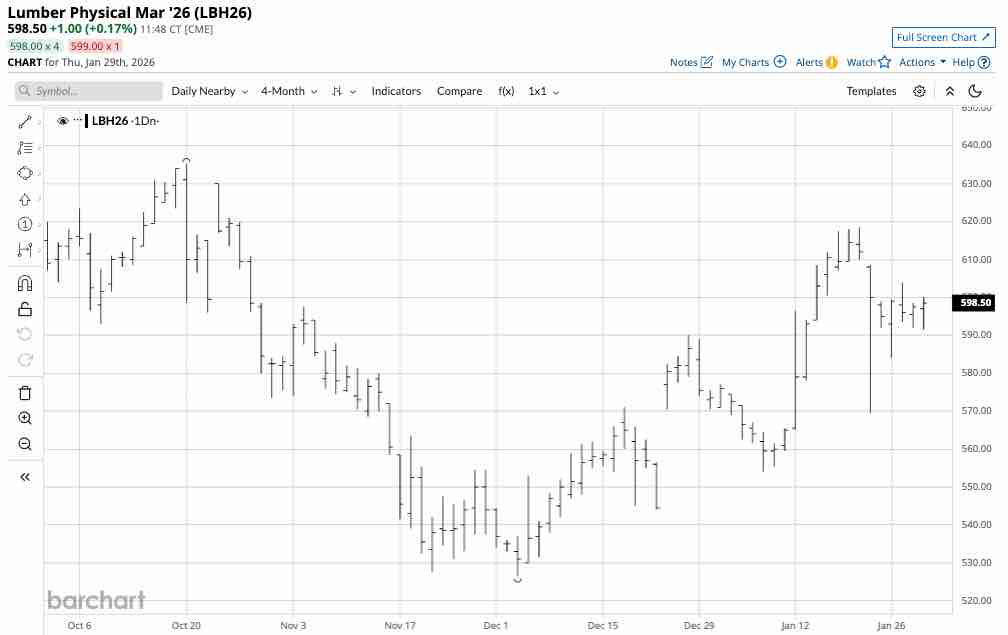

OTTAWA – Prime Minister Mark Carney and the premiers said Thursday they’re maintaining a united front under the long shadow of the upcoming negotiations for the review of North America’s key free trade agreement. …Carney updated the premiers on Ottawa’s plans for the coming review and committed to monthly meetings to update the premiers once CUSMA review talks officially begin. But Carney was tight-lipped on trade strategy. …In the meantime, Trump’s sector-specific tariffs continue to damage key Canadian industries such as steel, aluminum and softwood lumber. New Brunswick Premier Susan Holt said she wasn’t seeing a lot of US “movement or interest” in resolving the softwood lumber dispute, meaning a deal on duties outside of the CUSMA review process is unlikely. “We are constantly looking at ways to make it clear to the U.S. administration how the U.S. lumber producers are suffering under a low price,” Holt said.

OTTAWA – Prime Minister Mark Carney and the premiers said Thursday they’re maintaining a united front under the long shadow of the upcoming negotiations for the review of North America’s key free trade agreement. …Carney updated the premiers on Ottawa’s plans for the coming review and committed to monthly meetings to update the premiers once CUSMA review talks officially begin. But Carney was tight-lipped on trade strategy. …In the meantime, Trump’s sector-specific tariffs continue to damage key Canadian industries such as steel, aluminum and softwood lumber. New Brunswick Premier Susan Holt said she wasn’t seeing a lot of US “movement or interest” in resolving the softwood lumber dispute, meaning a deal on duties outside of the CUSMA review process is unlikely. “We are constantly looking at ways to make it clear to the U.S. administration how the U.S. lumber producers are suffering under a low price,” Holt said.

