CORVALLIS, Ore. – If mistletoe’s status as a nutrient-stealing freeloader has been cooling your holiday ardor, new research led by an Oregon State University scientist may help relight the fire. A survey of urban forests in seven western Oregon cities found no observable connection between mistletoe infestation and negative health outcomes for the trees it was parasitizing. So worry not: Your yuletide kissing tradition probably does not involve a tree killer. And as you’re setting concern aside, you might want to head outside. “This is the best time of year to look for mistletoe because there are no leaves on the trees,” said College of Forestry professor emeritus Dave Shaw, an OSU Extension Service forest health specialist. “Also, chances are it will be found in an oak tree – most other trees don’t get infested. So if you are looking for a kiss, keep an eye out for oaks.”

CORVALLIS, Ore. – If mistletoe’s status as a nutrient-stealing freeloader has been cooling your holiday ardor, new research led by an Oregon State University scientist may help relight the fire. A survey of urban forests in seven western Oregon cities found no observable connection between mistletoe infestation and negative health outcomes for the trees it was parasitizing. So worry not: Your yuletide kissing tradition probably does not involve a tree killer. And as you’re setting concern aside, you might want to head outside. “This is the best time of year to look for mistletoe because there are no leaves on the trees,” said College of Forestry professor emeritus Dave Shaw, an OSU Extension Service forest health specialist. “Also, chances are it will be found in an oak tree – most other trees don’t get infested. So if you are looking for a kiss, keep an eye out for oaks.”

Hopes for relief on the tariffs front are likely on hold until the new year now that the US Supreme Court has adjourned for the holiday season before ruling on the matter of President Trump’s illogical and, likely, illegal trade tariffs. Their decision could come in January, which is a long wait for affected economies around the world. …It took just 35 days for lower courts to decide Trump’s use of the act for tariffs was invalid, which he appealed. …Rampant speculation is outlined by Daniel Schramm In the Missouri Independent: “

Hopes for relief on the tariffs front are likely on hold until the new year now that the US Supreme Court has adjourned for the holiday season before ruling on the matter of President Trump’s illogical and, likely, illegal trade tariffs. Their decision could come in January, which is a long wait for affected economies around the world. …It took just 35 days for lower courts to decide Trump’s use of the act for tariffs was invalid, which he appealed. …Rampant speculation is outlined by Daniel Schramm In the Missouri Independent: “ Canada-US Trade Minister Dominic LeBlanc says the door is open for American officials to restart trade talks with Canada. …”Canada believed it was making progress with the Americans — and talks would eventually move to automobiles and softwood lumber — but Trump “decided to suspend those negotiations. That’s regrettable.” …Canadian, American and Mexican officials are gearing up to review CUSMA, which offers Canada crucial protection from many of U.S. President Donald Trump’s tariffs. …On Thursday, Canada’s ambassador to the U.S. Kristen Hillman downplayed signals from the Trump administration about breaking down the trilateral pact and said she hasn’t “heard any indication from the US side that they want to change that foundation.” …All three countries must indicate by July 1 of next year whether they want to extend the agreement, renegotiate its terms or let it expire. LeBlanc said in private the conversations are “much more reassuring” about CUSMA.

Canada-US Trade Minister Dominic LeBlanc says the door is open for American officials to restart trade talks with Canada. …”Canada believed it was making progress with the Americans — and talks would eventually move to automobiles and softwood lumber — but Trump “decided to suspend those negotiations. That’s regrettable.” …Canadian, American and Mexican officials are gearing up to review CUSMA, which offers Canada crucial protection from many of U.S. President Donald Trump’s tariffs. …On Thursday, Canada’s ambassador to the U.S. Kristen Hillman downplayed signals from the Trump administration about breaking down the trilateral pact and said she hasn’t “heard any indication from the US side that they want to change that foundation.” …All three countries must indicate by July 1 of next year whether they want to extend the agreement, renegotiate its terms or let it expire. LeBlanc said in private the conversations are “much more reassuring” about CUSMA. The Office of the US Trade Representative (USTR) held a hearing regarding the six-year review of the United States-Mexico-Canada Agreement (USMCA). Though some stakeholders advocated for maintaining the current framework, many called for targeted updates. Despite varied perspectives, there was broad consensus that USMCA should be preserved. Transshipment and circumvention of Section 232 tariffs emerged as recurring concerns, particularly from the automotive, steel and aluminum, and wood and lumber sectors. …Stakeholders from the wood products, millwork and cabinetry industries raised serious concerns about how USMCA’s current rules of origin are being exploited to circumvent U.S. trade remedies and undermine domestic manufacturers. …The organization’s representative urged the adoption of Labor Value Content (LVC) rules for wood products modeled after those used in the automotive sector to ensure that qualifying goods reflect substantial North American production and fair labor practices.

