Kevin Mason

In mid-April, the Harvard Joint Centre for Housing Studies (JCHS) released its Leading Indicator of Remodeling Activity update, forecasting R&R growth ~+1.6% per quarter between now and Q1/26. This projected growth comes after a modest pullback in R&R spending in 2024 and will be welcomed by North American solid-wood producers given expected declines in demand from new residential construction in the coming quarters. …Recent pricing trends persisted in North American lumber markets over the past month, with S-P-F prices continuing lower while SYP prices moved higher. …A modest seasonal uptick in demand from treaters appears to be one of the catalysts creating SYP price improvement, while the pause on tariffs—the threat of which had previously boosted S-P-F prices—has now precipitated a drop in S-P-F lumber pricing.

As we’ve highlighted exhaustively over the past several months, duties on Canadian lumber exports to the US are scheduled to more than double later this year, and there is still potential for incremental lumber tariffs following a Section 232 investigation (there is the potential for tariffs to extend to panels, etc., but even producers don’t have any clarity). Barring an unlikely spike in lumber demand, many Canadian sawmills are likely to discover that the economics of selling lumber into the US no longer work (unless prices move substantially higher—but that will be driven by closures in Canada). …For Canadian producers, do alternative markets exist, or could a surge in Canadian homebuilding replace some of the lost volumes to the US? In short, there are no easily accessible markets that come close to the size of the US and that can be supplied by Canadian mills.

International Pulp Week kicked off today at the Pan Pacific Hotel in Vancouver, BC. This annual three-day conference organized by the

International Pulp Week kicked off today at the Pan Pacific Hotel in Vancouver, BC. This annual three-day conference organized by the  British Columbia is world renowned for its incredible wilderness landscape, mountains, rivers, lakes and forests. It’s a great place to live, work and play. Our forests are regionally diverse – from coastal and interior rainforests, dry belt pine and fir forest and higher elevation spruce and balsam, old growth and new growth – they all have one thing in common … trees!

British Columbia is world renowned for its incredible wilderness landscape, mountains, rivers, lakes and forests. It’s a great place to live, work and play. Our forests are regionally diverse – from coastal and interior rainforests, dry belt pine and fir forest and higher elevation spruce and balsam, old growth and new growth – they all have one thing in common … trees!  Whether working or playing, it is essential to be aware of a forest’s potential hazards and what can put you at risk, specifically as it relates to the trees. …“If a tree falls in the forest, does anyone hear?” … only if someone is near enough to hear. The same applies to the danger it may pose. If no one is near it, then even if it falls, it isn’t a danger to anyone. Spend enough time in a forest and you will witness a tree fall over on its own.

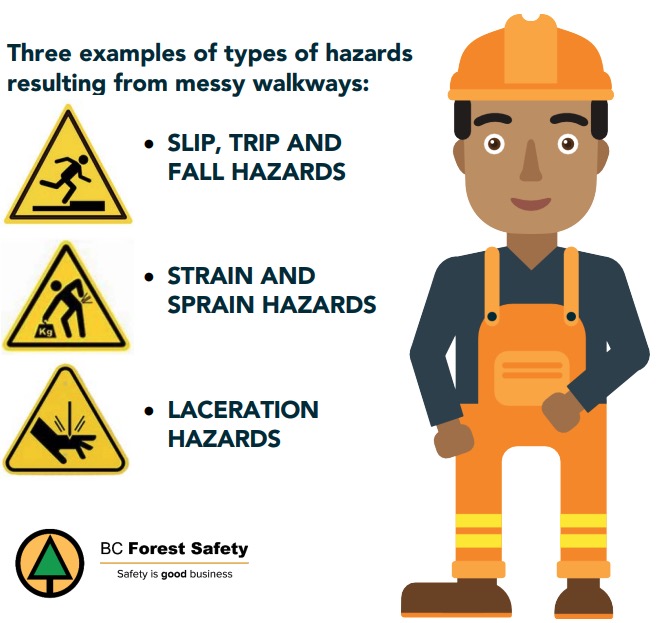

Whether working or playing, it is essential to be aware of a forest’s potential hazards and what can put you at risk, specifically as it relates to the trees. …“If a tree falls in the forest, does anyone hear?” … only if someone is near enough to hear. The same applies to the danger it may pose. If no one is near it, then even if it falls, it isn’t a danger to anyone. Spend enough time in a forest and you will witness a tree fall over on its own. These weekly resources are simple yet powerful tools to help keep safety conversations alive and evolving in your workplace. BCFSC offers a library of hundreds of Crew Talks each designed to support short, focused safety discussions in five minutes or less. They support effective supervisor-worker engagement, helping spark meaningful conversations about current safety procedures and concerns.

