Shortly after Prime Minister Carney’s announcement of $500-million to help Canada’s softwood-lumber industry decrease its reliance on the hostile US market, BC’s Forestry Minister offered a modest target of 10%. …History suggests, however, that even that degree of market diversification stands to be an uphill battle. …While there have been modest inroads in China and Japan, diversification has mostly proved quixotic − partly because the proximity of the massive US housing market, for which there is not enough lumber harvested stateside to serve, has been a disincentive to reach further….Rick Doman, chair BC’s Forestry Innovation Investment board − mentioned South Korea, Vietnam, India, Australia, Britain. …Canada Wood Group president Bruce St. John describe it as a painstaking process involving promotional efforts, direct engagement with local governments on building codes and standards, and expertise-building for industry. …To succeed, particularly amid growing softwood-export competition from Europe especially, will require steady focus through and perhaps beyond the Trump era. [to access the full story a Globe & Mail subscription is required]

Shortly after Prime Minister Carney’s announcement of $500-million to help Canada’s softwood-lumber industry decrease its reliance on the hostile US market, BC’s Forestry Minister offered a modest target of 10%. …History suggests, however, that even that degree of market diversification stands to be an uphill battle. …While there have been modest inroads in China and Japan, diversification has mostly proved quixotic − partly because the proximity of the massive US housing market, for which there is not enough lumber harvested stateside to serve, has been a disincentive to reach further….Rick Doman, chair BC’s Forestry Innovation Investment board − mentioned South Korea, Vietnam, India, Australia, Britain. …Canada Wood Group president Bruce St. John describe it as a painstaking process involving promotional efforts, direct engagement with local governments on building codes and standards, and expertise-building for industry. …To succeed, particularly amid growing softwood-export competition from Europe especially, will require steady focus through and perhaps beyond the Trump era. [to access the full story a Globe & Mail subscription is required]

The provincial government, through Newfoundland and Labrador Hydro, is extending its agreement with Corner Brook Pulp and Paper to buy electricity. The initial agreement was made in March, 2024 for Hydro to buy electricity from Deer Lake Power, which energizes the paper-making machines at the Corner Brook mill for 27.5 cents per kilowatt hour. The deal has now been extended until March 31, 2026. Hydro will continue to purchase excess green energy from Deer Lake Power, while the mill continues work to identify new revenue sources through viable wood-based projects “to unlock Newfoundland and Labrador’s high forest potential while further stabilizing the mill’s sustainability and future,” wrote the province’s Department of Fisheries, Forestry and Agriculture in a news release on Wednesday. The department said the agreement will not impact rate payers. The announcement comes after the mill was forced to pause operations due to a number of wildfires.

The provincial government, through Newfoundland and Labrador Hydro, is extending its agreement with Corner Brook Pulp and Paper to buy electricity. The initial agreement was made in March, 2024 for Hydro to buy electricity from Deer Lake Power, which energizes the paper-making machines at the Corner Brook mill for 27.5 cents per kilowatt hour. The deal has now been extended until March 31, 2026. Hydro will continue to purchase excess green energy from Deer Lake Power, while the mill continues work to identify new revenue sources through viable wood-based projects “to unlock Newfoundland and Labrador’s high forest potential while further stabilizing the mill’s sustainability and future,” wrote the province’s Department of Fisheries, Forestry and Agriculture in a news release on Wednesday. The department said the agreement will not impact rate payers. The announcement comes after the mill was forced to pause operations due to a number of wildfires.

