CALGARY, Alberta — Canadian Pacific Kansas City (CPKA) said that United Steelworkers (USW), representing approximately 600 clerical and intermodal employees in Canada, has ratified a new four-year collective agreement. …CPKC President and Chief Executive Officer Keith Creel said, “With this agreement and ratification, made possible through collaboration with the United Steelworkers, our railroaders remain focused on continuing to safely and efficiently serve our customers, moving Canada’s supply chain and supporting the North American economy.” This is the third new collective agreement ratified this year by CPKC employees in Canada. Teamsters Canada Rail Conference Maintenance of Way Employees Division representing approximately 2,300 engineering services employees in Canada and Unifor representing approximately 1,200 mechanical employees both ratified new four-year collective agreements in February.

CALGARY, Alberta — Canadian Pacific Kansas City (CPKA) said that United Steelworkers (USW), representing approximately 600 clerical and intermodal employees in Canada, has ratified a new four-year collective agreement. …CPKC President and Chief Executive Officer Keith Creel said, “With this agreement and ratification, made possible through collaboration with the United Steelworkers, our railroaders remain focused on continuing to safely and efficiently serve our customers, moving Canada’s supply chain and supporting the North American economy.” This is the third new collective agreement ratified this year by CPKC employees in Canada. Teamsters Canada Rail Conference Maintenance of Way Employees Division representing approximately 2,300 engineering services employees in Canada and Unifor representing approximately 1,200 mechanical employees both ratified new four-year collective agreements in February.

Despite decades of a fractious trade relationship between softwood producers in Canada and those in the U.S., the Canadian softwood lumber industry hasn’t liked to trumpet what it considers the superiority of its product because the two markets are so intertwined. Production has increased at U.S. sawmills in the past decade, including at facilities owned by companies with head offices in Canada. That’s now changing, with Canadian producers wanting to make plain to consumers in Canada, in the U.S. and no doubt, to potential new markets around the world, that the spruce, pine and fir grown north of the 49th parallel is a superior product. That’s because the growth rings are tighter than those found in the lumber in the U.S. South. It takes from 70 to 100 years before spruce, pine and fir (SPF) trees are considered ripe for harvesting in the B.C. Interior. By comparison, southern yellow pine trees are harvested after about 35 years. [a paid subscription is required to read this story]

Despite decades of a fractious trade relationship between softwood producers in Canada and those in the U.S., the Canadian softwood lumber industry hasn’t liked to trumpet what it considers the superiority of its product because the two markets are so intertwined. Production has increased at U.S. sawmills in the past decade, including at facilities owned by companies with head offices in Canada. That’s now changing, with Canadian producers wanting to make plain to consumers in Canada, in the U.S. and no doubt, to potential new markets around the world, that the spruce, pine and fir grown north of the 49th parallel is a superior product. That’s because the growth rings are tighter than those found in the lumber in the U.S. South. It takes from 70 to 100 years before spruce, pine and fir (SPF) trees are considered ripe for harvesting in the B.C. Interior. By comparison, southern yellow pine trees are harvested after about 35 years. [a paid subscription is required to read this story] As the cross-border trade war escalates, Canada’s softwood lumber industry has an advantage on its side that no tariff can completely erase – its product is objectively better than much of the timber harvested from US forests. Softwood supplies, especially from BC and Alberta, are widely viewed as more desirable for wood framing because the growth rings are tighter than those found in lumber in the US South. In the milder climate of the U.S. South, the growing season is much faster. It takes about 35 years before southern yellow pine (SYP) trees are harvested. …Canada’s secret weapon, however, is hiding in plain sight. Tighter growth rings tend to result in quality two-by-four or two-by-six SPF boards for home builders, meaning walls that will stay straight. Compared with American SYP lumber, Canadian SPF is also lighter in weight. …Eastern SYP is currently selling at lower prices when compared with SPF. “SYP is an imperfect substitute for SPF,” RBC Capital Markets analyst Matthew McKellar said. [to access the full story a Globe & Mail subscription is required]