The Office of the US Trade Representative (USTR) held a hearing regarding the six-year review of the United States-Mexico-Canada Agreement (USMCA). Though some stakeholders advocated for maintaining the current framework, many called for targeted updates. Despite varied perspectives, there was broad consensus that USMCA should be preserved. Transshipment and circumvention of Section 232 tariffs emerged as recurring concerns, particularly from the automotive, steel and aluminum, and wood and lumber sectors. …Stakeholders from the wood products, millwork and cabinetry industries raised serious concerns about how USMCA’s current rules of origin are being exploited to circumvent U.S. trade remedies and undermine domestic manufacturers. …The organization’s representative urged the adoption of Labor Value Content (LVC) rules for wood products modeled after those used in the automotive sector to ensure that qualifying goods reflect substantial North American production and fair labor practices.

The negotiations that remade the North American Free Trade Agreement were, as one participant put it, a series of “near-death” experiences. …In the years since the U.S.M.C.A was signed, Mexico and Canada have become America’s top trading partners. Millions of jobs depend on this economic alliance, which exceeds $1.8 trillion in trade. …Last week, Trump suggested that he would exit the U.S.M.C.A.: “We’ll either let it expire or, well, maybe work out another deal with Mexico and Canada.” Some observers discount Trump’s bluster as mere gamesmanship. …He returned to the White House on a promise to create jobs and lower prices—to make the country “boom like we’ve never boomed before.” Instead, tariffs are fuelling inflation, and many experts believe that it is only a matter of time before the economy starts hemorrhaging jobs. …As in the previous round of negotiations, time does not appear to be on Trump’s side.

The negotiations that remade the North American Free Trade Agreement were, as one participant put it, a series of “near-death” experiences. …In the years since the U.S.M.C.A was signed, Mexico and Canada have become America’s top trading partners. Millions of jobs depend on this economic alliance, which exceeds $1.8 trillion in trade. …Last week, Trump suggested that he would exit the U.S.M.C.A.: “We’ll either let it expire or, well, maybe work out another deal with Mexico and Canada.” Some observers discount Trump’s bluster as mere gamesmanship. …He returned to the White House on a promise to create jobs and lower prices—to make the country “boom like we’ve never boomed before.” Instead, tariffs are fuelling inflation, and many experts believe that it is only a matter of time before the economy starts hemorrhaging jobs. …As in the previous round of negotiations, time does not appear to be on Trump’s side.

The effect of 10% tariffs on Canadian wood imports was the subject of a public hearing before the state’s Maine-Canadian Legislative Advisory Commission Wednesday. Dana Doran is executive director of the Professional Logging Contractors of the Northeast who says his members are struggling to stay afloat. “If they buy wood from Canada it’s hit by a 10% tariff on those raw logs. If they export any of their finished product they’re subject to any of the export tariffs,” Doran said. “So we’ve seen a chaotic situation that has occurred over the past 8 weeks because of the situation with tariffs.” Doran says if the U.S. had more domestic manufacturing of building and construction products it would have a bigger share of the marketplace, which could blunt tariffs. But Canada, he says, has 60% of that market.

