The European Commission plans to delay its anti-deforestation rules again—citing the need to reduce red tape. In other Forestry news: the USDA’s Roadless Rule outreach garnered a massive response; WWF-Canada’s Living Planet Report says over half of species are in decline; Vancouver Island mayors and MP Gunn say BC forestry is in crisis; Apple launches project to protect California redwoods; the US Forest Service reflects on Hurricane Helene recovery; and the unexpected upside of Canada’s wildfires.

The European Commission plans to delay its anti-deforestation rules again—citing the need to reduce red tape. In other Forestry news: the USDA’s Roadless Rule outreach garnered a massive response; WWF-Canada’s Living Planet Report says over half of species are in decline; Vancouver Island mayors and MP Gunn say BC forestry is in crisis; Apple launches project to protect California redwoods; the US Forest Service reflects on Hurricane Helene recovery; and the unexpected upside of Canada’s wildfires.

In Company news: Western Forest Products will curtail ~50 million board feet in BC, Interfor secures $5M to upgrade its Sault Ste. Marie mill, Acadian Timber invests in digital forestry at University of New Brunswick; Canadian Kraft Paper says First Nations suit in The Pas, Manitoba should be tossed; and a Sustainable Timber Tasmania error resulted in protester charges being dropped. Meanwhile, perspectives on what’s wrong with housing policy in Ontario and the United States.

Finally, FPAC honoured MP Gord Johns and Mayors Spencer Coyne and Crystal McAteer with the 2025 Jim Carr Forest Community Champion Award.

Kelly McCloskey, Tree Frog Editor

Canada aims to establish duty-free access for up to 95 per cent of its exports to Indonesia over the next eight to 12 months, International Trade Minister Maninder Sidhu said, after signing a trade agreement. The Comprehensive Economic Partnership Agreement is Canada’s first in the economically crucial Indo-Pacific region since

Canada aims to establish duty-free access for up to 95 per cent of its exports to Indonesia over the next eight to 12 months, International Trade Minister Maninder Sidhu said, after signing a trade agreement. The Comprehensive Economic Partnership Agreement is Canada’s first in the economically crucial Indo-Pacific region since

As the trade war sparked by Donald Trump’s tariffs rages on, Canada’s lumber industry is pushing back on U.S. claims that a $1.2 billion aid package announced last month amounts to an unfair subsidy for Canadian softwood. …The aid package includes $500 million in funding to help Canadian lumber producers diversify away from dependency on the American market, and $700 million in loan guarantees to help producers restructure. …The American argument is undercut, however, by the fact that export aid and loan guarantees are both used by various levels of government to support the US‘s own lumber industry, said Niquidet, president of the BC Lumber Trade Council. “There are a lot of tax incentives.” …The measures taken by Prime Minister Carney are in response to unjustified and illegal trade practices being advanced by the United States,” said Ian Dunn, CEO of the Ontario Forest Industry Association. [to access the full story a Toronto Star subscription is required]

As the trade war sparked by Donald Trump’s tariffs rages on, Canada’s lumber industry is pushing back on U.S. claims that a $1.2 billion aid package announced last month amounts to an unfair subsidy for Canadian softwood. …The aid package includes $500 million in funding to help Canadian lumber producers diversify away from dependency on the American market, and $700 million in loan guarantees to help producers restructure. …The American argument is undercut, however, by the fact that export aid and loan guarantees are both used by various levels of government to support the US‘s own lumber industry, said Niquidet, president of the BC Lumber Trade Council. “There are a lot of tax incentives.” …The measures taken by Prime Minister Carney are in response to unjustified and illegal trade practices being advanced by the United States,” said Ian Dunn, CEO of the Ontario Forest Industry Association. [to access the full story a Toronto Star subscription is required] OTTAWA — Canada has dropped two legal challenges of United States duties on Canadian softwood lumber. …The Wall Street Journal first reported this week that Canada dropped long-standing appeals earlier this month of two U.S. anti-dumping reviews dating back to the previous decade. The US undertakes administrative reviews each year to set the level of duties. Canada has regularly challenged those orders. Global Affairs Canada spokeswoman Dina Destin said that the decision to drop the two appeals was made “in close consultation with Canadian industry, provinces and key partners, and it reflects a strategic choice to maximize long-term interests and prospects for a negotiated resolution with the United States.” She said Canada still believes U.S. anti-dumping duties on softwood lumber are unfair and Ottawa is still pursuing six other legal challenges on the matter.

