If there is a prolonged trade war between the US and Canada, expect insurance rates… to rise in price. The industry notes there’s a lot of uncertainty about tariffs right now. But one outcome the industry can likely count on is increases to home and auto rates, says Steven Harris. …Although home insurance premiums haven’t increased as high as auto rates — in 2024 Q4, for example, personal property premium rates increased 7.3% from the previous year — consumers are likely to see any impacts from the tariffs appear on their home insurance policy renewal much sooner, says Harris. “And if building materials like software lumber are tariffed, and thereby more expensive to import, they’ll cost more to insure. …“Tariffs on building materials directly inflate rebuilding expenses, necessitating higher replacement cost coverage for homeowners.”

If there is a prolonged trade war between the US and Canada, expect insurance rates… to rise in price. The industry notes there’s a lot of uncertainty about tariffs right now. But one outcome the industry can likely count on is increases to home and auto rates, says Steven Harris. …Although home insurance premiums haven’t increased as high as auto rates — in 2024 Q4, for example, personal property premium rates increased 7.3% from the previous year — consumers are likely to see any impacts from the tariffs appear on their home insurance policy renewal much sooner, says Harris. “And if building materials like software lumber are tariffed, and thereby more expensive to import, they’ll cost more to insure. …“Tariffs on building materials directly inflate rebuilding expenses, necessitating higher replacement cost coverage for homeowners.”

CNN’s Vanessa Yurkevich explains how much US home prices could increase due to President Donald Trump’s tariffs. [Video report only, 2 .5 minutes]

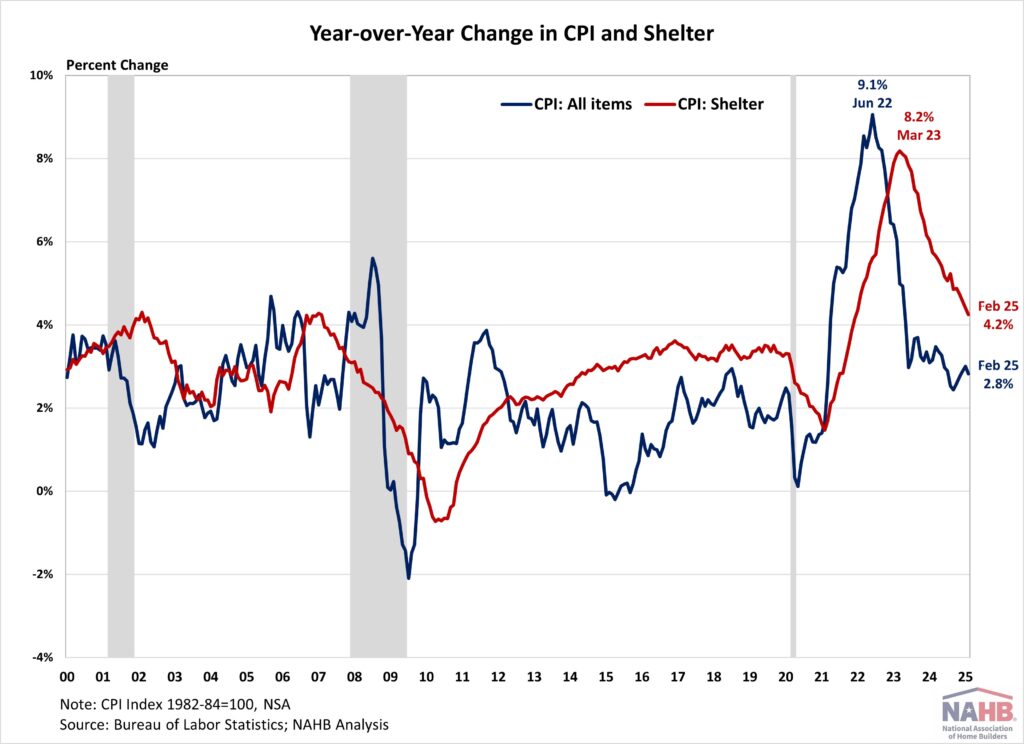

CNN’s Vanessa Yurkevich explains how much US home prices could increase due to President Donald Trump’s tariffs. [Video report only, 2 .5 minutes] A surprise jump in inflation and a flood of “noise” in the economy may push the Bank of Canada to pause its interest rate cuts next month, some economists argue. Statistics Canada said that the annual rate of inflation accelerated sharply to 2.6% in February as the federal government’s temporary tax break came to an end mid-month. That marks a sizeable jump from the 1.9% increase seen in January, when Canadians saw GST and HST taken off a variety of household staples. …Economists expect Ottawa’s move to strike the consumer carbon price as of April 1 will take some steam out of the inflation figures next month. But Nguyen argued the pressure from the trade dispute — Trump has threatened another wave of tariffs on April 2 — will “outweigh” the benefits of eliminating the carbon price for consumers.

