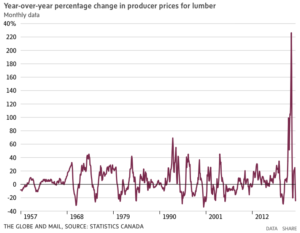

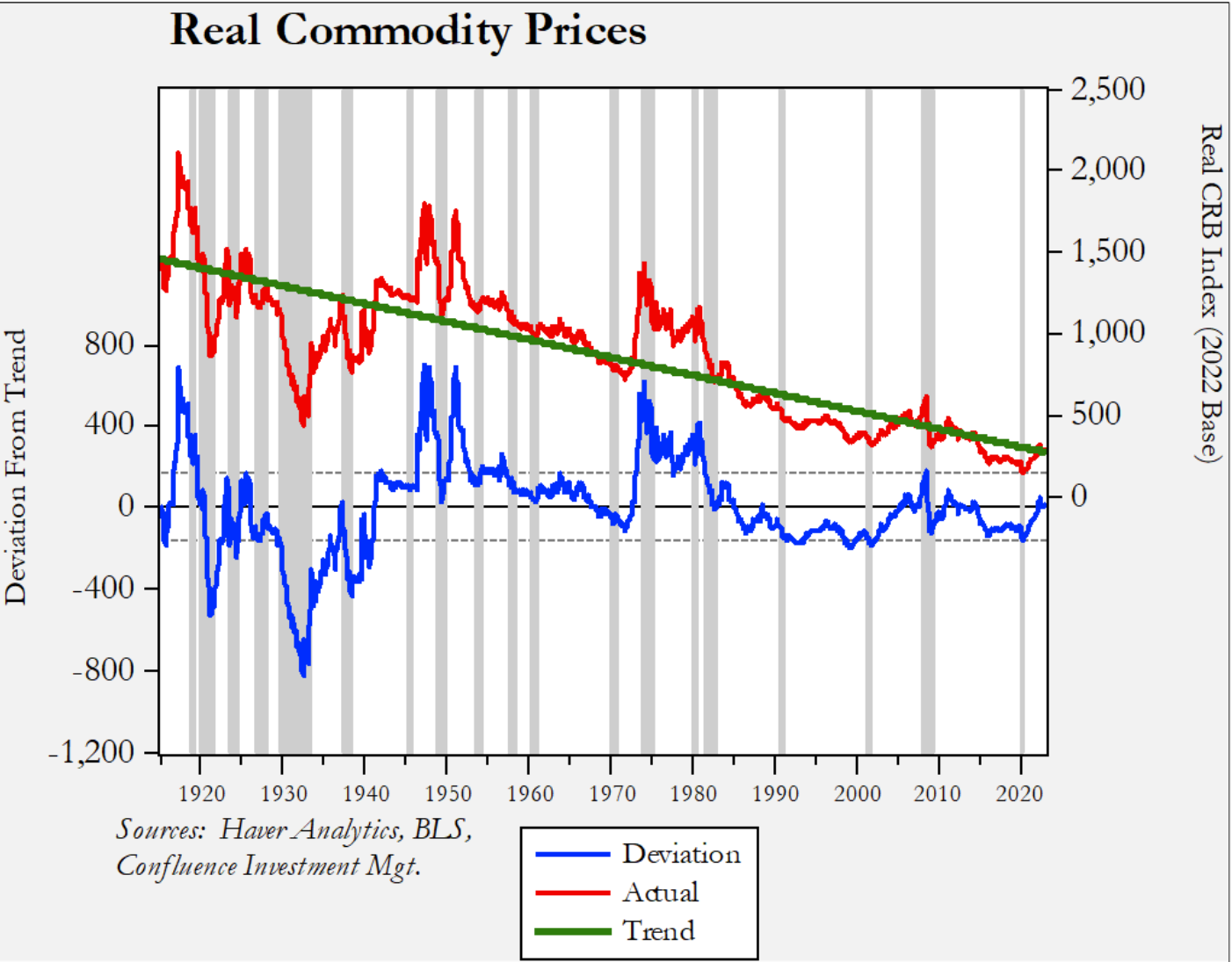

The chill in North America’s housing market has lumber traders saying the commodity’s recent rally may not have much more room to run. Benchmark futures in Chicago rose as much as 6.1% to $418.80 per 1,000 board feet Wednesday, heading for the longest rally in two weeks. The bounce comes after prices slumped to the lowest in more than two years last week. While major producers are slashing production, buyers are still spooked by rising interest rates and passing up cheap supplies, meaning any price recovery is “not going to go very far,” said Russ Taylor, Russ Taylor Global. …Charlie Thorpe, a commodities trader at Olympic Industries said, “It’s been tough slogging for sales.” …A glut of European lumber has buoyed supplies in North America despite the production cuts, and wood inventories remain high. The market has shifted from extreme volatility to “flat,” he said.

The chill in North America’s housing market has lumber traders saying the commodity’s recent rally may not have much more room to run. Benchmark futures in Chicago rose as much as 6.1% to $418.80 per 1,000 board feet Wednesday, heading for the longest rally in two weeks. The bounce comes after prices slumped to the lowest in more than two years last week. While major producers are slashing production, buyers are still spooked by rising interest rates and passing up cheap supplies, meaning any price recovery is “not going to go very far,” said Russ Taylor, Russ Taylor Global. …Charlie Thorpe, a commodities trader at Olympic Industries said, “It’s been tough slogging for sales.” …A glut of European lumber has buoyed supplies in North America despite the production cuts, and wood inventories remain high. The market has shifted from extreme volatility to “flat,” he said.

Canada’s banking regulator will consider new constraints on firms’ mortgage lending in an attempt to protect the financial system, potentially adding more headwinds for the housing market. Superintendent of Financial Institutions Peter Routledge said a review of the country’s mortgage-underwriting rules that starts later this week will look beyond its current main measure — a stress test requiring borrowers to qualify for higher interest rates than what their banks are offering. …Bucking pressure to weaken its rules, the Office of the Superintendent of Financial Institutions in December maintained the stress test, which requires borrowers seeking uninsured mortgages to qualify for their loans at a rate two percentage points higher than the bank’s offered rate or 5.25 per cent, whichever is higher.

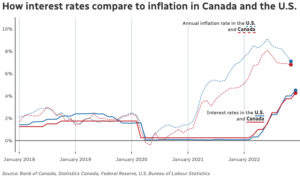