OTTAWA — Canada has dropped two legal challenges of United States duties on Canadian softwood lumber. …The Wall Street Journal first reported this week that Canada dropped long-standing appeals earlier this month of two U.S. anti-dumping reviews dating back to the previous decade. The US undertakes administrative reviews each year to set the level of duties. Canada has regularly challenged those orders. Global Affairs Canada spokeswoman Dina Destin said that the decision to drop the two appeals was made “in close consultation with Canadian industry, provinces and key partners, and it reflects a strategic choice to maximize long-term interests and prospects for a negotiated resolution with the United States.” She said Canada still believes U.S. anti-dumping duties on softwood lumber are unfair and Ottawa is still pursuing six other legal challenges on the matter. CAMPBELL RIVER — Several mayors from across BC have united to advocate for resource development by creating the Alliance of Resource Communities, with Campbell River’s mayor at the helm. “It’s time for an alliance of community leaders from all corners of the province to come together and strongly advocate for a secure and brighter economic future through the responsible development of our abundant natural resources,” said Mayor Kermit Dahl at the Get it Done conference on Sept. 22, which was hosted by Resource Works. “While it’s encouraging that the federal and provincial governments are becoming more vocal in support of major projects, thousands of people in my community who rely on natural resource industries face an uncertain future,” said Dahl, referring to Prime Minister Mark Carney’s pledge to fast-track nation-building projects and the recent announcement of five major infrastructure projects.

CAMPBELL RIVER — Several mayors from across BC have united to advocate for resource development by creating the Alliance of Resource Communities, with Campbell River’s mayor at the helm. “It’s time for an alliance of community leaders from all corners of the province to come together and strongly advocate for a secure and brighter economic future through the responsible development of our abundant natural resources,” said Mayor Kermit Dahl at the Get it Done conference on Sept. 22, which was hosted by Resource Works. “While it’s encouraging that the federal and provincial governments are becoming more vocal in support of major projects, thousands of people in my community who rely on natural resource industries face an uncertain future,” said Dahl, referring to Prime Minister Mark Carney’s pledge to fast-track nation-building projects and the recent announcement of five major infrastructure projects. The union representing thousands of forest-industry workers on the coast is calling for a united effort to address a growing crisis in the sector. Brian Butler, president of United Steelworkers Local 1-1937, says government, industry, First Nations and the union need a plan to resolve the issues that remain under the province’s control. He said members of the union, which represents 5,500 workers on the coast, are being hit hard with layoffs, most of which are either due to market conditions or lack of available logs. “Right now, as we see it, stakeholders work independently in their own silos, rather than collectively,” he said. On Monday, Western Forest Products, which supports about 3,300 jobs on the coast, announced that curtailments at its Chemainus sawmill will be extended until the end of the year. …Butler said there are plenty more examples of trouble in the sector around the Island.

The union representing thousands of forest-industry workers on the coast is calling for a united effort to address a growing crisis in the sector. Brian Butler, president of United Steelworkers Local 1-1937, says government, industry, First Nations and the union need a plan to resolve the issues that remain under the province’s control. He said members of the union, which represents 5,500 workers on the coast, are being hit hard with layoffs, most of which are either due to market conditions or lack of available logs. “Right now, as we see it, stakeholders work independently in their own silos, rather than collectively,” he said. On Monday, Western Forest Products, which supports about 3,300 jobs on the coast, announced that curtailments at its Chemainus sawmill will be extended until the end of the year. …Butler said there are plenty more examples of trouble in the sector around the Island. “The BC Council of Forest Industries (COFI)… is encouraged to see recognition of the urgency to ‘increase performance, move more fibre, and better serve the current client base, including the primary sector.’ To create the stability, certainty, and predictability needed, we urge government to prioritize and fast track the Task Force’s recommendations that focus on increasing wood flow to manufacturers across the province. While BCTS has consistently underperformed in its core function of delivering wood supply to the market, the government is choosing to expand its mandate and propose additional volumes be allocated to BCTS. …COFI is pleased to see harvest targets in Recommendation 17, however, the proposal to increase the BCTS volumes by only 1 million m³ per year is not ambitious enough to meet the government’s Major Project commitment to reach a 45 million m³ harvest.