A surprise jump in inflation and a flood of “noise” in the economy may push the Bank of Canada to pause its interest rate cuts next month, some economists argue. Statistics Canada said that the annual rate of inflation accelerated sharply to 2.6% in February as the federal government’s temporary tax break came to an end mid-month. That marks a sizeable jump from the 1.9% increase seen in January, when Canadians saw GST and HST taken off a variety of household staples. …Economists expect Ottawa’s move to strike the consumer carbon price as of April 1 will take some steam out of the inflation figures next month. But Nguyen argued the pressure from the trade dispute — Trump has threatened another wave of tariffs on April 2 — will “outweigh” the benefits of eliminating the carbon price for consumers.

Trump’s escalating trade tariffs will hit world growth and raise inflation, the OECD has predicted. Canada and Mexico are forecast to see the biggest impact as they have had the harshest tariffs imposed on them, but US growth is also expected to be hit. …Trump has imposed 25% tariffs on all steel and aluminium imports. The US has also imposed 25% tariffs on other imports from Mexico and Canada – with some exemptions – and a 20% levy on Chinese goods. Canada and the EU have announced retaliatory tariffs. …Canada’s economy is predicted to grow by just 0.7% this year and in 2026, compared with the previous forecast of 2% for both years. Mexico is now forecast to contract by 1.3% this year and shrink a further 0.6% next year, instead of growing by 1.2% and 1.6%. Growth in the US has also been downgraded, with growth of 2.2% this year and 1.6% in 2025, down from previous forecasts of 2.4% and 2.1% China’s growth forecast will fall slightly to 4.8%.

Trump’s escalating trade tariffs will hit world growth and raise inflation, the OECD has predicted. Canada and Mexico are forecast to see the biggest impact as they have had the harshest tariffs imposed on them, but US growth is also expected to be hit. …Trump has imposed 25% tariffs on all steel and aluminium imports. The US has also imposed 25% tariffs on other imports from Mexico and Canada – with some exemptions – and a 20% levy on Chinese goods. Canada and the EU have announced retaliatory tariffs. …Canada’s economy is predicted to grow by just 0.7% this year and in 2026, compared with the previous forecast of 2% for both years. Mexico is now forecast to contract by 1.3% this year and shrink a further 0.6% next year, instead of growing by 1.2% and 1.6%. Growth in the US has also been downgraded, with growth of 2.2% this year and 1.6% in 2025, down from previous forecasts of 2.4% and 2.1% China’s growth forecast will fall slightly to 4.8%. The Trump administration’s tariffs on imported goods from Canada, Mexico and China — some already in place, others set to take effect in a few weeks — are already driving up the cost of building materials used in new residential construction and home remodeling projects. The tariffs are projected to raise the costs that go into building a single-family home in the U.S. by US$7,500 to US$10,000, according to the NAHB. We Buy Houses in San Francisco, which purchases foreclosed homes and then typically renovates and sells them, is increasing prices on its refurbished properties between 7% and 12%. That’s even after stockpiling 62% more Canadian lumber than usual. …The timing of the tariffs couldn’t be worse as this is typically the busiest time of year for home sales. …Confusion over the timing and scope of the tariffs, and their impact on the economy, could have a bigger chilling effect on the new-home market than higher prices.

The Trump administration’s tariffs on imported goods from Canada, Mexico and China — some already in place, others set to take effect in a few weeks — are already driving up the cost of building materials used in new residential construction and home remodeling projects. The tariffs are projected to raise the costs that go into building a single-family home in the U.S. by US$7,500 to US$10,000, according to the NAHB. We Buy Houses in San Francisco, which purchases foreclosed homes and then typically renovates and sells them, is increasing prices on its refurbished properties between 7% and 12%. That’s even after stockpiling 62% more Canadian lumber than usual. …The timing of the tariffs couldn’t be worse as this is typically the busiest time of year for home sales. …Confusion over the timing and scope of the tariffs, and their impact on the economy, could have a bigger chilling effect on the new-home market than higher prices.

