OTTAWA — The six-month trend in housing starts declined 2.5% in January to 236,892 units, according to Canada Mortgage and Housing Corporation (CMHC). …The total monthly SAAR of housing starts for all areas in Canada increased 3% in January (239,739 units) compared to December (232,492 units). Actual housing starts were up 7% year-over-year in centres with a population of 10,000 or greater, with 15,930 units recorded in January 2025, compared to 14,883 in January 2024. …“Both the monthly SAAR and actual housing starts increased in Canada’s urban centres in January. This was primarily driven by an 8% increase in multi-unit starts, particularly purpose-built rentals concentrated in Quebec and British Columbia. While these increases show early signs of progress to begin the year, foreign trade risks add significant uncertainty for housing construction going forward,” said Tania Bourassa-Ochoa, CMHC’s Deputy Chief Economist.

BURNABY, BC — Interfor recorded a net loss in Q4, 2024 of $49.9 million compared to a Net loss of $105.7 million in Q3, 2024 and a net loss of $169.0 million. Adjusted EBITDA was $80.4 million on sales of $746.5 million in Q4, 2024. …For the full year, Interfor reported a net loss of $304 million in 2024, a 14% increase from the $267 million net loss in 2023. Total sales fell 9% to $3 billion, down from $3.3 billion in the previous year. …Near-term volatility could be further impacted by a potential tariff on Canadian lumber exports… however, the Company is well positioned with a diversified product mix in Canada and the U.S., with approximately 60% of its total lumber produced and sold within the U.S. …Despite challenges, the company remains positioned to adjust production and capital spending in response to market conditions. …The company plans to invest $85 million in 2025, including the continued rebuild of the Thomaston, Georgia sawmill.

BURNABY, BC — Interfor recorded a net loss in Q4, 2024 of $49.9 million compared to a Net loss of $105.7 million in Q3, 2024 and a net loss of $169.0 million. Adjusted EBITDA was $80.4 million on sales of $746.5 million in Q4, 2024. …For the full year, Interfor reported a net loss of $304 million in 2024, a 14% increase from the $267 million net loss in 2023. Total sales fell 9% to $3 billion, down from $3.3 billion in the previous year. …Near-term volatility could be further impacted by a potential tariff on Canadian lumber exports… however, the Company is well positioned with a diversified product mix in Canada and the U.S., with approximately 60% of its total lumber produced and sold within the U.S. …Despite challenges, the company remains positioned to adjust production and capital spending in response to market conditions. …The company plans to invest $85 million in 2025, including the continued rebuild of the Thomaston, Georgia sawmill. VANCOUVER, BC — Western Forest Products announced improved fourth quarter and fiscal 2024 results compared to the same period last year. Adjusted EBITDA was $14.4 million in the fourth quarter of 2024, as compared to negative $1.2 million in the fourth quarter of 2023, and negative EBITDA of $10.7 million in the third quarter of 2024. Adjusted EBITDA was $8.9 million for fiscal 2024, as compared to negative $29.9 million in fiscal 2023. Net loss was $1.2 million in the fourth quarter of 2024, as compared to a net loss of $14.3 million in the fourth quarter of 2023, and a net loss of $19.6 million in the third quarter of 2024. …“Despite challenging markets, we were successful in returning our business to positive EBITDA in 2024,” said Steven Hofer, CEO. …“The planned incremental US tariff will unfairly target and harm Canadian exporters like us, [and] will also hurt American consumers through higher lumber prices.” …We have informed customers of our intention to pass on the incremental US tariff.

VANCOUVER, BC — Western Forest Products announced improved fourth quarter and fiscal 2024 results compared to the same period last year. Adjusted EBITDA was $14.4 million in the fourth quarter of 2024, as compared to negative $1.2 million in the fourth quarter of 2023, and negative EBITDA of $10.7 million in the third quarter of 2024. Adjusted EBITDA was $8.9 million for fiscal 2024, as compared to negative $29.9 million in fiscal 2023. Net loss was $1.2 million in the fourth quarter of 2024, as compared to a net loss of $14.3 million in the fourth quarter of 2023, and a net loss of $19.6 million in the third quarter of 2024. …“Despite challenging markets, we were successful in returning our business to positive EBITDA in 2024,” said Steven Hofer, CEO. …“The planned incremental US tariff will unfairly target and harm Canadian exporters like us, [and] will also hurt American consumers through higher lumber prices.” …We have informed customers of our intention to pass on the incremental US tariff.

