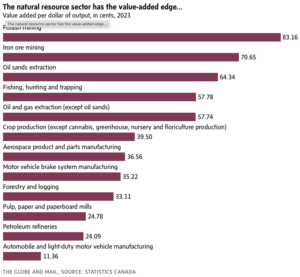

It’s been nearly a century since political economist Harold Innis popularized the phrase “hewers of wood and drawers of water” in decrying Canada’s dependence on natural resources. …Underpinning that cry is the (wrongheaded) assumption that natural resources such as mining, agriculture and energy are second-grade economic activity, less desirable than manufacturing. …That mistake is the foundation for many public policy blunders over many decades. The numbers demolish that myth, and tell a very different story, one in which energy, mining and other natural resources sectors create enormous economic value and are globally competitive. …The federal government needs to get itself out of the way of some of the strongest parts of the Canadian economy. Stop subsidizing inefficient sectors. Stop raising protective tariffs that harm other parts of the economy. Focus on rolling back unjustified regulatory barriers that harm the ability of the entire economy, particularly globally exposed natural resources sectors, to compete. And, most of all, stop the undervaluing Canada’s great natural advantage in natural resources. [to access the full story a Globe & Mail subscription is required]

It’s been nearly a century since political economist Harold Innis popularized the phrase “hewers of wood and drawers of water” in decrying Canada’s dependence on natural resources. …Underpinning that cry is the (wrongheaded) assumption that natural resources such as mining, agriculture and energy are second-grade economic activity, less desirable than manufacturing. …That mistake is the foundation for many public policy blunders over many decades. The numbers demolish that myth, and tell a very different story, one in which energy, mining and other natural resources sectors create enormous economic value and are globally competitive. …The federal government needs to get itself out of the way of some of the strongest parts of the Canadian economy. Stop subsidizing inefficient sectors. Stop raising protective tariffs that harm other parts of the economy. Focus on rolling back unjustified regulatory barriers that harm the ability of the entire economy, particularly globally exposed natural resources sectors, to compete. And, most of all, stop the undervaluing Canada’s great natural advantage in natural resources. [to access the full story a Globe & Mail subscription is required]

The pace of homebuilding in Canada continues to slow with no near-term signs of a turnaround, said Canada Mortgage and Housing Corp. on Monday. The national housing agency said the seasonally-adjusted annual pace of housing starts declined 15% in January. Housing starts can vary considerably month-to-month as big projects get started, but the agency’s six-month moving average for annual starts also showed a 3.5% decline. “The six-month trend has decreased for the fourth consecutive month,” said CMHC deputy chief economist Tania Bourassa-Ochoa in a news release. “We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity.” She said a near-term turnaround is looking unlikely, and reflects what the agency has been hearing from developers over recent months. The pullback comes amid a variety of pressures, including lower immigration numbers and US trade policy.

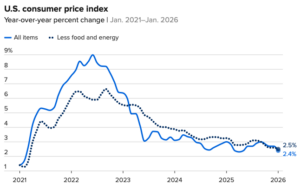

The pace of homebuilding in Canada continues to slow with no near-term signs of a turnaround, said Canada Mortgage and Housing Corp. on Monday. The national housing agency said the seasonally-adjusted annual pace of housing starts declined 15% in January. Housing starts can vary considerably month-to-month as big projects get started, but the agency’s six-month moving average for annual starts also showed a 3.5% decline. “The six-month trend has decreased for the fourth consecutive month,” said CMHC deputy chief economist Tania Bourassa-Ochoa in a news release. “We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity.” She said a near-term turnaround is looking unlikely, and reflects what the agency has been hearing from developers over recent months. The pullback comes amid a variety of pressures, including lower immigration numbers and US trade policy. Canada’s annual inflation rate edged down to 2.3% in January, Statistics Canada said on Tuesday, driven downward by a decline in the cost of gasoline. Economists were largely expecting the rate to remain unchanged from December’s 2.4%. Pump prices put pressure on the headline rate, having fallen 16.7% in January compared to the same period last year. With gas excluded, January’s inflation rate came in at 3%. The Bank of Canada’s preferred measures of core inflation, which strip away volatility from one-time tax changes and gas prices, all ticked down in January — bringing those rates closer to the central bank’s two per cent inflation target. “Overall, this is an encouraging result for the Bank of Canada, with inflation finally nearing the [2%] target on a broader basis,” wrote Douglas Porter, chief economist at Bank of Montreal. ›

