Tree Frog Editor: This insight paper by political risk analyst Robert McKellar offers a strategic lens on how a second Trump administration is shaping US behaviour as a global actor — an issue with direct implications for trade-exposed sectors. McKellar is a founding partner at Harmattan Risk and the co-author of “Trump’s Second Term: Political Risk and the Forest Products Sector,” an analysis of US trade policy, tariff dynamics, and geopolitical uncertainty. In this paper, he steps back from industry-specific analysis to explore the broader strategic logic — and contradictions — underlying current US global behaviour, providing context for the policy volatility and trade uncertainty facing the sector.

Robert McKellar

The US, a lynchpin global player, has become a change bomb, and having a clear sense of the US as an agent on the world stage is critical to sense-making that can inform appropriate strategic responses. But as it stands, Trump, whose character shapes his administration, is a wildcard. He is seemingly bored to tears by stability in any issue he deals with, and bored by a set menu of priorities. …Do we resign ourselves to perpetually playing catch up with US moves and their reverberations, or is it possible to get ahead of the Trumpian storm with a reasonably accurate sketch of the US as a global actor? If its moves were guided by strategic rationality, we would be able to extrapolate some idea of its future behaviour, and even a sense of how the international system might look in a few years and the critical challenges any given state might present…

Seasoned observers of US politics and international behaviour might have foreseen some of what is happening now, but by and large they did not expect Godzilla. Thus, they have often latched onto their own predispositions to fill in the considerable blanks. This has, for the most part, yielded two poles of interpretation. One is that Trump and his team are acting on a strategic assessment, and that despite apparent mayhem their moves are rational, even coldly calculating. The other is that the US has succumbed to the baser aspects of personal rule. Thus, Trump’s eccentric character and ego are the main source of US global behaviour. …The emerging reality no doubt lies somewhere in between, but to triangulate to an approximation, we need to prod around both poles of interpretation.

The unravelling of our trade relationship with the US compels us to act decisively. The chaotic diplomacy of the Trump Administration should encourage Canada to build up economic capacity where Canadians possess both agency and an existing industrial base to rely upon. This capacity‑building goal dovetails with the inherent purpose of the Sustainable Jobs Action Plan (SJAP). …Acting on these priorities, industry can direct its capital and follow its own strategic objectives, but it will do so in an environment that better reflects Canada’s long‑term economic goals. The SJAP can play a pivotal role. …One can look to the forestry sector. …Forestry faces an existential crisis from the 45% U.S. duties and tariffs imposed on Canadian lumber. …However, the sector also holds immense potential for manufacturing a variety of high value‑added products while also being a renewable resource key to decarbonizing construction.

The unravelling of our trade relationship with the US compels us to act decisively. The chaotic diplomacy of the Trump Administration should encourage Canada to build up economic capacity where Canadians possess both agency and an existing industrial base to rely upon. This capacity‑building goal dovetails with the inherent purpose of the Sustainable Jobs Action Plan (SJAP). …Acting on these priorities, industry can direct its capital and follow its own strategic objectives, but it will do so in an environment that better reflects Canada’s long‑term economic goals. The SJAP can play a pivotal role. …One can look to the forestry sector. …Forestry faces an existential crisis from the 45% U.S. duties and tariffs imposed on Canadian lumber. …However, the sector also holds immense potential for manufacturing a variety of high value‑added products while also being a renewable resource key to decarbonizing construction.

Montana’s forestry industry is entering this year with more questions than answers, from low lumber prices to high housing costs for workers to questions about tariffs, but there is room for strategic adaptation. That’s according to an economist who gave an update on the sector in the 2026 Montana Economic Report, put out by the Bureau of Business and Economic Research at the University of Montana. …Scott said the number of people employed in the private sector in forestry in Montana statewide has dropped in 2025. …His main points are that while timber harvests are down, the federal government is making a push to increase harvests. …He said the Trump administration’s tariff policy remains another wildcard. “A combination of lumber and trade-related tariffs has been implemented to bolster domestic demand, by raising the cost of Canadian lumber… it is still too early to tell whether these measures will meaningfully shift trade flows.”