The significant risk that tariffs pose to Canada’s economy casts a potentially dark shadow over the housing market. Any economic turbulence arising from tariffs would be felt by participants, whose confidence is critical to the stability of the housing market. …Therefore, assessing the outlook for Canada’s housing market at this juncture is like putting a price on a home before an earthquake—it’s hard to know what shape the structure will be in at the end of the day. Still, we highlight some of the key themes in 2025. …Lower interest rates heat up demand. …Inventory of homes for sale is rebuilding in Canada. …Strained affordability, immigration and uncertainty to keep buyers cautious. …Affordability relief from rate drop will only be partial. …Absent any major economic shock, we’d expect housing market demand and supply to stay balanced in the year ahead, yielding minimal price increases Canada-wide.

The significant risk that tariffs pose to Canada’s economy casts a potentially dark shadow over the housing market. Any economic turbulence arising from tariffs would be felt by participants, whose confidence is critical to the stability of the housing market. …Therefore, assessing the outlook for Canada’s housing market at this juncture is like putting a price on a home before an earthquake—it’s hard to know what shape the structure will be in at the end of the day. Still, we highlight some of the key themes in 2025. …Lower interest rates heat up demand. …Inventory of homes for sale is rebuilding in Canada. …Strained affordability, immigration and uncertainty to keep buyers cautious. …Affordability relief from rate drop will only be partial. …Absent any major economic shock, we’d expect housing market demand and supply to stay balanced in the year ahead, yielding minimal price increases Canada-wide. Pressing ahead with steep tariffs on Canada and Mexico risks exacerbating the US housing crisis and threatening the broader economy, dozens of congressional Democrats have warned Donald Trump. …In a letter to Trump seen by the Guardian, Democrats noted that the US imports key construction materials worth billions of dollars – from lumber to cement products – from Canada and Mexico each year. “Given the severe housing shortage, compounded by rising construction costs, persistent supply chain disruptions, and an estimated shortfall of 6m homes, these looming tariffs, while intended to protect domestic industries, risk further exacerbating the housing supply and affordability crisis while stifling the development of new housing,” they wrote. More than 40 Democrats urged the White House to consider housebuilding industry estimates that the proposed tariffs will raise the cost of imported construction materials by up to $4bn.

Pressing ahead with steep tariffs on Canada and Mexico risks exacerbating the US housing crisis and threatening the broader economy, dozens of congressional Democrats have warned Donald Trump. …In a letter to Trump seen by the Guardian, Democrats noted that the US imports key construction materials worth billions of dollars – from lumber to cement products – from Canada and Mexico each year. “Given the severe housing shortage, compounded by rising construction costs, persistent supply chain disruptions, and an estimated shortfall of 6m homes, these looming tariffs, while intended to protect domestic industries, risk further exacerbating the housing supply and affordability crisis while stifling the development of new housing,” they wrote. More than 40 Democrats urged the White House to consider housebuilding industry estimates that the proposed tariffs will raise the cost of imported construction materials by up to $4bn.

