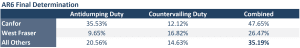

The United States has increased countervailing duties on Canadian softwood lumber [from 6.74% to 14.63%], bringing the total duties on lumber to 35.19%. The decision was announced on Friday by the US Department of Commerce. Although the escalating fees were anticipated, they still drew swift condemnation and words of alarm from industry and political leaders in BC and Ontario, who say it is yet the latest example of unfair treatment of the industry from their largest and most important international partner. “Two words describe Donald Trump’s latest move to increase countervailing duties on Canadian softwood lumber: absurd and reckless,” B.C.’s Forests Minister Ravi Parmar said. “Adding these additional softwood duties … will only worsen an affordability crisis on both sides of the border.”

The United States has increased countervailing duties on Canadian softwood lumber [from 6.74% to 14.63%], bringing the total duties on lumber to 35.19%. The decision was announced on Friday by the US Department of Commerce. Although the escalating fees were anticipated, they still drew swift condemnation and words of alarm from industry and political leaders in BC and Ontario, who say it is yet the latest example of unfair treatment of the industry from their largest and most important international partner. “Two words describe Donald Trump’s latest move to increase countervailing duties on Canadian softwood lumber: absurd and reckless,” B.C.’s Forests Minister Ravi Parmar said. “Adding these additional softwood duties … will only worsen an affordability crisis on both sides of the border.”

In response to the increase in countervailing duties:

- Kim Haakstad, Council of Forest Industries: COFI condemns doubling of duties. Urges action to improve business environment for forestry in BC

- Government of Ontario Ministers: Ontario renews calls for removal of duties on softwood lumber exports

- Kurt Niquidet, BC Lumber Trade Council: Urges Canada and the US governments to make resolving the dispute a top economic priority

- Northern Ontario Municipalities: Softwood lumber tariffs ‘deal a serious blow’ to northern forestry sector

A $1.2-billion lifeline from Ottawa that’s being thrown to the forest industry is welcome news to northwestern Ontario mayors and the Canadian Wood Council. …The 37-member Northwestern Ontario Municipal Association (NOMA) called it a “significant and timely commitment to ensuring the long-term competitiveness of the forest sector” and comes at a crucial time when local jobs, economic growth and municipal stability is on the line. …“These measures recognize the vital role of forestry in Northwestern Ontario and across Canada,” said Marathon Mayor and NOMA president Rick Dubas in a statement, “helping our sector adapt to ongoing trade challenges, protect local jobs, and create opportunities for both Indigenous and non-Indigenous communities.”

A $1.2-billion lifeline from Ottawa that’s being thrown to the forest industry is welcome news to northwestern Ontario mayors and the Canadian Wood Council. …The 37-member Northwestern Ontario Municipal Association (NOMA) called it a “significant and timely commitment to ensuring the long-term competitiveness of the forest sector” and comes at a crucial time when local jobs, economic growth and municipal stability is on the line. …“These measures recognize the vital role of forestry in Northwestern Ontario and across Canada,” said Marathon Mayor and NOMA president Rick Dubas in a statement, “helping our sector adapt to ongoing trade challenges, protect local jobs, and create opportunities for both Indigenous and non-Indigenous communities.” A BC manufacturer that says it’s facing closure is accusing the provincial government of hypocrisy after the premier recently touted a product it had a hand in. BC Veneer Products provided the wood fibre that UBC designers used to fabricate a soccer ball out of innovative “wood leather,” something which Premier Eby promoted while on a June trade mission to Japan. …The problem, Gunia explained, is the company hasn’t been able to secure more logs to keep his plant and its 17 employees working. The forestry company he works with on Vancouver Island has already reached its maximum allowable cut for the year. The operator has another block it can harvest in January, but Gunia says that will be too late. …Gunia said his company’s troubles are particularly galling, given the emphasis the premier and the province have put on promoting value-added wood products.

