RBC analyst Paul Quinn is expecting “mixed” third-quarter financial results from North American paper and forest product companies, seeing “more supportive building materials prices but somewhat lower prices across several other commodities. “Pulp prices seem to have bottomed, led by a resumption of purchasing activity by China, although significant capacity additions and elevated inventory levels are likely to slow the pace of a recovery,” he said. “Paper prices have moved only modestly lower, but operating rates are weak. Supply-demand tension in containerboard is improving somewhat with recently announced closures, and prices have stabilized, but we expect market-related downtime to offset new mill start-ups to continue for the near-term. Timber prices remain weak across North America due to weak lumber and other end use consumption.

“During the Q3 earnings season, we think investors will be focused on the trajectory into 2024, particularly as it relates to wood products demand against a backdrop of elevated interest rates, and demand for graphic paper and paper packaging. While we wait for an inflection point in the economy, interest rates and overall confidence, we note that valuations remain near historic lows.” Heading into earnings season, Mr. Quinn predicts lumber prices are likely to “struggle to gain meaningful momentum” through the remainder of the year, “barring any transportation issues or unforeseen events, driven by both seasonality and higher interest rates weighing on new construction and R&R activity.

The North American lumber market has been stalled for much of 2023… [but] the longer-term fundamentals of the US and Canadian housing markets look good, as there is still an apparent pent-up demand for homes. As new residential housing represents 35 per cent of US lumber consumption, any upside in housing demand should increase lumber demand, especially after mortgage rates start declining next year. …Repair and remodelling activity (40 per cent of US lumber consumption) is slowing and expected to decline (but remain positive) for the rest of 2023 and then become negative, at least into the first half of next year.

The North American lumber market has been stalled for much of 2023… [but] the longer-term fundamentals of the US and Canadian housing markets look good, as there is still an apparent pent-up demand for homes. As new residential housing represents 35 per cent of US lumber consumption, any upside in housing demand should increase lumber demand, especially after mortgage rates start declining next year. …Repair and remodelling activity (40 per cent of US lumber consumption) is slowing and expected to decline (but remain positive) for the rest of 2023 and then become negative, at least into the first half of next year.  The summer of 2023 will go down as the year of smoke in North America, and while it would be easy to panic and predict the end of days, history teaches that this could easily be a one-off year, followed by a cool and rainy summer. …But there is no denying that 2023 will go down as the worst year for forest fires in recorded Canadian history. What was particularly noteworthy was how widespread it was, with nearly every province within the boreal forest scrambling to fight fires. It truly was a national event—and not a good one. It would be easy to blame Climate Change for this dire situation, and there is no doubt that it is causing more extreme weather patterns like long periods of drought. This contributed to the size of the fires that burned in 2023.

The summer of 2023 will go down as the year of smoke in North America, and while it would be easy to panic and predict the end of days, history teaches that this could easily be a one-off year, followed by a cool and rainy summer. …But there is no denying that 2023 will go down as the worst year for forest fires in recorded Canadian history. What was particularly noteworthy was how widespread it was, with nearly every province within the boreal forest scrambling to fight fires. It truly was a national event—and not a good one. It would be easy to blame Climate Change for this dire situation, and there is no doubt that it is causing more extreme weather patterns like long periods of drought. This contributed to the size of the fires that burned in 2023.

From timber long houses in Europe to temples in Asia, wood has been a primary construction material in buildings since the Stone Age, with some still standing more than a thousand years later. Today, modern technology and engineering is turning wood into a “new” building material, mass timber, which is set to transform the North American lumber industry. …For decades, Europe has been at the forefront of this revolution, but growing momentum in the still-nascent North American market is fostering an environment ripe for commercial opportunities. …The number of North American mass timber plants has grown to 22 from just 4 in 2016, and that number could more than double by 2027… and there are many opportunities to participate in different parts of the business. These include fabrication of and design services for the various components and connections, all the way to working with architects and engineers on fully integrated design and supply solutions.

