Kevin Mason

The US tariff regime is far from over despite a US Supreme Court ruling striking down last year’s tariffs authorized by President Trump under the International Emergency Economic Powers Act (IEEPA). Although the court noted in its ruling that the president overstepped his authority in applying reciprocal tariffs on virtually all trading partners, it did leave the door open for other means of tariff application—and the US Administration has wasted no time in charging through that door, turning to Section 122 of the Trade Act of 1974 to impose new global tariffs of 10% (likely moving to 15%). Tariffs under Section 122 expire after 150 days without congressional approval, but we assume other options will be put in place before expiry (Section 232, 301 or some other creative mechanism).

With respect to the forest products industry, cessation of IEEPA tariffs and application of these new Section 122 tariffs have no impact on existing lumber duties (35% remains intact), nor for any existing tariffs under Section 232 (at 10%) or goods currently compliant under USMCA (such goods remain tariff-free under Section 122). Although USMCA-compliant goods are safe from tariffs for now, with that trade deal being reviewed this summer the tariff-free flow of goods among the US, Mexico and Canada could be upended. Since almost all newsprint supply comes from Canada (see page 19), that fear is ostensibly already causing U.S. buyers to accelerate purchases. Our table details what we know at the moment about the new tariff regime (Section 122 at 10% but probably moving to 15%). Brazil and China appear to be winners in these latest moves, but, with other mechanisms available to Trump, we don’t think these recent tariff reductions are going to lead to any dramatic increase in imports from these countries (uncertainty seems to be part of the goal under Trump’s methods).

Canada-US Trade Minister Dominic LeBlanc says he sees a path to renew the Canada-United States-Mexico Agreement (CUSMA) and anticipates more specifics from the U.S. administration soon. Gearing up to head back to Washington, DC next week to meet with US Trade Representative Jamieson Greer and “others” next week, LeBlanc said he’s “not pessimistic about renewing the trilateral framework.” “Renewing. It doesn’t expire, it expires in 2036. But the review is not a renegotiation,” LeBlanc said. LeBlanc said two of the key factors underpinning his optimism are that when US President Trump levied his latest global tariff, he maintained the CUSMA exemption, and because American political and business leaders are “speaking up more now.” …Amid speculation that Trump wants to scrap the trilateral trade pact and strike trade deals with Canada and Mexico independently, LeBlanc said the way he sees it, Trump may pursue separate bilateral deals, but that doesn’t necessarily mean the end of CUSMA.

Canada-US Trade Minister Dominic LeBlanc says he sees a path to renew the Canada-United States-Mexico Agreement (CUSMA) and anticipates more specifics from the U.S. administration soon. Gearing up to head back to Washington, DC next week to meet with US Trade Representative Jamieson Greer and “others” next week, LeBlanc said he’s “not pessimistic about renewing the trilateral framework.” “Renewing. It doesn’t expire, it expires in 2036. But the review is not a renegotiation,” LeBlanc said. LeBlanc said two of the key factors underpinning his optimism are that when US President Trump levied his latest global tariff, he maintained the CUSMA exemption, and because American political and business leaders are “speaking up more now.” …Amid speculation that Trump wants to scrap the trilateral trade pact and strike trade deals with Canada and Mexico independently, LeBlanc said the way he sees it, Trump may pursue separate bilateral deals, but that doesn’t necessarily mean the end of CUSMA. Trade negotiations used to be underpinned by an unspoken assumption: that trade barriers were lose-lose propositions. All sides could gain something if they mutually disarmed. …[They] were always about how much tariffs and other walls would go down, not how much they would go up. …United States Trade Representative Jamieson Greer sums up the Trump administration’s break with the postwar trade consensus, saying the administration is “focused on reshoring supply chains related to automotive, steel, aluminum … If Canada wants to come in and participate in this type of reshoring we’re trying to do, we’re happy to have those discussions.” …The U.S. wants higher tariffs at home, and lower tariffs abroad. The old give-and-take is now take-and-take. …”We want to have production here. We don’t necessarily want to be dependent on China, Canada or anybody else for things like cars.” [This article is only available to subscribers to the Globe and Mail]