Canada’s forest industry is being dismantled in plain sight. …For decades, Canada built its forest economy around a single export market and a narrow set of commodity products. That strategy has now been exposed as dangerously fragile. Our closest trading partner has proven unreliable, and the cost of over-dependence is being paid by rural workers and regions across the country. Canada does not have a forestry problem. We have a market diversification problem. Ironically, today’s global uncertainty has created a once-in-a-generation opportunity. …Capital is mobile, and companies are actively looking for stable jurisdictions in which to build new production facilities. Canada can and should be at the top of that list—but we need to build the foundational infrastructure to make this happen. …The federal government’s new Canadian Forest Sector Transformation Task Force opens a critical window to address structural weaknesses in Canada’s forest economy.

Canada’s forest industry is being dismantled in plain sight. …For decades, Canada built its forest economy around a single export market and a narrow set of commodity products. That strategy has now been exposed as dangerously fragile. Our closest trading partner has proven unreliable, and the cost of over-dependence is being paid by rural workers and regions across the country. Canada does not have a forestry problem. We have a market diversification problem. Ironically, today’s global uncertainty has created a once-in-a-generation opportunity. …Capital is mobile, and companies are actively looking for stable jurisdictions in which to build new production facilities. Canada can and should be at the top of that list—but we need to build the foundational infrastructure to make this happen. …The federal government’s new Canadian Forest Sector Transformation Task Force opens a critical window to address structural weaknesses in Canada’s forest economy.

OTTAWA — Canada’s premiers are set for two days of huddling in the nation’s capital with the economy, affordability and trade expected to be high on the agenda. The premiers meet with Prime Minister Mark Carney on Thursday, and will want to show a united “Team Canada” front as trade tensions rise again with Canada’s largest trading partner. The meetings come a year after U.S. President Donald Trump assumed office and hit Canada with blistering tariffs, and just ahead of negotiations to renew the Canada-United States-Mexico agreement, due for its first formal review this summer. Trump threatened Canada in recent days with 100% across-the-board tariffs on exports, which would land on top of the sectors already hit by steep U.S. tariffs, such as steel, softwood lumber and vehicles. Ontario Premier Doug Ford said the premiers will show they stand united as the whole Canadian economy remains under attack.

OTTAWA — Canada’s premiers are set for two days of huddling in the nation’s capital with the economy, affordability and trade expected to be high on the agenda. The premiers meet with Prime Minister Mark Carney on Thursday, and will want to show a united “Team Canada” front as trade tensions rise again with Canada’s largest trading partner. The meetings come a year after U.S. President Donald Trump assumed office and hit Canada with blistering tariffs, and just ahead of negotiations to renew the Canada-United States-Mexico agreement, due for its first formal review this summer. Trump threatened Canada in recent days with 100% across-the-board tariffs on exports, which would land on top of the sectors already hit by steep U.S. tariffs, such as steel, softwood lumber and vehicles. Ontario Premier Doug Ford said the premiers will show they stand united as the whole Canadian economy remains under attack.

A federal task force announced earlier this month will attempt to save Canada’s stricken forest industry from further decline through product and market diversification. While the support will no doubt be welcomed by the industry, in BC the more immediate need is access to timber. Canada’s forestry sector has been pummeled by a one-two punch of low lumber prices, and US duties on softwood lumber. The situation is particularly dire in BC where an integrated industry of lumber, remanufacturing, pulp and pellet mills has been collapsing like a row of dominos. …The industry is in crisis, a number of speakers said at the

A federal task force announced earlier this month will attempt to save Canada’s stricken forest industry from further decline through product and market diversification. While the support will no doubt be welcomed by the industry, in BC the more immediate need is access to timber. Canada’s forestry sector has been pummeled by a one-two punch of low lumber prices, and US duties on softwood lumber. The situation is particularly dire in BC where an integrated industry of lumber, remanufacturing, pulp and pellet mills has been collapsing like a row of dominos. …The industry is in crisis, a number of speakers said at the  The unravelling of our trade relationship with the US compels us to act decisively. The chaotic diplomacy of the Trump Administration should encourage Canada to build up economic capacity where Canadians possess both agency and an existing industrial base to rely upon. This capacity‑building goal dovetails with the inherent purpose of the Sustainable Jobs Action Plan (SJAP). …Acting on these priorities, industry can direct its capital and follow its own strategic objectives, but it will do so in an environment that better reflects Canada’s long‑term economic goals. The SJAP can play a pivotal role. …One can look to the forestry sector. …Forestry faces an existential crisis from the 45% U.S. duties and tariffs imposed on Canadian lumber. …However, the sector also holds immense potential for manufacturing a variety of high value‑added products while also being a renewable resource key to decarbonizing construction.