Now that a 25% tariff on lumber from Canada is looming, will this cause crazy wood pricing to return? To some extent, that is very probable, and here’s why. In 2024, our country got about 72% of its lumber from its own forests. The rest was imported from various countries, especially Canada, from which we purchased 28.1 million cubic meters last year. Canada accounts for 84.3% of all softwood lumber imports. …While it might be possible to switch to importing more lumber from other countries, none has Canada’s large production capacity. Also, supply chains — especially for lumber — are complex and costly to change, says Frederik Laleicke, at NC State University. …As long as demand for lumber doesn’t drop, a 25% tariff on Canada will likely make lumber—and therefore new houses and renovations—more expensive since US companies will raise the price of Canadian-sourced lumber to compensate for the tariffs.

Now that a 25% tariff on lumber from Canada is looming, will this cause crazy wood pricing to return? To some extent, that is very probable, and here’s why. In 2024, our country got about 72% of its lumber from its own forests. The rest was imported from various countries, especially Canada, from which we purchased 28.1 million cubic meters last year. Canada accounts for 84.3% of all softwood lumber imports. …While it might be possible to switch to importing more lumber from other countries, none has Canada’s large production capacity. Also, supply chains — especially for lumber — are complex and costly to change, says Frederik Laleicke, at NC State University. …As long as demand for lumber doesn’t drop, a 25% tariff on Canada will likely make lumber—and therefore new houses and renovations—more expensive since US companies will raise the price of Canadian-sourced lumber to compensate for the tariffs. Lumber futures rebounded to around $650 per thousand board feet, nearing the two-and-a-half-year high of $658 touched earlier this month as escalating U.S. tariff threats on steel, aluminum, and dairy—along with the prospect of sharply higher auto tariffs—stoked fears of further trade restrictions, reversing the recent plunge. The renewed trade war tensions have heightened concerns that lumber could be the next target, prompting traders to reassess supply risks. Earlier, prices had dropped to around $600 after President Trump delayed a 25% tariff on Canadian softwood for the second time, temporarily easing supply concerns. The proposed levy, which would raise total duties to as much as 52%, could significantly strain North American production and push construction costs higher. However, the latest escalation in the trade war has reversed sentiment, with traders wary that lumber could still face new restrictions, driving speculative buying. [END]

Lumber futures rebounded to around $650 per thousand board feet, nearing the two-and-a-half-year high of $658 touched earlier this month as escalating U.S. tariff threats on steel, aluminum, and dairy—along with the prospect of sharply higher auto tariffs—stoked fears of further trade restrictions, reversing the recent plunge. The renewed trade war tensions have heightened concerns that lumber could be the next target, prompting traders to reassess supply risks. Earlier, prices had dropped to around $600 after President Trump delayed a 25% tariff on Canadian softwood for the second time, temporarily easing supply concerns. The proposed levy, which would raise total duties to as much as 52%, could significantly strain North American production and push construction costs higher. However, the latest escalation in the trade war has reversed sentiment, with traders wary that lumber could still face new restrictions, driving speculative buying. [END] I have received several questions from owners and contractors regarding what to expect with lumber prices given the tariffs (or the potential of tariffs, depending on the day). The short answer is prices will go up. The long answer is much more complicated and hinges on a number of factors and considerations. 1. Almost 30 percent of the lumber used in the U.S. each year comes from Canada. …2. Any tariffs or potential for tariffs creates opportunistic price increases. …3. Demand, however, doesn’t seem to be particularly strong for new construction at this time. …4. Tariffs do help to onshore manufacturing (a long-term positive), but the trees aren’t all in America. …In the short-term, tariffs create more uncertainty and increased pricing, which only further adds to the inflation story. In the long-term, tariffs on lumber won’t achieve the level of onshoring that can happen in other industries.

