade. Global growth, meanwhile, is also expected to be lower than previously forecast, with the OECD saying that “the slowdown is concentrated in the United States, Canada and Mexico”. “Global GDP growth is projected to slow from 3.3% in 2024 to 2.9% this year and in 2026. It had previously forecast global growth of 3.1% this year and 3% in 2026. …The OECD adjusted its inflation forecast, saying “higher trade costs will also push up inflation.” Lumber is in the spotlight as the National Association of Home Builders (NAHB) and the US Lumber Coalition disagree over what’s behind the U.S. housing market slump. The NAHB has pointed to tariff uncertainty and lumber prices as being partly responsible. The US’s current anti-dumping and anti-subsidy duty on imported Canadian softwood lumber stands at 14.5%. It could potentially climb later in the year to nearly 35%. “I share President Trump’s desire to create fair and balanced trade across our borders, certainly would bring back as much production as we can,” NAHB CEO Jim Tobin said. “But until we do that, and it will take years and millions of dollars of investment, we need to make sure that we have a reliable, affordable source of lumber.” …The US Lumber Coalition has also been critical of Canada, saying that “ongoing unfair trade practices” by its lumber industry have been “extremely harmful to US lumber producers.”

Lumber is in the spotlight as the National Association of Home Builders (NAHB) and the US Lumber Coalition disagree over what’s behind the U.S. housing market slump. The NAHB has pointed to tariff uncertainty and lumber prices as being partly responsible. The US’s current anti-dumping and anti-subsidy duty on imported Canadian softwood lumber stands at 14.5%. It could potentially climb later in the year to nearly 35%. “I share President Trump’s desire to create fair and balanced trade across our borders, certainly would bring back as much production as we can,” NAHB CEO Jim Tobin said. “But until we do that, and it will take years and millions of dollars of investment, we need to make sure that we have a reliable, affordable source of lumber.” …The US Lumber Coalition has also been critical of Canada, saying that “ongoing unfair trade practices” by its lumber industry have been “extremely harmful to US lumber producers.” US market conditions have been lackluster since the Trump tariffs on Canadian lumber were postponed for the second time in early April. …The proposed 25% tariffs were the catalyst for SPF prices rising in the first two months of 2025. …Today, this puts BC Interior SPF mills back near break-even levels at current lumber prices and 14.4% duties with other Canadian regions looking to be marginally profitable. With tariffs in suspension mode, the US market fundamentals have now been exposed – the market is weak and remain weak – and there is too much supply – again! ….The silliness of the Trump administration’s irrational rhetoric as well as biased trade policies will only result in raising all lumber prices to the US home builder, the renovation contractor, and the consumer. How much of the tariffs (or Canadian duties) are passed on to the consumer is the only wild card, but it will likely be the majority.

US market conditions have been lackluster since the Trump tariffs on Canadian lumber were postponed for the second time in early April. …The proposed 25% tariffs were the catalyst for SPF prices rising in the first two months of 2025. …Today, this puts BC Interior SPF mills back near break-even levels at current lumber prices and 14.4% duties with other Canadian regions looking to be marginally profitable. With tariffs in suspension mode, the US market fundamentals have now been exposed – the market is weak and remain weak – and there is too much supply – again! ….The silliness of the Trump administration’s irrational rhetoric as well as biased trade policies will only result in raising all lumber prices to the US home builder, the renovation contractor, and the consumer. How much of the tariffs (or Canadian duties) are passed on to the consumer is the only wild card, but it will likely be the majority. VANCOUVER, BC

VANCOUVER, BC A final tally of which Ontario municipalities hit their housing targets and how many fell short last year has been finished since mid-February, according to government documents obtained, despite the province refusing to release the data for months. For the past two years, the Ford government has set targets for new homes in towns and cities, promising them extra cash if they meet those goals. The numbers Ontario uses to assess whether or not cities have hit their goals are made up of new homes, long-term care beds and additional units like basements or garden suites. The government set up a website to show which cities had hit their goals. Around October 2024, however, with housing starts across the province stuttering, the government stopped updating the tracker. …While the tracker has appeared abandoned for close to half a year, the government has had “finalized” data for months.

A final tally of which Ontario municipalities hit their housing targets and how many fell short last year has been finished since mid-February, according to government documents obtained, despite the province refusing to release the data for months. For the past two years, the Ford government has set targets for new homes in towns and cities, promising them extra cash if they meet those goals. The numbers Ontario uses to assess whether or not cities have hit their goals are made up of new homes, long-term care beds and additional units like basements or garden suites. The government set up a website to show which cities had hit their goals. Around October 2024, however, with housing starts across the province stuttering, the government stopped updating the tracker. …While the tracker has appeared abandoned for close to half a year, the government has had “finalized” data for months.