Trade negotiations used to be underpinned by an unspoken assumption: that trade barriers were lose-lose propositions. All sides could gain something if they mutually disarmed. …[They] were always about how much tariffs and other walls would go down, not how much they would go up. …United States Trade Representative Jamieson Greer sums up the Trump administration’s break with the postwar trade consensus, saying the administration is “focused on reshoring supply chains related to automotive, steel, aluminum … If Canada wants to come in and participate in this type of reshoring we’re trying to do, we’re happy to have those discussions.” …The U.S. wants higher tariffs at home, and lower tariffs abroad. The old give-and-take is now take-and-take. …”We want to have production here. We don’t necessarily want to be dependent on China, Canada or anybody else for things like cars.” [This article is only available to subscribers to the Globe and Mail]

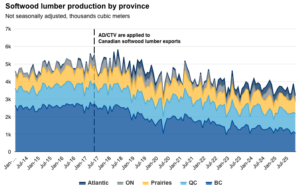

Anti-dumping and countervailing duties, and now additional tariffs on softwood lumber and derivative wood products add to a long history of trade measures applied to Canadian exports. …Recent trade data shows exports of targeted wood products to the US have declined by roughly 11% in 2025 from a year earlier with losses concentrated in Quebec and BC. Export gains elsewhere have only partially compensated for reduced US market access—in part reflecting the geographical constraints in shipping lumber and wood products. …Average industrial capacity utilization rate for wood product manufacturing has declined roughly 10 percentage points to 75% in 2025 Q3 from a decade earlier, while employment in sawmills and wood preservation fell roughly 20% between May 2017 and November 2025 with more pronounced declines in BC (-32%) and Quebec (-13%). …Reduced domestic supply could also put pressure on downstream industries such as pulp and paper mills and construction. The combination of weak demand and constrained supply raises the risk of further production curtailments and mill closures.

Anti-dumping and countervailing duties, and now additional tariffs on softwood lumber and derivative wood products add to a long history of trade measures applied to Canadian exports. …Recent trade data shows exports of targeted wood products to the US have declined by roughly 11% in 2025 from a year earlier with losses concentrated in Quebec and BC. Export gains elsewhere have only partially compensated for reduced US market access—in part reflecting the geographical constraints in shipping lumber and wood products. …Average industrial capacity utilization rate for wood product manufacturing has declined roughly 10 percentage points to 75% in 2025 Q3 from a decade earlier, while employment in sawmills and wood preservation fell roughly 20% between May 2017 and November 2025 with more pronounced declines in BC (-32%) and Quebec (-13%). …Reduced domestic supply could also put pressure on downstream industries such as pulp and paper mills and construction. The combination of weak demand and constrained supply raises the risk of further production curtailments and mill closures. Fiber and glass are among the packaging substrates hardest hit by February closure and layoff announcements. Here are the North American facilities that have announced downsizing efforts:

Fiber and glass are among the packaging substrates hardest hit by February closure and layoff announcements. Here are the North American facilities that have announced downsizing efforts: The escalating crisis in the Middle East could extend transport times for Finnish forest industry products to Asia by several weeks. At the same time, freight costs may rise, and container availability could become increasingly uncertain. Iran has announced the closure of the Strait of Hormuz. According to international reporting, several major shipping lines have also paused or reduced traffic through the Suez Canal, redirecting vessels around Africa via the Cape of Good Hope on routes to Asia. The Strait of Hormuz is a critical artery for global oil trade, and disruptions there primarily push up energy prices. For Finland’s forest industry, however, access through the Suez Canal is more directly decisive. Approximately 20 percent of the forest industry’s exports go to Asia, and the majority of those shipments pass through the Suez Canal, says Maarit Lindström, Director and Chief Economist at Metsäteollisuus ry.

The escalating crisis in the Middle East could extend transport times for Finnish forest industry products to Asia by several weeks. At the same time, freight costs may rise, and container availability could become increasingly uncertain. Iran has announced the closure of the Strait of Hormuz. According to international reporting, several major shipping lines have also paused or reduced traffic through the Suez Canal, redirecting vessels around Africa via the Cape of Good Hope on routes to Asia. The Strait of Hormuz is a critical artery for global oil trade, and disruptions there primarily push up energy prices. For Finland’s forest industry, however, access through the Suez Canal is more directly decisive. Approximately 20 percent of the forest industry’s exports go to Asia, and the majority of those shipments pass through the Suez Canal, says Maarit Lindström, Director and Chief Economist at Metsäteollisuus ry.