Montana’s forestry industry is entering this year with more questions than answers, from low lumber prices to high housing costs for workers to questions about tariffs, but there is room for strategic adaptation. That’s according to an economist who gave an update on the sector in the 2026 Montana Economic Report, put out by the Bureau of Business and Economic Research at the University of Montana. …Scott said the number of people employed in the private sector in forestry in Montana statewide has dropped in 2025. …His main points are that while timber harvests are down, the federal government is making a push to increase harvests. …He said the Trump administration’s tariff policy remains another wildcard. “A combination of lumber and trade-related tariffs has been implemented to bolster domestic demand, by raising the cost of Canadian lumber… it is still too early to tell whether these measures will meaningfully shift trade flows.”

Australia’s forestry industry says cheap imported timber products are flooding the local market and taking up increased space in local homes and buildings. South Australian Forest Products Association (SAFPA) chief executive Nathan Paine said international trade conditions, fuelled by US tariffs, were responsible for imports reaching Australia at about half the price of local timber. This timber includes laminated veneer lumber (LVL) — a construction product that competes with locally grown radiata pine. …Analysis from Forest and Wood Products Australia showed LVL imports had increased 63% in 2025 compared to a year earlier. …Primary Industries Minister Clare Scriven said the state government could stand behind its past support for the timber industry. Housing Industry Australia chief executive of industry and policy Simon Croft said the pandemic’s trade disruptions had caused a spike in construction costs.

Australia’s forestry industry says cheap imported timber products are flooding the local market and taking up increased space in local homes and buildings. South Australian Forest Products Association (SAFPA) chief executive Nathan Paine said international trade conditions, fuelled by US tariffs, were responsible for imports reaching Australia at about half the price of local timber. This timber includes laminated veneer lumber (LVL) — a construction product that competes with locally grown radiata pine. …Analysis from Forest and Wood Products Australia showed LVL imports had increased 63% in 2025 compared to a year earlier. …Primary Industries Minister Clare Scriven said the state government could stand behind its past support for the timber industry. Housing Industry Australia chief executive of industry and policy Simon Croft said the pandemic’s trade disruptions had caused a spike in construction costs. Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

Canada’s housing and homelessness crisis touches nearly every Canadian. Over the past decade, while federal housing spending has increased, affordability has worsened for all but the wealthiest, and homelessness is surging. Despite recent declines in housing prices and rents, unsheltered homelessness is still up 300% since 2018, according to the most recent national point-in-time count. The country has a narrow but historic window to tackle this crisis and rebuild our housing system so it delivers at the speed, scale and affordability this moment demands. …Federal action alone won’t get us there. Provinces and territories control the planning systems, development-charge frameworks, zoning rules, supportive housing, health services and income supports. …That is why we need a Canada Housing Accord. [Tim Richter is the chief executive of the Canadian Alliance to End Homelessness and Tyler Meredith is a senior fellow at the Munk School of Global Affairs and Public Policy]

Canada’s housing and homelessness crisis touches nearly every Canadian. Over the past decade, while federal housing spending has increased, affordability has worsened for all but the wealthiest, and homelessness is surging. Despite recent declines in housing prices and rents, unsheltered homelessness is still up 300% since 2018, according to the most recent national point-in-time count. The country has a narrow but historic window to tackle this crisis and rebuild our housing system so it delivers at the speed, scale and affordability this moment demands. …Federal action alone won’t get us there. Provinces and territories control the planning systems, development-charge frameworks, zoning rules, supportive housing, health services and income supports. …That is why we need a Canada Housing Accord. [Tim Richter is the chief executive of the Canadian Alliance to End Homelessness and Tyler Meredith is a senior fellow at the Munk School of Global Affairs and Public Policy]

RUSS TAYLOR provided the latest quarterly report from the

RUSS TAYLOR provided the latest quarterly report from the

When it comes to housing affordability, the logic of “build build build” is straightforward enough: Housing is too expensive. If there were more of it, prices would fall. …Homebuilders are even pushing a plan for a million new affordable houses. …Unfortunately, it’s not that simple. The problem of housing affordability is much bigger than insufficient supply; it’s a mismatch with demand. And that demand is driven by income inequality that has seen soaring income growth at the top and tepid growth (or even stagnation) in the middle. In other words: The way to improve housing affordability is to reduce income inequality. …What’s needed are policies that increase income for households at the bottom and middle. Rather than boosting the housing supply in the hope that they benefit, the answer is to fix the labor market to make sure that they do.