Canada’s annual inflation rate edged down to 2.3% in January, Statistics Canada said on Tuesday, driven downward by a decline in the cost of gasoline. Economists were largely expecting the rate to remain unchanged from December’s 2.4%. Pump prices put pressure on the headline rate, having fallen 16.7% in January compared to the same period last year. With gas excluded, January’s inflation rate came in at 3%. The Bank of Canada’s preferred measures of core inflation, which strip away volatility from one-time tax changes and gas prices, all ticked down in January — bringing those rates closer to the central bank’s two per cent inflation target. “Overall, this is an encouraging result for the Bank of Canada, with inflation finally nearing the [2%] target on a broader basis,” wrote Douglas Porter, chief economist at Bank of Montreal. › BURNABY, BC — Interfor recorded a net loss in Q4, 2025 of $104.6 million, compared to a net loss of $215.8 million in Q3’25 and a net loss of $49.9 million in Q4’24. Adjusted EBITDA was a loss of $29.2 million on sales of $600.6 million in Q4’25 versus an Adjusted EBITDA loss of $183.8 million on sales of $689.3 million in Q3’25 and Adjusted EBITDA of $80.4 million on sales of $746.5 million in Q4’24. …During and subsequent to Q4’25, Interfor completed a series of financing transactions. Taken together, these transactions significantly enhance Interfor’s financial flexibility, bolster liquidity and provide meaningful additional runway as the Company continues to navigate volatile lumber market conditions. …Lumber production of 753 million board feet was down 159 million board feet versus the preceding quarter. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle.

BURNABY, BC — Interfor recorded a net loss in Q4, 2025 of $104.6 million, compared to a net loss of $215.8 million in Q3’25 and a net loss of $49.9 million in Q4’24. Adjusted EBITDA was a loss of $29.2 million on sales of $600.6 million in Q4’25 versus an Adjusted EBITDA loss of $183.8 million on sales of $689.3 million in Q3’25 and Adjusted EBITDA of $80.4 million on sales of $746.5 million in Q4’24. …During and subsequent to Q4’25, Interfor completed a series of financing transactions. Taken together, these transactions significantly enhance Interfor’s financial flexibility, bolster liquidity and provide meaningful additional runway as the Company continues to navigate volatile lumber market conditions. …Lumber production of 753 million board feet was down 159 million board feet versus the preceding quarter. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle. NEW YORK, New York — Mercer International reported fourth quarter 2025 Operating EBITDA of negative $20.1 million compared to positive $99.2 million in the same quarter of 2024 and negative $28.1 million in the third quarter of 2025. In the fourth quarter of 2025, net loss was $308.7 million compared to net income of $16.7 million in the fourth quarter of 2024 and a net loss of $80.8 million in the third quarter of 2025. The net loss in the fourth quarter of 2025 included total non-cash impairments of $238.7 million. This included non-cash impairments of $203.5 million recognized against long-lived assets at our Peace River mill due to the continued down-cycle environment of hardwood pulp markets, $12.2 million against certain obsolete equipment and $23.0 million against pulp inventory due to low prices and high fiber costs. …Mr. Juan Carlos Bueno, CEO: “We continue to prioritize improving liquidity and working capital, committing to rebalancing our asset portfolio and maintaining operating discipline.”

NEW YORK, New York — Mercer International reported fourth quarter 2025 Operating EBITDA of negative $20.1 million compared to positive $99.2 million in the same quarter of 2024 and negative $28.1 million in the third quarter of 2025. In the fourth quarter of 2025, net loss was $308.7 million compared to net income of $16.7 million in the fourth quarter of 2024 and a net loss of $80.8 million in the third quarter of 2025. The net loss in the fourth quarter of 2025 included total non-cash impairments of $238.7 million. This included non-cash impairments of $203.5 million recognized against long-lived assets at our Peace River mill due to the continued down-cycle environment of hardwood pulp markets, $12.2 million against certain obsolete equipment and $23.0 million against pulp inventory due to low prices and high fiber costs. …Mr. Juan Carlos Bueno, CEO: “We continue to prioritize improving liquidity and working capital, committing to rebalancing our asset portfolio and maintaining operating discipline.” VANCOUVER, BC

