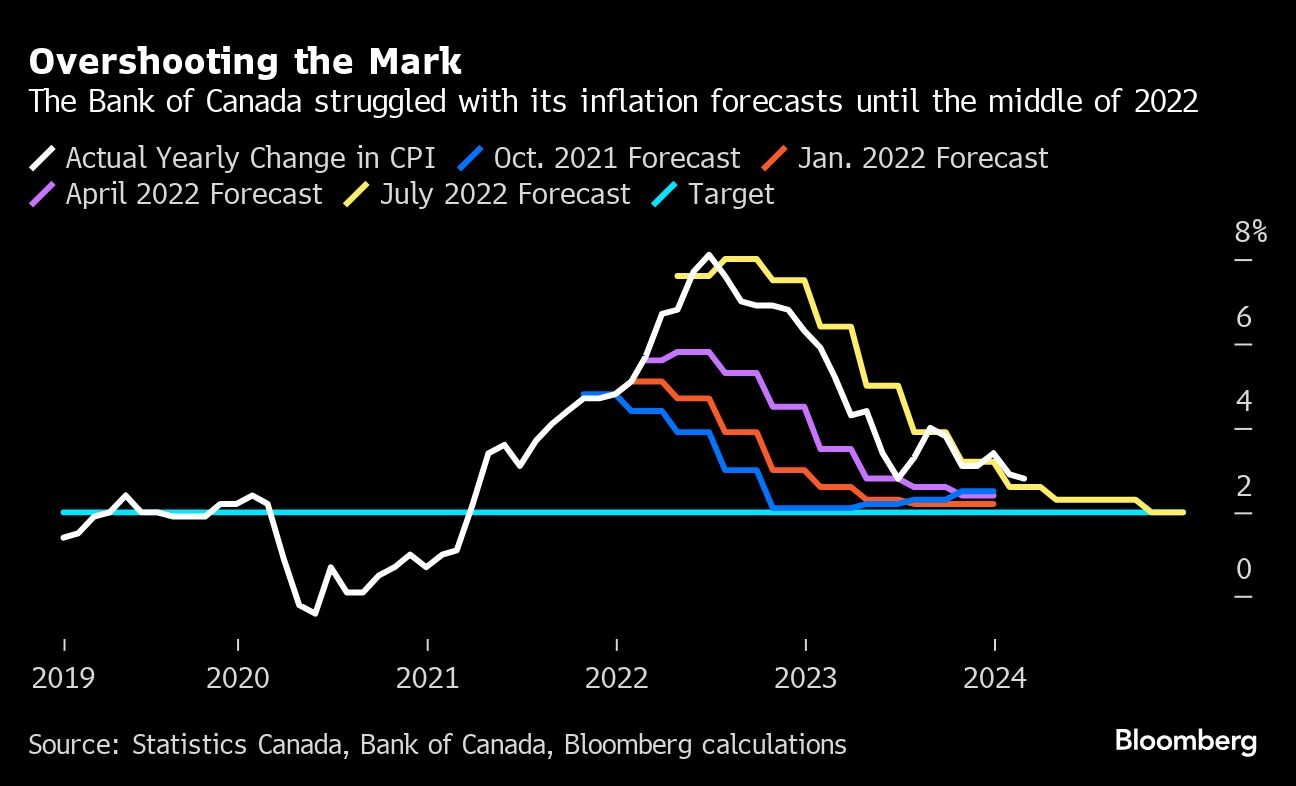

The Bank of Canada is making progress in its battle against inflation, but Governor Tiff Macklem still has a big reason to be cautious about launching into rate cuts too soon — his credibility’s on the line. The central bank, after enduring one of its toughest trials of the last 50 years, is edging closer to getting inflation back to its two per cent target. Economists are forecasting it will get close by the end this year, without a recession. That would be a major win for the institution — which, like the U.S. Federal Reserve and other central banks, has been scrutinized and criticized for the surge in consumer prices that began in 2021. Lowering rates prematurely, only to see inflation take off again, would be a brutal outcome for a central bank that’s been dragged through the mud by politicians on the left and right.

The Bank of Canada is making progress in its battle against inflation, but Governor Tiff Macklem still has a big reason to be cautious about launching into rate cuts too soon — his credibility’s on the line. The central bank, after enduring one of its toughest trials of the last 50 years, is edging closer to getting inflation back to its two per cent target. Economists are forecasting it will get close by the end this year, without a recession. That would be a major win for the institution — which, like the U.S. Federal Reserve and other central banks, has been scrutinized and criticized for the surge in consumer prices that began in 2021. Lowering rates prematurely, only to see inflation take off again, would be a brutal outcome for a central bank that’s been dragged through the mud by politicians on the left and right.