Friday’s Tree Frog interview with political risk expert Robert McKellar drew exceptional interest—and for good reason. Given reader response and the ongoing fallout from Trump’s trade policies, we’re featuring it again for those who missed it. McKellar, who divides his time between Turkey and Canada, brings an international perspective to his analysis of Trump’s second-term trade environment and its implications for Canada’s forest sector. His message is clear: US protectionism is not a passing phase. The current tariff and duty structure reflects a broader nationalist realignment that will persist well beyond the Trump presidency. He notes it is unlikely that the upcoming USMCA review will restore pre-Trump-2 market access, and that while Washington is betting tariffs will attract new foreign investment, the result has instead been greater political risk.

McKellar also examines the recent US–China flare-up, concluding it is unlikely to reignite a full-scale trade war. Within the US, he observes that political momentum currently favours the US Lumber Coalition over homebuilders, but that balance could shift if housing affordability again becomes a political flashpoint. Should the housing crisis deepen, Trump has shown he’s willing to adjust course when broader political pressures outweigh protectionist instincts. For Canadian producers, diversification and value-added strategies remain essential—but slow to materialize. That reality underpins McKellar’s central question: “If that’s true—then what?” His answer calls for a fundamental shift in mindset—challenging the sector to rethink its future and chart a course less dependent on the US market. He concludes that companies should view political-risk awareness as a practical framework—linking foresight, market intelligence, and decision-making into a continuous process of adaptation. The tools already exist within most organizations, he says; the opportunity lies in using them more deliberately as part of everyday business planning.

A U.S.-Canada trade deal on steel, aluminium and energy could be ready for Prime Minister Mark Carney and US President Donald Trump to sign at the Asia-Pacific Economic Cooperation summit later this month in South Korea, the

A U.S.-Canada trade deal on steel, aluminium and energy could be ready for Prime Minister Mark Carney and US President Donald Trump to sign at the Asia-Pacific Economic Cooperation summit later this month in South Korea, the

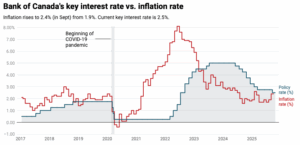

OTTAWA — Some economists say surprisingly strong September inflation figures will give the Bank of Canada pause ahead of its interest rate decision next week. Annual inflation accelerated to 2.4% last month, Statistics Canada said Tuesday. That’s a jump of half a percentage point from 1.9% in August and a tick higher than economists’ expectations. …The September inflation report will be the Bank of Canada’s last look at price data before the central bank’s next interest rate decision on Oct. 29. The central bank lowered its benchmark interest rate by a quarter point to 2.5% at its last decision in September. The Bank of Canada’s preferred measures of core inflation showed some stubbornness in September, holding above the three per cent mark. “This will make the Bank of Canada’s decision a bit more interesting next week than previously expected,” said BMO chief economist Doug Porter.

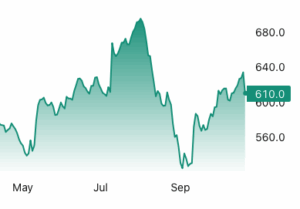

OTTAWA — Some economists say surprisingly strong September inflation figures will give the Bank of Canada pause ahead of its interest rate decision next week. Annual inflation accelerated to 2.4% last month, Statistics Canada said Tuesday. That’s a jump of half a percentage point from 1.9% in August and a tick higher than economists’ expectations. …The September inflation report will be the Bank of Canada’s last look at price data before the central bank’s next interest rate decision on Oct. 29. The central bank lowered its benchmark interest rate by a quarter point to 2.5% at its last decision in September. The Bank of Canada’s preferred measures of core inflation showed some stubbornness in September, holding above the three per cent mark. “This will make the Bank of Canada’s decision a bit more interesting next week than previously expected,” said BMO chief economist Doug Porter. Lumber futures fell below $610 per thousand board feet, their lowest level since October 8 and down 12% from a three-year high in early August, as a slowing US housing market outweighed potential supply curbs from tariffs. August building permits dropped to a seasonally adjusted annualized rate of 1.33 million, the lowest since May 2020, while housing starts fell 8.5%, marking the fourth-lowest reading in over five years. Earlier this month, the US imposed a 10% tariff on Canadian lumber, with the Trump administration stating it aims to expand domestic timber harvesting and reduce reliance on foreign lumber. Looking ahead, expected Federal Reserve rate cuts could stimulate construction and home buying and encourage homeowners to borrow for repairs and renovations, the largest driver of lumber demand. However, signs of a slowing labor market and rising inflation suggest demand may remain subdued.

