Bob Brash, Charlene Higgins, Susan Yurkovich and Melissa Sanderson

Delving deeper into the merits of the specifics, was the second TLA session on perspectives related to Modernizing Forest Policy in BC. Melissa Sanderson, ADM, Forest Policy and Indigenous Relations, BC Ministry of Forests, described the government’s vision and context—which is that the current policy framework is inadequate to address today’s challenges. According to Sanderson, the Intentions Paper was “greatly informed by engagements that have taken place in the past, notwithstanding the challenge of overlapping crises [covid, fires and floods], and that the engagement will be ongoing”.

Charlene Higgins, CEO of the BC First Nations Forestry Council, described what she’s been hearing from First Nations related to the modernization policies as “one of frustration… and that frustration is growing”. According to Higgins, this is because the polices were developed with no First Nations involvement. …Given government’s alignment with many of the First Nations Forestry Strategy goals, Higgins called the effort a “missed opportunity”. As such, she is seeking a full reset on the engagement process. Higgins concluded by saying, “the public wants a different approach to the use of BC’s forests, with real collaboration with First Nations regarding the use and management of forest land and resources.” And “First Nations involvement in the sector as full partners is the new paradigm that will create the climate for investment needed to support a thriving forest sector.”

Susan Yurkovich, President and CEO of the BC Council of Forest Industries, noted “the importance of this conversation because of breadth and depth the industry has on the economic and social fabric of the province.” From industry’s perspective, the modernization of BC’s forest policy must start with a fact-based, balanced, and inclusive approach (agreed set of facts and then look at balancing the values); an inclusive group of people (meaning everyone is at the table); have Indigenous Nations as full partners (a say and meaningful revenue sharing); and champion BC’s low-carbon forest products as part of the climate solution.”

“But”, says Yurkovich, “predictable access to fibre at a reasonable cost is the key for all participants, regardless of size. …We need policy choices that are going to create predictability to encourage innovation and reinvestment.” …”There are a lot of challenges but also a lot of opportunities. BC has great people, great fibre, and the expertise, knowhow and technology to capitalize on the opportunity to be the preferred supplier of low-carbon, sustainable management forest products that will fight climate change. But we have to get it right, and we can’t get it right if we aren’t all working together.”

North American lumber markets continue to strengthen from ongoing logistical problems and supply chain woes. …SPF mills in BC continue to face railcar shortages… and now the Russia- Ukraine invasion threatens lumber exports from the world’s largest exporter. This event will only tighten up the world’s lumber supplies and push prices even higher, especially in Europe. …US lumber and panel demand continues to advance, spurred on by COVID-19 constraints and steady demand for new homes. US housing starts continue to move higher and reached 1.597 million units in 2021, a 15.8 per cent increase from 2020. However, a slower rate of new house construction is forecast for 2022 (+3 to 5 per cent) as builders simply cannot build houses fast enough. …US repair and remodelling activity accounts for 40 per cent of US lumber consumption and it is expected to increase significantly again in 2022.

North American lumber markets continue to strengthen from ongoing logistical problems and supply chain woes. …SPF mills in BC continue to face railcar shortages… and now the Russia- Ukraine invasion threatens lumber exports from the world’s largest exporter. This event will only tighten up the world’s lumber supplies and push prices even higher, especially in Europe. …US lumber and panel demand continues to advance, spurred on by COVID-19 constraints and steady demand for new homes. US housing starts continue to move higher and reached 1.597 million units in 2021, a 15.8 per cent increase from 2020. However, a slower rate of new house construction is forecast for 2022 (+3 to 5 per cent) as builders simply cannot build houses fast enough. …US repair and remodelling activity accounts for 40 per cent of US lumber consumption and it is expected to increase significantly again in 2022.

Assuming all the announced transactions are completed. …The top five companies are led by #1 West Fraser (which is also the largest OSB producer), followed closely by #2 Canfor (including its Swedish mills), #3 Weyerhaeuser, #4 Interfor (with its recent acquisition of EACOM as well as four G-P mills), and #5 Sierra-Pacific (with its acquisition of Seneca). Each of these behemoth companies have more than 5 million m3 (3 billion bf) of lumber capacity. Stora Enso at #6… with mills throughout nine countries in Europe as well as Russia. Moving up quickly in the ranks… is #7 binderholz headquartered in Austria with the strategic acquisitions of the two ex-Klausner sawmills in the US South and BSW’s seven sawmill sites in the UK, one in Latvia and seven other production sites in the UK.

