OTTAWA — The Supreme Court of Canada will help decide the appropriate means of reviewing a company’s complaint about the service provided by a railway. In November 2023, the Canadian Transportation Agency ruled that Canadian National Railway Co. failed to meet the level of service it owed to Alberta Pacific Forest Industries Inc. The agency is a federal regulator and quasi-judicial tribunal and, under section 41 of the Canadian Transportation Act, its decisions may be appealed to the Federal Court of Appeal on questions of law or jurisdiction. CN wanted to contest factual findings so it pursued an appeal under a provision of the Federal Courts Act, not under section 41.

OTTAWA — The Supreme Court of Canada will help decide the appropriate means of reviewing a company’s complaint about the service provided by a railway. In November 2023, the Canadian Transportation Agency ruled that Canadian National Railway Co. failed to meet the level of service it owed to Alberta Pacific Forest Industries Inc. The agency is a federal regulator and quasi-judicial tribunal and, under section 41 of the Canadian Transportation Act, its decisions may be appealed to the Federal Court of Appeal on questions of law or jurisdiction. CN wanted to contest factual findings so it pursued an appeal under a provision of the Federal Courts Act, not under section 41.

Prime Minister Mark Carney has chosen former Privy Council clerk Janice Charette to head Canada’s trade negotiations as it prepares for a review of the North American trade pact. Charette’s title is chief trade negotiator to the United States, according to a Monday news release from the Prime Minister’s Office (PMO). She’ll be a senior adviser to Carney and Canada-U.S. Trade Minister Dominic LeBlanc. “Charette brings extraordinary leadership, expertise and a deep commitment to advancing Canada’s interests,” Carney said in the release. “She will advance Canadian interests and a strengthened trade and investment relationship that benefits workers and industries in both Canada and the United States.” The announcement comes as the federal government prepares for a scheduled review of the Canada-U.S.-Mexico Agreement (CUSMA) this year. It also comes a day after Mark Wiseman, a global investment banker and pension fund manager, took the reins as Canada’s next ambassador to Washington.

Prime Minister Mark Carney has chosen former Privy Council clerk Janice Charette to head Canada’s trade negotiations as it prepares for a review of the North American trade pact. Charette’s title is chief trade negotiator to the United States, according to a Monday news release from the Prime Minister’s Office (PMO). She’ll be a senior adviser to Carney and Canada-U.S. Trade Minister Dominic LeBlanc. “Charette brings extraordinary leadership, expertise and a deep commitment to advancing Canada’s interests,” Carney said in the release. “She will advance Canadian interests and a strengthened trade and investment relationship that benefits workers and industries in both Canada and the United States.” The announcement comes as the federal government prepares for a scheduled review of the Canada-U.S.-Mexico Agreement (CUSMA) this year. It also comes a day after Mark Wiseman, a global investment banker and pension fund manager, took the reins as Canada’s next ambassador to Washington. Almost three years after declaring bankruptcy, and more than two years under new owners, legal proceedings for Penticton’s Structurlam are continuing through the courts as it fights with the company that sent it into bankruptcy in the first place. In January, the case returned to the BC Supreme Court in Vancouver to order two Canadian engineering firms to produce documents and reports for the proceedings as Structurlam faces $80 million US in claims from Walmart, according to a decision published on Feb. 11. In 2023, Structurlam began bankruptcy proceedings after Walmart ended its contract to build the company’s new home office campus in Arkansas. …In July, Walmart filed a claim for over $80 million US for allegedly defective, nonconforming, rejected, nondelivered, or returned goods that it had paid for and alleged costs to replace said goods. The January 2026 B.C. Supreme Court decision orders two engineering firms to provide their documentation.

Almost three years after declaring bankruptcy, and more than two years under new owners, legal proceedings for Penticton’s Structurlam are continuing through the courts as it fights with the company that sent it into bankruptcy in the first place. In January, the case returned to the BC Supreme Court in Vancouver to order two Canadian engineering firms to produce documents and reports for the proceedings as Structurlam faces $80 million US in claims from Walmart, according to a decision published on Feb. 11. In 2023, Structurlam began bankruptcy proceedings after Walmart ended its contract to build the company’s new home office campus in Arkansas. …In July, Walmart filed a claim for over $80 million US for allegedly defective, nonconforming, rejected, nondelivered, or returned goods that it had paid for and alleged costs to replace said goods. The January 2026 B.C. Supreme Court decision orders two engineering firms to provide their documentation. WINDSOR, Ontario — For months, trade negotiations between Canada and the United States have been stalled. This week that all changed when US President Trump announced negotiations were back on. During his social media tirade about Windsor, Ontario’s Gordie Howe Bridge, and a list of other perceived transgressions, Trump wrote… we will start negotiations, IMMEDIATELY.” While Trump’s political speed bump threatens to derail the planned opening of the commercial corridor, some industry leaders see an opening to accelerate negotiations. “Trade conversations have now restarted, a few weeks ago conversations weren’t happening. I see this as a positive,” says Canadian Association of Moldmakers Nicole Vlanich. …With Trump restarting trade negotiations that he once brought to a screeching halt, business leaders in Windsor hope this will be an important first step towards paving a clearer picture for economic growth for both the Canadian and US economies.