As the cross-border trade war escalates, Canada’s softwood lumber industry has an advantage on its side that no tariff can completely erase – its product is objectively better than much of the timber harvested from US forests. Softwood supplies, especially from BC and Alberta, are widely viewed as more desirable for wood framing because the growth rings are tighter than those found in lumber in the US South. In the milder climate of the U.S. South, the growing season is much faster. It takes about 35 years before southern yellow pine (SYP) trees are harvested. …Canada’s secret weapon, however, is hiding in plain sight. Tighter growth rings tend to result in quality two-by-four or two-by-six SPF boards for home builders, meaning walls that will stay straight. Compared with American SYP lumber, Canadian SPF is also lighter in weight. …Eastern SYP is currently selling at lower prices when compared with SPF. “SYP is an imperfect substitute for SPF,” RBC Capital Markets analyst Matthew McKellar said. [to access the full story a Globe & Mail subscription is required]

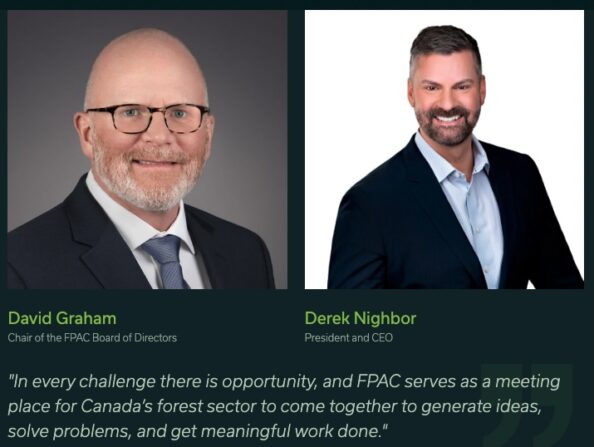

This year, Canadian forest companies and their employees continued to navigate a rapidly changing political, economic, and trade environment. Customers, investors, and local communities have a shared interest in good environmental outcomes and sustaining and growing family-supporting jobs. As a global leader in sustainable forest management and responsible sourcing, Canada’s forest sector and its people have met these challenges head-on. In 2024, FPAC and its members continued to make meaningful strides on climate action, biodiversity conservation, and expanded partnerships with Indigenous Peoples and inclusion of Indigenous knowledge into Sustainable Forest Management. Buyers of Canadian forest products can be confident that measures to improve environmental performance, strengthen relationships with Indigenous Peoples, and provide the highest quality of products are being implemented across our operations and throughout the country – ensuring that forestry practices in Canada contribute to maintaining and supporting the ecosystems, wildlife, and people that rely on them now and for generations to come.

This year, Canadian forest companies and their employees continued to navigate a rapidly changing political, economic, and trade environment. Customers, investors, and local communities have a shared interest in good environmental outcomes and sustaining and growing family-supporting jobs. As a global leader in sustainable forest management and responsible sourcing, Canada’s forest sector and its people have met these challenges head-on. In 2024, FPAC and its members continued to make meaningful strides on climate action, biodiversity conservation, and expanded partnerships with Indigenous Peoples and inclusion of Indigenous knowledge into Sustainable Forest Management. Buyers of Canadian forest products can be confident that measures to improve environmental performance, strengthen relationships with Indigenous Peoples, and provide the highest quality of products are being implemented across our operations and throughout the country – ensuring that forestry practices in Canada contribute to maintaining and supporting the ecosystems, wildlife, and people that rely on them now and for generations to come. WASHINGTON — Canadian officials are set to meet with the U.S. commerce secretary in Washington today — days after a dust-up with U.S. President Donald Trump that ended with Ontario pausing its surcharge on electricity exports to the United States. Finance Minister Dominic LeBlanc, Ambassador to the U.S. Kirsten Hillman and Ontario Premier Doug Ford are meeting with Howard Lutnick, and Ford says his goal for the meeting is to get a coherent sense of the Trump administration’s plans for tariffs. …Elsewhere in the American capital, Trump’s choice for the next U.S ambassador to Canada is set to take questions today as the relationship between the two countries is strained by tariffs and threats of annexation. Pete Hoekstra, a former Michigan congressman, is scheduled to appear before the Senate Foreign Relations Committee for a nomination hearing.

