Canada’s lumber industry is heavily export-dependent. Roughly 65% of Canadian lumber production is sold abroad, and the US remains by far the largest customer, accounting for about 87% of exports in 2025 . This reliance leaves Canada highly exposed to US trade policy. …Canada’s lumber and forest sector is expected to continue contracting through 2030. Sawmill capacity will decline, particularly among smaller and older operations in regions affected by insects and fires, and export patterns will slowly rebalance away from the US. Rural communities will bear the greatest impacts. If US tariffs are eventually removed, the surviving modern mills could benefit from improved margins as lumber prices are likely to increase in the US. Meanwhile, opportunities exist in gradually growing overseas markets and in the domestic construction sector, where housing starts would need to roughly double by 2035 to meet projected demand.

Canada’s lumber industry is heavily export-dependent. Roughly 65% of Canadian lumber production is sold abroad, and the US remains by far the largest customer, accounting for about 87% of exports in 2025 . This reliance leaves Canada highly exposed to US trade policy. …Canada’s lumber and forest sector is expected to continue contracting through 2030. Sawmill capacity will decline, particularly among smaller and older operations in regions affected by insects and fires, and export patterns will slowly rebalance away from the US. Rural communities will bear the greatest impacts. If US tariffs are eventually removed, the surviving modern mills could benefit from improved margins as lumber prices are likely to increase in the US. Meanwhile, opportunities exist in gradually growing overseas markets and in the domestic construction sector, where housing starts would need to roughly double by 2035 to meet projected demand.

BURNABY, BC — Interfor reported its Q3, 2025 results. The company recorded a net loss of $215.8 million compared to net earnings of $11.1 million in Q2’25 and a net loss of $105.7 million in Q3’24. Adjusted EBITDA was a loss of $183.8 million on sales of $689.3 million in Q3’25 versus Adjusted EBITDA of $17.2 million on sales of $780.5 million in Q2’25 and an Adjusted EBITDA loss of $22.0 million on sales of $692.7 million in Q3’24. Lumber production of 912 million board feet was down 23 million board feet versus the preceding quarter. This decline largely reflects the Company’s announcement on September 4, 2025, to temporarily curtail production. …Weak lumber market conditions were reflected in Interfor’s average selling price of $618 per mfbm, down $66 per mfbm versus Q2’25. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle.

BURNABY, BC — Interfor reported its Q3, 2025 results. The company recorded a net loss of $215.8 million compared to net earnings of $11.1 million in Q2’25 and a net loss of $105.7 million in Q3’24. Adjusted EBITDA was a loss of $183.8 million on sales of $689.3 million in Q3’25 versus Adjusted EBITDA of $17.2 million on sales of $780.5 million in Q2’25 and an Adjusted EBITDA loss of $22.0 million on sales of $692.7 million in Q3’24. Lumber production of 912 million board feet was down 23 million board feet versus the preceding quarter. This decline largely reflects the Company’s announcement on September 4, 2025, to temporarily curtail production. …Weak lumber market conditions were reflected in Interfor’s average selling price of $618 per mfbm, down $66 per mfbm versus Q2’25. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle. NEW YORK — Mercer International reported third quarter 2025 Operating EBITDA of negative $28.1 million, a decrease from positive $50.5 million in the same quarter of 2024 and negative $20.9 million in the second quarter of 2025. In the third quarter of 2025, net loss was $80.8 million compared to $17.6 million in the same quarter of 2024 and $86.1 million in the second quarter of 2025. Mr. Juan Carlos Bueno, CEO, stated: “In the third quarter of 2025, persistent global economic and trade uncertainties, fiber scarcity in Germany as well as the impact of pulp substitution accelerated the decline in pulp market demand and pricing, which negatively impacted our operating results and contributed to a $20.4 million non-cash inventory impairment charge in the quarter.