I have received several questions from owners and contractors regarding what to expect with lumber prices given the tariffs (or the potential of tariffs, depending on the day). The short answer is prices will go up. The long answer is much more complicated and hinges on a number of factors and considerations. 1. Almost 30 percent of the lumber used in the U.S. each year comes from Canada. …2. Any tariffs or potential for tariffs creates opportunistic price increases. …3. Demand, however, doesn’t seem to be particularly strong for new construction at this time. …4. Tariffs do help to onshore manufacturing (a long-term positive), but the trees aren’t all in America. …In the short-term, tariffs create more uncertainty and increased pricing, which only further adds to the inflation story. In the long-term, tariffs on lumber won’t achieve the level of onshoring that can happen in other industries.  US lumber futures have fallen from their all-time highs after president Trump’s delay to tariffs on Canada this week halted a surge in prices. Contracts tracking a truckload of lumber hit the highest point in their 30-month history this week. …Trump initially planned to impose 25% tariffs on critical Canadian imports, boosting prices, but Thursday’s pause for a month pushed prices for delivery in May down more than 6% over two days, to $651 per MBF. Even so, prices remain elevated as Trump also ordered a federal investigation into Canadian companies potentially dumping excess supplies into the US market. …Together with potential tariffs, the total duty on Canadian imports could rise from 14.5 per cent to 52 per cent. “This is going to be devastating for Canadian producers,” said Dustin Jalbert, senior economist for wood products at price reporting agency Fastmarkets. “No Canadian producer is making the margin to be able to absorb that.”

US lumber futures have fallen from their all-time highs after president Trump’s delay to tariffs on Canada this week halted a surge in prices. Contracts tracking a truckload of lumber hit the highest point in their 30-month history this week. …Trump initially planned to impose 25% tariffs on critical Canadian imports, boosting prices, but Thursday’s pause for a month pushed prices for delivery in May down more than 6% over two days, to $651 per MBF. Even so, prices remain elevated as Trump also ordered a federal investigation into Canadian companies potentially dumping excess supplies into the US market. …Together with potential tariffs, the total duty on Canadian imports could rise from 14.5 per cent to 52 per cent. “This is going to be devastating for Canadian producers,” said Dustin Jalbert, senior economist for wood products at price reporting agency Fastmarkets. “No Canadian producer is making the margin to be able to absorb that.”

VANCOUVER, BC — Canfor Corporation reported its fourth quarter of 2024 results. Highlights include: Q4 2024 operating loss of $46 million; shareholder net loss of $63 million; Supply-driven uptick in North American lumber markets and pricing through the fourth quarter led to improved results from the Company’s Western Canadian and US South operations; another quarter of solid earnings from Europe; Improved

VANCOUVER, BC — Canfor Corporation reported its fourth quarter of 2024 results. Highlights include: Q4 2024 operating loss of $46 million; shareholder net loss of $63 million; Supply-driven uptick in North American lumber markets and pricing through the fourth quarter led to improved results from the Company’s Western Canadian and US South operations; another quarter of solid earnings from Europe; Improved

VANCOUVER — Conifex Timber reported results for the fourth quarter and year ended December 31, 2024. EBITDA from continuing operations was negative $2.1 million for the quarter and negative $13.6 million for the year, compared to EBITDA of negative $3.5 million in the fourth quarter of 2023 and negative $25.8 million for the year. Net loss was $29.8 million for the quarter while it was $11.8 million for the full year. …While there are signs that the macro-environment for the lumber industry is starting to improve, Conifex continues to review its options to improve liquidity. …Since January 6, 2025, we have been operating our sawmill complex on a two-shift basis and capturing the dual benefits of higher shipments and lower unit costs that a two-shift operation provides over a single-shift configuration.

VANCOUVER — Conifex Timber reported results for the fourth quarter and year ended December 31, 2024. EBITDA from continuing operations was negative $2.1 million for the quarter and negative $13.6 million for the year, compared to EBITDA of negative $3.5 million in the fourth quarter of 2023 and negative $25.8 million for the year. Net loss was $29.8 million for the quarter while it was $11.8 million for the full year. …While there are signs that the macro-environment for the lumber industry is starting to improve, Conifex continues to review its options to improve liquidity. …Since January 6, 2025, we have been operating our sawmill complex on a two-shift basis and capturing the dual benefits of higher shipments and lower unit costs that a two-shift operation provides over a single-shift configuration.  The B.C. Council of Forest Industries (COFI) welcomed B.C.’s responses to American tariffs, but questioned aspects of the provincial budget tabled Tuesday. B.C.’s forests minister, meanwhile, is calling on Ottawa to step up supports. Kim Haakstad, president and CEO of COFI, said her organization welcomes the budget’s focus on responding to new tariffs announced March 4. “We are disappointed by the absence of dedicated support for the forest sector,” Haakstad said. “As Premier (David) Eby and (Forests) Minister (Ravi) Parmar have acknowledged, the forest sector will be particularly hard hit by the new tariffs at a time when the industry is already facing significant challenges. These broad-based tariffs apply to all forest product exports … adding further pressure on workers, companies and communities already affected by softwood lumber duties.” …COFI remains committed to working with the government to advance solutions that strengthen the forestry sector, improve the provincial economy and diversify markets.