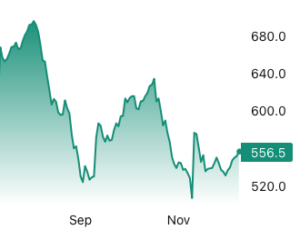

The effect of 10% tariffs on Canadian wood imports was the subject of a public hearing before the state’s Maine-Canadian Legislative Advisory Commission Wednesday. Dana Doran is executive director of the Professional Logging Contractors of the Northeast who says his members are struggling to stay afloat. “If they buy wood from Canada it’s hit by a 10% tariff on those raw logs. If they export any of their finished product they’re subject to any of the export tariffs,” Doran said. “So we’ve seen a chaotic situation that has occurred over the past 8 weeks because of the situation with tariffs.” Doran says if the U.S. had more domestic manufacturing of building and construction products it would have a bigger share of the marketplace, which could blunt tariffs. But Canada, he says, has 60% of that market. Lumber futures traded above $550 per thousand board feet as markets absorbed a dovish turn from the Federal Reserve that brightened the demand outlook for construction materials. The Fed’s widely anticipated 25bp cut and Chair Powell’s dovish rhetoric pushed traders to price additional easing next year, which should put downward pressure on mortgage rates and lift homebuilding and renovation activity. Those interest rate dynamics have heightened the incentive for builders and distributors to restock, while persistent tariff and trade frictions have constrained supply. Canadian log exports are down year to date even as shipments into the US have risen, Canadian manufacturing output has slipped and US lumber exports are lower, a mix that reduces available millfeed and forces buyers to compete for the supplies that remain.

Lumber futures traded above $550 per thousand board feet as markets absorbed a dovish turn from the Federal Reserve that brightened the demand outlook for construction materials. The Fed’s widely anticipated 25bp cut and Chair Powell’s dovish rhetoric pushed traders to price additional easing next year, which should put downward pressure on mortgage rates and lift homebuilding and renovation activity. Those interest rate dynamics have heightened the incentive for builders and distributors to restock, while persistent tariff and trade frictions have constrained supply. Canadian log exports are down year to date even as shipments into the US have risen, Canadian manufacturing output has slipped and US lumber exports are lower, a mix that reduces available millfeed and forces buyers to compete for the supplies that remain. Nonfarm payrolls grew slightly more than expected in November but slumped in October while unemployment hit its highest in four years, the Bureau of Labor Statistics reported Tuesday in numbers delayed by the government shutdown. Job growth totaled a seasonally adjusted 64,000 for the month, better than the Dow Jones estimate of 45,000 and up from a sharp decline in October. The unemployment rate rose to 4.6%, more than expected and its highest level since September 2021. A more encompassing measure that includes discouraged workers and those holding part-time jobs for economic reasons swelled to 8.7%, its peak going back to August 2021. In addition to the November report, the BLS released an abbreviated October count that showed payrolls down 105,000. While there was no official estimate, Wall Street economists were largely expecting a decline following a surprise increase of 108,000 in September.

Nonfarm payrolls grew slightly more than expected in November but slumped in October while unemployment hit its highest in four years, the Bureau of Labor Statistics reported Tuesday in numbers delayed by the government shutdown. Job growth totaled a seasonally adjusted 64,000 for the month, better than the Dow Jones estimate of 45,000 and up from a sharp decline in October. The unemployment rate rose to 4.6%, more than expected and its highest level since September 2021. A more encompassing measure that includes discouraged workers and those holding part-time jobs for economic reasons swelled to 8.7%, its peak going back to August 2021. In addition to the November report, the BLS released an abbreviated October count that showed payrolls down 105,000. While there was no official estimate, Wall Street economists were largely expecting a decline following a surprise increase of 108,000 in September.

ATLANTA — Home Depot gave a cautious outlook for fiscal 2026 as the housing market continues to lag. Shares of the home-improvement retailer fell 2.4% to $341.62 in premarket trading on Tuesday. The company expects sales to rise between 2.5% to 4.5% in fiscal 2026, the midpoint of which is up from its guidance for 3% growth this fiscal year. Analysts polled by FactSet were looking for growth of 4.5%. …Home Depot said it expects those metrics to rise at a faster clip if the housing market gains momentum and there is increased spend on larger projects, driven by pent-up demand. The Atlanta company’s market-recovery case forecasts sales will grow about 5% to 6%, earnings per share will increase about mid- to high-single digits and comparable sales will be up 4% to 5%. “We believe that the pressures in housing will correct and provide the home improvement market with support for growth faster than the general economy”.

