Homebuilder stocks plunged Monday following reports that the US is preparing to sharply increase tariffs on Canadian lumber, independent of President Donald Trump’s new “reciprocal” tariffs. …After reports of the new lumber duties emerged over the weekend, however, shares of homebuilders plunged swiftly Monday. …”Tariffs are the clear culprit for the stock market pullback and fears of recession,” says Realtor.com® Senior Economist Joel Berner. “Recession risk is especially poignant for builders.” …The latest round of tariffs, however, will likely increase materials costs for all homebuilders, to some extent, with a recent survey of builders finding that they expect an average cost increase of $9,200 per home as a result of tariffs. …Over the weekend, Moody’s Analytics Chief Economist Mark Zandi raised his outlook for the odds of a recession this year to 60%, up from just 15% a few months ago.

Homebuilder stocks plunged Monday following reports that the US is preparing to sharply increase tariffs on Canadian lumber, independent of President Donald Trump’s new “reciprocal” tariffs. …After reports of the new lumber duties emerged over the weekend, however, shares of homebuilders plunged swiftly Monday. …”Tariffs are the clear culprit for the stock market pullback and fears of recession,” says Realtor.com® Senior Economist Joel Berner. “Recession risk is especially poignant for builders.” …The latest round of tariffs, however, will likely increase materials costs for all homebuilders, to some extent, with a recent survey of builders finding that they expect an average cost increase of $9,200 per home as a result of tariffs. …Over the weekend, Moody’s Analytics Chief Economist Mark Zandi raised his outlook for the odds of a recession this year to 60%, up from just 15% a few months ago.

Canada’s economy was already stumbling a few months ago. Now, it is on the brink of recession because of President Trump’s tariffs. Canada’s economy is starting to shed jobs after months of tariff-fueled anxiety, while the outlook among businesses and consumers has become increasingly dour as one of the US’s largest trading partners braces for more pain to come. …Last week, Canada’s statistical agency reported that 33,000 Canadians lost their jobs in March, the worst jobs report in more than three years. On Monday, the Bank of Canada reported that businesses and households expect inflation to climb, and company executives warned they expect to pass on higher, tariff-fueled costs to customers regardless of the hit to consumer demand. …Canada’s fiscal and monetary outlook has also been complicated by the government’s decision to retaliate against the US. [to access the full story a WSJ subscription is required]

Canada’s economy was already stumbling a few months ago. Now, it is on the brink of recession because of President Trump’s tariffs. Canada’s economy is starting to shed jobs after months of tariff-fueled anxiety, while the outlook among businesses and consumers has become increasingly dour as one of the US’s largest trading partners braces for more pain to come. …Last week, Canada’s statistical agency reported that 33,000 Canadians lost their jobs in March, the worst jobs report in more than three years. On Monday, the Bank of Canada reported that businesses and households expect inflation to climb, and company executives warned they expect to pass on higher, tariff-fueled costs to customers regardless of the hit to consumer demand. …Canada’s fiscal and monetary outlook has also been complicated by the government’s decision to retaliate against the US. [to access the full story a WSJ subscription is required]

Dear Deputy Assistant Secretary Longnecker: The U.S. Chamber strongly opposes the establishment of tariffs or quantitative restrictions on imports of timber, lumber, and their derivative products such as paper, cardboard, and pulp. Imports of these goods do not represent a national security risk, as addressed below. Imposing tariffs on these goods would raise costs for U.S. businesses and home construction, undermine the export success enjoyed by the U.S. paper industry, and reduce incomes in many U.S. communities… It is unreasonable to suggest that imports of these goods represent a national security risk, in part because the chief source of imports in this sector is Canada, a NATO ally and North American Aerospace Defense Command (NORAD) partner… It is not reasonable to claim that imports of these goods from a close ally somehow pose a threat to U.S. national security.

Dear Deputy Assistant Secretary Longnecker: The U.S. Chamber strongly opposes the establishment of tariffs or quantitative restrictions on imports of timber, lumber, and their derivative products such as paper, cardboard, and pulp. Imports of these goods do not represent a national security risk, as addressed below. Imposing tariffs on these goods would raise costs for U.S. businesses and home construction, undermine the export success enjoyed by the U.S. paper industry, and reduce incomes in many U.S. communities… It is unreasonable to suggest that imports of these goods represent a national security risk, in part because the chief source of imports in this sector is Canada, a NATO ally and North American Aerospace Defense Command (NORAD) partner… It is not reasonable to claim that imports of these goods from a close ally somehow pose a threat to U.S. national security.

