PORTLAND, Ore. – Layoffs are expected at the beginning of April for Roseburg Forest Products Co.’s Riddle Plywood facility, according to a WARN notice filed this week. The notice, filed Feb. 4, says the company expects to permanently lay off 146 team members at the Riddle By-Pass Road location, though the facility will remain open. These layoffs are expected to take place after a 60-day WARN period. The company said April 5 “will be the last day of work for a majority of the affected team members before the layoff and that the remaining affected team members, if any, will be within 14 days of that date.” Impacted positions span a number of job titles, though the majority consist of Layup WAT Operators, Finish End WAT Operators, and Common Laborers.

PORTLAND, Ore. – Layoffs are expected at the beginning of April for Roseburg Forest Products Co.’s Riddle Plywood facility, according to a WARN notice filed this week. The notice, filed Feb. 4, says the company expects to permanently lay off 146 team members at the Riddle By-Pass Road location, though the facility will remain open. These layoffs are expected to take place after a 60-day WARN period. The company said April 5 “will be the last day of work for a majority of the affected team members before the layoff and that the remaining affected team members, if any, will be within 14 days of that date.” Impacted positions span a number of job titles, though the majority consist of Layup WAT Operators, Finish End WAT Operators, and Common Laborers.

Duties on Canadian imports are driving up domestic sales at some Maine lumber companies. …Protection from historically lower Canadian lumber prices has given Pleasant River Lumber the confidence to add an additional manufacturing shift in Enfield, according to co-owner Jason Brochu. Photo by Katherine Emery. …Historically Canadian companies have both outbid them for timber harvested in Maine and undercut American lumber prices when they export the finished lumber product back across the border. …An industry analyst and two other mill leaders said that inflation and a sputtering housing market make it unclear whether the tariffs will have a positive or negative effect on business in the long run. The effects of the tariffs will also vary based on the different products sawmills make. …Sawmills rely on certainty, said Alden Robbins, of Robbins Lumber, and neither the markets nor foreign trade relationships have been stable recently.

Duties on Canadian imports are driving up domestic sales at some Maine lumber companies. …Protection from historically lower Canadian lumber prices has given Pleasant River Lumber the confidence to add an additional manufacturing shift in Enfield, according to co-owner Jason Brochu. Photo by Katherine Emery. …Historically Canadian companies have both outbid them for timber harvested in Maine and undercut American lumber prices when they export the finished lumber product back across the border. …An industry analyst and two other mill leaders said that inflation and a sputtering housing market make it unclear whether the tariffs will have a positive or negative effect on business in the long run. The effects of the tariffs will also vary based on the different products sawmills make. …Sawmills rely on certainty, said Alden Robbins, of Robbins Lumber, and neither the markets nor foreign trade relationships have been stable recently.

