![]() The Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in October, down from a 2.4% increase in September. The all-items CPI decelerated largely due to gasoline prices, which fell at a faster pace year over year in October (-9.4%) compared with September (-4.1%). Excluding gasoline, the CPI rose 2.6% in October, matching the increase in September. …The CPI rose 0.2% month over month in October. On a seasonally adjusted monthly basis, the CPI was up 0.1%. …Consumers paid more year over year in October for homeowners’ home and mortgage insurance (+6.8%) and passenger vehicle insurance premiums (+7.3%). Among the provinces, prices rose the most in Alberta for both measures, with a 13.7% increase in homeowners’ home and mortgage insurance and a 17.8% increase in passenger vehicle insurance premiums.

The Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in October, down from a 2.4% increase in September. The all-items CPI decelerated largely due to gasoline prices, which fell at a faster pace year over year in October (-9.4%) compared with September (-4.1%). Excluding gasoline, the CPI rose 2.6% in October, matching the increase in September. …The CPI rose 0.2% month over month in October. On a seasonally adjusted monthly basis, the CPI was up 0.1%. …Consumers paid more year over year in October for homeowners’ home and mortgage insurance (+6.8%) and passenger vehicle insurance premiums (+7.3%). Among the provinces, prices rose the most in Alberta for both measures, with a 13.7% increase in homeowners’ home and mortgage insurance and a 17.8% increase in passenger vehicle insurance premiums.

BURNABY, BC — Interfor reported its Q3, 2025 results. The company recorded a net loss of $215.8 million compared to net earnings of $11.1 million in Q2’25 and a net loss of $105.7 million in Q3’24. Adjusted EBITDA was a loss of $183.8 million on sales of $689.3 million in Q3’25 versus Adjusted EBITDA of $17.2 million on sales of $780.5 million in Q2’25 and an Adjusted EBITDA loss of $22.0 million on sales of $692.7 million in Q3’24. Lumber production of 912 million board feet was down 23 million board feet versus the preceding quarter. This decline largely reflects the Company’s announcement on September 4, 2025, to temporarily curtail production. …Weak lumber market conditions were reflected in Interfor’s average selling price of $618 per mfbm, down $66 per mfbm versus Q2’25. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle.

BURNABY, BC — Interfor reported its Q3, 2025 results. The company recorded a net loss of $215.8 million compared to net earnings of $11.1 million in Q2’25 and a net loss of $105.7 million in Q3’24. Adjusted EBITDA was a loss of $183.8 million on sales of $689.3 million in Q3’25 versus Adjusted EBITDA of $17.2 million on sales of $780.5 million in Q2’25 and an Adjusted EBITDA loss of $22.0 million on sales of $692.7 million in Q3’24. Lumber production of 912 million board feet was down 23 million board feet versus the preceding quarter. This decline largely reflects the Company’s announcement on September 4, 2025, to temporarily curtail production. …Weak lumber market conditions were reflected in Interfor’s average selling price of $618 per mfbm, down $66 per mfbm versus Q2’25. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle. NEW YORK — Mercer International reported third quarter 2025 Operating EBITDA of negative $28.1 million, a decrease from positive $50.5 million in the same quarter of 2024 and negative $20.9 million in the second quarter of 2025. In the third quarter of 2025, net loss was $80.8 million compared to $17.6 million in the same quarter of 2024 and $86.1 million in the second quarter of 2025. Mr. Juan Carlos Bueno, CEO, stated: “In the third quarter of 2025, persistent global economic and trade uncertainties, fiber scarcity in Germany as well as the impact of pulp substitution accelerated the decline in pulp market demand and pricing, which negatively impacted our operating results and contributed to a $20.4 million non-cash inventory impairment charge in the quarter.