“The BC Council of Forest Industries (COFI)… is encouraged to see recognition of the urgency to ‘increase performance, move more fibre, and better serve the current client base, including the primary sector.’ To create the stability, certainty, and predictability needed, we urge government to prioritize and fast track the Task Force’s recommendations that focus on increasing wood flow to manufacturers across the province. While BCTS has consistently underperformed in its core function of delivering wood supply to the market, the government is choosing to expand its mandate and propose additional volumes be allocated to BCTS. …COFI is pleased to see harvest targets in Recommendation 17, however, the proposal to increase the BCTS volumes by only 1 million m³ per year is not ambitious enough to meet the government’s Major Project commitment to reach a 45 million m³ harvest. MERRITT, BC — Aspen Planers has halted operations at its Merritt sawmill and planer facility for an undetermined period, citing what it calls a lack of available logs and rising costs that have made continued production unsustainable. “Simply put, our mill lacks logs,” said regional manager Surinder Momrath. “Our Lillooet veneer plant has also curtailed operations for the same reason. These two closures are linked given that we source logs from both our Merritt and Lillooet forest licenses – and the saw logs are processed in Merritt while the plywood ‘peeler’ logs are processed in Lillooet.” The company pointed to an inability to obtain cutting permits under its AAC. Aspen Planers’ licenses provide for 490,000 cubic metres, but over the past two and a half years the company has only harvested 29% of that amount. …He says the shortage stems from provincial policy decisions, including Indigenous co-governance under DRIPA and old growth initiatives.

MERRITT, BC — Aspen Planers has halted operations at its Merritt sawmill and planer facility for an undetermined period, citing what it calls a lack of available logs and rising costs that have made continued production unsustainable. “Simply put, our mill lacks logs,” said regional manager Surinder Momrath. “Our Lillooet veneer plant has also curtailed operations for the same reason. These two closures are linked given that we source logs from both our Merritt and Lillooet forest licenses – and the saw logs are processed in Merritt while the plywood ‘peeler’ logs are processed in Lillooet.” The company pointed to an inability to obtain cutting permits under its AAC. Aspen Planers’ licenses provide for 490,000 cubic metres, but over the past two and a half years the company has only harvested 29% of that amount. …He says the shortage stems from provincial policy decisions, including Indigenous co-governance under DRIPA and old growth initiatives. British Columbia’s forestry industry is “under pressure from all sides,” prompting the provincial government to bring in changes to expand the role of BC Timber Sales, including allowing some communities to manage their own forest resources. Forests Minister Ravi Parmar says attacks from US President Trump, “increasingly intense” wildfires and climate change all put extra pressure on the industry. A review of the work done by BC Timber Sales, an organization that manages 20% of Crown timber, has generated 54 recommendations in a plan to help support a thriving forest economy. One of the key recommendations includes expanding three community forests in Vanderhoof, Fraser Lake and Fort St. James. …Parmar said he wants the changes implemented as quickly as possible, but a number of them will require legislative change to move forward. Parmar said the B.C. forestry sector is also looking to expand into other foreign markets.

British Columbia’s forestry industry is “under pressure from all sides,” prompting the provincial government to bring in changes to expand the role of BC Timber Sales, including allowing some communities to manage their own forest resources. Forests Minister Ravi Parmar says attacks from US President Trump, “increasingly intense” wildfires and climate change all put extra pressure on the industry. A review of the work done by BC Timber Sales, an organization that manages 20% of Crown timber, has generated 54 recommendations in a plan to help support a thriving forest economy. One of the key recommendations includes expanding three community forests in Vanderhoof, Fraser Lake and Fort St. James. …Parmar said he wants the changes implemented as quickly as possible, but a number of them will require legislative change to move forward. Parmar said the B.C. forestry sector is also looking to expand into other foreign markets.