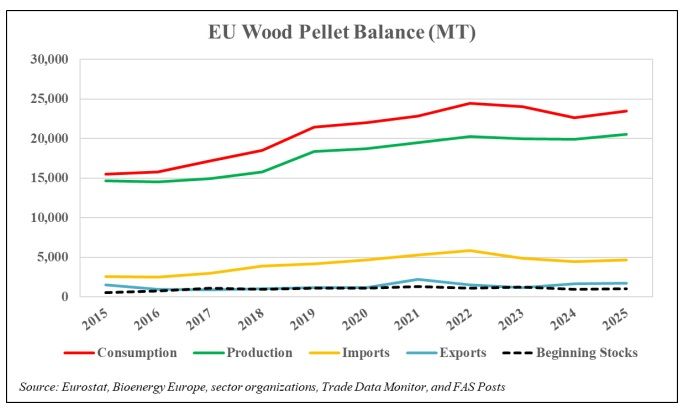

Donald Trump has called on the European Union to hit China and India with tariffs of up to 100% to force Russian president Vladimir Putin to end the war in Ukraine. The US president made the demand during a meeting between US and EU officials discussing options to increase economic pressure on Russia. …Last month, the US imposed a 50% tariff on goods from India, which included a 25% penalty for its transactions with Russia. Although the EU has said it would end its dependency on Russian energy, around 19% of its natural gas imports still come from there. If the EU does impose the tariffs on China and India it would mark a change to its approach of attempting to isolate Russia with sanctions rather than levies.

Donald Trump has called on the European Union to hit China and India with tariffs of up to 100% to force Russian president Vladimir Putin to end the war in Ukraine. The US president made the demand during a meeting between US and EU officials discussing options to increase economic pressure on Russia. …Last month, the US imposed a 50% tariff on goods from India, which included a 25% penalty for its transactions with Russia. Although the EU has said it would end its dependency on Russian energy, around 19% of its natural gas imports still come from there. If the EU does impose the tariffs on China and India it would mark a change to its approach of attempting to isolate Russia with sanctions rather than levies.

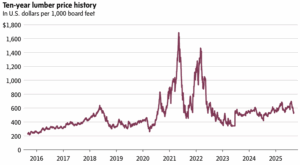

EUGENE, Oregon — President Trump’s demand that the US increase timber output by a quarter is running into a math problem: Lumber companies may not make as much money on wood in the coming months. A steep drop in lumber futures prices nationally is jolting the wood products business just as the Trump administration is prodding the industry — including the government’s own forest managers — to ramp up production so the US doesn’t have to rely on imports. Futures prices on lumber at the end of last week dipped to $527 per MFBM, the lowest point in a year. For Weyerhaeuser, which operates a mill in Cottage Grove, Oregon, the pricing signal isn’t sounding alarms just yet. The mill’s in the middle of a multiyear modernization said representatives who figure the market is doing one of its usual seesaws. [to access the full story an E&E News subscription is required]

EUGENE, Oregon — President Trump’s demand that the US increase timber output by a quarter is running into a math problem: Lumber companies may not make as much money on wood in the coming months. A steep drop in lumber futures prices nationally is jolting the wood products business just as the Trump administration is prodding the industry — including the government’s own forest managers — to ramp up production so the US doesn’t have to rely on imports. Futures prices on lumber at the end of last week dipped to $527 per MFBM, the lowest point in a year. For Weyerhaeuser, which operates a mill in Cottage Grove, Oregon, the pricing signal isn’t sounding alarms just yet. The mill’s in the middle of a multiyear modernization said representatives who figure the market is doing one of its usual seesaws. [to access the full story an E&E News subscription is required] SHERIDAN, Oregon — The Oregon Department of Environmental Quality (DEQ) has fined a Yamhill County wood treating company $1,055,825 for numerous violations of environmental regulations for water quality, hazardous waste and spill response and cleanup.

SHERIDAN, Oregon — The Oregon Department of Environmental Quality (DEQ) has fined a Yamhill County wood treating company $1,055,825 for numerous violations of environmental regulations for water quality, hazardous waste and spill response and cleanup.

BEMIDJI, Minnesota — The West Fraser wood engineering plant west of Bemidji was one of three companies to receive part of $4.2 million in business expansion grants from the state. The state’s Department of Employment and Economic Development stated in a news release that the three projects are expected to create or retain 587 jobs and leverage more than $270 million in private investment. West Fraser plans to renovate an existing building and improve the operating site in the small community of Solway. The operation there produces engineered wood products, such as OSB or particle board, that are used widely in construction and other industries. The project will receive more than $1 million in financing from the state’s Job Creation Fund, with the company expected to invest $137 million. The project is expected to retain 132 jobs.