NEW YORK — Mercer International reported third quarter 2025 Operating EBITDA of negative $28.1 million, a decrease from positive $50.5 million in the same quarter of 2024 and negative $20.9 million in the second quarter of 2025. In the third quarter of 2025, net loss was $80.8 million compared to $17.6 million in the same quarter of 2024 and $86.1 million in the second quarter of 2025. Mr. Juan Carlos Bueno, CEO, stated: “In the third quarter of 2025, persistent global economic and trade uncertainties, fiber scarcity in Germany as well as the impact of pulp substitution accelerated the decline in pulp market demand and pricing, which negatively impacted our operating results and contributed to a $20.4 million non-cash inventory impairment charge in the quarter. VANCOUVER, BC — Canfor Corporation reported its third quarter of 2025 results. The Company reported an operating loss of $208 million and a net loss of $172 million. …Canfor’s CEO, Susan Yurkovich, stated: “The ongoing global economic and trade uncertainty, in conjunction with punitive US softwood lumber duties, led to persistently weak market conditions and subdued demand across all of our operating regions during the third quarter of 2025. …For the lumber segment, the operating loss was $182.2 million for the third quarter of 2025, compared to the previous quarter’s operating loss of $229.2 million. …For the

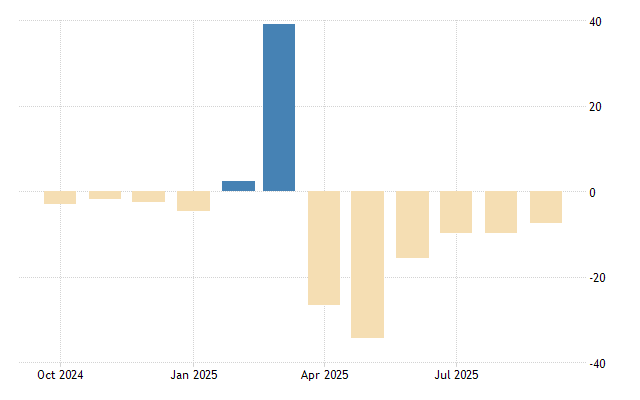

VANCOUVER, BC — Canfor Corporation reported its third quarter of 2025 results. The Company reported an operating loss of $208 million and a net loss of $172 million. …Canfor’s CEO, Susan Yurkovich, stated: “The ongoing global economic and trade uncertainty, in conjunction with punitive US softwood lumber duties, led to persistently weak market conditions and subdued demand across all of our operating regions during the third quarter of 2025. …For the lumber segment, the operating loss was $182.2 million for the third quarter of 2025, compared to the previous quarter’s operating loss of $229.2 million. …For the  Lumber futures steadied around $540 per thousand board feet, hovering near seven-week lows, after a sharp selloff driven mainly by softer US construction demand and lingering post-rally inventories. US housing starts and builder activity failed to accelerate, leaving order flow thin and dealer and distributor stocks higher than the summer buying binge implied. Supply has only partially adjusted, with North American mills signaling temporary curtailments, but looming US softwood measures and announced support for Canada’s industry have kept export channels and production incentives intact, preventing a rapid physical tightening. Traders are now pricing a likely mix of modest Q4 production cuts, seasonal pre-winter restocking and the risk of trade-related disruptions.

Lumber futures steadied around $540 per thousand board feet, hovering near seven-week lows, after a sharp selloff driven mainly by softer US construction demand and lingering post-rally inventories. US housing starts and builder activity failed to accelerate, leaving order flow thin and dealer and distributor stocks higher than the summer buying binge implied. Supply has only partially adjusted, with North American mills signaling temporary curtailments, but looming US softwood measures and announced support for Canada’s industry have kept export channels and production incentives intact, preventing a rapid physical tightening. Traders are now pricing a likely mix of modest Q4 production cuts, seasonal pre-winter restocking and the risk of trade-related disruptions. MONTREAL — CN Rail reported its financial and operating results for the third quarter ended September 30, 2025. Highlights include: Revenues of C$4,165 million, an increase of C$55 million, or 1%; Net income of C$1,139 million, an increase of C$54 million, or 5%. …Tracy Robinson, President and Chief Executive Officer said, “We are taking decisive actions to navigate a challenging macro environment including doubling down on productivity efforts, setting our 2026 capital spend at C$2.8 billion*, down nearly C$600 million from this year’s levels, driving increased free cash flow on a go-forward basis. We are positioning this business to benefit from higher future volumes and ensuring everything we do enhances our customers and shareholders long term value.”