Lumber futures fell below $610 per thousand board feet, their lowest level since October 8 and down 12% from a three-year high in early August, as a slowing US housing market outweighed potential supply curbs from tariffs. August building permits dropped to a seasonally adjusted annualized rate of 1.33 million, the lowest since May 2020, while housing starts fell 8.5%, marking the fourth-lowest reading in over five years. Earlier this month, the US imposed a 10% tariff on Canadian lumber, with the Trump administration stating it aims to expand domestic timber harvesting and reduce reliance on foreign lumber. Looking ahead, expected Federal Reserve rate cuts could stimulate construction and home buying and encourage homeowners to borrow for repairs and renovations, the largest driver of lumber demand. However, signs of a slowing labor market and rising inflation suggest demand may remain subdued. Alain Ouzilleau, owner of Groupe Cabico, spent millions upgrading his two factories in Quebec and Ontario into state-of-the-art facilities shipping around $100-million worth of high-end kitchen cabinets to the US each year. Almost overnight, that business has been thrown into jeopardy. …“We have very long-term loyal customers,” Mr. Ouzilleau said. “But the 50% that is planned to be effective January 1st is just a death sentence.” …Hundreds of other Canadian cabinet and furniture makers also stand to lose their key export business, with limited ability to expand in a crowded domestic market. …What started as tariffs on steel, aluminum and automobiles has expanded to include copper and lumber, with a tariff on heavy trucks slated to come into force in November. The Trump administration is also conducting investigations into aircraft, semiconductors and industrial machinery, among other industries, suggesting more tariffs are on the horizon. [to access the full story a Globe & Mail subscription is required]

Alain Ouzilleau, owner of Groupe Cabico, spent millions upgrading his two factories in Quebec and Ontario into state-of-the-art facilities shipping around $100-million worth of high-end kitchen cabinets to the US each year. Almost overnight, that business has been thrown into jeopardy. …“We have very long-term loyal customers,” Mr. Ouzilleau said. “But the 50% that is planned to be effective January 1st is just a death sentence.” …Hundreds of other Canadian cabinet and furniture makers also stand to lose their key export business, with limited ability to expand in a crowded domestic market. …What started as tariffs on steel, aluminum and automobiles has expanded to include copper and lumber, with a tariff on heavy trucks slated to come into force in November. The Trump administration is also conducting investigations into aircraft, semiconductors and industrial machinery, among other industries, suggesting more tariffs are on the horizon. [to access the full story a Globe & Mail subscription is required]

Section 232 tariffs were once seen as a fortress for US metals. Yet, that fortress now casts a much longer shadow. Companies far removed from the steel and aluminum sector could soon find themselves ensnared in tariffs they never imagined, thanks to the inclusion process for “derivative” products. The Trump Administration has steadily expanded Section 232 authority well beyond their original steel and aluminum targets, to copper, automobiles, trucks, lumber, and even wooden cabinets. These tariffs, which range from 10% (for lumber) to 50% (for steel and aluminum), are layered on top of normal import duties. At first glance, these measures appeared to strike only those industries handling raw materials. But in 2025 the Administration sought to close what it saw as a loophole: downstream products containing tariffed metals that could enter duty-free. As a result, section 232 tariffs were imposed on the raw material and a finite list of derivative products.