Construction of new homes fell 9.8% in May, as builders pulled back amid waning demand from home buyers. Housing starts fell to a 1.26 million annual pace from 1.39 million the previous month, the government said. The annual pace refers to how many houses would be built over an entire year if May’s rate of construction were to continue. The pace of home building is down to the lowest level since May 2020 — during the peak of the COVID-19 pandemic. New-home construction is down 4.6% from the same period a year ago. Building permits, a sign of future construction, also fell 2% from the previous month to a 1.39 million rate. Builders have slowed down the construction of new homes primarily due to a pullback in buyer demand. Rising inventory levels and weak buyer demand have resulted in homes sitting longer on the market. More builders are also resorting to home prices to encourage buyers.

Construction of new homes fell 9.8% in May, as builders pulled back amid waning demand from home buyers. Housing starts fell to a 1.26 million annual pace from 1.39 million the previous month, the government said. The annual pace refers to how many houses would be built over an entire year if May’s rate of construction were to continue. The pace of home building is down to the lowest level since May 2020 — during the peak of the COVID-19 pandemic. New-home construction is down 4.6% from the same period a year ago. Building permits, a sign of future construction, also fell 2% from the previous month to a 1.39 million rate. Builders have slowed down the construction of new homes primarily due to a pullback in buyer demand. Rising inventory levels and weak buyer demand have resulted in homes sitting longer on the market. More builders are also resorting to home prices to encourage buyers.

Stocks wavered Thursday as President Trump threatened setting unilateral tariffs on trading partners in two weeks. The S&P 500 added 0.2%, while the Nasdaq Composite gained 0.1%. …Wall Street awaits further developments on trade policy, especially between the U.S. and China, as talks between the two countries have been a focal point this week. Trump said Wednesday he would be willing to extend a July 8 deadline for finishing trade talks with countries before higher US levies take effect, but that the extensions may not be necessary. …“We still think the primary driver for market direction and to break out to all-time highs would be some resolution for tariffs and how they interlink with the budget and the Fed. And we see a lot of headlines about negotiations or pauses or frameworks, but we still haven’t seen a single signed trade deal,” said Tom Hainlin at U.S. Bank Asset Management Group.

Stocks wavered Thursday as President Trump threatened setting unilateral tariffs on trading partners in two weeks. The S&P 500 added 0.2%, while the Nasdaq Composite gained 0.1%. …Wall Street awaits further developments on trade policy, especially between the U.S. and China, as talks between the two countries have been a focal point this week. Trump said Wednesday he would be willing to extend a July 8 deadline for finishing trade talks with countries before higher US levies take effect, but that the extensions may not be necessary. …“We still think the primary driver for market direction and to break out to all-time highs would be some resolution for tariffs and how they interlink with the budget and the Fed. And we see a lot of headlines about negotiations or pauses or frameworks, but we still haven’t seen a single signed trade deal,” said Tom Hainlin at U.S. Bank Asset Management Group.

WASHINGTON, DC – Fannie Mae published the results of its May 2025 National Housing Survey® (NHS), which includes the

WASHINGTON, DC – Fannie Mae published the results of its May 2025 National Housing Survey® (NHS), which includes the  U.S. home prices will rise steadily over coming years on an expected further decline in mortgage rates, according to property experts in a Reuters survey who expressed a near-unanimous view President Donald Trump’s tariffs would hinder affordable home construction. The same analysts had said three months ago that affordability and turnover in the market would improve, an upbeat outlook hinging on expectations the Federal Reserve will resume cutting interest rates after staying on the sidelines all year. That optimism has since been tempered with Congress passing a sweeping tax-cut and spending bill estimated to add roughly $3.3 trillion by 2034 to an already-enormous $36.2 trillion debt pile, according to nonpartisan think tank the Committee for a Responsible Federal Budget. Long-term bond yields have spiked higher, limiting scope for a decline in mortgage rates.

U.S. home prices will rise steadily over coming years on an expected further decline in mortgage rates, according to property experts in a Reuters survey who expressed a near-unanimous view President Donald Trump’s tariffs would hinder affordable home construction. The same analysts had said three months ago that affordability and turnover in the market would improve, an upbeat outlook hinging on expectations the Federal Reserve will resume cutting interest rates after staying on the sidelines all year. That optimism has since been tempered with Congress passing a sweeping tax-cut and spending bill estimated to add roughly $3.3 trillion by 2034 to an already-enormous $36.2 trillion debt pile, according to nonpartisan think tank the Committee for a Responsible Federal Budget. Long-term bond yields have spiked higher, limiting scope for a decline in mortgage rates. SACRAMENTO, California — There is already a crisis of available and affordable housing in America. But now, political uncertainty and economic volatility could make home buying even less attainable. …The proposed Trump tariffs on building materials are creating financial volatility that could send housing prices up significantly. Since his announcement of widespread tariffs on April 2, the additional costs imposed on imported lumber, gypsum, aluminum, electronics and other related materials delayed the nation’s housing starts in April, according to NAHB. …“More tariffs equal more anxiety and uncertainty for American businesses and consumers,” said David French, at the National Retail Federation. “Tariffs are a tax paid by the U.S. importer that will be passed along to the end consumer. …One of the largest material costs for housing construction is lumber, and the largest amounts are imported into the US from Canada.