WASHINGTON — Canadian officials are set to meet with the U.S. commerce secretary in Washington today — days after a dust-up with U.S. President Donald Trump that ended with Ontario pausing its surcharge on electricity exports to the United States. Finance Minister Dominic LeBlanc, Ambassador to the U.S. Kirsten Hillman and Ontario Premier Doug Ford are meeting with Howard Lutnick, and Ford says his goal for the meeting is to get a coherent sense of the Trump administration’s plans for tariffs. …Elsewhere in the American capital, Trump’s choice for the next U.S ambassador to Canada is set to take questions today as the relationship between the two countries is strained by tariffs and threats of annexation. Pete Hoekstra, a former Michigan congressman, is scheduled to appear before the Senate Foreign Relations Committee for a nomination hearing.

Ravi Parmar, Minister of Forests, celebrated the official opening of Canoe Forest Products’ new kiln. The new kiln was made possible with funding from the Province’s BC Manufacturing Jobs Fund (BCMJF). …Canoe received more than $2.2 million in November 2023 to commission a new kiln, boosting both production and sustainability at its operation in Salmon Arm and help protect 200 jobs. …Parmar accompanied Canoe employees, community guests, and Nick Arkle, CEO of the Gorman Group, at an opening ribbon-cutting ceremony. …Parmar is also visited Tolko Industries who received $8 million to help expand Tolko’s Heffley Creek operation. Family-run Gilbert Smith Forest Products in Barriere received $1.1 million to support facility modernization and new equipment. AcuTruss Industries in Vernon received $100,000 to support the purchase and commissioning of equipment to manufacture precision cut I-joists through automation.

Ravi Parmar, Minister of Forests, celebrated the official opening of Canoe Forest Products’ new kiln. The new kiln was made possible with funding from the Province’s BC Manufacturing Jobs Fund (BCMJF). …Canoe received more than $2.2 million in November 2023 to commission a new kiln, boosting both production and sustainability at its operation in Salmon Arm and help protect 200 jobs. …Parmar accompanied Canoe employees, community guests, and Nick Arkle, CEO of the Gorman Group, at an opening ribbon-cutting ceremony. …Parmar is also visited Tolko Industries who received $8 million to help expand Tolko’s Heffley Creek operation. Family-run Gilbert Smith Forest Products in Barriere received $1.1 million to support facility modernization and new equipment. AcuTruss Industries in Vernon received $100,000 to support the purchase and commissioning of equipment to manufacture precision cut I-joists through automation.

Lumber and other costs could soar … but that’s not even the biggest problem. First, Canada was hit with tariffs. Then it wasn’t. Then came March 4, a.k.a. Tariff Tuesday. Then the U.S. stock markets tanked and big American industries — including the auto sector — ramped up their tariff objections. Then we had Oops Never Mind About Those Tariffs For Now Thursday. …As it stands, Canada has a second tariff reprieve on goods covered under the Canada-U.S.-Mexico Free Trade Agreement. Until April 2. So this trade war is far from over. Whether directly or due to instability, it affects every aspect of our economy — and that includes housing. …While builders can use Canadian lumber, of course, other materials and products are traditionally imported largely from the U.S. These include appliances, glass windows and doors, ceramic tiles, hardware components such as fasteners, and machinery and tools.

Lumber and other costs could soar … but that’s not even the biggest problem. First, Canada was hit with tariffs. Then it wasn’t. Then came March 4, a.k.a. Tariff Tuesday. Then the U.S. stock markets tanked and big American industries — including the auto sector — ramped up their tariff objections. Then we had Oops Never Mind About Those Tariffs For Now Thursday. …As it stands, Canada has a second tariff reprieve on goods covered under the Canada-U.S.-Mexico Free Trade Agreement. Until April 2. So this trade war is far from over. Whether directly or due to instability, it affects every aspect of our economy — and that includes housing. …While builders can use Canadian lumber, of course, other materials and products are traditionally imported largely from the U.S. These include appliances, glass windows and doors, ceramic tiles, hardware components such as fasteners, and machinery and tools.