VANCOUVER, BC

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

Canada’s housing and homelessness crisis touches nearly every Canadian. Over the past decade, while federal housing spending has increased, affordability has worsened for all but the wealthiest, and homelessness is surging. Despite recent declines in housing prices and rents, unsheltered homelessness is still up 300% since 2018, according to the most recent national point-in-time count. The country has a narrow but historic window to tackle this crisis and rebuild our housing system so it delivers at the speed, scale and affordability this moment demands. …Federal action alone won’t get us there. Provinces and territories control the planning systems, development-charge frameworks, zoning rules, supportive housing, health services and income supports. …That is why we need a Canada Housing Accord. [Tim Richter is the chief executive of the Canadian Alliance to End Homelessness and Tyler Meredith is a senior fellow at the Munk School of Global Affairs and Public Policy]

Canada’s housing and homelessness crisis touches nearly every Canadian. Over the past decade, while federal housing spending has increased, affordability has worsened for all but the wealthiest, and homelessness is surging. Despite recent declines in housing prices and rents, unsheltered homelessness is still up 300% since 2018, according to the most recent national point-in-time count. The country has a narrow but historic window to tackle this crisis and rebuild our housing system so it delivers at the speed, scale and affordability this moment demands. …Federal action alone won’t get us there. Provinces and territories control the planning systems, development-charge frameworks, zoning rules, supportive housing, health services and income supports. …That is why we need a Canada Housing Accord. [Tim Richter is the chief executive of the Canadian Alliance to End Homelessness and Tyler Meredith is a senior fellow at the Munk School of Global Affairs and Public Policy] RUSS TAYLOR provided the latest quarterly report from the

RUSS TAYLOR provided the latest quarterly report from the

MONTREAL — Tariffs and economic angst delivered a significant blow to Canadian National Railway Co. last year, as the question mark hanging over North American free trade continues to threaten profits in 2026. “Tariffs, trade uncertainty and volatility impacted our full-year 2025 revenues by over $350 million,” chief commercial officer Janet Drysdale told analysts on a conference call Friday. Forest products and metals took the biggest bruising, she said, with the two segments seeing a year-over-year revenue drop of eight and four per cent, respectively, in the latest quarter. …On top of trade uncertainty, a less publicized source of angst has rippled through the rail industry since last summer. Union Pacific Corp., the second-largest railway operator in the United States, announced in July it wants to buy Norfolk Southern Corp. in a US$85-billion deal that would create that country’s first transcontinental railway, and potentially trigger a final wave of rail mergers across North America.

MONTREAL — Tariffs and economic angst delivered a significant blow to Canadian National Railway Co. last year, as the question mark hanging over North American free trade continues to threaten profits in 2026. “Tariffs, trade uncertainty and volatility impacted our full-year 2025 revenues by over $350 million,” chief commercial officer Janet Drysdale told analysts on a conference call Friday. Forest products and metals took the biggest bruising, she said, with the two segments seeing a year-over-year revenue drop of eight and four per cent, respectively, in the latest quarter. …On top of trade uncertainty, a less publicized source of angst has rippled through the rail industry since last summer. Union Pacific Corp., the second-largest railway operator in the United States, announced in July it wants to buy Norfolk Southern Corp. in a US$85-billion deal that would create that country’s first transcontinental railway, and potentially trigger a final wave of rail mergers across North America. B.C.’s export performance moved against the national pattern in November. Domestic exports to international markets rose 7.6 per cent year over year to $4.59 billion, whereas exports nationally declined by about four per cent on a customs basis. This contrast partly reflects differences in the types of goods each region exports. Nevertheless, provincial export trends remain soft, reflecting U.S. tariffs on key products like lumber, and end of de minimis treatment of low value exports. Year-to-date, B.C. exports slipped a mild 0.1 per cent from same-period 2024, which was slightly stronger than the national reading. …That said, a declining trend continued in the battered forestry sector (-13.7 per cent year over year), where tariffs have compounded weakness from timber supply constraints and other duties already imposed by the U.S.

