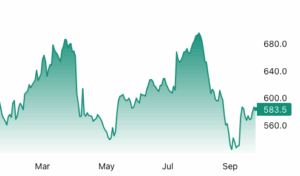

Lumber futures traded above $580 per thousand board feet in September, holding above earlier month lows as supply tightened and housing demand showed signs of renewal. Major producers such as Interfor reduced output through maintenance and shift cuts and mill idling while Canadian softwood flows remained constrained by tariff uncertainty which compressed prompt availability. Expectations of Fed further rate cuts later in 2025 encouraged forward looking builders to replenish inventories. New single family sales rose 20.5% to an 800k seasonally adjusted annualized rate in August which was the largest monthly rise since August 2022. Existing home sales held at a 4.00m SAAR in August and housing inventory stood at 1.53m units equivalent to 4.6 months of supply.

Lumber futures traded above $580 per thousand board feet in September, holding above earlier month lows as supply tightened and housing demand showed signs of renewal. Major producers such as Interfor reduced output through maintenance and shift cuts and mill idling while Canadian softwood flows remained constrained by tariff uncertainty which compressed prompt availability. Expectations of Fed further rate cuts later in 2025 encouraged forward looking builders to replenish inventories. New single family sales rose 20.5% to an 800k seasonally adjusted annualized rate in August which was the largest monthly rise since August 2022. Existing home sales held at a 4.00m SAAR in August and housing inventory stood at 1.53m units equivalent to 4.6 months of supply.