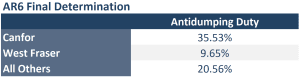

It’s been over a week since the U.S. Commerce Department confirmed that it’s nearly tripling its anti-dumping duties on Canadian lumber imports from 7.66% to 20.56% following its annual review. The response from north of the border has been apoplectic, to say the least. …In the US, several entities are worried about the hiked duties, too. The NAHB continues to sound the alarm that new duties will raise the cost of homebuilding. …”We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement.” …The US Lumber Coalition continues to be the loudest voice in the room in favor. …”Canada continues its relentless shipments of dumped and subsidized lumber with devastating consequences for mills, workers, and communities.” …The downstream effects of all these trade war machinations remain to be seen, though the cross-border lumber trade has already slowed down considerably.

It’s been over a week since the U.S. Commerce Department confirmed that it’s nearly tripling its anti-dumping duties on Canadian lumber imports from 7.66% to 20.56% following its annual review. The response from north of the border has been apoplectic, to say the least. …In the US, several entities are worried about the hiked duties, too. The NAHB continues to sound the alarm that new duties will raise the cost of homebuilding. …”We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement.” …The US Lumber Coalition continues to be the loudest voice in the room in favor. …”Canada continues its relentless shipments of dumped and subsidized lumber with devastating consequences for mills, workers, and communities.” …The downstream effects of all these trade war machinations remain to be seen, though the cross-border lumber trade has already slowed down considerably.

Canada’s merchandise trade deficit widened in June to C$5.9 billion as imports grew faster than exports due to a one-time high-value oil equipment import. The deficit observed in June is the second highest on record after the deficit expanded to its largest in history in April to C$7.6 billion, when the impact of US tariffs first started to weigh. Canada’s exports to the US as a share of total exports shrank to 70% in June from 83% in the same period a year ago while its surplus with the US contracted by a half in the same period, data showed. Total imports were up 1.4% in June to C$67.6 billion from a drop of 1.6% in the prior month, Statistics Canada said. Canada’s total exports grew 0.9% in June to C$61.74 billion following an increase of 2% in May, led primarily by an increase in crude oil exports.

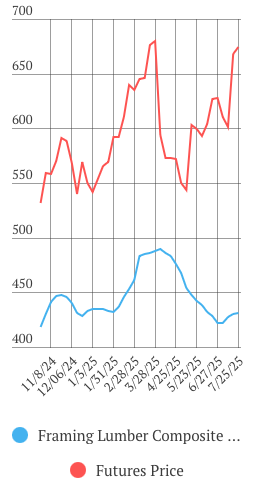

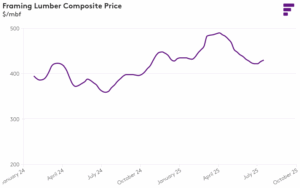

Canada’s merchandise trade deficit widened in June to C$5.9 billion as imports grew faster than exports due to a one-time high-value oil equipment import. The deficit observed in June is the second highest on record after the deficit expanded to its largest in history in April to C$7.6 billion, when the impact of US tariffs first started to weigh. Canada’s exports to the US as a share of total exports shrank to 70% in June from 83% in the same period a year ago while its surplus with the US contracted by a half in the same period, data showed. Total imports were up 1.4% in June to C$67.6 billion from a drop of 1.6% in the prior month, Statistics Canada said. Canada’s total exports grew 0.9% in June to C$61.74 billion following an increase of 2% in May, led primarily by an increase in crude oil exports. Lumber futures hit their highest price in three years Friday despite a home-building slump and a lackluster remodeling market. Though wood demand is tepid, traders are pricing in dramatically higher duties on lumber imports from Canada. Lumber futures for September delivery hit $695 per thousand board feet Friday, up 39% from a year ago and the highest price since summer 2022, when the price of two-by-fours was tumbling down from its pandemic surge. November futures are trading even higher, around $710. The US raised its antidumping duty Tuesday to nearly 21% from 7.7%… [and] The Commerce Department said it would impose a higher countervailing duty in the coming days. The combined rate is expected to be around 35%. …”We don’t make a tremendous amount of money on distributing lumber,” Builders FirstSource CEO Peter Jacksons told investors. “We’re not eating a 20-point increase in lumber. It’s not possible. So it will be passed through. The market will adapt.” [to access the full story a WSJ subscription is required]