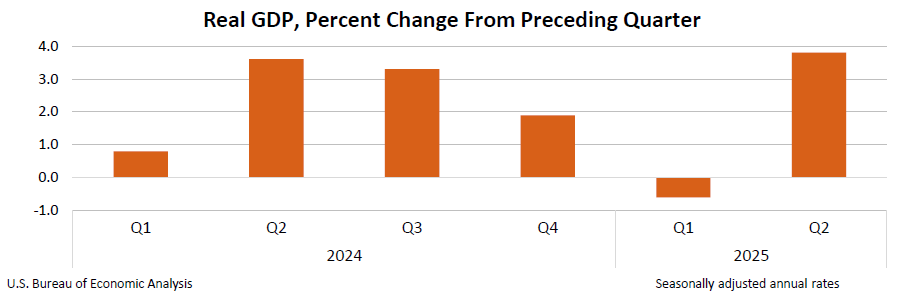

US President Trump said Thursday that he will put import taxes of 100% on pharmaceutical drugs, 50% on kitchen cabinets and bathroom vanities, 30% on upholstered furniture and 25% on heavy trucks starting on Wednesday. Trump’s devotion to tariffs did not end with the trade frameworks that were launched in August, a reflection of the president’s confidence that taxes will help to reduce his government’s budget deficit while increasing domestic manufacturing. But the additional tariffs risk intensifying inflation that is already elevated, as well as slowing economic growth. …Trump said that foreign manufacturers of furniture and cabinetry were flooding the US with their products and that tariffs must be applied “for National Security and other reasons.” The new tariffs on cabinetry could further increase the costs for homebuilders when many people seeking to buy a house feel priced out by the mix of housing shortages and high mortgage rates.

US President Trump said Thursday that he will put import taxes of 100% on pharmaceutical drugs, 50% on kitchen cabinets and bathroom vanities, 30% on upholstered furniture and 25% on heavy trucks starting on Wednesday. Trump’s devotion to tariffs did not end with the trade frameworks that were launched in August, a reflection of the president’s confidence that taxes will help to reduce his government’s budget deficit while increasing domestic manufacturing. But the additional tariffs risk intensifying inflation that is already elevated, as well as slowing economic growth. …Trump said that foreign manufacturers of furniture and cabinetry were flooding the US with their products and that tariffs must be applied “for National Security and other reasons.” The new tariffs on cabinetry could further increase the costs for homebuilders when many people seeking to buy a house feel priced out by the mix of housing shortages and high mortgage rates.

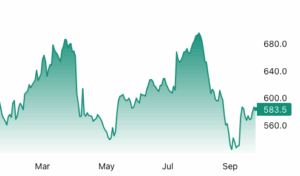

Lumber futures traded above $580 per thousand board feet in September, holding above earlier month lows as supply tightened and housing demand showed signs of renewal. Major producers such as Interfor reduced output through maintenance and shift cuts and mill idling while Canadian softwood flows remained constrained by tariff uncertainty which compressed prompt availability. Expectations of Fed further rate cuts later in 2025 encouraged forward looking builders to replenish inventories. New single family sales rose 20.5% to an 800k seasonally adjusted annualized rate in August which was the largest monthly rise since August 2022. Existing home sales held at a 4.00m SAAR in August and housing inventory stood at 1.53m units equivalent to 4.6 months of supply.

Lumber futures traded above $580 per thousand board feet in September, holding above earlier month lows as supply tightened and housing demand showed signs of renewal. Major producers such as Interfor reduced output through maintenance and shift cuts and mill idling while Canadian softwood flows remained constrained by tariff uncertainty which compressed prompt availability. Expectations of Fed further rate cuts later in 2025 encouraged forward looking builders to replenish inventories. New single family sales rose 20.5% to an 800k seasonally adjusted annualized rate in August which was the largest monthly rise since August 2022. Existing home sales held at a 4.00m SAAR in August and housing inventory stood at 1.53m units equivalent to 4.6 months of supply. BURNABY, BC — Interfor announced that it has entered into an agreement with a syndicate of underwriters led by RBC Capital Markets and Scotiabank, under which the Underwriters have agreed to purchase, on a bought deal basis, 12,437,800 common shares of the Company at a price of $10.05 per Common Share for gross proceeds of $125 million. The Company has agreed to grant the Underwriters an over-allotment option to purchase up to an additional 15% of the Common Shares. …The Company intends to use the net proceeds of the Offering to pay down existing indebtedness and for general corporate purposes. …Proceeds of the Offering are expected to further enhance Interfor’s flexibility to navigate near-term market volatility. The Offering is scheduled to close on or about October 1, 2025.