A BC manufacturer that says it’s facing closure is accusing the provincial government of hypocrisy after the premier recently touted a product it had a hand in. BC Veneer Products provided the wood fibre that UBC designers used to fabricate a soccer ball out of innovative “wood leather,” something which Premier Eby promoted while on a June trade mission to Japan. …The problem, Gunia explained, is the company hasn’t been able to secure more logs to keep his plant and its 17 employees working. The forestry company he works with on Vancouver Island has already reached its maximum allowable cut for the year. The operator has another block it can harvest in January, but Gunia says that will be too late. …Gunia said his company’s troubles are particularly galling, given the emphasis the premier and the province have put on promoting value-added wood products. For one local lumber mill, the federal government’s announcement of support for the Canadian softwood lumber industry is a step in the right direction. Nick Arkle, CEO at Gorman Brothers Lumber, said in his 50 years of working in the forestry industry, he hasn’t sensed a government that has been this supportive at a federal level. “Both federally and provincially, I’m seeing some major shifts,” Arkle said after Prime Minister Mark Carney visited the Gorman Brothers Lumber mill in West Kelowna to announce the federal government’s strategy to bolster Canada’s softwood lumber industry. …Arkle said Canada also has to figure out how to get along with its neighbours. Gorman Brothers has strong relationships with many customers in the U.S., said Arkle, and those customers can’t figure out why they’ve got this trade action going on because they want Gorman Brothers’ lumber.

For one local lumber mill, the federal government’s announcement of support for the Canadian softwood lumber industry is a step in the right direction. Nick Arkle, CEO at Gorman Brothers Lumber, said in his 50 years of working in the forestry industry, he hasn’t sensed a government that has been this supportive at a federal level. “Both federally and provincially, I’m seeing some major shifts,” Arkle said after Prime Minister Mark Carney visited the Gorman Brothers Lumber mill in West Kelowna to announce the federal government’s strategy to bolster Canada’s softwood lumber industry. …Arkle said Canada also has to figure out how to get along with its neighbours. Gorman Brothers has strong relationships with many customers in the U.S., said Arkle, and those customers can’t figure out why they’ve got this trade action going on because they want Gorman Brothers’ lumber.

KINGSPORT, Tennessee — Vera Gilmer, a 30-year Kingsport resident, arrived at the Kingsport Economic Development Board meeting for the update on Domtar’s packaging mill. She shared her frustration with the board about the mill’s odor over the last month. …Gilmer stressed that the smell has worsened recently. …Domtar mill manager Troy Wilson gave an update on the digester’s construction and addressed what could possibly worsen Domtar’s odor in the meantime. …Wilson said worsening odor is likely attributable to Domtar’s current wastewater treatment system, a lagoon system which he described as “antiquated” and sensitive to the weather. He also shared that the rainstorm that passed over Kingsport Wednesday last week put a strain on the wastewater system. …Domtar has spent $20 million on the digester so far. At its peak, the digester project will employ 140 people, according to Wilson.

KINGSPORT, Tennessee — Vera Gilmer, a 30-year Kingsport resident, arrived at the Kingsport Economic Development Board meeting for the update on Domtar’s packaging mill. She shared her frustration with the board about the mill’s odor over the last month. …Gilmer stressed that the smell has worsened recently. …Domtar mill manager Troy Wilson gave an update on the digester’s construction and addressed what could possibly worsen Domtar’s odor in the meantime. …Wilson said worsening odor is likely attributable to Domtar’s current wastewater treatment system, a lagoon system which he described as “antiquated” and sensitive to the weather. He also shared that the rainstorm that passed over Kingsport Wednesday last week put a strain on the wastewater system. …Domtar has spent $20 million on the digester so far. At its peak, the digester project will employ 140 people, according to Wilson.

VANCOUVER, BC – Western Forest Products reported its second quarter 2025 financial results. Highlights include: Revenue of $289.1 million (versus $309.5 million in the second quarter of 2024, and $262.5 million in the first quarter of 2025); Adjusted EBITDA of $0.5 million in the second quarter of 2025 (versus $9.4 million in the second quarter of 2024, and $3.5 million in the first quarter of 2025; Net loss was $17.4 million in the second quarter of 2025, as compared to a net loss of $5.7 million in the second quarter of 2024, and net income of $13.8 million in the first quarter of 2025. …Markets in North America are expected to be volatile through the third quarter of 2025 as softwood lumber duties have increased significantly. Persistently high interest rates, low consumer confidence and general economic uncertainty are leading to a slower pace in repairs and renovations, and housing activity. Expectations are for this trend to continue throughout the third quarter of 2025.