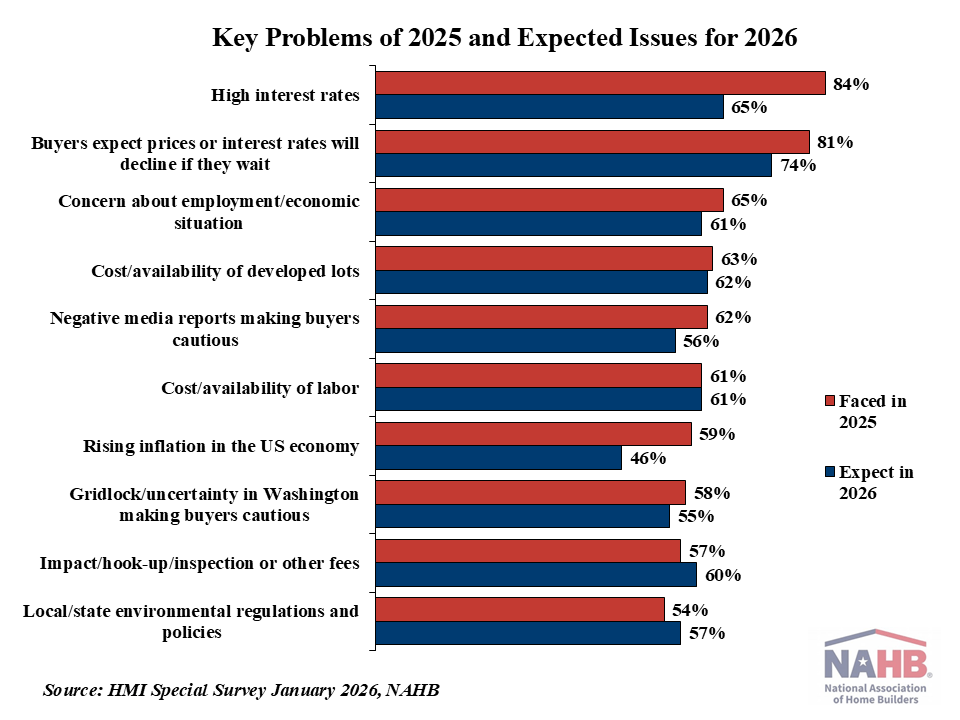

When it comes to housing affordability, the logic of “build build build” is straightforward enough: Housing is too expensive. If there were more of it, prices would fall. …Homebuilders are even pushing a plan for a million new affordable houses. …Unfortunately, it’s not that simple. The problem of housing affordability is much bigger than insufficient supply; it’s a mismatch with demand. And that demand is driven by income inequality that has seen soaring income growth at the top and tepid growth (or even stagnation) in the middle. In other words: The way to improve housing affordability is to reduce income inequality. …What’s needed are policies that increase income for households at the bottom and middle. Rather than boosting the housing supply in the hope that they benefit, the answer is to fix the labor market to make sure that they do.  Long-term mortgage rates continued to decline in January. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.10% last month, 9 basis points (bps) lower than December. Meanwhile, the 15-year rate declined 4 bps to 5.44%. Compared to a year ago, the 30-year rate is lower by 86 bps. The 15-year rate is also lower by 72 bps. The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.20% in January – an increase of 8 bps from the previous month, but remained considerably lower than last year by 43 bps. While mortgage rates typically move in tandem with the treasury yields, the spread between the two narrowed during the month. Reports that the Trump administration encouraged Fannie Mae and Freddie Mac to expand purchases of mortgage-backed securities (MBS) boosted demand for MBS, pushing mortgage rates lower. However, treasury yields rose sharply in the final week of January from global and fiscal pressures.