From timber long houses in Europe to temples in Asia, wood has been a primary construction material in buildings since the Stone Age, with some still standing more than a thousand years later. Today, modern technology and engineering is turning wood into a “new” building material, mass timber, which is set to transform the North American lumber industry. …For decades, Europe has been at the forefront of this revolution, but growing momentum in the still-nascent North American market is fostering an environment ripe for commercial opportunities. …The number of North American mass timber plants has grown to 22 from just 4 in 2016, and that number could more than double by 2027… and there are many opportunities to participate in different parts of the business. These include fabrication of and design services for the various components and connections, all the way to working with architects and engineers on fully integrated design and supply solutions.

This presents the opportunity for both the lumber and pulp industries to co-operate on land management, sharing in the carbon offset credit revenue to help pay for the establishment of the plantation, while benefiting from additional fibre sources over a shorter time span. …There is plenty of room in Canada for both conventional crop farming and tree farming. The key is to plan strategically and aim, for example, at productive land parcels that are difficult to farm but could still generate income through the sale of carbon offset credits. Parcels as small as one hectare could still be monetized into a valuable tree farm. …If Canada wants to achieve its GHG reduction targets, it’s going to have to do a lot more than just pump carbon dioxide back into the ground… and making tree farming affordable goes a long way toward building a natural climate change solution.

This presents the opportunity for both the lumber and pulp industries to co-operate on land management, sharing in the carbon offset credit revenue to help pay for the establishment of the plantation, while benefiting from additional fibre sources over a shorter time span. …There is plenty of room in Canada for both conventional crop farming and tree farming. The key is to plan strategically and aim, for example, at productive land parcels that are difficult to farm but could still generate income through the sale of carbon offset credits. Parcels as small as one hectare could still be monetized into a valuable tree farm. …If Canada wants to achieve its GHG reduction targets, it’s going to have to do a lot more than just pump carbon dioxide back into the ground… and making tree farming affordable goes a long way toward building a natural climate change solution. One of my biggest pet peeves is the misguided expectations that come from using the number of jobs per thousand cubic metres of timber harvested to compare British Columbia’s forest sector to other jurisdictions. Critics have attempted to associate BC’s comparatively low generation of jobs per thousand cubic metres harvested to issues such as log exports, mechanization, forest management practices and minimal value-added processing. …BC is often compared to Quebec and Ontario, which have much higher jobs per thousand cubic metres harvested. …Jobs per thousand cubic metres of timber harvested is a relative metric useful for comparison to other regions, but it does not tell the behind-the-scenes story.

One of my biggest pet peeves is the misguided expectations that come from using the number of jobs per thousand cubic metres of timber harvested to compare British Columbia’s forest sector to other jurisdictions. Critics have attempted to associate BC’s comparatively low generation of jobs per thousand cubic metres harvested to issues such as log exports, mechanization, forest management practices and minimal value-added processing. …BC is often compared to Quebec and Ontario, which have much higher jobs per thousand cubic metres harvested. …Jobs per thousand cubic metres of timber harvested is a relative metric useful for comparison to other regions, but it does not tell the behind-the-scenes story.

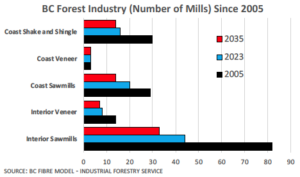

When we look out to 2035, a full 30 years after the industry peak, the picture is sobering. Using a forecast for a province-wide Crown AAC of 38 million m3, only 33 or 40% of sawmills operating in the BC Interior in 2005 will remain and lumber production capacity will fall to a mere 38% of that peak. On the coast, 14 sawmills are expected to continue operating, with 56% of the capacity of 2005. On the pulp and paper side, more closures are forecast… with pulp capacity forecast to settle at 54% of that in 2005 with paper capacity at a mere 11%. For other forest products manufacturers there may be 10 veneer production facilities, 14 shake and shingle mills and potentially just a few specialty operations remaining. …Despite the ever-present prognostications of doom and gloom there are those still willing to invest in this province. Most recently, Canfor’s new state-of-the-art 350 million board feet sawmill in Houston. …The BC government wants more investment to transition the industry, and specifically to add more mass timber manufacturing. Unless a plan can be developed to cut short the current trends, a much smaller industry is forecast by 2035.