The US Department of Commerce preliminarily determined that hardwood and decorative plywood from China was sold in the US at less than fair value during the period Oct. 1, 2024, through March 31, 2025, and it also made a preliminary affirmative determination of critical circumstances. Starting March 2, 2026, the publication date of the Commerce Department notice in the Federal Register, US Customs and Border Protection will begin suspending liquidation and collecting cash deposits on covered entries at the applicable rates. The notice sets an estimated weighted-average dumping margin of 187.27% for the China-wide entity and an adjusted cash-deposit rate of 185.96% for the listed producer-exporter combinations as well as for the China-wide entity. …Commerce said it plans to issue its final determination by May 10, 2026, within 75 days of the preliminary decision’s Feb. 24 signature date, after which the US International Trade Commission will decide whether the U.S. industry was materially injured by the imports.

The US Department of Commerce preliminarily determined that hardwood and decorative plywood from China was sold in the US at less than fair value during the period Oct. 1, 2024, through March 31, 2025, and it also made a preliminary affirmative determination of critical circumstances. Starting March 2, 2026, the publication date of the Commerce Department notice in the Federal Register, US Customs and Border Protection will begin suspending liquidation and collecting cash deposits on covered entries at the applicable rates. The notice sets an estimated weighted-average dumping margin of 187.27% for the China-wide entity and an adjusted cash-deposit rate of 185.96% for the listed producer-exporter combinations as well as for the China-wide entity. …Commerce said it plans to issue its final determination by May 10, 2026, within 75 days of the preliminary decision’s Feb. 24 signature date, after which the US International Trade Commission will decide whether the U.S. industry was materially injured by the imports.

VANCOUVER, Washington — Canadian-owned Western Forest Products plans to expand its Fruit Valley manufacturing operation, according to pre-planning documents submitted to the city of Vancouver. Plans show the company expects to build up to three prefabricated steel buildings and an office building, as well as demolish its existing Fruit Valley lumber drying kilns and storage buildings. “We are supporting a modest expansion of our product and service portfolio,” Babita Khunkhun, the company’s senior director of communications, said. Khunkhun said planning for the expansion will continue throughout the year. The company intends to invest in new machinery at its Fruit Valley manufacturing site and make ready-to-install fabricated glulam beams, she said. The Fruit Valley operation is currently used for secondary lumber manufacturing. …A summer blaze left the company’s Columbia Vista sawmill beyond repair according to a state layoff notification from July. The company has decided to sell that site.

VANCOUVER, Washington — Canadian-owned Western Forest Products plans to expand its Fruit Valley manufacturing operation, according to pre-planning documents submitted to the city of Vancouver. Plans show the company expects to build up to three prefabricated steel buildings and an office building, as well as demolish its existing Fruit Valley lumber drying kilns and storage buildings. “We are supporting a modest expansion of our product and service portfolio,” Babita Khunkhun, the company’s senior director of communications, said. Khunkhun said planning for the expansion will continue throughout the year. The company intends to invest in new machinery at its Fruit Valley manufacturing site and make ready-to-install fabricated glulam beams, she said. The Fruit Valley operation is currently used for secondary lumber manufacturing. …A summer blaze left the company’s Columbia Vista sawmill beyond repair according to a state layoff notification from July. The company has decided to sell that site. An Oregon jury has awarded $305 million to 16 wildfire survivors harmed by the Santiam Canyon wildfire that burned across hundreds of thousands of acres in 2020. This is the largest jury verdict issued in relation to the James v. PacifiCorp class-action lawsuit, pushing PacifiCorp’s total liability past $1 billion. PacifiCorp — the parent company of Pacific Power, Oregon’s second-largest electric utility — kept its lines charged over the 2020 Labor Day weekend, despite fire officials’ warnings about hot, windy weather. Five people died in the Santiam Canyon fire, and more than 400,000 acres burned across four counties. In 2023, a jury found PacifiCorp was reckless and acted in “gross negligence” in relation to multiple wildfires, including the Santiam fire. In addition to the 17 plaintiffs who sued the company in that case, the jury found a broader class of thousands of people can bring additional claims against PacifiCorp for those wildfires.