WINDSOR, Ontario — For months, trade negotiations between Canada and the United States have been stalled. This week that all changed when US President Trump announced negotiations were back on. During his social media tirade about Windsor, Ontario’s Gordie Howe Bridge, and a list of other perceived transgressions, Trump wrote… we will start negotiations, IMMEDIATELY.” While Trump’s political speed bump threatens to derail the planned opening of the commercial corridor, some industry leaders see an opening to accelerate negotiations. “Trade conversations have now restarted, a few weeks ago conversations weren’t happening. I see this as a positive,” says Canadian Association of Moldmakers Nicole Vlanich. …With Trump restarting trade negotiations that he once brought to a screeching halt, business leaders in Windsor hope this will be an important first step towards paving a clearer picture for economic growth for both the Canadian and US economies. WASHINGTON, DC — In a vote that GOP leaders fought hard to avoid, a half dozen Republicans sent a blunt message to President Trump that they do not support the tariff regime that he has made the centerpiece of his second term. Six Republicans joined with Democrats in the vote to effectively repeal the president’s tariffs on Canada, the culmination of months of consternation in the GOP over the president’s trade war that has quietly rattled even some of his staunchest loyalists in Congress. …The Senate has already passed a similar measure to cancel Trump’s tariffs on Canada, which — unlike most measures — can be passed with a simple majority rather than 60 votes. But even if the Senate does agree to this same House measure, Trump would still have the power to veto it. The House did not secure enough votes to protect a veto override.

WASHINGTON, DC — In a vote that GOP leaders fought hard to avoid, a half dozen Republicans sent a blunt message to President Trump that they do not support the tariff regime that he has made the centerpiece of his second term. Six Republicans joined with Democrats in the vote to effectively repeal the president’s tariffs on Canada, the culmination of months of consternation in the GOP over the president’s trade war that has quietly rattled even some of his staunchest loyalists in Congress. …The Senate has already passed a similar measure to cancel Trump’s tariffs on Canada, which — unlike most measures — can be passed with a simple majority rather than 60 votes. But even if the Senate does agree to this same House measure, Trump would still have the power to veto it. The House did not secure enough votes to protect a veto override. Some of Canada’s major labour organizations are urging Ottawa to put workers at the centre of any renegotiation of the Canada-US-Mexico Agreement as preparations begin for the pact’s mandatory 2026 review. Leaders met with Dominic LeBlanc, the federal minister responsible for Canada–US trade, for what they described as a high-level roundtable on the future of CUSMA amid rising trade tensions and renewed threats of U.S. tariffs. Canadian Labour Congress president Bea Bruske said unions delivered a “clear and urgent message” that Canada should not accept a revised trade deal that weakens domestic industry or costs Canadian jobs. …Bruske was joined by leaders from several large manufacturing and building trades unions representing sectors heavily exposed to trade policy decisions, including auto manufacturing, construction and resource-based industries. Bruske said the upcoming CUSMA review should strengthen Canadian industries and working-class communities, not “hollow them out” in the rush to renew the agreement.

Some of Canada’s major labour organizations are urging Ottawa to put workers at the centre of any renegotiation of the Canada-US-Mexico Agreement as preparations begin for the pact’s mandatory 2026 review. Leaders met with Dominic LeBlanc, the federal minister responsible for Canada–US trade, for what they described as a high-level roundtable on the future of CUSMA amid rising trade tensions and renewed threats of U.S. tariffs. Canadian Labour Congress president Bea Bruske said unions delivered a “clear and urgent message” that Canada should not accept a revised trade deal that weakens domestic industry or costs Canadian jobs. …Bruske was joined by leaders from several large manufacturing and building trades unions representing sectors heavily exposed to trade policy decisions, including auto manufacturing, construction and resource-based industries. Bruske said the upcoming CUSMA review should strengthen Canadian industries and working-class communities, not “hollow them out” in the rush to renew the agreement.