These weekly resources are simple yet powerful tools to help keep safety conversations alive and evolving in your workplace. BCFSC offers a library of hundreds of Crew Talks each designed to support short, focused safety discussions in five minutes or less. They support effective supervisor-worker engagement, helping spark meaningful conversations about current safety procedures and concerns. People who work outdoors can often be at the highest risk for heat-related illnesses and injuries during hot summer conditions. High temperatures and sunshine can be a wonderful thing when enjoying time at the lake or on the beach but can cause serious health issues. The wide variety of job roles and often rigorous physical activity in forestry can put workers at risk for heat-related illness if not managed properly.

People who work outdoors can often be at the highest risk for heat-related illnesses and injuries during hot summer conditions. High temperatures and sunshine can be a wonderful thing when enjoying time at the lake or on the beach but can cause serious health issues. The wide variety of job roles and often rigorous physical activity in forestry can put workers at risk for heat-related illness if not managed properly. Managing psychological health and safety in the workplace is as important as managing physical health and safety. A psychologically healthy and safe workplace prevents harm to workers’ mental health and promotes mental well-being. While many factors outside the workplace can affect mental health, it is an employer’s responsibility to address the factors that are within the control, responsibility, or influence of the workplace. Psychological health and safety involves how people interact with each other daily, how working conditions and management practices are structured, and how decisions are made and communicated. In the forestry sector, workers face unique psychological challenges, including financial stress from an unstable market, job instability, social isolation, and the impact of climate change and severe weather conditions.

Managing psychological health and safety in the workplace is as important as managing physical health and safety. A psychologically healthy and safe workplace prevents harm to workers’ mental health and promotes mental well-being. While many factors outside the workplace can affect mental health, it is an employer’s responsibility to address the factors that are within the control, responsibility, or influence of the workplace. Psychological health and safety involves how people interact with each other daily, how working conditions and management practices are structured, and how decisions are made and communicated. In the forestry sector, workers face unique psychological challenges, including financial stress from an unstable market, job instability, social isolation, and the impact of climate change and severe weather conditions. They are also required to conduct regular emergency and first aid drills as part of their annual drill requirements to ensure workers understand their roles and responsibilities. As forestry operations in BC move into more remote and rugged areas, getting help to an injured worker quickly can be a serious challenge. …To help companies build stronger ERPs—especially when it comes to worker extraction—the BC Forest Safety Council and the Trucking and Harvesting Advisory Group created a video series.

They are also required to conduct regular emergency and first aid drills as part of their annual drill requirements to ensure workers understand their roles and responsibilities. As forestry operations in BC move into more remote and rugged areas, getting help to an injured worker quickly can be a serious challenge. …To help companies build stronger ERPs—especially when it comes to worker extraction—the BC Forest Safety Council and the Trucking and Harvesting Advisory Group created a video series. Noise-induced hearing loss (NIHL) is not just a long-term risk, it’s a fast-growing occupational disease that affects workers across the province. Over the past decade, WorkSafeBC has accepted almost 2,000 claims for hearing loss in the forestry sector. To prevent hearing loss, employers in the forestry sector must proactively recognize risks and understand the specific tasks workers will undertake, making pre-work planning a key step in injury prevention. The impact of noise on hearing “The risk of hearing loss depends on both noise level and exposure time,” says Sasha Brown, an occupational audiologist with WorkSafeBC. “For example, brief exposure to extremely loud noise or sustained exposure to moderate levels can be equally damaging to hearing.”

