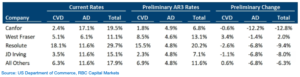

Although lower duty rates were expected by the industry, we view lower rates as a positive for Canadian softwood lumber producers. At current prices, the duty revision could save ~$100-150/mfbm of duty costs. The largest beneficiary of the revised rates is Canfor, given that its rates are expected to fall by 12.8 percentage points to ~6.8%, the lowest rate in Canada. Resolute Forest Products will also benefit from lower rates, with preliminary rates falling by 9.4 percentage points to 20.2% (still the highest in Canada). Although West Fraser currently has the lowest rates in Canada, the company will see its rates increase by 2.0 percentage points to 13.1%, which is modestly above the “All Other” rate of 11.6%. Companies covered by the “All Others” rate include Interfor, Western Forest Products, and Conifex Timber.

Although lower duty rates were expected by the industry, we view lower rates as a positive for Canadian softwood lumber producers. At current prices, the duty revision could save ~$100-150/mfbm of duty costs. The largest beneficiary of the revised rates is Canfor, given that its rates are expected to fall by 12.8 percentage points to ~6.8%, the lowest rate in Canada. Resolute Forest Products will also benefit from lower rates, with preliminary rates falling by 9.4 percentage points to 20.2% (still the highest in Canada). Although West Fraser currently has the lowest rates in Canada, the company will see its rates increase by 2.0 percentage points to 13.1%, which is modestly above the “All Other” rate of 11.6%. Companies covered by the “All Others” rate include Interfor, Western Forest Products, and Conifex Timber.

The US Department of Commerce released its preliminary determination for the Third Administrative Review (“AR3”) in anti-dumping (“AD”) and countervailing (“CVD”) investigations of imports of certain softwood lumber products from Canada – The Department of Commerce (preliminarily) determined that subsidies were provided during the period of review (January 1, 2020 to December 31, 2020). Unless the deadline is extended, the US Department of Commerce intends to issue the final results of the administrative review within 120 days (May 31, 2022).

The US Department of Commerce released its preliminary determination for the Third Administrative Review (“AR3”) in anti-dumping (“AD”) and countervailing (“CVD”) investigations of imports of certain softwood lumber products from Canada – The Department of Commerce (preliminarily) determined that subsidies were provided during the period of review (January 1, 2020 to December 31, 2020). Unless the deadline is extended, the US Department of Commerce intends to issue the final results of the administrative review within 120 days (May 31, 2022).

The US Lumber Coalition supports the “continued enforcement of trade laws” – According to Jason Brochu, US Lumber Coalition Chairman and Co-President of Pleasant River Lumber Company, “the enforcement will maximize long-term domestic production and lumber availability to meet strong demand to build more American homes”. The US industry remains open to a new US-Canada softwood lumber trade agreement “if and when Canada can demonstrate that it is serious about negotiations for an agreement that addresses Canada’s unfair trade practices”.

The National Association of Homebuilders (“NAHB”) welcomes the move to lower lumber tariffs – The NAHB believes that lower tariffs would mitigate uncertainty and associated volatility that has plagued the marketplace and could help to ease upward pressure on lumber prices.