WASHINGTON — CNN published an article citing the Canadian Chamber of Commerce… claiming that tariffs on Canadian building materials, with an emphasis on lumber, will drive up the cost of housing for US consumers. This is incorrect. …”In order to continue seeing the massive growth of US softwood lumber production capacity that we have seen over the last nine years as a result of US trade law enforcement, it is essential that President Trump takes all necessary steps to downsizing Canada’s unsustainable 8 billion board feet of excess lumber capacity that is stifling continued US growth,” said Andrew Miller. …”Canadian softwood lumber companies, not U.S. consumers, directly pay the import duties through their U.S. subsidiaries. …”Canada is desperately trying to avoid paying their bill to the US taxpayers. …They are suggesting relieving Canada from having to pay future duties while continuing to dump their excess lumber into the US market,” added Zoltan van Heyningen.

WASHINGTON — CNN published an article citing the Canadian Chamber of Commerce… claiming that tariffs on Canadian building materials, with an emphasis on lumber, will drive up the cost of housing for US consumers. This is incorrect. …”In order to continue seeing the massive growth of US softwood lumber production capacity that we have seen over the last nine years as a result of US trade law enforcement, it is essential that President Trump takes all necessary steps to downsizing Canada’s unsustainable 8 billion board feet of excess lumber capacity that is stifling continued US growth,” said Andrew Miller. …”Canadian softwood lumber companies, not U.S. consumers, directly pay the import duties through their U.S. subsidiaries. …”Canada is desperately trying to avoid paying their bill to the US taxpayers. …They are suggesting relieving Canada from having to pay future duties while continuing to dump their excess lumber into the US market,” added Zoltan van Heyningen.

VANCOUVER, BC – Canfor announced today that its 77%-owned subsidiary, Vida AB, has entered into an agreement to purchase AB Karl Hedin Sågverk from Mattsbo Såg AB and certain minority shareholders for a purchase price of $164 million, including working capital of ~$39 million. AB Karl Hedin Sågverk operates three sawmills located in Central Sweden and will add approximately 230 million board feet to Vida’s annual production capacity. Following completion of this acquisition, Vida will have annual production capacity of approximately 2.1 billion board feet. Annual synergies of approximately $15 million are expected to be achieved within three years as a result of this transaction principally related to alignment of marketing programs as well as log procurement and operational practices. …These operations have access to exceptionally high-quality timber and are well positioned to complement Vida’s high-value product offering,” said CEO Susan Yurkovich. …The transaction is expected to close over the next several months.

VANCOUVER, BC – Canfor announced today that its 77%-owned subsidiary, Vida AB, has entered into an agreement to purchase AB Karl Hedin Sågverk from Mattsbo Såg AB and certain minority shareholders for a purchase price of $164 million, including working capital of ~$39 million. AB Karl Hedin Sågverk operates three sawmills located in Central Sweden and will add approximately 230 million board feet to Vida’s annual production capacity. Following completion of this acquisition, Vida will have annual production capacity of approximately 2.1 billion board feet. Annual synergies of approximately $15 million are expected to be achieved within three years as a result of this transaction principally related to alignment of marketing programs as well as log procurement and operational practices. …These operations have access to exceptionally high-quality timber and are well positioned to complement Vida’s high-value product offering,” said CEO Susan Yurkovich. …The transaction is expected to close over the next several months. Through the Domtar Connects program, employees lead impactful local initiatives—ranging from education and environmental projects to support for Indigenous communities—reflecting a long-term, values-driven commitment to social responsibility. …With nearly 14,000 employees across more than 60 locations, Domtar’s footprint is large, but its approach is local. The Domtar Connects community investment program responds directly to the unique needs of each operating community, ensuring that support is tailored, meaningful and led by employee input. Recent highlights include:

Through the Domtar Connects program, employees lead impactful local initiatives—ranging from education and environmental projects to support for Indigenous communities—reflecting a long-term, values-driven commitment to social responsibility. …With nearly 14,000 employees across more than 60 locations, Domtar’s footprint is large, but its approach is local. The Domtar Connects community investment program responds directly to the unique needs of each operating community, ensuring that support is tailored, meaningful and led by employee input. Recent highlights include:

In April 2021, Shreveport attorney Rich Lamb saw an opportunity. Lamb’s family has owned timberlands for several generations. …Fast forward to today. A more than $100 million Southern yellow pine sawmill sits outside of Plain Dealing. …Lamb learned that Canadian companies were relocating to the southern United States to build sawmills due to the unfavorable business climate in Canada. Lamb raised money and recruited Canadian company Teal Jones as an operating partner… Teal Jones acquired 57% of the sawmill, with Lamb and local investors owning the remaining 43%. But in 2024, Teal needed to sell. “Because of the pricing environment, interest rate environment and political climate in Canada, Teal Jones got into financial distress and went into reorganization,” Lamb explained. “They needed to sell their 57% interest to get liquidity.” Fortunately for Lamb and his group, a new buyer was found. Earlier this month, Sumitomo Forestry America Inc. purchased Teal Jones’ stake in the mill.

In April 2021, Shreveport attorney Rich Lamb saw an opportunity. Lamb’s family has owned timberlands for several generations. …Fast forward to today. A more than $100 million Southern yellow pine sawmill sits outside of Plain Dealing. …Lamb learned that Canadian companies were relocating to the southern United States to build sawmills due to the unfavorable business climate in Canada. Lamb raised money and recruited Canadian company Teal Jones as an operating partner… Teal Jones acquired 57% of the sawmill, with Lamb and local investors owning the remaining 43%. But in 2024, Teal needed to sell. “Because of the pricing environment, interest rate environment and political climate in Canada, Teal Jones got into financial distress and went into reorganization,” Lamb explained. “They needed to sell their 57% interest to get liquidity.” Fortunately for Lamb and his group, a new buyer was found. Earlier this month, Sumitomo Forestry America Inc. purchased Teal Jones’ stake in the mill. Texas’ timber industry continues to generate a significant economic impact for the state, with employment and output levels holding steady compared to 2023, said Eric Taylor, Ph.D., a silviculturist with Texas A&M AgriLife Extension Service and Texas A&M Forest Service. Market conditions remain largely unchanged from two years ago, with strong demand for sawtimber, coming primarily from pine trees in East Texas. On the flipside, there is an oversupply of smaller-diameter trees, keeping pulpwood prices soft, Taylor said. Roughly one-fifth of the state…provides about 12 million productive acres of timber out of roughly 22 million acres in the region. Most of the land is privately owned… While the Texas timber sector generally operates as a net-importer state, trade with Mexico and Canada accounts for 88% of Texas’ exports and 42% of its imports in 2024, Taylor said. …One bright spot is the growing interest in mass timber…

Texas’ timber industry continues to generate a significant economic impact for the state, with employment and output levels holding steady compared to 2023, said Eric Taylor, Ph.D., a silviculturist with Texas A&M AgriLife Extension Service and Texas A&M Forest Service. Market conditions remain largely unchanged from two years ago, with strong demand for sawtimber, coming primarily from pine trees in East Texas. On the flipside, there is an oversupply of smaller-diameter trees, keeping pulpwood prices soft, Taylor said. Roughly one-fifth of the state…provides about 12 million productive acres of timber out of roughly 22 million acres in the region. Most of the land is privately owned… While the Texas timber sector generally operates as a net-importer state, trade with Mexico and Canada accounts for 88% of Texas’ exports and 42% of its imports in 2024, Taylor said. …One bright spot is the growing interest in mass timber…