MONTREAL — CN Rail reported its financial and operating results for the third quarter ended September 30, 2025. Highlights include: Revenues of C$4,165 million, an increase of C$55 million, or 1%; Net income of C$1,139 million, an increase of C$54 million, or 5%. …Tracy Robinson, President and Chief Executive Officer said, “We are taking decisive actions to navigate a challenging macro environment including doubling down on productivity efforts, setting our 2026 capital spend at C$2.8 billion*, down nearly C$600 million from this year’s levels, driving increased free cash flow on a go-forward basis. We are positioning this business to benefit from higher future volumes and ensuring everything we do enhances our customers and shareholders long term value.” Canadian Pacific Kansas City reported a big profit boost in its latest quarter despite US tariff disruption and fears over fallout from a potential merger of rivals down the line. The railway saw net income for the quarter ended Sept. 30 rise 10% year-over-year to $917 million. Revenues increased three per cent to $3.66 billion on the back of higher shipping volumes. Grain, potash and container volumes rose markedly year-over-year while forest products — struggling under a sectoral tariff imposed by US President Trump — and energy, chemicals and plastics sagged. …Cross-border steel shipments also dropped due to 50% US tariffs on imports of the metal, though CPKC helped make up the decline with domestic traffic and direct Canada-to-Mexico trade, said chief marketing officer John Brooks. A new item of concern crossed the CEO’s desk over the summer. Union Pacific announced in July it wants to buy Norfolk Southern, and potentially trigger a final wave of rail mergers.

Canadian Pacific Kansas City reported a big profit boost in its latest quarter despite US tariff disruption and fears over fallout from a potential merger of rivals down the line. The railway saw net income for the quarter ended Sept. 30 rise 10% year-over-year to $917 million. Revenues increased three per cent to $3.66 billion on the back of higher shipping volumes. Grain, potash and container volumes rose markedly year-over-year while forest products — struggling under a sectoral tariff imposed by US President Trump — and energy, chemicals and plastics sagged. …Cross-border steel shipments also dropped due to 50% US tariffs on imports of the metal, though CPKC helped make up the decline with domestic traffic and direct Canada-to-Mexico trade, said chief marketing officer John Brooks. A new item of concern crossed the CEO’s desk over the summer. Union Pacific announced in July it wants to buy Norfolk Southern, and potentially trigger a final wave of rail mergers. Lumber futures tumbled toward $560 per thousand board feet, a seven-week low, as weakening demand, persistent oversupply, and trade-policy uncertainties converged. US tariffs are intensifying pressure on Canadian softwood, with existing antidumping and countervailing duties around 35%, plus new Section 232 levies of 10% on timber and 25% on wood products, lifting import costs above 45%. Weak demand compounds the decline, with US residential building permits at a seasonally adjusted 1.4 million units in July, the lowest since June 2020, and construction spending down 3.4% from May 2024. Housing starts remain near five-year lows, keeping retail price pass-through muted despite higher import costs. Export channels have narrowed, with Canadian softwood constrained by tariffs and hardwood exports to China dropping from 40% of volume in 2017 to 7% today. Temporary curtailments and mill closures are emerging, yet abundant inventories and sluggish construction sustain downward pressure. [END]