ATLANTA — Home Depot gave a cautious outlook for fiscal 2026 as the housing market continues to lag. Shares of the home-improvement retailer fell 2.4% to $341.62 in premarket trading on Tuesday. The company expects sales to rise between 2.5% to 4.5% in fiscal 2026, the midpoint of which is up from its guidance for 3% growth this fiscal year. Analysts polled by FactSet were looking for growth of 4.5%. …Home Depot said it expects those metrics to rise at a faster clip if the housing market gains momentum and there is increased spend on larger projects, driven by pent-up demand. The Atlanta company’s market-recovery case forecasts sales will grow about 5% to 6%, earnings per share will increase about mid- to high-single digits and comparable sales will be up 4% to 5%. “We believe that the pressures in housing will correct and provide the home improvement market with support for growth faster than the general economy”.

President Trump swept into office with a promise to ramp up the timber business on national forests. So far, they’re just treading water. The Forest Service reported relatively flat timber harvests and sales for the fiscal year that ended Sept. 30. …According to the agency’s cut-and-sold reports, national forests cut 2.52 billion board feet of timber for the fiscal year, down slightly from the 2.66 billion board feet cut during the last full fiscal year of the Biden administration. Sales volume totalled 2.95 billion board feet, a slight increase from the prior year but a drop from 3.08 billion board feet the year before that. The suppressed returns reflect some of the challenges in meeting Trumps’s directive to use national forests to reduce the nation’s reliance on wood imports. Those include wildfires, market conditions… and the Forest Service’s ability to set up and run timber sales after the administration whittled the workforce. [to access the full story, an E&E News subscription is required]

President Trump swept into office with a promise to ramp up the timber business on national forests. So far, they’re just treading water. The Forest Service reported relatively flat timber harvests and sales for the fiscal year that ended Sept. 30. …According to the agency’s cut-and-sold reports, national forests cut 2.52 billion board feet of timber for the fiscal year, down slightly from the 2.66 billion board feet cut during the last full fiscal year of the Biden administration. Sales volume totalled 2.95 billion board feet, a slight increase from the prior year but a drop from 3.08 billion board feet the year before that. The suppressed returns reflect some of the challenges in meeting Trumps’s directive to use national forests to reduce the nation’s reliance on wood imports. Those include wildfires, market conditions… and the Forest Service’s ability to set up and run timber sales after the administration whittled the workforce. [to access the full story, an E&E News subscription is required]

WASHINGTON, D.C. —

WASHINGTON, D.C. —  The Trump administration’s pending deletion of the Endangered Species Act’s definition of “harm” will have an outsize impact on imperiled species in Northwest forests targeted for logging, especially the northern spotted owl, environmental attorneys say. Habitat for several species, including the threatened owl and the endangered marbled murrelet seabird, overlap with federally-managed forests in Oregon, Washington, and California, where logging is expected to increase under White House emergency orders and a new law that requires a roughly 75% increase in timber harvesting in national forests by 2034. “Without adequate, suitable places to live and reproduce, species go extinct,” said Melinda Taylor, senior lecturer at the University of Texas at Austin School of Law. “Repealing the definition of harm would undermine almost all of the regulatory framework in place to protect endangered species.”