Canada’s banking regulator will consider new constraints on firms’ mortgage lending in an attempt to protect the financial system, potentially adding more headwinds for the housing market. Superintendent of Financial Institutions Peter Routledge said a review of the country’s mortgage-underwriting rules that starts later this week will look beyond its current main measure — a stress test requiring borrowers to qualify for higher interest rates than what their banks are offering. …Bucking pressure to weaken its rules, the Office of the Superintendent of Financial Institutions in December maintained the stress test, which requires borrowers seeking uninsured mortgages to qualify for their loans at a rate two percentage points higher than the bank’s offered rate or 5.25 per cent, whichever is higher.  The minutes from the U.S. Federal Reserve’s December meeting along with various payroll reports last week caused lumber prices (along with other commodities) to fall. In its December minutes, the central bank stated it will keep the Fed funds rate “higher for longer” and the ADP private payroll report showed employers added 235,000 jobs in December, above the expected level of 200,000. The payroll reports support the Fed’s stance that interest rates will not be coming down any time soon. Higher interest rates mean higher mortgage rates and a slower housing market, so less demand for lumber. In fact, the price of the commodity is now below the average cost of production. [to access the full story a Globe & Mail subscription is required].

The minutes from the U.S. Federal Reserve’s December meeting along with various payroll reports last week caused lumber prices (along with other commodities) to fall. In its December minutes, the central bank stated it will keep the Fed funds rate “higher for longer” and the ADP private payroll report showed employers added 235,000 jobs in December, above the expected level of 200,000. The payroll reports support the Fed’s stance that interest rates will not be coming down any time soon. Higher interest rates mean higher mortgage rates and a slower housing market, so less demand for lumber. In fact, the price of the commodity is now below the average cost of production. [to access the full story a Globe & Mail subscription is required]. It’s basically unanimous that whatever Canada’s economic foibles right now, they’re almost certainly going to get worse. All the usual suspects within Canadian banking have been forecasting a contraction of the economy since the fall, and some are guessing it’s already happening. …Even Prime Minister Justin Trudeau ditched his usual tack of pretending that everything is going great. …So what bone-chilling horrors will be brought to bear by the coming economic reckoning? Here’s a sampling:

It’s basically unanimous that whatever Canada’s economic foibles right now, they’re almost certainly going to get worse. All the usual suspects within Canadian banking have been forecasting a contraction of the economy since the fall, and some are guessing it’s already happening. …Even Prime Minister Justin Trudeau ditched his usual tack of pretending that everything is going great. …So what bone-chilling horrors will be brought to bear by the coming economic reckoning? Here’s a sampling: This week, we highlight recent announcements regarding changes in capacity across the paper and forest products space:

This week, we highlight recent announcements regarding changes in capacity across the paper and forest products space:

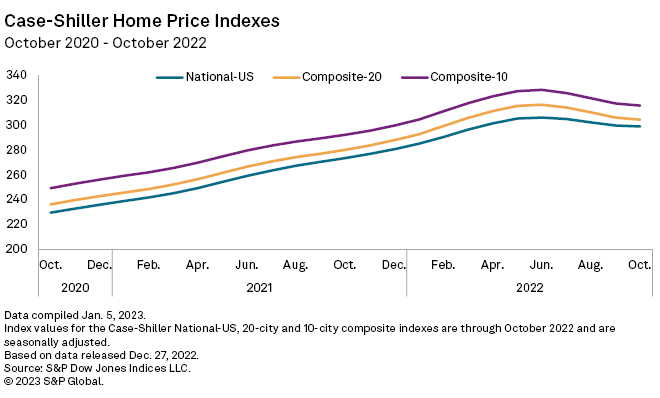

Canada is likely in for another year of elevated inflation, at least one more interest rate hike and a continued downturn in the housing market, BMO said in a note predicting the top economic trends for 2023. …An inflation rate of three per cent or more is much too high for the Bank of Canada’s comfort. …BMO expects at least one more interest rate hike this year, with even more expected in the US and Europe. It also means consumers shouldn’t bet on interest rates coming down this year. …The economy won’t be able to escape central bankers’ medicine to tame inflation, and BMO predicts Canada will succumb to a mild recession sometime in 2023. …Meanwhile, persistent high interest rates will continue to wallop the housing market. BMO expects home prices to drop a further 12 per cent, sales to fall 15 per cent and homebuilding to crater this year.

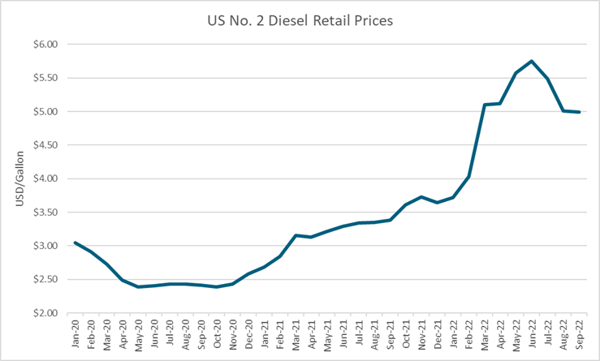

Canada is likely in for another year of elevated inflation, at least one more interest rate hike and a continued downturn in the housing market, BMO said in a note predicting the top economic trends for 2023. …An inflation rate of three per cent or more is much too high for the Bank of Canada’s comfort. …BMO expects at least one more interest rate hike this year, with even more expected in the US and Europe. It also means consumers shouldn’t bet on interest rates coming down this year. …The economy won’t be able to escape central bankers’ medicine to tame inflation, and BMO predicts Canada will succumb to a mild recession sometime in 2023. …Meanwhile, persistent high interest rates will continue to wallop the housing market. BMO expects home prices to drop a further 12 per cent, sales to fall 15 per cent and homebuilding to crater this year. Canada’s inflation rate cooled to 6.8 per cent last month as prices for gasoline and furniture went down, but the cost of food and rent went up. Statistics Canada reported Wednesday that gasoline prices across the country fell by 3.6 per cent during the month. They’re still up by 13.7 per cent compared to where they were a year ago, but that’s down from the 17.8 per cent annual increase clocked the month before. The price of a fill-up may be inching down from record highs, but the cost to fill up a belly continues to increase at an astonishing pace. Grocery bills increased at an 11.4 per cent annual pace last month, up from the 11 per cent increase seen in October. …The cost to keep a roof over one’s head is also increasing at a rapid clip, with overall shelter costs up 7.2 per cent in the past year.