Long-term mortgage rates continued to decline in January. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.10% last month, 9 basis points (bps) lower than December. Meanwhile, the 15-year rate declined 4 bps to 5.44%. Compared to a year ago, the 30-year rate is lower by 86 bps. The 15-year rate is also lower by 72 bps. The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.20% in January – an increase of 8 bps from the previous month, but remained considerably lower than last year by 43 bps. While mortgage rates typically move in tandem with the treasury yields, the spread between the two narrowed during the month. Reports that the Trump administration encouraged Fannie Mae and Freddie Mac to expand purchases of mortgage-backed securities (MBS) boosted demand for MBS, pushing mortgage rates lower. However, treasury yields rose sharply in the final week of January from global and fiscal pressures.  The United States is one of the world’s largest timberland investment markets, with returns driven primarily by land values rather than timber prices, according to Domain Timber Advisors’ timberland market analysis. Timberland values remain strong at the end of 2025, supported by continued appreciation in land values, while timber prices remain relatively flat. …During 2025, Domain underwrites 14 institutional bid events, 54 public listings, and 38 off-market or non-public offerings. By the end of the fourth quarter, the acquisition pipeline consists of 46 deals covering more than 500 thousand acres, providing visibility into pricing dynamics, regional demand shifts, and emerging non-timber value drivers. …Looking ahead, Domain states that renewable energy development and technology infrastructure are expected to expand non-timber revenue opportunities in 2026 and beyond. Alternative timber product markets, including molded fiber products and biomass-to-electricity, are expected to offset part of the pulpwood demand lost due to mill closures and production quotas.

The United States is one of the world’s largest timberland investment markets, with returns driven primarily by land values rather than timber prices, according to Domain Timber Advisors’ timberland market analysis. Timberland values remain strong at the end of 2025, supported by continued appreciation in land values, while timber prices remain relatively flat. …During 2025, Domain underwrites 14 institutional bid events, 54 public listings, and 38 off-market or non-public offerings. By the end of the fourth quarter, the acquisition pipeline consists of 46 deals covering more than 500 thousand acres, providing visibility into pricing dynamics, regional demand shifts, and emerging non-timber value drivers. …Looking ahead, Domain states that renewable energy development and technology infrastructure are expected to expand non-timber revenue opportunities in 2026 and beyond. Alternative timber product markets, including molded fiber products and biomass-to-electricity, are expected to offset part of the pulpwood demand lost due to mill closures and production quotas.

The federal government

The federal government  Imagine if we embraced wood as the primary solution for everything we are capable of building tall. As Canada and industry mobilize to scale our national housing stock under Build Canada Homes, I believe that the way we build in Canada is on the precipice of a pivotal moment. Optimizing mass timber for multifamily residential construction — a key pillar of the federal housing plan — presents a tremendous opportunity to bolster our forestry and manufacturing economies while gaining on national targets for emission reductions. On top of delivering urgently needed housing, prioritizing Canadian mass timber is also regenerative for our communities, our economies and our planet. …Having received Royal Assent in 2009, British Columbia’s Wood First Act was enacted to promote the use of wood in provincially funded buildings — a prime example of legislation that strengthened the provincial forestry industry and heavily influenced mass timber adoption across the province.

Imagine if we embraced wood as the primary solution for everything we are capable of building tall. As Canada and industry mobilize to scale our national housing stock under Build Canada Homes, I believe that the way we build in Canada is on the precipice of a pivotal moment. Optimizing mass timber for multifamily residential construction — a key pillar of the federal housing plan — presents a tremendous opportunity to bolster our forestry and manufacturing economies while gaining on national targets for emission reductions. On top of delivering urgently needed housing, prioritizing Canadian mass timber is also regenerative for our communities, our economies and our planet. …Having received Royal Assent in 2009, British Columbia’s Wood First Act was enacted to promote the use of wood in provincially funded buildings — a prime example of legislation that strengthened the provincial forestry industry and heavily influenced mass timber adoption across the province.  California’s wildfire insurance crisis intensified this week as major insurers faced renewed scrutiny over denied or delayed payouts, while regulators and lawmakers moved to address mounting consumer complaints. The