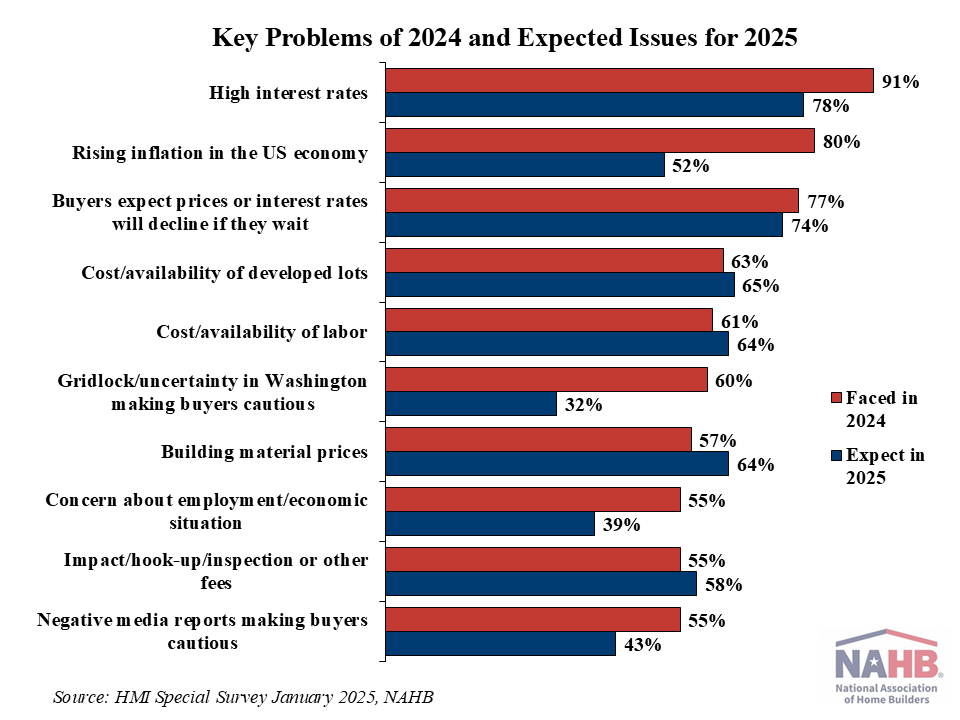

President Trump’s tariff plans threaten to raise US home construction costs, making it even more difficult for Americans already facing a tight housing market. Trump’s proposed 25% tariffs have been delayed until at least March, along with a 10% levy now in effect on products from China, could make building a typical home as much as $29,000 pricier, said David Belman, a second-generation homebuilder in Wisconsin. A large portion of that increase — as much as $14,000 — would come from the tariff on Canada, said Belman. …Current lumber inventories may only last one to two months, even with demand still weak and the US not yet in its peak building season, said Dustin Jalbert at Fastmarkets. “It’s not going to take long for prices to have to start moving higher here to keep the supply chain stocked,” Jalbert said. Lumber futures in Chicago slumped 4.6% Tuesday on news of tariff delays, erasing gains from the previous two sessions.

President Trump’s tariff plans threaten to raise US home construction costs, making it even more difficult for Americans already facing a tight housing market. Trump’s proposed 25% tariffs have been delayed until at least March, along with a 10% levy now in effect on products from China, could make building a typical home as much as $29,000 pricier, said David Belman, a second-generation homebuilder in Wisconsin. A large portion of that increase — as much as $14,000 — would come from the tariff on Canada, said Belman. …Current lumber inventories may only last one to two months, even with demand still weak and the US not yet in its peak building season, said Dustin Jalbert at Fastmarkets. “It’s not going to take long for prices to have to start moving higher here to keep the supply chain stocked,” Jalbert said. Lumber futures in Chicago slumped 4.6% Tuesday on news of tariff delays, erasing gains from the previous two sessions.

Framing lumber markets hovered in a holding pattern as traders embraced a wait-and-see approach to a potential 25% tariff on Canadian shipments. The Random Lengths Framing Lumber Composite Price finished the week $1 lower. Western S-P-F buyers moved to the sidelines in late trading, citing minimal immediate needs and uncertainty about the tariffs and near-term prospects. …Price weakness lingered in the Southern Pine market amid sluggish to stagnant sales. Buyers lacked urgency and the potential impact of tariffs on demand for SYP was a widespread topic of conversation. …Traders debated how much of a price spread between Western S-P-F and SYP would need to emerge before end users substituted species on a larger scale. …In Coast markets, Hem-Fir dimension continued to face serious downward pressure from soft Inland prices. Meanwhile, dry Douglas Fir dimension prices stabilized, assisted by a green market that has found its footing.