VANCOUVER, BC

VANCOUVER, BC A CUSMA Chapter 10 binational panel remanded [for further explanation] two statistical methodologies in the US Department of Commerce’s Administrative Review 1 antidumping duty determination on Canadian softwood lumber, requiring Commerce to reassess its use of the Cohen’s d test and to apply weighted pooled variances in its meaningful-difference analysis according to the panel’s Decision and Order. …The panel affirmed all other aspect of the results challenged in this appeal…The review stems from a December 22, 2020 request by Resolute Forest Products and the Ontario Forest Industries Association. …The panel remanded Commerce’s application of Cohen’s d because the Federal Circuit’s decision in Marmen Inc. v. United States Wind Tower Trade Coalition requires that the test’s key assumptions, normal data distribution, equal variances and adequate sample size, be demonstrated before use. …The panel also remanded Commerce’s pooling of variances, directing the Department to use weighted pooled variances that reflect differing sample sizes. …Commerce must respond by October 20, 2025.

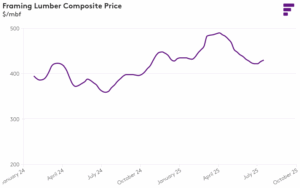

A CUSMA Chapter 10 binational panel remanded [for further explanation] two statistical methodologies in the US Department of Commerce’s Administrative Review 1 antidumping duty determination on Canadian softwood lumber, requiring Commerce to reassess its use of the Cohen’s d test and to apply weighted pooled variances in its meaningful-difference analysis according to the panel’s Decision and Order. …The panel affirmed all other aspect of the results challenged in this appeal…The review stems from a December 22, 2020 request by Resolute Forest Products and the Ontario Forest Industries Association. …The panel remanded Commerce’s application of Cohen’s d because the Federal Circuit’s decision in Marmen Inc. v. United States Wind Tower Trade Coalition requires that the test’s key assumptions, normal data distribution, equal variances and adequate sample size, be demonstrated before use. …The panel also remanded Commerce’s pooling of variances, directing the Department to use weighted pooled variances that reflect differing sample sizes. …Commerce must respond by October 20, 2025. Lumber markets remained flat this week as vacation time, industry gatherings, sweltering heat and general economic uncertainty contributed to sluggish sales. Minimal immediate needs limited replenishment purchases to modest volumes while a lack of clarity regarding near-term prospects stifled speculative trading across North American framing lumber markets. 2×4 led gains in many species, but the increases were modest. Seasonal factors, including unusually heavy rainfall and normal summer heat, contributed to the ongoing sluggish pace across the South. Mills worked hard to capture modest premiums. The coming hike in duties on Canadian shipments to the US did little to alter the ongoing lack of urgency among buyers. …Sales of Western S-P-F were governed by tepid demand and uncertainty regarding the timing and scope of higher duties and potential tariffs. …Sales in the Coast region were lukewarm with most lumber markets trends holding.

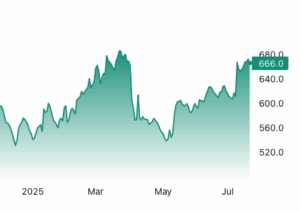

Lumber markets remained flat this week as vacation time, industry gatherings, sweltering heat and general economic uncertainty contributed to sluggish sales. Minimal immediate needs limited replenishment purchases to modest volumes while a lack of clarity regarding near-term prospects stifled speculative trading across North American framing lumber markets. 2×4 led gains in many species, but the increases were modest. Seasonal factors, including unusually heavy rainfall and normal summer heat, contributed to the ongoing sluggish pace across the South. Mills worked hard to capture modest premiums. The coming hike in duties on Canadian shipments to the US did little to alter the ongoing lack of urgency among buyers. …Sales of Western S-P-F were governed by tepid demand and uncertainty regarding the timing and scope of higher duties and potential tariffs. …Sales in the Coast region were lukewarm with most lumber markets trends holding.  Lumber futures traded above $680 per thousand board feet, approaching the two-and-a-half-year peak of $685 recorded on March?24th, driven by a squeeze on supply meeting unfaltering construction demand. On the demand front, US housing starts held surprisingly steady at an annualized 1.6?million units in June even as existing-home sales slipped 2.7% to a nine-month low, ensuring that framing requirements remained robust. At the same time, US softwood lumber tariffs on Canadian imports continue to add roughly 9% to landed costs, while Pacific Northwest mills have withdrawn nearly 20% of regional capacity for mid-season maintenance, sharply curtailing shipments to distributors. Internationally, imports from Europe and New?Zealand are throttled by 25% duties on Russian lumber and persistent ocean-freight bottlenecks, collectively depleting distributor inventories to their lowest levels in more than two years and reinforcing today’s sharp advance in futures prices. [END]