VANCOUVER, BC – Western Forest Products reported its second quarter 2025 financial results. Highlights include: Revenue of $289.1 million (versus $309.5 million in the second quarter of 2024, and $262.5 million in the first quarter of 2025); Adjusted EBITDA of $0.5 million in the second quarter of 2025 (versus $9.4 million in the second quarter of 2024, and $3.5 million in the first quarter of 2025; Net loss was $17.4 million in the second quarter of 2025, as compared to a net loss of $5.7 million in the second quarter of 2024, and net income of $13.8 million in the first quarter of 2025. …Markets in North America are expected to be volatile through the third quarter of 2025 as softwood lumber duties have increased significantly. Persistently high interest rates, low consumer confidence and general economic uncertainty are leading to a slower pace in repairs and renovations, and housing activity. Expectations are for this trend to continue throughout the third quarter of 2025. BURNABY, BC — Interfor recorded net earnings in Q2’25 of $11.1 million compared to a net loss of $35.1 million in Q1’25 and a net loss of $75.8 million Q2’24. Adjusted EBITDA was $17.2 million on sales of $780.5 million in Q2’25 versus Adjusted EBITDA of $48.6 million on sales of $735.5 million in Q1’25 and an Adjusted EBITDA loss of $16.7 million on sales of $771.2 million in Q2’24. …North American lumber markets over the near term are expected to remain volatile as the economy continues to adjust to changing monetary policies, tariffs, labour shortages and geo-political uncertainty. …Overall, the Company is well positioned to navigate this volatility with a diversified product mix in Canada and the US, with approximately 60% of its total lumber produced and sold within the US Ultimately, only about 25% of the Company’s total lumber production is exported from Canada to the U.S. and exposed to duties and any potential tariff.

BURNABY, BC — Interfor recorded net earnings in Q2’25 of $11.1 million compared to a net loss of $35.1 million in Q1’25 and a net loss of $75.8 million Q2’24. Adjusted EBITDA was $17.2 million on sales of $780.5 million in Q2’25 versus Adjusted EBITDA of $48.6 million on sales of $735.5 million in Q1’25 and an Adjusted EBITDA loss of $16.7 million on sales of $771.2 million in Q2’24. …North American lumber markets over the near term are expected to remain volatile as the economy continues to adjust to changing monetary policies, tariffs, labour shortages and geo-political uncertainty. …Overall, the Company is well positioned to navigate this volatility with a diversified product mix in Canada and the US, with approximately 60% of its total lumber produced and sold within the US Ultimately, only about 25% of the Company’s total lumber production is exported from Canada to the U.S. and exposed to duties and any potential tariff. The Canada Mortgage and Housing Corporation (CMHC) has just issued a sobering warning to policymakers regarding the state of Canadian housing. Yet, governments do not appear to be getting the message, nor do they seem willing to take the necessary steps to address the crisis. In their

The Canada Mortgage and Housing Corporation (CMHC) has just issued a sobering warning to policymakers regarding the state of Canadian housing. Yet, governments do not appear to be getting the message, nor do they seem willing to take the necessary steps to address the crisis. In their  Canada’s merchandise trade deficit widened in June to C$5.9 billion as imports grew faster than exports due to a one-time high-value oil equipment import. The deficit observed in June is the second highest on record after the deficit expanded to its largest in history in April to C$7.6 billion, when the impact of US tariffs first started to weigh. Canada’s exports to the US as a share of total exports shrank to 70% in June from 83% in the same period a year ago while its surplus with the US contracted by a half in the same period, data showed. Total imports were up 1.4% in June to C$67.6 billion from a drop of 1.6% in the prior month, Statistics Canada said. Canada’s total exports grew 0.9% in June to C$61.74 billion following an increase of 2% in May, led primarily by an increase in crude oil exports.