Canada’s inflation rate cooled to 6.8 per cent last month as prices for gasoline and furniture went down, but the cost of food and rent went up. Statistics Canada reported Wednesday that gasoline prices across the country fell by 3.6 per cent during the month. They’re still up by 13.7 per cent compared to where they were a year ago, but that’s down from the 17.8 per cent annual increase clocked the month before. The price of a fill-up may be inching down from record highs, but the cost to fill up a belly continues to increase at an astonishing pace. Grocery bills increased at an 11.4 per cent annual pace last month, up from the 11 per cent increase seen in October. …The cost to keep a roof over one’s head is also increasing at a rapid clip, with overall shelter costs up 7.2 per cent in the past year.

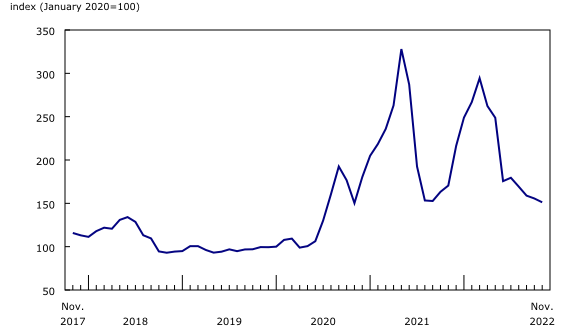

Lumber prices extended their six-day losing streak on Monday after homebuilder sentiment fell for the 12th month in a row. Lumber futures dropped as much as 4% to $370.40 per thousand board feet, representing a fresh low for 2022 and its lowest level since June 2020. The essential building commodity is now down 68% year-to-date and is off 79% from its record high reached in May 2021, when strong demand for homes was compounded by supply chain issues. The weakness in lumber largely stems from this year’s deceleration seen in all facets of the housing market, as soaring mortgage rates helped slow down sales, rein in home price growth, and put a serious dent in homebuilder confidence.

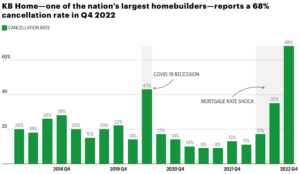

Lumber prices extended their six-day losing streak on Monday after homebuilder sentiment fell for the 12th month in a row. Lumber futures dropped as much as 4% to $370.40 per thousand board feet, representing a fresh low for 2022 and its lowest level since June 2020. The essential building commodity is now down 68% year-to-date and is off 79% from its record high reached in May 2021, when strong demand for homes was compounded by supply chain issues. The weakness in lumber largely stems from this year’s deceleration seen in all facets of the housing market, as soaring mortgage rates helped slow down sales, rein in home price growth, and put a serious dent in homebuilder confidence. Speaking to reporters in September, Fed Chair Jerome Powell was asked to clarify what he meant when he said spiking mortgage rates would cause a housing “reset.” The meaning, he said, was that the U.S. housing market would slip into a “difficult correction.” …Of course, this so-called “difficult [housing] correction” has already arrived. Look no further than the latest earnings report by KB Home. …On Wednesday, KB Home announced that its buyer cancellation rate in the fourth quarter of 2022 spiked to 68%. That’s up from 35% in the third quarter of 2022, and up from 13% in the fourth quarter of 2021. …Historically speaking, a 68% cancellation rate is off the charts. Even during the darkest days of the 2008 era crash, the average builder cancellation rate only reached 47%. What’s going on? Pressurized affordability. …The problem: builders still have a tremendous amount of inventory—both single-family and multi-family—in the pipeline.