California’s wildfire insurance crisis intensified this week as major insurers faced renewed scrutiny over denied or delayed payouts, while regulators and lawmakers moved to address mounting consumer complaints. The

CLEVELAND, Ohio — A state panel this week extended its offer to help finance construction of a new 129-room boutique hotel in Cleveland’s Ohio City neighborhood. While that doesn’t guarantee the hotel will move forward, the developer leading the project said construction can’t start without the state’s financing. The board… offered until Jan. 31, 2027 are $35 million worth of state bonds for the roughly $55 million project that would build a Marriott Tribute Portfolio boutique hotel. …The air quality facilities noted in the resolution include the seven-story building’s proposed use of mass-timber in its construction. …The presence of wood-timber construction above a first-floor reinforced concrete deck is noted in this axonometric view of the proposed Ohio City Hotel (DLR). The use of mass timber instead of reinforced concrete can save up to 40% in ongoing heating and cooling emissions for a building’s user as well as reduced emissions, according to Dan Whalen, at Places Development.

CLEVELAND, Ohio — A state panel this week extended its offer to help finance construction of a new 129-room boutique hotel in Cleveland’s Ohio City neighborhood. While that doesn’t guarantee the hotel will move forward, the developer leading the project said construction can’t start without the state’s financing. The board… offered until Jan. 31, 2027 are $35 million worth of state bonds for the roughly $55 million project that would build a Marriott Tribute Portfolio boutique hotel. …The air quality facilities noted in the resolution include the seven-story building’s proposed use of mass-timber in its construction. …The presence of wood-timber construction above a first-floor reinforced concrete deck is noted in this axonometric view of the proposed Ohio City Hotel (DLR). The use of mass timber instead of reinforced concrete can save up to 40% in ongoing heating and cooling emissions for a building’s user as well as reduced emissions, according to Dan Whalen, at Places Development.

The attorney general of BC has decided to take over any potential prosecutions of those arrested for violating an injunction prohibiting people from blocking roads in an area of the Walbran Valley. Forestry company Tsawak-qin Forestry Limited Partnership, which has rights to log in the area where protesters have set up blockades, asked the attorney general to take over the proceedings, and to determine if there is enough evidence to charge those arrested with criminal contempt. Those arrested have faced civil contempt of court charges for alleged breaches of the injunction. …Lawyer Noah Ross, who represents Bill Jones, a Pacheedaht First Nation elder who opposes the logging, said, “By being willing to step in and fund the prosecution, they make it effectively cheaper for the logging company”. …The decision means it’s now up to the BC Prosecution Service to determine what charges, if any, it will approve against those arrested.

The attorney general of BC has decided to take over any potential prosecutions of those arrested for violating an injunction prohibiting people from blocking roads in an area of the Walbran Valley. Forestry company Tsawak-qin Forestry Limited Partnership, which has rights to log in the area where protesters have set up blockades, asked the attorney general to take over the proceedings, and to determine if there is enough evidence to charge those arrested with criminal contempt. Those arrested have faced civil contempt of court charges for alleged breaches of the injunction. …Lawyer Noah Ross, who represents Bill Jones, a Pacheedaht First Nation elder who opposes the logging, said, “By being willing to step in and fund the prosecution, they make it effectively cheaper for the logging company”. …The decision means it’s now up to the BC Prosecution Service to determine what charges, if any, it will approve against those arrested. Forests Minister Ravi Parmer hosted the high-profile first National Wildfire Symposium in Vancouver and wildfire risk featured prominently at the 23rd B.C. Natural Resources Forum in Prince George. Dialogue at the symposium made it clear that wildfire is a coast-to-coast-to-coast challenge. It has stretched the resources of all provinces and territories. …But what if there is a way for our provincial government to more effectively spend available dollars to maintain wildfire suppression, improve prevention capabilities and support beneficial fires as an essential ecological function, while at the same time becoming better at identifying cross-government areas for new investments to improve wildfire resilience? This is the focus of a new report being published by the