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

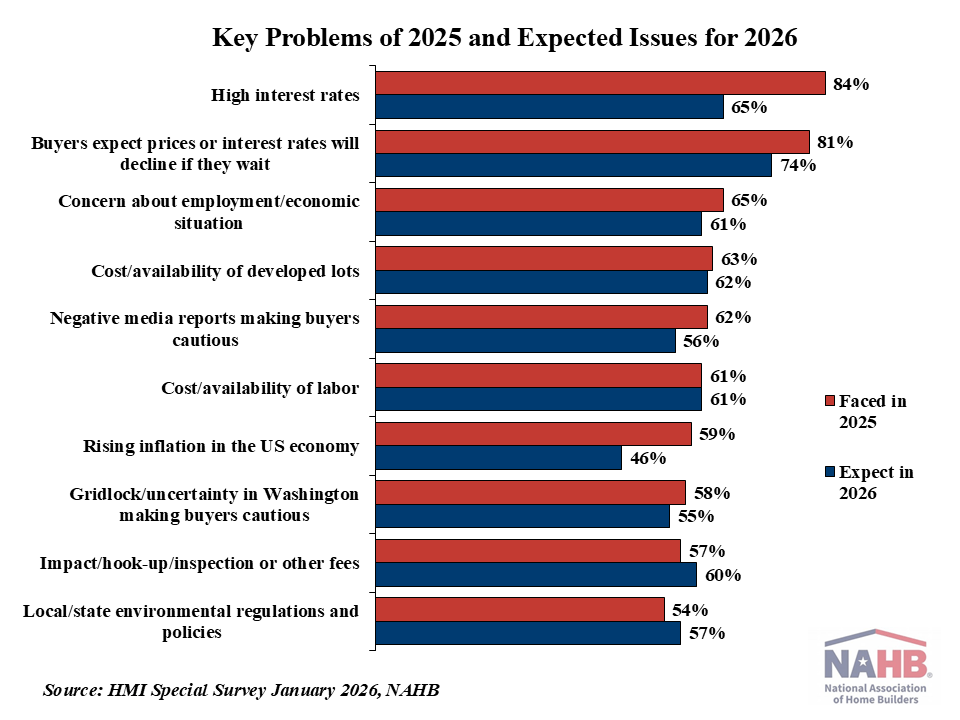

Long-term mortgage rates continued to decline in January. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.10% last month, 9 basis points (bps) lower than December. Meanwhile, the 15-year rate declined 4 bps to 5.44%. Compared to a year ago, the 30-year rate is lower by 86 bps. The 15-year rate is also lower by 72 bps. The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.20% in January – an increase of 8 bps from the previous month, but remained considerably lower than last year by 43 bps. While mortgage rates typically move in tandem with the treasury yields, the spread between the two narrowed during the month. Reports that the Trump administration encouraged Fannie Mae and Freddie Mac to expand purchases of mortgage-backed securities (MBS) boosted demand for MBS, pushing mortgage rates lower. However, treasury yields rose sharply in the final week of January from global and fiscal pressures.

Long-term mortgage rates continued to decline in January. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.10% last month, 9 basis points (bps) lower than December. Meanwhile, the 15-year rate declined 4 bps to 5.44%. Compared to a year ago, the 30-year rate is lower by 86 bps. The 15-year rate is also lower by 72 bps. The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.20% in January – an increase of 8 bps from the previous month, but remained considerably lower than last year by 43 bps. While mortgage rates typically move in tandem with the treasury yields, the spread between the two narrowed during the month. Reports that the Trump administration encouraged Fannie Mae and Freddie Mac to expand purchases of mortgage-backed securities (MBS) boosted demand for MBS, pushing mortgage rates lower. However, treasury yields rose sharply in the final week of January from global and fiscal pressures.  When it comes to housing affordability, the logic of “build build build” is straightforward enough: Housing is too expensive. If there were more of it, prices would fall. …Homebuilders are even pushing a plan for a million new affordable houses. …Unfortunately, it’s not that simple. The problem of housing affordability is much bigger than insufficient supply; it’s a mismatch with demand. And that demand is driven by income inequality that has seen soaring income growth at the top and tepid growth (or even stagnation) in the middle. In other words: The way to improve housing affordability is to reduce income inequality. …What’s needed are policies that increase income for households at the bottom and middle. Rather than boosting the housing supply in the hope that they benefit, the answer is to fix the labor market to make sure that they do.

When it comes to housing affordability, the logic of “build build build” is straightforward enough: Housing is too expensive. If there were more of it, prices would fall. …Homebuilders are even pushing a plan for a million new affordable houses. …Unfortunately, it’s not that simple. The problem of housing affordability is much bigger than insufficient supply; it’s a mismatch with demand. And that demand is driven by income inequality that has seen soaring income growth at the top and tepid growth (or even stagnation) in the middle. In other words: The way to improve housing affordability is to reduce income inequality. …What’s needed are policies that increase income for households at the bottom and middle. Rather than boosting the housing supply in the hope that they benefit, the answer is to fix the labor market to make sure that they do.  The United States is one of the world’s largest timberland investment markets, with returns driven primarily by land values rather than timber prices, according to Domain Timber Advisors’ timberland market analysis. Timberland values remain strong at the end of 2025, supported by continued appreciation in land values, while timber prices remain relatively flat. …During 2025, Domain underwrites 14 institutional bid events, 54 public listings, and 38 off-market or non-public offerings. By the end of the fourth quarter, the acquisition pipeline consists of 46 deals covering more than 500 thousand acres, providing visibility into pricing dynamics, regional demand shifts, and emerging non-timber value drivers. …Looking ahead, Domain states that renewable energy development and technology infrastructure are expected to expand non-timber revenue opportunities in 2026 and beyond. Alternative timber product markets, including molded fiber products and biomass-to-electricity, are expected to offset part of the pulpwood demand lost due to mill closures and production quotas.

