Derek Nighbor

Canada’s forest-dependent communities are at a critical point. Rising global demand creates an opportunity to bring more Canadian wood products to the world, while simultaneously growing jobs, building more homes, and reducing fire risks here at home. But as the Canadian economy faces significant upheaval and needs to transform, the industry and its 200,000 employees can’t do it alone. The current trade environment is volatile. Increased duties on softwood lumber exports to the US and related trade uncertainty threaten Canadian forestry’s ability to deliver at scale. …Securing the best possible outcome at the Canada-US negotiating table is job one. Exports remain the foundation of the sector and the livelihood of forest-dependent communities. Concurrent to that, we need the federal government to focus on the policy levers we can control.

The Canadian government can act now by implementing three priorities: Designating domestic wood as a strategic material in its Build Canada Homes recommendations prioritizes made-in-Canada forest products in federal housing projects to reduce emissions, accelerate build times, and support rural and northern job creation. …By strengthening competition and accountability among carriers and growing investment in trade corridors, Canada can markedly improve supply chain performance for all economic sectors. …Improving competitiveness through smarter regulation—a new approach that leverages provincial systems, reduces duplication, focuses on outcomes, and will make Canada a destination for more strategic investment in infrastructure and people. …Despite the challenging headwinds and uncertainty that abound, Canadian forestry sees a path forward to transformation and growth. That path must be anchored in a new partnership with the federal government—one that stabilizes the sector, creates greater certainty and predictability in regulation, and allows us to bring more innovative, sustainably-sourced, Made in Canada wood products to Canada and the world.

As leaders gather t

As leaders gather t his week at the 2025 Union of BC Municipalities’ convention to chart the future of British Columbia, forestry must be central to those discussions. Forestry touches communities of every size in every part of BC It is not just an industry — it is part of BC’s fabric. And at a time of pressing challenges, forestry offers solutions: for rural, urban and Indigenous communities, it can and should be a unifying force. …Yet the sector faces headwinds. US softwood lumber duties exceed 35%, global markets remain volatile and further tariff increases loom. These forces are beyond our control, but they make action at home urgent. In challenging times, we need to focus on solutions that make us stronger together — solutions that are about “and”, not “or.”

his week at the 2025 Union of BC Municipalities’ convention to chart the future of British Columbia, forestry must be central to those discussions. Forestry touches communities of every size in every part of BC It is not just an industry — it is part of BC’s fabric. And at a time of pressing challenges, forestry offers solutions: for rural, urban and Indigenous communities, it can and should be a unifying force. …Yet the sector faces headwinds. US softwood lumber duties exceed 35%, global markets remain volatile and further tariff increases loom. These forces are beyond our control, but they make action at home urgent. In challenging times, we need to focus on solutions that make us stronger together — solutions that are about “and”, not “or.”

.jpg)

Terrace, a small town nestled in the foothills of the mountains of BC, boomed in the 1920s, shipping Canadian cedar for telephone lines and power cables across the globe. But today local sawmill owners such as Warren Gavronsky are on the front line of a crisis hitting the country’s US$63bn forestry industry as a result of US duties and a slowdown in the world’s largest economy. …Canada’s forest products industry is one of the country’s largest employers, operating in hundreds of communities and providing 200,000 direct jobs. …Ottawa this week quietly withdrew two challenges to US anti-dumping duties on softwood lumber, a “strategic choice” aimed at improving relations with Washington, said Canada’s foreign ministry. The issue for US housebuilders, according to Gavronsky, is that they need softwood lumber. …The US industry accuses its Canadian rivals of dumping because they have no other market to sell into and it is convenient to ship it across the border.