Framing lumber markets hovered in a holding pattern as traders embraced a wait-and-see approach to a potential 25% tariff on Canadian shipments. The Random Lengths Framing Lumber Composite Price finished the week $1 lower. Western S-P-F buyers moved to the sidelines in late trading, citing minimal immediate needs and uncertainty about the tariffs and near-term prospects. …Price weakness lingered in the Southern Pine market amid sluggish to stagnant sales. Buyers lacked urgency and the potential impact of tariffs on demand for SYP was a widespread topic of conversation. …Traders debated how much of a price spread between Western S-P-F and SYP would need to emerge before end users substituted species on a larger scale. …In Coast markets, Hem-Fir dimension continued to face serious downward pressure from soft Inland prices. Meanwhile, dry Douglas Fir dimension prices stabilized, assisted by a green market that has found its footing. Lumber futures surged to over $590 per thousand board feet, approaching the two-month high of $600 from January 6th following US President Trump’s decision to implement tariffs on Canada, a major supplier of wood to the US. The tariffs were threatened by the US President shortly after taking office, but conflicting messages from the Presidential administration raised skepticism for investors on whether trade barriers would actually be raised. According to the latest data, Canada supplied around 30% of lumber used in the US last year. The 25% tax on Canadian goods, including wood, add to the already existing anti-dumping duties of 14.5%, raising capacity pressures on domestically produced alternatives. In the meantime, the greater degree of confidence that the Fed will deliver more than one rate cut this year drove benchmark mortgage rates to ease below 7%, giving some respite to construction demand. [END]

Lumber futures surged to over $590 per thousand board feet, approaching the two-month high of $600 from January 6th following US President Trump’s decision to implement tariffs on Canada, a major supplier of wood to the US. The tariffs were threatened by the US President shortly after taking office, but conflicting messages from the Presidential administration raised skepticism for investors on whether trade barriers would actually be raised. According to the latest data, Canada supplied around 30% of lumber used in the US last year. The 25% tax on Canadian goods, including wood, add to the already existing anti-dumping duties of 14.5%, raising capacity pressures on domestically produced alternatives. In the meantime, the greater degree of confidence that the Fed will deliver more than one rate cut this year drove benchmark mortgage rates to ease below 7%, giving some respite to construction demand. [END] Stocks in B.C.’s three major publicly traded forestry companies were predictably down this morning (February 3), when stock markets opened after this weekend’s declaration of a trade war between the U.S., Canada and Mexico. U.S. stock markets were jolted, too, Monday morning, as was the S&P TSX composite Index. The Canadian dollar fell to $0.68 to the American dollar following Saturday’s confirmation that Trump will hit Canadian imports with 25 per cent tariffs, and 10 per cent tariffs on Canadian energy imports, beginning Tuesday. North American stocks fell sharply in early morning trading before recovering somewhat. Canadian companies that are highly exposed to the U.S. were jolted, with companies like West Fraser Timber, Canfor Corp and Interfor Corp. experiencing early morning drops of four, five and six per cent respectively, before correcting somewhat later in the morning.

Stocks in B.C.’s three major publicly traded forestry companies were predictably down this morning (February 3), when stock markets opened after this weekend’s declaration of a trade war between the U.S., Canada and Mexico. U.S. stock markets were jolted, too, Monday morning, as was the S&P TSX composite Index. The Canadian dollar fell to $0.68 to the American dollar following Saturday’s confirmation that Trump will hit Canadian imports with 25 per cent tariffs, and 10 per cent tariffs on Canadian energy imports, beginning Tuesday. North American stocks fell sharply in early morning trading before recovering somewhat. Canadian companies that are highly exposed to the U.S. were jolted, with companies like West Fraser Timber, Canfor Corp and Interfor Corp. experiencing early morning drops of four, five and six per cent respectively, before correcting somewhat later in the morning.