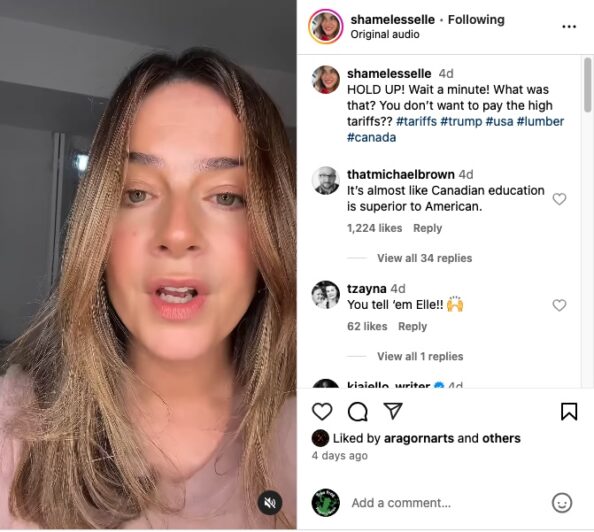

A Vernon internet personality known for her funny online responses has shifted to creating political content with an upcoming federal election and ongoing trade war with the United States. Vernonite Elle James, known online as Shameless Elle, has been creating content for years, primarily making humorous reaction videos. Things started to shift for James during the most recent U.S presidential election.

A Vernon internet personality known for her funny online responses has shifted to creating political content with an upcoming federal election and ongoing trade war with the United States. Vernonite Elle James, known online as Shameless Elle, has been creating content for years, primarily making humorous reaction videos. Things started to shift for James during the most recent U.S presidential election.

SAGUENAY, QUE. — Wood, as well as aluminum, are economic drivers in Quebec’s Saguenay-Lac-St-Jean region north of Quebec City. The … looming 25 per cent tariffs are leaving businesses in Saguenay-Lac-St-Jean bracing for impact. Inotech, a company that specializes in manufacturing equipment for the wood industry, said the economic disruption started in early February, when Trump had initially promised to impose tariffs, before delaying them. “In Quebec, the entire wood market was paralyzed,” said Michel Marceau, the company’s CEO. “People are waiting to see what will happen and during this time, no one is investing,” added Michael Dufour, Inotech’s sales director. A recent study from the Canadian Chamber of Commerce identified Saguenay and Drummondville — a city northeast of Montreal — among the Canadian cities most vulnerable to U.S. tariffs.

SAGUENAY, QUE. — Wood, as well as aluminum, are economic drivers in Quebec’s Saguenay-Lac-St-Jean region north of Quebec City. The … looming 25 per cent tariffs are leaving businesses in Saguenay-Lac-St-Jean bracing for impact. Inotech, a company that specializes in manufacturing equipment for the wood industry, said the economic disruption started in early February, when Trump had initially promised to impose tariffs, before delaying them. “In Quebec, the entire wood market was paralyzed,” said Michel Marceau, the company’s CEO. “People are waiting to see what will happen and during this time, no one is investing,” added Michael Dufour, Inotech’s sales director. A recent study from the Canadian Chamber of Commerce identified Saguenay and Drummondville — a city northeast of Montreal — among the Canadian cities most vulnerable to U.S. tariffs. Following the US government’s imposed tariffs on steel and aluminium, Cepi has called on the European Commission to continue negotiations, citing the potential for future tariffs including pulp and paper and aiming to avoid supply chain disruptions. Cepi is currently taking part in a consultation launched by the European Commission. …The confederation asks the Commission to exclude from such EU retaliation list products that risk being in short supply in the EU. …According to Cepi, the EU imports around 900,000 tonnes of pulp per year from the US and close to 600,000 tonnes of paper and board, while the EU exports about 1600,000 tonnes of paper and board to the US and around 350,000 tonnes of pulp. It states that since a multilateral agreement of all major pulp and paper producers in January 2004, there have been no import tariffs on both sides of the Atlantic.

Following the US government’s imposed tariffs on steel and aluminium, Cepi has called on the European Commission to continue negotiations, citing the potential for future tariffs including pulp and paper and aiming to avoid supply chain disruptions. Cepi is currently taking part in a consultation launched by the European Commission. …The confederation asks the Commission to exclude from such EU retaliation list products that risk being in short supply in the EU. …According to Cepi, the EU imports around 900,000 tonnes of pulp per year from the US and close to 600,000 tonnes of paper and board, while the EU exports about 1600,000 tonnes of paper and board to the US and around 350,000 tonnes of pulp. It states that since a multilateral agreement of all major pulp and paper producers in January 2004, there have been no import tariffs on both sides of the Atlantic. WASHINGTON — A gobsmacked planet is wondering what’s next from President Donald Trump on the tariff spree he’s set in zigzag motion. In recent weeks, Trump has announced punishing tariffs against allies and adversaries alike, selectively paused and imposed them, doubled and then halved some, and warned late in the week that he’ll tax European wine and spirits a stratospheric 200% if the European Union doesn’t drop a 50% tariff on U.S. whiskey. His ultimate stated goal is clear: to revive American manufacturing and win compromises along the way. But people and nations whose fortunes rise and fall on trade are trying to divine a method to his machinations. So far, he’s spurred fears about slower growth and higher inflation that are dragging down the stock market and consumer confidence. “His tariff policy is erratic,” Robert Halver, at Germany’s Baader Bank, said. “So, there is no planning certainty at all.”