Terrace, a small town nestled in the foothills of the mountains of BC, boomed in the 1920s, shipping Canadian cedar for telephone lines and power cables across the globe. But today local sawmill owners such as Warren Gavronsky are on the front line of a crisis hitting the country’s US$63bn forestry industry as a result of US duties and a slowdown in the world’s largest economy. …Canada’s forest products industry is one of the country’s largest employers, operating in hundreds of communities and providing 200,000 direct jobs. …Ottawa this week quietly withdrew two challenges to US anti-dumping duties on softwood lumber, a “strategic choice” aimed at improving relations with Washington, said Canada’s foreign ministry. The issue for US housebuilders, according to Gavronsky, is that they need softwood lumber. …The US industry accuses its Canadian rivals of dumping because they have no other market to sell into and it is convenient to ship it across the border. Canada is expected to announce it’s launching formal consultations on the North American trade pact within the next week, after the Trump administration kicked off its own review and the US ambassador said a larger deal is “not going to happen” soon. Canada-US Trade Minister Dominic LeBlanc’s office said the government is expected to imminently post an official notice seeking the public’s comments and feedback about the Canada-US-Mexico Agreement (CUSMA). In preparation for the review, “Canada will be engaging with Canadian industry leaders, provinces and territories and Indigenous partners,” LeBlanc’s office said. The US announced Tuesday it’s formally starting consultations to evaluate the agreement’s results over the past five years. …The formal negotiations to review CUSMA could begin in early 2026. …The prime minister and several ministers are headed to Mexico… an effort to shore up support ahead of the CUSMA review.

Canada is expected to announce it’s launching formal consultations on the North American trade pact within the next week, after the Trump administration kicked off its own review and the US ambassador said a larger deal is “not going to happen” soon. Canada-US Trade Minister Dominic LeBlanc’s office said the government is expected to imminently post an official notice seeking the public’s comments and feedback about the Canada-US-Mexico Agreement (CUSMA). In preparation for the review, “Canada will be engaging with Canadian industry leaders, provinces and territories and Indigenous partners,” LeBlanc’s office said. The US announced Tuesday it’s formally starting consultations to evaluate the agreement’s results over the past five years. …The formal negotiations to review CUSMA could begin in early 2026. …The prime minister and several ministers are headed to Mexico… an effort to shore up support ahead of the CUSMA review. Canada withdrew challenges against some import taxes the US levied against softwood lumber in what the government called a “strategic choice,” as Prime Minister Carney seeks a trade deal with President Trump. The government has revoked two separate claims disputing US anti-dumping duties on softwood lumber based on trading between June 2017 and December 2019, according to Canada’s Global Affairs department. “Canada has made this decision in close consultation with Canadian industry, provinces and key partners, and it reflects a strategic choice to maximize long-term interests and prospects for a negotiated resolution with the US,” John Babcock said. …The move follows a pattern of Carney’s government trying to remove so-called trade irritants in pursuit of a wider settlement with the Trump administration, which has erected tariffs against key Canadian industries like steel and autos, as well as a 35% “emergency” tariff against other goods if they aren’t compliant with the US-Mexico-Canada trade deal.

Canada withdrew challenges against some import taxes the US levied against softwood lumber in what the government called a “strategic choice,” as Prime Minister Carney seeks a trade deal with President Trump. The government has revoked two separate claims disputing US anti-dumping duties on softwood lumber based on trading between June 2017 and December 2019, according to Canada’s Global Affairs department. “Canada has made this decision in close consultation with Canadian industry, provinces and key partners, and it reflects a strategic choice to maximize long-term interests and prospects for a negotiated resolution with the US,” John Babcock said. …The move follows a pattern of Carney’s government trying to remove so-called trade irritants in pursuit of a wider settlement with the Trump administration, which has erected tariffs against key Canadian industries like steel and autos, as well as a 35% “emergency” tariff against other goods if they aren’t compliant with the US-Mexico-Canada trade deal.  Western Forest Products announced planned temporary operating curtailments at its BC sawmills during the fourth quarter of 2025. These planned curtailments, combined with temporary curtailments taken in Q3 of 2025, will collectively reduce lumber production by ~50 million board feet in the second half of 2025, amounting to ~6% of the Company’s annual lumber capacity. The curtailments are in response to persistently weak market conditions, further impacted by increases in US lumber duties. In addition, certain factors relating to the operating environment, including a lack of available economic log supply, ongoing harvesting permitting delays and the strike by the United Steelworkers Local 1-1937 at our La-kwa sa muqw Forestry Limited Partnership are also contributing factors. The temporary curtailments will be taken through a combination of reduced operating hours, an extended holiday break and reconfigured shifting schedules. The Chemainus sawmill, which was curtailed for the third quarter of 2025, will remain temporarily curtailed for the fourth quarter.