Flatbed trucking rates have surged over the past month as steel and lumber shippers hurry to stockpile inventory amid tariff whiplash threatening to roil their supply chains, experts say. A six-week increase in rates has led to the highest flatbed pricing to start a year since 2017, according to DAT, as freight repositioning combines with a typical seasonal pickup in construction and other industries. “Demand usually picks up in March and April as planti ng, building, construction, machinery imports, and nursery seasons gear up,” said DAT Principal Analyst Dean Croke. “…Last week, the average flatbed spot rate went up 4 cents to $2.13 per mile compared to the previous week. Meanwhile, the load-to-truck ratio for flatbed went up to 46.92 from 41.12 loads per truck.Shippers have pulled forward cargo imports such as machinery, lumber, metals and oversized flatbed freight to mitigate tariff uncertainty.

Flatbed trucking rates have surged over the past month as steel and lumber shippers hurry to stockpile inventory amid tariff whiplash threatening to roil their supply chains, experts say. A six-week increase in rates has led to the highest flatbed pricing to start a year since 2017, according to DAT, as freight repositioning combines with a typical seasonal pickup in construction and other industries. “Demand usually picks up in March and April as planti ng, building, construction, machinery imports, and nursery seasons gear up,” said DAT Principal Analyst Dean Croke. “…Last week, the average flatbed spot rate went up 4 cents to $2.13 per mile compared to the previous week. Meanwhile, the load-to-truck ratio for flatbed went up to 46.92 from 41.12 loads per truck.Shippers have pulled forward cargo imports such as machinery, lumber, metals and oversized flatbed freight to mitigate tariff uncertainty.  US President Donald Trump’s tariff threat could motivate more Canadian lumber producers to shift to the US southern border while accelerating efforts to find new markets, industry experts said. The levies are the latest in a nearly four-decade dispute between the neighbors over softwood lumber, used in construction, furniture and paper production. Levies on Canadian lumber could hit 40% if current duties of 14.54%, and Trump’s proposed 25% tariffs are added. …”Disparity in log costs and availability are the major drivers here, but Canadian investment in the region has certainly been partially motivated to moving operations where they avoid the impact of duties,” said Dustin Jalbert at FastMarkets. …”In 2004, there were only two sawmills owned by a Canadian manufacturer. Today, we have more than 50,” said Kyle Little, at Sherwood Lumber.” Canadian companies now produce more than a third of the volume of the largest producing region in the US – the US South.”

US President Donald Trump’s tariff threat could motivate more Canadian lumber producers to shift to the US southern border while accelerating efforts to find new markets, industry experts said. The levies are the latest in a nearly four-decade dispute between the neighbors over softwood lumber, used in construction, furniture and paper production. Levies on Canadian lumber could hit 40% if current duties of 14.54%, and Trump’s proposed 25% tariffs are added. …”Disparity in log costs and availability are the major drivers here, but Canadian investment in the region has certainly been partially motivated to moving operations where they avoid the impact of duties,” said Dustin Jalbert at FastMarkets. …”In 2004, there were only two sawmills owned by a Canadian manufacturer. Today, we have more than 50,” said Kyle Little, at Sherwood Lumber.” Canadian companies now produce more than a third of the volume of the largest producing region in the US – the US South.” The ongoing trade spat between the U.S. and Canada is impacting BC’s construction sector in ways that could bring short-term gain and long-term pain. At first, there could be an oversupply of lumber if Canadian softwood is taken out of the U.S. equation, resulting in lower costs for B.C. builders and developers, said Padraic Kelly, Vancouver-based director with BTY Group. But costs would later rise significantly, he said. “The medium- and long-term pain would be that if the American market is choked out, mills would close, supply would be constrained and costs would ultimately go up,” Kelly said. The total levy on Canadian softwood lumber going into the U.S. could total between 45% and 55%, taking into account anti-dumping measures introduced by the Biden administration and scheduled to increase this August. Other big-ticket impacts to B.C. construction could be the mechanical and electrical divisions within construction budgets, he said.

