VANCOUVER — Canfor Corporation reported its Q1, 2025 results. The Company reported an operating loss of $28.5 million for the first quarter of 2025, compared to an operating loss of $45.9 million in the fourth quarter of 2024. …These results largely reflected improved lumber segment results and, to a lesser extent, the pulp and paper segment. Canfor’s CEO, Susan Yurkovich said, “While improved lumber benchmark prices provided some relief, rising global economic and trade uncertainty, and US lumber duties, create a challenging backdrop. Through our diversified operating platform in Canada, the US South and Europe, we are positioned to mitigate these challenges, while remaining focused on what we can control. …“For our pulp business” Yurkovich added, “this was another solid quarter with improved results and a strong operational performance. However, global economic uncertainty is also putting pressure on global softwood pulp markets in the near term.”

VANCOUVER — Canfor Corporation reported its Q1, 2025 results. The Company reported an operating loss of $28.5 million for the first quarter of 2025, compared to an operating loss of $45.9 million in the fourth quarter of 2024. …These results largely reflected improved lumber segment results and, to a lesser extent, the pulp and paper segment. Canfor’s CEO, Susan Yurkovich said, “While improved lumber benchmark prices provided some relief, rising global economic and trade uncertainty, and US lumber duties, create a challenging backdrop. Through our diversified operating platform in Canada, the US South and Europe, we are positioned to mitigate these challenges, while remaining focused on what we can control. …“For our pulp business” Yurkovich added, “this was another solid quarter with improved results and a strong operational performance. However, global economic uncertainty is also putting pressure on global softwood pulp markets in the near term.”

Related coverage: Canfor Pulp reported Q1, 2025 operating income of $11 million

Fresh trade data shows deepening US reliance on Canadian goods, even as the president claims the opposite. …According to the US Census Bureau and Bureau of Economic Analysis, the US goods trade deficit with Canada widened to $4.9 billion in March, up sharply from prior months. The surge was driven by higher imports of Canadian-made cars, crude oil, and finished wood products — the exact categories Trump dismissed. Automotive imports rose by $2.6 billion, including a $2.1 billion spike in passenger vehicles, many of which are assembled in Canada. Oil and lumber purchases also increased, contributing to a 14% month-over-month jump in the broader US trade deficit, which hit a new monthly high of $140.5 billion in March. …The US typically runs a services surplus with Canada, and American firms rely heavily on Canadian supply chains in autos, energy, and materials, as the fresh BEA data suggests.

Fresh trade data shows deepening US reliance on Canadian goods, even as the president claims the opposite. …According to the US Census Bureau and Bureau of Economic Analysis, the US goods trade deficit with Canada widened to $4.9 billion in March, up sharply from prior months. The surge was driven by higher imports of Canadian-made cars, crude oil, and finished wood products — the exact categories Trump dismissed. Automotive imports rose by $2.6 billion, including a $2.1 billion spike in passenger vehicles, many of which are assembled in Canada. Oil and lumber purchases also increased, contributing to a 14% month-over-month jump in the broader US trade deficit, which hit a new monthly high of $140.5 billion in March. …The US typically runs a services surplus with Canada, and American firms rely heavily on Canadian supply chains in autos, energy, and materials, as the fresh BEA data suggests. Uncertainty over international trade barriers has caused significant fluctuations in lumber prices in recent months, according to Keta Kosman, publisher of Madison’s Lumber Reporter. “The whipsaw fatigue of conflicting tariff announcements over two months had Western Canadian suppliers hoping to see the market settle down,” Kosman. …Some stakeholders held off on buying lumber altogether, while others ordered early in hopes of securing delivery ahead of any potential trade restrictions. “Others decidedly switched their purchasing to Southern Yellow Pine from SPF,” Kosman says. …Data from the WWPA indicates US sawmills were running at only 67% of full capacity in January, compared to 72% for the full-year 2024. In Canada, sawmill utilization was 74% of capacity, down just one percentage point compared to the previous year. …“At this time, there is significant lumber supply able to come back online at existing facilities should demand improve into the summer.”