The United States is one of the world’s largest timberland investment markets, with returns driven primarily by land values rather than timber prices, according to Domain Timber Advisors’ timberland market analysis. Timberland values remain strong at the end of 2025, supported by continued appreciation in land values, while timber prices remain relatively flat. …During 2025, Domain underwrites 14 institutional bid events, 54 public listings, and 38 off-market or non-public offerings. By the end of the fourth quarter, the acquisition pipeline consists of 46 deals covering more than 500 thousand acres, providing visibility into pricing dynamics, regional demand shifts, and emerging non-timber value drivers. …Looking ahead, Domain states that renewable energy development and technology infrastructure are expected to expand non-timber revenue opportunities in 2026 and beyond. Alternative timber product markets, including molded fiber products and biomass-to-electricity, are expected to offset part of the pulpwood demand lost due to mill closures and production quotas. As mass timber continues to grow in popularity in the US, manufacturers are evolving the scale and sourcing of wood production to meet rising demand.

As mass timber continues to grow in popularity in the US, manufacturers are evolving the scale and sourcing of wood production to meet rising demand.  Walk through any design-forward neighbourhood… and you’ll notice something the catalogues haven’t caught up with yet. The windows are changing. After decades dominated by vinyl, aluminium, and composite frames, timber is making a decisive return to high-end residential architecture. And the architects driving this shift aren’t motivated by nostalgia. They’re choosing wood because, for the homes they’re designing, nothing else performs quite the same way. The broader design world has been moving in this direction for several years. Mass timber construction, reclaimed wood interiors, rammed earth walls, natural stone — the 2025–2026 architectural conversation is dominated by what designers call “material honesty.” The idea is straightforward: use materials that are what they appear to be. No laminate pretending to be oak. …The knock against timber windows has always been practical: they need maintenance, they warp, they cost more. Two decades ago, much of that was fair. Modern engineered timber has changed the equation.

Walk through any design-forward neighbourhood… and you’ll notice something the catalogues haven’t caught up with yet. The windows are changing. After decades dominated by vinyl, aluminium, and composite frames, timber is making a decisive return to high-end residential architecture. And the architects driving this shift aren’t motivated by nostalgia. They’re choosing wood because, for the homes they’re designing, nothing else performs quite the same way. The broader design world has been moving in this direction for several years. Mass timber construction, reclaimed wood interiors, rammed earth walls, natural stone — the 2025–2026 architectural conversation is dominated by what designers call “material honesty.” The idea is straightforward: use materials that are what they appear to be. No laminate pretending to be oak. …The knock against timber windows has always been practical: they need maintenance, they warp, they cost more. Two decades ago, much of that was fair. Modern engineered timber has changed the equation.