The B.C. Council of Forest Industries (COFI) welcomed B.C.’s responses to American tariffs, but questioned aspects of the provincial budget tabled Tuesday. B.C.’s forests minister, meanwhile, is calling on Ottawa to step up supports. Kim Haakstad, president and CEO of COFI, said her organization welcomes the budget’s focus on responding to new tariffs announced March 4. “We are disappointed by the absence of dedicated support for the forest sector,” Haakstad said. “As Premier (David) Eby and (Forests) Minister (Ravi) Parmar have acknowledged, the forest sector will be particularly hard hit by the new tariffs at a time when the industry is already facing significant challenges. These broad-based tariffs apply to all forest product exports … adding further pressure on workers, companies and communities already affected by softwood lumber duties.” …COFI remains committed to working with the government to advance solutions that strengthen the forestry sector, improve the provincial economy and diversify markets.

Shopping for a new home? Ready to renovate your kitchen or install a new deck? You’ll be paying more to do so. The Trump administration’s tariffs on imported goods from Canada, Mexico and China are already driving up the cost of building materials used in new residential construction and home remodeling projects. The tariffs are projected to raise the costs that go into building a single-family home in the U.S. by $7,500 to $10,000… Such costs are typically passed along to the homebuyer in the form of higher prices, which could hurt demand at a time when the U.S. housing market remains in a slump and many builders are having to offer buyers costly incentives to drum up sales… “These prices will never come down,” Schnipper said. “Whatever is going to happen, these things will be sticky and hopefully we’re good enough as a small business, that we can absorb some of that.”