Western Forest Products announced planned temporary operating curtailments at its BC sawmills during the fourth quarter of 2025. These planned curtailments, combined with temporary curtailments taken in Q3 of 2025, will collectively reduce lumber production by ~50 million board feet in the second half of 2025, amounting to ~6% of the Company’s annual lumber capacity. The curtailments are in response to persistently weak market conditions, further impacted by increases in US lumber duties. In addition, certain factors relating to the operating environment, including a lack of available economic log supply, ongoing harvesting permitting delays and the strike by the United Steelworkers Local 1-1937 at our La-kwa sa muqw Forestry Limited Partnership are also contributing factors. The temporary curtailments will be taken through a combination of reduced operating hours, an extended holiday break and reconfigured shifting schedules. The Chemainus sawmill, which was curtailed for the third quarter of 2025, will remain temporarily curtailed for the fourth quarter.  Ontario’s Associate Minister of Forestry and Forest Products announced over $5 million in funding today for Interfor Sault Ste. Marie at the company’s mill on Peoples Road.

Ontario’s Associate Minister of Forestry and Forest Products announced over $5 million in funding today for Interfor Sault Ste. Marie at the company’s mill on Peoples Road.

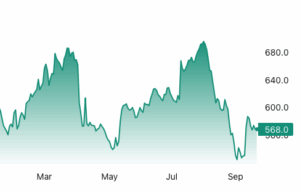

Lumber futures fell back below $570 per thousand board feet in September, reflecting the struggles in the US housing market. Builders are scaling back new construction amid a recent inventory glut and growing economic uncertainty, while the Trump administration’s fluctuating stance on tariffs for imported lumber over the past few months has added further volatility. Meanwhile, a significant gap remains between the number of homes for sale and the demand from Americans seeking housing. Affordability challenges have caused many buyers to withdraw in recent months, keeping construction activity muted throughout 2025. However, recent cuts in US interest rates, along with prospects of further easing, have helped curb some of the losses. Without a substantial increase in new home demand, the subdued pace of construction is likely to persist, as builders continue to compete with the steadily growing inventory of existing homes. [END]

Lumber futures fell back below $570 per thousand board feet in September, reflecting the struggles in the US housing market. Builders are scaling back new construction amid a recent inventory glut and growing economic uncertainty, while the Trump administration’s fluctuating stance on tariffs for imported lumber over the past few months has added further volatility. Meanwhile, a significant gap remains between the number of homes for sale and the demand from Americans seeking housing. Affordability challenges have caused many buyers to withdraw in recent months, keeping construction activity muted throughout 2025. However, recent cuts in US interest rates, along with prospects of further easing, have helped curb some of the losses. Without a substantial increase in new home demand, the subdued pace of construction is likely to persist, as builders continue to compete with the steadily growing inventory of existing homes. [END]

When the Trump administration more than doubled import fees on Canadian softwood lumber earlier this year, the goal was to support domestic prices and boost US production. Instead, prices have plunged, and mills on both sides of the border are scaling back. A benchmark for the commodity mostly used in construction has plunged 18% since an August peak to the lowest in seven months, driven by sluggish homebuilding activity and a glut of inventory. The drop shows how protectionist measures aren’t always enough to protect domestic industries from broader market dynamics at a time when high interest rates and elevated costs are squeezing consumers and weighing on their confidence, dampening demand for new homes. …“The US producers were looking for more of a price bump from the duties, and they didn’t get one,” said Brooks Mendell, at Forisk Consulting. “The interpretation of that is, well, the demand isn’t there.”