Assuming all the announced transactions are completed. …The top five companies are led by #1 West Fraser (which is also the largest OSB producer), followed closely by #2 Canfor (including its Swedish mills), #3 Weyerhaeuser, #4 Interfor (with its recent acquisition of EACOM as well as four G-P mills), and #5 Sierra-Pacific (with its acquisition of Seneca). Each of these behemoth companies have more than 5 million m3 (3 billion bf) of lumber capacity. Stora Enso at #6… with mills throughout nine countries in Europe as well as Russia. Moving up quickly in the ranks… is #7 binderholz headquartered in Austria with the strategic acquisitions of the two ex-Klausner sawmills in the US South and BSW’s seven sawmill sites in the UK, one in Latvia and seven other production sites in the UK.

On three occasions, those who have been determined to bring their concerns via a rally directly to the BC legislature have been forced to cancel it. …Now, planning will be underway for the next attempt. Why the effort? Because the provincial government is making decisions that are simply wrong. Other than being one of a few hundred government spin doctors or a member of an entitled environmental corporation, all involved in our business know these decisions are wrong and that much better options exist to protect workers, communities, and the environment. On behalf of the TLA, I was going to have the honour of speaking at the rally. Well, no need to waste a speech, so here’s the essence of what I planned to say.

On three occasions, those who have been determined to bring their concerns via a rally directly to the BC legislature have been forced to cancel it. …Now, planning will be underway for the next attempt. Why the effort? Because the provincial government is making decisions that are simply wrong. Other than being one of a few hundred government spin doctors or a member of an entitled environmental corporation, all involved in our business know these decisions are wrong and that much better options exist to protect workers, communities, and the environment. On behalf of the TLA, I was going to have the honour of speaking at the rally. Well, no need to waste a speech, so here’s the essence of what I planned to say.

Last year BC exported over $16.3 billion of forest products… But will BC forestry and the workers, communities, First Nations and professionals in this sector continue to be a robust part of our economy as it has been for more than a century? The NDP government recently tabled ideologically-driven plans to damage the forest sector, perhaps irreparably. Their plans needs a sober second look and major rethink. These radical, unprecedented proposals were dropped on rural BC communities, forest workers, unions, forest professionals, First Nations, the forestry industry and 10,000 BC businesses supported by forestry. In my 50 years’ experience working in our forests, it’s hard to fathom why so little consultation was done with those most affected.

Last year BC exported over $16.3 billion of forest products… But will BC forestry and the workers, communities, First Nations and professionals in this sector continue to be a robust part of our economy as it has been for more than a century? The NDP government recently tabled ideologically-driven plans to damage the forest sector, perhaps irreparably. Their plans needs a sober second look and major rethink. These radical, unprecedented proposals were dropped on rural BC communities, forest workers, unions, forest professionals, First Nations, the forestry industry and 10,000 BC businesses supported by forestry. In my 50 years’ experience working in our forests, it’s hard to fathom why so little consultation was done with those most affected. British Columbia’s forest industry is losing a battle against those who would prefer the sector be reduced to a small cottage industry. The evidence of such loss is real – major changes to forest policy have been implemented by the BC government, without much apparent regard to the industry. The industry has barely shown up to the fight due to an unwillingness to engage in a public campaign designed to illicit emotions. All the while the effective use of social media by the industry’s antagonists has been a game changer for the public’s perception of forestry. Some industry folk believe the public perceives the industry as “bad” so it’s better not to put ourselves out there. In my opinion, that’s wrong.

British Columbia’s forest industry is losing a battle against those who would prefer the sector be reduced to a small cottage industry. The evidence of such loss is real – major changes to forest policy have been implemented by the BC government, without much apparent regard to the industry. The industry has barely shown up to the fight due to an unwillingness to engage in a public campaign designed to illicit emotions. All the while the effective use of social media by the industry’s antagonists has been a game changer for the public’s perception of forestry. Some industry folk believe the public perceives the industry as “bad” so it’s better not to put ourselves out there. In my opinion, that’s wrong.