Lumber futures hit their highest price in three years Friday despite a home-building slump and a lackluster remodeling market. Though wood demand is tepid, traders are pricing in dramatically higher duties on lumber imports from Canada. Lumber futures for September delivery hit $695 per thousand board feet Friday, up 39% from a year ago and the highest price since summer 2022, when the price of two-by-fours was tumbling down from its pandemic surge. November futures are trading even higher, around $710. The US raised its antidumping duty Tuesday to nearly 21% from 7.7%… [and] The Commerce Department said it would impose a higher countervailing duty in the coming days. The combined rate is expected to be around 35%. …”We don’t make a tremendous amount of money on distributing lumber,” Builders FirstSource CEO Peter Jacksons told investors. “We’re not eating a 20-point increase in lumber. It’s not possible. So it will be passed through. The market will adapt.” [to access the full story a WSJ subscription is required] VANCOUVER, BC —

VANCOUVER, BC —  NEW YORK, NY -‑ Mercer International reported second quarter 2025. In the second quarter of 2025, net loss was $86.1 million compared to $67.6 million in the same quarter of 2024 and $22.3 million in the first quarter of 2025. Mr. Juan Carlos Bueno, Chief Executive Officer, stated: “Our operating results for the second quarter of 2025 reflect the impacts of ongoing uncertainties in the global trade environment coupled with the resulting weaker dollar. This challenging backdrop contributed to weaker demand for pulp in China during the quarter. …Our lumber sales realizations in both the U.S. and Europe increased in the second quarter of 2025 as a result of lower supply and steady demand.

NEW YORK, NY -‑ Mercer International reported second quarter 2025. In the second quarter of 2025, net loss was $86.1 million compared to $67.6 million in the same quarter of 2024 and $22.3 million in the first quarter of 2025. Mr. Juan Carlos Bueno, Chief Executive Officer, stated: “Our operating results for the second quarter of 2025 reflect the impacts of ongoing uncertainties in the global trade environment coupled with the resulting weaker dollar. This challenging backdrop contributed to weaker demand for pulp in China during the quarter. …Our lumber sales realizations in both the U.S. and Europe increased in the second quarter of 2025 as a result of lower supply and steady demand. Canada’s pension funds have more than $1tn invested in the United States, and that figure could grow by $100bn or more annually, said Dominic LeBlanc, the federal minister responsible for US trade, during a visit to Washington. …Financial Post reported that LeBlanc made the comments in response to questions about whether US President Donald Trump might request specific commitments on Canadian investment as part of trade talks. The US has offered increased foreign investment as a possible pathway to improved trade terms. …Despite the potential growth in US exposure, LeBlanc said the federal government would not direct pension managers to increase their holdings or participate in specific American projects as a condition for reduced tariffs. Canada’s pension funds are already deeply integrated into US markets.

Canada’s pension funds have more than $1tn invested in the United States, and that figure could grow by $100bn or more annually, said Dominic LeBlanc, the federal minister responsible for US trade, during a visit to Washington. …Financial Post reported that LeBlanc made the comments in response to questions about whether US President Donald Trump might request specific commitments on Canadian investment as part of trade talks. The US has offered increased foreign investment as a possible pathway to improved trade terms. …Despite the potential growth in US exposure, LeBlanc said the federal government would not direct pension managers to increase their holdings or participate in specific American projects as a condition for reduced tariffs. Canada’s pension funds are already deeply integrated into US markets. The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. While some elements of US trade policy have started to become more concrete in recent weeks, trade negotiations are fluid, threats of new sectoral tariffs continue, and US trade actions remain unpredictable. …The current tariff scenario has global growth slowing modestly to around 2½% by the end of 2025 before returning to around 3% over 2026 and 2027. CPI inflation was 1.9% in June, up slightly from the previous month. …Based on a range of indicators, underlying inflation is assessed to be around 2½%.