Section 232 tariffs were once seen as a fortress for US metals. Yet, that fortress now casts a much longer shadow. Companies far removed from the steel and aluminum sector could soon find themselves ensnared in tariffs they never imagined, thanks to the inclusion process for “derivative” products. The Trump Administration has steadily expanded Section 232 authority well beyond their original steel and aluminum targets, to copper, automobiles, trucks, lumber, and even wooden cabinets. These tariffs, which range from 10% (for lumber) to 50% (for steel and aluminum), are layered on top of normal import duties. At first glance, these measures appeared to strike only those industries handling raw materials. But in 2025 the Administration sought to close what it saw as a loophole: downstream products containing tariffed metals that could enter duty-free. As a result, section 232 tariffs were imposed on the raw material and a finite list of derivative products. Ikea is increasing the amount of products it makes in the US as the world’s largest home furnishings retailer comes under pressure from US President Donald Trump’s tariffs on furniture and kitchen cabinets. The flat-pack retailer, which made revenues of $5.5bn in the US last year, currently produces only about 15% of products that it sells in the US domestically. That compares with 75% local production in Europe and 80% in Asia. “We want to continue to expand in the US and Canada — how do we optimise a good supply set-up where we secure the right access to materials, to components, to production? That’s very long-term work that we’re doing,” Jon Abrahamsson Ring, chief executive of Inter Ikea. Trump imposed tariffs of between 10% and 50% on imports of foreign furniture and wood products. Ikea, which is responsible for about 1% of total industrial production, is set to take a significant hit.

Ikea is increasing the amount of products it makes in the US as the world’s largest home furnishings retailer comes under pressure from US President Donald Trump’s tariffs on furniture and kitchen cabinets. The flat-pack retailer, which made revenues of $5.5bn in the US last year, currently produces only about 15% of products that it sells in the US domestically. That compares with 75% local production in Europe and 80% in Asia. “We want to continue to expand in the US and Canada — how do we optimise a good supply set-up where we secure the right access to materials, to components, to production? That’s very long-term work that we’re doing,” Jon Abrahamsson Ring, chief executive of Inter Ikea. Trump imposed tariffs of between 10% and 50% on imports of foreign furniture and wood products. Ikea, which is responsible for about 1% of total industrial production, is set to take a significant hit.

With new tariffs taking effect on furniture and lumber, an analysis released by Goldman Sachs finds American consumers are paying for more than half of the cost of the levies imposed by President Donald Trump. In a research note to its clients, the global investment and banking giant said U.S. consumers will absorb 55% of tariff costs by the end of this year. American businesses would pay 22% of the costs, foreign exporters would absorb 18% and 5% would be evaded, according to the Goldman Sachs analysis. Consumers could end up paying 70% of the cost by the end of next year, the report said. “At the moment, however, US businesses are likely bearing a larger share of the costs because some tariffs have just gone into effect and it takes time to raise prices on consumers and negotiate lower import prices with foreign suppliers,” the analysis adds.

With new tariffs taking effect on furniture and lumber, an analysis released by Goldman Sachs finds American consumers are paying for more than half of the cost of the levies imposed by President Donald Trump. In a research note to its clients, the global investment and banking giant said U.S. consumers will absorb 55% of tariff costs by the end of this year. American businesses would pay 22% of the costs, foreign exporters would absorb 18% and 5% would be evaded, according to the Goldman Sachs analysis. Consumers could end up paying 70% of the cost by the end of next year, the report said. “At the moment, however, US businesses are likely bearing a larger share of the costs because some tariffs have just gone into effect and it takes time to raise prices on consumers and negotiate lower import prices with foreign suppliers,” the analysis adds.  Anthony Cabrera, who started working with a contractor in March to construct the three-bedroom house, was eager to get ahead of a fresh round of tariffs on key building materials and home items that took effect earlier this week. Mr Cabrera had already seen his initial budget of roughly $300,000 balloon to $450,000 as prices for a range of products. …A recent report from Goldman Sachs found that US consumers will shoulder as much as 55% of the cost. It takes time to raise prices on consumers, the economists noted, and US firms will increasingly pass on costs in the coming months. The new tariffs “will create additional headwinds for an already challenged housing market” Buddy Hughes, chairman for the NAHB, said. Affordable housing construction could be hit particularly hard, said Elena Patel, of the Urban-Brookings Tax Policy Center. …Matthew Walsh, at Moody’s Analytics, said that cost uncertainty will be the most immediate effect.