Lumber futures tumbled toward $560 per thousand board feet, a seven-week low, as weakening demand, persistent oversupply, and trade-policy uncertainties converged. US tariffs are intensifying pressure on Canadian softwood, with existing antidumping and countervailing duties around 35%, plus new Section 232 levies of 10% on timber and 25% on wood products, lifting import costs above 45%. Weak demand compounds the decline, with US residential building permits at a seasonally adjusted 1.4 million units in July, the lowest since June 2020, and construction spending down 3.4% from May 2024. Housing starts remain near five-year lows, keeping retail price pass-through muted despite higher import costs. Export channels have narrowed, with Canadian softwood constrained by tariffs and hardwood exports to China dropping from 40% of volume in 2017 to 7% today. Temporary curtailments and mill closures are emerging, yet abundant inventories and sluggish construction sustain downward pressure. [END] US tariffs on key Canadian goods and weakening global demand triggered a sharp pullback in exports in the second quarter of 2025, according to new data released by

US tariffs on key Canadian goods and weakening global demand triggered a sharp pullback in exports in the second quarter of 2025, according to new data released by  The Bank of Canada cut its interest rate by 25 basis points to 2.25 per cent on Wednesday, but signalled that it may end its easing cycle there if the economy operates in line with its latest forecast. …Bank of Canada governor Tiff Macklem said, “If the economy evolves roughly in line with the outlook in our Monetary Policy Report, governing council sees the current policy rate at about the right level to keep inflation close to 2% while.” …The central bank presented its first baseline forecast since January after trade war uncertainty prompted policymakers to instead assess multiple potential scenarios. After a contraction in the second quarter, the bank expects weak growth for the remainder of 2025, with 0.5% annualized GDP growth in the third quarter and 1% growth in the last quarter of this year. It projects GDP growth of 1.1% in 2026 and 1.6& in 2027.

The Bank of Canada cut its interest rate by 25 basis points to 2.25 per cent on Wednesday, but signalled that it may end its easing cycle there if the economy operates in line with its latest forecast. …Bank of Canada governor Tiff Macklem said, “If the economy evolves roughly in line with the outlook in our Monetary Policy Report, governing council sees the current policy rate at about the right level to keep inflation close to 2% while.” …The central bank presented its first baseline forecast since January after trade war uncertainty prompted policymakers to instead assess multiple potential scenarios. After a contraction in the second quarter, the bank expects weak growth for the remainder of 2025, with 0.5% annualized GDP growth in the third quarter and 1% growth in the last quarter of this year. It projects GDP growth of 1.1% in 2026 and 1.6& in 2027.

Vancouver, BC — Western Forest Products Inc. reported Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export duty expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. In comparison, the Company reported Adjusted EBITDA of negative $10.7 million in the third quarter of 2024, which included a $1.0 million export duty recovery related to the determination of final duty rates from the fifth AR, and Adjusted EBITDA of $0.5 million in the second quarter of 2025. Net loss was $61.3 million in the third quarter of 2025, as compared to a net loss of $19.6 million in the third quarter of 2024, and net loss of $17.4 million in the second quarter of 2025.

Vancouver, BC — Western Forest Products Inc. reported Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export duty expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. In comparison, the Company reported Adjusted EBITDA of negative $10.7 million in the third quarter of 2024, which included a $1.0 million export duty recovery related to the determination of final duty rates from the fifth AR, and Adjusted EBITDA of $0.5 million in the second quarter of 2025. Net loss was $61.3 million in the third quarter of 2025, as compared to a net loss of $19.6 million in the third quarter of 2024, and net loss of $17.4 million in the second quarter of 2025.

MONTREAL, Quebec – Stella-Jones announced financial results for its third quarter ended September 30, 2025. Highlights include: Sales of $958 million, up 5% from Q3 2024; Operating income of $135 million, up 4% from Q3 2024; EBITDA of $171 million, or 17.8% margin, up 6% from Q3 2024; and Net Income of $88 million, up 10% from Q3, 2024. …“Stella-Jones achieved another solid performance in the third quarter, supported by volume improvements, robust margins, improved cash flow and a strong balance sheet,” said Eric Vachon, CEO. …The increase in pressure-treated wood sales resulted from an increase in utility poles and industrial products volumes and higher pricing for railway ties and residential lumber. This was partially offset by lower pricing for utility poles. Logs and lumber sales decreased by $14 million or 47%, mainly driven by lower logs activity.