California’s wildfire insurance crisis intensified this week as major insurers faced renewed scrutiny over denied or delayed payouts, while regulators and lawmakers moved to address mounting consumer complaints. The

California’s wildfire insurance crisis intensified this week as major insurers faced renewed scrutiny over denied or delayed payouts, while regulators and lawmakers moved to address mounting consumer complaints. The LANSING, Michigan – A state program to aid mass timber projects in Michigan has been extended for the Upper Peninsula after the region submitted no applications for funding in 2026. …A supplemental call for proposals makes available $50,000 through March 2. Those awards will be announced March 16. The awardees are:

LANSING, Michigan – A state program to aid mass timber projects in Michigan has been extended for the Upper Peninsula after the region submitted no applications for funding in 2026. …A supplemental call for proposals makes available $50,000 through March 2. Those awards will be announced March 16. The awardees are:

For the first time, researchers have been able to confirm that our planet’s boreal forests are on the move. Using nearly a quarter million Landsat satellite images spanning 36 years, scientists have confirmed for the first time that Earth’s boreal forest—the planet’s largest forested biome—is shifting northward, revealing unprecedented changes in this critical ecosystem that stores more than a third of the world’s forests and helps regulate our global climate. [5 min. video]

For the first time, researchers have been able to confirm that our planet’s boreal forests are on the move. Using nearly a quarter million Landsat satellite images spanning 36 years, scientists have confirmed for the first time that Earth’s boreal forest—the planet’s largest forested biome—is shifting northward, revealing unprecedented changes in this critical ecosystem that stores more than a third of the world’s forests and helps regulate our global climate. [5 min. video] The Interior Department is blazing ahead with a reorganization plan that will bring all of its wildland firefighting operations into a single agency. Starting next week, all the department’s wildland fire employees and programs will be moved into a new Wildland Fire Service. Congress did not approve funds for this consolidation of federal firefighting programs into one agency. The Wildland Fire Service also stops short of merging wildland fire personnel or programs from the USDA’s Forest Service with those same resources at the Interior Department. An internal memo sent to staff on Monday states the Wildland Fire Service “will unify wildland fire management within DOI only.” According to the memo, obtained by Federal News Network, the Wildland Fire Service will “align operations” with USDA through shared procurement, predictive services, research, and policy reforms.

The Interior Department is blazing ahead with a reorganization plan that will bring all of its wildland firefighting operations into a single agency. Starting next week, all the department’s wildland fire employees and programs will be moved into a new Wildland Fire Service. Congress did not approve funds for this consolidation of federal firefighting programs into one agency. The Wildland Fire Service also stops short of merging wildland fire personnel or programs from the USDA’s Forest Service with those same resources at the Interior Department. An internal memo sent to staff on Monday states the Wildland Fire Service “will unify wildland fire management within DOI only.” According to the memo, obtained by Federal News Network, the Wildland Fire Service will “align operations” with USDA through shared procurement, predictive services, research, and policy reforms.

Lawmakers from both parties agreed at a congressional hearing Tuesday that the federal government must act to address the growing threat of catastrophic wildfires, but they were sharply divided over how, and whether pending legislation known as the Fix Our Forests Act offers the right path forward. The House of Representatives passed the FOFA legislation in January 2025, and its companion bill is pending in the Senate. …Republican supporters of the bill championed its focus on fast-tracking the thinning and clearing of forests on large tracks of land by making exceptions to requirements in bedrock environmental laws. They argue that those steps are a fix for intensifying fires. …Democrats on the House Committee sharply criticized parts of the wildfire bill, arguing that it unnecessarily erodes environmental safeguards and expands logging, despite limited evidence that either makes communities safer. …Outside of the hearing, scientists and environmental advocates also criticized parts of FOFA.