Uncertainty over international trade barriers has caused significant fluctuations in lumber prices in recent months, according to Keta Kosman, publisher of Madison’s Lumber Reporter. “The whipsaw fatigue of conflicting tariff announcements over two months had Western Canadian suppliers hoping to see the market settle down,” Kosman. …Some stakeholders held off on buying lumber altogether, while others ordered early in hopes of securing delivery ahead of any potential trade restrictions. “Others decidedly switched their purchasing to Southern Yellow Pine from SPF,” Kosman says. …Data from the WWPA indicates US sawmills were running at only 67% of full capacity in January, compared to 72% for the full-year 2024. In Canada, sawmill utilization was 74% of capacity, down just one percentage point compared to the previous year. …“At this time, there is significant lumber supply able to come back online at existing facilities should demand improve into the summer.” Lumber futures fell below $550 per thousand board feet, hovering at yearly lows as excess supply from winter restocking collided added to a decline in demand. A 14.2% drop in U.S. single-family housing starts to an annualized 940,000 units in March, pushed new-home inventories to nearly eight months of supply. While a federal directive to raise timber production from public lands by 25% may ease constraints in the long term, the 90-day pause on new reciprocal tariffs has removed near-term urgency for buyers to cover import risks. At the same time, expectations of sharply higher anti-dumping duties on Canadian lumber have prompted mills to hold back supply, further pressuring prices as domestic inventories accumulate and demand remains subdued despite the onset of the spring building season.

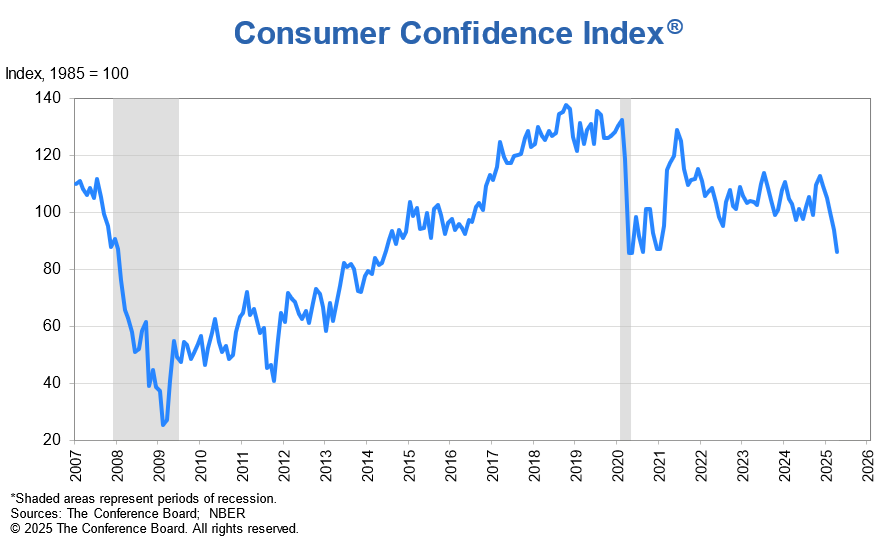

Lumber futures fell below $550 per thousand board feet, hovering at yearly lows as excess supply from winter restocking collided added to a decline in demand. A 14.2% drop in U.S. single-family housing starts to an annualized 940,000 units in March, pushed new-home inventories to nearly eight months of supply. While a federal directive to raise timber production from public lands by 25% may ease constraints in the long term, the 90-day pause on new reciprocal tariffs has removed near-term urgency for buyers to cover import risks. At the same time, expectations of sharply higher anti-dumping duties on Canadian lumber have prompted mills to hold back supply, further pressuring prices as domestic inventories accumulate and demand remains subdued despite the onset of the spring building season. Risks are high that the global economy will slip into recession this year, according to a majority of economists in a Reuters poll, in which scores said US President Donald Trump’s tariffs have damaged business sentiment. Just three months ago, the same group of economists covering nearly 50 economies had expected the global economy to grow at a strong, steady clip. …While Trump has suspended the heaviest tariffs imposed on almost all trading partners for a few months, a 10% blanket duty remains, as well as a 145% tariff on China, the United States’ largest trading partner. …Showing unusual unanimity… three-quarters of economists cut their 2025 global growth forecast, bringing the median to 2.7% from 3.0% in a January poll. …China and Russia were forecast to grow 4.5% and 1.7% respectively, outperforming the US. However, growth forecasts for Mexico and Canada were downgraded from January by some of the largest margins, to 0.2% and 1.2%.