Noise-induced hearing loss (NIHL) is not just a long-term risk, it’s a fast-growing occupational disease that affects workers across the province. Over the past decade, WorkSafeBC has accepted almost 2,000 claims for hearing loss in the forestry sector. To prevent hearing loss, employers in the forestry sector must proactively recognize risks and understand the specific tasks workers will undertake, making pre-work planning a key step in injury prevention. The impact of noise on hearing “The risk of hearing loss depends on both noise level and exposure time,” says Sasha Brown, an occupational audiologist with WorkSafeBC. “For example, brief exposure to extremely loud noise or sustained exposure to moderate levels can be equally damaging to hearing.” All resource road users play a key role in ensuring safe passage on these roads. Always exercise caution and have an understanding of the risks. Most resource roads have gravel surfaces and are often single lanes with limited visibility due to roadside brush and sharp, winding turns and curves. They often have soft shoulders, minimal ditches, steeper grades, changing road surfaces with loose or rough gravel and potholes. Drivers should always read and understand the signs at the start of the road and along the way as they provide important information about the road, radio channel, restrictions, expected traffic and other hazards and obstacles you may encounter while driving.

All resource road users play a key role in ensuring safe passage on these roads. Always exercise caution and have an understanding of the risks. Most resource roads have gravel surfaces and are often single lanes with limited visibility due to roadside brush and sharp, winding turns and curves. They often have soft shoulders, minimal ditches, steeper grades, changing road surfaces with loose or rough gravel and potholes. Drivers should always read and understand the signs at the start of the road and along the way as they provide important information about the road, radio channel, restrictions, expected traffic and other hazards and obstacles you may encounter while driving. BC Hydro data shows that severe weather events in the last 3 to 5 years have led to some of the most damaging storms in BC Hydro’s history. BC’s forest health aerial surveys show that the area of windthrown timber in 2021 (12,600+ ha) was 3 times the average over the last decade. Wind events pose significant risks to people working on and traveling to and from woodlots and community forests. This bulletin provides licensees, managers and workers with guidance and resources they can use to plan and conduct operations that minimize risk of injury to workers during those events.

BC Hydro data shows that severe weather events in the last 3 to 5 years have led to some of the most damaging storms in BC Hydro’s history. BC’s forest health aerial surveys show that the area of windthrown timber in 2021 (12,600+ ha) was 3 times the average over the last decade. Wind events pose significant risks to people working on and traveling to and from woodlots and community forests. This bulletin provides licensees, managers and workers with guidance and resources they can use to plan and conduct operations that minimize risk of injury to workers during those events. The following focuses on considerations for supervisors and owners when developing a PPE program. Components of a good PPE program include: Regulation Check; Planning; Appropriate Selection; Fitting; Education and Training; Supervisor and Management Support; Inspection and Maintenance; and Auditing the Program. Get all the details by clicking the Read More!

The following focuses on considerations for supervisors and owners when developing a PPE program. Components of a good PPE program include: Regulation Check; Planning; Appropriate Selection; Fitting; Education and Training; Supervisor and Management Support; Inspection and Maintenance; and Auditing the Program. Get all the details by clicking the Read More! By implementing ergonomic practices, promoting proper body mechanics and fostering a culture of early reporting and prevention, employers and workers can work together to significantly reduce the occurrence and impact of MSIs across the industry. Although musculoskeletal injuries can affect workers across all areas of forestry, certain roles are particularly vulnerable due to the physical demands and repetitive nature of their tasks.

By implementing ergonomic practices, promoting proper body mechanics and fostering a culture of early reporting and prevention, employers and workers can work together to significantly reduce the occurrence and impact of MSIs across the industry. Although musculoskeletal injuries can affect workers across all areas of forestry, certain roles are particularly vulnerable due to the physical demands and repetitive nature of their tasks. Steep slope harvesting can be approached in several ways, each with its own set of challenges and safety considerations. …Steep slope harvesting presents significant risks, but with careful planning, proper equipment, and a culture of safety, these risks can be managed. “Safety is not a one-time effort but an ongoing process that requires daily attention,” says Pawlowski. “By consistently prioritizing hazard assessment, equipment suitability, proper setup, and staying in the clear, employers and workers can minimize risks and help ensure that steep slope harvesting remains a safe and effective method of timber harvesting.”

Steep slope harvesting can be approached in several ways, each with its own set of challenges and safety considerations. …Steep slope harvesting presents significant risks, but with careful planning, proper equipment, and a culture of safety, these risks can be managed. “Safety is not a one-time effort but an ongoing process that requires daily attention,” says Pawlowski. “By consistently prioritizing hazard assessment, equipment suitability, proper setup, and staying in the clear, employers and workers can minimize risks and help ensure that steep slope harvesting remains a safe and effective method of timber harvesting.” Here again in 2025, phase congestion has become a heightened concern as forestry operations are scrambling to produce in the face of uncertainty which could lead to dangerous situations for workers. History has proven that during uncertain times, productivity becomes the main driver, not for all contractors, but for some, and safety can be put on the backburner which puts everyone at risk, even those who put safety first.