Lumber futures traded above $680 per thousand board feet, approaching the two-and-a-half-year peak of $685 recorded on March?24th, driven by a squeeze on supply meeting unfaltering construction demand. On the demand front, US housing starts held surprisingly steady at an annualized 1.6?million units in June even as existing-home sales slipped 2.7% to a nine-month low, ensuring that framing requirements remained robust. At the same time, US softwood lumber tariffs on Canadian imports continue to add roughly 9% to landed costs, while Pacific Northwest mills have withdrawn nearly 20% of regional capacity for mid-season maintenance, sharply curtailing shipments to distributors. Internationally, imports from Europe and New?Zealand are throttled by 25% duties on Russian lumber and persistent ocean-freight bottlenecks, collectively depleting distributor inventories to their lowest levels in more than two years and reinforcing today’s sharp advance in futures prices. [END] President Trump’s tariffs could have an unintended side effect: making homeownership even less affordable for many Americans. A new report from the Canadian Chamber of Commerce estimates that the average cost of building a US home could rise by an additional $14,000 by the end of 2027 if tariffs on Canadian imports remain in place, even as many experts estimate that America needs millions more affordable homes. In 2023 alone, Canada accounted for 69% of US lumber imports, 25% of imported iron and steel and 18% of copper imports, all key construction materials, the report said. The White House pushed back on the assertion that tariffs would increase costs for Americans. …The report underscores that Trump’s tariff policy, intended to support American industry, may instead worsen housing affordability. Taking into account tariffs first imposed during Trump’s first term, the total added cost from tariffs could reach $20,000 per home by 2027, the Canadian Chamber of Commerce found.

President Trump’s tariffs could have an unintended side effect: making homeownership even less affordable for many Americans. A new report from the Canadian Chamber of Commerce estimates that the average cost of building a US home could rise by an additional $14,000 by the end of 2027 if tariffs on Canadian imports remain in place, even as many experts estimate that America needs millions more affordable homes. In 2023 alone, Canada accounted for 69% of US lumber imports, 25% of imported iron and steel and 18% of copper imports, all key construction materials, the report said. The White House pushed back on the assertion that tariffs would increase costs for Americans. …The report underscores that Trump’s tariff policy, intended to support American industry, may instead worsen housing affordability. Taking into account tariffs first imposed during Trump’s first term, the total added cost from tariffs could reach $20,000 per home by 2027, the Canadian Chamber of Commerce found..png)

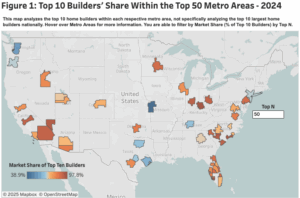

An earlier post described how the top 10 builders

An earlier post described how the top 10 builders Mass timber may have antimicrobial benefits that could make it useful for hospital construction, according to a recent study from the University of Oregon. The research team found that when wood was exposed to a brief wetting, it tested lower for levels of bacterial abundance than an empty plastic enclosure used as a control. “People generally think of wood as unhygienic in a medical setting,” said Mark Fretz, assistant professor, co-director of the University of Oregon’s Institute for Health in the Built Environment and principal investigator for the study. “But wood actually transfers microbes at a lower rate than other less porous materials such as stainless steel.”