The unravelling of our trade relationship with the US compels us to act decisively. The chaotic diplomacy of the Trump Administration should encourage Canada to build up economic capacity where Canadians possess both agency and an existing industrial base to rely upon. This capacity‑building goal dovetails with the inherent purpose of the Sustainable Jobs Action Plan (SJAP). …Acting on these priorities, industry can direct its capital and follow its own strategic objectives, but it will do so in an environment that better reflects Canada’s long‑term economic goals. The SJAP can play a pivotal role. …One can look to the forestry sector. …Forestry faces an existential crisis from the 45% U.S. duties and tariffs imposed on Canadian lumber. …However, the sector also holds immense potential for manufacturing a variety of high value‑added products while also being a renewable resource key to decarbonizing construction.

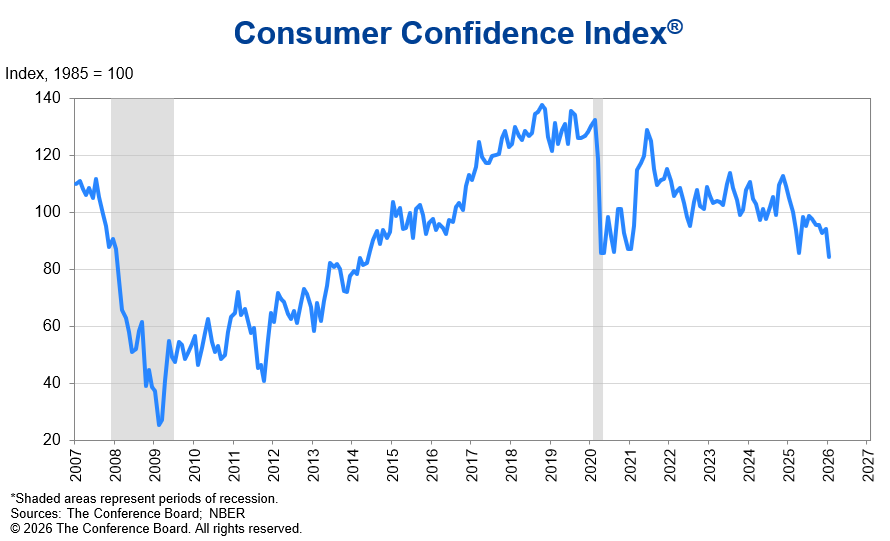

The Bank of Canada held its overnight interest rate steady at 2.25 per cent on Wednesday in a move widely expected by economists. The announcement comes amid ongoing trade uncertainty, with increased focus on the negotiation of the Canada-U.S.-Mexico Agreement and a murky outlook for the Canadian economy later in the year. Ahead of the announcement, economists polled by Reuters were unanimous in their expectations for a hold today, and nearly 75% forecast the central bank will stay on hold through 2026. In its December decision the Bank also held its policy rate stable. …“While this rate hold provides some stability, other factors such as economic uncertainty, potential job loss and affordability are continuing to put downward pressure on the housing market,” Rates.ca mortgage and real estate expert Victor Tran said in a statement following today’s decision.”