Lawmakers from both parties agreed at a congressional hearing Tuesday that the federal government must act to address the growing threat of catastrophic wildfires, but they were sharply divided over how, and whether pending legislation known as the Fix Our Forests Act offers the right path forward. The House of Representatives passed the FOFA legislation in January 2025, and its companion bill is pending in the Senate. …Republican supporters of the bill championed its focus on fast-tracking the thinning and clearing of forests on large tracks of land by making exceptions to requirements in bedrock environmental laws. They argue that those steps are a fix for intensifying fires. …Democrats on the House Committee sharply criticized parts of the wildfire bill, arguing that it unnecessarily erodes environmental safeguards and expands logging, despite limited evidence that either makes communities safer. …Outside of the hearing, scientists and environmental advocates also criticized parts of FOFA. MISSOULA, Montana — Forester Sean Steinebach felt stunned when US District Court Judge Donald Molloy in Missoula vacated a federal magistrate judge’s favorable recommendations about the proposed South Plateau timber project. “Judge Molloy is a thorn in my side,” said Steinebach, outreach forester for Sun Mountain Lumber, based in Deer Lodge. …Molloy’s ruling was filed Dec. 11, vacating March 31 recommendations by Magistrate Judge Kathleen DeSoto that had allowed the project to proceed. Sun Mountain Lumber operates a sawmill in Deer Lodge and one in Livingston. …Steinebach said incessant lawsuits by environmental groups like the Alliance for the Wild Rockies, the Center for Biological Diversity and the Council on Wildlife and Fish sabotage timber projects, threaten sawmill communities, loggers and others. …One key issue for Judge Molloy was secure habitat for grizzly bears, but Canada lynx habitat was also a concern. Both are considered threatened species under the Endangered Species Act.

MISSOULA, Montana — Forester Sean Steinebach felt stunned when US District Court Judge Donald Molloy in Missoula vacated a federal magistrate judge’s favorable recommendations about the proposed South Plateau timber project. “Judge Molloy is a thorn in my side,” said Steinebach, outreach forester for Sun Mountain Lumber, based in Deer Lodge. …Molloy’s ruling was filed Dec. 11, vacating March 31 recommendations by Magistrate Judge Kathleen DeSoto that had allowed the project to proceed. Sun Mountain Lumber operates a sawmill in Deer Lodge and one in Livingston. …Steinebach said incessant lawsuits by environmental groups like the Alliance for the Wild Rockies, the Center for Biological Diversity and the Council on Wildlife and Fish sabotage timber projects, threaten sawmill communities, loggers and others. …One key issue for Judge Molloy was secure habitat for grizzly bears, but Canada lynx habitat was also a concern. Both are considered threatened species under the Endangered Species Act.

University of Oregon Assistant Research Professor James Johnston said he was taught that when a large fire burned a moist, Western Cascade forest to the ground, and the area didn’t burn for hundreds of years afterward, that’s what created a complex, old-growth landscape. Instead, his study found that ancient tree stumps in the Mount Hood and Willamette National Forests had burn scars from multiple fires over their long lives. It’s the first time tree-ring scars have been used to document fire records in the region. Johnston said forests are complex because of—not in spite of—lower-severity wildfires which don’t kill many of the trees. …Johnston said to figure out the best ways to foster healthy forests, relatively recent upheavals also need to be considered. Those include clearcuts, human infrastructure at the margins of forests, and hotter and drier weather patterns.

University of Oregon Assistant Research Professor James Johnston said he was taught that when a large fire burned a moist, Western Cascade forest to the ground, and the area didn’t burn for hundreds of years afterward, that’s what created a complex, old-growth landscape. Instead, his study found that ancient tree stumps in the Mount Hood and Willamette National Forests had burn scars from multiple fires over their long lives. It’s the first time tree-ring scars have been used to document fire records in the region. Johnston said forests are complex because of—not in spite of—lower-severity wildfires which don’t kill many of the trees. …Johnston said to figure out the best ways to foster healthy forests, relatively recent upheavals also need to be considered. Those include clearcuts, human infrastructure at the margins of forests, and hotter and drier weather patterns. OLYMPIA, WA – Two Washington tribal leaders could soon sit on the state’s Board of Natural Resources, which guides logging sales and other management decisions on public land. Sen. Claudia Kauffman, a Democrat and first Native American woman to serve in the state Senate, proposed Senate Bill 5838. On Monday, it was voted out of the Senate Committee on Agriculture and Natural Resources. The bill originally called for only one tribal representative, but it was changed to two members as it moved through the committee process. The proposal is backed by Public Lands Commissioner Dave Upthegrove, who chairs the board and leads the Department of Natural Resources. The department requested the legislation. If enacted, the governor would appoint a tribal representative from each side of the Cascades… Eligible tribal members must hold an elected position in a federally recognized tribe whose reservation or treaty-ceded lands are in Washington.