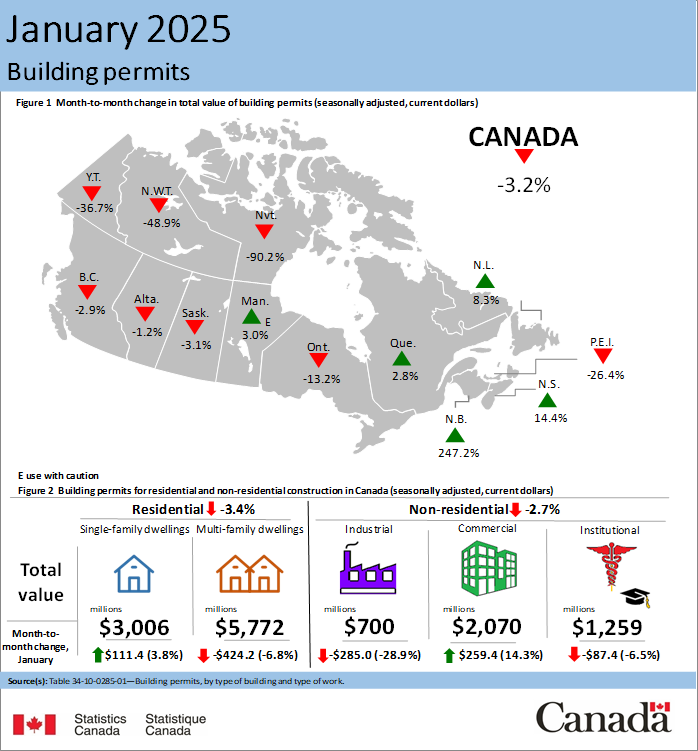

Shopping for a new home? Ready to renovate your kitchen or install a new deck? You’ll be paying more to do so. The Trump administration’s tariffs on imported goods from Canada, Mexico and China are already driving up the cost of building materials used in new residential construction and home remodeling projects. The tariffs are projected to raise the costs that go into building a single-family home in the U.S. by $7,500 to $10,000… Such costs are typically passed along to the homebuyer in the form of higher prices, which could hurt demand at a time when the U.S. housing market remains in a slump and many builders are having to offer buyers costly incentives to drum up sales… “These prices will never come down,” Schnipper said. “Whatever is going to happen, these things will be sticky and hopefully we’re good enough as a small business, that we can absorb some of that.” The US housing market showed mixed signals in February, with a sharp rise in housing starts contrasting with a decline in building permits. According to the latest data from the U.S. Census Bureau, new residential construction activity picked up, but future construction intentions weakened, raising questions about the sector’s near-term strength. Privately-owned housing starts surged to a seasonally adjusted annual rate of 1.501 million in February, marking an 11.2% increase from January’s revised figure of 1.350 million. The single-family sector led the gains, with starts rising 11.4% to 1.108 million units. However, despite this strong monthly performance, overall starts remained 2.9% below February 2024 levels, signaling ongoing challenges in year-over-year growth. …This decline extended the downward trend, with permits now 6.8% below year-ago levels. Single-family authorizations remained relatively stable at 992,000, down just 0.2% from January.

The US housing market showed mixed signals in February, with a sharp rise in housing starts contrasting with a decline in building permits. According to the latest data from the U.S. Census Bureau, new residential construction activity picked up, but future construction intentions weakened, raising questions about the sector’s near-term strength. Privately-owned housing starts surged to a seasonally adjusted annual rate of 1.501 million in February, marking an 11.2% increase from January’s revised figure of 1.350 million. The single-family sector led the gains, with starts rising 11.4% to 1.108 million units. However, despite this strong monthly performance, overall starts remained 2.9% below February 2024 levels, signaling ongoing challenges in year-over-year growth. …This decline extended the downward trend, with permits now 6.8% below year-ago levels. Single-family authorizations remained relatively stable at 992,000, down just 0.2% from January.  Trump administration officials are roiled in debate over how to implement the president’s pledge to equalize U.S. tariffs with those charged by other nations, with aides scrambling to meet the president’s self-imposed deadline of April 2 to debut a plan. Officials have recently weighed whether to simplify the complex task of devising new tariff rates for hundreds of U.S. trading partners by instead sorting nations into one of three tariff tiers, according to people close to the policy discussions, who emphasized that the situation remains fluid and could evolve in the coming weeks. The proposal was later ruled out, said an administration official close to the talks, adding that Trump’s team is still trying to sort how to implement an individualized rate for each nation. …The reciprocal tariff plan is expected to be introduced on April 2, along with additional 25% duties on a handful of industries, such as autos, semiconductors and pharmaceuticals.

Trump administration officials are roiled in debate over how to implement the president’s pledge to equalize U.S. tariffs with those charged by other nations, with aides scrambling to meet the president’s self-imposed deadline of April 2 to debut a plan. Officials have recently weighed whether to simplify the complex task of devising new tariff rates for hundreds of U.S. trading partners by instead sorting nations into one of three tariff tiers, according to people close to the policy discussions, who emphasized that the situation remains fluid and could evolve in the coming weeks. The proposal was later ruled out, said an administration official close to the talks, adding that Trump’s team is still trying to sort how to implement an individualized rate for each nation. …The reciprocal tariff plan is expected to be introduced on April 2, along with additional 25% duties on a handful of industries, such as autos, semiconductors and pharmaceuticals.

President Trump’s tariffs could increase material costs for the average new home by as much as $10,000, according to the National Association of Home Builders. The trade group said it has received anecdotal reports from members that Trump’s plan would raise material prices by between $7,500 and $10,000 for the average new single-family home. …The NAHB said softwood lumber is mainly sourced from Canada, while gypsum, a component of drywall, comes primarily from Mexico. Other materials like steel and aluminum — in addition to completed home appliances — are imported to the U.S. from China, the group said. An implementation of the 25% tariff on Canada and Mexico as previously laid out by Trump would raise total costs for imported construction materials by more than $3 billion, according to the NAHB.

President Trump’s tariffs could increase material costs for the average new home by as much as $10,000, according to the National Association of Home Builders. The trade group said it has received anecdotal reports from members that Trump’s plan would raise material prices by between $7,500 and $10,000 for the average new single-family home. …The NAHB said softwood lumber is mainly sourced from Canada, while gypsum, a component of drywall, comes primarily from Mexico. Other materials like steel and aluminum — in addition to completed home appliances — are imported to the U.S. from China, the group said. An implementation of the 25% tariff on Canada and Mexico as previously laid out by Trump would raise total costs for imported construction materials by more than $3 billion, according to the NAHB.