NEW YORK — Mercer International reported third quarter 2025 Operating EBITDA of negative $28.1 million, a decrease from positive $50.5 million in the same quarter of 2024 and negative $20.9 million in the second quarter of 2025. In the third quarter of 2025, net loss was $80.8 million compared to $17.6 million in the same quarter of 2024 and $86.1 million in the second quarter of 2025. Mr. Juan Carlos Bueno, CEO, stated: “In the third quarter of 2025, persistent global economic and trade uncertainties, fiber scarcity in Germany as well as the impact of pulp substitution accelerated the decline in pulp market demand and pricing, which negatively impacted our operating results and contributed to a $20.4 million non-cash inventory impairment charge in the quarter. VANCOUVER, BC — Canfor Corporation reported its third quarter of 2025 results. The Company reported an operating loss of $208 million and a net loss of $172 million. …Canfor’s CEO, Susan Yurkovich, stated: “The ongoing global economic and trade uncertainty, in conjunction with punitive US softwood lumber duties, led to persistently weak market conditions and subdued demand across all of our operating regions during the third quarter of 2025. …For the lumber segment, the operating loss was $182.2 million for the third quarter of 2025, compared to the previous quarter’s operating loss of $229.2 million. …For the

VANCOUVER, BC — Canfor Corporation reported its third quarter of 2025 results. The Company reported an operating loss of $208 million and a net loss of $172 million. …Canfor’s CEO, Susan Yurkovich, stated: “The ongoing global economic and trade uncertainty, in conjunction with punitive US softwood lumber duties, led to persistently weak market conditions and subdued demand across all of our operating regions during the third quarter of 2025. …For the lumber segment, the operating loss was $182.2 million for the third quarter of 2025, compared to the previous quarter’s operating loss of $229.2 million. …For the  Lumber futures steadied around $540 per thousand board feet, hovering near seven-week lows, after a sharp selloff driven mainly by softer US construction demand and lingering post-rally inventories. US housing starts and builder activity failed to accelerate, leaving order flow thin and dealer and distributor stocks higher than the summer buying binge implied. Supply has only partially adjusted, with North American mills signaling temporary curtailments, but looming US softwood measures and announced support for Canada’s industry have kept export channels and production incentives intact, preventing a rapid physical tightening. Traders are now pricing a likely mix of modest Q4 production cuts, seasonal pre-winter restocking and the risk of trade-related disruptions.

Lumber futures steadied around $540 per thousand board feet, hovering near seven-week lows, after a sharp selloff driven mainly by softer US construction demand and lingering post-rally inventories. US housing starts and builder activity failed to accelerate, leaving order flow thin and dealer and distributor stocks higher than the summer buying binge implied. Supply has only partially adjusted, with North American mills signaling temporary curtailments, but looming US softwood measures and announced support for Canada’s industry have kept export channels and production incentives intact, preventing a rapid physical tightening. Traders are now pricing a likely mix of modest Q4 production cuts, seasonal pre-winter restocking and the risk of trade-related disruptions.

Vancouver, BC — Western Forest Products Inc. reported Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export duty expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. In comparison, the Company reported Adjusted EBITDA of negative $10.7 million in the third quarter of 2024, which included a $1.0 million export duty recovery related to the determination of final duty rates from the fifth AR, and Adjusted EBITDA of $0.5 million in the second quarter of 2025. Net loss was $61.3 million in the third quarter of 2025, as compared to a net loss of $19.6 million in the third quarter of 2024, and net loss of $17.4 million in the second quarter of 2025.

Vancouver, BC — Western Forest Products Inc. reported Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export duty expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. In comparison, the Company reported Adjusted EBITDA of negative $10.7 million in the third quarter of 2024, which included a $1.0 million export duty recovery related to the determination of final duty rates from the fifth AR, and Adjusted EBITDA of $0.5 million in the second quarter of 2025. Net loss was $61.3 million in the third quarter of 2025, as compared to a net loss of $19.6 million in the third quarter of 2024, and net loss of $17.4 million in the second quarter of 2025.