BEMIDJI, Minnesota — The West Fraser wood engineering plant west of Bemidji was one of three companies to receive part of $4.2 million in business expansion grants from the state. The state’s Department of Employment and Economic Development stated in a news release that the three projects are expected to create or retain 587 jobs and leverage more than $270 million in private investment. West Fraser plans to renovate an existing building and improve the operating site in the small community of Solway. The operation there produces engineered wood products, such as OSB or particle board, that are used widely in construction and other industries. The project will receive more than $1 million in financing from the state’s Job Creation Fund, with the company expected to invest $137 million. The project is expected to retain 132 jobs.

Timber illegally sourced from Russia has been found in the UK housing supply chain, according to an investigation by Australian forensic supply chain specialist Source Certain. Imports of Russian timber were prohibited in 2022 following the invasion of Ukraine. However, the investigation identified a smuggling operation that concealed the timber’s origin by relabelling it as material from the Baltic States, including Estonia, Latvia and Lithuania. The findings raise concerns for the housing and construction sectors, where suppliers investing in certified and responsibly sourced timber face higher operational costs. Industry voices warn that without effective monitoring, compliant businesses are being undercut and the credibility of the wider supply chain is being damaged. In response, UK-based Think Timber has introduced a packaging system designed to provide traceability from forest to building site. Each pack incorporates a unique QR code that, when scanned, verifies the chain of custody and origin of the material.

Timber illegally sourced from Russia has been found in the UK housing supply chain, according to an investigation by Australian forensic supply chain specialist Source Certain. Imports of Russian timber were prohibited in 2022 following the invasion of Ukraine. However, the investigation identified a smuggling operation that concealed the timber’s origin by relabelling it as material from the Baltic States, including Estonia, Latvia and Lithuania. The findings raise concerns for the housing and construction sectors, where suppliers investing in certified and responsibly sourced timber face higher operational costs. Industry voices warn that without effective monitoring, compliant businesses are being undercut and the credibility of the wider supply chain is being damaged. In response, UK-based Think Timber has introduced a packaging system designed to provide traceability from forest to building site. Each pack incorporates a unique QR code that, when scanned, verifies the chain of custody and origin of the material.