MONTREAL, Quebec – Stella-Jones announced financial results for its third quarter ended September 30, 2025. Highlights include: Sales of $958 million, up 5% from Q3 2024; Operating income of $135 million, up 4% from Q3 2024; EBITDA of $171 million, or 17.8% margin, up 6% from Q3 2024; and Net Income of $88 million, up 10% from Q3, 2024. …“Stella-Jones achieved another solid performance in the third quarter, supported by volume improvements, robust margins, improved cash flow and a strong balance sheet,” said Eric Vachon, CEO. …The increase in pressure-treated wood sales resulted from an increase in utility poles and industrial products volumes and higher pricing for railway ties and residential lumber. This was partially offset by lower pricing for utility poles. Logs and lumber sales decreased by $14 million or 47%, mainly driven by lower logs activity. EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results1 for the three months ended September 27, 2025. Acadian generated sales of $23.0 million, compared to $26.0 million in the prior year period. …Operating costs and expenses decreased $2.0 million compared to the prior year period as a result of decreased timber sales volumes and timber services activity, partially offset by higher average operating costs and expenses per m

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results1 for the three months ended September 27, 2025. Acadian generated sales of $23.0 million, compared to $26.0 million in the prior year period. …Operating costs and expenses decreased $2.0 million compared to the prior year period as a result of decreased timber sales volumes and timber services activity, partially offset by higher average operating costs and expenses per m The Supreme Court could decide on the legality of many of the Trump administration’s tariffs within months, but the ruling won’t impact many of the administration’s levies on imported construction materials such as lumber, steel, aluminum and copper. …Many construction materials imported into the US will remain subject to hefty tariffs regardless of how the Supreme Court rules. Some homebuilding leaders warn that home prices could increase by thousands of dollars beginning next year. …Cristian deRitis, at Moody’s Analytics, said “While importers of other building materials might experience some relief, this could be temporary. The administration may choose to expand the Section 232 tariffs as a fallback strategy if the reciprocal tariffs are invalidated,” deRitis said. …There hasn’t yet been an increase in lumber prices, but NAHB Chairman Buddy Hughes forecasted that the lumber tariffs “will create additional headwinds for an already challenged housing market by further raising construction and renovation costs.”

The Supreme Court could decide on the legality of many of the Trump administration’s tariffs within months, but the ruling won’t impact many of the administration’s levies on imported construction materials such as lumber, steel, aluminum and copper. …Many construction materials imported into the US will remain subject to hefty tariffs regardless of how the Supreme Court rules. Some homebuilding leaders warn that home prices could increase by thousands of dollars beginning next year. …Cristian deRitis, at Moody’s Analytics, said “While importers of other building materials might experience some relief, this could be temporary. The administration may choose to expand the Section 232 tariffs as a fallback strategy if the reciprocal tariffs are invalidated,” deRitis said. …There hasn’t yet been an increase in lumber prices, but NAHB Chairman Buddy Hughes forecasted that the lumber tariffs “will create additional headwinds for an already challenged housing market by further raising construction and renovation costs.”

An extended slowdown in sales of cardboard boxes is intensifying concern that this holiday season will be a disappointing one for US retailers. US corrugated box shipments fell to the lowest third-quarter reading since 2015, maintaining the more measured pace seen in the previous quarter, according to the Fibre Box Association. Packaging companies in recent weeks have warned that economic uncertainty is weighing on retailers and consumers. …This time of year is crucial for the box industry, with shipments typically peaking in October as retailers prepare for the holidays. Box plants said orders were flat or below normal in October, while US consumer sentiment fell to a five-month low and manufacturing activity dropped for an eighth straight month. …US box industry shipments are poised to drop 1% to 1.5% this year versus 2024,” IP’s Andy Silvernail said last week. [to access the full story a Bloomberg subscription is required]