WASHINGTON — A gobsmacked planet is wondering what’s next from President Donald Trump on the tariff spree he’s set in zigzag motion. In recent weeks, Trump has announced punishing tariffs against allies and adversaries alike, selectively paused and imposed them, doubled and then halved some, and warned late in the week that he’ll tax European wine and spirits a stratospheric 200% if the European Union doesn’t drop a 50% tariff on U.S. whiskey. His ultimate stated goal is clear: to revive American manufacturing and win compromises along the way. But people and nations whose fortunes rise and fall on trade are trying to divine a method to his machinations. So far, he’s spurred fears about slower growth and higher inflation that are dragging down the stock market and consumer confidence. “His tariff policy is erratic,” Robert Halver, at Germany’s Baader Bank, said. “So, there is no planning certainty at all.”

The Commerce Department’s Bureau of Industry and Security (BIS) has formally launched two Section 232 investigations that could lead to import restrictions on copper and lumber and timber, according to Federal Register notices scheduled for publication on Thursday. Trump signed an executive order on Feb. 25 ordering the copper probe and another on March 1 for lumber and timber. Both instructed Commerce Secretary Howard Lutnick to start the investigations, which threaten to further strain trade relations with Canada and other trading partners. The Section 232 law allows up to 270 days for a probe, but White House officials said they expect Lutnick to move faster. In one sign of that, BIS set an extremely short period for public comment in the two investigations, ending on April 1. that coincides with the deadline for executive branch agencies to compete a number of trade reports for the White House. [to access the full story a PoliticoPro subscription is required]

The Commerce Department’s Bureau of Industry and Security (BIS) has formally launched two Section 232 investigations that could lead to import restrictions on copper and lumber and timber, according to Federal Register notices scheduled for publication on Thursday. Trump signed an executive order on Feb. 25 ordering the copper probe and another on March 1 for lumber and timber. Both instructed Commerce Secretary Howard Lutnick to start the investigations, which threaten to further strain trade relations with Canada and other trading partners. The Section 232 law allows up to 270 days for a probe, but White House officials said they expect Lutnick to move faster. In one sign of that, BIS set an extremely short period for public comment in the two investigations, ending on April 1. that coincides with the deadline for executive branch agencies to compete a number of trade reports for the White House. [to access the full story a PoliticoPro subscription is required]

KUALA LUMPUR, Malaysia — The proposed classification of two timber species commonly found in Malaysia as unsustainable by the United States and the European Union (EU) under the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) will result in the cancellation of Malaysian timber exports to the US and the EU. The Timber Exporters’ Association of Malaysia (TEAM) treasurer Wong Kar Wai said that in addition to impending tariffs, the US and the EU are proposing to classify certain timber species common to Southeast Asia, including Malaysia – namely Shorea, locally known as Meranti, and Apitong, known as Keruing – under CITES despite being sustainably harvested and processed. “Keruing is a special type of timber primarily used for floorboards, with the US being its main market. A major buyer is the US military, which uses Keruing for the flooring of trucks and tanks due to its durability and strength.

KUALA LUMPUR, Malaysia — The proposed classification of two timber species commonly found in Malaysia as unsustainable by the United States and the European Union (EU) under the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) will result in the cancellation of Malaysian timber exports to the US and the EU. The Timber Exporters’ Association of Malaysia (TEAM) treasurer Wong Kar Wai said that in addition to impending tariffs, the US and the EU are proposing to classify certain timber species common to Southeast Asia, including Malaysia – namely Shorea, locally known as Meranti, and Apitong, known as Keruing – under CITES despite being sustainably harvested and processed. “Keruing is a special type of timber primarily used for floorboards, with the US being its main market. A major buyer is the US military, which uses Keruing for the flooring of trucks and tanks due to its durability and strength.