B.C.’s export performance moved against the national pattern in November. Domestic exports to international markets rose 7.6 per cent year over year to $4.59 billion, whereas exports nationally declined by about four per cent on a customs basis. This contrast partly reflects differences in the types of goods each region exports. Nevertheless, provincial export trends remain soft, reflecting U.S. tariffs on key products like lumber, and end of de minimis treatment of low value exports. Year-to-date, B.C. exports slipped a mild 0.1 per cent from same-period 2024, which was slightly stronger than the national reading. …That said, a declining trend continued in the battered forestry sector (-13.7 per cent year over year), where tariffs have compounded weakness from timber supply constraints and other duties already imposed by the U.S. VANCOUVER – Western Forest Products reported adjusted EBITDA of negative $6.2 million in the fourth quarter of 2025. In comparison, the Company reported Adjusted EBITDA of $14.4 million in the fourth quarter of 2024 and Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export tax expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. Net loss was $17.5 million in the fourth quarter of 2025, as compared to a net loss of $1.2 million in the fourth quarter of 2024, and net loss of $61.3 million in the third quarter of 2025. …For the full year 2025, the net loss was $82.4 million compared to to a net loss of $34.5 million in 2024. …“Despite more challenging markets and higher softwood lumber duties and tariffs in 2025, we enter 2026 with a significantly improved balance sheet to navigate the expected near-term market uncertainty,” said Steven Hofer, President and CEO of Western Forest Products.

VANCOUVER – Western Forest Products reported adjusted EBITDA of negative $6.2 million in the fourth quarter of 2025. In comparison, the Company reported Adjusted EBITDA of $14.4 million in the fourth quarter of 2024 and Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export tax expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. Net loss was $17.5 million in the fourth quarter of 2025, as compared to a net loss of $1.2 million in the fourth quarter of 2024, and net loss of $61.3 million in the third quarter of 2025. …For the full year 2025, the net loss was $82.4 million compared to to a net loss of $34.5 million in 2024. …“Despite more challenging markets and higher softwood lumber duties and tariffs in 2025, we enter 2026 with a significantly improved balance sheet to navigate the expected near-term market uncertainty,” said Steven Hofer, President and CEO of Western Forest Products. EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended December 31, 2025 as well as for the full 2025 fiscal year. “While 2025 brought a multitude of challenges, Acadian delivered steady operational performance in New Brunswick, helping to offset weather-related challenges, trucking constraints, and productivity issues in Maine,” said Adam Sheparski, President and Chief Executive Officer. …During the fourth quarter, Acadian generated sales of $22.0 million compared to $20.2 million in the fourth quarter of 2024. Acadian generated $5.2 million of Adjusted EBITDA and declared dividends of $5.3 million. During 2025, Acadian generated revenue from timber sales and services of $87.0 million, compared to $91.6 million in the prior year. The sale of 752,100 voluntary carbon credits contributed an additional $24.6 million to total sales in 2024 while no sales of carbon credits occurred in 2025.

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended December 31, 2025 as well as for the full 2025 fiscal year. “While 2025 brought a multitude of challenges, Acadian delivered steady operational performance in New Brunswick, helping to offset weather-related challenges, trucking constraints, and productivity issues in Maine,” said Adam Sheparski, President and Chief Executive Officer. …During the fourth quarter, Acadian generated sales of $22.0 million compared to $20.2 million in the fourth quarter of 2024. Acadian generated $5.2 million of Adjusted EBITDA and declared dividends of $5.3 million. During 2025, Acadian generated revenue from timber sales and services of $87.0 million, compared to $91.6 million in the prior year. The sale of 752,100 voluntary carbon credits contributed an additional $24.6 million to total sales in 2024 while no sales of carbon credits occurred in 2025.