Speaking to reporters in September, Fed Chair Jerome Powell was asked to clarify what he meant when he said spiking mortgage rates would cause a housing “reset.” The meaning, he said, was that the U.S. housing market would slip into a “difficult correction.” …Of course, this so-called “difficult [housing] correction” has already arrived. Look no further than the latest earnings report by KB Home. …On Wednesday, KB Home announced that its buyer cancellation rate in the fourth quarter of 2022 spiked to 68%. That’s up from 35% in the third quarter of 2022, and up from 13% in the fourth quarter of 2021. …Historically speaking, a 68% cancellation rate is off the charts. Even during the darkest days of the 2008 era crash, the average builder cancellation rate only reached 47%. What’s going on? Pressurized affordability. …The problem: builders still have a tremendous amount of inventory—both single-family and multi-family—in the pipeline.

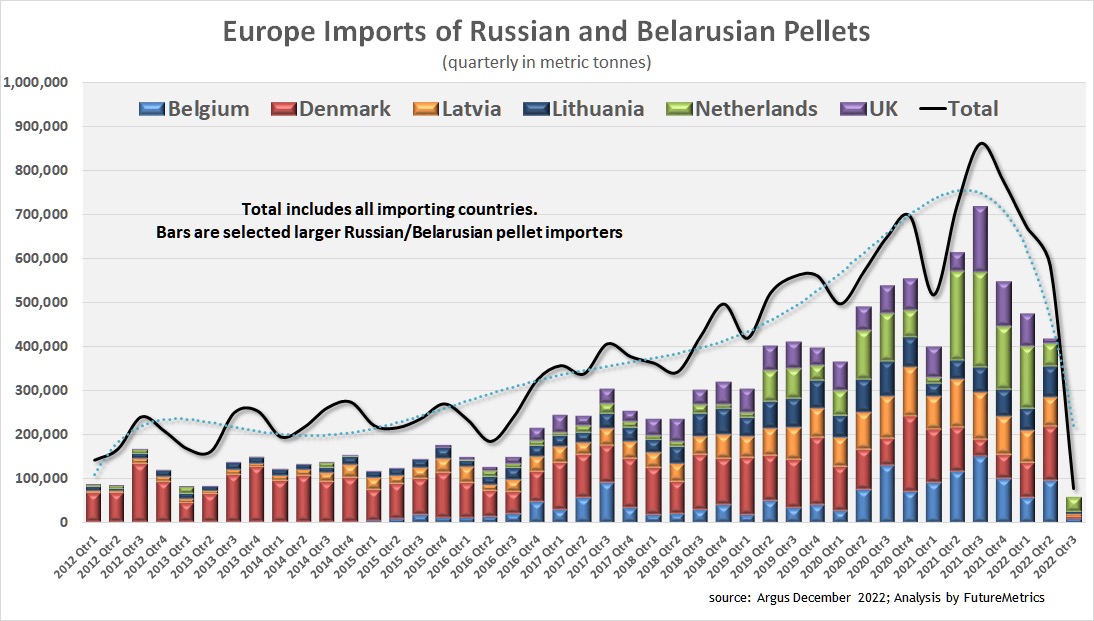

The U.S. exported 694,199.7 metric tons of wood pellets in November, down from 750,989.2 metric tons in October and 764,259.6 metric tons in November 2021, according to data released by the USDA Foreign Agricultural Service on Jan. 5. The U.S. exported wood pellets to approximately 17 countries in November. The U.K. was the top destination at 442,194.8 metric tons, followed by the Netherlands at 143,207.2 metric tons and Japan at 54,844 metric tons. The value of U.S. wood pellet exports was at $120.94 million in November, down from $132.21 million the previous month, but up from $102.06 million in November 2021. Total U.S. wood pellet exports for the first 11 months of 2022 reached 8.06 million metric tons at a value of $1.39 billion, compared to 6.65 million metric tons exported during the same period of 2021 at a value of $949.99 million. [END]

The U.S. exported 694,199.7 metric tons of wood pellets in November, down from 750,989.2 metric tons in October and 764,259.6 metric tons in November 2021, according to data released by the USDA Foreign Agricultural Service on Jan. 5. The U.S. exported wood pellets to approximately 17 countries in November. The U.K. was the top destination at 442,194.8 metric tons, followed by the Netherlands at 143,207.2 metric tons and Japan at 54,844 metric tons. The value of U.S. wood pellet exports was at $120.94 million in November, down from $132.21 million the previous month, but up from $102.06 million in November 2021. Total U.S. wood pellet exports for the first 11 months of 2022 reached 8.06 million metric tons at a value of $1.39 billion, compared to 6.65 million metric tons exported during the same period of 2021 at a value of $949.99 million. [END]