MONTREAL, Quebec – Stella-Jones announced financial results for its third quarter ended September 30, 2025. Highlights include: Sales of $958 million, up 5% from Q3 2024; Operating income of $135 million, up 4% from Q3 2024; EBITDA of $171 million, or 17.8% margin, up 6% from Q3 2024; and Net Income of $88 million, up 10% from Q3, 2024. …“Stella-Jones achieved another solid performance in the third quarter, supported by volume improvements, robust margins, improved cash flow and a strong balance sheet,” said Eric Vachon, CEO. …The increase in pressure-treated wood sales resulted from an increase in utility poles and industrial products volumes and higher pricing for railway ties and residential lumber. This was partially offset by lower pricing for utility poles. Logs and lumber sales decreased by $14 million or 47%, mainly driven by lower logs activity.

MONTREAL, Quebec – Stella-Jones announced financial results for its third quarter ended September 30, 2025. Highlights include: Sales of $958 million, up 5% from Q3 2024; Operating income of $135 million, up 4% from Q3 2024; EBITDA of $171 million, or 17.8% margin, up 6% from Q3 2024; and Net Income of $88 million, up 10% from Q3, 2024. …“Stella-Jones achieved another solid performance in the third quarter, supported by volume improvements, robust margins, improved cash flow and a strong balance sheet,” said Eric Vachon, CEO. …The increase in pressure-treated wood sales resulted from an increase in utility poles and industrial products volumes and higher pricing for railway ties and residential lumber. This was partially offset by lower pricing for utility poles. Logs and lumber sales decreased by $14 million or 47%, mainly driven by lower logs activity.

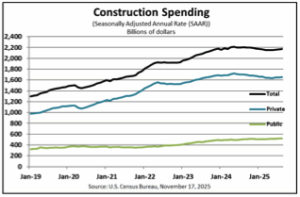

The US Census Bureau announced the following value put in place construction statistics. …Construction spending during August 2025 was estimated at a seasonally adjusted annual rate of $2,169.5 billion, 0.2 percent (±0.7 percent) above the revised July estimate of $2,165.0 billion. The August figure is 1.6 percent (±1.5 percent) below the August 2024 estimate of $2,205.3 billion. During the first eight months of this year, construction spending amounted to $1,438.0 billion, 1.8 percent (±1.0 percent) below the $1,463.7 billion for the same period in 2024. …Spending on private construction was at a seasonally adjusted annual rate of $1,652.1 billion, 0.3 percent (±0.5 percent) above the revised July estimate of $1,647.5 billion. …In August, the estimated seasonally adjusted annual rate of public construction spending was $517.3 billion, virtually unchanged from (±1.2 percent) the revised July estimate of $517.5 billion.

The US Census Bureau announced the following value put in place construction statistics. …Construction spending during August 2025 was estimated at a seasonally adjusted annual rate of $2,169.5 billion, 0.2 percent (±0.7 percent) above the revised July estimate of $2,165.0 billion. The August figure is 1.6 percent (±1.5 percent) below the August 2024 estimate of $2,205.3 billion. During the first eight months of this year, construction spending amounted to $1,438.0 billion, 1.8 percent (±1.0 percent) below the $1,463.7 billion for the same period in 2024. …Spending on private construction was at a seasonally adjusted annual rate of $1,652.1 billion, 0.3 percent (±0.5 percent) above the revised July estimate of $1,647.5 billion. …In August, the estimated seasonally adjusted annual rate of public construction spending was $517.3 billion, virtually unchanged from (±1.2 percent) the revised July estimate of $517.5 billion.  The Supreme Court could decide on the legality of many of the Trump administration’s tariffs within months, but the ruling won’t impact many of the administration’s levies on imported construction materials such as lumber, steel, aluminum and copper. …Many construction materials imported into the US will remain subject to hefty tariffs regardless of how the Supreme Court rules. Some homebuilding leaders warn that home prices could increase by thousands of dollars beginning next year. …Cristian deRitis, at Moody’s Analytics, said “While importers of other building materials might experience some relief, this could be temporary. The administration may choose to expand the Section 232 tariffs as a fallback strategy if the reciprocal tariffs are invalidated,” deRitis said. …There hasn’t yet been an increase in lumber prices, but NAHB Chairman Buddy Hughes forecasted that the lumber tariffs “will create additional headwinds for an already challenged housing market by further raising construction and renovation costs.”