Experts told us that, in theory, if the US stopped importing crude oil and lumber from Canada and Mexico, it still would be able to meet domestic demand using natural resources available in the U.S. But, in reality, they said, the transition would be costly and take some time to implement, among other complications. “Sure: we could probably meet most of our lumber needs domestically,” said Marc McDill at Penn State University. “The reasons why we don’t boil down to two things: 1) sometimes imports are cheaper than our own suppliers, and 2) we value our forests for a lot of other things.” He added that without lumber from Canada, “1) prices would go up, 2) we would harvest more of our own trees, and 3) we would import more from countries.” …Rhett Jackson at the University of Georgia, said that differences in the lumber produced in the US and Canada may be problematic. …“All lumber is not created equally.”

Experts told us that, in theory, if the US stopped importing crude oil and lumber from Canada and Mexico, it still would be able to meet domestic demand using natural resources available in the U.S. But, in reality, they said, the transition would be costly and take some time to implement, among other complications. “Sure: we could probably meet most of our lumber needs domestically,” said Marc McDill at Penn State University. “The reasons why we don’t boil down to two things: 1) sometimes imports are cheaper than our own suppliers, and 2) we value our forests for a lot of other things.” He added that without lumber from Canada, “1) prices would go up, 2) we would harvest more of our own trees, and 3) we would import more from countries.” …Rhett Jackson at the University of Georgia, said that differences in the lumber produced in the US and Canada may be problematic. …“All lumber is not created equally.” A 30-day delay in implementation of tariffs on Canadian shipments to the US reset recent trends in framing lumber markets. Sales picked up in most regions and species, but higher quotes early in the week retreated nearer to last week’s levels. Western S-P-F sales were mixed, but several secondaries reported their strongest days of the year as buyers padded relatively thin inventories with insurance loads. Prices remained close to last week’s levels, but supplies of some items tightened in late trading. Lumber futures swung from extreme volatility Monday and Tuesday to an upward trend towards the end of the week. The threat of tariffs drove prices up, but selling commenced after the delay. The biggest gains were posted in green Fir, where a supply-side rally pushed Std/#2&Btr dimension prices $15-35 higher. The Random Lengths Framing Lumber Composite Price posted another modest adjustment, finishing $5 higher. Most Southern Pine producers throttled back quotes.

A 30-day delay in implementation of tariffs on Canadian shipments to the US reset recent trends in framing lumber markets. Sales picked up in most regions and species, but higher quotes early in the week retreated nearer to last week’s levels. Western S-P-F sales were mixed, but several secondaries reported their strongest days of the year as buyers padded relatively thin inventories with insurance loads. Prices remained close to last week’s levels, but supplies of some items tightened in late trading. Lumber futures swung from extreme volatility Monday and Tuesday to an upward trend towards the end of the week. The threat of tariffs drove prices up, but selling commenced after the delay. The biggest gains were posted in green Fir, where a supply-side rally pushed Std/#2&Btr dimension prices $15-35 higher. The Random Lengths Framing Lumber Composite Price posted another modest adjustment, finishing $5 higher. Most Southern Pine producers throttled back quotes. The U.S. market accounts for 5-10% of Sweden’s forest industry exports, depending on the segment, meaning the direct impact of potential new tariffs remains limited, said Christian Nielsen, market analyst for wood products at Swedish Forest Industries Federation. The U.S. relies on imports for 25% of its lumber consumption, primarily from Canada. Higher tariffs on Canadian wood could raise costs for American consumers while improving the competitive position of European suppliers. However, Nielsen noted that future tariffs directly targeting EU exports remain uncertain. In the pulp and paper sector, the U.S. could rely entirely on domestic production, reducing the need for imports. Sweden currently exports 7% of its pulp and 5% of its paper and board products to the US. In total, Sweden exports 92% of its paper and board production, and global trade flows could be affected by tariff changes. [END]