The ongoing trade spat between the U.S. and Canada is impacting BC’s construction sector in ways that could bring short-term gain and long-term pain. At first, there could be an oversupply of lumber if Canadian softwood is taken out of the U.S. equation, resulting in lower costs for B.C. builders and developers, said Padraic Kelly, Vancouver-based director with BTY Group. But costs would later rise significantly, he said. “The medium- and long-term pain would be that if the American market is choked out, mills would close, supply would be constrained and costs would ultimately go up,” Kelly said. The total levy on Canadian softwood lumber going into the U.S. could total between 45% and 55%, taking into account anti-dumping measures introduced by the Biden administration and scheduled to increase this August. Other big-ticket impacts to B.C. construction could be the mechanical and electrical divisions within construction budgets, he said.

While the current tariff war is justifiably on the minds of many Americans, another type of import tax may be coming later this summer that could have a big impact on new home construction. …The US is preparing to raise duties on Canadian softwood lumber from 14.5% to 34.45%. …A final review of the levies will be published in August or September, with the rate increase taking effect then, according to the National Association of Home Builders. The NAHB has previously estimated that Trump’s tariffs could increase the cost of building a new home by $9,200. ….The proposal to more than double the tax would be a blow to Canadians, but it would also mean “driving up housing costs for Americans,” BC Premier David Eby said. …Some have praised the proposal, suggesting that it will give domestic lumber companies an opportunity to increase production, even if that means higher costs.

While the current tariff war is justifiably on the minds of many Americans, another type of import tax may be coming later this summer that could have a big impact on new home construction. …The US is preparing to raise duties on Canadian softwood lumber from 14.5% to 34.45%. …A final review of the levies will be published in August or September, with the rate increase taking effect then, according to the National Association of Home Builders. The NAHB has previously estimated that Trump’s tariffs could increase the cost of building a new home by $9,200. ….The proposal to more than double the tax would be a blow to Canadians, but it would also mean “driving up housing costs for Americans,” BC Premier David Eby said. …Some have praised the proposal, suggesting that it will give domestic lumber companies an opportunity to increase production, even if that means higher costs.

The Swedish Forest Industries Federation expresses concern over newly imposed US tariffs on pulp, paper, and board imports from the EU, which took effect on April 5 at 10% and are scheduled to double to 20% by April 2025. The federation emphasizes that free trade is critical to the Swedish forest industry, which is heavily export-oriented, with 5–10% of its exports directed to the United States. Europe remains its largest market, accounting for around 60%. …The federation’s CEO, Viveka Beckeman, highlights that the sector depends on international demand. While timber has been excluded from the latest round of tariffs, it remains under review in an ongoing US investigation that may lead to import duties as early as November 2025. The industry, which employs approximately 140,000 people in Sweden either directly or indirectly, represents 9–12% of the country’s industrial employment, export, turnover, and added value.

The Swedish Forest Industries Federation expresses concern over newly imposed US tariffs on pulp, paper, and board imports from the EU, which took effect on April 5 at 10% and are scheduled to double to 20% by April 2025. The federation emphasizes that free trade is critical to the Swedish forest industry, which is heavily export-oriented, with 5–10% of its exports directed to the United States. Europe remains its largest market, accounting for around 60%. …The federation’s CEO, Viveka Beckeman, highlights that the sector depends on international demand. While timber has been excluded from the latest round of tariffs, it remains under review in an ongoing US investigation that may lead to import duties as early as November 2025. The industry, which employs approximately 140,000 people in Sweden either directly or indirectly, represents 9–12% of the country’s industrial employment, export, turnover, and added value.  US trade wars could have major implications for an already tenuous housing market….A price hike on building materials will likely make building affordable housing feasible, an approach that many real estate experts believe is crucial to resolving the housing market gridlock. The housing sector comprises over 15% of the US GDP and will be heavily impacted by tariffs on building materials such as lumber and steel. And 70% of imported lumber comes from Canada. The NAHB noted that the tariffs are “not only expected to raise the cost of building materials, which are up 34% since December 2020, far higher than the rate of inflation, but also wreak havoc on the building material supply chain. In turn, this will put even more upward price pressure on building materials.” …Uncertainty stemming from the newly unveiled tariffs has eroded consumer and investor confidence, which has, in turn, diminished homebuyer optimism.