An Oregon jury has awarded $305 million to 16 wildfire survivors harmed by the Santiam Canyon wildfire that burned across hundreds of thousands of acres in 2020. This is the largest jury verdict issued in relation to the James v. PacifiCorp class-action lawsuit, pushing PacifiCorp’s total liability past $1 billion. PacifiCorp — the parent company of Pacific Power, Oregon’s second-largest electric utility — kept its lines charged over the 2020 Labor Day weekend, despite fire officials’ warnings about hot, windy weather. Five people died in the Santiam Canyon fire, and more than 400,000 acres burned across four counties. In 2023, a jury found PacifiCorp was reckless and acted in “gross negligence” in relation to multiple wildfires, including the Santiam fire. In addition to the 17 plaintiffs who sued the company in that case, the jury found a broader class of thousands of people can bring additional claims against PacifiCorp for those wildfires. RHINELANDER, Wisconsin — Logging has been a major part of the Northwoods for centuries. In recent years, though, several economic factors may have the industry in jeopardy. Logging has a major economic impact in the Northwoods. But a trend is beginning to start with Wisconsin-based paper mills ceasing certain operations, meaning many logging companies are slowing lumber output. James Wilson, Master logger and owner of Wilson Forestry in Athens, has had his business for over 12 years, but after Ahlstrom announced it will close two paper machines and a pulp mill in Mosinee, options are running thin for where they can sell the wood to. Not only will it cost 200 mill workers their jobs, it will be a major blow to local loggers. Wilson was a supplier of the recently closed Mosinee pulp mill, and has his concerns about the future of the industry.

RHINELANDER, Wisconsin — Logging has been a major part of the Northwoods for centuries. In recent years, though, several economic factors may have the industry in jeopardy. Logging has a major economic impact in the Northwoods. But a trend is beginning to start with Wisconsin-based paper mills ceasing certain operations, meaning many logging companies are slowing lumber output. James Wilson, Master logger and owner of Wilson Forestry in Athens, has had his business for over 12 years, but after Ahlstrom announced it will close two paper machines and a pulp mill in Mosinee, options are running thin for where they can sell the wood to. Not only will it cost 200 mill workers their jobs, it will be a major blow to local loggers. Wilson was a supplier of the recently closed Mosinee pulp mill, and has his concerns about the future of the industry. MOSINEE, Wisconsin — About 200 employees at the Mosinee paper mill were told before their shifts this week that their jobs are at risk as Ahlstrom moves forward with a phased shutdown of key operations at the plant. Several employees, speaking on condition of anonymity, told Wausau Pilot late Wednesday that management told workers Paper Machine No. 2 will shut down June 30, with Paper Machine No. 3 and the pulp mill slated to close Sept. 30. …In the letter to suppliers, Ahlstrom said it plans to permanently close the pulp mill and idle the M2 and M3 paper machines as part of a restructuring of operations at the Mosinee facility. The company cited rising costs and limited automation at those operations as reasons for the decision. …Ahlstrom said Paper Machines No. 1 and No. 4 will continue operating at the Mosinee mill. The company also said it plans to invest in modern technologies at those remaining machines.

MOSINEE, Wisconsin — About 200 employees at the Mosinee paper mill were told before their shifts this week that their jobs are at risk as Ahlstrom moves forward with a phased shutdown of key operations at the plant. Several employees, speaking on condition of anonymity, told Wausau Pilot late Wednesday that management told workers Paper Machine No. 2 will shut down June 30, with Paper Machine No. 3 and the pulp mill slated to close Sept. 30. …In the letter to suppliers, Ahlstrom said it plans to permanently close the pulp mill and idle the M2 and M3 paper machines as part of a restructuring of operations at the Mosinee facility. The company cited rising costs and limited automation at those operations as reasons for the decision. …Ahlstrom said Paper Machines No. 1 and No. 4 will continue operating at the Mosinee mill. The company also said it plans to invest in modern technologies at those remaining machines.