Risks are high that the global economy will slip into recession this year, according to a majority of economists in a Reuters poll, in which scores said US President Donald Trump’s tariffs have damaged business sentiment. Just three months ago, the same group of economists covering nearly 50 economies had expected the global economy to grow at a strong, steady clip. …While Trump has suspended the heaviest tariffs imposed on almost all trading partners for a few months, a 10% blanket duty remains, as well as a 145% tariff on China, the United States’ largest trading partner. …Showing unusual unanimity… three-quarters of economists cut their 2025 global growth forecast, bringing the median to 2.7% from 3.0% in a January poll. …China and Russia were forecast to grow 4.5% and 1.7% respectively, outperforming the US. However, growth forecasts for Mexico and Canada were downgraded from January by some of the largest margins, to 0.2% and 1.2%. VANCOUVER – Western Forest Products reported improved financial results in the first quarter of 2025, as compared to the same period last year. Net income was $13.8 million in the first quarter of 2025, as compared to a net loss of $8.0 million in the first quarter of 2024, and a net loss of $1.2 million in the fourth quarter of 2024. …lumber production of 134 million board feet (versus 145 million board feet in Q1 2024); average lumber selling price of $1,533 per mfbm. …North American markets are expected to be volatile due to concerns around the economic impact caused by potential further US tariffs and retaliatory tariffs. The spring building season which typically leads to gains in softwood lumber demand could be more muted. …In Japan, the spring housing demand is stronger than expected and channel inventories have declined. …Demand for our Industrial lumber products in North America are expected to strengthen as supply remains tight across all species.

VANCOUVER – Western Forest Products reported improved financial results in the first quarter of 2025, as compared to the same period last year. Net income was $13.8 million in the first quarter of 2025, as compared to a net loss of $8.0 million in the first quarter of 2024, and a net loss of $1.2 million in the fourth quarter of 2024. …lumber production of 134 million board feet (versus 145 million board feet in Q1 2024); average lumber selling price of $1,533 per mfbm. …North American markets are expected to be volatile due to concerns around the economic impact caused by potential further US tariffs and retaliatory tariffs. The spring building season which typically leads to gains in softwood lumber demand could be more muted. …In Japan, the spring housing demand is stronger than expected and channel inventories have declined. …Demand for our Industrial lumber products in North America are expected to strengthen as supply remains tight across all species.

MONTREAL — Stella-Jones announced financial results for its first quarter ended March 31, 2025. Highlights include: Sales of $773 million, relatively unchanged from Q1 2024; Operating income of $143 million, including insurance settlement of $38 million; EBITDA of $179 million, or 23.2% margin; Acquisition post-quarter of a steel transmission structure manufacturer, aligned with strategy to support North American infrastructure. …Eric Vachon, President and Chief Executive Officer of Stella-Jones said “Though macroeconomic headwinds continue to impact volume growth, at this stage we remain confident in our ability to achieve our financial objectives. …“The Company entered into a definitive agreement to acquire Locwel., a leading manufacturer of lattice towers and steel poles for electrical transmission. This transaction marks a step forward in Stella-Jones’ long-term vision, allowing us to enhance our infrastructure offering and establish a presence in the growing steel transmission structure industry.”

MONTREAL — Stella-Jones announced financial results for its first quarter ended March 31, 2025. Highlights include: Sales of $773 million, relatively unchanged from Q1 2024; Operating income of $143 million, including insurance settlement of $38 million; EBITDA of $179 million, or 23.2% margin; Acquisition post-quarter of a steel transmission structure manufacturer, aligned with strategy to support North American infrastructure. …Eric Vachon, President and Chief Executive Officer of Stella-Jones said “Though macroeconomic headwinds continue to impact volume growth, at this stage we remain confident in our ability to achieve our financial objectives. …“The Company entered into a definitive agreement to acquire Locwel., a leading manufacturer of lattice towers and steel poles for electrical transmission. This transaction marks a step forward in Stella-Jones’ long-term vision, allowing us to enhance our infrastructure offering and establish a presence in the growing steel transmission structure industry.”

BEIJING — China announced a barrage of measures meant to counter the blow to its economy from US President Donald Trump ’s trade war, as the two sides prepared for talks later this week. Beijing’s central bank governor and other top financial officials outlined plans Wednesday to cut interest rates and reduce bank reserve requirements to help free up more funding for lending. …Trump’s tariffs on imports from China, have begun to take a toll on its export-dependent economy at a time when it’s already under pressure from a prolonged downturn in the property sector. China has retaliated with tariff hikes of up to 125% on US goods and stopped buying most American farm products. Late Tuesday, China and the US announced plans for talks. …The agreement to talk comes at a time when both sides have remained adamant, at least in public, about not compromising on the tariffs.