The U.S. market accounts for 5-10% of Sweden’s forest industry exports, depending on the segment, meaning the direct impact of potential new tariffs remains limited, said Christian Nielsen, market analyst for wood products at Swedish Forest Industries Federation. The U.S. relies on imports for 25% of its lumber consumption, primarily from Canada. Higher tariffs on Canadian wood could raise costs for American consumers while improving the competitive position of European suppliers. However, Nielsen noted that future tariffs directly targeting EU exports remain uncertain. In the pulp and paper sector, the U.S. could rely entirely on domestic production, reducing the need for imports. Sweden currently exports 7% of its pulp and 5% of its paper and board products to the US. In total, Sweden exports 92% of its paper and board production, and global trade flows could be affected by tariff changes. [END]

The stock market fell on Monday after President Donald Trump slapped tariffs on Canada, Mexico and China, eliciting threats of retaliation and setting the stage for a trade war. The Dow Jones Industrial Average slid about 550 points, or 1.25%, in early trading on Monday. The S&P 500 dropped 1.5%, and the tech-heavy Nasdaq plummeted 2%. Traders demonstrated their jitters with a selloff of U.S. auto companies, which hold deep ties to suppliers in Canada and Mexico. Shares of General Motors plummeted 6%, while Ford saw its stock price plunge 4%. The market rout extended worldwide. Japan’s Nikkei index fell 2.5% on Monday, and the pan-European STOXX 600 dropped about 1%.