Anthony Cabrera, who started working with a contractor in March to construct the three-bedroom house, was eager to get ahead of a fresh round of tariffs on key building materials and home items that took effect earlier this week. Mr Cabrera had already seen his initial budget of roughly $300,000 balloon to $450,000 as prices for a range of products. …A recent report from Goldman Sachs found that US consumers will shoulder as much as 55% of the cost. It takes time to raise prices on consumers, the economists noted, and US firms will increasingly pass on costs in the coming months. The new tariffs “will create additional headwinds for an already challenged housing market” Buddy Hughes, chairman for the NAHB, said. Affordable housing construction could be hit particularly hard, said Elena Patel, of the Urban-Brookings Tax Policy Center. …Matthew Walsh, at Moody’s Analytics, said that cost uncertainty will be the most immediate effect.

More companies that provide rayon, lyocell and modal to fashion brands are sourcing less from ancient and endangered forests, according to the nonprofit Canopy. Although the vast majority of cellulosic fibers are still spun from virgin materials, some of the biggest producers have been quickly adopting forest-friendly and circular materials. 70% of companies making semi-synthetic, cellulose-based fibers now exhibit green practices that reduce pressures on forests. 54% of fiber producers that the group tracked have reached the nonprofit’s favorable green rating. …Canopy uses this annual report in part to help brands make informed sourcing decisions. The use of recycled materials for such fibers is still rare, although it grew to 1.1% in 2024. Such textiles represent only 6% of the global fiber market, according to Textile Exchange. It found that fibers approved by Forest Stewardship Council (FSC) or other certification made up as much as 70 percent of cellulosic fiber market share.

More companies that provide rayon, lyocell and modal to fashion brands are sourcing less from ancient and endangered forests, according to the nonprofit Canopy. Although the vast majority of cellulosic fibers are still spun from virgin materials, some of the biggest producers have been quickly adopting forest-friendly and circular materials. 70% of companies making semi-synthetic, cellulose-based fibers now exhibit green practices that reduce pressures on forests. 54% of fiber producers that the group tracked have reached the nonprofit’s favorable green rating. …Canopy uses this annual report in part to help brands make informed sourcing decisions. The use of recycled materials for such fibers is still rare, although it grew to 1.1% in 2024. Such textiles represent only 6% of the global fiber market, according to Textile Exchange. It found that fibers approved by Forest Stewardship Council (FSC) or other certification made up as much as 70 percent of cellulosic fiber market share. Canada’s vast forests are the envy of much of the world, but they’ve seen brighter days. Our changing climate has beckoned wilder wildfires, disease and drought. And after decades of cutting big and fast to maximize profits, the country’s logging industry is in freefall. But there’s opportunity in crisis — or that’s the bet some First Nations in British Columbia are making. …“Now we’re dealing with a lot of scrub in that corner that we didn’t get to before,” Garry Merkel, a professional forester and a member of the Tahltan Nation. …In Manitoba, the forestry industry watched this summer as profits went up in smoke. Devastating fires burned more forest in logging areas than any year in recorded wildfire history, according to an analysis by Manitoba reporter Julia-Simone Rutgers. And forestry companies are “scared to death,” said.