Mass timber may have antimicrobial benefits that could make it useful for hospital construction, according to a recent study from the University of Oregon. The research team found that when wood was exposed to a brief wetting, it tested lower for levels of bacterial abundance than an empty plastic enclosure used as a control. “People generally think of wood as unhygienic in a medical setting,” said Mark Fretz, assistant professor, co-director of the University of Oregon’s Institute for Health in the Built Environment and principal investigator for the study. “But wood actually transfers microbes at a lower rate than other less porous materials such as stainless steel.” U.S. Rep. Marie Gluesenkamp Perez, D-Skamania, and Rep. David Rouzer, R-North Carolina, recently introduced the bipartisan Jobs in the Woods Act, which aims to connect young people with careers and training in forestry.

U.S. Rep. Marie Gluesenkamp Perez, D-Skamania, and Rep. David Rouzer, R-North Carolina, recently introduced the bipartisan Jobs in the Woods Act, which aims to connect young people with careers and training in forestry.

The Trump administration aims to end the prohibition on logging on tens of millions of acres of roadless areas in national forests by the end of next year, according to a draft schedule at the Forest Service. The draft timeline… sets a schedule for drafting the new policy, conducting public comment sessions and consulting with tribes before making a final decision in November or December of 2026. Agriculture Secretary Brooke Rollins has already said she’s decided to rescind the roadless-area protections, which have blocked road construction, timber harvesting. The rule applies on 58.5 million of the forest system’s 193 million acres, with Alaska’s Tongass National Forest having the most in any one place. In a June 23 statement, Rollins said, “Once again, President Trump is removing absurd obstacles to common sense management of our natural resources by rescinding the overly restrictive roadless rule.” [to access the full story an E&E News subscription is required]

The Trump administration aims to end the prohibition on logging on tens of millions of acres of roadless areas in national forests by the end of next year, according to a draft schedule at the Forest Service. The draft timeline… sets a schedule for drafting the new policy, conducting public comment sessions and consulting with tribes before making a final decision in November or December of 2026. Agriculture Secretary Brooke Rollins has already said she’s decided to rescind the roadless-area protections, which have blocked road construction, timber harvesting. The rule applies on 58.5 million of the forest system’s 193 million acres, with Alaska’s Tongass National Forest having the most in any one place. In a June 23 statement, Rollins said, “Once again, President Trump is removing absurd obstacles to common sense management of our natural resources by rescinding the overly restrictive roadless rule.” [to access the full story an E&E News subscription is required]

More than a quarter of firefighting positions at the United States Forest Service (USFS) remain vacant, according to internal data reviewed by the Guardian, creating staffing shortages as extreme conditions fuel dozens of blazes across the US. The data paints a dangerously different picture than the one offered by Tom Schultz, the chief of the USFS, who has repeatedly assured lawmakers and the public that the agency is fully prepared for the onslaught in fire activity expected through this year. It’s already been busy. So far this year there have been more than 41,000 wildfires – an amount nearly 31% higher than the ten-year average. “In terms of firefighting capacity we are there,” Schultz said during a Senate committee hearing on 10 July, claiming the USFS had hit 99% of hiring goals. He repeated the claim multiple times.

More than a quarter of firefighting positions at the United States Forest Service (USFS) remain vacant, according to internal data reviewed by the Guardian, creating staffing shortages as extreme conditions fuel dozens of blazes across the US. The data paints a dangerously different picture than the one offered by Tom Schultz, the chief of the USFS, who has repeatedly assured lawmakers and the public that the agency is fully prepared for the onslaught in fire activity expected through this year. It’s already been busy. So far this year there have been more than 41,000 wildfires – an amount nearly 31% higher than the ten-year average. “In terms of firefighting capacity we are there,” Schultz said during a Senate committee hearing on 10 July, claiming the USFS had hit 99% of hiring goals. He repeated the claim multiple times.