When we look out to 2035, a full 30 years after the industry peak, the picture is sobering. Using a forecast for a province-wide Crown AAC of 38 million m3, only 33 or 40% of sawmills operating in the BC Interior in 2005 will remain and lumber production capacity will fall to a mere 38% of that peak. On the coast, 14 sawmills are expected to continue operating, with 56% of the capacity of 2005. On the pulp and paper side, more closures are forecast… with pulp capacity forecast to settle at 54% of that in 2005 with paper capacity at a mere 11%. For other forest products manufacturers there may be 10 veneer production facilities, 14 shake and shingle mills and potentially just a few specialty operations remaining. …Despite the ever-present prognostications of doom and gloom there are those still willing to invest in this province. Most recently, Canfor’s new state-of-the-art 350 million board feet sawmill in Houston. …The BC government wants more investment to transition the industry, and specifically to add more mass timber manufacturing. Unless a plan can be developed to cut short the current trends, a much smaller industry is forecast by 2035.

Over the last few months, the BC forest sector has increasingly been the beneficiary of broad proclamations by many who work outside of the sector about an upcoming “paradigm shift” and “transformative future” in the management of BC’s forests. For some, these are apparently new and wise revelations worthy of our everlasting gratitude. The reality is that many of us have been around long enough to know that for decades, these terms have been bandied around repeatedly when each generation believes they have found the grand solution to the forestry issues of the day. These many decades have also seen the ebb and flow of the lobbying influence each faction in the debates can harness for their agendas dependent upon the government’s leanings in any particular election cycle. Today, many would say the pendulum is weighted towards environmental influences, while others will argue the industry’s influences were dominant in previous times. There is probably merit on both sides of the argument.

Over the last few months, the BC forest sector has increasingly been the beneficiary of broad proclamations by many who work outside of the sector about an upcoming “paradigm shift” and “transformative future” in the management of BC’s forests. For some, these are apparently new and wise revelations worthy of our everlasting gratitude. The reality is that many of us have been around long enough to know that for decades, these terms have been bandied around repeatedly when each generation believes they have found the grand solution to the forestry issues of the day. These many decades have also seen the ebb and flow of the lobbying influence each faction in the debates can harness for their agendas dependent upon the government’s leanings in any particular election cycle. Today, many would say the pendulum is weighted towards environmental influences, while others will argue the industry’s influences were dominant in previous times. There is probably merit on both sides of the argument.

There are many times when I’ve been frustrated by the headlines sensationalizing protests about forest management in BC. The relentlessness of the attacks on our forest sector becomes, right or wrong, numbing. …I’m not talking about the legal and passionate protests and dialogue about the future of forest management in BC. This is about those that flout the law, discourage real discussion, discourage democracy, and have a new brand of colonialism. One protest group dumped a pile of manure at the front door of Premier Horgan’s constituency office. Wow, that is really mature. Next, Minister Conroy’s home phone number was published online and both she and her family members received threatening messages. Wow, what kind of person does that?

There are many times when I’ve been frustrated by the headlines sensationalizing protests about forest management in BC. The relentlessness of the attacks on our forest sector becomes, right or wrong, numbing. …I’m not talking about the legal and passionate protests and dialogue about the future of forest management in BC. This is about those that flout the law, discourage real discussion, discourage democracy, and have a new brand of colonialism. One protest group dumped a pile of manure at the front door of Premier Horgan’s constituency office. Wow, that is really mature. Next, Minister Conroy’s home phone number was published online and both she and her family members received threatening messages. Wow, what kind of person does that?