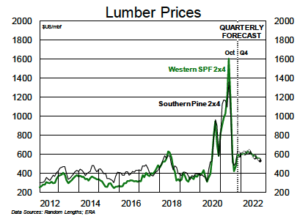

LUMBER – Lumber markets have enjoyed a fantastic month, with prices for all species and dimensions posting impressive gains. S-P-F 2x4s are up $89 on the month at $622; SYP 2x4s have performed even better, increasing by $127 to $679. Steady (if not spectacular) demand, combined with lingering supply challenges, has underpinned this run. However, with the seasonally slower demand period approaching, we see limited near-term upside for prices. A capitulation is not anticipated, but lumber prices should start cycling lower later in the quarter before rebounding again in the spring.

LUMBER – Lumber markets have enjoyed a fantastic month, with prices for all species and dimensions posting impressive gains. S-P-F 2x4s are up $89 on the month at $622; SYP 2x4s have performed even better, increasing by $127 to $679. Steady (if not spectacular) demand, combined with lingering supply challenges, has underpinned this run. However, with the seasonally slower demand period approaching, we see limited near-term upside for prices. A capitulation is not anticipated, but lumber prices should start cycling lower later in the quarter before rebounding again in the spring.

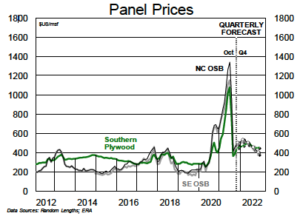

PANEL – OSB prices moved higher across all producing regions this month, with demand running far enough ahead of supply for producers to build multi-week order files. North Central 7/16″ is trading at $500, up $30 on the month, while Southeast and Western Canadian 7/16″ are at $460 and $455, respectively. Further gains should be limited, but an upcoming mill conversion to siding is likely to keep tension in markets through the seasonal slower winter months. Rising imports have yet to cause any challenges. In plywood, prices have nudged higher in both the West and the South, but cracks are appearing and further upside is unlikely.

PANEL – OSB prices moved higher across all producing regions this month, with demand running far enough ahead of supply for producers to build multi-week order files. North Central 7/16″ is trading at $500, up $30 on the month, while Southeast and Western Canadian 7/16″ are at $460 and $455, respectively. Further gains should be limited, but an upcoming mill conversion to siding is likely to keep tension in markets through the seasonal slower winter months. Rising imports have yet to cause any challenges. In plywood, prices have nudged higher in both the West and the South, but cracks are appearing and further upside is unlikely.

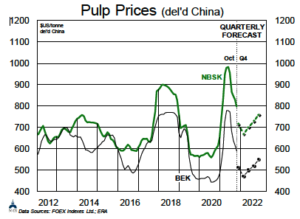

PULP – Pulp prices have come under increasing pressure following widespread Chinese power cuts that have reduced paper & board operating rates (although tissue is reported to be unscathed). China will — as always — lead price direction, but we expect other regions to follow through Q4/early 2022 at a faster pace than our prior forecast reflected. As Chinese inventories retrench, a buying surge should occur in early 2022, driving prices higher again. Markets remain tighter in Europe (in part on reduced paper imports) and North America. New capacity is coming in BEK, while NBSK remains relatively more constrained (high producer inventories reflect volumes stuck in the supply chain, and exert less downward pressure on prices)

PULP – Pulp prices have come under increasing pressure following widespread Chinese power cuts that have reduced paper & board operating rates (although tissue is reported to be unscathed). China will — as always — lead price direction, but we expect other regions to follow through Q4/early 2022 at a faster pace than our prior forecast reflected. As Chinese inventories retrench, a buying surge should occur in early 2022, driving prices higher again. Markets remain tighter in Europe (in part on reduced paper imports) and North America. New capacity is coming in BEK, while NBSK remains relatively more constrained (high producer inventories reflect volumes stuck in the supply chain, and exert less downward pressure on prices)

LABOUR – Labour shortages have intensified since COVID-19 entered our collective discourse, and there is scarcely a corner of the global economy that hasn’t been impacted by labour-related challenges. …Virtually all of the companies we cover have seen labour shortages worsen over the past 20 months, and labour supply was already tight to begin with — particularly in the U.S. South, where much of North America’s forest products jobs are located and where future growth will be centralized. The pandemic has revealed just how fragile our global transportation networks are, and the streamlining and optimization that makes just-in-time deliveries so cost-effective and efficient (in “normal” environments at least), has left very little wiggle room for when problems do arise — and boy, have we had some problems this year. While container shipping backlogs should clear eventually (not likely before H2/22), trucking will continue to be plagued by driver shortages. …However, the news on labour hasn’t been universally negative. We’ve seen at least one positive update in recent months: construction employment has rebounded well over the past 12 months, with 196,000 jobs added (a 2.6% increase) across the 48 states that report this data. Still, strong construction-sector labour growth will mean little if snarled up supply chains prevent building materials from getting to job sites.

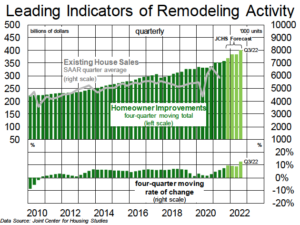

REMODELING – Last week, the Harvard Joint Center for Housing Studies (JCHS) released its latest Leading Indicator of Remodeling Activity (LIRA) update, and the outlook for North American repair and remodel activity remains robust. The JCHS anticipates that spending on remodelling activity (not volume of wood products consumed by R&R projects) will increase by 9% y/y this quarter, and will maintain roughly the same pace of growth through H1/22 before rising to over 12% in Q3/22. …Elsewhere, John Burns Real Estate Consulting (JBREC) expects total repair and remodel spending to grow by a more modest 7% y/y in 2022 (to $455B) — unchanged from 7% y/y growth in 2021. …We note that both of these indicators focus on total dollars spent — as opposed to volumes consumed — in the R&R channel. They also include a whole host of products, ranging from tiles to drywall and everything in between. Focusing just on wood products (lumber, OSB, plywood), given our forecast for continued elevated commodity pricing into at least H1/22, this high-single-digit growth in R&R spending should translate into low-single-digit growth in solid wood volumes. We are currently forecasting solid-wood demand from the R&R channel growing by 2%–3% next year.

REMODELING – Last week, the Harvard Joint Center for Housing Studies (JCHS) released its latest Leading Indicator of Remodeling Activity (LIRA) update, and the outlook for North American repair and remodel activity remains robust. The JCHS anticipates that spending on remodelling activity (not volume of wood products consumed by R&R projects) will increase by 9% y/y this quarter, and will maintain roughly the same pace of growth through H1/22 before rising to over 12% in Q3/22. …Elsewhere, John Burns Real Estate Consulting (JBREC) expects total repair and remodel spending to grow by a more modest 7% y/y in 2022 (to $455B) — unchanged from 7% y/y growth in 2021. …We note that both of these indicators focus on total dollars spent — as opposed to volumes consumed — in the R&R channel. They also include a whole host of products, ranging from tiles to drywall and everything in between. Focusing just on wood products (lumber, OSB, plywood), given our forecast for continued elevated commodity pricing into at least H1/22, this high-single-digit growth in R&R spending should translate into low-single-digit growth in solid wood volumes. We are currently forecasting solid-wood demand from the R&R channel growing by 2%–3% next year.

Kevin Mason