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. While some elements of US trade policy have started to become more concrete in recent weeks, trade negotiations are fluid, threats of new sectoral tariffs continue, and US trade actions remain unpredictable. …The current tariff scenario has global growth slowing modestly to around 2½% by the end of 2025 before returning to around 3% over 2026 and 2027. CPI inflation was 1.9% in June, up slightly from the previous month. …Based on a range of indicators, underlying inflation is assessed to be around 2½%. I am surprised at how President Trump is gradually succeeding in his goal. …Canada, along with China, is the only country standing up to the US, but it is inevitable that if no agreement is reached, the chances of a recession will increase. …Canada needs the US to avoid the worst, but the point of the article is different: how much does the US need Canada? My impression is that this issue is often underestimated. …We don’t need their lumber. But is that really the case? …Why Canadian lumber is essential. …The first and probably most important reason is that US forests are mainly privately owned (by companies or families). …Becoming less dependent on Canada is extremely complicated for the US due to the usual logistical challenges. …This industry has been in gradual decline for decades, and wanting to save it in order to be less dependent on Canada is a waste of resources.

I am surprised at how President Trump is gradually succeeding in his goal. …Canada, along with China, is the only country standing up to the US, but it is inevitable that if no agreement is reached, the chances of a recession will increase. …Canada needs the US to avoid the worst, but the point of the article is different: how much does the US need Canada? My impression is that this issue is often underestimated. …We don’t need their lumber. But is that really the case? …Why Canadian lumber is essential. …The first and probably most important reason is that US forests are mainly privately owned (by companies or families). …Becoming less dependent on Canada is extremely complicated for the US due to the usual logistical challenges. …This industry has been in gradual decline for decades, and wanting to save it in order to be less dependent on Canada is a waste of resources.

The U.S. Commerce Department has announced it is nearly tripling its anti-dumping duties on Canadian lumber imports from 7.66% to 20.56% following its annual review of existing tariffs. The anti-dumping duties are in addition to current countervailing duties set at 6.74%, which would bring the total lumber duties above 27%. However, the countervailing duty rate is expected to move higher on Aug. 8. Commerce issued a preliminary determination on countervailing duties earlier this year that would raise the countervailing duty rate to 14.38%. Moreover, President Trump’s Section 232 [investigation] could result in higher lumber tariffs. …For years, NAHB has been leading the fight against lumber tariffs because of their detrimental effect on housing affordability. In effect, the lumber tariffs act as a tax on American builders, home buyers and consumers. …We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement that will… eliminate tariffs altogether.

The U.S. Commerce Department has announced it is nearly tripling its anti-dumping duties on Canadian lumber imports from 7.66% to 20.56% following its annual review of existing tariffs. The anti-dumping duties are in addition to current countervailing duties set at 6.74%, which would bring the total lumber duties above 27%. However, the countervailing duty rate is expected to move higher on Aug. 8. Commerce issued a preliminary determination on countervailing duties earlier this year that would raise the countervailing duty rate to 14.38%. Moreover, President Trump’s Section 232 [investigation] could result in higher lumber tariffs. …For years, NAHB has been leading the fight against lumber tariffs because of their detrimental effect on housing affordability. In effect, the lumber tariffs act as a tax on American builders, home buyers and consumers. …We are also urging the administration to move immediately to enter into negotiations with Canada on a new softwood lumber agreement that will… eliminate tariffs altogether. The US Lumber Coalition (USLC) has aggressively promoted strong enforcement of US trade laws and railed against “unfair Canadian trade practices.” …The USLC’s arguments have been challenged by a pair of Canadian independent consultants — Russ Taylor Global and Spar Tree Group:

The US Lumber Coalition (USLC) has aggressively promoted strong enforcement of US trade laws and railed against “unfair Canadian trade practices.” …The USLC’s arguments have been challenged by a pair of Canadian independent consultants — Russ Taylor Global and Spar Tree Group: OTTAWA—Home buyers and builders in Canada are in retreat, adding to the woes of an economy struggling under the weight of President Trump’s tariffs. Housing helped spur growth in Canada just prior to, and after the worst of, the Covid-19 pandemic. …Data this month indicated existing-home sales climbed modestly for three straight months as of June. But economists and real estate agents are far from convinced it signals recovery after a tariff-fueled slowdown. They note the sales rebound was the result of sellers cutting their listing price. Housing affordability remains stretched in Canada, according to the Bank of Canada data. …For builders, prices for new homes are failing to cover higher costs for labor, loans and taxes and fees set at the municipal level. The Canadian Home Builders’ Association said its own confidence index is at historically pessimistic levels. [to access the full story a WSJ subscription is required]