Canada’s vast forests are the envy of much of the world, but they’ve seen brighter days. Our changing climate has beckoned wilder wildfires, disease and drought. And after decades of cutting big and fast to maximize profits, the country’s logging industry is in freefall. But there’s opportunity in crisis — or that’s the bet some First Nations in British Columbia are making. …“Now we’re dealing with a lot of scrub in that corner that we didn’t get to before,” Garry Merkel, a professional forester and a member of the Tahltan Nation. …In Manitoba, the forestry industry watched this summer as profits went up in smoke. Devastating fires burned more forest in logging areas than any year in recorded wildfire history, according to an analysis by Manitoba reporter Julia-Simone Rutgers. And forestry companies are “scared to death,” said. BC’s forest communities are on life support. Families are losing jobs, mills are shuttering, and entire towns are being hollowed out. And now, with another punishing softwood lumber tariff slapped on by the U.S., the bleeding has gone from slow to catastrophic. Premier David Eby calls it an “existential crisis” and wants the prime minister to declare a national emergency. Here’s a better idea: How about the premier stops being the emergency? For eight years, the B.C. NDP has dismantled the foundation of our forest industry. They have made it harder to cut, harder to haul, harder to process, and harder to survive. Now Eby is running to Ottawa and blaming the Americans while ignoring the damage his government has already done. Let’s be clear. The forest industry is not collapsing because of one more tariff. It is collapsing because this government has gutted it from the inside.

BC’s forest communities are on life support. Families are losing jobs, mills are shuttering, and entire towns are being hollowed out. And now, with another punishing softwood lumber tariff slapped on by the U.S., the bleeding has gone from slow to catastrophic. Premier David Eby calls it an “existential crisis” and wants the prime minister to declare a national emergency. Here’s a better idea: How about the premier stops being the emergency? For eight years, the B.C. NDP has dismantled the foundation of our forest industry. They have made it harder to cut, harder to haul, harder to process, and harder to survive. Now Eby is running to Ottawa and blaming the Americans while ignoring the damage his government has already done. Let’s be clear. The forest industry is not collapsing because of one more tariff. It is collapsing because this government has gutted it from the inside.

The bipartisan Fix Our Forests Act passed out of the Senate Agriculture Committee on Tuesday morning, marking the first advancement of the bill since it previously stalled in committees under both the Biden and the previous Trump administration. The Act would create an interagency Fireshed Center focused on wildfire prediction and tracking, establish fireshed management areas in forests with high wildfire risks, and expedite the review of wildfire-related forest management projects under the National Environmental Policy Act. The act has gained support from lawmakers on both sides of the aisle, along with numerous environmental and wildfire-focused organizations. Critics of the Act claim it would further open up

The bipartisan Fix Our Forests Act passed out of the Senate Agriculture Committee on Tuesday morning, marking the first advancement of the bill since it previously stalled in committees under both the Biden and the previous Trump administration. The Act would create an interagency Fireshed Center focused on wildfire prediction and tracking, establish fireshed management areas in forests with high wildfire risks, and expedite the review of wildfire-related forest management projects under the National Environmental Policy Act. The act has gained support from lawmakers on both sides of the aisle, along with numerous environmental and wildfire-focused organizations. Critics of the Act claim it would further open up  CLANCY, Montana — Healthy forests depend on a strong forest products industry. Sawmills help support thousands of Montana jobs, reduce wildfire risks, and provide a renewable resource. Despite recent mill closures in Missoula and Seeley Lake, Marks Lumber in Clancy continues to carry on. …Both Roseburg Forest Products in Missoula and Pyramid Mountain Lumber in Seeley Lake closed last year. Marks Lumber has been open for 36 years, and they have adapted to industry changes before. “ …In light of the recent closures, they have made some changes, including shifting to more board production (processed wood) rather than the raw tree, which is more expensive to manufacture, and slowing down on how much logging they do. Marks Lumber also had to change where their sawdust and chips go. Roseburg used to buy that material, but now they send them to Weyerhaeuser Forest Products in Columbia Falls.