President Trump’s push for tariffs on Canada – and his subsequent delays and exemptions – are frustrating efforts to import lumber from the country and putting the building supply market on edge. The back-and-forth over whether tariffs will be imposed or not has businesses unable to trust price stability, and risks backing up the supply chain for US homebuilders. The reluctance to pay a tariff, which could be changed or cancelled any day, “freezes these markets up,” according to Don Magruder, who runs a building material company based in Florida. …Andy Rielly, president of Rielly Lumber in British Columbia, said he’s been in talks with long-term customers on how to divvy up the extra costs, but not everyone has been able to strike deals. …The US’s National Association of Home Builders chairman Buddy Hughes said tariffs risk worsening housing affordability. …The US Lumber Coalition said that lumber prices are only a fraction of homebuilding costs.

President Trump’s push for tariffs on Canada – and his subsequent delays and exemptions – are frustrating efforts to import lumber from the country and putting the building supply market on edge. The back-and-forth over whether tariffs will be imposed or not has businesses unable to trust price stability, and risks backing up the supply chain for US homebuilders. The reluctance to pay a tariff, which could be changed or cancelled any day, “freezes these markets up,” according to Don Magruder, who runs a building material company based in Florida. …Andy Rielly, president of Rielly Lumber in British Columbia, said he’s been in talks with long-term customers on how to divvy up the extra costs, but not everyone has been able to strike deals. …The US’s National Association of Home Builders chairman Buddy Hughes said tariffs risk worsening housing affordability. …The US Lumber Coalition said that lumber prices are only a fraction of homebuilding costs. The Trump administration is moving at a record pace on a varied list of priorities, but insiders hope a focus on housing will remain at the top of the agenda in 2025. With housing affordability a central focus, bills addressing zoning, permitting, workforce development, and taxes are taking shape. …Despite all these areas of concern, one concern looms largest – tariffs. Approximately 22% of the products used in the average home are imported from China, 70% of lumber used in construction is sourced from Canada, and Mexico is the largest provider of gypsum. …The NAHB has advocated for an exemption for building materials, and the association continues to engage in conversations with lawmakers about the harmful effects these tariffs could have on housing affordability. NAHB’s Karl Eckhart says “These Canadian and Mexican tariffs are going to have a direct and painful impact on the price to build a house.”

The Trump administration is moving at a record pace on a varied list of priorities, but insiders hope a focus on housing will remain at the top of the agenda in 2025. With housing affordability a central focus, bills addressing zoning, permitting, workforce development, and taxes are taking shape. …Despite all these areas of concern, one concern looms largest – tariffs. Approximately 22% of the products used in the average home are imported from China, 70% of lumber used in construction is sourced from Canada, and Mexico is the largest provider of gypsum. …The NAHB has advocated for an exemption for building materials, and the association continues to engage in conversations with lawmakers about the harmful effects these tariffs could have on housing affordability. NAHB’s Karl Eckhart says “These Canadian and Mexican tariffs are going to have a direct and painful impact on the price to build a house.” Lumber producers have migrated from Canada to the US South. Now lumber-futures trading is heading to the Southern pineries as well. The exchange operator CME Group said it would launch trading in Southern yellow pine futures on March 31, a response to rising export taxes on Canadian lumber. The futures contracts—ticker: SYP—will give the South’s loblolly planters, loggers, sawmills, pressure treaters and builders a mechanism to manage their exposure to price swings that is more in line with the local market than existing futures. …Traders and the exchange have for years discussed Southern yellow pine futures as the region’s production grew. Now that Northern lumber is a lot more expensive, they are saying the time is right. …Southern yellow pine doesn’t always work as a substitute for the Northern species favored by home builders. But executives said the growing price difference is prompting pockets of buyers to swap.

Lumber producers have migrated from Canada to the US South. Now lumber-futures trading is heading to the Southern pineries as well. The exchange operator CME Group said it would launch trading in Southern yellow pine futures on March 31, a response to rising export taxes on Canadian lumber. The futures contracts—ticker: SYP—will give the South’s loblolly planters, loggers, sawmills, pressure treaters and builders a mechanism to manage their exposure to price swings that is more in line with the local market than existing futures. …Traders and the exchange have for years discussed Southern yellow pine futures as the region’s production grew. Now that Northern lumber is a lot more expensive, they are saying the time is right. …Southern yellow pine doesn’t always work as a substitute for the Northern species favored by home builders. But executives said the growing price difference is prompting pockets of buyers to swap.