OTTAWA—Home buyers and builders in Canada are in retreat, adding to the woes of an economy struggling under the weight of President Trump’s tariffs. Housing helped spur growth in Canada just prior to, and after the worst of, the Covid-19 pandemic. …Data this month indicated existing-home sales climbed modestly for three straight months as of June. But economists and real estate agents are far from convinced it signals recovery after a tariff-fueled slowdown. They note the sales rebound was the result of sellers cutting their listing price. Housing affordability remains stretched in Canada, according to the Bank of Canada data. …For builders, prices for new homes are failing to cover higher costs for labor, loans and taxes and fees set at the municipal level. The Canadian Home Builders’ Association said its own confidence index is at historically pessimistic levels. [to access the full story a WSJ subscription is required] As a tariff storm blew in from south of the border earlier this year, many industries in Canada, including the home building sector, feared the unknown ahead of them. With stakeholders already keenly aware of the need to rapidly scale up housing supply and improve Canada’s housing affordability gap, blanket tariffs and more targeted material-specific levies meant additional unwelcome obstacles to overcome. That included a potential need to slow down the pace of construction as supply chains shifted and key construction parts became more expensive. …About six months after US President Trump’s return to the White House, many in the home construction sector say unpredictability persists around the cost and timing of obtaining the materials they need. For Geranium Homes, a residential developer in southern Ontario, that’s meant having to pivot on the fly when it comes to the supply chains it’s long relied on.

As a tariff storm blew in from south of the border earlier this year, many industries in Canada, including the home building sector, feared the unknown ahead of them. With stakeholders already keenly aware of the need to rapidly scale up housing supply and improve Canada’s housing affordability gap, blanket tariffs and more targeted material-specific levies meant additional unwelcome obstacles to overcome. That included a potential need to slow down the pace of construction as supply chains shifted and key construction parts became more expensive. …About six months after US President Trump’s return to the White House, many in the home construction sector say unpredictability persists around the cost and timing of obtaining the materials they need. For Geranium Homes, a residential developer in southern Ontario, that’s meant having to pivot on the fly when it comes to the supply chains it’s long relied on. VANCOUVER, BC

VANCOUVER, BC A CUSMA Chapter 10 binational panel remanded [for further explanation] two statistical methodologies in the US Department of Commerce’s Administrative Review 1 antidumping duty determination on Canadian softwood lumber, requiring Commerce to reassess its use of the Cohen’s d test and to apply weighted pooled variances in its meaningful-difference analysis according to the panel’s Decision and Order. …The panel affirmed all other aspect of the results challenged in this appeal…The review stems from a December 22, 2020 request by Resolute Forest Products and the Ontario Forest Industries Association. …The panel remanded Commerce’s application of Cohen’s d because the Federal Circuit’s decision in Marmen Inc. v. United States Wind Tower Trade Coalition requires that the test’s key assumptions, normal data distribution, equal variances and adequate sample size, be demonstrated before use. …The panel also remanded Commerce’s pooling of variances, directing the Department to use weighted pooled variances that reflect differing sample sizes. …Commerce must respond by October 20, 2025.

A CUSMA Chapter 10 binational panel remanded [for further explanation] two statistical methodologies in the US Department of Commerce’s Administrative Review 1 antidumping duty determination on Canadian softwood lumber, requiring Commerce to reassess its use of the Cohen’s d test and to apply weighted pooled variances in its meaningful-difference analysis according to the panel’s Decision and Order. …The panel affirmed all other aspect of the results challenged in this appeal…The review stems from a December 22, 2020 request by Resolute Forest Products and the Ontario Forest Industries Association. …The panel remanded Commerce’s application of Cohen’s d because the Federal Circuit’s decision in Marmen Inc. v. United States Wind Tower Trade Coalition requires that the test’s key assumptions, normal data distribution, equal variances and adequate sample size, be demonstrated before use. …The panel also remanded Commerce’s pooling of variances, directing the Department to use weighted pooled variances that reflect differing sample sizes. …Commerce must respond by October 20, 2025. Lumber markets remained flat this week as vacation time, industry gatherings, sweltering heat and general economic uncertainty contributed to sluggish sales. Minimal immediate needs limited replenishment purchases to modest volumes while a lack of clarity regarding near-term prospects stifled speculative trading across North American framing lumber markets. 2×4 led gains in many species, but the increases were modest. Seasonal factors, including unusually heavy rainfall and normal summer heat, contributed to the ongoing sluggish pace across the South. Mills worked hard to capture modest premiums. The coming hike in duties on Canadian shipments to the US did little to alter the ongoing lack of urgency among buyers. …Sales of Western S-P-F were governed by tepid demand and uncertainty regarding the timing and scope of higher duties and potential tariffs. …Sales in the Coast region were lukewarm with most lumber markets trends holding.