The Canada Mortgage and Housing Corporation (CMHC) released its

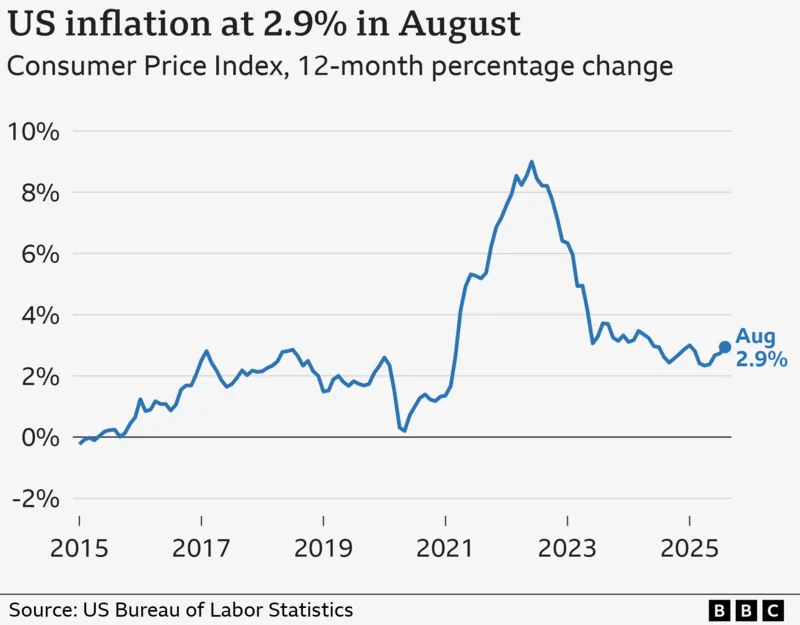

The Canada Mortgage and Housing Corporation (CMHC) released its  A “normal” annual softwood lumber price cycle sees prices dropping from Labour Day until early in the new year when buying starts again for the spring construction season. We are also expecting three interest rate cuts this year from the US Federal Reserve. With lower mortgage rates expected, will we see increasing demand for lumber? …The short term outlook for lumber prices continues to see weakness with price projections as low as US$450 per thousand board feet until the spring construction season. Looking into 2026 and 2027, prices are expected to recover to the mid-US$500 to low-US$600 per thousand board feet range. Ongoing duties, the upcoming court rulings on tariffs and the protracted housing shortage will all impact the price of lumber over the next two years. [to access the full story, a Globe & Mail subscription is required]

A “normal” annual softwood lumber price cycle sees prices dropping from Labour Day until early in the new year when buying starts again for the spring construction season. We are also expecting three interest rate cuts this year from the US Federal Reserve. With lower mortgage rates expected, will we see increasing demand for lumber? …The short term outlook for lumber prices continues to see weakness with price projections as low as US$450 per thousand board feet until the spring construction season. Looking into 2026 and 2027, prices are expected to recover to the mid-US$500 to low-US$600 per thousand board feet range. Ongoing duties, the upcoming court rulings on tariffs and the protracted housing shortage will all impact the price of lumber over the next two years. [to access the full story, a Globe & Mail subscription is required]

Michelle Conroy says she appreciates all the work the province’s firefighters have put into protecting Miramichi, as wildfires raged out of control. But the Progressive Conservative MLA for Miramichi East also wonders if their employer, the Department of Natural Resources, might have unintentionally made conditions in the forests worse by encouraging herbicide spraying so that New Brunswick’s powerful timber industry could have softwood plantations. …The idea that the ecosystem could had been thrown “out of balance,” was addressed by Deputy Minister Cade Libby. “Your comment is one we’ve heard quite a few times,” Libby said. “Yes, herbicides target broad-leafed plants. …But a working forest is a great way to mitigate forest fire risk.” The deputy minister said timber cutters use forestry roads that act as fire breaks and that they work on forests of various types and age classes that have less fuel load than virgin, old-growth forests do.

Michelle Conroy says she appreciates all the work the province’s firefighters have put into protecting Miramichi, as wildfires raged out of control. But the Progressive Conservative MLA for Miramichi East also wonders if their employer, the Department of Natural Resources, might have unintentionally made conditions in the forests worse by encouraging herbicide spraying so that New Brunswick’s powerful timber industry could have softwood plantations. …The idea that the ecosystem could had been thrown “out of balance,” was addressed by Deputy Minister Cade Libby. “Your comment is one we’ve heard quite a few times,” Libby said. “Yes, herbicides target broad-leafed plants. …But a working forest is a great way to mitigate forest fire risk.” The deputy minister said timber cutters use forestry roads that act as fire breaks and that they work on forests of various types and age classes that have less fuel load than virgin, old-growth forests do. NOVA SCOTIA — Mikmaq have begun blocking logging trucks from leaving Hunters Mountain. Madonna Bernard began the blockade on Monday afternoon when she stood in front of two logging trucks. She was then joined by other Mi’kmaq seeking to stop harvesting from the Cape Breton Highlands. …“This is not a protest, this is a protection. We’re willing to stay as long as it takes.” A large RCMP presence has gathered and more Mi’kmaq supporters are arriving. …Port Hawkesbury Paper mill manager Bevan Lock said that the supercalendered paper relies on wood coming from the highlands for a significant part of its woods fibre. He said some 70 people work for forestry and logging contractors operating in the area. “The province and RCMP have taken steps to remove the blockade and allow travel on a public road,” said Lock.