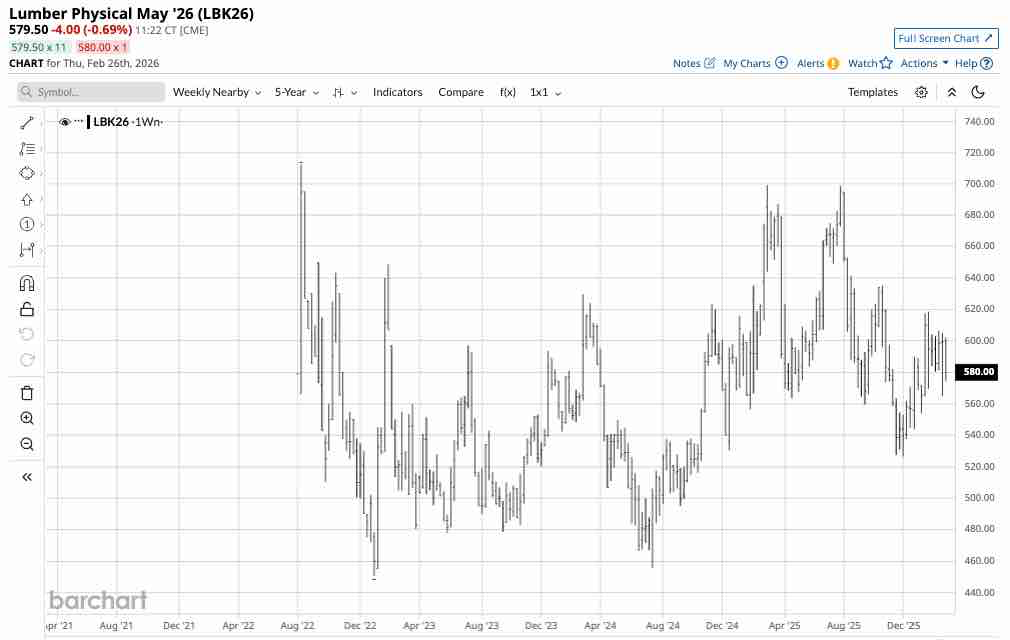

Lumber futures fell toward $550 per thousand board feet, marking a six-week low, as a stagnant North American housing sector failed to absorb heavy seasonal inventories. Demand weakened as January data showed a 7% year over year drop in single family starts and an 8.4% decline in units under construction. High 6.25% mortgage rates and a 5.8% slump in Canadian home sales during January 2026 further stalled new project starts. On the supply side, regional inventory remained bloated. While BC curtailments continued harsh winter storms in the US South halted jobsite activity more than mill output, creating a distributor logjam and forcing aggressive dealer discounting to clear yard space. Additionally, while Trump’s administration 45% softwood duties were meant to buoy prices they instead stifled demand by adding nearly $17,500 to average home costs. This eroded the builder confidence needed to clear current supply.

Lumber futures fell toward $550 per thousand board feet, marking a six-week low, as a stagnant North American housing sector failed to absorb heavy seasonal inventories. Demand weakened as January data showed a 7% year over year drop in single family starts and an 8.4% decline in units under construction. High 6.25% mortgage rates and a 5.8% slump in Canadian home sales during January 2026 further stalled new project starts. On the supply side, regional inventory remained bloated. While BC curtailments continued harsh winter storms in the US South halted jobsite activity more than mill output, creating a distributor logjam and forcing aggressive dealer discounting to clear yard space. Additionally, while Trump’s administration 45% softwood duties were meant to buoy prices they instead stifled demand by adding nearly $17,500 to average home costs. This eroded the builder confidence needed to clear current supply. If enacted, the new legislation would aim to streamline tariff exclusions for goods used in home construction, help stabilize material pricing, and support efforts to expand housing supply nationwide U.S. Sens. Jacky Rosen (D‑NV) and Chris Coons (D‑DE) have introduced legislation aimed at easing construction costs and addressing America’s housing affordability crisis by excluding key homebuilding materials from tariffs imposed under the Trump administration. The Housing Tariff Exclusion Act would create a process to automatically exempt many building materials from current and future tariffs and allow importers to apply for exemptions on other essential construction inputs. The bill comes amid ongoing concerns that tariffs on imported materials such as lumber, steel, and other construction inputs have driven up costs for builders, contributing to higher home prices and exacerbating supply shortages. …The bill has garnered support from industry groups including the NAHB.

If enacted, the new legislation would aim to streamline tariff exclusions for goods used in home construction, help stabilize material pricing, and support efforts to expand housing supply nationwide U.S. Sens. Jacky Rosen (D‑NV) and Chris Coons (D‑DE) have introduced legislation aimed at easing construction costs and addressing America’s housing affordability crisis by excluding key homebuilding materials from tariffs imposed under the Trump administration. The Housing Tariff Exclusion Act would create a process to automatically exempt many building materials from current and future tariffs and allow importers to apply for exemptions on other essential construction inputs. The bill comes amid ongoing concerns that tariffs on imported materials such as lumber, steel, and other construction inputs have driven up costs for builders, contributing to higher home prices and exacerbating supply shortages. …The bill has garnered support from industry groups including the NAHB. After falling below 6%, matching their lowest level in several years, mortgage rates reversed course Monday, hitting their highest point in two weeks. The average rate on the popular 30-year fixed loan rose 13 basis points to 6.12%, according to Mortgage News Daily. It had fallen to a recent low of 5.99% on Feb. 23 and pretty much sat there all week. The drop was welcome news as the all-important spring housing market gets underway. Potential buyers have been sidelined by high home prices and concerns over the broader economy. Mortgage rates crossing into the 5% range broke an emotional barrier for some, suggesting buyers might jump at the opportunity. Mortgage rates loosely follow the yield on the U.S. 10-year Treasury, which rose back above 4% on Monday. The growing conflict with Iran caused a spike in oil prices, raising inflation worries and pushing yields higher.