The Trump administration’s pending deletion of the Endangered Species Act’s definition of “harm” will have an outsize impact on imperiled species in Northwest forests targeted for logging, especially the northern spotted owl, environmental attorneys say. Habitat for several species, including the threatened owl and the endangered marbled murrelet seabird, overlap with federally-managed forests in Oregon, Washington, and California, where logging is expected to increase under White House emergency orders and a new law that requires a roughly 75% increase in timber harvesting in national forests by 2034. “Without adequate, suitable places to live and reproduce, species go extinct,” said Melinda Taylor, senior lecturer at the University of Texas at Austin School of Law. “Repealing the definition of harm would undermine almost all of the regulatory framework in place to protect endangered species.”  Gov. Jared Polis signed an

Gov. Jared Polis signed an  Climate change is contributing to drier conditions in the Pacific Northwest, causing wildfires to become more intense and destructive. A growing reforestation industry has emerged in their wake. The company Silvaseed is a key player in the region. Based southeast of Olympia in Roy, Washington, Silvaseed collects, cleans, catalogues and preserves seeds. It also raises millions of seedlings every year in its greenhouses and fields. Customers include private timber companies, public land managers and tribal nations. …Inside a warehouse built in the 1940s, Silvaseed general manager Kea Woodruff starts a tour of the facilities by flipping a switch to fire up a huge, old kiln. …Woodruff said most species’ cones need the kiln to reach about 100 degrees Fahrenheit. …At every step of the way, as the seed gets refined and purified, the bags are meticulously labeled and tracked.

Climate change is contributing to drier conditions in the Pacific Northwest, causing wildfires to become more intense and destructive. A growing reforestation industry has emerged in their wake. The company Silvaseed is a key player in the region. Based southeast of Olympia in Roy, Washington, Silvaseed collects, cleans, catalogues and preserves seeds. It also raises millions of seedlings every year in its greenhouses and fields. Customers include private timber companies, public land managers and tribal nations. …Inside a warehouse built in the 1940s, Silvaseed general manager Kea Woodruff starts a tour of the facilities by flipping a switch to fire up a huge, old kiln. …Woodruff said most species’ cones need the kiln to reach about 100 degrees Fahrenheit. …At every step of the way, as the seed gets refined and purified, the bags are meticulously labeled and tracked.

Two meetings next week between U.S. Forest Service leadership and timber industry representatives in Southeast Alaska are raising concerns among tribal and other officials about the possibility a years-long revision of the management plan for the Tongass National Forest will be halted by the Trump administration. At least one additional meeting is now planned next week because of those concerns, scheduled next Friday in Juneau between Forest Service leaders and members of the Central Council of the Tlingit and Haida Indian Tribes of Alaska, according to officials. A request to halt work on the revised plan is being made by the Alaska Forest Association, which states less than 10% of old-growth trees allotted to the timber industry in a 2016 revision of the plan have actually been authorized for harvest. The allocation of 430 million board feet (mmbf) was intended to support a 15-year industry transition to harvesting new-growth trees, according to AFA.

Two meetings next week between U.S. Forest Service leadership and timber industry representatives in Southeast Alaska are raising concerns among tribal and other officials about the possibility a years-long revision of the management plan for the Tongass National Forest will be halted by the Trump administration. At least one additional meeting is now planned next week because of those concerns, scheduled next Friday in Juneau between Forest Service leaders and members of the Central Council of the Tlingit and Haida Indian Tribes of Alaska, according to officials. A request to halt work on the revised plan is being made by the Alaska Forest Association, which states less than 10% of old-growth trees allotted to the timber industry in a 2016 revision of the plan have actually been authorized for harvest. The allocation of 430 million board feet (mmbf) was intended to support a 15-year industry transition to harvesting new-growth trees, according to AFA.

A federal judge on Thursday vacated the U.S. Forest Service’s approval of a massive logging project [to harvest] about 16,500 acres of pine trees in the Custer Gallatin National Forest in southern Montana, just north of Yellowstone National Park. Senior U.S. District Judge Donald Molloy in Missoula, Montana, agreed with a collective of environmental advocates that the U.S. Forest Service failed to meet the requirements of the National Environmental Policy Act by relying on a condition-based management approach, which doesn’t identify the location of the 56.8 miles of temporary roads for the project and, as such, doesn’t adequately consider their impact on “secure habitat” for grizzly bears. Condition-based management defers specific decisions on how to proceed until the Forest Service has conducted field reviews. Here, it means the Forest Service has preliminarily identified areas as suitable for logging without identifying the precise location and size of the area to be cleared…