An extended slowdown in sales of cardboard boxes is intensifying concern that this holiday season will be a disappointing one for US retailers. US corrugated box shipments fell to the lowest third-quarter reading since 2015, maintaining the more measured pace seen in the previous quarter, according to the Fibre Box Association. Packaging companies in recent weeks have warned that economic uncertainty is weighing on retailers and consumers. …This time of year is crucial for the box industry, with shipments typically peaking in October as retailers prepare for the holidays. Box plants said orders were flat or below normal in October, while US consumer sentiment fell to a five-month low and manufacturing activity dropped for an eighth straight month. …US box industry shipments are poised to drop 1% to 1.5% this year versus 2024,” IP’s Andy Silvernail said last week. [to access the full story a Bloomberg subscription is required] Kimberly-Clark is buying Tylenol maker Kenvue in a cash and stock deal worth about $48.7 billion, creating a massive consumer health goods company. Shareholders of Kimberly-Clark will own about 54% of the combined company. Kenvue shareholders will own about 46%. The combined company will have a large stable of household brands under one roof, putting Kenvue’s Listerine mouthwash and Band-Aid side-by-side with Kimberly-Clark’s Cottonelle toilet paper, Huggies and Kleenex tissues. It will also generate about $32 billion in annual revenue. Kenvue has spent a relatively brief period as an independent company, having been spun off by Johnson & Johnson two years ago. The deal announced Monday is among the largest corporate takeovers of the year. …The deal is expected to close in the second half of next year. It still needs approval from shareholders of both both companies. …Shares of Kimberly-Clark slipped more than 15% before the market open, while Kenvue’s stock jumped more than 20%.

Kimberly-Clark is buying Tylenol maker Kenvue in a cash and stock deal worth about $48.7 billion, creating a massive consumer health goods company. Shareholders of Kimberly-Clark will own about 54% of the combined company. Kenvue shareholders will own about 46%. The combined company will have a large stable of household brands under one roof, putting Kenvue’s Listerine mouthwash and Band-Aid side-by-side with Kimberly-Clark’s Cottonelle toilet paper, Huggies and Kleenex tissues. It will also generate about $32 billion in annual revenue. Kenvue has spent a relatively brief period as an independent company, having been spun off by Johnson & Johnson two years ago. The deal announced Monday is among the largest corporate takeovers of the year. …The deal is expected to close in the second half of next year. It still needs approval from shareholders of both both companies. …Shares of Kimberly-Clark slipped more than 15% before the market open, while Kenvue’s stock jumped more than 20%.

Shares of D.R. Horton took a hit Tuesday, as the home builder confirmed that the market for new houses was still weak, and it wasn’t just because prices and mortgage rates were too high — people are afraid to shell out so much for a new house when they’re worried about the economy and their jobs. …But even with lower prices and mortgage rates, the number of homes closed fell 1.2% to 23,368, which was below the average analyst estimate. And that weakness comes despite higher incentives to home buyers to boost sales, which pushed profits below what Wall Street was expecting. …Chief Executive Paul Romanowski said affordability was certainly still an issue. But consumers were also concerned about the “volatility and uncertainty” in the economy, which may be leading to worries about the job market. It certainly won’t help matters to see large layoff announcements from high-profile companies.

Shares of D.R. Horton took a hit Tuesday, as the home builder confirmed that the market for new houses was still weak, and it wasn’t just because prices and mortgage rates were too high — people are afraid to shell out so much for a new house when they’re worried about the economy and their jobs. …But even with lower prices and mortgage rates, the number of homes closed fell 1.2% to 23,368, which was below the average analyst estimate. And that weakness comes despite higher incentives to home buyers to boost sales, which pushed profits below what Wall Street was expecting. …Chief Executive Paul Romanowski said affordability was certainly still an issue. But consumers were also concerned about the “volatility and uncertainty” in the economy, which may be leading to worries about the job market. It certainly won’t help matters to see large layoff announcements from high-profile companies.