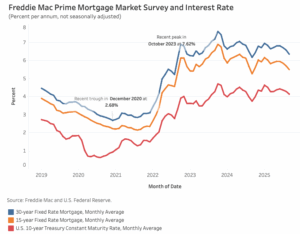

BURNABY, BC — Interfor announced that it has entered into an agreement with a syndicate of underwriters led by RBC Capital Markets and Scotiabank, under which the Underwriters have agreed to purchase, on a bought deal basis, 12,437,800 common shares of the Company at a price of $10.05 per Common Share for gross proceeds of $125 million. The Company has agreed to grant the Underwriters an over-allotment option to purchase up to an additional 15% of the Common Shares. …The Company intends to use the net proceeds of the Offering to pay down existing indebtedness and for general corporate purposes. …Proceeds of the Offering are expected to further enhance Interfor’s flexibility to navigate near-term market volatility. The Offering is scheduled to close on or about October 1, 2025. Average mortgage rates in September trended lower as the bond market priced in expectations of rate cuts by the Federal Reserve. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.35%, 24 basis points (bps) lower than August. Meanwhile, the 15-year rate declined 21 bps to 5.50%. Despite the recent drop, rates remain higher than a year ago as last September saw the lowest levels in about two years. The 30-year rate is currently higher by 17 basis points (bps), and the 15-year rate is higher by 24 bps, year-over-year. …Markets began pricing in rate cuts from the Fed at the start of the month, particularly after news that jobless claims rose while inflation remained modest. On September 17, the Federal Reserve announced a 25 bps cut to the federal funds rate, bringing the target range to 4.00% – 4.25%. Falling mortgage rates have already shown an impact on housing activity.

Average mortgage rates in September trended lower as the bond market priced in expectations of rate cuts by the Federal Reserve. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.35%, 24 basis points (bps) lower than August. Meanwhile, the 15-year rate declined 21 bps to 5.50%. Despite the recent drop, rates remain higher than a year ago as last September saw the lowest levels in about two years. The 30-year rate is currently higher by 17 basis points (bps), and the 15-year rate is higher by 24 bps, year-over-year. …Markets began pricing in rate cuts from the Fed at the start of the month, particularly after news that jobless claims rose while inflation remained modest. On September 17, the Federal Reserve announced a 25 bps cut to the federal funds rate, bringing the target range to 4.00% – 4.25%. Falling mortgage rates have already shown an impact on housing activity.

Four new buildings in B.C. are each receiving $500,000 — totalling $2 million — to demonstrate and showcase the benefits of mass-timber construction. “Mass timber represents a transformative, locally sourced solution that’s generating significant employment opportunities, spurring cutting-edge innovation, and revitalizing rural economies across British Columbia,” said Ravi Kahlon, Minister of Jobs and Economic Growth. …The four projects were announced at the 2025 International Woodrise Congress. …Delivered through the Province’s Crown corporation Forestry Innovation Investment. The four projects are:

Four new buildings in B.C. are each receiving $500,000 — totalling $2 million — to demonstrate and showcase the benefits of mass-timber construction. “Mass timber represents a transformative, locally sourced solution that’s generating significant employment opportunities, spurring cutting-edge innovation, and revitalizing rural economies across British Columbia,” said Ravi Kahlon, Minister of Jobs and Economic Growth. …The four projects were announced at the 2025 International Woodrise Congress. …Delivered through the Province’s Crown corporation Forestry Innovation Investment. The four projects are: In many places, moose, bear, wolves and other wildlife can simply walk between the two nations. There are barriers — roads, development and a lack of protected habitat on either side — but for more than a century, relatively relaxed border policy and a shared sense of purpose saw conservationists in both countries working together to overcome them. Now, US President Trump has ratcheted up the challenges to cross-border conservation. …Many of Trump’s actions have explicit implications for cross-border conservation — in North America and globally. …Canadian conservation organizations have reported losing co-funding as a result of Trump’s cuts to foreign aid. As his administration has stretched staffing thin and proposed deep budget cuts at the US National Park Service, it ended funding many found crucial to habitat conservation work across the border. Trump has also withdrawn from the Green Climate Fund and the Paris Agreement.