NOVA SCOTIA — Mikmaq have begun blocking logging trucks from leaving Hunters Mountain. Madonna Bernard began the blockade on Monday afternoon when she stood in front of two logging trucks. She was then joined by other Mi’kmaq seeking to stop harvesting from the Cape Breton Highlands. …“This is not a protest, this is a protection. We’re willing to stay as long as it takes.” A large RCMP presence has gathered and more Mi’kmaq supporters are arriving. …Port Hawkesbury Paper mill manager Bevan Lock said that the supercalendered paper relies on wood coming from the highlands for a significant part of its woods fibre. He said some 70 people work for forestry and logging contractors operating in the area. “The province and RCMP have taken steps to remove the blockade and allow travel on a public road,” said Lock. After years of wildland firefighters developing cancer, lung disease and other health issues while not being allowed to wear masks as they work, the US Forest Service will now allow these crews to wear masks. The policy turnaround comes as the Forest Service posted new guidance on Monday “acknowledging for the first time that masks can protect firefighters against harmful particles in wildfire smoke,” per

After years of wildland firefighters developing cancer, lung disease and other health issues while not being allowed to wear masks as they work, the US Forest Service will now allow these crews to wear masks. The policy turnaround comes as the Forest Service posted new guidance on Monday “acknowledging for the first time that masks can protect firefighters against harmful particles in wildfire smoke,” per  The Trump administration is looking to finalize a repeal of a longstanding Roadless Rule with a public comment period that

The Trump administration is looking to finalize a repeal of a longstanding Roadless Rule with a public comment period that  LINCOLN COUNTY, Oregon — Travelers exploring private timber lands along the Oregon Coast may encounter locked gates or restricted access, but this is not due to a desire to keep citizens off the property, the Lincoln County Sheriff’s Office said. The closures are a response to increasing incidents of littering, vehicle abandonment, theft of forest products, and criminal mischief. Common acts of vandalism include property destruction by 4x4s and ATVs in unauthorized areas and damage to road access gates, officials said. These actions not only destroy the natural beauty of the forests but also incur costs for cleanup and repairs, which are paid by private timber companies and taxpayers.

LINCOLN COUNTY, Oregon — Travelers exploring private timber lands along the Oregon Coast may encounter locked gates or restricted access, but this is not due to a desire to keep citizens off the property, the Lincoln County Sheriff’s Office said. The closures are a response to increasing incidents of littering, vehicle abandonment, theft of forest products, and criminal mischief. Common acts of vandalism include property destruction by 4x4s and ATVs in unauthorized areas and damage to road access gates, officials said. These actions not only destroy the natural beauty of the forests but also incur costs for cleanup and repairs, which are paid by private timber companies and taxpayers. The increase in wildfires over the past few decades is changing the Colorado landscape in more ways than one. Not only do fires temporarily decimate the impacted areas but according to research out of Colorado State University, they are actually changing how, and if, forests regenerate post fire. “There are definitely some places where they’re coming back really well; it just takes a long time for trees to grow back,” said Camille Stevens-Rumann, CSU associate professor of Forest and Rangeland Stewardship. “But there are definitely other places that are not recovering and are not turning back into the forests that we expect them to be. …Reseeding efforts in these locations have shown mixed results, forcing researchers and forestry officials to look at alternative species. …“I think we do have to adapt and think about the fact that those forests are going to look differently.”

The increase in wildfires over the past few decades is changing the Colorado landscape in more ways than one. Not only do fires temporarily decimate the impacted areas but according to research out of Colorado State University, they are actually changing how, and if, forests regenerate post fire. “There are definitely some places where they’re coming back really well; it just takes a long time for trees to grow back,” said Camille Stevens-Rumann, CSU associate professor of Forest and Rangeland Stewardship. “But there are definitely other places that are not recovering and are not turning back into the forests that we expect them to be. …Reseeding efforts in these locations have shown mixed results, forcing researchers and forestry officials to look at alternative species. …“I think we do have to adapt and think about the fact that those forests are going to look differently.”

