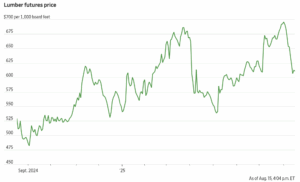

Lumber futures have dropped about 12% since hitting a three-year high two weeks ago, a sign that wood buyers stocked up before duties on Canadian two-by-fours more than doubled this month and that traders are worried about the U.S. housing market. Futures for September delivery fell to around $610 per thousand board feet late Friday and have declined in nine of the past 10 trading sessions. On-the-spot prices are also down, according to Random Lengths. …Jordan Rizzuto, chief investment officer at GammaRoad Capital Partners… said that besides indicating that lumber was piled high in U.S. lumberyards before the higher duties took effect, the whipsaw in wood prices is a warning sign for other asset classes. “Lumber’s price behavior over the past several weeks relative to countercyclical and defensive assets suggests potential weakening of new construction and cyclical sectors of the economy,” he said. [to access the full story a WSJ subscription is required]

Lumber futures have dropped about 12% since hitting a three-year high two weeks ago, a sign that wood buyers stocked up before duties on Canadian two-by-fours more than doubled this month and that traders are worried about the U.S. housing market. Futures for September delivery fell to around $610 per thousand board feet late Friday and have declined in nine of the past 10 trading sessions. On-the-spot prices are also down, according to Random Lengths. …Jordan Rizzuto, chief investment officer at GammaRoad Capital Partners… said that besides indicating that lumber was piled high in U.S. lumberyards before the higher duties took effect, the whipsaw in wood prices is a warning sign for other asset classes. “Lumber’s price behavior over the past several weeks relative to countercyclical and defensive assets suggests potential weakening of new construction and cyclical sectors of the economy,” he said. [to access the full story a WSJ subscription is required]