Forests Minister Ravi Parmer hosted the high-profile first National Wildfire Symposium in Vancouver and wildfire risk featured prominently at the 23rd B.C. Natural Resources Forum in Prince George. Dialogue at the symposium made it clear that wildfire is a coast-to-coast-to-coast challenge. It has stretched the resources of all provinces and territories. …But what if there is a way for our provincial government to more effectively spend available dollars to maintain wildfire suppression, improve prevention capabilities and support beneficial fires as an essential ecological function, while at the same time becoming better at identifying cross-government areas for new investments to improve wildfire resilience? This is the focus of a new report being published by the  A forest advisory council has recommended shifting BC’s forest regime towards more local decision-making. The plan has received applause from forestry groups, the BC Greens and the head of the BC First Nations Forestry Council. But some experts warn the plan lacks teeth and risks putting fragile forest ecosystems at risk. …“I think of this like the cod fishery,” said Garry Merkel, a forester and co-chair of the advisory council, at the report’s launch event Monday. Merkel likened B.C.’s crisis to the fishery collapse on Canada’s East Coast. …BC First Nations Forestry Council’s Lennard Joe said he supports efforts to bring forest decision-making closer to people it affects. …But UBC forest management professor Peter Wood noted that the report made little mention of the province’s Old Growth Strategic Review. …Rachel Holt, a conservation ecologist worries that the council’s recommendations stop short of changes that are required to protect key ecosystems.

A forest advisory council has recommended shifting BC’s forest regime towards more local decision-making. The plan has received applause from forestry groups, the BC Greens and the head of the BC First Nations Forestry Council. But some experts warn the plan lacks teeth and risks putting fragile forest ecosystems at risk. …“I think of this like the cod fishery,” said Garry Merkel, a forester and co-chair of the advisory council, at the report’s launch event Monday. Merkel likened B.C.’s crisis to the fishery collapse on Canada’s East Coast. …BC First Nations Forestry Council’s Lennard Joe said he supports efforts to bring forest decision-making closer to people it affects. …But UBC forest management professor Peter Wood noted that the report made little mention of the province’s Old Growth Strategic Review. …Rachel Holt, a conservation ecologist worries that the council’s recommendations stop short of changes that are required to protect key ecosystems.

NEW BRUNSWICK — J.D. Irving approached a number of municipalities last fall, asking them to support its request to be able to log 32,000 hectares of protected areas on its Crown timber licence in exchange for conserving forest near those communities. At least nine municipalities signed a letter asking that Natural Resources Minister John Herron “give equal weight to the social and economic interests of local governments when seeking to balance the interests of multiple stakeholders across New Brunswick.” …Conservation groups, including the Conservation Council of New Brunswick, said the proposal is extremely concerning. Roberta Clowater questioned why protected areas would be treated as “a wood bank for industry.” …The proposal is in response to the government’s promise to increase conservation lands from 10% to 15% of the province’s landmass. That would mean protecting an additional 360,000 hectares, which the province hopes to source from a mixture of Crown and private land.

NEW BRUNSWICK — J.D. Irving approached a number of municipalities last fall, asking them to support its request to be able to log 32,000 hectares of protected areas on its Crown timber licence in exchange for conserving forest near those communities. At least nine municipalities signed a letter asking that Natural Resources Minister John Herron “give equal weight to the social and economic interests of local governments when seeking to balance the interests of multiple stakeholders across New Brunswick.” …Conservation groups, including the Conservation Council of New Brunswick, said the proposal is extremely concerning. Roberta Clowater questioned why protected areas would be treated as “a wood bank for industry.” …The proposal is in response to the government’s promise to increase conservation lands from 10% to 15% of the province’s landmass. That would mean protecting an additional 360,000 hectares, which the province hopes to source from a mixture of Crown and private land. Lawmakers from both parties agreed at a congressional hearing Tuesday that the federal government must act to address the growing threat of catastrophic wildfires, but they were sharply divided over how, and whether pending legislation known as the Fix Our Forests Act offers the right path forward. The House of Representatives passed the FOFA legislation in January 2025, and its companion bill is pending in the Senate. …Republican supporters of the bill championed its focus on fast-tracking the thinning and clearing of forests on large tracks of land by making exceptions to requirements in bedrock environmental laws. They argue that those steps are a fix for intensifying fires. …Democrats on the House Committee sharply criticized parts of the wildfire bill, arguing that it unnecessarily erodes environmental safeguards and expands logging, despite limited evidence that either makes communities safer. …Outside of the hearing, scientists and environmental advocates also criticized parts of FOFA.