Canada’s merchandise trade deficit widened in June to C$5.9 billion as imports grew faster than exports due to a one-time high-value oil equipment import. The deficit observed in June is the second highest on record after the deficit expanded to its largest in history in April to C$7.6 billion, when the impact of US tariffs first started to weigh. Canada’s exports to the US as a share of total exports shrank to 70% in June from 83% in the same period a year ago while its surplus with the US contracted by a half in the same period, data showed. Total imports were up 1.4% in June to C$67.6 billion from a drop of 1.6% in the prior month, Statistics Canada said. Canada’s total exports grew 0.9% in June to C$61.74 billion following an increase of 2% in May, led primarily by an increase in crude oil exports. It’s been over a week since the U.S. Commerce Department confirmed that it’s nearly tripling its anti-dumping duties on Canadian lumber imports from 7.66% to 20.56% following its annual review. The response from north of the border has been apoplectic, to say the least. …In the US, several entities are worried about the hiked duties, too. The NAHB continues to sound the alarm that new duties will raise the cost of homebuilding. …”We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement.” …The US Lumber Coalition continues to be the loudest voice in the room in favor. …”Canada continues its relentless shipments of dumped and subsidized lumber with devastating consequences for mills, workers, and communities.” …The downstream effects of all these trade war machinations remain to be seen, though the cross-border lumber trade has already slowed down considerably.

It’s been over a week since the U.S. Commerce Department confirmed that it’s nearly tripling its anti-dumping duties on Canadian lumber imports from 7.66% to 20.56% following its annual review. The response from north of the border has been apoplectic, to say the least. …In the US, several entities are worried about the hiked duties, too. The NAHB continues to sound the alarm that new duties will raise the cost of homebuilding. …”We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement.” …The US Lumber Coalition continues to be the loudest voice in the room in favor. …”Canada continues its relentless shipments of dumped and subsidized lumber with devastating consequences for mills, workers, and communities.” …The downstream effects of all these trade war machinations remain to be seen, though the cross-border lumber trade has already slowed down considerably.

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended June 28, 2025. “During the second quarter, Acadian delivered mixed results,” said Adam Sheparski, CEO. …Acadian generated sales of $17.1 million, compared to $41.2 million in the prior year period. The second quarter of 2024 included $19.7 million in carbon credit sales, while no carbon credit sales occurred in the second quarter of 2025. Acadian generated $0.8 million of Free Cash Flow during the second quarter and declared dividends of $5.2 million or $0.29 per share to our shareholders. …While the second quarter of the year is traditionally our weakest due to seasonal operating conditions, operating activity in Maine was impacted by prolonged wet conditions which significantly delayed the commencement of deliveries in the spring.

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended June 28, 2025. “During the second quarter, Acadian delivered mixed results,” said Adam Sheparski, CEO. …Acadian generated sales of $17.1 million, compared to $41.2 million in the prior year period. The second quarter of 2024 included $19.7 million in carbon credit sales, while no carbon credit sales occurred in the second quarter of 2025. Acadian generated $0.8 million of Free Cash Flow during the second quarter and declared dividends of $5.2 million or $0.29 per share to our shareholders. …While the second quarter of the year is traditionally our weakest due to seasonal operating conditions, operating activity in Maine was impacted by prolonged wet conditions which significantly delayed the commencement of deliveries in the spring. The impact of President Trump’s tariffs on consumer prices is just getting started, according to research by Goldman Sachs Group, adding more uncertainty to a Treasury market that has been gripped by shifting bets on the pace of interest rate cuts. US companies have so far taken the bulk of the hit but the burden will increasingly be passed on to consumers as companies hike prices, economists including Jan Hatzius wrote. Consumers in the US have absorbed an estimated 22% of tariff costs through June, but their share will rise to 67% if the latest tariffs follow the pattern of levies in previous years, they wrote. The net result: faster inflation. The core personal consumer expenditure index, one of the Federal Reserve’s favorite measures of inflation, will hit 3.2% year-on-year in December. They said underlying inflation net of tariffs would be 2.4%. The rate was 2.8% in June.