OLYMPIA, WA – Two Washington tribal leaders could soon sit on the state’s Board of Natural Resources, which guides logging sales and other management decisions on public land. Sen. Claudia Kauffman, a Democrat and first Native American woman to serve in the state Senate, proposed Senate Bill 5838. On Monday, it was voted out of the Senate Committee on Agriculture and Natural Resources. The bill originally called for only one tribal representative, but it was changed to two members as it moved through the committee process. The proposal is backed by Public Lands Commissioner Dave Upthegrove, who chairs the board and leads the Department of Natural Resources. The department requested the legislation. If enacted, the governor would appoint a tribal representative from each side of the Cascades… Eligible tribal members must hold an elected position in a federally recognized tribe whose reservation or treaty-ceded lands are in Washington. Anytime someone talks about shifting management of federal lands to Idaho, know that they have a bigger goal in mind. In a recent interview on The Ranch Podcast, Rep. Jordan Redman, R-Coeur d’Alene, was frank about his goals for public lands in Idaho. He said his father, former Rep. Eric Redman, dreamed of Idaho taking ownership of federal lands, and his goal is the same. The first step is for Idaho to manage public lands for a bit, then the state takes ownership of them. “How do we get that federal land back in ownership for the state?” Rep. Jordan Redman said. Back? It should be said that Idaho has never owned federal land. Redman should try reading the Constitution he swore to uphold: “… the people of the state of Idaho do agree and declare that we forever disclaim all right and title to the unappropriated public lands lying within the boundaries thereof … .” You can’t get back what you never owned; you can only take it. In service of the goal of taking federal land, Redman made a familiar argument.

Anytime someone talks about shifting management of federal lands to Idaho, know that they have a bigger goal in mind. In a recent interview on The Ranch Podcast, Rep. Jordan Redman, R-Coeur d’Alene, was frank about his goals for public lands in Idaho. He said his father, former Rep. Eric Redman, dreamed of Idaho taking ownership of federal lands, and his goal is the same. The first step is for Idaho to manage public lands for a bit, then the state takes ownership of them. “How do we get that federal land back in ownership for the state?” Rep. Jordan Redman said. Back? It should be said that Idaho has never owned federal land. Redman should try reading the Constitution he swore to uphold: “… the people of the state of Idaho do agree and declare that we forever disclaim all right and title to the unappropriated public lands lying within the boundaries thereof … .” You can’t get back what you never owned; you can only take it. In service of the goal of taking federal land, Redman made a familiar argument. Baker City, Oregon — Baker County Commissioner Christina Witham lauded the Wallowa-Whitman National Forest for cutting and piling trees southwest of Baker City, the start of a project that will continue for several years with a goal of reducing the risk of a wildfire in the city’s watershed. “It’s looking really nice,” Witham said during commissioners’ meeting Wednesday morning, Feb. 4. Witham, whose focus areas as a commissioner include natural resources, said she recently toured some of the work areas with Forest Service officials. …According to the Wallowa-Whitman, the project, which totals about 23,000 acres, is designed not only to reduce the fire risk within the watershed, but also to curb the threat of a fire spreading into the watershed, particularly from the south, a path that summer lightning storms often follow.