In many places, moose, bear, wolves and other wildlife can simply walk between the two nations. There are barriers — roads, development and a lack of protected habitat on either side — but for more than a century, relatively relaxed border policy and a shared sense of purpose saw conservationists in both countries working together to overcome them. Now, US President Trump has ratcheted up the challenges to cross-border conservation. …Many of Trump’s actions have explicit implications for cross-border conservation — in North America and globally. …Canadian conservation organizations have reported losing co-funding as a result of Trump’s cuts to foreign aid. As his administration has stretched staffing thin and proposed deep budget cuts at the US National Park Service, it ended funding many found crucial to habitat conservation work across the border. Trump has also withdrawn from the Green Climate Fund and the Paris Agreement. The Interior Department says it’s on track to meet a federal goal to increase logging on federal lands, even as timber industry analysts warn low prices, scarce sawmills, and litigation will likely threaten progress. Interior’s Bureau of Land Management has increased timber sales by 4.6% so far in fiscal 2025 over all of fiscal 2024. Interior spokeswoman Alyse Sharpe said. …Trump’s logging goals face fierce headwinds, however, as depressed lumber prices, a worker shortage in the timber industry, and an overriding sense of uncertainty about the future of logging are chilling timber industry interest in actually cutting down the trees sold in federal sales, said Mindy Crandall, at Oregon State University. “The Forest Service can put the timber up for sale, but someone has to want it,” Crandall said. But Trump’s logging policies are likely to have limited reach across the US in part because federal lands make up only a small part of the timber supply, and tariffs are unlikely to crush the demand for Canadian lumber.

The Interior Department says it’s on track to meet a federal goal to increase logging on federal lands, even as timber industry analysts warn low prices, scarce sawmills, and litigation will likely threaten progress. Interior’s Bureau of Land Management has increased timber sales by 4.6% so far in fiscal 2025 over all of fiscal 2024. Interior spokeswoman Alyse Sharpe said. …Trump’s logging goals face fierce headwinds, however, as depressed lumber prices, a worker shortage in the timber industry, and an overriding sense of uncertainty about the future of logging are chilling timber industry interest in actually cutting down the trees sold in federal sales, said Mindy Crandall, at Oregon State University. “The Forest Service can put the timber up for sale, but someone has to want it,” Crandall said. But Trump’s logging policies are likely to have limited reach across the US in part because federal lands make up only a small part of the timber supply, and tariffs are unlikely to crush the demand for Canadian lumber. Can the problems of wildfire and forestry industry setbacks be solved at once? …It will be a tough goal, especially with the Province’s timber supply forecast not projecting timber supply to turn in a positive direction until 2060. …The forest industry has been attempting to fight this every year. For wildfires, the BC Wildfire Service (BCWS) have adopted techniques, such as prescribed burnings, to try and mitigate the intense wildfire seasons. …One way is the more novel practice of harnessing the manpower of the logging industry. Nick Reynolds, acting director of investigations at the BC Forest Practices Board, was involved in two recent special investigations from the FPB on wildfire mitigation. …“Why don’t we use that engine and muscle (of the forestry industry)” Reynolds said. …Jason Fisher, executive director of FESBC, said that through their funding platform, they’ve seen workers who’ve specialized in traditional logging take on WRR work.

Can the problems of wildfire and forestry industry setbacks be solved at once? …It will be a tough goal, especially with the Province’s timber supply forecast not projecting timber supply to turn in a positive direction until 2060. …The forest industry has been attempting to fight this every year. For wildfires, the BC Wildfire Service (BCWS) have adopted techniques, such as prescribed burnings, to try and mitigate the intense wildfire seasons. …One way is the more novel practice of harnessing the manpower of the logging industry. Nick Reynolds, acting director of investigations at the BC Forest Practices Board, was involved in two recent special investigations from the FPB on wildfire mitigation. …“Why don’t we use that engine and muscle (of the forestry industry)” Reynolds said. …Jason Fisher, executive director of FESBC, said that through their funding platform, they’ve seen workers who’ve specialized in traditional logging take on WRR work.

WASHINGTON, DC — US Secretary of Agriculture Rollins announced the USDA Forest Service is investing

WASHINGTON, DC — US Secretary of Agriculture Rollins announced the USDA Forest Service is investing  IDAHO — After a slew of firings and deferred resignations last winter, the loss of federal workers left holes throughout the Northwest. “When we get to peak fire season, it’s kind of an all-hands-on-deck call, if you will,” said Jim Wimer, a fire prevention officer for the Nez Perce-Clearwater National Forests. US Forest Service employees who are normally in the office — like wildlife biologists or hydrologists — jumped in to help with fire information this summer, he said. …Workers even drove trucks with supplies to wildfires, often working overtime to help, he said. Not only does it help local fire efforts, but it also gets people out to other parts of the country to gain unique experiences and helps other forests that are in similar situations, Wimer said. …This year, there have been 364 fires on land the agency manages, but not a lot of acreage burned, he said.