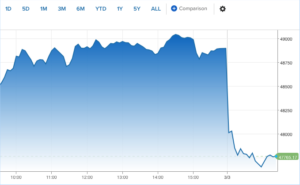

After falling below 6%, matching their lowest level in several years, mortgage rates reversed course Monday, hitting their highest point in two weeks. The average rate on the popular 30-year fixed loan rose 13 basis points to 6.12%, according to Mortgage News Daily. It had fallen to a recent low of 5.99% on Feb. 23 and pretty much sat there all week. The drop was welcome news as the all-important spring housing market gets underway. Potential buyers have been sidelined by high home prices and concerns over the broader economy. Mortgage rates crossing into the 5% range broke an emotional barrier for some, suggesting buyers might jump at the opportunity. Mortgage rates loosely follow the yield on the U.S. 10-year Treasury, which rose back above 4% on Monday. The growing conflict with Iran caused a spike in oil prices, raising inflation worries and pushing yields higher. US equities tumbled on Tuesday, undoing a Monday equity comeback, as oil prices spiked again and traders began to worry the U.S.-Iran conflict could drag on longer than anticipated. The Dow Jones Industrial Average lost 1,238 points, or 2.5%. If that holds, it would mark the blue-chip index’s first 1,000-point decline since April 10, 2025. The S&P 500 slipped 2.2%, while the Nasdaq Composite was down 2.3%. Brent crude oil, the international benchmark, topped $84 a barrel, up 8% Tuesday following a 6% spike Monday. WTI crude jumped 8% to above $77 a barrel after a 6% jump as well on Monday. Iranian Revolutionary Guard commander said the Strait of Hormuz — the world’s most vital transit route for crude oil — is closed and that Iran would set ablaze ships attempting the route, Reuters reported, citing Iranian media.

US equities tumbled on Tuesday, undoing a Monday equity comeback, as oil prices spiked again and traders began to worry the U.S.-Iran conflict could drag on longer than anticipated. The Dow Jones Industrial Average lost 1,238 points, or 2.5%. If that holds, it would mark the blue-chip index’s first 1,000-point decline since April 10, 2025. The S&P 500 slipped 2.2%, while the Nasdaq Composite was down 2.3%. Brent crude oil, the international benchmark, topped $84 a barrel, up 8% Tuesday following a 6% spike Monday. WTI crude jumped 8% to above $77 a barrel after a 6% jump as well on Monday. Iranian Revolutionary Guard commander said the Strait of Hormuz — the world’s most vital transit route for crude oil — is closed and that Iran would set ablaze ships attempting the route, Reuters reported, citing Iranian media.

Real estate professionals active in the Los Angeles market are bracing themselves for another wave of tariff-induced uncertainty following the US Supreme Court’s ruling. …Despite the Feb. 20 ruling, President Donald Trump has been adamant that he will find other avenues to impose his tariffs. Trump’s tariff policies have already caused upheaval for local businesses, and now the country’s heightened situation with tariffs will further disrupt L.A.’s real estate market, according to experts across development, manufacturing and finance. “This is a very shifting landscape for American companies,” said Ken Calligar, founder of RSG 3•D. …Garret Weyand, at Cedar Street Partners, said, “If costs are too high because of these tariffs, then projects don’t get built.” Banks will likely make borrowers increase the amount of equity so that the bank is covered in the event tariffs and inflation raise project costs.