Baker City, Oregon — Baker County Commissioner Christina Witham lauded the Wallowa-Whitman National Forest for cutting and piling trees southwest of Baker City, the start of a project that will continue for several years with a goal of reducing the risk of a wildfire in the city’s watershed. “It’s looking really nice,” Witham said during commissioners’ meeting Wednesday morning, Feb. 4. Witham, whose focus areas as a commissioner include natural resources, said she recently toured some of the work areas with Forest Service officials. …According to the Wallowa-Whitman, the project, which totals about 23,000 acres, is designed not only to reduce the fire risk within the watershed, but also to curb the threat of a fire spreading into the watershed, particularly from the south, a path that summer lightning storms often follow. OLYMPIA — The House Agriculture and Natural Resources Committee showed a lively interest in repealing a rule that will lock up 200,000 acres of timber in Western Washington. The committee held a hearing Feb. 3 on House Bill 2620, sponsored by a mix of conservative Republicans and progressive Democrats. The bill targets the Forest Practices Board’s decision in November to widen and lengthen riparian buffers along streams without fish. The bigger buffers will eliminate $2.8 billion worth of timber, a University of Washington analysis estimates. The rule barely passed, 7-5. …The buffers, which go into effect Aug. 31, are needed to keep logging from raising water temperatures in most cases, according to Ecology. Timber groups say Ecology’s no-increase-in-water-temperature standard is humanly impossible to meet. What matters is that water temperatures stay cool enough for fish downstream, they argue. Forest landowners and the Washington State Association of Counties suggested buffers that would take 44,500 acres out of production.

OLYMPIA — The House Agriculture and Natural Resources Committee showed a lively interest in repealing a rule that will lock up 200,000 acres of timber in Western Washington. The committee held a hearing Feb. 3 on House Bill 2620, sponsored by a mix of conservative Republicans and progressive Democrats. The bill targets the Forest Practices Board’s decision in November to widen and lengthen riparian buffers along streams without fish. The bigger buffers will eliminate $2.8 billion worth of timber, a University of Washington analysis estimates. The rule barely passed, 7-5. …The buffers, which go into effect Aug. 31, are needed to keep logging from raising water temperatures in most cases, according to Ecology. Timber groups say Ecology’s no-increase-in-water-temperature standard is humanly impossible to meet. What matters is that water temperatures stay cool enough for fish downstream, they argue. Forest landowners and the Washington State Association of Counties suggested buffers that would take 44,500 acres out of production.

STARKVILLE, Miss. — Carbon dioxide is the most commonly produced greenhouse gas, the substances that trap heat in the atmosphere keeping the planet warm enough for life. Carbon is stored in high amounts in timber, of which Mississippi has an abundance. The state ranks in the top 10 nationally in timber production, with close to 20 million acres of timberland. The U.S. Geological Survey says that carbon sequestration is the process of capturing and storing atmospheric carbon dioxide. Removing carbon dioxide from the atmosphere reduces the potential for global climate change. Since timber stores carbon efficiently, a tremendous amount of the greenhouse gas carbon dioxide is stored in Mississippi’s forests. This makes timber a valuable resource in efforts to limit the amount of carbon available as a greenhouse gas. Carbon credits and the carbon offset market have made an impact on Mississippi’s economy to a degree for about 20 years.

STARKVILLE, Miss. — Carbon dioxide is the most commonly produced greenhouse gas, the substances that trap heat in the atmosphere keeping the planet warm enough for life. Carbon is stored in high amounts in timber, of which Mississippi has an abundance. The state ranks in the top 10 nationally in timber production, with close to 20 million acres of timberland. The U.S. Geological Survey says that carbon sequestration is the process of capturing and storing atmospheric carbon dioxide. Removing carbon dioxide from the atmosphere reduces the potential for global climate change. Since timber stores carbon efficiently, a tremendous amount of the greenhouse gas carbon dioxide is stored in Mississippi’s forests. This makes timber a valuable resource in efforts to limit the amount of carbon available as a greenhouse gas. Carbon credits and the carbon offset market have made an impact on Mississippi’s economy to a degree for about 20 years. Misleading. Unjustified. Hypocritical. Those are just some of the words that Department of Energy scientists used to describe a 141-page report on climate change that was commissioned by DOE Secretary Chris Wright. The feedback appears in newly revealed emails that were made public as part of a court fight between DOE and public interest groups. And they show that criticism of the report isn’t limited to scientists outside the Trump administration. The department’s own internal reviewers took issue with the document, which was written by five climate contrarians from outside DOE who were handpicked by Wright. …One DOE reviewer echoed that opinion and said it was “misleading” for the report to talk about how climate change could boost plant growth without mentioning its other drawbacks. Another comment described the report’s criticism of climate modeling as an “unjustified (and at worst a biased) judgement.”