The Supreme Court could decide on the legality of many of the Trump administration’s tariffs within months, but the ruling won’t impact many of the administration’s levies on imported construction materials such as lumber, steel, aluminum and copper. …Many construction materials imported into the US will remain subject to hefty tariffs regardless of how the Supreme Court rules. Some homebuilding leaders warn that home prices could increase by thousands of dollars beginning next year. …Cristian deRitis, at Moody’s Analytics, said “While importers of other building materials might experience some relief, this could be temporary. The administration may choose to expand the Section 232 tariffs as a fallback strategy if the reciprocal tariffs are invalidated,” deRitis said. …There hasn’t yet been an increase in lumber prices, but NAHB Chairman Buddy Hughes forecasted that the lumber tariffs “will create additional headwinds for an already challenged housing market by further raising construction and renovation costs.”

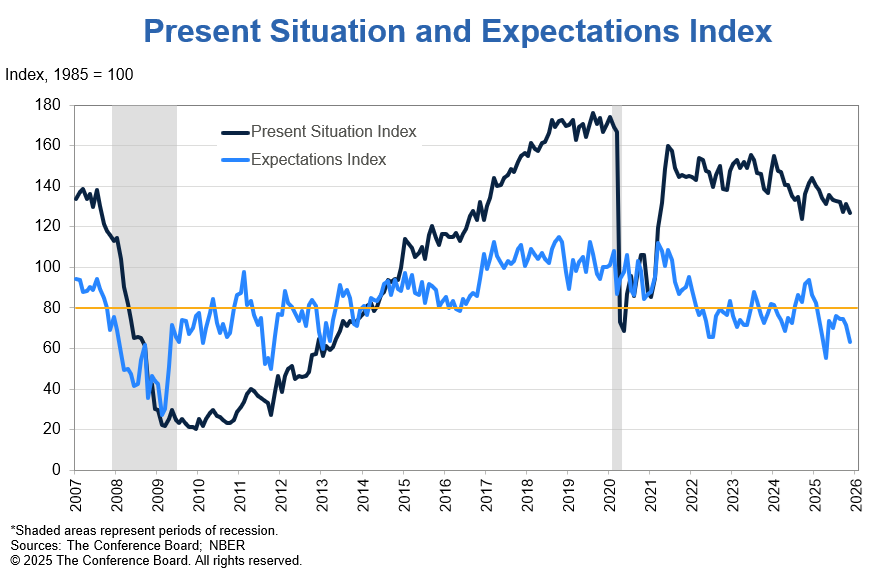

An extended slowdown in sales of cardboard boxes is intensifying concern that this holiday season will be a disappointing one for US retailers. US corrugated box shipments fell to the lowest third-quarter reading since 2015, maintaining the more measured pace seen in the previous quarter, according to the Fibre Box Association. Packaging companies in recent weeks have warned that economic uncertainty is weighing on retailers and consumers. …This time of year is crucial for the box industry, with shipments typically peaking in October as retailers prepare for the holidays. Box plants said orders were flat or below normal in October, while US consumer sentiment fell to a five-month low and manufacturing activity dropped for an eighth straight month. …US box industry shipments are poised to drop 1% to 1.5% this year versus 2024,” IP’s Andy Silvernail said last week. [to access the full story a Bloomberg subscription is required]