Snuneymuxw First Nation is calling on other levels of government to act to protect its waters following an oil spill and long-standing discharge of “toxic sawmill effluent” at Duke Point near Nanaimo. The nation is calling for a full environmental investigation following the incidents it says are caused by Environmental 360 and Western Forest Products. The nation has sent letters to the federal, provincial and municipal governments calling on them to act. This comes after an

Snuneymuxw First Nation is calling on other levels of government to act to protect its waters following an oil spill and long-standing discharge of “toxic sawmill effluent” at Duke Point near Nanaimo. The nation is calling for a full environmental investigation following the incidents it says are caused by Environmental 360 and Western Forest Products. The nation has sent letters to the federal, provincial and municipal governments calling on them to act. This comes after an  The CN railway running through 100 Mile House will not be discontinued after all. District of 100 Mile House Mayor Maureen Pinkney said that the consultant hired to assess the rail line’s future had told her, and around 87 other stakeholders in the region between North Vancouver and Prince George, that removal of the rails was off the table. …CN Rail announced it would be discontinuing service between Squamish and 100 Mile House… and that rails and ties are removed after discontinuance. …Potentials for the new use of the rail tracks include the return of passenger rail to 100 Mile House. …Pinkney said that there could be opportunities from the saved rail line to make up for lost tax revenue from the closure of the West Fraser Mill, as well as the OSB plant.

The CN railway running through 100 Mile House will not be discontinued after all. District of 100 Mile House Mayor Maureen Pinkney said that the consultant hired to assess the rail line’s future had told her, and around 87 other stakeholders in the region between North Vancouver and Prince George, that removal of the rails was off the table. …CN Rail announced it would be discontinuing service between Squamish and 100 Mile House… and that rails and ties are removed after discontinuance. …Potentials for the new use of the rail tracks include the return of passenger rail to 100 Mile House. …Pinkney said that there could be opportunities from the saved rail line to make up for lost tax revenue from the closure of the West Fraser Mill, as well as the OSB plant.

The BC government is forecasting that the natural gas industry will play a larger role as the top driver of provincial resource revenue, while warning about tough times in the former economic powerhouse of forestry. Natural gas royalties are expected to ring in at nearly $1.3-billion for the 12 months ending March 31, 2027, up 38%. …The government is anticipating $521-million in forestry revenue for the 2026-27 fiscal year, up 3%, but still down sharply when compared with several years ago. …In the 2020-21 fiscal year, forestry revenue surpassed $1.3-billion and natural gas royalties reached $196-million. …Tuesday’s budget introduces a temporary Stumpage Payment Deferral Program in an effort to ease the cash crunch for companies. The voluntary program covers the first 11 months of 2026. …The government anticipates that the trend of depressed annual volumes of tree harvesting will continue over the next several years, restricting the production of softwood lumber. [to access the full story a Globe & Mail subscription is required]

The BC government is forecasting that the natural gas industry will play a larger role as the top driver of provincial resource revenue, while warning about tough times in the former economic powerhouse of forestry. Natural gas royalties are expected to ring in at nearly $1.3-billion for the 12 months ending March 31, 2027, up 38%. …The government is anticipating $521-million in forestry revenue for the 2026-27 fiscal year, up 3%, but still down sharply when compared with several years ago. …In the 2020-21 fiscal year, forestry revenue surpassed $1.3-billion and natural gas royalties reached $196-million. …Tuesday’s budget introduces a temporary Stumpage Payment Deferral Program in an effort to ease the cash crunch for companies. The voluntary program covers the first 11 months of 2026. …The government anticipates that the trend of depressed annual volumes of tree harvesting will continue over the next several years, restricting the production of softwood lumber. [to access the full story a Globe & Mail subscription is required] The United Steelworkers union found positives in a difficult BC budget. …Recognizing the uncertainty created by US trade policy… USW Western Canada Director Scott Lunny said… “Today’s budget advances the government’s work towards long-term economic stability, including BC’s goal of securing $200 billion in private-sector investment over the next decade in sectors including mining, forestry and manufacturing”. …USW noted positives, including: a continued commitment in funding to strengthen permitting capacity in resource industries; a $400- million Strategic Investments Special Account to leverage federal government dollars for investment and job creation in key sectors like value-added forestry, responsible mining, manufacturing and clean energy; and unprecedented investment in skilled trades funding as well as a training grant to encourage apprenticeships. …”While we welcome the $20 million to help workers and employers in tariff-impacted sectors like steel and forestry, there is still a missing commitment to stabilizing and sustaining the primary forestry sector,” said Lunny.