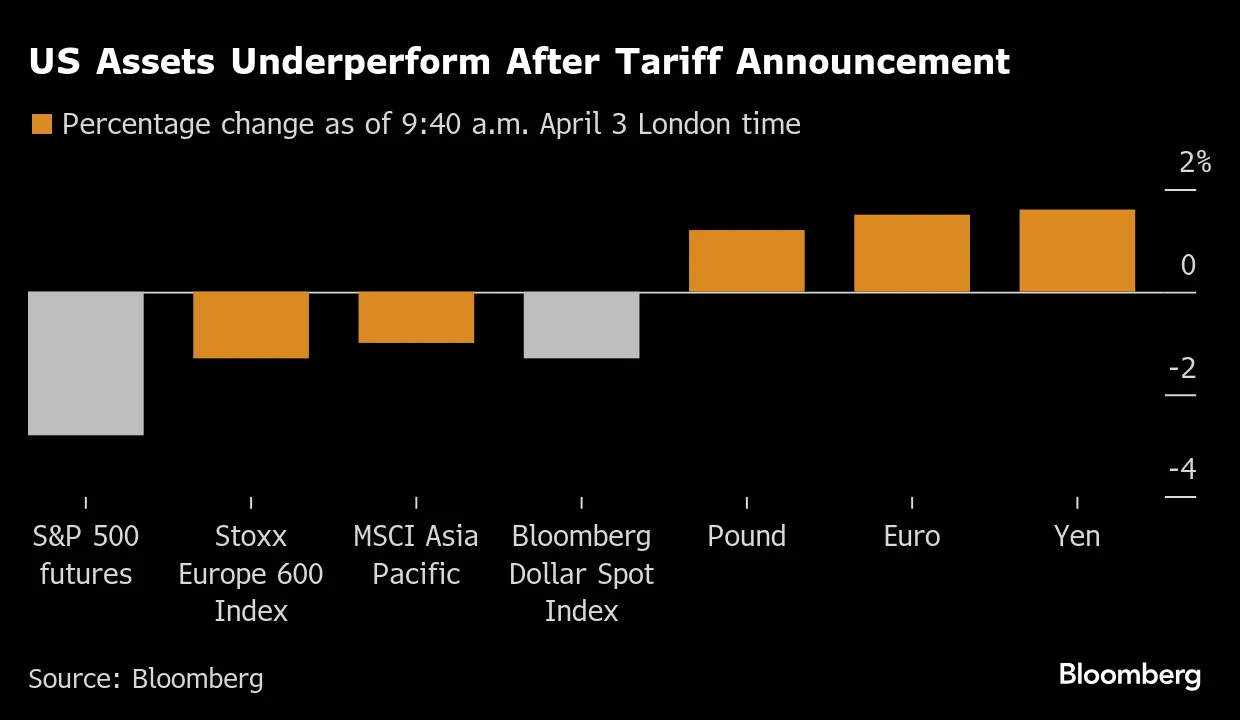

US trade wars could have major implications for an already tenuous housing market….A price hike on building materials will likely make building affordable housing feasible, an approach that many real estate experts believe is crucial to resolving the housing market gridlock. The housing sector comprises over 15% of the US GDP and will be heavily impacted by tariffs on building materials such as lumber and steel. And 70% of imported lumber comes from Canada. The NAHB noted that the tariffs are “not only expected to raise the cost of building materials, which are up 34% since December 2020, far higher than the rate of inflation, but also wreak havoc on the building material supply chain. In turn, this will put even more upward price pressure on building materials.” …Uncertainty stemming from the newly unveiled tariffs has eroded consumer and investor confidence, which has, in turn, diminished homebuyer optimism. US stocks opened lower Monday as markets around the world tumbled over concerns about how President Trump’s sweeping tariffs might upend the global economy and stymie US economic growth. Markets opened in bear market territory – a decline of 20% from a recent peak – after a historic rout in Asia and massive losses in Europe. The Dow fell 1,200 points, or 3.2%. The broader S&P 500 was 3.4% lower and opened in bear territory. The Nasdaq Composite slid 3.96%. The S&P 500 hit a record high less than seven weeks ago, on February 19. If the index closes in bear market territory, that would be the second-fastest peak-to-bear market shift in history. Wall Street’s fear gauge has surged to levels not seen since the Covid-19 pandemic as investors fret over the market’s next move. CNN’s Fear and Greed Index has slumped to its lowest levels this year.