Lawmakers from both parties agreed at a congressional hearing Tuesday that the federal government must act to address the growing threat of catastrophic wildfires, but they were sharply divided over how, and whether pending legislation known as the Fix Our Forests Act offers the right path forward. The House of Representatives passed the FOFA legislation in January 2025, and its companion bill is pending in the Senate. …Republican supporters of the bill championed its focus on fast-tracking the thinning and clearing of forests on large tracks of land by making exceptions to requirements in bedrock environmental laws. They argue that those steps are a fix for intensifying fires. …Democrats on the House Committee sharply criticized parts of the wildfire bill, arguing that it unnecessarily erodes environmental safeguards and expands logging, despite limited evidence that either makes communities safer. …Outside of the hearing, scientists and environmental advocates also criticized parts of FOFA. OLYMPIA — The House Agriculture and Natural Resources Committee showed a lively interest in repealing a rule that will lock up 200,000 acres of timber in Western Washington. The committee held a hearing Feb. 3 on House Bill 2620, sponsored by a mix of conservative Republicans and progressive Democrats. The bill targets the Forest Practices Board’s decision in November to widen and lengthen riparian buffers along streams without fish. The bigger buffers will eliminate $2.8 billion worth of timber, a University of Washington analysis estimates. The rule barely passed, 7-5. …The buffers, which go into effect Aug. 31, are needed to keep logging from raising water temperatures in most cases, according to Ecology. Timber groups say Ecology’s no-increase-in-water-temperature standard is humanly impossible to meet. What matters is that water temperatures stay cool enough for fish downstream, they argue. Forest landowners and the Washington State Association of Counties suggested buffers that would take 44,500 acres out of production.

OLYMPIA — The House Agriculture and Natural Resources Committee showed a lively interest in repealing a rule that will lock up 200,000 acres of timber in Western Washington. The committee held a hearing Feb. 3 on House Bill 2620, sponsored by a mix of conservative Republicans and progressive Democrats. The bill targets the Forest Practices Board’s decision in November to widen and lengthen riparian buffers along streams without fish. The bigger buffers will eliminate $2.8 billion worth of timber, a University of Washington analysis estimates. The rule barely passed, 7-5. …The buffers, which go into effect Aug. 31, are needed to keep logging from raising water temperatures in most cases, according to Ecology. Timber groups say Ecology’s no-increase-in-water-temperature standard is humanly impossible to meet. What matters is that water temperatures stay cool enough for fish downstream, they argue. Forest landowners and the Washington State Association of Counties suggested buffers that would take 44,500 acres out of production.

ALASKA — The US Forest Service is moving forward with a plan to harvest over 5,000 acres of trees in the Tongass National Forest, just east of Ketchikan. A majority of that will be old-growth trees, which some people worry will be devastating to the forest. The Forest Service released the

ALASKA — The US Forest Service is moving forward with a plan to harvest over 5,000 acres of trees in the Tongass National Forest, just east of Ketchikan. A majority of that will be old-growth trees, which some people worry will be devastating to the forest. The Forest Service released the  PITTSBURG, New Hampshire — The state has reached a deal on the management of the Connecticut Lakes Headwaters Working Forest, a 146,000 acre property constituting 3% of New Hampshire’s forests, according to Gov. Kelly Ayotte. The forest is privately owned but is under a conservation easement, which means the state has oversight regarding how the land is managed and can ensure it remains a working timberland. Since the land was purchased in 2022 by an out-of-state carbon offset company, Aurora Sustainable Lands, local loggers have raised concerns about reduced timber harvesting on the property. As a carbon-offset company, Aurora curbed logging in order to sell the carbon they stored. …In the plan agreed upon last month, Aurora will increase the average annual timber harvest. …“The Connecticut Lakes Headwaters Working Forest is critical to recreation, tourism and the timber industry in our North Country,” Ayotte said.