When the Trump administration more than doubled import fees on Canadian softwood lumber earlier this year, the goal was to support domestic prices and boost US production. Instead, prices have plunged, and mills on both sides of the border are scaling back. A benchmark for the commodity mostly used in construction has plunged 18% since an August peak to the lowest in seven months, driven by sluggish homebuilding activity and a glut of inventory. The drop shows how protectionist measures aren’t always enough to protect domestic industries from broader market dynamics at a time when high interest rates and elevated costs are squeezing consumers and weighing on their confidence, dampening demand for new homes. …“The US producers were looking for more of a price bump from the duties, and they didn’t get one,” said Brooks Mendell, at Forisk Consulting. “The interpretation of that is, well, the demand isn’t there.”  Housing starts and pre-sales in much of Southern Ontario have earned failing grades and are on track to get even worse, a new study warns — a situation that “should alarm policymakers across all three orders of government.” The report from University of Ottawa’s Missing Middle Initiative compares housing starts and sales in 34 municipalities across the Greater Toronto Area and neighbouring Southern Ontario cities for the first six months of 2025 with the same period from 2021–2024. It found starts are down 40% relative to that four-year average, with pre-construction condo sales plunging 89 per cent and other homes 70 per cent. The reduction in starts has direct employment implications, and the collapse in pre-construction sales, the study says, is “a clear indication that Ontario’s housing situation will get worse before it gets better, and that market weakness is not isolated to the condo market.” …The study paints a similarly bleak picture for the first half of 2025.

Housing starts and pre-sales in much of Southern Ontario have earned failing grades and are on track to get even worse, a new study warns — a situation that “should alarm policymakers across all three orders of government.” The report from University of Ottawa’s Missing Middle Initiative compares housing starts and sales in 34 municipalities across the Greater Toronto Area and neighbouring Southern Ontario cities for the first six months of 2025 with the same period from 2021–2024. It found starts are down 40% relative to that four-year average, with pre-construction condo sales plunging 89 per cent and other homes 70 per cent. The reduction in starts has direct employment implications, and the collapse in pre-construction sales, the study says, is “a clear indication that Ontario’s housing situation will get worse before it gets better, and that market weakness is not isolated to the condo market.” …The study paints a similarly bleak picture for the first half of 2025. Housing is the foundation of the economy. …It’s not a surprise, then, that the Trump administration recently said it was considering declaring the housing crisis a national emergency. The federal government alone can’t solve the housing crisis. That said, the administration could take steps that would meaningfully help make American housing more affordable. …One of the biggest issues is supply. …But

Housing is the foundation of the economy. …It’s not a surprise, then, that the Trump administration recently said it was considering declaring the housing crisis a national emergency. The federal government alone can’t solve the housing crisis. That said, the administration could take steps that would meaningfully help make American housing more affordable. …One of the biggest issues is supply. …But  Cardboard-box demand is slumping, flashing a potential warning about the health of the American consumer given that goods ranging from pizzas to ovens are transported in corrugated packaging. A historic run of pulp-mill closures is also signaling problems for the companies that make corrugated packaging as well as the timberland owners who sell them wood. International Paper, the country’s biggest box maker, announced last month the shutdown of two US containerboard mills, which make the brown paper that is folded into corrugated packaging. …It is a surprising turn in the e-commerce era. Box makers and analysts say demand presently suffers from uncertainty in US boardrooms and export markets because of President Trump’s tariffs as well as from weakening consumer spending. The sputtering housing market has also hurt, reducing the need for moving boxes as well as packaging for building products and appliances. [to access the full story a WSJ subscription is required]

Cardboard-box demand is slumping, flashing a potential warning about the health of the American consumer given that goods ranging from pizzas to ovens are transported in corrugated packaging. A historic run of pulp-mill closures is also signaling problems for the companies that make corrugated packaging as well as the timberland owners who sell them wood. International Paper, the country’s biggest box maker, announced last month the shutdown of two US containerboard mills, which make the brown paper that is folded into corrugated packaging. …It is a surprising turn in the e-commerce era. Box makers and analysts say demand presently suffers from uncertainty in US boardrooms and export markets because of President Trump’s tariffs as well as from weakening consumer spending. The sputtering housing market has also hurt, reducing the need for moving boxes as well as packaging for building products and appliances. [to access the full story a WSJ subscription is required]