A major logging project in Montana can continue after a federal judge on Tuesday denied a motion for a preliminary injunction filed by four environmental groups. Last year, the U.S. Forest Service and the U.S. Fish and Wildlife Service approved the Round Star logging project, which covers 28,300 acres of land about 13 miles west of the city of Whitefish. …The agencies also approved the construction of nearly 20 miles of permanent roads in the national forest. …The four conservation groups — Alliance for the Wild Rockies, Native Ecosystems Council, Council on Wildlife and Fish and Yellowstone to Uintas Connection — sued to stop the logging in January, and filed their motion for a preliminary injunction months later. By that time, the logging was already underway. …Though the timing of the motion wasn’t a dealbreaker for the motion, DeSoto also found that the plaintiffs are unlikely to succeed on the merits of the case.

A major logging project in Montana can continue after a federal judge on Tuesday denied a motion for a preliminary injunction filed by four environmental groups. Last year, the U.S. Forest Service and the U.S. Fish and Wildlife Service approved the Round Star logging project, which covers 28,300 acres of land about 13 miles west of the city of Whitefish. …The agencies also approved the construction of nearly 20 miles of permanent roads in the national forest. …The four conservation groups — Alliance for the Wild Rockies, Native Ecosystems Council, Council on Wildlife and Fish and Yellowstone to Uintas Connection — sued to stop the logging in January, and filed their motion for a preliminary injunction months later. By that time, the logging was already underway. …Though the timing of the motion wasn’t a dealbreaker for the motion, DeSoto also found that the plaintiffs are unlikely to succeed on the merits of the case.

After months of deliberation, a years-old vision to restore local control of some of Pacific and Wahkiakum counties’ most productive timberlands is a step closer to becoming a reality. Last Tuesday, representatives from the Columbia Land Trust presented to both sets of commissioners a near-complete draft of the charter for the Upper Grays River Community Forest. The document lays out the legal framework and governance structure for a working forest in the upper Grays River watershed, which will straddle the boundary between the two counties. “The purpose… is to provide a legal entity… to undertake, assist with and otherwise facilitate the acquisition, ownership, maintenance, harvest, and management of a community forest or forests within Pacific County and Wahkiakum County to provide economic, environmental and community benefits to the public,” the charter’s fourth article reads.

After months of deliberation, a years-old vision to restore local control of some of Pacific and Wahkiakum counties’ most productive timberlands is a step closer to becoming a reality. Last Tuesday, representatives from the Columbia Land Trust presented to both sets of commissioners a near-complete draft of the charter for the Upper Grays River Community Forest. The document lays out the legal framework and governance structure for a working forest in the upper Grays River watershed, which will straddle the boundary between the two counties. “The purpose… is to provide a legal entity… to undertake, assist with and otherwise facilitate the acquisition, ownership, maintenance, harvest, and management of a community forest or forests within Pacific County and Wahkiakum County to provide economic, environmental and community benefits to the public,” the charter’s fourth article reads. On March 1, 2025, President Trump issued an executive order directing the Secretaries of Agriculture and the Interior to develop plans to increase timber production on federal lands. The order was motivated by two stated priorities: expanding the timber supply and addressing rising wildfire risks. The US Forest Service has responded with a goal of increasing timber offered for sale by 25 percent over the next four to five years. This report puts the Trump administration’s actions into context by reviewing the history of harvest from federal lands and evaluating current forest inventories and treatment needs. It asks: What would be the effect on wildfire risk if federal land management agencies increased harvests by 25 percent? Opportunities for harvests that successfully mitigate risk may be limited by the absence of active timber markets, the availability of a qualified workforce, and the economics of fuel removals.