CLANCY, Montana — Healthy forests depend on a strong forest products industry. Sawmills help support thousands of Montana jobs, reduce wildfire risks, and provide a renewable resource. Despite recent mill closures in Missoula and Seeley Lake, Marks Lumber in Clancy continues to carry on. …Both Roseburg Forest Products in Missoula and Pyramid Mountain Lumber in Seeley Lake closed last year. Marks Lumber has been open for 36 years, and they have adapted to industry changes before. “ …In light of the recent closures, they have made some changes, including shifting to more board production (processed wood) rather than the raw tree, which is more expensive to manufacture, and slowing down on how much logging they do. Marks Lumber also had to change where their sawdust and chips go. Roseburg used to buy that material, but now they send them to Weyerhaeuser Forest Products in Columbia Falls. The European Union proposed granting companies six months of leeway to comply with its landmark law to curb deforestation across the world, rejecting a longer delay despite industry complaints. The EU’s Deforestation Regulation aims to tackle the felling of trees associated with imports. Yet it has faced criticism at home and abroad for being too bureaucratic. The European Commission proposed Tuesday giving large companies six months of relief from sanctions after the law goes into effect at the end of the year. Bloomberg previously reported plans to delay implementing the rules by a year. …Both parliament and member states will need to sign off on the changes before the end of the year, and have the right to propose amendments. …A six-month adjustment period will be welcomed by environmental activists, alarmed by high rates of deforestation, said Luciana Chávez. [to access the full story a Bloomberg subscription is required]

The European Union proposed granting companies six months of leeway to comply with its landmark law to curb deforestation across the world, rejecting a longer delay despite industry complaints. The EU’s Deforestation Regulation aims to tackle the felling of trees associated with imports. Yet it has faced criticism at home and abroad for being too bureaucratic. The European Commission proposed Tuesday giving large companies six months of relief from sanctions after the law goes into effect at the end of the year. Bloomberg previously reported plans to delay implementing the rules by a year. …Both parliament and member states will need to sign off on the changes before the end of the year, and have the right to propose amendments. …A six-month adjustment period will be welcomed by environmental activists, alarmed by high rates of deforestation, said Luciana Chávez. [to access the full story a Bloomberg subscription is required] SWEDEN — Ingka Investments, the investment arm of Ingka Group (the largest IKEA retailer), has agreed to acquire approximately 153,000 hectares of land in Latvia and Estonia, of which 89% are forestland, from Södra, Sweden’s largest forest owners’ association. Completion is subject to approval by the relevant regulatory authorities. “Our unique ownership structure allows us to invest with a long-term perspective rather than short-term quarterly thinking.” …As the world’s largest IKEA retailer, Ingka Group operates in 31 markets and represents 87% of global IKEA sales. …Niks Sauva, Country Manager, Ingka Investments Latvia, continued: “We’re committed to creating more value locally in the Baltics. Our goal is to increase the share of wood processed regionally to strengthen the Baltic forestry value chain.” …Completion is subject to approval by the relevant authorities in Latvia and Estonia.