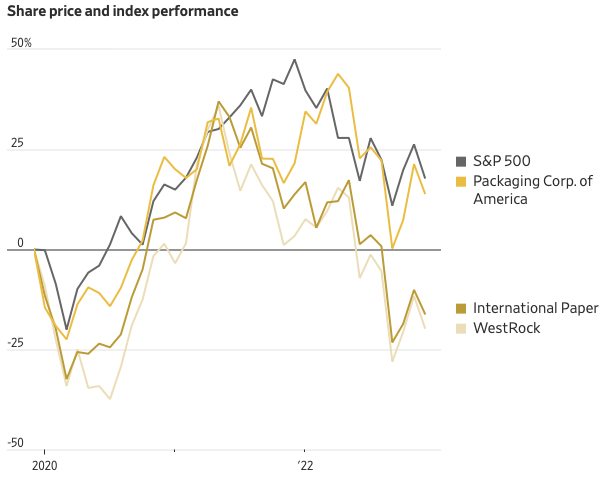

Prices for containerboard, the material that is folded into shipping boxes, declined for the second straight month, according to Fastmarkets RISI’s PPI Pulp & Paper Week, a trade publication that sets benchmarks by surveying buyers and sellers. Prices dropped $20 a ton, or about 2.2%, in December. It was the same decline as in November, which was the first time containerboard had gotten cheaper since the summer of 2019. Containerboard prices soared to records during the pandemic e-commerce explosion, but lately easing demand, ample inventories and new production capacity have forced big box makers, such as International Paper, to curtail output in hopes of balancing the market. [END]

Prices for containerboard, the material that is folded into shipping boxes, declined for the second straight month, according to Fastmarkets RISI’s PPI Pulp & Paper Week, a trade publication that sets benchmarks by surveying buyers and sellers. Prices dropped $20 a ton, or about 2.2%, in December. It was the same decline as in November, which was the first time containerboard had gotten cheaper since the summer of 2019. Containerboard prices soared to records during the pandemic e-commerce explosion, but lately easing demand, ample inventories and new production capacity have forced big box makers, such as International Paper, to curtail output in hopes of balancing the market. [END] New US home construction continued to decline in November and permits plunged as high borrowing costs paired with widespread inflation eroded housing affordability and demand. Residential starts decreased 0.5% last month to a 1.43 million annualized rate. Single-family homebuilding dropped to an annualized 828,000 rate, the lowest since May 2020. Applications to build, a proxy for future construction, decreased 11.2% to an annualized 1.34 million units. Permits for construction of one-family homes fell 7.1% to the weakest pace since 2020. …Multifamily starts increased, while permits for new construction declined to a more than one-year low. Groundbreakings on single-family homes dropped in the South and Midwest, while permits declined in three of four regions. Meanwhile, the number of homes completed jumped nearly 11% to an annualized 1.49 million, the highest since August 2007 and a sign builders are making greater progress on backlogs amid a demand pullback.

New US home construction continued to decline in November and permits plunged as high borrowing costs paired with widespread inflation eroded housing affordability and demand. Residential starts decreased 0.5% last month to a 1.43 million annualized rate. Single-family homebuilding dropped to an annualized 828,000 rate, the lowest since May 2020. Applications to build, a proxy for future construction, decreased 11.2% to an annualized 1.34 million units. Permits for construction of one-family homes fell 7.1% to the weakest pace since 2020. …Multifamily starts increased, while permits for new construction declined to a more than one-year low. Groundbreakings on single-family homes dropped in the South and Midwest, while permits declined in three of four regions. Meanwhile, the number of homes completed jumped nearly 11% to an annualized 1.49 million, the highest since August 2007 and a sign builders are making greater progress on backlogs amid a demand pullback. As the clock winds down to the holidays and the year’s end, investors and economists alike will have plenty to pore over this week when it comes to the state of the housing sector, the overall strength of the economy and the present trajectory of inflation. Monday brings the first reading of the week on housing, with the NAHBs sentiment survey for December… and there is no reason to think the last one of 2022 will show any improvement. …The government will release its final estimate for third-quarter gross domestic product. Analysts believe it will be unchanged, at 2.9% annual growth… with most economists predicting a recession in 2023. …The week ends with the personal consumption expenditures price index, a measure of inflation. …The economy will end 2022 with most expecting worsening conditions headed into 2023.