Saskatchewan has always been a sleeping giant in terms of its contribution to the Canadian forest industry, despite its massive and mature—though seriously under-utilized—forest resource. But it seems that the giant has now finally awakened. In a flurry of press releases over the span of a week, the province announced a reallocation of its forest resource primarily located north of Saskatoon that will result in significant forest industry investment. It includes a huge sawmill expansion by Dunkley Lumber in Carrot River, Carrier Forest Products ramping up production in Big River, a OSB plant for Prince Albert by new business venture, One Sky Forest Products, and the re-opening of the geographically iconic pulp mill located north of Prince Albert, now owned by Paper Excellence. All told, it will result in over $1 billion in new investment over two years.

Saskatchewan has always been a sleeping giant in terms of its contribution to the Canadian forest industry, despite its massive and mature—though seriously under-utilized—forest resource. But it seems that the giant has now finally awakened. In a flurry of press releases over the span of a week, the province announced a reallocation of its forest resource primarily located north of Saskatoon that will result in significant forest industry investment. It includes a huge sawmill expansion by Dunkley Lumber in Carrot River, Carrier Forest Products ramping up production in Big River, a OSB plant for Prince Albert by new business venture, One Sky Forest Products, and the re-opening of the geographically iconic pulp mill located north of Prince Albert, now owned by Paper Excellence. All told, it will result in over $1 billion in new investment over two years.