The European Commission has announced dates for virtual training sessions on the EUDR Information System, open to all interested parties. These sessions provide guidance on submitting due diligence statements under the European Union Deforestation Regulation (EUDR). While these sessions are available to all, WPAC anticipates that most of our members will meet their EUDR obligations through the Sustainable Biomass Program (SBP) system, which we helped to develop. EUDR establishes robust requirements for traceability, due diligence, and risk mitigation. SBP has developed a voluntary EUDR module integrated into its Data Transfer System (DTS), helping Certificate Holders prepare now for compliance ahead of the December 2025 implementation deadline. …Learn more about

The European Commission has announced dates for virtual training sessions on the EUDR Information System, open to all interested parties. These sessions provide guidance on submitting due diligence statements under the European Union Deforestation Regulation (EUDR). While these sessions are available to all, WPAC anticipates that most of our members will meet their EUDR obligations through the Sustainable Biomass Program (SBP) system, which we helped to develop. EUDR establishes robust requirements for traceability, due diligence, and risk mitigation. SBP has developed a voluntary EUDR module integrated into its Data Transfer System (DTS), helping Certificate Holders prepare now for compliance ahead of the December 2025 implementation deadline. …Learn more about  The UK’s largest and most advanced seed centre has opened in Cheshire. The store near Delamere Forest will process four tonnes of seeds every year, which Forestry England said was enough to grow millions of trees for decades to come. It added the centre was “a significant milestone in protecting the future resilience of our forests”. Forestry Minister Mary Creagh said the building was “nationally significant” because it was “part of our climate resilience”. Creagh added: “We are the largest wood importer in the world, and in a climate-constrained future we are going to have to grow more of our own.” The centre, funded through the Nature for Climate Fund and Forestry England, aims to provide seeds to grow climate-adapted trees. …Tristram Hilborn, chief operating officer of Forestry England, said: “What we need to consider for 100 a years’ time is the sort of trees that will thrive in that sort of climate.”

The UK’s largest and most advanced seed centre has opened in Cheshire. The store near Delamere Forest will process four tonnes of seeds every year, which Forestry England said was enough to grow millions of trees for decades to come. It added the centre was “a significant milestone in protecting the future resilience of our forests”. Forestry Minister Mary Creagh said the building was “nationally significant” because it was “part of our climate resilience”. Creagh added: “We are the largest wood importer in the world, and in a climate-constrained future we are going to have to grow more of our own.” The centre, funded through the Nature for Climate Fund and Forestry England, aims to provide seeds to grow climate-adapted trees. …Tristram Hilborn, chief operating officer of Forestry England, said: “What we need to consider for 100 a years’ time is the sort of trees that will thrive in that sort of climate.” In the Northern Hemisphere, the more than twofold difference between the atmospheric inversion and remote sensing–derived estimate of the net land carbon sink is an unresolved puzzle that challenges our fundamental understanding of the global carbon cycle. We provide several lines of evidence that much of this discrepancy can be resolved by a weak net land carbon sink that is distributed mainly in the Northern Hemisphere, together with a relatively small reduction in the magnitude of fossil fuel emissions and a small increase in ocean uptake. …A strong land carbon sink, as identified in past research, has often been used to support the potential of nature-based climate solutions in meeting climate stabilization targets. However, if the weak land sink hypothesis is correct, then the role of CO2 fertilization in enhancing forest carbon stocks might be overestimated. At the same time, projections of carbon accumulation in reforestation and afforestation projects may be optimistic too.

In the Northern Hemisphere, the more than twofold difference between the atmospheric inversion and remote sensing–derived estimate of the net land carbon sink is an unresolved puzzle that challenges our fundamental understanding of the global carbon cycle. We provide several lines of evidence that much of this discrepancy can be resolved by a weak net land carbon sink that is distributed mainly in the Northern Hemisphere, together with a relatively small reduction in the magnitude of fossil fuel emissions and a small increase in ocean uptake. …A strong land carbon sink, as identified in past research, has often been used to support the potential of nature-based climate solutions in meeting climate stabilization targets. However, if the weak land sink hypothesis is correct, then the role of CO2 fertilization in enhancing forest carbon stocks might be overestimated. At the same time, projections of carbon accumulation in reforestation and afforestation projects may be optimistic too.