Real estate professionals active in the Los Angeles market are bracing themselves for another wave of tariff-induced uncertainty following the US Supreme Court’s ruling. …Despite the Feb. 20 ruling, President Donald Trump has been adamant that he will find other avenues to impose his tariffs. Trump’s tariff policies have already caused upheaval for local businesses, and now the country’s heightened situation with tariffs will further disrupt L.A.’s real estate market, according to experts across development, manufacturing and finance. “This is a very shifting landscape for American companies,” said Ken Calligar, founder of RSG 3•D. …Garret Weyand, at Cedar Street Partners, said, “If costs are too high because of these tariffs, then projects don’t get built.” Banks will likely make borrowers increase the amount of equity so that the bank is covered in the event tariffs and inflation raise project costs. Logging and forest trucking industry added an estimated $1.3 billion to the Northeast region in 2024, with Maine contributing $534 million of that amount, according to a study released this week. Maine’s figure included $283 million in total labor earnings and an estimated $23 million in state tax revenues. The Pine Tree State numbers represented 2,744 direct logging and trucking jobs, along with an additional 1,715 indirect jobs, for a total of about 4,460 jobs statewide. The Augusta-based Professional Logging Contractors of the Northeast released the results of its first-ever regional study on Wednesday, conducted by Wallace Economic Advisers LLC. It showed that in 2024, logging and forest trucking supported around 6,930 jobs in the region, generated $393 million in labor income, pumped an estimated $61 million into state and local tax coffers, and remained critical to a range of industries and communities.

Logging and forest trucking industry added an estimated $1.3 billion to the Northeast region in 2024, with Maine contributing $534 million of that amount, according to a study released this week. Maine’s figure included $283 million in total labor earnings and an estimated $23 million in state tax revenues. The Pine Tree State numbers represented 2,744 direct logging and trucking jobs, along with an additional 1,715 indirect jobs, for a total of about 4,460 jobs statewide. The Augusta-based Professional Logging Contractors of the Northeast released the results of its first-ever regional study on Wednesday, conducted by Wallace Economic Advisers LLC. It showed that in 2024, logging and forest trucking supported around 6,930 jobs in the region, generated $393 million in labor income, pumped an estimated $61 million into state and local tax coffers, and remained critical to a range of industries and communities.

The mass timber supply chain has spent more than a decade proving the product works. …Now, research produced by Michigan State University argues that none of it matters much if the system surrounding the product isn’t built to match. Led by George Berghorn, Modular Mass Timber for Housing Construction, research published in the

The mass timber supply chain has spent more than a decade proving the product works. …Now, research produced by Michigan State University argues that none of it matters much if the system surrounding the product isn’t built to match. Led by George Berghorn, Modular Mass Timber for Housing Construction, research published in the  Since International Paper closed its mills in Liberty and Chatham counties last fall, business owners in Southeast Georgia who once made the state the largest timber exporter in the nation have been feeling acute pain. As of January, demand for timber had dropped more than 60%. …The cost of pulpwood, meanwhile, had plummeted. …Gov. Brian Kemp has carved $14 million for the timber industry in his draft budget, based on recommendations from a

Since International Paper closed its mills in Liberty and Chatham counties last fall, business owners in Southeast Georgia who once made the state the largest timber exporter in the nation have been feeling acute pain. As of January, demand for timber had dropped more than 60%. …The cost of pulpwood, meanwhile, had plummeted. …Gov. Brian Kemp has carved $14 million for the timber industry in his draft budget, based on recommendations from a

OREGON — A historic state-tribal collaboration in Oregon has stalled after a charitable foundation pulled out of a potential land deal. The Oregon Department of Fish and Wildlife was preparing to purchase 11,438 acres of private timberland using a federal grant. The area is about 10 miles southwest of La Grande in the Blue Mountains. The agency planned to manage the land alongside the Confederated Tribes of the Umatilla Indian Reservation — the first such collaboration in Oregon. But the landowner, the Harry A. Merlo Foundation, has withdrawn from the deal “for undisclosed reasons,” according to the Oregon Department of Fish and Wildlife. The state wildlife department and tribes had secured $22 million in federal funding to acquire and co-manage the land. …The plan was to restore this swath of forests and meadows for elk and salmon habitat.

OREGON — A historic state-tribal collaboration in Oregon has stalled after a charitable foundation pulled out of a potential land deal. The Oregon Department of Fish and Wildlife was preparing to purchase 11,438 acres of private timberland using a federal grant. The area is about 10 miles southwest of La Grande in the Blue Mountains. The agency planned to manage the land alongside the Confederated Tribes of the Umatilla Indian Reservation — the first such collaboration in Oregon. But the landowner, the Harry A. Merlo Foundation, has withdrawn from the deal “for undisclosed reasons,” according to the Oregon Department of Fish and Wildlife. The state wildlife department and tribes had secured $22 million in federal funding to acquire and co-manage the land. …The plan was to restore this swath of forests and meadows for elk and salmon habitat.