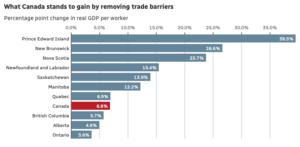

The Bank of Canada held its overnight interest rate steady at 2.25 per cent on Wednesday in a move widely expected by economists. The announcement comes amid ongoing trade uncertainty, with increased focus on the negotiation of the Canada-U.S.-Mexico Agreement and a murky outlook for the Canadian economy later in the year. Ahead of the announcement, economists polled by Reuters were unanimous in their expectations for a hold today, and nearly 75% forecast the central bank will stay on hold through 2026. In its December decision the Bank also held its policy rate stable. …“While this rate hold provides some stability, other factors such as economic uncertainty, potential job loss and affordability are continuing to put downward pressure on the housing market,” Rates.ca mortgage and real estate expert Victor Tran said in a statement following today’s decision.” Canada’s economy could gain nearly 7%, or $210 billion, in real GDP over a gradual period by fully removing internal trade barriers between the country’s 13 provinces and territories, according to a report published Tuesday by the International Monetary Fund (IMF). On average, regulation-related barriers are the equivalent of a 9% tariff nationally, estimates the report, which was co-authored by IMF researchers Federico J. Diez and Yuanchen Yang with contributions from University of Calgary economist Trevor Tombe. …Because of the trade barriers between provinces, “Canada isn’t really one economy. It’s really 10 economies,” said Alicia Planincic, director of policy and economics at the Business Council of Alberta in Calgary. …The report points to finance, telecom, transportation and professional services as far-reaching sectors that “ripple through the economy” and raise costs for all of the businesses they touch.

Canada’s economy could gain nearly 7%, or $210 billion, in real GDP over a gradual period by fully removing internal trade barriers between the country’s 13 provinces and territories, according to a report published Tuesday by the International Monetary Fund (IMF). On average, regulation-related barriers are the equivalent of a 9% tariff nationally, estimates the report, which was co-authored by IMF researchers Federico J. Diez and Yuanchen Yang with contributions from University of Calgary economist Trevor Tombe. …Because of the trade barriers between provinces, “Canada isn’t really one economy. It’s really 10 economies,” said Alicia Planincic, director of policy and economics at the Business Council of Alberta in Calgary. …The report points to finance, telecom, transportation and professional services as far-reaching sectors that “ripple through the economy” and raise costs for all of the businesses they touch.  In November, the volume of cargo carried by Canadian railways was up slightly (+0.5%) from November 2024 to 31.4 million tonnes. Higher volumes of intermodal shipments (mainly containers) as well as higher carloadings of wheat largely contributed to the increase in November 2025. The overall freight volume in November was on par with the five-year average of 31.5 million tonnes for the month. …Growth in non-intermodal freight loadings in November was moderated by declines in several commodities. Loadings of other oil seeds and nuts, and other agricultural products were down sharply by 35.4% (-312 000 tonnes) year over year—the largest drop in tonnage since December 2018. In November 2025, loadings of iron ores and concentrates decreased 6.4% (-287 000 tonnes) compared with November 2024, while loadings of lumber were down 22.1% (-143 000 tonnes), a fourth consecutive month of year-over-year decline.

In November, the volume of cargo carried by Canadian railways was up slightly (+0.5%) from November 2024 to 31.4 million tonnes. Higher volumes of intermodal shipments (mainly containers) as well as higher carloadings of wheat largely contributed to the increase in November 2025. The overall freight volume in November was on par with the five-year average of 31.5 million tonnes for the month. …Growth in non-intermodal freight loadings in November was moderated by declines in several commodities. Loadings of other oil seeds and nuts, and other agricultural products were down sharply by 35.4% (-312 000 tonnes) year over year—the largest drop in tonnage since December 2018. In November 2025, loadings of iron ores and concentrates decreased 6.4% (-287 000 tonnes) compared with November 2024, while loadings of lumber were down 22.1% (-143 000 tonnes), a fourth consecutive month of year-over-year decline.