New residential construction in the US rose to a five-month high in December, as homebuilders boosted production to take advantage of lower borrowing costs. Housing starts increased 6.2% to an annual pace of 1.4 million homes in December, according to figures released Wednesday by the government, which were delayed by fall’s federal shutdown. …The advance was broad-based, with both single-family home starts and apartment projects rising at year’s end. The number of one-family homes started was the highest since February. The stronger construction numbers suggest that builders were growing more confident at year’s end even as they continued to sell off a bloated inventory of new houses. For the full year, however, starts notched a fourth-straight annual decline …In December, building permits, which point to future construction, rose 4.3% to an annualized pace of 1.45 million, the highest since March, government data show. Single-family permits fell slightly. [to access the full story a Bloomberg subscription is required]

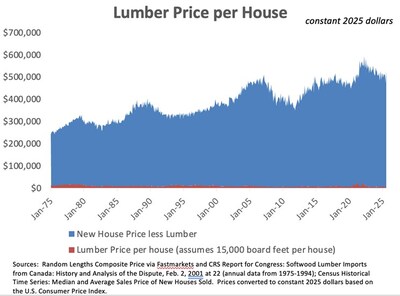

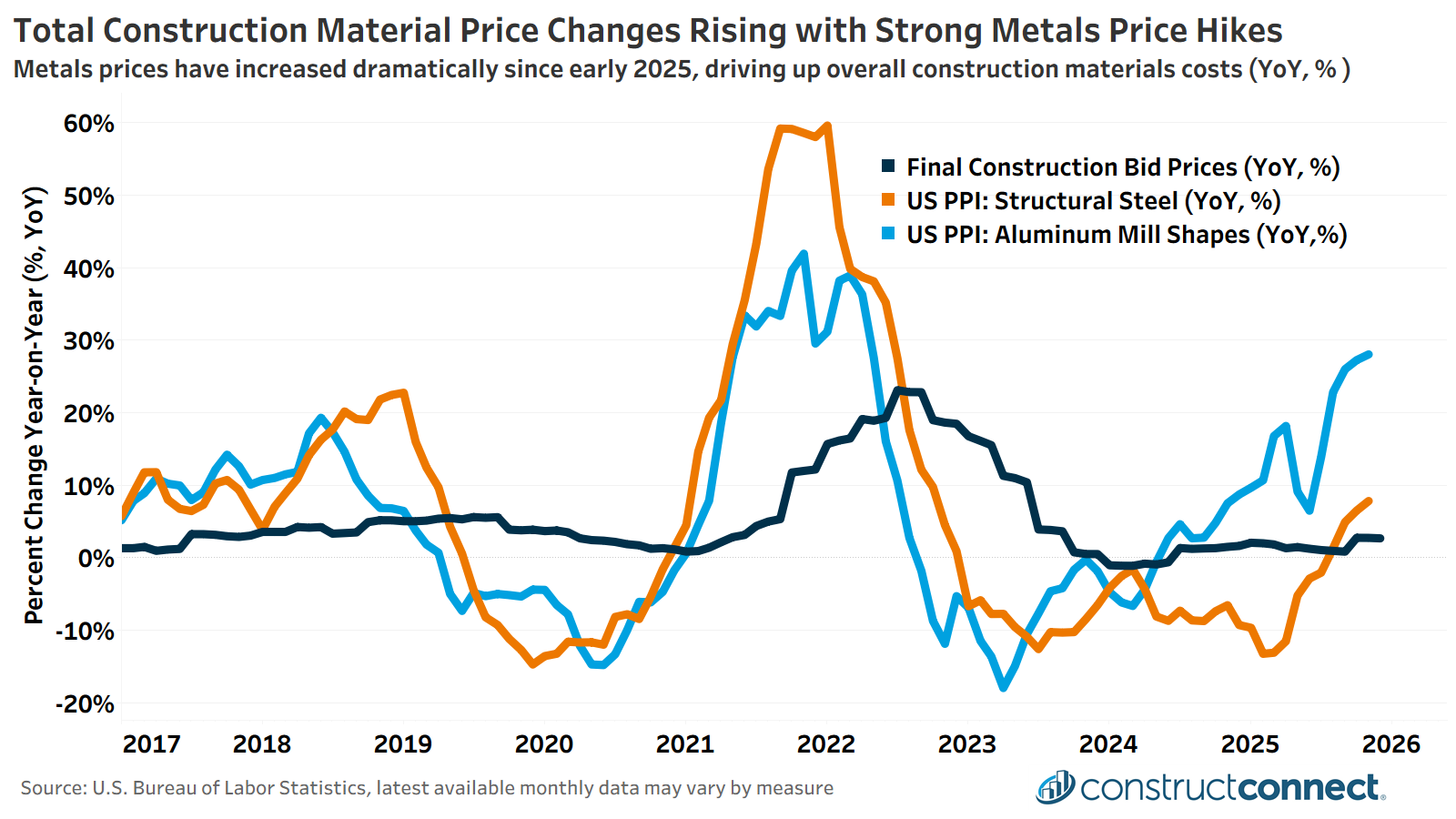

New residential construction in the US rose to a five-month high in December, as homebuilders boosted production to take advantage of lower borrowing costs. Housing starts increased 6.2% to an annual pace of 1.4 million homes in December, according to figures released Wednesday by the government, which were delayed by fall’s federal shutdown. …The advance was broad-based, with both single-family home starts and apartment projects rising at year’s end. The number of one-family homes started was the highest since February. The stronger construction numbers suggest that builders were growing more confident at year’s end even as they continued to sell off a bloated inventory of new houses. For the full year, however, starts notched a fourth-straight annual decline …In December, building permits, which point to future construction, rose 4.3% to an annualized pace of 1.45 million, the highest since March, government data show. Single-family permits fell slightly. [to access the full story a Bloomberg subscription is required] Reality-television stars are rarely consulted on matters of public policy. But in April, Realtor.com asked Tarek El Moussa to comment on the White House’s “Liberation Day” tariffs. The Southern California entrepreneur, who rose to fame on the popularity of HGTV’s Flip or Fop franchise, warned that higher import taxes would harm “new-home builders” and “first-time buyers” the most — after all, “luxury buyers” could absorb greater costs. Aspiring homeowners, he averred, are “usually strapped for cash,” and “doing everything they can just to buy a house.” Now that the second Trump administration has passed its one-year anniversary, all evidence indicates that El Moussa understands his industry well. There is little doubt that his trade war erects a sizable obstacle before those looking to find a place of their own. …The types of wood available in the US are not always the same as what’s available from Canadian imports.