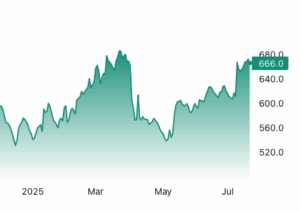

Lumber markets remained flat this week as vacation time, industry gatherings, sweltering heat and general economic uncertainty contributed to sluggish sales. Minimal immediate needs limited replenishment purchases to modest volumes while a lack of clarity regarding near-term prospects stifled speculative trading across North American framing lumber markets. 2×4 led gains in many species, but the increases were modest. Seasonal factors, including unusually heavy rainfall and normal summer heat, contributed to the ongoing sluggish pace across the South. Mills worked hard to capture modest premiums. The coming hike in duties on Canadian shipments to the US did little to alter the ongoing lack of urgency among buyers. …Sales of Western S-P-F were governed by tepid demand and uncertainty regarding the timing and scope of higher duties and potential tariffs. …Sales in the Coast region were lukewarm with most lumber markets trends holding.  Lumber futures traded above $680 per thousand board feet, approaching the two-and-a-half-year peak of $685 recorded on March?24th, driven by a squeeze on supply meeting unfaltering construction demand. On the demand front, US housing starts held surprisingly steady at an annualized 1.6?million units in June even as existing-home sales slipped 2.7% to a nine-month low, ensuring that framing requirements remained robust. At the same time, US softwood lumber tariffs on Canadian imports continue to add roughly 9% to landed costs, while Pacific Northwest mills have withdrawn nearly 20% of regional capacity for mid-season maintenance, sharply curtailing shipments to distributors. Internationally, imports from Europe and New?Zealand are throttled by 25% duties on Russian lumber and persistent ocean-freight bottlenecks, collectively depleting distributor inventories to their lowest levels in more than two years and reinforcing today’s sharp advance in futures prices. [END]

Lumber futures traded above $680 per thousand board feet, approaching the two-and-a-half-year peak of $685 recorded on March?24th, driven by a squeeze on supply meeting unfaltering construction demand. On the demand front, US housing starts held surprisingly steady at an annualized 1.6?million units in June even as existing-home sales slipped 2.7% to a nine-month low, ensuring that framing requirements remained robust. At the same time, US softwood lumber tariffs on Canadian imports continue to add roughly 9% to landed costs, while Pacific Northwest mills have withdrawn nearly 20% of regional capacity for mid-season maintenance, sharply curtailing shipments to distributors. Internationally, imports from Europe and New?Zealand are throttled by 25% duties on Russian lumber and persistent ocean-freight bottlenecks, collectively depleting distributor inventories to their lowest levels in more than two years and reinforcing today’s sharp advance in futures prices. [END] President Trump’s tariffs could have an unintended side effect: making homeownership even less affordable for many Americans. A new report from the Canadian Chamber of Commerce estimates that the average cost of building a US home could rise by an additional $14,000 by the end of 2027 if tariffs on Canadian imports remain in place, even as many experts estimate that America needs millions more affordable homes. In 2023 alone, Canada accounted for 69% of US lumber imports, 25% of imported iron and steel and 18% of copper imports, all key construction materials, the report said. The White House pushed back on the assertion that tariffs would increase costs for Americans. …The report underscores that Trump’s tariff policy, intended to support American industry, may instead worsen housing affordability. Taking into account tariffs first imposed during Trump’s first term, the total added cost from tariffs could reach $20,000 per home by 2027, the Canadian Chamber of Commerce found.