BEIJING — China announced a barrage of measures meant to counter the blow to its economy from US President Donald Trump ’s trade war, as the two sides prepared for talks later this week. Beijing’s central bank governor and other top financial officials outlined plans Wednesday to cut interest rates and reduce bank reserve requirements to help free up more funding for lending. …Trump’s tariffs on imports from China, have begun to take a toll on its export-dependent economy at a time when it’s already under pressure from a prolonged downturn in the property sector. China has retaliated with tariff hikes of up to 125% on US goods and stopped buying most American farm products. Late Tuesday, China and the US announced plans for talks. …The agreement to talk comes at a time when both sides have remained adamant, at least in public, about not compromising on the tariffs.

Mortgage loan applications saw little change in April, as refinancing activity decreased. The Market Composite Index, which measures mortgage loan application volume based on the

Mortgage loan applications saw little change in April, as refinancing activity decreased. The Market Composite Index, which measures mortgage loan application volume based on the  Gross domestic product (GDP) contracted in the first quarter by 0.3%, with imported goods being a large contributor to the decline as the suppliers prepared for President Trump’s tariff proposals once he took office. NAHB estimates this should even out in the second quarter. Other economic data of note are inflation, which is still elevated but creeping downward, and the unemployment rate, which remains low but may edge up among economic uncertainty. …NAHB Chief Economist Robert Dietz hasn’t hit the panic button yet. And I still think that we don’t know what President Trump’s economy really is yet. It’s been policy by sledgehammer, and now they’re going to start putting the pieces back together.” NAHB Senior Officers and staff continue to actively engage with lawmakers on this and other policies, including a special BUILD-PAC Capital Club event this week featuring an interview with Sen. Tim Sheehy.

Gross domestic product (GDP) contracted in the first quarter by 0.3%, with imported goods being a large contributor to the decline as the suppliers prepared for President Trump’s tariff proposals once he took office. NAHB estimates this should even out in the second quarter. Other economic data of note are inflation, which is still elevated but creeping downward, and the unemployment rate, which remains low but may edge up among economic uncertainty. …NAHB Chief Economist Robert Dietz hasn’t hit the panic button yet. And I still think that we don’t know what President Trump’s economy really is yet. It’s been policy by sledgehammer, and now they’re going to start putting the pieces back together.” NAHB Senior Officers and staff continue to actively engage with lawmakers on this and other policies, including a special BUILD-PAC Capital Club event this week featuring an interview with Sen. Tim Sheehy. Tuesday marked the 100th day of President Trump’s second term in office and there are signs of stress and jitters in the US construction industry, with rising prices, falling confidence, and a sharp uptick in abandoned projects. “Lumber and metals prices shot up in March, while contractors’ inboxes are bulging with ‘Dear Valued Customer’ letters announcing further increases for many products,” said Ken Simonson, chief economist at AGC. “Rapid-fire changes in tariffs threaten to drive prices higher for many essential construction goods,” he added. The price of materials and services used in nonresidential construction rose 0.4% in March, the third monthly increase in a row, AGC said. It was the first time since September 2023 that input prices had risen for three consecutive months, and comes after more than a year of stable or falling prices, Simonson said. …Within the 0.4% hike, lumber and plywood rose 2.7%.

Tuesday marked the 100th day of President Trump’s second term in office and there are signs of stress and jitters in the US construction industry, with rising prices, falling confidence, and a sharp uptick in abandoned projects. “Lumber and metals prices shot up in March, while contractors’ inboxes are bulging with ‘Dear Valued Customer’ letters announcing further increases for many products,” said Ken Simonson, chief economist at AGC. “Rapid-fire changes in tariffs threaten to drive prices higher for many essential construction goods,” he added. The price of materials and services used in nonresidential construction rose 0.4% in March, the third monthly increase in a row, AGC said. It was the first time since September 2023 that input prices had risen for three consecutive months, and comes after more than a year of stable or falling prices, Simonson said. …Within the 0.4% hike, lumber and plywood rose 2.7%.