Tokyo — Housing starts in Japan fell 6.5% from the previous year to 740,667 units in 2025, down for the third straight year and hitting a 62-year low, the land ministry said Friday. The drop reflected deterioration in consumer sentiment amid rising prices, as well as falling demand due to the country’s shrinking population. Of the total, owner-occupied houses dropped 7.7% to 201,285 units, down for the fourth consecutive year. Housing for rent fell 5.0% to 324,991 units, down for the third year in a row. Condominiums and houses for sale decreased 7.6% to 208,169 units, down for the third consecutive year. The results can also be attributed to a law revision in April that led to delays in construction starts for wooden homes with energy-saving features.

Tokyo — Housing starts in Japan fell 6.5% from the previous year to 740,667 units in 2025, down for the third straight year and hitting a 62-year low, the land ministry said Friday. The drop reflected deterioration in consumer sentiment amid rising prices, as well as falling demand due to the country’s shrinking population. Of the total, owner-occupied houses dropped 7.7% to 201,285 units, down for the fourth consecutive year. Housing for rent fell 5.0% to 324,991 units, down for the third year in a row. Condominiums and houses for sale decreased 7.6% to 208,169 units, down for the third consecutive year. The results can also be attributed to a law revision in April that led to delays in construction starts for wooden homes with energy-saving features. In the construction industry, ideas or materials first seen on the margins of construction processes later become an established part of those processes. …And so it seems to be with Mass Timber Construction (MTC). MTC entered the construction industry as an intriguing approach to reduce embodied carbon. …Today, MTC has become a mainstream building method. Across North America, there are reportedly 2,500 MTC buildings already built or in the planning stages. Similar levels of acceptance are seen in Europe. The world’s leading architects and designers have embraced MTC by incorporating wood components into a wide range of building types and sizes, from commercial offices to housing, campuses, infrastructure and even data centres. Interest and acceptance have moved beyond the pure environmental benefits of using MTC. Economics, simple dollars and cents, are now recognized as a persuasive factor as well. This is because mass timber changes the mechanics of construction.

In the construction industry, ideas or materials first seen on the margins of construction processes later become an established part of those processes. …And so it seems to be with Mass Timber Construction (MTC). MTC entered the construction industry as an intriguing approach to reduce embodied carbon. …Today, MTC has become a mainstream building method. Across North America, there are reportedly 2,500 MTC buildings already built or in the planning stages. Similar levels of acceptance are seen in Europe. The world’s leading architects and designers have embraced MTC by incorporating wood components into a wide range of building types and sizes, from commercial offices to housing, campuses, infrastructure and even data centres. Interest and acceptance have moved beyond the pure environmental benefits of using MTC. Economics, simple dollars and cents, are now recognized as a persuasive factor as well. This is because mass timber changes the mechanics of construction.

NEW BRUNSWICK — J.D. Irving approached a number of municipalities last fall, asking them to support its request to be able to log 32,000 hectares of protected areas on its Crown timber licence in exchange for conserving forest near those communities. At least nine municipalities signed a letter asking that Natural Resources Minister John Herron “give equal weight to the social and economic interests of local governments when seeking to balance the interests of multiple stakeholders across New Brunswick.” …Conservation groups, including the Conservation Council of New Brunswick, said the proposal is extremely concerning. Roberta Clowater questioned why protected areas would be treated as “a wood bank for industry.” …The proposal is in response to the government’s promise to increase conservation lands from 10% to 15% of the province’s landmass. That would mean protecting an additional 360,000 hectares, which the province hopes to source from a mixture of Crown and private land.