The impact of President Trump’s tariffs on consumer prices is just getting started, according to research by Goldman Sachs Group, adding more uncertainty to a Treasury market that has been gripped by shifting bets on the pace of interest rate cuts. US companies have so far taken the bulk of the hit but the burden will increasingly be passed on to consumers as companies hike prices, economists including Jan Hatzius wrote. Consumers in the US have absorbed an estimated 22% of tariff costs through June, but their share will rise to 67% if the latest tariffs follow the pattern of levies in previous years, they wrote. The net result: faster inflation. The core personal consumer expenditure index, one of the Federal Reserve’s favorite measures of inflation, will hit 3.2% year-on-year in December. They said underlying inflation net of tariffs would be 2.4%. The rate was 2.8% in June.

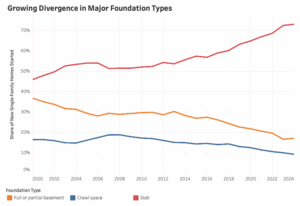

In 2024, 73% of new single-family homes started were built on slab foundations, according to NAHB analysis of the

In 2024, 73% of new single-family homes started were built on slab foundations, according to NAHB analysis of the

TORONTO — George Brown College’s (GBC) Limberlost Place has helped trigger major changes to Ontario’s building codes and is playing a key role in the province’s strategy to grow its mass timber construction sector, college officials say. The 10-storey academic building—Canada’s first institutional structure made from mass timber and designed to achieve net-zero carbon emissions—has served as a catalyst for the Ontario government’s Advanced Wood Construction Action Plan, unveiled on June 26. The action plan outlines four goals: Promote awareness and use of advanced wood construction; Remove regulatory barriers in codes and standards; Stimulate innovation and investment in advanced manufacturing; and Showcase successful projects to build industry confidence. Limberlost Place embodies all four goals. …By demonstrating the viability and benefits of mass timber at scale, George Brown College has positioned itself—and Ontario—as a leader in sustainable construction and advanced wood manufacturing.

TORONTO — George Brown College’s (GBC) Limberlost Place has helped trigger major changes to Ontario’s building codes and is playing a key role in the province’s strategy to grow its mass timber construction sector, college officials say. The 10-storey academic building—Canada’s first institutional structure made from mass timber and designed to achieve net-zero carbon emissions—has served as a catalyst for the Ontario government’s Advanced Wood Construction Action Plan, unveiled on June 26. The action plan outlines four goals: Promote awareness and use of advanced wood construction; Remove regulatory barriers in codes and standards; Stimulate innovation and investment in advanced manufacturing; and Showcase successful projects to build industry confidence. Limberlost Place embodies all four goals. …By demonstrating the viability and benefits of mass timber at scale, George Brown College has positioned itself—and Ontario—as a leader in sustainable construction and advanced wood manufacturing.

The European Federation of Wooden Pallet and Packaging Manufacturers (FEFPEB) has advised that the EU Deforestation Regulation (EUDR) will not have significant implications for customers using wood pallets and packaging for transport. The organization

The European Federation of Wooden Pallet and Packaging Manufacturers (FEFPEB) has advised that the EU Deforestation Regulation (EUDR) will not have significant implications for customers using wood pallets and packaging for transport. The organization  With wildfires forcing evacuations from Vancouver Island on the Pacific Coast to Newfoundland in the North Atlantic, Canadian officials were mustering additional resources on Thursday to help provinces cope with the blazes and the disruption. Eleanor Olszewski, Canada’s emergency management minister, announced on social media Thursday morning that the armed forces and the Coast Guard would assist the island province of Newfoundland in fighting blazes. Three out-of-control fires forced the evacuation of 900 people in the province on Thursday. Some provinces have moved this week to limit activities like hiking that could spark additional blazes, with forecasts indicating it is unlikely that sufficient rain would fall in regions plagued by out-of-control fires. Canada’s national fire threat level has been at 5, the highest danger rating, since late May. About 7.1 million hectares, or 27,000 square miles, of forest have burned so far this season in the country. [to access the full story a NY Times subscription is required]