TORONTO — World Wildlife Fund Canada’s

TORONTO — World Wildlife Fund Canada’s  Mosaic Forest Management says it has heard Vancouver Islanders loud and clear when it comes to accessing private forest lands,

Mosaic Forest Management says it has heard Vancouver Islanders loud and clear when it comes to accessing private forest lands,  Today on the back steps of the Legislature building, MP Aaron Gunn, MLA Anna Kindy along with five North Island Mayors are calling on Ottawa and BC to remove the red tape when it comes to cutting permits in the province. North Island- Powell River MP Aaron Gunn sent an open letter today to both Premier David Eby and Prime Minister Mark Carney telling North Vancouver Island and the province is in a forestry crisis. “Harvest volumes have collapsed in half and more than 5,400 jobs have been lost. It’s the result of made in BC, made in Canada policies that have delayed permitting, dramatically increased harvesting costs and crippled investors confidence,” said Gunn. The Mayor of Powell River Ron Woznow was at the press conference with Gunn, echoing his concerns. …BC Forests Minister Ravi Parmar reacted briefly… adding that more details on a ‘refreshed BC timber sales’ will be released Tuesday.

Today on the back steps of the Legislature building, MP Aaron Gunn, MLA Anna Kindy along with five North Island Mayors are calling on Ottawa and BC to remove the red tape when it comes to cutting permits in the province. North Island- Powell River MP Aaron Gunn sent an open letter today to both Premier David Eby and Prime Minister Mark Carney telling North Vancouver Island and the province is in a forestry crisis. “Harvest volumes have collapsed in half and more than 5,400 jobs have been lost. It’s the result of made in BC, made in Canada policies that have delayed permitting, dramatically increased harvesting costs and crippled investors confidence,” said Gunn. The Mayor of Powell River Ron Woznow was at the press conference with Gunn, echoing his concerns. …BC Forests Minister Ravi Parmar reacted briefly… adding that more details on a ‘refreshed BC timber sales’ will be released Tuesday.

Mosaic Forest Management has clearly heard that communities value their outdoor access. After receiving what the company calls an “overwhelming” response to a survey, they will be moving forward with next steps on improving its recreation program. The survey garnered 7,600 responses in 23 days. “What we heard was clear. Communities value access to the outdoors and want more and better opportunities to do so,” said Mosaic’s CEO Duncan Davies (see report titled

Mosaic Forest Management has clearly heard that communities value their outdoor access. After receiving what the company calls an “overwhelming” response to a survey, they will be moving forward with next steps on improving its recreation program. The survey garnered 7,600 responses in 23 days. “What we heard was clear. Communities value access to the outdoors and want more and better opportunities to do so,” said Mosaic’s CEO Duncan Davies (see report titled

Only a month after the twentieth anniversary of Hurricane Katrina, another anniversary comes due for a different catastrophic storm—it is the first anniversary after Hurricane Helene devastated the communities of the Southern Appalachians. On September 26, 2024, Hurricane Helene made landfall in southwestern Florida as a Category 4 hurricane with a peak sustained windspeed of 140 mph. After inundating Florida with storm surge, Helene swept north into Georgia and then the Carolinas, before stalling over Tennessee, Kentucky and Virginia and eventually dissipating. However, it brought both tornado-strength winds and a deluge of rainfall that triggered flooding throughout the mountains and valleys of the Southeast. The hurricane was one of the deadliest and most destructive on record, causing more than 250 deaths and just under $80 billion in damage. Helene cut a path over nine national forests from Florida to Kentucky. The forests and the USDA Forest Service employees that manage them were right in the path of destruction.