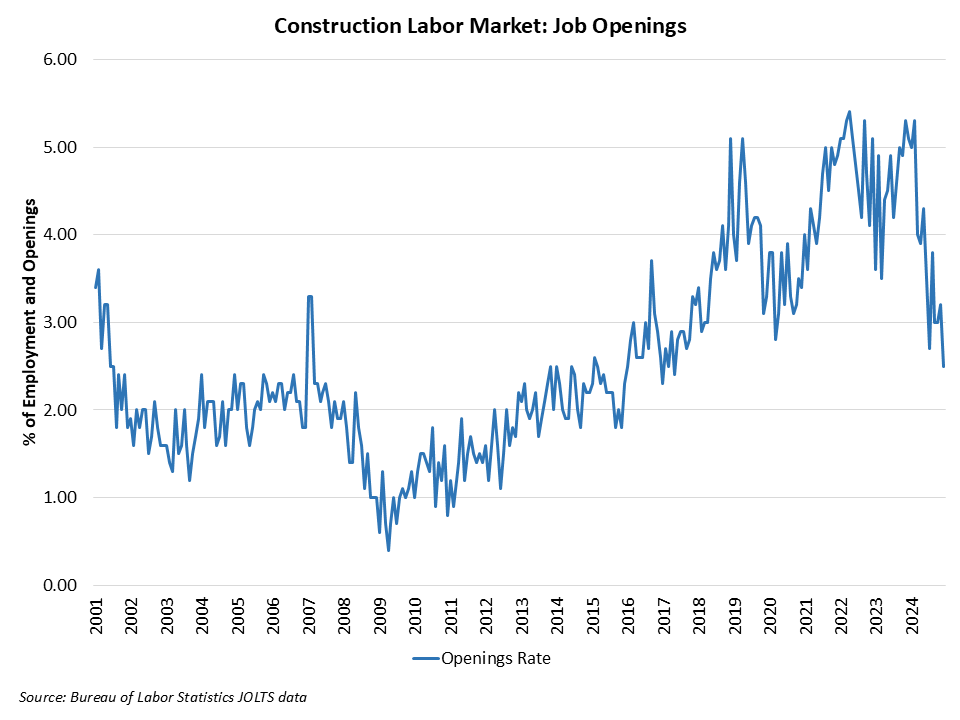

The stock market fell on Monday after President Donald Trump slapped tariffs on Canada, Mexico and China, eliciting threats of retaliation and setting the stage for a trade war. The Dow Jones Industrial Average slid about 550 points, or 1.25%, in early trading on Monday. The S&P 500 dropped 1.5%, and the tech-heavy Nasdaq plummeted 2%. Traders demonstrated their jitters with a selloff of U.S. auto companies, which hold deep ties to suppliers in Canada and Mexico. Shares of General Motors plummeted 6%, while Ford saw its stock price plunge 4%. The market rout extended worldwide. Japan’s Nikkei index fell 2.5% on Monday, and the pan-European STOXX 600 dropped about 1%. Homeownership has long played a starring role in the American dream. …Nearly nine in 10 homeowners (88% / 81% in 2025) in a survey said the true cost of owning a home is more expensive than they’d expected. …Recent, unexpected hurricane-related floods in Western North Carolina and massive fires across Los Angeles County, which both occurred after the survey was conducted, will surely raise costs even more dramatically this year, and not just in the affected regions. This will be due to fierce competition for construction supplies and labor as disaster-stricken areas compete for resources and everyone else looks to maintain and improve their homes. Tariffs, depending on how they’re applied – e.g., Canadian lumber for rebuilding or across-the-board Chinese imports hitting home improvement store shelves – and potential disruption to the construction workforce can also surge homeownership costs.

Homeownership has long played a starring role in the American dream. …Nearly nine in 10 homeowners (88% / 81% in 2025) in a survey said the true cost of owning a home is more expensive than they’d expected. …Recent, unexpected hurricane-related floods in Western North Carolina and massive fires across Los Angeles County, which both occurred after the survey was conducted, will surely raise costs even more dramatically this year, and not just in the affected regions. This will be due to fierce competition for construction supplies and labor as disaster-stricken areas compete for resources and everyone else looks to maintain and improve their homes. Tariffs, depending on how they’re applied – e.g., Canadian lumber for rebuilding or across-the-board Chinese imports hitting home improvement store shelves – and potential disruption to the construction workforce can also surge homeownership costs. Lumber prices are 9.6% higher than they were one year ago. …Impact of wood and lumber prices on the cost of a new home: In addition to narrowly defined framing lumber, products such as plywood, OSB, particleboard, fiberboard, shakes and shingles make up a considerable portion of the total

Lumber prices are 9.6% higher than they were one year ago. …Impact of wood and lumber prices on the cost of a new home: In addition to narrowly defined framing lumber, products such as plywood, OSB, particleboard, fiberboard, shakes and shingles make up a considerable portion of the total

Year-end 2024 Southern Pine lumber (treated and untreated) exports hit 565.7 Mbf, which was up 11% over the previous year, according to December 2024 data from the USDA. On a monthly basis, Southern Pine lumber exports were up 21.9% in December 2024 over the same month in 2023 but down 2.2% from November 2024. …Softwood imports, meanwhile, were down 11.5% in December 2024 compared with the same month a year ago and down 11% from November 2024. …Mexico remains the largest export market (by volume) of Southern Pine and treated lumber, up 23% over 2023 with 150.2 Mbf of imports. The Dominican Republic, the No. 2 importer of Southern Pine, ended the year 19.1% ahead of 2023 with 92.3 Mbf. India’s total of SYP imports ended 3.1% ahead of last year with 36.6 Mbf. Canada: up 30% with 27.4 Mbf in 2024. Canada ended the year as the No. 5 importer of Southern Pine lumber (treated and untreated).

Year-end 2024 Southern Pine lumber (treated and untreated) exports hit 565.7 Mbf, which was up 11% over the previous year, according to December 2024 data from the USDA. On a monthly basis, Southern Pine lumber exports were up 21.9% in December 2024 over the same month in 2023 but down 2.2% from November 2024. …Softwood imports, meanwhile, were down 11.5% in December 2024 compared with the same month a year ago and down 11% from November 2024. …Mexico remains the largest export market (by volume) of Southern Pine and treated lumber, up 23% over 2023 with 150.2 Mbf of imports. The Dominican Republic, the No. 2 importer of Southern Pine, ended the year 19.1% ahead of 2023 with 92.3 Mbf. India’s total of SYP imports ended 3.1% ahead of last year with 36.6 Mbf. Canada: up 30% with 27.4 Mbf in 2024. Canada ended the year as the No. 5 importer of Southern Pine lumber (treated and untreated).