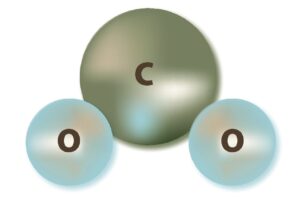

SWEDEN — Ingka Investments, the investment arm of Ingka Group (the largest IKEA retailer), has agreed to acquire approximately 153,000 hectares of land in Latvia and Estonia, of which 89% are forestland, from Södra, Sweden’s largest forest owners’ association. Completion is subject to approval by the relevant regulatory authorities. “Our unique ownership structure allows us to invest with a long-term perspective rather than short-term quarterly thinking.” …As the world’s largest IKEA retailer, Ingka Group operates in 31 markets and represents 87% of global IKEA sales. …Niks Sauva, Country Manager, Ingka Investments Latvia, continued: “We’re committed to creating more value locally in the Baltics. Our goal is to increase the share of wood processed regionally to strengthen the Baltic forestry value chain.” …Completion is subject to approval by the relevant authorities in Latvia and Estonia. Google has announced plans to address greenhouse gases beyond carbon dioxide by purchasing credits to support the emerging market for removing short-lived but highly potent “superpollutants.” The company will buy up to 25,000 tonnes of superpollutant-destruction credits by 2030 from two organisations, Recoolit and Cool Effect—equivalent to about one million tonnes of CO₂ removal over the long term. While carbon dioxide remains a key focus, Google said gases such as methane, hydrofluorocarbons (HFCs), chlorofluorocarbons (CFCs) and nitrous oxide have a much greater near-term warming impact. “It’s the right thing to do for the planet,” said Randy Spock, Google’s carbon credits and removals lead. “CO₂ is obviously very important… but if we think only about CO₂, then we’re just looking at one piece of the puzzle.” …Sam Abernethy, a climate scientist at Spark Climate Solutions, said: “Superpollutants only get a few percent of climate finance… that’s a misallocation given their importance.”

Google has announced plans to address greenhouse gases beyond carbon dioxide by purchasing credits to support the emerging market for removing short-lived but highly potent “superpollutants.” The company will buy up to 25,000 tonnes of superpollutant-destruction credits by 2030 from two organisations, Recoolit and Cool Effect—equivalent to about one million tonnes of CO₂ removal over the long term. While carbon dioxide remains a key focus, Google said gases such as methane, hydrofluorocarbons (HFCs), chlorofluorocarbons (CFCs) and nitrous oxide have a much greater near-term warming impact. “It’s the right thing to do for the planet,” said Randy Spock, Google’s carbon credits and removals lead. “CO₂ is obviously very important… but if we think only about CO₂, then we’re just looking at one piece of the puzzle.” …Sam Abernethy, a climate scientist at Spark Climate Solutions, said: “Superpollutants only get a few percent of climate finance… that’s a misallocation given their importance.” Atmospheric carbon dioxide (CO₂) rose faster in 2024 than in any year since records began. …Our new satellite analysis shows that the Amazon rainforest is struggling to keep up. And worryingly, the satellite that made this discovery could soon be switched off [due to proposed NASA budget cuts.]. Systematic measurements of CO₂ in the atmosphere began in the late 1950s. …Across six decades of measurements, CO₂ has gradually increased. …The largest change was over the Amazon, where much less CO₂ is being absorbed. Similar slowdowns also appeared over southern Africa and southeast Asia, parts of Australia, the eastern US, Alaska and western Russia. Conversely, we detected more carbon being absorbed over western Europe, the US and central Canada. …It’s not yet clear whether 2023-24 is a short-term blip or an early sign of a long-term shift. But evidence points to an increasingly fragile situation, as tropical forests are stressed by hot and dry conditions.

Atmospheric carbon dioxide (CO₂) rose faster in 2024 than in any year since records began. …Our new satellite analysis shows that the Amazon rainforest is struggling to keep up. And worryingly, the satellite that made this discovery could soon be switched off [due to proposed NASA budget cuts.]. Systematic measurements of CO₂ in the atmosphere began in the late 1950s. …Across six decades of measurements, CO₂ has gradually increased. …The largest change was over the Amazon, where much less CO₂ is being absorbed. Similar slowdowns also appeared over southern Africa and southeast Asia, parts of Australia, the eastern US, Alaska and western Russia. Conversely, we detected more carbon being absorbed over western Europe, the US and central Canada. …It’s not yet clear whether 2023-24 is a short-term blip or an early sign of a long-term shift. But evidence points to an increasingly fragile situation, as tropical forests are stressed by hot and dry conditions.