US stocks opened lower Monday as markets around the world tumbled over concerns about how President Trump’s sweeping tariffs might upend the global economy and stymie US economic growth. Markets opened in bear market territory – a decline of 20% from a recent peak – after a historic rout in Asia and massive losses in Europe. The Dow fell 1,200 points, or 3.2%. The broader S&P 500 was 3.4% lower and opened in bear territory. The Nasdaq Composite slid 3.96%. The S&P 500 hit a record high less than seven weeks ago, on February 19. If the index closes in bear market territory, that would be the second-fastest peak-to-bear market shift in history. Wall Street’s fear gauge has surged to levels not seen since the Covid-19 pandemic as investors fret over the market’s next move. CNN’s Fear and Greed Index has slumped to its lowest levels this year. Wall Street’s main indexes reversed course and moved sharply higher after White House economic adviser Kevin Hassett said in an interview that President Donald Trump was considering a 90-day tariff pause on all countries expect China. At 10:20 a.m. the Dow Jones Industrial Average rose 333.50 points, or 0.87%, to 38,614.49, the S&P 500 gained 79.99 points, or 1.69%, to 5,154.07 and the Nasdaq Composite gained 362.69 points, or 2.33%, to 15,950.47.

Wall Street’s main indexes reversed course and moved sharply higher after White House economic adviser Kevin Hassett said in an interview that President Donald Trump was considering a 90-day tariff pause on all countries expect China. At 10:20 a.m. the Dow Jones Industrial Average rose 333.50 points, or 0.87%, to 38,614.49, the S&P 500 gained 79.99 points, or 1.69%, to 5,154.07 and the Nasdaq Composite gained 362.69 points, or 2.33%, to 15,950.47. The stock market took another pounding Friday after China retaliated with new tariffs on U.S. goods, raising fears a trade war will tip the globe into a recession. The Dow Jones Industrial Average traded 1,130 points, or 2.8%. This follows a 1,679.39 point decline on Thursday. The S&P 500 slid 3.2% after the benchmark shed 4.84% on Thursday. The Nasdaq Composite shed 3.5% as many tech companies have exposure to China. …“The Trump administration may be playing a game of chicken with trading partners, but market participants aren’t willing to wait around for the results,” said Michael Arone, at State Street Global Advisors. “Investors are selling first and asking questions later.” Bank stocks tumbled in the premarket as worries of a U.S. economic slowdown grew. …The 10-year Treasury yield fell back below 4% Friday as investors flooded into bonds for safety. JPMorgan late Thursday raised the odds of a recession this year to 60% from 40%.

The stock market took another pounding Friday after China retaliated with new tariffs on U.S. goods, raising fears a trade war will tip the globe into a recession. The Dow Jones Industrial Average traded 1,130 points, or 2.8%. This follows a 1,679.39 point decline on Thursday. The S&P 500 slid 3.2% after the benchmark shed 4.84% on Thursday. The Nasdaq Composite shed 3.5% as many tech companies have exposure to China. …“The Trump administration may be playing a game of chicken with trading partners, but market participants aren’t willing to wait around for the results,” said Michael Arone, at State Street Global Advisors. “Investors are selling first and asking questions later.” Bank stocks tumbled in the premarket as worries of a U.S. economic slowdown grew. …The 10-year Treasury yield fell back below 4% Friday as investors flooded into bonds for safety. JPMorgan late Thursday raised the odds of a recession this year to 60% from 40%. Manufactured homes play a measurable role in the U.S. housing market by providing an affordable supply option for millions of households. According to the American Housing Survey, there are 7.2 million occupied manufactured homes in the U.S., representing 5.4% of total occupied housing and a source of affordable housing, in particular, for rural and lower income households. Often thought of as synonymous to “mobile homes” or “trailers”, manufactured homes are a specific type of factory-built housing that adheres to the U.S. Department of Housing and Urban Development’s Manufactured Home Construction and Safety Standards code. …The East South Central division (Alabama, Kentucky, Mississippi and Tennessee) have the highest concentration of manufactured homes, representing 9.3% of total occupied housing. The Mountain region follows with 8.5%, while the South Atlantic region holds 7.7%.