IDAHO — After a slew of firings and deferred resignations last winter, the loss of federal workers left holes throughout the Northwest. “When we get to peak fire season, it’s kind of an all-hands-on-deck call, if you will,” said Jim Wimer, a fire prevention officer for the Nez Perce-Clearwater National Forests. US Forest Service employees who are normally in the office — like wildlife biologists or hydrologists — jumped in to help with fire information this summer, he said. …Workers even drove trucks with supplies to wildfires, often working overtime to help, he said. Not only does it help local fire efforts, but it also gets people out to other parts of the country to gain unique experiences and helps other forests that are in similar situations, Wimer said. …This year, there have been 364 fires on land the agency manages, but not a lot of acreage burned, he said.

INDIANA — The controversial and slow-moving forest management plan inside the Hoosier National Forest hit another roadblock last week. All related activities — including timber sales, prescribed burns, road construction — have been temporarily halted by a court order. The Houston South Project would have opened up about 13,500 acres of the Hoosier National Forest to prescribed burning, 4,000 acres to logging, 2,000 acres to herbicide application and 400 acres to clearcutting. Opponents of the Houston South Project say this ruling is a meaningful step in the right direction. …Groups like the Indiana Forest Alliance have argued that cutting, spraying and burning on the steep slopes could lead to pollution in the reservoir jeopardizing drinking water quality and public health for the 130,000 people in the Bloomington area. …Chief Judge Tanya Pratt halted the project after finding that the USFS violated the National Environmental Policy Act in failing to consider the potential environmental impacts of the plan.

INDIANA — The controversial and slow-moving forest management plan inside the Hoosier National Forest hit another roadblock last week. All related activities — including timber sales, prescribed burns, road construction — have been temporarily halted by a court order. The Houston South Project would have opened up about 13,500 acres of the Hoosier National Forest to prescribed burning, 4,000 acres to logging, 2,000 acres to herbicide application and 400 acres to clearcutting. Opponents of the Houston South Project say this ruling is a meaningful step in the right direction. …Groups like the Indiana Forest Alliance have argued that cutting, spraying and burning on the steep slopes could lead to pollution in the reservoir jeopardizing drinking water quality and public health for the 130,000 people in the Bloomington area. …Chief Judge Tanya Pratt halted the project after finding that the USFS violated the National Environmental Policy Act in failing to consider the potential environmental impacts of the plan. Brazil will invest $1 billion in the

Brazil will invest $1 billion in the  EASTERN OREGON — More than $7.4 million to support removal and transport of 417,308 tons of low-value trees and woody debris from national forests to processing facilities is being allocated to Eastern Oregon forests. The allocation includes a critical $4.6 million award to support the forest products industry in Grant County. Two other projects are in or near Wallowa County, Oregon’s US Sens. Ron Wyden and Jeff Merkley announced Friday, Sept. 19. This $7.4 million investment from the U.S. Forest Service’s Hazardous Fuels Transportation Assistance Program will be distributed as follows: Heartwood Biomass Inc. in Wallowa: $773,031; Boise Cascade Wood Products LLC in Elgin: $385,138; Iron Triangle LLC in John Day: $4,665,063;Dodge Logging Inc. in Maupin: $648,000; Gilchrist Forest Products LLC in Gilchrist: $588,648; Rude Logging LLC in John Day: $410,748.

EASTERN OREGON — More than $7.4 million to support removal and transport of 417,308 tons of low-value trees and woody debris from national forests to processing facilities is being allocated to Eastern Oregon forests. The allocation includes a critical $4.6 million award to support the forest products industry in Grant County. Two other projects are in or near Wallowa County, Oregon’s US Sens. Ron Wyden and Jeff Merkley announced Friday, Sept. 19. This $7.4 million investment from the U.S. Forest Service’s Hazardous Fuels Transportation Assistance Program will be distributed as follows: Heartwood Biomass Inc. in Wallowa: $773,031; Boise Cascade Wood Products LLC in Elgin: $385,138; Iron Triangle LLC in John Day: $4,665,063;Dodge Logging Inc. in Maupin: $648,000; Gilchrist Forest Products LLC in Gilchrist: $588,648; Rude Logging LLC in John Day: $410,748. NEW YORK — Some countries’ leaders are watching rising seas threaten to swallow their homes. Others are watching their citizens die in floods, hurricanes and heat waves, all exacerbated by climate change. But the world US President Donald Trump described in his speech at the United Nations General Assembly didn’t match the one many world leaders in the audience are contending with. Nor did it align with what scientists have long been observing. “This ‘climate change,’ it’s the greatest con job ever perpetrated on the world, in my opinion,” Trump said. “All of these predictions made by the United Nations and many others, often for bad reasons, were wrong. If you don’t get away from this green scam, your country is going to fail.” Trump has long been a critic of climate science and polices aimed at helping the world transition to green energies like wind and solar.