Reality-television stars are rarely consulted on matters of public policy. But in April, Realtor.com asked Tarek El Moussa to comment on the White House’s “Liberation Day” tariffs. The Southern California entrepreneur, who rose to fame on the popularity of HGTV’s Flip or Fop franchise, warned that higher import taxes would harm “new-home builders” and “first-time buyers” the most — after all, “luxury buyers” could absorb greater costs. Aspiring homeowners, he averred, are “usually strapped for cash,” and “doing everything they can just to buy a house.” Now that the second Trump administration has passed its one-year anniversary, all evidence indicates that El Moussa understands his industry well. There is little doubt that his trade war erects a sizable obstacle before those looking to find a place of their own. …The types of wood available in the US are not always the same as what’s available from Canadian imports.

The cost of goods and services rose at a slower annual rate than expected in January, providing hope that the nagging U.S. inflation problem could be starting to ease. The consumer price index for January accelerated 2.4% from the same time a year ago, down 0.3 percentage point from the prior month, the Bureau of Labor Statistics reported Friday. That pulled the inflation rate down to where it was the month after President Donald Trump in April 2025 announced aggressive tariffs on U.S. imports. Excluding food and energy, the core CPI was up 2.5%. Economists surveyed by Dow Jones had been looking for an annual rate of 2.5% for both readings. On a monthly basis, the all-items index was up a seasonally adjusted 0.2% while core gained 0.3%. …Though the category accounted for much of the CPI gain, shelter costs rose just 0.2% for the month, bringing the annual increase down to 3%.

The cost of goods and services rose at a slower annual rate than expected in January, providing hope that the nagging U.S. inflation problem could be starting to ease. The consumer price index for January accelerated 2.4% from the same time a year ago, down 0.3 percentage point from the prior month, the Bureau of Labor Statistics reported Friday. That pulled the inflation rate down to where it was the month after President Donald Trump in April 2025 announced aggressive tariffs on U.S. imports. Excluding food and energy, the core CPI was up 2.5%. Economists surveyed by Dow Jones had been looking for an annual rate of 2.5% for both readings. On a monthly basis, the all-items index was up a seasonally adjusted 0.2% while core gained 0.3%. …Though the category accounted for much of the CPI gain, shelter costs rose just 0.2% for the month, bringing the annual increase down to 3%.