Manufactured homes play a measurable role in the U.S. housing market by providing an affordable supply option for millions of households. According to the American Housing Survey, there are 7.2 million occupied manufactured homes in the U.S., representing 5.4% of total occupied housing and a source of affordable housing, in particular, for rural and lower income households. Often thought of as synonymous to “mobile homes” or “trailers”, manufactured homes are a specific type of factory-built housing that adheres to the U.S. Department of Housing and Urban Development’s Manufactured Home Construction and Safety Standards code. …The East South Central division (Alabama, Kentucky, Mississippi and Tennessee) have the highest concentration of manufactured homes, representing 9.3% of total occupied housing. The Mountain region follows with 8.5%, while the South Atlantic region holds 7.7%.

Contractors are bracing for a new wave of tariffs set to take effect April 2, this time on certain material imported from Canada and Mexico — such as steel, aluminum and lumber. Though reports indicate the Trump administration could roll back the ultimate scope of this action, contractors say just the threat of tariffs can have an immediate impact on material costs. That’s why that looming deadline on Canadian and Mexican imports has already sparked concern across the construction industry, particularly around reinforcing and structural steel, curtainwall systems and Canadian lumber, said Steve Stouthamer, executive VP Skanska USA Building. Stouthamer talks about the materials most at risk, tariffs’ impact on budgets and negotiations and steps contractors can take to minimize financial exposure. …The Trump administration has indicated Canadian lumber will be included in the reciprocal tariffs. Lumber has already seen a significant increase, 10% to 15% in cost, in anticipation of this tariff.

Contractors are bracing for a new wave of tariffs set to take effect April 2, this time on certain material imported from Canada and Mexico — such as steel, aluminum and lumber. Though reports indicate the Trump administration could roll back the ultimate scope of this action, contractors say just the threat of tariffs can have an immediate impact on material costs. That’s why that looming deadline on Canadian and Mexican imports has already sparked concern across the construction industry, particularly around reinforcing and structural steel, curtainwall systems and Canadian lumber, said Steve Stouthamer, executive VP Skanska USA Building. Stouthamer talks about the materials most at risk, tariffs’ impact on budgets and negotiations and steps contractors can take to minimize financial exposure. …The Trump administration has indicated Canadian lumber will be included in the reciprocal tariffs. Lumber has already seen a significant increase, 10% to 15% in cost, in anticipation of this tariff.

There is a 20% tariff on products from China and 25% on many goods from Canada and Mexico. What is sure is that they will increase the cost of DIY projects and home renovations, says Pelin Pekgun, at Wake Forest University School of Business. …“While prices will not rise immediately, higher material costs, potential shortages and supply delays could result in tighter renovation budgets in the coming months.” …One of the most significant products the tariffs will impact is lumber. More than 25% of cement and concrete are imported from Canada and Mexico, so the cost of pouring foundations and flatwork, such as driveways and walkways, will likely increase. …Many other building materials will likely get more expensive, including flooring, cabinets, countertops and lighting. Though not a direct consequence of tariffs, labor costs are also a growing concern in the construction industry, says roofer Michael Green.

There is a 20% tariff on products from China and 25% on many goods from Canada and Mexico. What is sure is that they will increase the cost of DIY projects and home renovations, says Pelin Pekgun, at Wake Forest University School of Business. …“While prices will not rise immediately, higher material costs, potential shortages and supply delays could result in tighter renovation budgets in the coming months.” …One of the most significant products the tariffs will impact is lumber. More than 25% of cement and concrete are imported from Canada and Mexico, so the cost of pouring foundations and flatwork, such as driveways and walkways, will likely increase. …Many other building materials will likely get more expensive, including flooring, cabinets, countertops and lighting. Though not a direct consequence of tariffs, labor costs are also a growing concern in the construction industry, says roofer Michael Green.