NEW BRUNSWICK — J.D. Irving approached a number of municipalities last fall, asking them to support its request to be able to log 32,000 hectares of protected areas on its Crown timber licence in exchange for conserving forest near those communities. At least nine municipalities signed a letter asking that Natural Resources Minister John Herron “give equal weight to the social and economic interests of local governments when seeking to balance the interests of multiple stakeholders across New Brunswick.” …Conservation groups, including the Conservation Council of New Brunswick, said the proposal is extremely concerning. Roberta Clowater questioned why protected areas would be treated as “a wood bank for industry.” …The proposal is in response to the government’s promise to increase conservation lands from 10% to 15% of the province’s landmass. That would mean protecting an additional 360,000 hectares, which the province hopes to source from a mixture of Crown and private land. Oregon’s forestry department has proposed a flexible approach to managing state-owned forests west of the Cascades over the next 70 years. Staff say it will allow them to adapt as scientific understanding evolves — and as the climate changes. But environmental groups say the department has drafted a plan that’s too vague. They would like to see more focus on saving the mature and complex forests. Members of the public can

Oregon’s forestry department has proposed a flexible approach to managing state-owned forests west of the Cascades over the next 70 years. Staff say it will allow them to adapt as scientific understanding evolves — and as the climate changes. But environmental groups say the department has drafted a plan that’s too vague. They would like to see more focus on saving the mature and complex forests. Members of the public can

Ingka Investments, the investment arm of Ingka Group (IKEA’s largest retailer), has completed the acquisition of forestland from Södra in Latvia and Estonia, following the signing of the agreement announced in October 2025. The transaction is part of Ingka Investments’ strategy to invest in long‑term assets that combine financial resilience with positive impact for the Ingka Group and IKEA business, building a strong foundation for many generations to come. With the acquisition now completed, Ingka Investments will take on the role of long‑term forest owner, with the ambition to manage the forest in a responsible way, while contributing to local economic activity. …Total area included in the acquisition is 135,232 ha in Latvia, and 17,742 ha in Estonia. The purchase price of the asset was EUR 720 million. …With IKEA retail operations in 32 markets, Ingka Group is the largest IKEA retailer and represents 87% of IKEA retail sales.

Ingka Investments, the investment arm of Ingka Group (IKEA’s largest retailer), has completed the acquisition of forestland from Södra in Latvia and Estonia, following the signing of the agreement announced in October 2025. The transaction is part of Ingka Investments’ strategy to invest in long‑term assets that combine financial resilience with positive impact for the Ingka Group and IKEA business, building a strong foundation for many generations to come. With the acquisition now completed, Ingka Investments will take on the role of long‑term forest owner, with the ambition to manage the forest in a responsible way, while contributing to local economic activity. …Total area included in the acquisition is 135,232 ha in Latvia, and 17,742 ha in Estonia. The purchase price of the asset was EUR 720 million. …With IKEA retail operations in 32 markets, Ingka Group is the largest IKEA retailer and represents 87% of IKEA retail sales. UK energy company Drax’s ambitions of becoming a significant wood pellet supplier to Asia are in danger of faltering as Japanese policymakers wind back generous subsidies for the biomass sector. Japan is set to soon surpass the UK as the world’s largest wood pellet importer after a post-Fukushima push to diversify power sources that caused hundreds of plants to spring up that burn wood pellets, palm kernel shells — a palm oil byproduct — and other organic materials. But policymakers in Japan are pulling support for the controversial industry after realising the hurdles to bringing down fuel costs. Tokyo has already cut subsidies for new projects of more than 10 megawatts. “The real intention is quite simple: no new government support, phasing out. We don’t see any clear path of bringing down costs in the foreseeable future,” said one government official. “Existing projects might survive but no new projects are coming.”

UK energy company Drax’s ambitions of becoming a significant wood pellet supplier to Asia are in danger of faltering as Japanese policymakers wind back generous subsidies for the biomass sector. Japan is set to soon surpass the UK as the world’s largest wood pellet importer after a post-Fukushima push to diversify power sources that caused hundreds of plants to spring up that burn wood pellets, palm kernel shells — a palm oil byproduct — and other organic materials. But policymakers in Japan are pulling support for the controversial industry after realising the hurdles to bringing down fuel costs. Tokyo has already cut subsidies for new projects of more than 10 megawatts. “The real intention is quite simple: no new government support, phasing out. We don’t see any clear path of bringing down costs in the foreseeable future,” said one government official. “Existing projects might survive but no new projects are coming.”