The United Steelworkers union found positives in a difficult BC budget. …Recognizing the uncertainty created by US trade policy… USW Western Canada Director Scott Lunny said… “Today’s budget advances the government’s work towards long-term economic stability, including BC’s goal of securing $200 billion in private-sector investment over the next decade in sectors including mining, forestry and manufacturing”. …USW noted positives, including: a continued commitment in funding to strengthen permitting capacity in resource industries; a $400- million Strategic Investments Special Account to leverage federal government dollars for investment and job creation in key sectors like value-added forestry, responsible mining, manufacturing and clean energy; and unprecedented investment in skilled trades funding as well as a training grant to encourage apprenticeships. …”While we welcome the $20 million to help workers and employers in tariff-impacted sectors like steel and forestry, there is still a missing commitment to stabilizing and sustaining the primary forestry sector,” said Lunny.

The only thing more surprising than the collapse of the co-operation agreement between the BC Greens and NDP would have been if the two sides had agreed on a new deal. …The Co-Operation and Responsible Government Accord (CARGA)… didn’t seem to be meeting anyone’s needs. For the NDP, the deal was supposed to act as a safety net for a slim one-seat majority. …It worked for last year’s budget. But outside of that, the Greens refused to back the NDP on three other confidence matters. And for that, the government agreed to advance the Green causes… [including] an early review of CleanBC and another review of the forestry system. For the Greens …it was a mixed bag, at best. The NDP did launch reviews of CleanBC and forestry, but then didn’t accept the resulting recommendations. The documents seem destined for that dusty shelf in the legislature library where unwanted reports go to die.

The only thing more surprising than the collapse of the co-operation agreement between the BC Greens and NDP would have been if the two sides had agreed on a new deal. …The Co-Operation and Responsible Government Accord (CARGA)… didn’t seem to be meeting anyone’s needs. For the NDP, the deal was supposed to act as a safety net for a slim one-seat majority. …It worked for last year’s budget. But outside of that, the Greens refused to back the NDP on three other confidence matters. And for that, the government agreed to advance the Green causes… [including] an early review of CleanBC and another review of the forestry system. For the Greens …it was a mixed bag, at best. The NDP did launch reviews of CleanBC and forestry, but then didn’t accept the resulting recommendations. The documents seem destined for that dusty shelf in the legislature library where unwanted reports go to die.

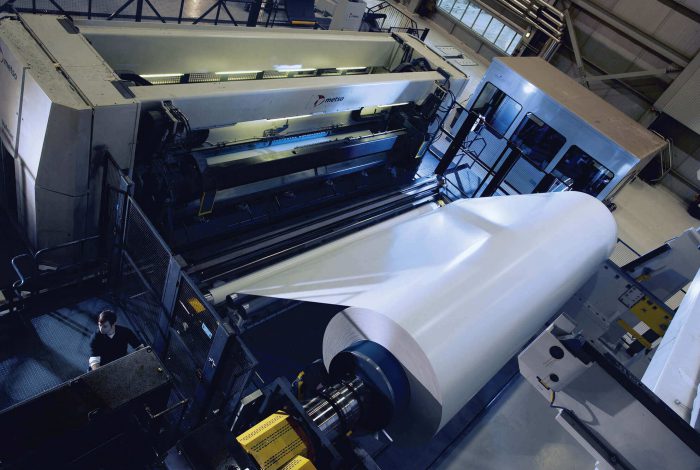

FINLAND — Metsä Group’s demo plant for a new lignin product has started up in Äänekoski, Finland. The plant uses lignin extracted from the bioproduct mill’s production process as its raw material and it has a nameplate capacity of two tons of a new type of lignin product per day. The plant was built in cooperation with the equipment supplier ANDRITZ. Dow, a leading materials science company, is a key partner. Metsä Group’s new lignin products are called Metsä LigO™. According to Ismo Nousiainen, CEO of Metsä Fibre, part of Metsä Group, the company aims to use the wood raw material, including side streams of pulp production, as efficiently as possible to generate the greatest possible added value. …”The purpose of the new demo plant is to ensure the functionality of the lignin product’s production process, as well as the product’s characteristics and suitability for the market.”

FINLAND — Metsä Group’s demo plant for a new lignin product has started up in Äänekoski, Finland. The plant uses lignin extracted from the bioproduct mill’s production process as its raw material and it has a nameplate capacity of two tons of a new type of lignin product per day. The plant was built in cooperation with the equipment supplier ANDRITZ. Dow, a leading materials science company, is a key partner. Metsä Group’s new lignin products are called Metsä LigO™. According to Ismo Nousiainen, CEO of Metsä Fibre, part of Metsä Group, the company aims to use the wood raw material, including side streams of pulp production, as efficiently as possible to generate the greatest possible added value. …”The purpose of the new demo plant is to ensure the functionality of the lignin product’s production process, as well as the product’s characteristics and suitability for the market.”