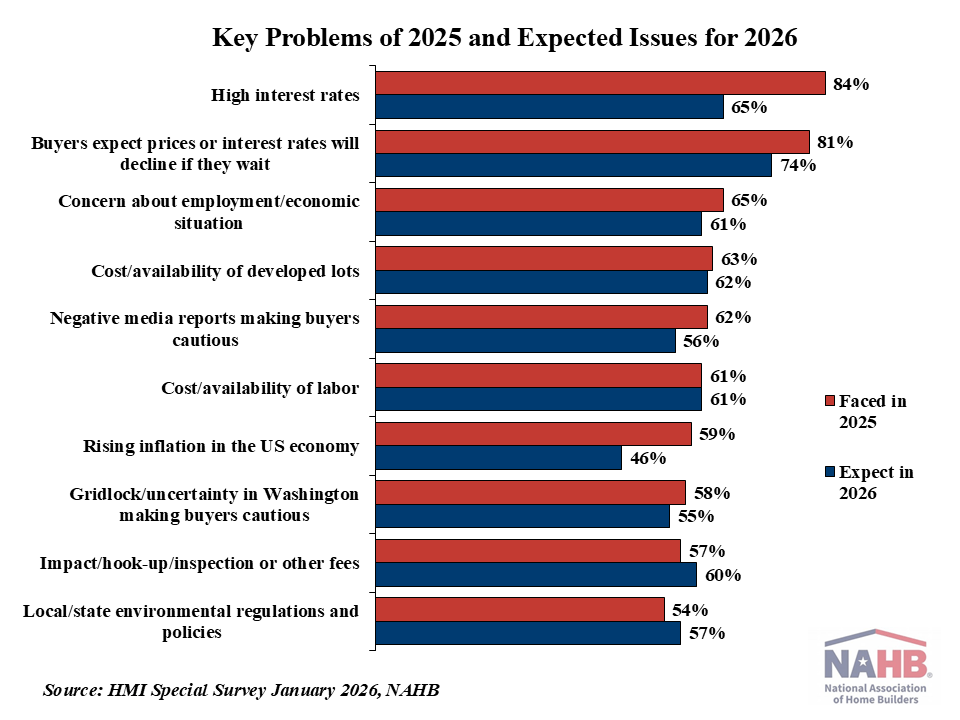

Long-term mortgage rates continued to decline in January. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.10% last month, 9 basis points (bps) lower than December. Meanwhile, the 15-year rate declined 4 bps to 5.44%. Compared to a year ago, the 30-year rate is lower by 86 bps. The 15-year rate is also lower by 72 bps. The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.20% in January – an increase of 8 bps from the previous month, but remained considerably lower than last year by 43 bps. While mortgage rates typically move in tandem with the treasury yields, the spread between the two narrowed during the month. Reports that the Trump administration encouraged Fannie Mae and Freddie Mac to expand purchases of mortgage-backed securities (MBS) boosted demand for MBS, pushing mortgage rates lower. However, treasury yields rose sharply in the final week of January from global and fiscal pressures.

Long-term mortgage rates continued to decline in January. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.10% last month, 9 basis points (bps) lower than December. Meanwhile, the 15-year rate declined 4 bps to 5.44%. Compared to a year ago, the 30-year rate is lower by 86 bps. The 15-year rate is also lower by 72 bps. The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.20% in January – an increase of 8 bps from the previous month, but remained considerably lower than last year by 43 bps. While mortgage rates typically move in tandem with the treasury yields, the spread between the two narrowed during the month. Reports that the Trump administration encouraged Fannie Mae and Freddie Mac to expand purchases of mortgage-backed securities (MBS) boosted demand for MBS, pushing mortgage rates lower. However, treasury yields rose sharply in the final week of January from global and fiscal pressures.  When it comes to housing affordability, the logic of “build build build” is straightforward enough: Housing is too expensive. If there were more of it, prices would fall. …Homebuilders are even pushing a plan for a million new affordable houses. …Unfortunately, it’s not that simple. The problem of housing affordability is much bigger than insufficient supply; it’s a mismatch with demand. And that demand is driven by income inequality that has seen soaring income growth at the top and tepid growth (or even stagnation) in the middle. In other words: The way to improve housing affordability is to reduce income inequality. …What’s needed are policies that increase income for households at the bottom and middle. Rather than boosting the housing supply in the hope that they benefit, the answer is to fix the labor market to make sure that they do.