A federal judge on Thursday vacated the U.S. Forest Service’s approval of a massive logging project [to harvest] about 16,500 acres of pine trees in the Custer Gallatin National Forest in southern Montana, just north of Yellowstone National Park. Senior U.S. District Judge Donald Molloy in Missoula, Montana, agreed with a collective of environmental advocates that the U.S. Forest Service failed to meet the requirements of the National Environmental Policy Act by relying on a condition-based management approach, which doesn’t identify the location of the 56.8 miles of temporary roads for the project and, as such, doesn’t adequately consider their impact on “secure habitat” for grizzly bears. Condition-based management defers specific decisions on how to proceed until the Forest Service has conducted field reviews. Here, it means the Forest Service has preliminarily identified areas as suitable for logging without identifying the precise location and size of the area to be cleared… WASHINGTON — On Tuesday, the U.S. House of Representatives passed two major bills for Washington state Tribes, the Lower Elwha Klallam Tribe Project Lands Restoration Act, and the Quinault Indian Nation Land Transfer Act. Both bills initiate the first step to return land back to the Tribes by transferring ownership from the federal government to the Bureau of Indian Affairs to be held in trust for the benefit of the Tribes. [The bills were introduced into] legislation in April 2025. The bills now go to the Senate for consideration. “Today, we took an important step in upholding our treaty obligations by passing legislation to transfer land into trust for the Lower Elwha Klallam Tribe and the Quinault Indian Nation,” said Rep. Randall. “I urge my colleagues in the Senate to quickly pass these two bills to ensure we meet our trust responsibilities to restore Tribal lands.”

WASHINGTON — On Tuesday, the U.S. House of Representatives passed two major bills for Washington state Tribes, the Lower Elwha Klallam Tribe Project Lands Restoration Act, and the Quinault Indian Nation Land Transfer Act. Both bills initiate the first step to return land back to the Tribes by transferring ownership from the federal government to the Bureau of Indian Affairs to be held in trust for the benefit of the Tribes. [The bills were introduced into] legislation in April 2025. The bills now go to the Senate for consideration. “Today, we took an important step in upholding our treaty obligations by passing legislation to transfer land into trust for the Lower Elwha Klallam Tribe and the Quinault Indian Nation,” said Rep. Randall. “I urge my colleagues in the Senate to quickly pass these two bills to ensure we meet our trust responsibilities to restore Tribal lands.” A new analysis making the rounds on Capitol Hill says the U.S. Forest Service sharply scaled back prescribed burns, thinning and other fuel-reduction work this year, leaving far fewer acres treated than in recent years. Through the first nine months of 2025, the agency logged under 1.7 million acres of treatments, well below the roughly four-year average that wildfire experts say is needed to protect communities and watersheds. The drop-off has Democratic senators and veteran firefighters pressing the agency for staffing numbers and a concrete plan to catch up before next fire season. As reported by Times of San Diego, the data cited by lawmakers comes from an analysis compiled by Grassroots Wildland Firefighters that compares the January-September 2025 total to a roughly 3.6 million-acre annual average from 2021-2024. Senators circulated that tally in a letter demanding detailed staffing and mitigation plans from the Forest Service.

A new analysis making the rounds on Capitol Hill says the U.S. Forest Service sharply scaled back prescribed burns, thinning and other fuel-reduction work this year, leaving far fewer acres treated than in recent years. Through the first nine months of 2025, the agency logged under 1.7 million acres of treatments, well below the roughly four-year average that wildfire experts say is needed to protect communities and watersheds. The drop-off has Democratic senators and veteran firefighters pressing the agency for staffing numbers and a concrete plan to catch up before next fire season. As reported by Times of San Diego, the data cited by lawmakers comes from an analysis compiled by Grassroots Wildland Firefighters that compares the January-September 2025 total to a roughly 3.6 million-acre annual average from 2021-2024. Senators circulated that tally in a letter demanding detailed staffing and mitigation plans from the Forest Service.