Wildfires in the northern boreal forests of Alaska, Canada, Scandinavia and Russia may be more damaging to the climate than previously thought, a new UC Berkeley-led study suggests. That’s because these fires don’t just burn through trees; they can also penetrate deep into the carbon-rich layers of soil underneath many boreal forests, releasing carbon that has been accumulating for hundreds or even thousands of years. These carbon-rich soils, also known as peat, are primarily found in the far north, where the cold, wet climate prevents vegetation from fully decomposing and leads to a buildup of partially decayed organic matter over time. The study found that major models of wildfire carbon emissions — which are largely based on data from fires at lower latitudes, and use satellite images of visible flames to guide their estimates — are not properly accounting for the impact of fire on these underground carbon stores.

Wildfires in the northern boreal forests of Alaska, Canada, Scandinavia and Russia may be more damaging to the climate than previously thought, a new UC Berkeley-led study suggests. That’s because these fires don’t just burn through trees; they can also penetrate deep into the carbon-rich layers of soil underneath many boreal forests, releasing carbon that has been accumulating for hundreds or even thousands of years. These carbon-rich soils, also known as peat, are primarily found in the far north, where the cold, wet climate prevents vegetation from fully decomposing and leads to a buildup of partially decayed organic matter over time. The study found that major models of wildfire carbon emissions — which are largely based on data from fires at lower latitudes, and use satellite images of visible flames to guide their estimates — are not properly accounting for the impact of fire on these underground carbon stores.  The US Forest Service is proposing a massive project in a national forest in Michigan that would log land roughly the size of Detroit, expand gravel mining and build roads. The Silver Branch Vegetation Management Project would span about 40 miles from north to south on the eastern edge of the Ottawa National Forest. The area includes habitat for the endangered northern long-eared bat, one of several reasons environmental groups have raised alarms. The proposal includes a wild rice seeding project, improvements to campgrounds and lake access and attempts to bolster habitat for the protected Kirtland’s warbler. The whole thing is projected to last around 30 years, with periodic reviews. …national forests serve multiple purposes [including] recreation, wildlife habitat and timber. Ottawa National Forest officials say the Silver Branch project is not primarily about logging, it’s about getting the right tree mix for forest maintenance and health. However, the project has drawn concerns from a wide range of groups.

The US Forest Service is proposing a massive project in a national forest in Michigan that would log land roughly the size of Detroit, expand gravel mining and build roads. The Silver Branch Vegetation Management Project would span about 40 miles from north to south on the eastern edge of the Ottawa National Forest. The area includes habitat for the endangered northern long-eared bat, one of several reasons environmental groups have raised alarms. The proposal includes a wild rice seeding project, improvements to campgrounds and lake access and attempts to bolster habitat for the protected Kirtland’s warbler. The whole thing is projected to last around 30 years, with periodic reviews. …national forests serve multiple purposes [including] recreation, wildlife habitat and timber. Ottawa National Forest officials say the Silver Branch project is not primarily about logging, it’s about getting the right tree mix for forest maintenance and health. However, the project has drawn concerns from a wide range of groups. Drax Group is launching a strategic review of its Canadian pellet operations due to a constrained fiber market and low margins. …CEO Will Gardiner discussed the company’s changing pellet production strategy. …“Our US business is fundamentally part of our UK supply chain. That business is doing very well As you will have seen, our Canadian business is more challenged, and we’ve been talking about this for some time as margins have come down due to fiber costs rising in Canada more rapidly than indexed power prices in Asia. As we noted last year, this dynamic contributed to the decision we’ve made to close one of our pellet plants in Williams Lake towards the end of last year.” As a result, Drax is not currently expecting to commit any additional capital to the pellet production segment, including the paused pellet plant planned for development in Longview, Washington.

Drax Group is launching a strategic review of its Canadian pellet operations due to a constrained fiber market and low margins. …CEO Will Gardiner discussed the company’s changing pellet production strategy. …“Our US business is fundamentally part of our UK supply chain. That business is doing very well As you will have seen, our Canadian business is more challenged, and we’ve been talking about this for some time as margins have come down due to fiber costs rising in Canada more rapidly than indexed power prices in Asia. As we noted last year, this dynamic contributed to the decision we’ve made to close one of our pellet plants in Williams Lake towards the end of last year.” As a result, Drax is not currently expecting to commit any additional capital to the pellet production segment, including the paused pellet plant planned for development in Longview, Washington.