In a move that merges sustainable finance with industrial-scale environmental stewardship, Sydney-based natural capital investment manager New Forests has partnered with Japan’s Oji Holdings Corporation, one of the world’s largest pulp and paper producers, to establish the Future Forest Innovations Fund. With an initial commitment of US$300 million ( US$297 million from Oji and US$3 million from New Forests ), the fund aims to acquire and manage 70,000 hectares of plantation forests across Southeast Asia, North and Latin America, and Africa… The partnership signals an alignment between traditional manufacturing and ecological impact investing. Oji Holdings, which already manages 635,000 hectares of plantation forests worldwide, is leveraging this initiative to meet its 2030 net sequestration goal of 1.5 million tonnes of carbon dioxide equivalent per year, integrating climate action into its global forest footprint.

In a move that merges sustainable finance with industrial-scale environmental stewardship, Sydney-based natural capital investment manager New Forests has partnered with Japan’s Oji Holdings Corporation, one of the world’s largest pulp and paper producers, to establish the Future Forest Innovations Fund. With an initial commitment of US$300 million ( US$297 million from Oji and US$3 million from New Forests ), the fund aims to acquire and manage 70,000 hectares of plantation forests across Southeast Asia, North and Latin America, and Africa… The partnership signals an alignment between traditional manufacturing and ecological impact investing. Oji Holdings, which already manages 635,000 hectares of plantation forests worldwide, is leveraging this initiative to meet its 2030 net sequestration goal of 1.5 million tonnes of carbon dioxide equivalent per year, integrating climate action into its global forest footprint. BEIJING — UBS analysts became the latest to raise expectations that China’s struggling real estate market is close to stabilizing. “After four or five years of a downward cycle, we have begun to see some relatively positive signals,” John Lam at UBS Investment Bank. …“Of course these signals aren’t nationwide, and may be local,” Lam said. One indicator is improving sales in China’s largest cities. Existing home sales in five major Chinese cities have climbed by more than 30% from a year ago on a weekly basis as of Wednesday. The category is typically called “secondary home sales” in China, in contrast to the primary market, which has typically consisted of newly built apartment homes. UBS now predicts China’s home prices can stabilize in early 2026, earlier than the mid-2026 timeframe previously forecast. They expect secondary transactions could reach half of the total by 2026.

BEIJING — UBS analysts became the latest to raise expectations that China’s struggling real estate market is close to stabilizing. “After four or five years of a downward cycle, we have begun to see some relatively positive signals,” John Lam at UBS Investment Bank. …“Of course these signals aren’t nationwide, and may be local,” Lam said. One indicator is improving sales in China’s largest cities. Existing home sales in five major Chinese cities have climbed by more than 30% from a year ago on a weekly basis as of Wednesday. The category is typically called “secondary home sales” in China, in contrast to the primary market, which has typically consisted of newly built apartment homes. UBS now predicts China’s home prices can stabilize in early 2026, earlier than the mid-2026 timeframe previously forecast. They expect secondary transactions could reach half of the total by 2026. The Arizona House of Representatives recently passed out of the House, a wildfire insurance risk modeling bill, designed to reduce homeowner insurance cancellations, and help residents in wildfire prone regions to obtain homeowners’ insurance. Sponsored by District 7 Representative Dave Marshal, the bill would reduce the insurance companies practice of “blanket” cancellations of homeowner insurance. The key element of the legislation would cause the insurance companies to apply a wildfire risk modeling assessment on “individual” properties rather than the “blanket” assessments practice of entire neighborhoods… Property owners who want a cozy home in a small canyon surrounded by dense brush and low-level trees are at great risk of losing insurance coverage and losing their home to fire.

The Arizona House of Representatives recently passed out of the House, a wildfire insurance risk modeling bill, designed to reduce homeowner insurance cancellations, and help residents in wildfire prone regions to obtain homeowners’ insurance. Sponsored by District 7 Representative Dave Marshal, the bill would reduce the insurance companies practice of “blanket” cancellations of homeowner insurance. The key element of the legislation would cause the insurance companies to apply a wildfire risk modeling assessment on “individual” properties rather than the “blanket” assessments practice of entire neighborhoods… Property owners who want a cozy home in a small canyon surrounded by dense brush and low-level trees are at great risk of losing insurance coverage and losing their home to fire.