PITTSBURG, New Hampshire — The state has reached a deal on the management of the Connecticut Lakes Headwaters Working Forest, a 146,000 acre property constituting 3% of New Hampshire’s forests, according to Gov. Kelly Ayotte. The forest is privately owned but is under a conservation easement, which means the state has oversight regarding how the land is managed and can ensure it remains a working timberland. Since the land was purchased in 2022 by an out-of-state carbon offset company, Aurora Sustainable Lands, local loggers have raised concerns about reduced timber harvesting on the property. As a carbon-offset company, Aurora curbed logging in order to sell the carbon they stored. …In the plan agreed upon last month, Aurora will increase the average annual timber harvest. …“The Connecticut Lakes Headwaters Working Forest is critical to recreation, tourism and the timber industry in our North Country,” Ayotte said. Misleading. Unjustified. Hypocritical. Those are just some of the words that Department of Energy scientists used to describe a 141-page report on climate change that was commissioned by DOE Secretary Chris Wright. The feedback appears in newly revealed emails that were made public as part of a court fight between DOE and public interest groups. And they show that criticism of the report isn’t limited to scientists outside the Trump administration. The department’s own internal reviewers took issue with the document, which was written by five climate contrarians from outside DOE who were handpicked by Wright. …One DOE reviewer echoed that opinion and said it was “misleading” for the report to talk about how climate change could boost plant growth without mentioning its other drawbacks. Another comment described the report’s criticism of climate modeling as an “unjustified (and at worst a biased) judgement.”

Misleading. Unjustified. Hypocritical. Those are just some of the words that Department of Energy scientists used to describe a 141-page report on climate change that was commissioned by DOE Secretary Chris Wright. The feedback appears in newly revealed emails that were made public as part of a court fight between DOE and public interest groups. And they show that criticism of the report isn’t limited to scientists outside the Trump administration. The department’s own internal reviewers took issue with the document, which was written by five climate contrarians from outside DOE who were handpicked by Wright. …One DOE reviewer echoed that opinion and said it was “misleading” for the report to talk about how climate change could boost plant growth without mentioning its other drawbacks. Another comment described the report’s criticism of climate modeling as an “unjustified (and at worst a biased) judgement.”  Construction in New York City is one of the most dynamic and demanding industries in the country — but it’s also one of the most dangerous. …That’s why innovation in building materials and methods can have a real impact not only on efficiency and sustainability but also on safety. One such innovation, mass timber, is gaining traction. …Mass timber components are prefabricated in controlled factory settings. This approach greatly reduces the need for tasks like cutting, welding, or mixing concrete on-site — tasks that are commonly associated with jobsite injuries. …Additionally, since large panels arrive ready to install, crews spend less time working at height, which directly reduces the risk of falls — the leading cause of construction fatalities in the U.S., according to OSHA’s fall protection guidelines. …It also means a reduced need for powered hand tools and high-decibel equipment, lowering the risk of accidents related to hand injuries or communication breakdowns.

Construction in New York City is one of the most dynamic and demanding industries in the country — but it’s also one of the most dangerous. …That’s why innovation in building materials and methods can have a real impact not only on efficiency and sustainability but also on safety. One such innovation, mass timber, is gaining traction. …Mass timber components are prefabricated in controlled factory settings. This approach greatly reduces the need for tasks like cutting, welding, or mixing concrete on-site — tasks that are commonly associated with jobsite injuries. …Additionally, since large panels arrive ready to install, crews spend less time working at height, which directly reduces the risk of falls — the leading cause of construction fatalities in the U.S., according to OSHA’s fall protection guidelines. …It also means a reduced need for powered hand tools and high-decibel equipment, lowering the risk of accidents related to hand injuries or communication breakdowns.