With wildfires forcing evacuations from Vancouver Island on the Pacific Coast to Newfoundland in the North Atlantic, Canadian officials were mustering additional resources on Thursday to help provinces cope with the blazes and the disruption. Eleanor Olszewski, Canada’s emergency management minister, announced on social media Thursday morning that the armed forces and the Coast Guard would assist the island province of Newfoundland in fighting blazes. Three out-of-control fires forced the evacuation of 900 people in the province on Thursday. Some provinces have moved this week to limit activities like hiking that could spark additional blazes, with forecasts indicating it is unlikely that sufficient rain would fall in regions plagued by out-of-control fires. Canada’s national fire threat level has been at 5, the highest danger rating, since late May. About 7.1 million hectares, or 27,000 square miles, of forest have burned so far this season in the country. [to access the full story a NY Times subscription is required] MIRAMICHI, New Brunswick — In response to the increased wildfire risk, some forestry operations in New Brunswick will be restricted over the next couple of days. A release from the province’s Department of Natural Resources says the move is to protect both the forests and people living in the province. On Friday, the natural resources minister said in the release the restrictions will be on both Crown and private lands. “These measures will help protect our forests, animals, natural habitats and our communities, as well as our wildland fire crews,” John Herron said. As of midnight Friday, harvesting, forwarding, skidding, scarification, chipping and all pre-commercial thinning and cleaning are restricted until Tuesday. However, trucking, road construction and maintenance, vegetation management and tree planting are still getting the green light. These restrictions apply to all forested lands in the province, both private and Crown.

MIRAMICHI, New Brunswick — In response to the increased wildfire risk, some forestry operations in New Brunswick will be restricted over the next couple of days. A release from the province’s Department of Natural Resources says the move is to protect both the forests and people living in the province. On Friday, the natural resources minister said in the release the restrictions will be on both Crown and private lands. “These measures will help protect our forests, animals, natural habitats and our communities, as well as our wildland fire crews,” John Herron said. As of midnight Friday, harvesting, forwarding, skidding, scarification, chipping and all pre-commercial thinning and cleaning are restricted until Tuesday. However, trucking, road construction and maintenance, vegetation management and tree planting are still getting the green light. These restrictions apply to all forested lands in the province, both private and Crown. Cole Lindsay, the Oregon Department of Forestry aviation coordinator, said firefighters would typically have to hike into the dark canyon to check for new fires — a time-consuming and potentially dangerous task on a wildfire that had already roared to 23,890 acres in Wheeler County. But technology has advanced. Instead of sending people, Lindsay sent a drone equipped with an infrared camera to sweep across the canyon. “The cameras and sensors are so good that it would have seen something way before the human eye,” Lindsay said. …The Oregon Department of Forestry has 29 pilots. In 2024, ODF and its contractors flew 482 drone missions, 364 of which were for fire purposes. Out of 136 hours of flight time, 98.5 hours were on fire missions. So far in 2025, ODF, excluding its contractors, have flown 41 missions totaling 14 hours. Out of those 14 hours, 7.9 hours were for fire purposes.

Cole Lindsay, the Oregon Department of Forestry aviation coordinator, said firefighters would typically have to hike into the dark canyon to check for new fires — a time-consuming and potentially dangerous task on a wildfire that had already roared to 23,890 acres in Wheeler County. But technology has advanced. Instead of sending people, Lindsay sent a drone equipped with an infrared camera to sweep across the canyon. “The cameras and sensors are so good that it would have seen something way before the human eye,” Lindsay said. …The Oregon Department of Forestry has 29 pilots. In 2024, ODF and its contractors flew 482 drone missions, 364 of which were for fire purposes. Out of 136 hours of flight time, 98.5 hours were on fire missions. So far in 2025, ODF, excluding its contractors, have flown 41 missions totaling 14 hours. Out of those 14 hours, 7.9 hours were for fire purposes.  WASHINGTON STATE — Washington’s rural counties and school districts are preparing to start the school year without millions of dollars from a program meant to offset reduced revenue from logging on federal lands. The Secure Rural Schools program expired at the end of 2023 after Congress failed to renew it. Democratic and Republican lawmakers, along with local officials, are pushing US House leadership to bring a bill renewing the program to the floor. The lapsed program helps pay for roads and schools, providing $7 billion in payments to more than 700 counties and 4,400 school districts across 40 states since it was enacted in 2000. …Counties and schools have received logging revenue from the federal government for roads and schools since 1906. Federal law currently mandates that all counties annually receive 25% of the seven-year average of revenue generated by that county’s forests.