To kick off National Home Remodeling Month in May, which promotes the benefits of hiring a professional remodeler, the National Association of Home Builders (NAHB) has highlighted

To kick off National Home Remodeling Month in May, which promotes the benefits of hiring a professional remodeler, the National Association of Home Builders (NAHB) has highlighted

The US economy contracted in the first three months of 2025 on an import surge at the start of President Trump’s second term in office as he wages a potentially costly trade war. Gross domestic product fell at a 0.3% annualized pace, according to a Commerce Department report adjusted for seasonal factors and inflation. This was the first quarter of negative growth since Q1 of 2022. Economists had been looking for a gain of 0.4% after GDP rose by 2.4% in the fourth quarter of 2024. However, over the past day or so some Wall Street economists changed their outlook to negative growth, largely because of an unexpected rise in imports as companies and consumers sought to get ahead of the Trump tariffs implemented in early April. …The more telling number for the future of the expansion was consumer spending, and it grew, but at a relatively weak pace,” said Robert Frick.

The US economy contracted in the first three months of 2025 on an import surge at the start of President Trump’s second term in office as he wages a potentially costly trade war. Gross domestic product fell at a 0.3% annualized pace, according to a Commerce Department report adjusted for seasonal factors and inflation. This was the first quarter of negative growth since Q1 of 2022. Economists had been looking for a gain of 0.4% after GDP rose by 2.4% in the fourth quarter of 2024. However, over the past day or so some Wall Street economists changed their outlook to negative growth, largely because of an unexpected rise in imports as companies and consumers sought to get ahead of the Trump tariffs implemented in early April. …The more telling number for the future of the expansion was consumer spending, and it grew, but at a relatively weak pace,” said Robert Frick.

The clock is ticking on trade deals that the US will need to strike with many nations, most notably China, to avoid what Trump’s Treasury Secretary has described as an “unsustainable” tariffs war. But in the U.S. farming sector, the damage has already been done and the economic crisis already begun. US agriculture exporters say the global backlash to President Trump’s tariffs is punishing them, especially a decline in Chinese buying of US farm products, leading to cancelled export orders and layoffs. Peter Friedmann, of the Agriculture Transportation Coalition …says “massive” financial losses are already being shared by its members. …A wood pulp and paperboard exporter reported to the trade group the immediate cancellation or hold of 6,400 metric tons in a warehouse and a hold of 15 railcars sitting in what is known in the supply chain as “demurrage,” when fees are charged for delayed movement of goods.

The clock is ticking on trade deals that the US will need to strike with many nations, most notably China, to avoid what Trump’s Treasury Secretary has described as an “unsustainable” tariffs war. But in the U.S. farming sector, the damage has already been done and the economic crisis already begun. US agriculture exporters say the global backlash to President Trump’s tariffs is punishing them, especially a decline in Chinese buying of US farm products, leading to cancelled export orders and layoffs. Peter Friedmann, of the Agriculture Transportation Coalition …says “massive” financial losses are already being shared by its members. …A wood pulp and paperboard exporter reported to the trade group the immediate cancellation or hold of 6,400 metric tons in a warehouse and a hold of 15 railcars sitting in what is known in the supply chain as “demurrage,” when fees are charged for delayed movement of goods.

Drax Group plc on May 1

Drax Group plc on May 1

UK — Housing starts in the UK have lagged behind completions for the sixth successive quarter, including to the latest official data. Around 32,000 homes were started in the last quarter of 2024, compared to just over 49,000 completed during the same period, according to the Office for National Statistics. The number of starts is down from 37,000 in the preceding quarter and well below the average of 42,000 homes which have been started per quarter since the ONS resumed gathering the data after the pandemic in April 2022. Completions have remained more stable, rising in the last quarter of 2024 from 41,500 in the third quarter, with an average of just over 49,000 completions a year since the pandemic. Pocket Living chief executive Paul Rickard said: “By any measure these are a disappointing set of figures and continue to highlight the massive challenge the government has.”

UK — Housing starts in the UK have lagged behind completions for the sixth successive quarter, including to the latest official data. Around 32,000 homes were started in the last quarter of 2024, compared to just over 49,000 completed during the same period, according to the Office for National Statistics. The number of starts is down from 37,000 in the preceding quarter and well below the average of 42,000 homes which have been started per quarter since the ONS resumed gathering the data after the pandemic in April 2022. Completions have remained more stable, rising in the last quarter of 2024 from 41,500 in the third quarter, with an average of just over 49,000 completions a year since the pandemic. Pocket Living chief executive Paul Rickard said: “By any measure these are a disappointing set of figures and continue to highlight the massive challenge the government has.”