On March 1, 2025, President Trump issued an executive order directing the Secretaries of Agriculture and the Interior to develop plans to increase timber production on federal lands. The order was motivated by two stated priorities: expanding the timber supply and addressing rising wildfire risks. The US Forest Service has responded with a goal of increasing timber offered for sale by 25 percent over the next four to five years. This report puts the Trump administration’s actions into context by reviewing the history of harvest from federal lands and evaluating current forest inventories and treatment needs. It asks: What would be the effect on wildfire risk if federal land management agencies increased harvests by 25 percent? Opportunities for harvests that successfully mitigate risk may be limited by the absence of active timber markets, the availability of a qualified workforce, and the economics of fuel removals. An unusual alliance of Republican lawmakers and animal rights advocates, together with others, is creating storm clouds for a plan to protect one threatened owl by killing a more common one. Last August, the U.S. Fish and Wildlife Service approved a plan to shoot roughly 450,000 barred owls in California, Oregon and Washington over three decades. The barred owls have been out-competing imperiled northern spotted owls in the Pacific Northwest, as well as California spotted owls, pushing them out of their territory. Supporters of the approach — including conservation groups and prominent scientists — believe the cull is necessary to avert disastrous consequences for the spotted owls. Last month, The Times has found, federal officials canceled three owl-related grants to the California Department of Fish and Wildlife totaling roughly $1.1 million, including one study that would remove barred owls from over 192,000 acres in Mendocino and Sonoma counties.

An unusual alliance of Republican lawmakers and animal rights advocates, together with others, is creating storm clouds for a plan to protect one threatened owl by killing a more common one. Last August, the U.S. Fish and Wildlife Service approved a plan to shoot roughly 450,000 barred owls in California, Oregon and Washington over three decades. The barred owls have been out-competing imperiled northern spotted owls in the Pacific Northwest, as well as California spotted owls, pushing them out of their territory. Supporters of the approach — including conservation groups and prominent scientists — believe the cull is necessary to avert disastrous consequences for the spotted owls. Last month, The Times has found, federal officials canceled three owl-related grants to the California Department of Fish and Wildlife totaling roughly $1.1 million, including one study that would remove barred owls from over 192,000 acres in Mendocino and Sonoma counties. In 2023 and 2024, the hottest years on record, more than 78 million acres of forests burned around the globe. The fires sent veils of smoke and several billion tons of carbon dioxide into the atmosphere, subjecting millions of people to poor air quality. Extreme forest-fire years are becoming more common because of climate change, new research suggests. Boreal forests lost more than two times the canopy area in 2023-24 compared with the period between 2002 and 2022, the study found. Tropical forests saw three times as much loss, and North American forests lost nearly four times as much canopy, mostly because of Canada’s wildfires. Significant losses were in remote forests, far from human activities. That isolation suggests fires are increasing primarily because of climate change, said Calum Cunningham, a fire geographer at the University of Tasmania who was not involved with the study. “Chronic changes in climate are making these forests more conducive to burning,” Dr. Cunningham said. [a paid subscription is required to read this article]

In 2023 and 2024, the hottest years on record, more than 78 million acres of forests burned around the globe. The fires sent veils of smoke and several billion tons of carbon dioxide into the atmosphere, subjecting millions of people to poor air quality. Extreme forest-fire years are becoming more common because of climate change, new research suggests. Boreal forests lost more than two times the canopy area in 2023-24 compared with the period between 2002 and 2022, the study found. Tropical forests saw three times as much loss, and North American forests lost nearly four times as much canopy, mostly because of Canada’s wildfires. Significant losses were in remote forests, far from human activities. That isolation suggests fires are increasing primarily because of climate change, said Calum Cunningham, a fire geographer at the University of Tasmania who was not involved with the study. “Chronic changes in climate are making these forests more conducive to burning,” Dr. Cunningham said. [a paid subscription is required to read this article] Conservation groups sued the U.S. Fish and Wildlife Service on July 17 for denying Endangered Species Act (ESA) protections to the north Oregon Coast population of red tree voles. The lawsuit, filed by the Center for Biological Diversity, Bird Alliance of Oregon, Oregon Wild and Cascadia Wildlands, claims the USFWS’ February 2024 decision that the population was not warranted for ESA protections deprives it of critical protections necessary to ensure its survival. “Red tree voles have graced Oregon’s coastal old-growth forests for thousands of years, but we could lose them forever if they don’t get Endangered Species Act protections soon,” said Ryan Shannon, a senior attorney in the Center for Biological Diversity’s endangered species program. …Due to decades of logging, this population has been eliminated from most of its historic range. It also faces an existential threat from wildfire that is worsening under climate change, according to the lawsuit.