Misleading. Unjustified. Hypocritical. Those are just some of the words that Department of Energy scientists used to describe a 141-page report on climate change that was commissioned by DOE Secretary Chris Wright. The feedback appears in newly revealed emails that were made public as part of a court fight between DOE and public interest groups. And they show that criticism of the report isn’t limited to scientists outside the Trump administration. The department’s own internal reviewers took issue with the document, which was written by five climate contrarians from outside DOE who were handpicked by Wright. …One DOE reviewer echoed that opinion and said it was “misleading” for the report to talk about how climate change could boost plant growth without mentioning its other drawbacks. Another comment described the report’s criticism of climate modeling as an “unjustified (and at worst a biased) judgement.”  Chronic exposure to pollution from wildfires has been linked to tens of thousands of deaths annually in the United States, according to a new study. The paper found that from 2006 to 2020, long-term exposure to tiny particulates from wildfire smoke contributed to an average of 24,100 deaths a year in the lower 48 states. “Our message is: Wildfire smoke is very dangerous. It is an increasing threat to human health,” said Yaguang Wei, a study author and assistant professor in the department of environmental medicine at Icahn School of Medicine at Mount Sinai. …“It’s only if we’re doing multiple studies with many different designs that we gain scientific confidence of our outcomes,” said Michael Jerrett, professor of environmental health science at the University of California, Los Angeles. The paper’s researchers focused on deaths linked to chronic exposure to fine particulate matter, or PM2.5 — the main concern from wildfire smoke.

Chronic exposure to pollution from wildfires has been linked to tens of thousands of deaths annually in the United States, according to a new study. The paper found that from 2006 to 2020, long-term exposure to tiny particulates from wildfire smoke contributed to an average of 24,100 deaths a year in the lower 48 states. “Our message is: Wildfire smoke is very dangerous. It is an increasing threat to human health,” said Yaguang Wei, a study author and assistant professor in the department of environmental medicine at Icahn School of Medicine at Mount Sinai. …“It’s only if we’re doing multiple studies with many different designs that we gain scientific confidence of our outcomes,” said Michael Jerrett, professor of environmental health science at the University of California, Los Angeles. The paper’s researchers focused on deaths linked to chronic exposure to fine particulate matter, or PM2.5 — the main concern from wildfire smoke. Construction in New York City is one of the most dynamic and demanding industries in the country — but it’s also one of the most dangerous. …That’s why innovation in building materials and methods can have a real impact not only on efficiency and sustainability but also on safety. One such innovation, mass timber, is gaining traction. …Mass timber components are prefabricated in controlled factory settings. This approach greatly reduces the need for tasks like cutting, welding, or mixing concrete on-site — tasks that are commonly associated with jobsite injuries. …Additionally, since large panels arrive ready to install, crews spend less time working at height, which directly reduces the risk of falls — the leading cause of construction fatalities in the U.S., according to OSHA’s fall protection guidelines. …It also means a reduced need for powered hand tools and high-decibel equipment, lowering the risk of accidents related to hand injuries or communication breakdowns.

Construction in New York City is one of the most dynamic and demanding industries in the country — but it’s also one of the most dangerous. …That’s why innovation in building materials and methods can have a real impact not only on efficiency and sustainability but also on safety. One such innovation, mass timber, is gaining traction. …Mass timber components are prefabricated in controlled factory settings. This approach greatly reduces the need for tasks like cutting, welding, or mixing concrete on-site — tasks that are commonly associated with jobsite injuries. …Additionally, since large panels arrive ready to install, crews spend less time working at height, which directly reduces the risk of falls — the leading cause of construction fatalities in the U.S., according to OSHA’s fall protection guidelines. …It also means a reduced need for powered hand tools and high-decibel equipment, lowering the risk of accidents related to hand injuries or communication breakdowns.