WASHINGTON STATE — Washington’s rural counties and school districts are preparing to start the school year without millions of dollars from a program meant to offset reduced revenue from logging on federal lands. The Secure Rural Schools program expired at the end of 2023 after Congress failed to renew it. Democratic and Republican lawmakers, along with local officials, are pushing US House leadership to bring a bill renewing the program to the floor. The lapsed program helps pay for roads and schools, providing $7 billion in payments to more than 700 counties and 4,400 school districts across 40 states since it was enacted in 2000. …Counties and schools have received logging revenue from the federal government for roads and schools since 1906. Federal law currently mandates that all counties annually receive 25% of the seven-year average of revenue generated by that county’s forests.  VICTORIA — BC Wildfire Service said an out-of-control wildfire burning on Vancouver Island near Cameron Lake could generate smoke for the “coming weeks, and potentially the coming months.” The warning appears in a video that BCWS posted Sunday as part of a larger update on the Wesley Ridge wildfire. “The public will be seeing smoke at the height of land here on Wesley Ridge for the coming weeks, and potentially, the coming months,” said operations sections chief Beau Michaud while seen standing on a temporary helicopter landing pad fashioned out of logs. But Michaud added that he does not expect the fire to impact Highway 4 connecting communities along the western shore of Vancouver Island with communities on the eastern shore.

VICTORIA — BC Wildfire Service said an out-of-control wildfire burning on Vancouver Island near Cameron Lake could generate smoke for the “coming weeks, and potentially the coming months.” The warning appears in a video that BCWS posted Sunday as part of a larger update on the Wesley Ridge wildfire. “The public will be seeing smoke at the height of land here on Wesley Ridge for the coming weeks, and potentially, the coming months,” said operations sections chief Beau Michaud while seen standing on a temporary helicopter landing pad fashioned out of logs. But Michaud added that he does not expect the fire to impact Highway 4 connecting communities along the western shore of Vancouver Island with communities on the eastern shore. Fires, storms and the potential for near-record high temperatures across the western US are in the offing for the coming week. The Gifford Fire, about 125 miles northwest of Los Angeles, had burned 113,648 acres and was 21% contained through Saturday, according to Cal Fire. So far, 809 people have been evacuated and the Los Padres National Forest was closed because of the flames. There are 3,935 fire crews and support staff on the scene, and at least seven have been injured, according to a joint statement by Cal Fire, the US Forest Service and several local agencies. The Gifford blaze is the largest of 14 fires across the state. …Large wildfires in Colorado have also caused air quality to drop there, the U.S. National Weather Service said. …Meanwhile, smoke from forest fires in Canada has once again crossed into the US, causing air quality alerts to be posted in Minnesota and parts of Wisconsin.

Fires, storms and the potential for near-record high temperatures across the western US are in the offing for the coming week. The Gifford Fire, about 125 miles northwest of Los Angeles, had burned 113,648 acres and was 21% contained through Saturday, according to Cal Fire. So far, 809 people have been evacuated and the Los Padres National Forest was closed because of the flames. There are 3,935 fire crews and support staff on the scene, and at least seven have been injured, according to a joint statement by Cal Fire, the US Forest Service and several local agencies. The Gifford blaze is the largest of 14 fires across the state. …Large wildfires in Colorado have also caused air quality to drop there, the U.S. National Weather Service said. …Meanwhile, smoke from forest fires in Canada has once again crossed into the US, causing air quality alerts to be posted in Minnesota and parts of Wisconsin.