As the clock winds down to the holidays and the year’s end, investors and economists alike will have plenty to pore over this week when it comes to the state of the housing sector, the overall strength of the economy and the present trajectory of inflation. Monday brings the first reading of the week on housing, with the NAHBs sentiment survey for December… and there is no reason to think the last one of 2022 will show any improvement. …The government will release its final estimate for third-quarter gross domestic product. Analysts believe it will be unchanged, at 2.9% annual growth… with most economists predicting a recession in 2023. …The week ends with the personal consumption expenditures price index, a measure of inflation. …The economy will end 2022 with most expecting worsening conditions headed into 2023.

A pattern is emerging in lumber markets: First, a big sawmill owner announces production curtailments. The next day, lumber futures quickly rise by the most allowed by exchange rules. It played out after West Fraser Timber said that it will curb production at its Perry mill in Florida due to languishing prices for two-by-fours amid the slowdown in homebuilding. This morning, within about 90 minutes from the open, lumber futures shot up by $24 per thousand board feet. That’s the maximum allowed by exchange rules meant to maintain orderly markets. The same thing happened Dec. 6, when Canfor said it was cutting back output in British Columbia. The difference this time is that future prices have eased back down, illustrating the challenge even the increasingly consolidated sawmill sector will have buoying wood markets amid sharply declining demand from builders and do-it-yourselfers. [to access the full story a WSJ subscription is required]

A pattern is emerging in lumber markets: First, a big sawmill owner announces production curtailments. The next day, lumber futures quickly rise by the most allowed by exchange rules. It played out after West Fraser Timber said that it will curb production at its Perry mill in Florida due to languishing prices for two-by-fours amid the slowdown in homebuilding. This morning, within about 90 minutes from the open, lumber futures shot up by $24 per thousand board feet. That’s the maximum allowed by exchange rules meant to maintain orderly markets. The same thing happened Dec. 6, when Canfor said it was cutting back output in British Columbia. The difference this time is that future prices have eased back down, illustrating the challenge even the increasingly consolidated sawmill sector will have buoying wood markets amid sharply declining demand from builders and do-it-yourselfers. [to access the full story a WSJ subscription is required] South Korea’s economy grew at its slowest pace in a year in Q3 as poor net exports offset consumption and investment. …OECD cuts South Korea’s 2023 growth outlook to 2.2% from earlier forecast of 2.8%, citing uncertainties in the global economy.

South Korea’s economy grew at its slowest pace in a year in Q3 as poor net exports offset consumption and investment. …OECD cuts South Korea’s 2023 growth outlook to 2.2% from earlier forecast of 2.8%, citing uncertainties in the global economy. DUBAI, UAE — The global construction industry’s future looks promising, with opportunities in residential, non-residential, and infrastructure sector. The global construction industry is expected to reach $10.5 trillion by 2023, growing at a compound annual growth rate of 4.2% between 2018 and 2023. The major drivers of this market’s growth are rising housing starts and rising infrastructure as a result of increasing urbanisation and population growth. Emerging trends that have a direct impact on the dynamics of the construction industry include a rise in the need for green construction to reduce carbon footprint, bridge lock-up device systems to improve structure life, building information systems for efficient building management, and the use of cutting-edge technologies. In more detail: Robotics… Green building… Remote worksites… Modular design… Use of rented equipment.

DUBAI, UAE — The global construction industry’s future looks promising, with opportunities in residential, non-residential, and infrastructure sector. The global construction industry is expected to reach $10.5 trillion by 2023, growing at a compound annual growth rate of 4.2% between 2018 and 2023. The major drivers of this market’s growth are rising housing starts and rising infrastructure as a result of increasing urbanisation and population growth. Emerging trends that have a direct impact on the dynamics of the construction industry include a rise in the need for green construction to reduce carbon footprint, bridge lock-up device systems to improve structure life, building information systems for efficient building management, and the use of cutting-edge technologies. In more detail: Robotics… Green building… Remote worksites… Modular design… Use of rented equipment.