SACRAMENTO, California — There is already a crisis of available and affordable housing in America. But now, political uncertainty and economic volatility could make home buying even less attainable. …The proposed Trump tariffs on building materials are creating financial volatility that could send housing prices up significantly. Since his announcement of widespread tariffs on April 2, the additional costs imposed on imported lumber, gypsum, aluminum, electronics and other related materials delayed the nation’s housing starts in April, according to NAHB. …“More tariffs equal more anxiety and uncertainty for American businesses and consumers,” said David French, at the National Retail Federation. “Tariffs are a tax paid by the U.S. importer that will be passed along to the end consumer. …One of the largest material costs for housing construction is lumber, and the largest amounts are imported into the US from Canada. April 2025 Southern Pine lumber exports (treated and untreated) were up 22.7% over the same month in 2024 at 57.4 MMBF and up 34.8% over March 2025, according to April 2025 data from the USDA’s Foreign Agriculture Services’ Global Agricultural Trade System. Year-to-date exports, however, are running 4% behind the same period in 2024 at 179.7 MMBF. When looking at the report by dollar value, Southern Pine exports were up 27% to $22.6 million in April – a 12-month high – compared to the same month in 2024 and up 26% over March 2025. Mexico leads the way YTD 2025 at $20.7 million, followed by the Dominican Republic at $15.8 million, and Canada at $5 million. Treated lumber exports, meanwhile, were up 47% compared to April 2025 at $15 million and up 53% over March 2025. …Softwood lumber imports were down 5% in April to 1.2 MMBF over the year and down 13.7% over March 2025.

April 2025 Southern Pine lumber exports (treated and untreated) were up 22.7% over the same month in 2024 at 57.4 MMBF and up 34.8% over March 2025, according to April 2025 data from the USDA’s Foreign Agriculture Services’ Global Agricultural Trade System. Year-to-date exports, however, are running 4% behind the same period in 2024 at 179.7 MMBF. When looking at the report by dollar value, Southern Pine exports were up 27% to $22.6 million in April – a 12-month high – compared to the same month in 2024 and up 26% over March 2025. Mexico leads the way YTD 2025 at $20.7 million, followed by the Dominican Republic at $15.8 million, and Canada at $5 million. Treated lumber exports, meanwhile, were up 47% compared to April 2025 at $15 million and up 53% over March 2025. …Softwood lumber imports were down 5% in April to 1.2 MMBF over the year and down 13.7% over March 2025. An increasing demand for timber to meet Australia’s housing targets is set to drive a change in focus for one of Australia’s largest forestry regions. The Green Triangle, situated across the southern South Australia–Victorian border, has about 334,000 hectares of plantations, representing 17 per cent of Australia’s forestry industry. The region grows a mix of softwood timber, primarily used in domestic construction, and hardwood, which is often exported as wood chips and used in paper manufacturing. But as Australia looks to meet its goal of building 1.2 million new homes by 2029, investment in softwood is growing fast. “Both the state and the federal governments have incentives in place for industry and private investors to grow radiata pine,” University of Melbourne forest ecologist Rod Keenan said.

An increasing demand for timber to meet Australia’s housing targets is set to drive a change in focus for one of Australia’s largest forestry regions. The Green Triangle, situated across the southern South Australia–Victorian border, has about 334,000 hectares of plantations, representing 17 per cent of Australia’s forestry industry. The region grows a mix of softwood timber, primarily used in domestic construction, and hardwood, which is often exported as wood chips and used in paper manufacturing. But as Australia looks to meet its goal of building 1.2 million new homes by 2029, investment in softwood is growing fast. “Both the state and the federal governments have incentives in place for industry and private investors to grow radiata pine,” University of Melbourne forest ecologist Rod Keenan said. New Forests, a global investment manager of nature-based real assets and natural capital strategies, is today announcing its Tropical Asia Forest Fund 2 (TAFF2) has made its first investment in timber processing infrastructure in Vietnam by investing in the Tavico Group (Tavico), one of the country’s leading suppliers of solid wood lumber and logs. Tavico was founded in 2005 as a log trader and sawn timber mill with annual production capacity of 12,000m3 of lumber per annum, which is equivalent to approximately 800 medium sized houses. Tavico has established a 3,200-hectare FSC certified community forestry program with small holder farmers which provides employment and revenue sharing opportunities for local communities. The investment from TAFF2 will look to expand this program for smallholder farmers in Vietnam.

New Forests, a global investment manager of nature-based real assets and natural capital strategies, is today announcing its Tropical Asia Forest Fund 2 (TAFF2) has made its first investment in timber processing infrastructure in Vietnam by investing in the Tavico Group (Tavico), one of the country’s leading suppliers of solid wood lumber and logs. Tavico was founded in 2005 as a log trader and sawn timber mill with annual production capacity of 12,000m3 of lumber per annum, which is equivalent to approximately 800 medium sized houses. Tavico has established a 3,200-hectare FSC certified community forestry program with small holder farmers which provides employment and revenue sharing opportunities for local communities. The investment from TAFF2 will look to expand this program for smallholder farmers in Vietnam.