Conservation groups sued the U.S. Fish and Wildlife Service on July 17 for denying Endangered Species Act (ESA) protections to the north Oregon Coast population of red tree voles. The lawsuit, filed by the Center for Biological Diversity, Bird Alliance of Oregon, Oregon Wild and Cascadia Wildlands, claims the USFWS’ February 2024 decision that the population was not warranted for ESA protections deprives it of critical protections necessary to ensure its survival. “Red tree voles have graced Oregon’s coastal old-growth forests for thousands of years, but we could lose them forever if they don’t get Endangered Species Act protections soon,” said Ryan Shannon, a senior attorney in the Center for Biological Diversity’s endangered species program. …Due to decades of logging, this population has been eliminated from most of its historic range. It also faces an existential threat from wildfire that is worsening under climate change, according to the lawsuit.

The megabill President Trump signed into law this month is expected to make a major dent in the U.S.’s climate progress, adding significantly more planet-warming emissions to the atmosphere. Models of the legislation that have emerged since its passage earlier this month show U.S. emissions will rise as a result of its implementation. One from climate think tank C2ES found U.S. emissions will be 8 percent more than they would have been otherwise as a result of the package. “An 8% increase in our emissions is … still a massive amount of emissions,” said Brad Townsend, the group’s vice president for policy and outreach. Taking into account all of the efforts to reduce U.S. emissions over the last 20 years, Townsend said, the bill represents “rolling back a third of that progress with a stroke of a pen.” “From an emissions perspective, this bill is a disaster,” he said.

The megabill President Trump signed into law this month is expected to make a major dent in the U.S.’s climate progress, adding significantly more planet-warming emissions to the atmosphere. Models of the legislation that have emerged since its passage earlier this month show U.S. emissions will rise as a result of its implementation. One from climate think tank C2ES found U.S. emissions will be 8 percent more than they would have been otherwise as a result of the package. “An 8% increase in our emissions is … still a massive amount of emissions,” said Brad Townsend, the group’s vice president for policy and outreach. Taking into account all of the efforts to reduce U.S. emissions over the last 20 years, Townsend said, the bill represents “rolling back a third of that progress with a stroke of a pen.” “From an emissions perspective, this bill is a disaster,” he said. When seeking to make forests more fire resilient, removing fuels from the landscape is a tough task to make cost-effective. Thinning and limbing trees during fuels reduction treatments will sometimes produce marketable timber, but more often will produce small-diameter wood pieces that have traditionally been considered unmarketable. These pieces are typically chipped, masticated, or pile burned, and have long been considered ‘wood waste’. California researchers, industry leaders, and private forest landowners have been looking at ways to transform forest wood waste, particularly in wildfire-prone areas, into sustainable products. Utilizing forest biomass for building materials, soil amendments, and clean energy is a key strategy to economically incentivize improving forest conditions and can address both public and private industry needs. The state has also been making moves to decrease greenhouse gas emissions and aims to eliminate emissions entirely by 2045.

When seeking to make forests more fire resilient, removing fuels from the landscape is a tough task to make cost-effective. Thinning and limbing trees during fuels reduction treatments will sometimes produce marketable timber, but more often will produce small-diameter wood pieces that have traditionally been considered unmarketable. These pieces are typically chipped, masticated, or pile burned, and have long been considered ‘wood waste’. California researchers, industry leaders, and private forest landowners have been looking at ways to transform forest wood waste, particularly in wildfire-prone areas, into sustainable products. Utilizing forest biomass for building materials, soil amendments, and clean energy is a key strategy to economically incentivize improving forest conditions and can address both public and private industry needs. The state has also been making moves to decrease greenhouse gas emissions and aims to eliminate emissions entirely by 2045.