Kevin Mason

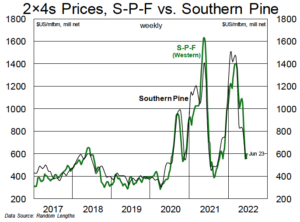

Having spent the past two months in freefall, lumber prices have found a near-term price floor. Western S-P-F 2×4 prices declined from $1,090 in early May to a low of $555 in mid-June, but have since rebounded to $600. SYP 2×4 prices corrected much earlier than S-P-F and thus had less room to fall this quarter, but they are still off by $274 since early May (trading at $560 last week). Conversations with industry contacts suggest that buyers have not jumped back in with two feet, and concerns about demand prospects for the back half of the year continue to weigh heavily on the market. However, homebuilding activity hasn’t fallen to zero overnight, and prices in the $500 range are far more palatable than $1,000+ for buyers looking to build/rebuild modest inventories.

The correction in lumber prices this quarter has been driven by a combination of improved supply (data for March, the most recent available, showed U.S. output up 12% y/y given the worst of COVID-related disruptions behind us) and slowing demand from the residential construction sector. While the outlook for demand, and particularly residential construction, remains shaky, we do expect lumber supply to also check back in high-cost BC. Even after the modest rebound in S-P-F prices over the last two weeks (to $600) we suspect many BC mills will be in the red after the July 1 stumpage rate recalculation adds upwards of ~C$30/m3 to sawlog costs (~C$120/mbf of lumber production); thus, even at $600 many mills in the province will be losing money. To date, Canfor has been the only major producer to announce downtime in BC (~375MMbf expected between late April and early August), but we suspect other producers have been operating on reduced schedules without press releasing it. Following the July stumpage reset, it’s likely downtime will intensify in BC; a wave of long-expected permanent mill closures may also commence.

The correction in lumber prices this quarter has been driven by a combination of improved supply (data for March, the most recent available, showed U.S. output up 12% y/y given the worst of COVID-related disruptions behind us) and slowing demand from the residential construction sector. While the outlook for demand, and particularly residential construction, remains shaky, we do expect lumber supply to also check back in high-cost BC. Even after the modest rebound in S-P-F prices over the last two weeks (to $600) we suspect many BC mills will be in the red after the July 1 stumpage rate recalculation adds upwards of ~C$30/m3 to sawlog costs (~C$120/mbf of lumber production); thus, even at $600 many mills in the province will be losing money. To date, Canfor has been the only major producer to announce downtime in BC (~375MMbf expected between late April and early August), but we suspect other producers have been operating on reduced schedules without press releasing it. Following the July stumpage reset, it’s likely downtime will intensify in BC; a wave of long-expected permanent mill closures may also commence.

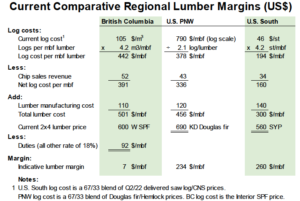

A look at our regional lumber margin comparison table shows just how challenging BC sawmilling economics have become. While we estimate that BC still has some of the lowest manufacturing costs owing to its large, well-capitalized mills (we note that the U.S. South will close the gap in time given the level of investment in the region), elevated log costs have removed any competitive advantage BC once had. When government stumpage rates increase in BC next week, we think log costs will rise by up to US$25/m3, effectively adding more than $100/mbf to total lumber production costs. This will push our theoretical breakeven lumber price above $600 for BC producers, even before factoring in the impact of duties (currently 18% but expected to drop once the next administrative review is completed). For less efficient mills with a weaker lumber recovery factor (i.e., the volume of logs required to produce one thousand board feet of lumber) and higher conversion costs, that breakeven price point could be comfortably above $650 in the quarters to come.

A look at our regional lumber margin comparison table shows just how challenging BC sawmilling economics have become. While we estimate that BC still has some of the lowest manufacturing costs owing to its large, well-capitalized mills (we note that the U.S. South will close the gap in time given the level of investment in the region), elevated log costs have removed any competitive advantage BC once had. When government stumpage rates increase in BC next week, we think log costs will rise by up to US$25/m3, effectively adding more than $100/mbf to total lumber production costs. This will push our theoretical breakeven lumber price above $600 for BC producers, even before factoring in the impact of duties (currently 18% but expected to drop once the next administrative review is completed). For less efficient mills with a weaker lumber recovery factor (i.e., the volume of logs required to produce one thousand board feet of lumber) and higher conversion costs, that breakeven price point could be comfortably above $650 in the quarters to come.

In the U.S. South, delivered sawlog prices have risen from ~$43/ton to ~$48/ton in the past couple of years. While we expect them to continue grinding higher in the years to come, southern mills’ log costs remain less than half of those in BC. In the PNW, log costs are much more responsive to changes in lumber prices (export markets are also a price driver), and we expect log costs to move lower in the region through the balance of the year. In BC, we foresee log costs remaining elevated until the next stumpage price recalculation in July 2023, although there may be some minor relief prior to then reflecting lower lumber prices in interim stumpage adjustments. Ultimately, BC costs will dictate the pricing floor for lumber for the next 12–18 months. Prices may temporarily overcorrect below this level (as we saw in Q3/21), but, barring a collapse in U.S. housing, we forecast lumber prices to average far above traditional levels (i.e., $550+) through the next 12 months.