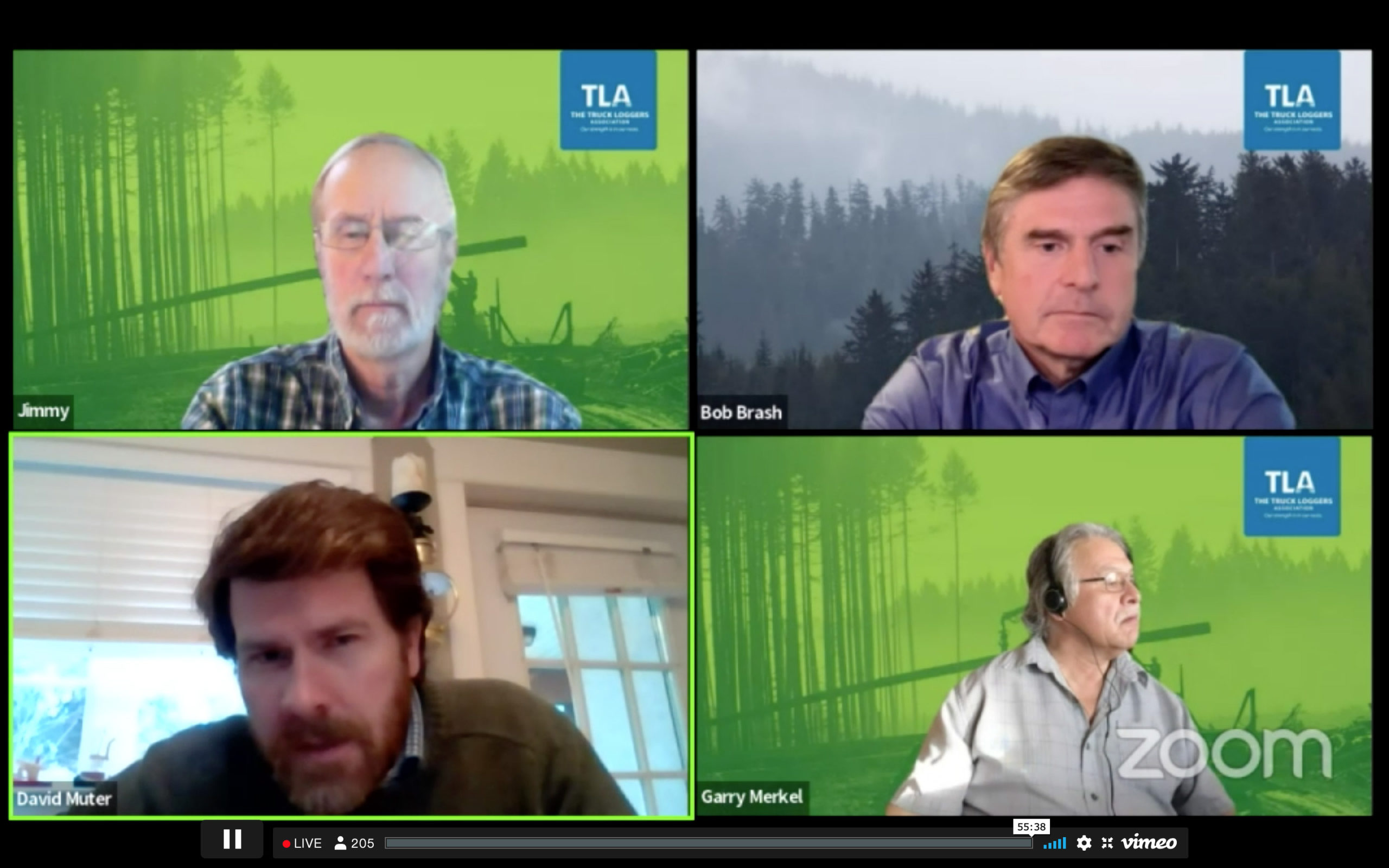

Kicking off Day 2 of the TLA’s panels on the BC government’s efforts to modernize forest policy was David Muter, ADM, Resource Stewardship Division, BC Ministry of Forests. …According to Muter, “putting a temporary pause in place on priority old growth areas provides the time and space to better understand what old growth we have left and how best to manage it.” Although the Technical Committee operated independent of government, Muter noted that “Ministry experts worked closely with the committee so as to understand the basis of their technical work and its credibility.” With respect to how the government’s commitment to First Nations is progressing, Muter said that, “some Nations feel confident in their current management regime (usually because of their deep partnerships with industry) and said they may not need deferrals. Some Nations said they need more time and others see the need for deferrals and want to proceed.”

Kicking off Day 2 of the TLA’s panels on the BC government’s efforts to modernize forest policy was David Muter, ADM, Resource Stewardship Division, BC Ministry of Forests. …According to Muter, “putting a temporary pause in place on priority old growth areas provides the time and space to better understand what old growth we have left and how best to manage it.” Although the Technical Committee operated independent of government, Muter noted that “Ministry experts worked closely with the committee so as to understand the basis of their technical work and its credibility.” With respect to how the government’s commitment to First Nations is progressing, Muter said that, “some Nations feel confident in their current management regime (usually because of their deep partnerships with industry) and said they may not need deferrals. Some Nations said they need more time and others see the need for deferrals and want to proceed.”

Next up was RBC analyst Paul Quinn, who titled his talk, BC – What Went Wrong and What Needs to Happen Now. As for what went wrong, Quinn says it’s “those policy changes that add even more costs to BC’s new status as North America’s high cost producer”. In effect, Quinn described the government’s efforts to modernize the forest sector as “the problem”. “Capital and investment are risk adverse and money flows away from uncertainty or it requires a premium return to offset the increased risk”, according to Quinn. “Unfortunately, the BC industry is producing below average returns while demonstrating a high and rising risk profile. BC has moved from the lowest cost jurisdiction in North America in 2010 to the highest cost in 2021, and recent policy changes will exacerbate the situation. Simply put, BC is becoming uninvestable”.

Next up was RBC analyst Paul Quinn, who titled his talk, BC – What Went Wrong and What Needs to Happen Now. As for what went wrong, Quinn says it’s “those policy changes that add even more costs to BC’s new status as North America’s high cost producer”. In effect, Quinn described the government’s efforts to modernize the forest sector as “the problem”. “Capital and investment are risk adverse and money flows away from uncertainty or it requires a premium return to offset the increased risk”, according to Quinn. “Unfortunately, the BC industry is producing below average returns while demonstrating a high and rising risk profile. BC has moved from the lowest cost jurisdiction in North America in 2010 to the highest cost in 2021, and recent policy changes will exacerbate the situation. Simply put, BC is becoming uninvestable”.