Kevin Mason

A recent story in Bloomberg confirmed what we all know: the global supply chain is a mess… and a January report by Goldman Sachs puts the congestion at a 10 out of 10. …These supply chain tensions are being felt acutely in virtually every industry in North America (and beyond) and the forest products industry has not been spared. The impacts are now also bubbling up to the consumer level, with prices rising rapidly and shelves emptying. A key issue throughout this supply-chain crisis is that concerns—or uncertainty—cause people to panic, inducing more panic buying and prolonging the problem. People hoard— that is a reality—and it isn’t just consumers. We hear of companies hoarding railcars; corporate buyers double- or triple-ordering product; etc.

In many cases, especially in the forest products industry, it appears the inventory in the supply chain is sufficient to meet actual consumption, but the volumes often aren’t where they are needed. Also, as buyers try to secure more goods, demand exceeds consumption, giving a false sense of market strength. We built a system for just-in-time delivery, but now people are focused on “just-in-case.” This craziness will dissipate somewhat this year, but we probably aren’t returning to normal until 2023 most likely (barring a recession). How quickly the supply chain returns to normal (or a semblance of normal) will have a huge impact on price action over the next couple of years.

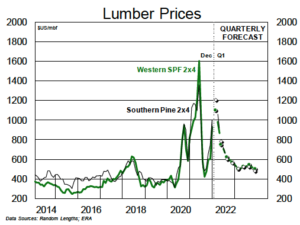

LUMBER – markets have enjoyed an incredible start to the year on steady demand and continued supply disruptions. SYP 2x4s have been the standout performer, increasing by $301 month-to-date—to a record-high of $1,505—while S-P-F 2x4s are up $180 to $1,225. Price appreciation will slow, and may reverse, in the coming weeks as buyers digest recent orders and take stock of H1/22 supply and demand prospects. However, steady demand, patchy production, lengthy order files and myriad transportation challenges should limit downside price risks through quarter-end.

LUMBER – markets have enjoyed an incredible start to the year on steady demand and continued supply disruptions. SYP 2x4s have been the standout performer, increasing by $301 month-to-date—to a record-high of $1,505—while S-P-F 2x4s are up $180 to $1,225. Price appreciation will slow, and may reverse, in the coming weeks as buyers digest recent orders and take stock of H1/22 supply and demand prospects. However, steady demand, patchy production, lengthy order files and myriad transportation challenges should limit downside price risks through quarter-end.

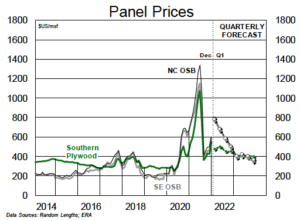

PANEL – markets are also on a tear as sluggish production leaves the market undersupplied. OSB prices are surging, with benchmark NC 7/16″ now at $875 and rising fast. In plywood, prices in both the South and out West have followed similar trends to OSB, but upward momentum has faded somewhat. A massive pullback in offshore plywood imports has been partially offset by a jump in normally modest OSB imports. Trade flows will have a larger than normal impact on panel prices in 2022.

PANEL – markets are also on a tear as sluggish production leaves the market undersupplied. OSB prices are surging, with benchmark NC 7/16″ now at $875 and rising fast. In plywood, prices in both the South and out West have followed similar trends to OSB, but upward momentum has faded somewhat. A massive pullback in offshore plywood imports has been partially offset by a jump in normally modest OSB imports. Trade flows will have a larger than normal impact on panel prices in 2022.

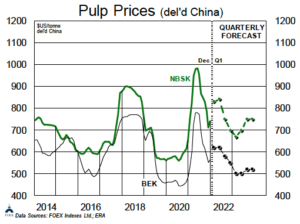

PULP prices are off to a strong start, rising in major geographies and across grades. The gains are mostly supply-driven as shocks out of Western Canada (logistics/downtime) and Europe (UPM strike) have abruptly tightened markets. Demand remains in line with prior levels, but buyers continue working to pass on price increases. We expect downward pressure on prices through H2/22 given increased supply, including lower downtime, the ramp-up of new capacity (particularly hardwood) and, potentially, the unwinding of the global supply-chain backlog (no sign of this yet!). Chinese demand should pull back through the Lunar New Year and Olympic Games, tempering upward momentum.

PULP prices are off to a strong start, rising in major geographies and across grades. The gains are mostly supply-driven as shocks out of Western Canada (logistics/downtime) and Europe (UPM strike) have abruptly tightened markets. Demand remains in line with prior levels, but buyers continue working to pass on price increases. We expect downward pressure on prices through H2/22 given increased supply, including lower downtime, the ramp-up of new capacity (particularly hardwood) and, potentially, the unwinding of the global supply-chain backlog (no sign of this yet!). Chinese demand should pull back through the Lunar New Year and Olympic Games, tempering upward momentum.