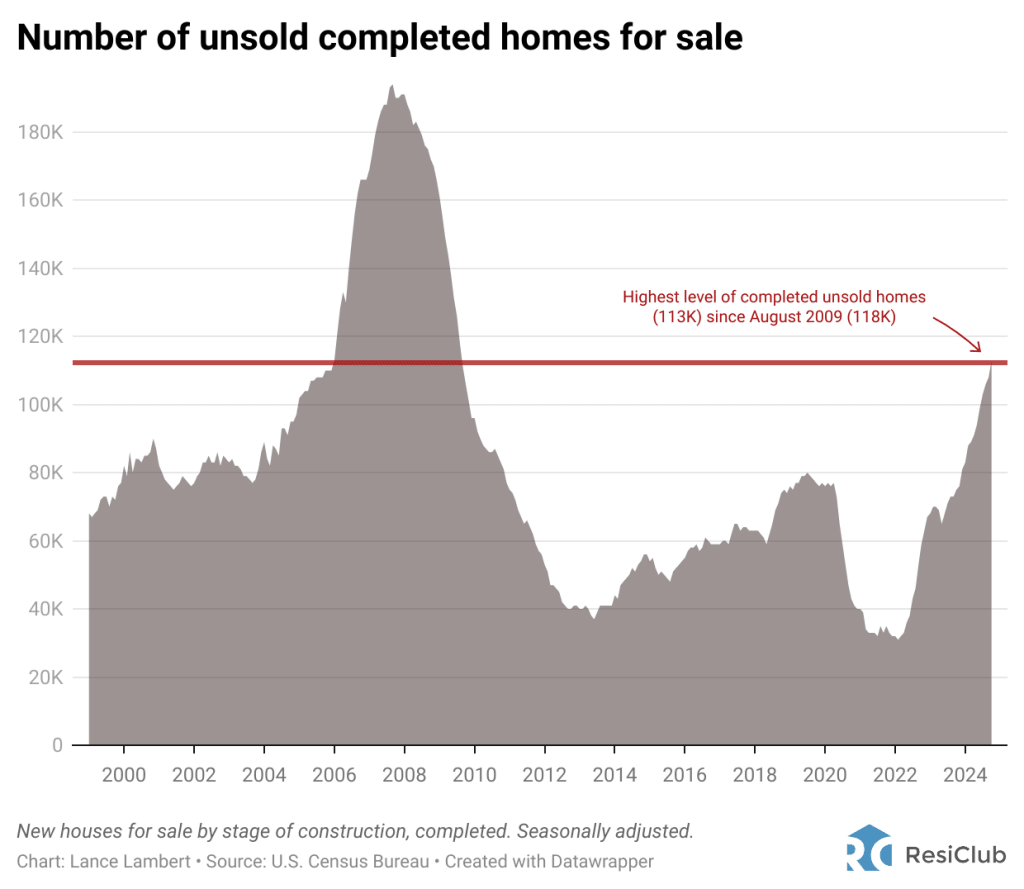

Since the pandemic housing boom fizzled out in 2022, the number of unsold completed new homes has been on a steady climb. The number of unsold completed new single-family homes in October 2024 (113,000) was the highest level since August 2009 (118,000)—although still far below the all-time high in September 2007 (194,000). This raises the question: Is rising standing inventory simply a sign that the new construction market is normalizing after a historic pandemic housing boom, or do builders—particularly in areas where unsold inventory is increasing the most—need to make further affordability adjustments, such as cutting prices or offering greater incentives? …Meritage Homes CEO says they’re building more spec inventory because they’re expecting a ‘strong’ 2025 spring market. …Housing analyst Kevin Erdmann thinks it’s a bullish—not bearish—sign for builders. …High standing inventory could prompt builders to offer discounts or slow down activity in Texas and Florida, suggests housing analyst Rick Palacios Jr.

Since the pandemic housing boom fizzled out in 2022, the number of unsold completed new homes has been on a steady climb. The number of unsold completed new single-family homes in October 2024 (113,000) was the highest level since August 2009 (118,000)—although still far below the all-time high in September 2007 (194,000). This raises the question: Is rising standing inventory simply a sign that the new construction market is normalizing after a historic pandemic housing boom, or do builders—particularly in areas where unsold inventory is increasing the most—need to make further affordability adjustments, such as cutting prices or offering greater incentives? …Meritage Homes CEO says they’re building more spec inventory because they’re expecting a ‘strong’ 2025 spring market. …Housing analyst Kevin Erdmann thinks it’s a bullish—not bearish—sign for builders. …High standing inventory could prompt builders to offer discounts or slow down activity in Texas and Florida, suggests housing analyst Rick Palacios Jr.