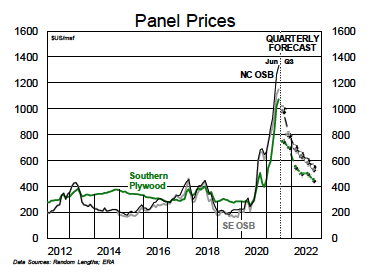

While North American lumber markets have spent most of the month in freefall, OSB markets have shown incredible resilience, with prices still nudging further into record-breaking territory through the month. Simply put, OSB is less exposed to softness in the repair and remodel channel (~20% of total end demand), thus robust demand from residential construction has been enough to keep markets tight and producers in the driver’s seat. Benchmark North Central 7/16″ is now trading at $1,345, up from $1,325 at the beginning of the month, while Western Canadian prices still lead the pack ($1,700 last week), although prices in that region have been unchanged over the past two weeks.

However, with incremental new supply from West Fraser’s restarted Chambord, QC mill (550MMsf) and the upcoming restart of LPX’s Peace Valley, BC mill (800MMsf) in Q3, the peak is likely approaching quickly, and we expect OSB prices to retreat in Q3 and continue trending lower through the balance of the year. We forecast an average NC 7/16″ price of $900 in H2/21 (still amazing, historically speaking).

In the medium-term, siding conversions at LPX’s mills in Houlton (250MMsf coming offline in Q1/22) and Sagola, MI (420MMsf in early 2023) will help to offset the restarts at Chambord and Peace Valley. However, over the longer-term, two recent capacity expansion announcements will add significant new supply. Last week, Huber announced plans to build a greenfield mill in Cohasset, MN. We estimate that capacity at the mill will be ~650MMsf, with the company targeting a mid-2024 start-up. Elsewhere, OneSky Forest Products plans to start up a 600MMsf OSB mill in Prince Albert, SK. We understand that OneSky will be relocating the old PolarBoard mill from Fort Nelson, BC (idled in 2008). OneSky’s website states that the company is targeting a Q1/22 start-up date, but, given challenges securing access to fibre, we believe a 2023 start-up is more likely.

North American plywood markets have piggybacked on incredible strength in OSB over the last 12 months and are also sitting near record highs today (chart). As of last week, the Western Fir Plywood Composite price was $2,328 (unchanged w/w), while the Southern Pine Plywood Composite was at $1,820 (down $14 w/w), up $1,591 and $1,185, respectively, y/y. While we do expect plywood prices to moderate in H2/21 (along with OSB), the rate of decline could be slower than initially anticipated if the ongoing dispute over the grading of South American imports slows the flow of Brazilian panels into the U.S.

Timber Products Inspection, a company that had been grading Brazilian plywood, decided in late May that it would halt its certification program in Brazil within the next 120 days (i.e., before the end of September). This is likely in response to a recent court ruling that found in favour of the U.S. Structural Plywood Integrity Coalition — a judge dismissed the plaintiffs’ (in this case, TPI and a host of other grading agencies) motion to have the negligence case against them dismissed. This is just the first step in what will be a long and drawn-out legal process that could negatively impact Brazilian plywood import volumes in the U.S.

In Q1/21, offshore plywood imports totalled 379MMsf, versus total North American plywood supply of 2.96Bsf (~13% on the quarter — lower than Q4/20’s total of ~20% due to South America’s pivot to Europe in Q1). Of that offshore total for Q1, Brazil represented ~225MMsf, or ~8% of North American plywood supply. Looking at that figure compared to total North American structural panel supply (i.e., plywood plus OSB; the two products are interchangeable in many applications) of 8.76Bsf, Brazilian plywood imports represented ~3% of total supply in Q1/21. Should this 3% be removed from the market, even temporarily, it could help keep structural panel prices stronger for longer.

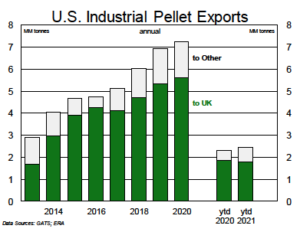

As the world moves toward a low to negative carbon future, industrial pellets are one of the many natural climate solutions available right now and at scale. Firing coal plants on industrial wood pellets can cut carbon emissions with minimal capex, extending the productive life of what would otherwise be stranded assets. With carbon capture, these plants can be carbon-negative. Companies in the U.S. South, with its vast (and growing) forest resources and relatively stable chip prices, are tapping this opportunity.

As the world moves toward a low to negative carbon future, industrial pellets are one of the many natural climate solutions available right now and at scale. Firing coal plants on industrial wood pellets can cut carbon emissions with minimal capex, extending the productive life of what would otherwise be stranded assets. With carbon capture, these plants can be carbon-negative. Companies in the U.S. South, with its vast (and growing) forest resources and relatively stable chip prices, are tapping this opportunity.

In May, Drax announced that the first of three 40kmt pellet “satellite” plants will be co-located with West Fraser’s Leola, AR sawmill (the locations of the next two have not been disclosed). Co-location with a reliable source of fibre on an existing industrial site is a win– win. For WFG, at very least, the pellet plant removes a growing management challenge for southern sawmills: what to do with residuals. Southern lumber production was up 5% LTM through Q1/21, and we expect a similar growth rate — for both lumber and residuals — going forward. At best, packaging and pulp end markets are growing at half of this pace (with recycled fibre feeding the majority of demand from new/converted packaging mills), while paper mills continue to close. WFG will now have some residual offtake on site.

At the other end of the size spectrum, Enviva executed the sixth “dropdown” acquisition from its sponsor in early June, spending $345MM to acquire the Lucedale, MS 750kmt pellet plant that is expected to start up in Q4/21 (along with a 3MMmt capacity pellet export terminal and 630mkt of supply contracts). The pellet plant is too big for any one sawmill to supply, and EVA indicates that only 17% of its fibre supply is from mill residuals (the majority is non-commercial material from forest thinnings).

There is clearly room for more of both types of pellet plants, as pellet exports are up 6% ytd. Drax plans two more satellite plants, and we assume they will also co-locate with sawmills. Enviva is evaluating several more sites for future large-scale plants as it accumulates long-term supply contracts with the winddown of coal power in Japan and elsewhere. As of Q1/21, Forisk’s comprehensive tracking of U.S. pellet production forecasts 15.8MMmt in 2021, up 21% y/y and 17MMmt in 2022 (up another 8%). With abundant supply and rising demand, pellet volumes have a long runway in the U.S. South.

__________

Kevin Mason, CFA Managing Director

www.era-research.com ▪ info@ERA-research.com ▪ TEL: +1 (250) 868-2680 ▪ Copyright © ERA Equity Research Associates Inc. All Rights Reserved.