Here again in 2025, phase congestion has become a heightened concern as forestry operations are scrambling to produce in the face of uncertainty which could lead to dangerous situations for workers. History has proven that during uncertain times, productivity becomes the main driver, not for all contractors, but for some, and safety can be put on the backburner which puts everyone at risk, even those who put safety first.

Professionals working in the lumber and sawmill sector and looking to advance their careers can gain specialized training through BCIT’s Associate Certificate in Industrial Wood Processing, starting June 2025. The IWP program was developed with industry subject matter experts and informed by industry leaders to support upskilling and professional development within the sector. The program is 1-year, delivered online and part-time to allow students to balance work and studies.

Professionals working in the lumber and sawmill sector and looking to advance their careers can gain specialized training through BCIT’s Associate Certificate in Industrial Wood Processing, starting June 2025. The IWP program was developed with industry subject matter experts and informed by industry leaders to support upskilling and professional development within the sector. The program is 1-year, delivered online and part-time to allow students to balance work and studies. The BC Truck Loggers Association is pleased to share and invite you to access the newly developed B.C. Timber Harvest Rate Model. The tool was built using data provided by contractors as a joint project of the TLA, ILA and NWLA. The tool calculates the hourly rates for equipment used in BC’s forest industry. It’s designed to give contractors a baseline rate for a selected piece of equipment, serving as a starting point. The rates in the model reflect the required revenues of a contractor who runs a reasonably efficient operation; however, they may vary based on specific operations. The parameters (such as labour and fuel) can be adjusted in the model to calculate rates tailored to specific needs.

The BC Truck Loggers Association is pleased to share and invite you to access the newly developed B.C. Timber Harvest Rate Model. The tool was built using data provided by contractors as a joint project of the TLA, ILA and NWLA. The tool calculates the hourly rates for equipment used in BC’s forest industry. It’s designed to give contractors a baseline rate for a selected piece of equipment, serving as a starting point. The rates in the model reflect the required revenues of a contractor who runs a reasonably efficient operation; however, they may vary based on specific operations. The parameters (such as labour and fuel) can be adjusted in the model to calculate rates tailored to specific needs.

…Mikko Antsalo began by stating, “Softwood pulp markets are projected to remain well-balanced,” citing steady demand growth and the absence of new capacity announcements as stabilizing factors. He concluded by reinforcing Metsä Fibre’s preparedness for the future: “We offer customers an optimized supply chain, fossil-free production, and are well positioned to fulfill upcoming sustainability requirements.”

…Mikko Antsalo began by stating, “Softwood pulp markets are projected to remain well-balanced,” citing steady demand growth and the absence of new capacity announcements as stabilizing factors. He concluded by reinforcing Metsä Fibre’s preparedness for the future: “We offer customers an optimized supply chain, fossil-free production, and are well positioned to fulfill upcoming sustainability requirements.”

Jonathan Rhone, CEO of CO280, began by stating that “capturing and permanently sequestering biogenic CO₂ from boiler stack emissions represents a $100 billion per year market opportunity for the global pulp and paper sector.” The market, he said, is being created by global technology and financial firms—“Microsoft, JPMorgan, Google”—that are purchasing high-durability carbon dioxide removals (CDRs) to meet their net zero obligations.

Jonathan Rhone, CEO of CO280, began by stating that “capturing and permanently sequestering biogenic CO₂ from boiler stack emissions represents a $100 billion per year market opportunity for the global pulp and paper sector.” The market, he said, is being created by global technology and financial firms—“Microsoft, JPMorgan, Google”—that are purchasing high-durability carbon dioxide removals (CDRs) to meet their net zero obligations. …Parker Budding, representing Osapiens, followed with a presentation on how pulp producers can prepare for the EU Deforestation Regulation (EUDR), which comes into force on December 31, 2025. The regulation prohibits companies from placing products on the EU market unless they can prove the goods are deforestation-free and legally produced.

…Parker Budding, representing Osapiens, followed with a presentation on how pulp producers can prepare for the EU Deforestation Regulation (EUDR), which comes into force on December 31, 2025. The regulation prohibits companies from placing products on the EU market unless they can prove the goods are deforestation-free and legally produced.