Only a month after the twentieth anniversary of Hurricane Katrina, another anniversary comes due for a different catastrophic storm—it is the first anniversary after Hurricane Helene devastated the communities of the Southern Appalachians. On September 26, 2024, Hurricane Helene made landfall in southwestern Florida as a Category 4 hurricane with a peak sustained windspeed of 140 mph. After inundating Florida with storm surge, Helene swept north into Georgia and then the Carolinas, before stalling over Tennessee, Kentucky and Virginia and eventually dissipating. However, it brought both tornado-strength winds and a deluge of rainfall that triggered flooding throughout the mountains and valleys of the Southeast. The hurricane was one of the deadliest and most destructive on record, causing more than 250 deaths and just under $80 billion in damage. Helene cut a path over nine national forests from Florida to Kentucky. The forests and the USDA Forest Service employees that manage them were right in the path of destruction.

The European Commission has proposed delaying the EU’s flagship anti-deforestation law for the second year in a row as it continues its war on red tape. The rules, which would force companies to stop using commodities that have been produced on deforested land, are unpopular with many businesses who argue they impose complex regulatory burdens. Several of the EU’s trading partners have also complained about the law. …The EU’s environment commissioner Jessika Roswall, announcing the delay of the European Union Deforestation Regulation said “We need the time to combat the risk with the load of information in the IT system.” …It’s the latest in a long string of actions by the Commission since late last year to weaken or delay green rules, part of a grand push to get rid of red tape and boost the global competitiveness of European industry.

The European Commission has proposed delaying the EU’s flagship anti-deforestation law for the second year in a row as it continues its war on red tape. The rules, which would force companies to stop using commodities that have been produced on deforested land, are unpopular with many businesses who argue they impose complex regulatory burdens. Several of the EU’s trading partners have also complained about the law. …The EU’s environment commissioner Jessika Roswall, announcing the delay of the European Union Deforestation Regulation said “We need the time to combat the risk with the load of information in the IT system.” …It’s the latest in a long string of actions by the Commission since late last year to weaken or delay green rules, part of a grand push to get rid of red tape and boost the global competitiveness of European industry.

WASHINGTON — Evidence that climate change harms public health is “beyond scientific dispute,” the independent National Academy of Sciences said in response to the Trump administration’s efforts to revoke a landmark U.S. government finding to that effect that underpins key environmental regulations. The NAS, a non-governmental nonprofit set up to advise the government on science, said human activity is releasing greenhouse gases that are warming the planet, increasing extreme temperatures and changing the oceans, all dangerous developments for the health and welfare of the United States public. Evidence to that effect has only grown stronger since 2009, the group said. In July, the Trump administration proposed revoking what’s known as the 2009 “endangerment” finding, the concept that climate change is a threat. Overturning it could pave the way for cutting a range of rules that limit pollution from cars, power plants and other sources.

WASHINGTON — Evidence that climate change harms public health is “beyond scientific dispute,” the independent National Academy of Sciences said in response to the Trump administration’s efforts to revoke a landmark U.S. government finding to that effect that underpins key environmental regulations. The NAS, a non-governmental nonprofit set up to advise the government on science, said human activity is releasing greenhouse gases that are warming the planet, increasing extreme temperatures and changing the oceans, all dangerous developments for the health and welfare of the United States public. Evidence to that effect has only grown stronger since 2009, the group said. In July, the Trump administration proposed revoking what’s known as the 2009 “endangerment” finding, the concept that climate change is a threat. Overturning it could pave the way for cutting a range of rules that limit pollution from cars, power plants and other sources. Wildfire smoke is the air quality nightmare of our generation, eating away at previous gains made by cracking down on industrial emissions and tailpipe pollution. Constant exposure to smoke is becoming a chronic threat even in places that historically haven’t had many wildfires. …All that smoke is projected to lead to tens of thousands more premature deaths in the coming years, according to a pair of eye-opening research papers published today in the journal Nature. …“Increasing wildfire smoke is a lived experience now for most people around the US,”

Wildfire smoke is the air quality nightmare of our generation, eating away at previous gains made by cracking down on industrial emissions and tailpipe pollution. Constant exposure to smoke is becoming a chronic threat even in places that historically haven’t had many wildfires. …All that smoke is projected to lead to tens of thousands more premature deaths in the coming years, according to a pair of eye-opening research papers published today in the journal Nature. …“Increasing wildfire smoke is a lived experience now for most people around the US,”