An extended slowdown in sales of cardboard boxes is intensifying concern that this holiday season will be a disappointing one for US retailers. US corrugated box shipments fell to the lowest third-quarter reading since 2015, maintaining the more measured pace seen in the previous quarter, according to the Fibre Box Association. Packaging companies in recent weeks have warned that economic uncertainty is weighing on retailers and consumers. …This time of year is crucial for the box industry, with shipments typically peaking in October as retailers prepare for the holidays. Box plants said orders were flat or below normal in October, while US consumer sentiment fell to a five-month low and manufacturing activity dropped for an eighth straight month. …US box industry shipments are poised to drop 1% to 1.5% this year versus 2024,” IP’s Andy Silvernail said last week. [to access the full story a Bloomberg subscription is required]

MOSCOW — Russia’s forestry sector could face a deep contraction next year as sanctions tighten, interest rates remain high and the ruble stays strong, Deputy Industry and Trade Minister Mikhail Yurin said Thursday. Addressing a Federation Council committee, Yurin said the industry has entered a “downward trend,” with the worst-case scenario pointing to a 20-30% drop in output in 2026. The ministry expects already falling production to continue declining into 2027 if geopolitical conditions worsen, Interfax quoted Yurin as saying. According to the Economic Development Ministry, wood-processing is among the weakest performers in Russia’s industrial landscape. Output fell 4.3% in the third quarter and the slump accelerated to 7.8% in October. …He said Russian timber exports have fallen by more than 20% since before the war, from $12.5 billion in 2021 to to $9.8 billion. Logging volumes are expected to hit a four-year low of 182 million cubic meters this year.

MOSCOW — Russia’s forestry sector could face a deep contraction next year as sanctions tighten, interest rates remain high and the ruble stays strong, Deputy Industry and Trade Minister Mikhail Yurin said Thursday. Addressing a Federation Council committee, Yurin said the industry has entered a “downward trend,” with the worst-case scenario pointing to a 20-30% drop in output in 2026. The ministry expects already falling production to continue declining into 2027 if geopolitical conditions worsen, Interfax quoted Yurin as saying. According to the Economic Development Ministry, wood-processing is among the weakest performers in Russia’s industrial landscape. Output fell 4.3% in the third quarter and the slump accelerated to 7.8% in October. …He said Russian timber exports have fallen by more than 20% since before the war, from $12.5 billion in 2021 to to $9.8 billion. Logging volumes are expected to hit a four-year low of 182 million cubic meters this year. China’s recent environmental policy shift is transforming the global recycled pulp market. After years of tightening restrictions on solid waste imports, China has now expanded its scope even further by banning certain types of recycled pulp. This development highlights the country’s ongoing goal to eliminate “foreign garbage” and improve the quality and sustainability of its locally produced paper. …In January 2021, China fully implemented the National Sword policy — a sweeping ban on most solid waste imports, including unsorted and recycled paper. …In October 2025, China took its environmental agenda a step further by targeting specific types of recycled pulp — particularly those processed through dry-milling techniques. …The new restrictions have rippled across the global paper recycling supply chain. Exporters that previously relied on China’s massive demand are scrambling to find alternative markets, while Chinese paper producers face delays and shortages in pulp supply.

China’s recent environmental policy shift is transforming the global recycled pulp market. After years of tightening restrictions on solid waste imports, China has now expanded its scope even further by banning certain types of recycled pulp. This development highlights the country’s ongoing goal to eliminate “foreign garbage” and improve the quality and sustainability of its locally produced paper. …In January 2021, China fully implemented the National Sword policy — a sweeping ban on most solid waste imports, including unsorted and recycled paper. …In October 2025, China took its environmental agenda a step further by targeting specific types of recycled pulp — particularly those processed through dry-milling techniques. …The new restrictions have rippled across the global paper recycling supply chain. Exporters that previously relied on China’s massive demand are scrambling to find alternative markets, while Chinese paper producers face delays and shortages in pulp supply.