NEW YORK — Some countries’ leaders are watching rising seas threaten to swallow their homes. Others are watching their citizens die in floods, hurricanes and heat waves, all exacerbated by climate change. But the world US President Donald Trump described in his speech at the United Nations General Assembly didn’t match the one many world leaders in the audience are contending with. Nor did it align with what scientists have long been observing. “This ‘climate change,’ it’s the greatest con job ever perpetrated on the world, in my opinion,” Trump said. “All of these predictions made by the United Nations and many others, often for bad reasons, were wrong. If you don’t get away from this green scam, your country is going to fail.” Trump has long been a critic of climate science and polices aimed at helping the world transition to green energies like wind and solar.  WISCONSIN — Lawmakers from northern and north-central Wisconsin are circulating a bill supporting Johnson Timber Corp. in Hayward to build a processing plant for aviation fuel made from logging debris to establish a processing plant in Wisconsin. The legislation would reward the company with a $60 million tax credit and access to $150 million in borrowing through Wisconsin’s bonding authority. Republican lawmakers wrote in a memo circulated Monday seeking cosponsors that the proposal would create 150 jobs and generate $1.2 billion a year in income after three years of operation. The processing plant in Hayward would be built by Johnson Timber Corp., in partnership with a German company… Synthec Fuels. Wisconsin along with Michigan and Minnesota are all vying for the project, Felzkowski said, “and the state that helps will be the first state” to get the facility and probably the headquarters for the overall processing operation.

WISCONSIN — Lawmakers from northern and north-central Wisconsin are circulating a bill supporting Johnson Timber Corp. in Hayward to build a processing plant for aviation fuel made from logging debris to establish a processing plant in Wisconsin. The legislation would reward the company with a $60 million tax credit and access to $150 million in borrowing through Wisconsin’s bonding authority. Republican lawmakers wrote in a memo circulated Monday seeking cosponsors that the proposal would create 150 jobs and generate $1.2 billion a year in income after three years of operation. The processing plant in Hayward would be built by Johnson Timber Corp., in partnership with a German company… Synthec Fuels. Wisconsin along with Michigan and Minnesota are all vying for the project, Felzkowski said, “and the state that helps will be the first state” to get the facility and probably the headquarters for the overall processing operation. REVELSTOKE, BC — A BC forestry worker was fatally injured while on the job last week, an industry safety group said Tuesday. “A skidder operator was fatally injured when their skidder rolled down a steep slope in an area north of Revelstoke,” the BC Forest Safety Council said of the Sept. 16 incident. “WorkSafeBC and the Coroners Service are currently investigating this incident.” It’s the fifth harvesting fatality in 2025 and BC Forestry said details are still to be determined. Contributing factors to the incident are not available during an ongoing investigation. The BC Forest Safety Council said they have several safety points to be considered as the process unfolds. Those include a thorough assessment before work begins to prepare operators for steep slope logging operations. …Maintain safety buffers by not operating on the steepest possible slopes. This helps operators recover when surprised by an unexpected event.

REVELSTOKE, BC — A BC forestry worker was fatally injured while on the job last week, an industry safety group said Tuesday. “A skidder operator was fatally injured when their skidder rolled down a steep slope in an area north of Revelstoke,” the BC Forest Safety Council said of the Sept. 16 incident. “WorkSafeBC and the Coroners Service are currently investigating this incident.” It’s the fifth harvesting fatality in 2025 and BC Forestry said details are still to be determined. Contributing factors to the incident are not available during an ongoing investigation. The BC Forest Safety Council said they have several safety points to be considered as the process unfolds. Those include a thorough assessment before work begins to prepare operators for steep slope logging operations. …Maintain safety buffers by not operating on the steepest possible slopes. This helps operators recover when surprised by an unexpected event.