President Trump’s tariffs could have an unintended side effect: making homeownership even less affordable for many Americans. A new report from the Canadian Chamber of Commerce estimates that the average cost of building a US home could rise by an additional $14,000 by the end of 2027 if tariffs on Canadian imports remain in place, even as many experts estimate that America needs millions more affordable homes. In 2023 alone, Canada accounted for 69% of US lumber imports, 25% of imported iron and steel and 18% of copper imports, all key construction materials, the report said. The White House pushed back on the assertion that tariffs would increase costs for Americans. …The report underscores that Trump’s tariff policy, intended to support American industry, may instead worsen housing affordability. Taking into account tariffs first imposed during Trump’s first term, the total added cost from tariffs could reach $20,000 per home by 2027, the Canadian Chamber of Commerce found. During April’s election campaign, the Carney government promised to double the pace of homebuilding in Canada by 2035—an unlikely outcome in light of Canada’s shortage of construction workers and investment dollars. But even if homebuilding were miraculously doubled, it would not solve Canada’s housing affordability crisis. That’s the sobering conclusion of a recent

During April’s election campaign, the Carney government promised to double the pace of homebuilding in Canada by 2035—an unlikely outcome in light of Canada’s shortage of construction workers and investment dollars. But even if homebuilding were miraculously doubled, it would not solve Canada’s housing affordability crisis. That’s the sobering conclusion of a recent

US and Chinese negotiators have agreed in principle to push back the deadline for escalating tariffs, although America’s representatives said any extension would need Donald Trump’s approval. Officials from both sides said after two days of talks in Stockholm that while had failed to find a resolution across the many areas of dispute they had agreed to extend a pause due to run out on 12 August. Beijing’s top trade negotiator, Li Chenggang, said the extension of a truce struck in mid-May would allow for further talks, without specifying when and for how long the latest pause would run. However, the US trade representative Jamieson Greer stressed that President Trump would have the “final call” on any extension. …Trump is on course to impose extra tariffs on Mexico and Canada from Friday, barring last-minute deals.

US and Chinese negotiators have agreed in principle to push back the deadline for escalating tariffs, although America’s representatives said any extension would need Donald Trump’s approval. Officials from both sides said after two days of talks in Stockholm that while had failed to find a resolution across the many areas of dispute they had agreed to extend a pause due to run out on 12 August. Beijing’s top trade negotiator, Li Chenggang, said the extension of a truce struck in mid-May would allow for further talks, without specifying when and for how long the latest pause would run. However, the US trade representative Jamieson Greer stressed that President Trump would have the “final call” on any extension. …Trump is on course to impose extra tariffs on Mexico and Canada from Friday, barring last-minute deals.

.png)

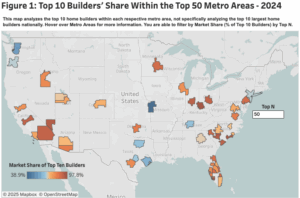

An earlier post described how the top 10 builders

An earlier post described how the top 10 builders

Japan’s housing starts fell 15.6% year-on-year in June 2025, slightly better than market expectations of a 15.8% drop and easing from May’s sharp 34.4% plunge—the steepest since September 2009. This marked the third consecutive monthly decline but the mildest in the sequence, as contractions slowed across key categories: owned (-16.4% vs -30.9%), rented (-14.0% vs -30.5%), built-for-sale (-17.9% vs -43.8%), and two-by-four homes (-5.7% vs -26.4%). On the other hand, prefabricated housing starts declined slightly more (-9.6% vs -9.3%), while growth in issued units moderated sharply to 10.2% from 76.7% in May.

Japan’s housing starts fell 15.6% year-on-year in June 2025, slightly better than market expectations of a 15.8% drop and easing from May’s sharp 34.4% plunge—the steepest since September 2009. This marked the third consecutive monthly decline but the mildest in the sequence, as contractions slowed across key categories: owned (-16.4% vs -30.9%), rented (-14.0% vs -30.5%), built-for-sale (-17.9% vs -43.8%), and two-by-four homes (-5.7% vs -26.4%). On the other hand, prefabricated housing starts declined slightly more (-9.6% vs -9.3%), while growth in issued units moderated sharply to 10.2% from 76.7% in May.