When it comes to housing affordability, the logic of “build build build” is straightforward enough: Housing is too expensive. If there were more of it, prices would fall. …Homebuilders are even pushing a plan for a million new affordable houses. …Unfortunately, it’s not that simple. The problem of housing affordability is much bigger than insufficient supply; it’s a mismatch with demand. And that demand is driven by income inequality that has seen soaring income growth at the top and tepid growth (or even stagnation) in the middle. In other words: The way to improve housing affordability is to reduce income inequality. …What’s needed are policies that increase income for households at the bottom and middle. Rather than boosting the housing supply in the hope that they benefit, the answer is to fix the labor market to make sure that they do.  The United States is one of the world’s largest timberland investment markets, with returns driven primarily by land values rather than timber prices, according to Domain Timber Advisors’ timberland market analysis. Timberland values remain strong at the end of 2025, supported by continued appreciation in land values, while timber prices remain relatively flat. …During 2025, Domain underwrites 14 institutional bid events, 54 public listings, and 38 off-market or non-public offerings. By the end of the fourth quarter, the acquisition pipeline consists of 46 deals covering more than 500 thousand acres, providing visibility into pricing dynamics, regional demand shifts, and emerging non-timber value drivers. …Looking ahead, Domain states that renewable energy development and technology infrastructure are expected to expand non-timber revenue opportunities in 2026 and beyond. Alternative timber product markets, including molded fiber products and biomass-to-electricity, are expected to offset part of the pulpwood demand lost due to mill closures and production quotas.

The United States is one of the world’s largest timberland investment markets, with returns driven primarily by land values rather than timber prices, according to Domain Timber Advisors’ timberland market analysis. Timberland values remain strong at the end of 2025, supported by continued appreciation in land values, while timber prices remain relatively flat. …During 2025, Domain underwrites 14 institutional bid events, 54 public listings, and 38 off-market or non-public offerings. By the end of the fourth quarter, the acquisition pipeline consists of 46 deals covering more than 500 thousand acres, providing visibility into pricing dynamics, regional demand shifts, and emerging non-timber value drivers. …Looking ahead, Domain states that renewable energy development and technology infrastructure are expected to expand non-timber revenue opportunities in 2026 and beyond. Alternative timber product markets, including molded fiber products and biomass-to-electricity, are expected to offset part of the pulpwood demand lost due to mill closures and production quotas.

Russia’s lumber industry is entering a period of sustained pressure as production volumes continue to fall and regulatory risks increase. Official data shows that lumber output declined by more than 2.5% last year, reinforcing concerns across the forestry and wood processing sectors. According to Rosstat, Russia’s lumber production dropped from 29.2 million cubic metres in 2024 to 28.48 million cubic metres in 2025. Output remains well below historical highs. Current production is estimated to be 2 to 3 million cubic metres lower than the 2019 peak of roughly 32 million cubic metres. The downturn reflects structural challenges rather than short-term disruption. Domestic demand has weakened. Export markets have narrowed. Access to European machinery and technology has been reduced. These pressures are being felt across both logging and downstream processing operations. China now absorbs more than 70% of Russia’s lumber exports. …Softwood lumber production fell by 3.5% last year. Output declined to 25.7 million cubic metres.

Russia’s lumber industry is entering a period of sustained pressure as production volumes continue to fall and regulatory risks increase. Official data shows that lumber output declined by more than 2.5% last year, reinforcing concerns across the forestry and wood processing sectors. According to Rosstat, Russia’s lumber production dropped from 29.2 million cubic metres in 2024 to 28.48 million cubic metres in 2025. Output remains well below historical highs. Current production is estimated to be 2 to 3 million cubic metres lower than the 2019 peak of roughly 32 million cubic metres. The downturn reflects structural challenges rather than short-term disruption. Domestic demand has weakened. Export markets have narrowed. Access to European machinery and technology has been reduced. These pressures are being felt across both logging and downstream processing operations. China now absorbs more than 70% of Russia’s lumber exports. …Softwood lumber production fell by 3.5% last year. Output declined to 25.7 million cubic metres.